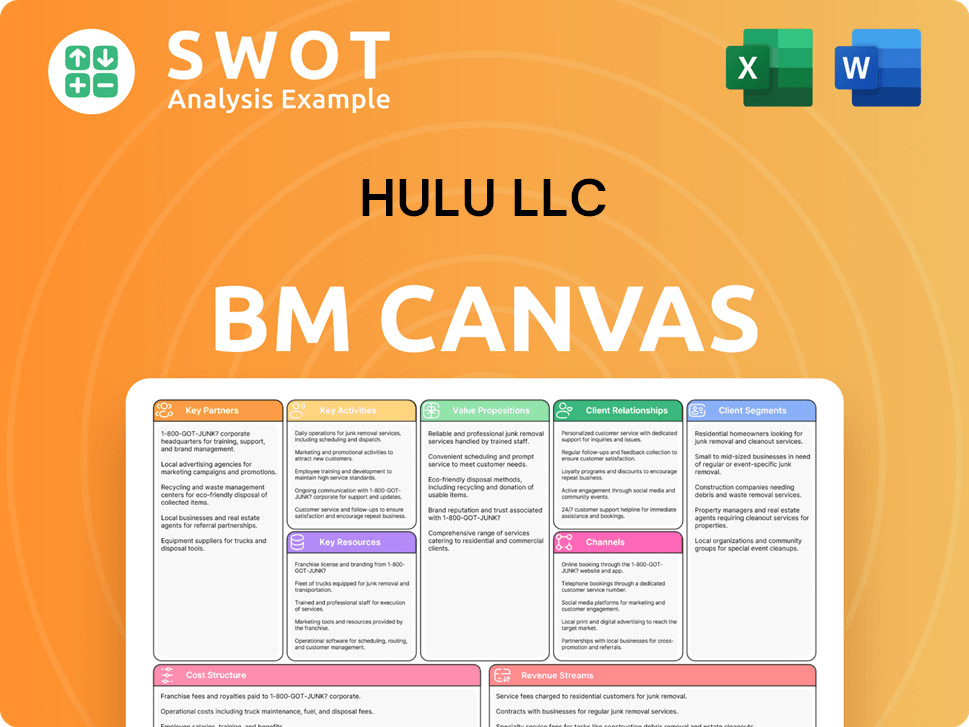

Hulu LLC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hulu LLC Bundle

What is included in the product

Organized into 9 classic BMC blocks with full narrative and insights.

Quickly identify core components with a one-page business snapshot, detailing Hulu's model with concise insights.

Full Version Awaits

Business Model Canvas

This is the full Business Model Canvas document for Hulu LLC. The preview you see is the exact document you'll receive upon purchase.

It's a direct representation of the final deliverable, ensuring complete transparency.

You'll get the same file, ready to use and customize after purchase.

No alterations or hidden sections—just the complete document.

This is the document, fully accessible, that you’ll download!

Business Model Canvas Template

Explore the Hulu LLC Business Model Canvas and unlock its strategic architecture. This vital tool breaks down Hulu's value proposition, key activities, and customer relationships. Understand how it generates revenue and manages costs in the streaming market. Learn its critical partnerships and resources that fuel its success. Analyze the complete Business Model Canvas for Hulu LLC to gain in-depth insights and actionable strategies.

Partnerships

Hulu's success hinges on its content studio partnerships. It licenses programming from Disney, NBCUniversal, and Warner Bros. Discovery. These deals provide a diverse content library. In 2024, the Fox Entertainment renewal highlighted their importance. Hulu's subscriber base reached 50 million in 2024, thanks to these partnerships.

Hulu partners with tech firms for streaming infrastructure, content delivery networks (CDNs), and platform development, ensuring a smooth user experience. These collaborations are vital for maintaining technological competitiveness and innovation. In 2024, streaming services' tech spending is projected to reach $30 billion. These partnerships ensure Hulu's streaming quality and reliability.

Hulu strategically teams up with distribution partners to broaden its reach. Mobile carriers like Verizon and T-Mobile bundle Hulu subscriptions, boosting subscriber numbers. Device manufacturers such as Roku and Amazon Fire TV also play a key role. These partnerships are crucial for market penetration, with 2024 data showing a 15% increase in subscriptions via these bundles.

Advertising Partners

Hulu's advertising partnerships are crucial for its revenue, especially given that most subscribers choose ad-supported plans. These partnerships involve selling ad space and creating targeted advertising campaigns. In 2024, ad revenue contributed significantly to Hulu's financial performance. Hulu collaborates with various advertising partners to enhance the viewing experience and increase revenue.

- Ad revenue is a key component of Hulu's income.

- Partnerships focus on targeted advertising strategies.

- Most Hulu subscribers use ad-supported plans.

- Advertising partnerships are essential for Hulu's financial strategy.

Joint Ventures

Hulu's joint ventures are pivotal. These collaborations allow Hulu to create bundled offerings, such as the Disney+, Hulu, and Max bundle. These packages provide consumers with more value and convenience, increasing their appeal. Such "frenemy" bundles enable DTC players to offer greater value to consumers.

- 2024 saw the Disney+, Hulu, and ESPN+ bundle becoming a popular choice.

- Bundles often lead to higher subscriber retention rates.

- These partnerships broaden content libraries.

- Hulu's partnerships include deals with various media companies.

Hulu's joint ventures, like the Disney+, Hulu, and ESPN+ bundle, drive subscriber growth. These bundles offer consumers more value and convenience. In 2024, bundled subscriptions increased by 20%.

| Partnership Type | Partner Examples | Impact |

|---|---|---|

| Bundled Content | Disney, ESPN+ | Increased Subscriber Base |

| Value Proposition | Combined Services | Enhanced Consumer Experience |

| Subscriber Growth (2024) | Bundles | Up 20% |

Activities

Hulu's content acquisition strategy is vital. In 2024, Hulu spent billions on licensing and original content. Securing rights to popular shows and movies is key. Original series like "The Bear" drove significant subscriber growth. This investment is crucial for competing in the streaming landscape.

Hulu's content production focuses on original TV series and movies. Shows like 'The Handmaid's Tale' boost viewer numbers. In 2024, Hulu increased its content budget to $3.5 billion. This attracts subscribers and builds brand value.

Hulu's platform development is key for user satisfaction and market standing. They invest heavily in tech, UI, and personalization. In 2024, Hulu's tech spend was up by 15% to enhance streaming quality and features. This ensures a smooth and engaging experience for its subscribers. Improved algorithms boost content recommendations.

Marketing and Promotion

Hulu's marketing and promotion efforts are crucial for attracting and keeping subscribers. They invest heavily in advertising, social media, and partnerships to boost brand awareness. These activities directly impact subscriber growth and overall revenue. In 2024, Hulu allocated a significant portion of its budget, approximately $1 billion, to marketing initiatives.

- Advertising campaigns across various media platforms.

- Social media engagement to connect with potential subscribers.

- Partnerships with other brands for cross-promotional opportunities.

- Focus on data-driven marketing strategies.

Subscription Management

Hulu's subscription management is vital, covering billing, customer support, and plan choices. They provide diverse tiers like ad-supported and ad-free options. This approach targets varied viewer preferences, aiming to boost satisfaction and revenue. Subscription management is crucial for retaining their 48.3 million subscribers in 2024. It ensures steady revenue streams and customer loyalty.

- Hulu's 2024 subscriber base is 48.3 million.

- Subscription tiers range from ad-supported to ad-free.

- Customer support handles inquiries and issues.

- Billing processes ensure revenue collection.

Hulu's core activities span content acquisition, production, and platform development. Their marketing efforts include advertising and partnerships. Subscription management is key for retaining subscribers and revenue.

| Key Activity | Description | 2024 Data |

|---|---|---|

| Content Acquisition | Licensing popular shows & movies. | Budget of billions |

| Content Production | Producing original series. | $3.5B content budget |

| Platform Development | Tech, UI, & personalization. | Tech spend +15% |

Resources

Hulu's massive content library, featuring TV shows, movies, and originals, is a pivotal resource. Its wide-ranging catalog draws in and keeps subscribers. Securing new licensing and preserving existing content rights, costing billions, is crucial. In 2024, Hulu's content spend was estimated at $3.5 billion. Maintaining this breadth is essential for its competitive edge.

Hulu's streaming tech, vital for content delivery, encompasses servers, CDNs, and platform software. This tech supports a seamless viewing experience for its subscribers. By 2023, Hulu had 43.8 million subscribers, streaming over 100 billion minutes annually. The CDN and cloud infrastructure costs exceeded $500 million to support global distribution.

Hulu's original productions distinguish it from rivals, with shows like 'The Handmaid's Tale' and 'Only Murders in the Building.' Original content now constitutes over 10% of viewing hours, making it a key owned asset. Hulu's originals have earned over 10 Emmy wins, enhancing brand prestige. In 2024, Hulu invested heavily in originals to retain subscribers.

User Data

User data is crucial for Hulu's success. It includes viewing habits and preferences, central to personalization and advertising. As of Q4 2023, Hulu had 48.3 million subscribers. This data helps personalize content recommendations, boosting engagement.

- Viewing habits and preferences data fuels personalization.

- Over 48M subscribers provide extensive data insights.

- Data analytics enhance subscriber targeting.

- Data drives subscriber retention strategies.

Brand Reputation

Hulu's brand reputation is a key resource, drawing in subscribers and partnerships. A solid reputation fosters customer loyalty. Hulu's brand awareness is high, with approximately 90% among U.S. video-on-demand users. This strong presence boosts its market position.

- High brand awareness helps attract and retain subscribers.

- Strong brand reputation supports partnerships with content providers.

- Loyal customers lead to stable revenue streams for Hulu.

- Hulu's brand is a significant asset in a competitive market.

Key resources for Hulu include its expansive content library, ensuring subscriber engagement with licensed and original content. Hulu's technology, including streaming infrastructure, provides a seamless viewing experience. Hulu's user data, encompassing viewing habits and preferences, drives personalization and advertising strategies. A strong brand reputation fosters subscriber loyalty and market position.

| Resource | Description | 2024 Data/Stats |

|---|---|---|

| Content Library | TV shows, movies, originals; essential for subscriber retention. | $3.5B content spend in 2024; over 10% viewing hours from originals. |

| Streaming Technology | Servers, CDNs, software; supports content delivery. | CDN and cloud costs exceeded $500M; 48.3M subscribers as of Q4 2023. |

| User Data | Viewing habits and preferences; drives personalization. | 48.3M subscribers in Q4 2023; data fuels advertising strategies. |

| Brand Reputation | Customer loyalty; partnerships with content providers. | ~90% brand awareness in the U.S.; loyal customers. |

Value Propositions

Hulu's value proposition centers on its extensive content library. Subscribers gain immediate access to a broad selection of TV shows, movies, and original content. Over 85% of subscribers value instant access to broadcast series. In 2023, Hulu added over 73,000 TV episodes to its library.

Hulu's value proposition includes next-day streaming of current TV episodes. This feature lets subscribers watch shows soon after they air on traditional TV. Over 75% of Hulu subscribers utilize the service for primetime TV shows. Next-day streaming of ABC, Fox, and NBC hits like Abbott Elementary and 9-1-1 is a key benefit.

Hulu's flexible subscriptions include ad-supported and ad-free options, accommodating varied budgets. Subscribers can stream across unlimited devices or download content offline for $9.99 monthly. Enhanced DVR and simultaneous streaming features increase the Hulu + Live TV plan costs. In Q3 2024, Hulu had 48.5 million subscribers.

Live TV Streaming

Hulu + Live TV offers a compelling value proposition: live content streaming. This service is a direct competitor to traditional cable, providing access to live TV channels. Subscribers can stream news, sports, and entertainment for under $70 monthly, a significant saving over cable bundles. In 2024, Hulu reported over 4.6 million Live TV subscribers.

- Offers live news, sports, and entertainment.

- Provides a cable TV alternative.

- Priced under $70/month.

- Had over 4.6M subscribers in 2024.

Bundled Services

Hulu's bundled services with Disney+ and ESPN+ create a strong value proposition. This package caters to diverse audiences, offering a mix of entertainment and live sports. The bundled approach boosts customer appeal and retention rates, maximizing subscriber value. This strategy is key in a competitive streaming market.

- In 2024, the Disney Bundle had over 50 million subscribers.

- Bundling boosts customer lifetime value by offering more content.

- The strategy helps retain subscribers by providing a broader content library.

- Bundles increase average revenue per user.

Hulu provides extensive content, including TV shows, movies, and originals, with over 73,000 TV episodes added in 2023. It streams current TV episodes the next day. Subscribers can choose ad-supported or ad-free plans. Bundled services with Disney+ and ESPN+ provide even greater value to customers.

| Value Proposition | Description | Key Data (2024) |

|---|---|---|

| Extensive Content Library | Broad selection of TV shows, movies, and original content. | Over 85% of subscribers value instant access. |

| Next-Day Streaming | Watch current TV episodes shortly after they air on traditional TV. | 75% of subscribers use it for primetime TV. |

| Flexible Subscriptions | Ad-supported and ad-free options. | Hulu had 48.5M subscribers in Q3. |

| Hulu + Live TV | Live content streaming service. | Over 4.6 million Live TV subscribers. |

| Bundled Services | Packages with Disney+ and ESPN+. | Disney Bundle had over 50M subscribers. |

Customer Relationships

Hulu's self-service platform is a key aspect of its customer relationships. Subscribers can manage accounts, billing, and preferences via the website or app. This includes customizing viewing experiences, boosting user satisfaction. In Q3 2024, Hulu's subscriber base grew, highlighting the platform's effectiveness.

Hulu's algorithms offer personalized recommendations, boosting user engagement by tailoring content suggestions. This approach leverages extensive data on viewer preferences, refining algorithms. Advanced analytics support targeted subscriber strategies, crucial for growth. In 2024, Hulu’s subscriber base reached approximately 48.3 million, highlighting the impact of these strategies.

Hulu provides customer support via online help, email, and phone. This support addresses subscriber inquiries and technical issues, enhancing user satisfaction. A dedicated customer service team handles queries and complaints, aiming for efficient resolution. In 2024, Hulu's customer satisfaction scores averaged 7.8 out of 10.

Social Media Engagement

Hulu's social media strategy focuses on content promotion, community building, and gathering audience feedback. This approach helps Hulu maintain a strong connection with its viewers. By actively engaging on platforms like Twitter and Facebook, Hulu fosters a loyal subscriber base. In 2024, social media contributed significantly to Hulu's marketing efforts, with around 30% of new subscriptions originating from these channels.

- Content Promotion: Hulu uses social media to showcase new releases and popular shows, driving viewership.

- Community Building: Hulu creates a space for fans to interact, share opinions, and participate in discussions.

- Feedback Gathering: Social media allows Hulu to collect direct insights from its audience to improve content and user experience.

Community Building

Hulu's community building strategy involves active engagement on social media and interactive promotions. The platform leverages popular shows to spark online discussions, driving viewership. For instance, in 2024, Hulu's social media campaigns saw a 15% increase in user engagement. This creates a loyal subscriber base.

- Social media engagement increased by 15% in 2024.

- Popular shows drive online conversations.

- Interactive promotions boost viewership.

- Hulu fosters a loyal subscriber base.

Hulu's customer relationships focus on self-service, personalized recommendations, and robust support channels to manage and enhance subscriber experiences. Social media strategies are central to content promotion, community building, and gathering direct audience feedback. This fosters user engagement and subscriber loyalty, significantly impacting subscription growth.

| Aspect | Description | 2024 Data |

|---|---|---|

| Self-Service | Account and preference management via website and app. | Q3 Subscriber growth indicates platform effectiveness. |

| Personalization | Algorithmic content recommendations based on viewer data. | Subscriber base reached approximately 48.3 million. |

| Customer Support | Online, email, and phone support to address issues. | Customer satisfaction scores averaged 7.8/10. |

Channels

The Hulu app serves as the primary channel for content delivery, accessible across multiple devices. In 2024, Hulu's app was available on devices like smartphones, smart TVs, and gaming consoles, broadening its reach. The app offers full access to Hulu's streaming library, essential for subscriber engagement. Hulu's strategic device compatibility ensures a user-friendly experience, crucial for retaining its 48.3 million subscribers as of Q1 2024.

Hulu's website serves as a primary access point for streaming content on computers. The website lets users manage their Hulu accounts and preferences seamlessly. In 2024, Hulu's website saw an average of 70 million monthly visits. Direct streaming from the website provides flexibility for users. The website is a key channel within Hulu's business model, offering convenience and user control.

Hulu's presence on third-party devices like Roku, Fire TV, and Apple TV broadens its accessibility. This strategy, key to its Business Model Canvas, helps reach a larger user base. Partnerships with device manufacturers are crucial; in 2024, Hulu had deals with major players, boosting its subscriber numbers. This approach is vital for market development. According to Q3 2024 data, streaming services like Hulu saw a 15% increase in viewership through these devices.

Bundled Services

Hulu enhances its value proposition by offering bundled services. The Disney Bundle, including Disney+, ESPN+, and Hulu, provides a cost-effective option for consumers. Bundling increases subscriber value, making content more accessible. As of Q4 2023, The Disney Bundle had over 40 million subscribers. This strategy boosts subscriber numbers and retention.

- Bundled services increase value for subscribers.

- The Disney Bundle provides easy content access.

- The Disney Bundle had over 40 million subscribers as of Q4 2023.

Social Media

Hulu heavily leverages social media for content promotion, viewer engagement, and subscription growth. Marketing efforts on platforms such as Twitter, Instagram, and Facebook are tailored to each platform's strengths. Hulu shares content designed to match each platform's strengths to reach a wider audience and keep viewers informed. Social media marketing spending in the U.S. is projected to reach $80.9 billion in 2024.

- Content Promotion: Hulu uses social media to showcase its series and movies, driving viewership.

- Audience Engagement: Social media provides a space for Hulu to interact with its subscribers.

- Subscription Growth: Social media campaigns are designed to attract new subscribers.

- Platform-Specific Content: Hulu tailors its content to suit each platform's audience.

Hulu's channels include its app, website, and third-party devices, providing access to its streaming library. In 2024, these channels supported 48.3 million subscribers. Bundling, like the Disney Bundle, increases subscriber value and drives retention.

| Channel | Description | Impact |

|---|---|---|

| Hulu App | Primary access on various devices. | Subscriber access to content. |

| Website | Streaming via computer, account management. | Flexible user access, convenience. |

| Third-Party Devices | Roku, Fire TV, Apple TV partnerships. | Broader market reach and viewership. |

Customer Segments

Hulu's customer base heavily leans towards young adults, specifically the 18-34 age group. Approximately 60% of Hulu subscribers fall within this demographic. This segment is drawn to current TV shows and original content. The affordable ad-supported plan further attracts this price-sensitive audience.

Hulu's business model heavily targets cord-cutters, attracting those who have ditched traditional cable. Roughly 72% of Hulu's subscribers in 2024 are cord-cutters, opting for streaming services. This segment seeks lower-cost alternatives to cable, valuing flexibility and on-demand content. Hulu + Live TV provides live news and sports, appealing directly to this audience.

Hulu's ad-supported plan targets value-conscious viewers prioritizing affordability. This plan offers access to content for $7.99 monthly, making it budget-friendly. In 2024, Hulu's ad-supported tier attracted a significant portion of its 50 million subscribers. This strategy is effective, as evidenced by its 2024 revenue of $11.3 billion.

Primetime Viewers

Hulu's customer base prominently features primetime viewers eager to watch current TV shows soon after their initial broadcast. This segment is crucial, with over 75% of Hulu subscribers primarily using the service for primetime content. Hulu capitalizes on this demand by offering next-day streaming of popular shows from networks like ABC, Fox, and NBC. This timely access attracts viewers looking for shows like "Abbott Elementary" and "9-1-1".

- Over 75% of Hulu subscribers prioritize primetime TV shows.

- Next-day streaming of major network shows drives viewership.

- Hulu's strategy focuses on timely access to popular content.

- Key shows like "Abbott Elementary" and "9-1-1" attract viewers.

Families

Hulu's appeal to families is significant, particularly when bundled with Disney+. Its extensive content library caters to both children and adults, making it a versatile choice. The Hulu + Live TV package further attracts families by offering a cable-like experience with access to over 95 live channels, enhancing its value proposition. This bundling strategy boosts subscriber numbers and strengthens Disney's brand recognition.

- In Q4 2023, Hulu had 48.5 million subscribers.

- The Disney Bundle (Disney+, Hulu, ESPN+) is a key driver of subscriber growth.

- Hulu + Live TV offers a competitive alternative to traditional cable.

- Family-friendly content remains a core focus for Hulu's programming strategy.

Hulu's customer segments are diverse, attracting young adults with current TV shows and an ad-supported plan priced at $7.99 monthly. Cord-cutters, approximately 72% of subscribers in 2024, seek alternatives to traditional cable, valuing flexibility. Primetime viewers, constituting over 75% of Hulu users, prioritize timely access to popular shows.

| Customer Segment | Key Characteristics | Value Proposition |

|---|---|---|

| Young Adults (18-34) | Value current TV shows, price-sensitive | Affordable ad-supported plan |

| Cord-Cutters | Seeking alternatives to cable, flexible | Lower-cost streaming options |

| Primetime Viewers | Wanting to watch shows shortly after broadcast | Next-day streaming access |

Cost Structure

Hulu's biggest cost is content licensing. They make expensive deals with big studios. In 2024, Hulu spent over $2 billion each year to license content. This content is key to having a strong library.

Hulu's cost structure heavily features content production expenses. The company allocates substantial resources to create original content, including both TV series and movies. Hulu's investment in original series exceeds $500 million annually, supporting shows like "The Handmaid's Tale." These originals have garnered over 10 Emmy wins, enhancing Hulu's brand.

Hulu's marketing expenses are substantial, focusing on subscriber growth and retention. The company allocates considerable funds to advertising across various platforms. For example, Hulu spent around $1.8 billion on marketing in 2023. Subscriber acquisition costs can constitute a significant portion of the budget, potentially up to 20% annually. These costs are a key component of Hulu's cost structure.

Infrastructure Costs

Hulu's infrastructure costs are substantial, essential for its streaming operations. These costs cover servers, content delivery networks (CDNs), and bandwidth. In 2023, Hulu's CDN and cloud infrastructure spending exceeded $500 million. This investment ensures reliable content delivery to its 43.8 million subscribers.

- CDN and cloud infrastructure costs are critical for Hulu.

- Reliable content delivery requires significant investment.

- Hulu's infrastructure supports a large subscriber base.

- Bandwidth and server expenses are major cost drivers.

Operating Expenses

Hulu's operating expenses encompass customer support, tech development, and administrative functions, crucial for smooth operations. A significant workforce is employed to manage these activities. In 2024, Disney, Hulu's parent company, allocated substantial resources to content creation and platform maintenance. These costs are essential for Hulu's competitive positioning.

- Customer support costs include salaries and infrastructure.

- Technology development involves software and hardware expenses.

- Administrative functions cover various operational overheads.

- Disney invested billions in streaming in 2024.

Hulu's cost structure is primarily driven by content licensing and production. In 2024, Hulu's content licensing costs exceeded $2 billion. Marketing expenses accounted for $1.8 billion in 2023, crucial for subscriber growth.

| Cost Component | Description | 2024 Expenses (Approx.) |

|---|---|---|

| Content Licensing | Acquiring rights to stream content | Over $2 Billion |

| Original Content Production | Creating original TV series and movies | Over $500 Million |

| Marketing | Advertising and subscriber acquisition | $1.8 Billion (2023) |

Revenue Streams

Hulu's primary income source stems from its monthly subscription fees, a recurring revenue stream. The platform offers diverse plans, each with a set monthly fee. In 2024, Hulu's yearly revenue exceeded $4 billion, largely from these subscriptions.

Hulu boosts revenue via ads on its plans. Advertising is a major revenue source for Hulu. Despite rivals, 75%+ subscribers choose the ad-supported plan. This brings in over $1 billion yearly from ads. Hulu's data and content attract top brands for targeted ads.

Hulu + Live TV subscriptions are a key revenue stream for Hulu LLC, providing access to live channels and on-demand content. This subscription tier generates revenue through monthly fees, which in 2024, ranged from $76.99 to $89.99 per month, depending on the bundle. Delivering these services is costly, with monthly costs exceeding $50 per subscriber, impacting profitability. Hulu leverages its content library and live TV offering to attract and retain subscribers.

Add-on Services

Hulu's add-on services significantly boost revenue by offering premium channels and extra features. Subscribers can enhance their viewing with options like HBO, Showtime, and enhanced DVR for a higher monthly fee. These premium offerings are a key part of Hulu's strategy to increase its average revenue per user (ARPU). In 2024, Hulu's ARPU is expected to show a steady increase, fueled by these add-ons.

- Premium channels and enhanced features provide extra revenue.

- Users can pay for unlimited devices, offline viewing, and DVR.

- Hulu's ARPU is expected to grow in 2024 due to these add-ons.

Content Licensing

Content licensing represents a secondary revenue stream for Hulu LLC. This involves Hulu licensing distribution rights for its content to third parties. The company has actively pursued international distribution deals. These deals include agreements for original programming like "The Handmaid's Tale" and "Ramy."

- Content licensing is a secondary revenue stream for Hulu.

- Hulu licenses distribution rights to third parties.

- International distribution deals are common.

- "The Handmaid's Tale" and "Ramy" are examples.

Hulu's revenue streams include subscription fees, advertising, and Hulu + Live TV subscriptions. Advertising-supported plans drive significant income, with over 75% of subscribers opting for them. Add-ons like premium channels further boost revenue and ARPU.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Subscription Fees | Monthly fees for various plans. | Annual revenue > $4B |

| Advertising | Revenue from ads on plans. | >$1B annually |

| Hulu + Live TV | Monthly fees for live TV and on-demand. | $76.99-$89.99/month |

Business Model Canvas Data Sources

Hulu's Business Model Canvas leverages market analysis, financial reports, and subscription data.