Inpex Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inpex Bundle

What is included in the product

In-depth examination of each product or business unit across all BCG Matrix quadrants

Printable summary optimized for A4 and mobile PDFs to save you time and paper.

What You’re Viewing Is Included

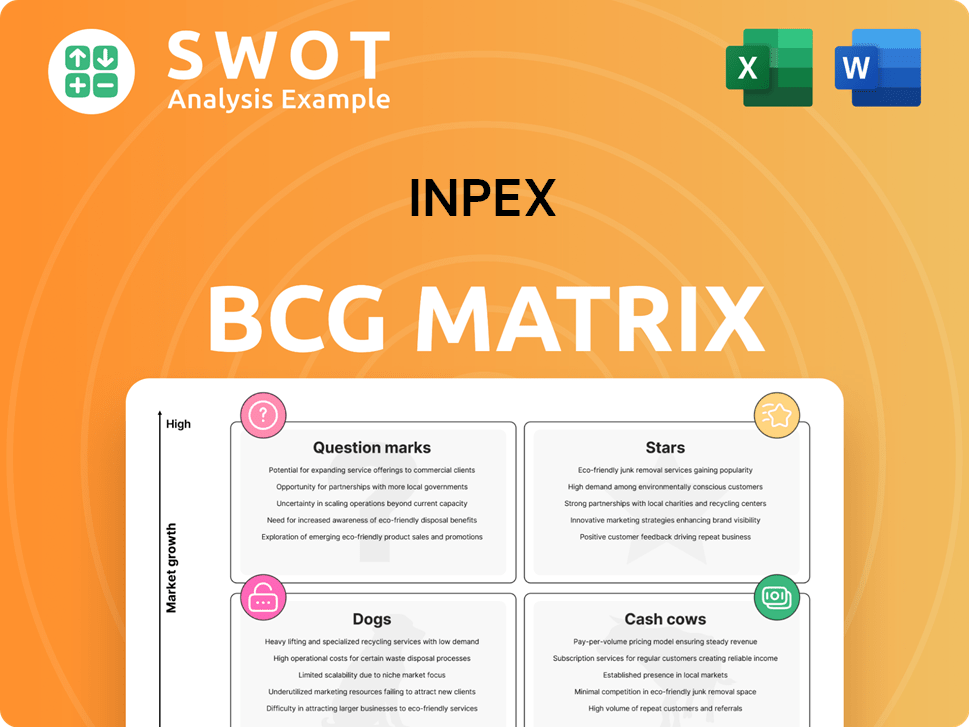

Inpex BCG Matrix

The Inpex BCG Matrix preview mirrors the complete document you receive after buying. This is the final, fully functional version: ready for your strategic analysis, complete with all the necessary elements, and available for immediate download.

BCG Matrix Template

Explore the Inpex BCG Matrix's snapshot: see how its offerings are categorized. Identify Stars, Cash Cows, Dogs, and Question Marks. This brief overview offers a glimpse into Inpex's strategic positioning. Need in-depth analysis? Uncover the full BCG Matrix for quadrant placements.

Stars

The Ichthys LNG Project is a vital revenue generator and core asset for INPEX. In 2024, it significantly influenced INPEX's production, accounting for a large portion of its LNG output. Further investment could boost its liquefaction capacity. The project is a key component of INPEX's long-term strategy.

The Abadi LNG project is a major growth driver for INPEX, with a targeted final investment decision (FID) in 2027. This project will boost INPEX's LNG production capacity. The project's estimated total cost is $13 billion. It’s expected to produce 9.5 million tons of LNG annually, enhancing long-term supply.

INPEX is significantly boosting crude oil production capacity in the UAE, partnering with ADNOC. These projects are vital for INPEX’s hydrocarbon output. This strategy reinforces existing projects for future expansion. INPEX's 2024 investments in the UAE are substantial, with $1.5 billion allocated for oil and gas projects.

Carbon Capture and Storage (CCS) Initiatives

INPEX is significantly investing in Carbon Capture and Storage (CCS) projects to decrease its environmental impact. These projects are crucial for meeting its net-zero objectives, with plans to capture and store significant amounts of CO2. The commitment to CCS tech showcases INPEX's dedication to environmental responsibility, which is increasingly important. As of 2024, INPEX has allocated substantial capital for CCS initiatives.

- Investment: INPEX has dedicated over $1 billion to CCS projects by 2024.

- Capacity: Plans to capture and store over 1 million tons of CO2 annually.

- Targets: Aiming to achieve net-zero emissions by 2050.

Exploration Blocks in Malaysia & Norway

INPEX is actively exploring in Malaysia and Norway, securing exploration blocks in both regions. These blocks are crucial for potential new discoveries, driving future production. The company's strategic moves aim to diversify its portfolio and expand its presence, especially in Southeast Asia and Europe. In 2024, INPEX's exploration budget is expected to be around $1.5 billion, reflecting its commitment to growth.

- Exploration blocks offer potential for new discoveries.

- Expansion aligns with diversification strategy.

- Focus on Southeast Asia and Europe.

- 2024 exploration budget around $1.5 billion.

Stars represent INPEX’s key assets with high growth potential, like the Ichthys and Abadi LNG projects, crucial to INPEX’s revenue generation.

These projects require substantial investment to maintain their strong market position, thus boosting overall production capacity.

INPEX strategically allocates significant capital, such as the $13 billion earmarked for the Abadi LNG project, reflecting its commitment to long-term growth and future expansion.

| Project | Investment (USD) | Expected Output |

|---|---|---|

| Ichthys LNG | Ongoing | Significant LNG output |

| Abadi LNG | $13 Billion | 9.5 million tons LNG annually |

| UAE Crude Oil | $1.5 Billion (2024) | Boost in hydrocarbon output |

Cash Cows

INPEX's existing oil and gas production generates substantial cash flow. These established assets are pivotal for financing new ventures and dividends. In 2024, INPEX's oil and gas sales reached $14.5 billion. Efficiency gains and cost reductions boost profits.

INPEX is boosting its LNG trading to be more flexible. This strategy lets INPEX seize market chances and refine its LNG holdings. INPEX aims to grow its natural gas and LNG sector. In 2024, LNG spot prices fluctuated, showing the importance of trading agility. INPEX's focus on trading helps navigate these shifts.

INPEX is actively investing in renewable energy, targeting 1-2 gigawatts of renewable assets by 2030. These investments, like solar and wind projects, generate a steady income, supporting INPEX's shift towards cleaner energy. In 2024, the renewable energy sector saw over $300 billion in global investment. Ensuring profitability requires thorough assessment of these green energy ventures.

Blue Ammonia Facility (Houston)

INPEX is investing in a blue ammonia facility in Houston, aiming to export ammonia to Asia. This project aligns with the rising demand for sustainable fuels, aiding in decarbonization. The facility will generate a new revenue stream, supporting INPEX's shift towards cleaner energy. The project is part of INPEX's strategy to diversify its energy portfolio.

- INPEX aims to produce 100,000 tons of blue ammonia annually.

- The project is expected to be completed by 2027.

- Total investment is estimated at $300 million.

- Blue ammonia reduces CO2 emissions by 80% compared to traditional ammonia.

Perovskite Solar Cell (PSC) Support

INPEX is backing Perovskite Solar Cells (PSCs) by supplying iodine, a crucial component. This support utilizes by-products from gas fields, promoting resource recovery. The move fits INPEX's goal of exploring new resource recovery ventures. INPEX's focus on PSCs is strategic, aiming for sustainable energy solutions. In 2024, the global PSC market was valued at $25 million, with expected growth.

- INPEX providing iodine to support PSC expansion.

- Leveraging gas field by-products for resource recovery.

- Aligning with INPEX's strategy for new ventures.

- Focus on sustainable energy through PSC technology.

INPEX's cash cows include oil and gas production, a key funding source. LNG trading enhances market flexibility and profitability. Renewable energy and blue ammonia ventures offer diverse income streams.

| Aspect | Details | 2024 Data |

|---|---|---|

| Oil & Gas Sales | Core revenue | $14.5B |

| LNG Trading | Strategic Market agility | Spot Price Fluctuations |

| Renewable Investment | Targeted Capacity | 1-2GW by 2030 |

Dogs

INPEX faces challenges due to past exploration failures, leading to portfolio reassessment. Expensive recovery plans for these ventures may not be viable. The company needs to cut investments in underperforming areas. In 2024, INPEX's net profit decreased by 15% due to these issues.

Assets with high carbon intensity and limited CCS potential are becoming less attractive. Divesting or repurposing these improves INPEX's environmental performance. Focus on assets aligning with sustainability goals. In 2024, INPEX aimed to reduce Scope 1 and 2 emissions by 30% by 2030.

Projects with high operating costs and low returns require a thorough review. For example, in 2024, some oil & gas projects saw operational expenses rise by 10-15% due to inflation and supply chain issues. Cost reduction and efficiency improvements are critical to enhance profitability, with strategies like automation potentially cutting costs by 5%. If cost-cutting fails, divestiture should be considered; in 2024, several energy firms divested unprofitable assets to improve financial health.

Assets in Geopolitically Unstable Regions

Assets in geopolitically unstable regions, like those in the Middle East, can be highly risky. Political instability can disrupt operations and impact asset values significantly. Reducing exposure to these areas through diversification is crucial. Focusing on secure regions helps protect investments. For instance, in 2024, geopolitical risks led to a 15% drop in investments in certain unstable zones.

- Geopolitical risks significantly impact asset values.

- Diversification is key to mitigating potential losses.

- Stable regions offer greater investment security.

- In 2024, investment dropped by 15% in unstable zones.

Non-Core Business Segments

INPEX should reduce non-core business segments that don't fit its main goals. Prioritizing key areas like LNG and CCS can boost overall results. Selling off non-core assets can unlock funds for better investments. This approach aligns with strategic financial planning. In 2024, INPEX reported a net profit of JPY 781.4 billion.

- Focus on core competencies to improve efficiency.

- Divest non-core assets to reallocate capital.

- Strategic alignment with LNG and CCS projects.

- Enhance financial performance through focused investments.

Dogs represent assets with low market share and low growth potential, requiring careful management. These assets often drain resources and may not provide sufficient returns. Companies may consider divestiture or restructuring.

| Category | Details | 2024 Data |

|---|---|---|

| Characteristics | Low market share, low growth. | INPEX: Several projects identified as Dogs. |

| Strategy | Divest, liquidate, or restructure. | Focus: Reducing exposure to underperforming segments. |

| Financial Impact | Drain on resources, minimal returns. | Potential for asset write-downs and losses. |

Question Marks

INPEX's geothermal project in Hokkaido, Japan, represents a "Question Mark" in its BCG matrix, as it is a new venture with high growth potential but faces considerable uncertainty. Initial investments in exploratory drilling are underway, reflecting the company's commitment to renewable energy sources. The viability of this project is currently under evaluation, with the potential to contribute to Japan's goal of increasing renewable energy to 36-38% of its power generation mix by 2030.

INPEX is advancing a CCS project in the Tokyo Metropolitan Area to address CO2 emissions. This initiative aligns with Japan's goal of achieving carbon neutrality by 2050. The project's success hinges on regulatory frameworks and technological breakthroughs. In 2024, Japan's CCS initiatives received approximately $1.5 billion in government funding, showcasing strong support.

INPEX is conducting integrated verification trials for hydrogen and ammonia production in Kashiwazaki City. These initiatives, though promising, need infrastructure expansion. Japan's hydrogen demand is projected to reach 3 million tons by 2030. Investing could establish INPEX in the hydrogen market. The global ammonia market was valued at $70.75 billion in 2023.

Deepwater Exploration

Venturing into ultra-deepwater reserves is a high-risk, high-reward endeavor for Inpex. These projects demand substantial capital investment and cutting-edge technological capabilities. Success hinges on favorable geological conditions and efficient extraction techniques. For example, the cost to drill and complete an offshore well can range from $50 million to over $200 million. In 2024, approximately 30% of global oil production came from offshore fields, highlighting their importance.

- High Capital Expenditure: Drilling and completion costs can be very high.

- Technological Complexity: Requires advanced drilling and extraction methods.

- Geological Risks: Success depends on the presence of oil and gas.

- Market Volatility: Oil prices can significantly impact project profitability.

Low-Carbon Technology Investments

Low-carbon technology investments present a "Question Mark" in the INPEX BCG matrix due to uncertain returns. These investments, such as renewable energy projects, require careful balancing with existing oil and gas projects to manage risk. INPEX needs to strategically select low-carbon projects for long-term success. This approach supports INPEX's transition towards a sustainable energy mix.

- INPEX invested $700 million in carbon capture and storage projects in 2024.

- The global renewable energy market is projected to reach $1.977 trillion by 2030.

- Balancing these investments with traditional oil and gas projects is crucial.

- Careful selection of low-carbon projects is essential for long-term success.

Question Marks in INPEX's BCG matrix are ventures with high growth potential but uncertain outcomes, such as renewable energy projects. These initiatives require substantial capital investments and careful strategic planning. Success depends on factors like market conditions and technological breakthroughs. INPEX's strategic allocation of resources is key to converting these "Question Marks" into Stars or Cash Cows.

| Project Type | Investment in 2024 (USD) | Growth Potential |

|---|---|---|

| Geothermal | Exploration Phase | High, dependent on regulatory support |

| CCS | $700M | Moderate, influenced by tech advances |

| Hydrogen/Ammonia | Pilot Projects | High, tied to infrastructure build-out |

BCG Matrix Data Sources

The INPEX BCG Matrix uses data from annual reports, market analyses, expert opinions and competitor evaluations to determine strategy.