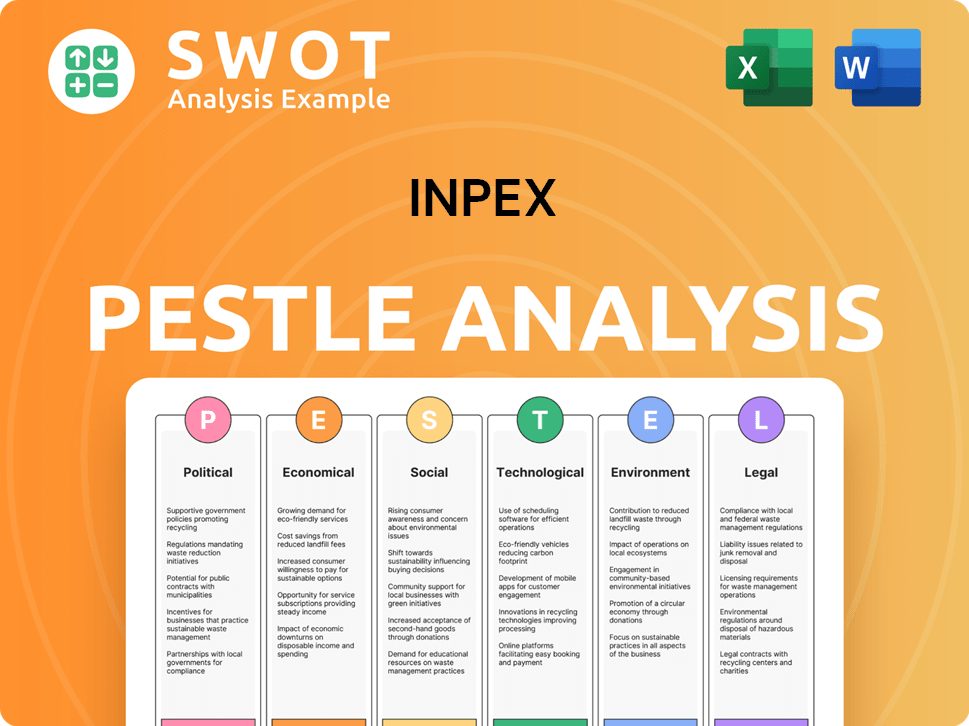

Inpex PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inpex Bundle

What is included in the product

Assesses how external macro factors influence Inpex, covering Political, Economic, Social, etc.

The INPEX PESTLE simplifies complex data for accessible stakeholder reviews.

What You See Is What You Get

Inpex PESTLE Analysis

See the complete Inpex PESTLE Analysis now. This is a real preview of the full, finalized document. After purchasing, you’ll instantly download this exact, ready-to-use report.

PESTLE Analysis Template

Uncover Inpex's strategic landscape with our focused PESTLE analysis. Examine the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping its path. Understand risks and opportunities affecting operations and profitability. Ready-to-use intelligence for strategy and decision-making. Download the full analysis for in-depth insights now!

Political factors

Geopolitical stability and regional conflicts are major factors affecting INPEX. Conflicts directly influence oil and gas prices and supply chains. The focus on energy security by countries also affects INPEX. For example, in 2024, Brent crude oil prices fluctuated, impacting INPEX's revenue.

Government policies on climate change and the energy transition significantly shape INPEX's operations. Japan's commitment to carbon neutrality by 2050 impacts INPEX's investments. The Japanese government plans to increase renewable energy's share to 36-38% by 2030. These policies influence INPEX's strategic shifts and investment in low-carbon initiatives.

Changes in trade regulations and sanctions significantly affect INPEX. Sanctions against specific countries hinder exploration, production, and transportation capabilities. These policies directly impact market access and project feasibility. For instance, sanctions on Russia have altered global energy trade patterns. INPEX must navigate these dynamic political landscapes.

Regulatory Environment in Operating Regions

INPEX's operations are significantly influenced by the political and regulatory environments in its operating regions. Changes in regulations, especially concerning exploration permits and environmental standards, can directly affect project feasibility. For instance, Japan's energy policies and regulations are key given INPEX's headquarters. Taxation policies also pose a considerable risk, impacting profitability.

- Japan's energy policies influence INPEX's strategic decisions.

- Environmental regulations, such as those related to carbon emissions, are crucial.

- Taxation policies in countries like Australia and Indonesia affect INPEX's financials.

- INPEX must comply with local content requirements in various regions.

Government Support for New Energy Technologies

Government support for new energy technologies is a crucial political factor for INPEX. Incentives, such as tax credits and subsidies, can significantly influence INPEX's investment decisions in areas like carbon capture and storage. Supportive policies can accelerate project development and reduce financial risks associated with these technologies. Conversely, the absence of such support may hinder INPEX's energy transition plans.

- In 2024, the U.S. government allocated $6.2 billion for carbon capture projects.

- Japan's Green Transformation (GX) initiative aims to support hydrogen and renewable energy.

Political factors critically shape INPEX's operations. Geopolitical instability impacts oil prices and supply chains; fluctuating Brent crude prices were notable in 2024. Climate policies, such as Japan’s 2050 carbon neutrality target and increased renewables to 36-38% by 2030, influence INPEX's strategies.

Trade regulations and sanctions affect INPEX's market access, exemplified by impacts from Russia-related sanctions. The political and regulatory environment in operating regions significantly influences INPEX. Tax and environmental policies are crucial. Government support for green technologies (like the $6.2 billion in the U.S. for carbon capture in 2024) also play an important role.

| Political Factor | Impact on INPEX | Data Point (2024/2025) |

|---|---|---|

| Geopolitical Instability | Oil Price Volatility | Brent Crude fluctuations; sanctions impact |

| Climate Change Policies | Strategic Investments | Japan's target: 36-38% renewable energy |

| Trade Regulations | Market Access | Impacts from Russian sanctions on supply chains. |

Economic factors

INPEX's financial health is significantly affected by crude oil and natural gas price swings. These prices are shaped by supply and demand, geopolitical issues, and the overall economy. In 2024, crude oil prices varied widely, impacting INPEX's revenue. For instance, Brent crude traded between $75 and $90 per barrel. Natural gas prices also fluctuated, influenced by regional demand and supply.

Global economic growth significantly influences energy demand, directly impacting INPEX's market. In 2024, global GDP growth is projected at 3.2%, affecting oil and gas consumption. Economic downturns can reduce demand and prices. Conversely, growth stimulates demand, as seen in Asia's rising energy needs.

INPEX faces currency exchange rate volatility, impacting its financials due to varying revenue and cost currencies. The Japanese yen's fluctuations against the USD are crucial, considering the company's global operations. In 2024, the USD/JPY exchange rate has shown significant volatility, affecting INPEX's reported earnings. A stronger yen can reduce the value of overseas earnings when converted to JPY.

Investment Environment and Capital Availability

The investment environment and capital availability are crucial for INPEX's funding of exploration, development, and production. The global energy sector saw significant investment, with renewable energy attracting substantial capital in 2024/2025. INPEX needs to secure financing for its projects, including those in new energy. Access to capital impacts project timelines and profitability.

- INPEX's capital expenditure for 2024 is projected at approximately $4 billion.

- The company is actively exploring partnerships for renewable energy projects.

- Changes in interest rates and investor sentiment can affect funding costs.

Inflation and Cost Pressures

Inflation poses a notable challenge for INPEX, potentially increasing operational costs. Rising prices for materials, equipment, and services directly affect profitability. Supply chain issues further amplify these cost pressures, impacting project timelines and budgets. In 2024, Japan's inflation rate fluctuated, with core consumer prices rising. INPEX must manage these inflationary risks carefully.

- Japan's core consumer price index increased by 2.8% in March 2024.

- INPEX's operational costs are sensitive to fluctuations in global commodity prices.

- Supply chain disruptions can lead to delays and increased expenses.

Economic factors, such as oil and gas prices and global growth, greatly impact INPEX's finances. Currency fluctuations, particularly the USD/JPY rate, also affect earnings. Access to capital, influenced by investment trends and interest rates, is crucial for INPEX's projects.

Inflation presents cost challenges, and supply chain issues exacerbate them. The 2024 capital expenditure is forecasted around $4 billion. INPEX is actively exploring new energy partnerships.

| Factor | Impact on INPEX | 2024/2025 Data |

|---|---|---|

| Oil Prices | Revenue and profitability | Brent crude traded $75-$90/bbl |

| Global GDP Growth | Energy demand and market | Projected 3.2% |

| USD/JPY Exchange Rate | Financial Reporting | Significant volatility |

Sociological factors

Public perception of the oil and gas industry is crucial. Negative views on environmental and social impacts influence regulations and talent acquisition. Climate change awareness is intensifying scrutiny. In 2024, 65% of people believe oil and gas companies harm the environment. This impacts Inpex's social license.

INPEX's success hinges on strong community ties. They navigate local concerns about environmental impact, land use, and economic benefits. In 2024, community engagement efforts saw a 15% increase in positive feedback. Building trust is crucial for project development.

INPEX's projects are significantly influenced by workforce availability and labor relations. For instance, in Australia, the Ichthys LNG project faced labor disputes, impacting schedules and costs. Australia's unemployment rate was around 4.1% as of April 2024. The presence of skilled workers and harmonious labor relations are crucial for INPEX's operational success. Conversely, labor shortages can increase project expenses.

Health and Safety Concerns

Prioritizing health and safety is crucial for Inpex, impacting its social responsibility and operational success. Accidents can harm individuals, damage Inpex's reputation, and disrupt operations. Robust safety protocols and training are essential to mitigate risks and ensure a safe working environment. In 2024, the oil and gas industry saw a 1.2% increase in workplace fatalities compared to 2023, highlighting the ongoing need for vigilance.

- In 2024, the industry average for total recordable incident rate (TRIR) was 2.1, a key safety metric.

- Inpex's 2024 safety report showed a TRIR of 1.8, below the industry average, indicating effective safety measures.

- A single major incident can lead to millions in fines and significant operational downtime.

Changing Consumer Behavior and Energy Preferences

Consumer behavior is changing, with more focus on sustainability. This impacts the demand for oil and gas. INPEX must adapt to these preferences. The company is investing in renewable energy. The global renewable energy market is projected to reach $1.977 trillion by 2028.

- Growing demand for electric vehicles (EVs) and renewable energy sources.

- Increased consumer awareness of environmental issues.

- Government policies supporting renewable energy.

- INPEX's strategic shift towards lower-carbon investments.

Public opinion profoundly shapes INPEX's operational environment, influencing regulatory pressures and impacting project approvals. Community relations are essential for project viability; strong engagement is critical. Labor availability and health/safety practices directly influence costs and operational continuity; labor disputes or accidents are expensive.

| Factor | Impact | Data (2024) |

|---|---|---|

| Public Perception | Regulatory risks, investment | 65% concerned about industry's environmental impact |

| Community Relations | Project delays, approvals | 15% rise in positive community feedback (INPEX) |

| Labor & Safety | Operational costs, reputation | Industry TRIR: 2.1; INPEX TRIR: 1.8, 1.2% increase in workplace fatalities |

Technological factors

INPEX benefits from tech in seismic imaging, drilling, and reservoir management. These advancements boost exploration and production efficiency. For instance, advanced drilling tech can cut costs by up to 15%. This helps INPEX access reserves better. INPEX's tech spending in 2024 was $1.2 billion.

Advancements in Carbon Capture and Storage (CCS) are vital for decreasing emissions from oil and gas operations. INPEX is involved in CCS projects, aiming to integrate these technologies. Recent data shows the CCS market is growing, with investments expected to reach billions by 2025. This shift presents new, lower-carbon business prospects for INPEX.

INPEX faces shifts in renewable energy. Solar and wind power are rapidly advancing, offering alternatives. Global investments in renewable energy reached $358.9 billion in 2024. This presents both challenges and chances for INPEX. The company is exploring ways to incorporate renewables into its business model.

Digitalization and Automation

Digitalization and automation are transforming INPEX's operations. The integration of AI and digital tools boosts efficiency and safety. In 2024, the global AI in oil and gas market was valued at $2.8 billion, projected to reach $7.5 billion by 2029. These technologies optimize decision-making across the value chain.

- AI-driven predictive maintenance can reduce downtime by up to 20%.

- Digital twins improve asset performance by 15%.

- Automated processes reduce operational costs by 10-15%.

Technological Solutions for Methane Emission Reduction

Technological advancements are crucial for INPEX to manage methane emissions. These include advanced sensors, drones, and satellite monitoring systems for leak detection. Implementing these technologies can significantly lower emissions, aligning with global sustainability goals. The global methane emissions reduction market is projected to reach $2.5 billion by 2028.

- Advanced Leak Detection and Repair (LDAR) programs using drones and sensors.

- Investment in carbon capture and storage (CCS) technologies.

- Deployment of AI and machine learning for predictive maintenance.

- Collaboration with tech companies for innovative solutions.

INPEX uses tech for efficiency and reducing emissions; advanced tech cuts costs by 15%. CCS projects and renewable integration present new business prospects. Digitalization boosts decision-making. The global AI in oil and gas market was valued at $2.8 billion in 2024.

| Technology Area | Impact | 2024/2025 Data |

|---|---|---|

| Drilling Tech | Cost Reduction | Up to 15% cost savings. |

| AI in Oil & Gas | Efficiency, decision-making | $2.8B market (2024), projected $7.5B by 2029. |

| Methane Emission Reduction | Lower emissions | Market projected to $2.5B by 2028. |

Legal factors

INPEX faces environmental regulations globally, impacting emissions, waste, and biodiversity. Increased regulatory stringency raises compliance costs. For instance, in 2024, INPEX allocated $500 million for environmental compliance. Delays due to environmental approvals are also a risk.

INPEX must adhere to stringent health and safety regulations to protect its employees. New regulations can lead to operational changes and increased safety investments. For instance, in 2024, INPEX allocated $150 million globally for safety enhancements. Furthermore, compliance costs can fluctuate, impacting overall expenses.

INPEX's operations hinge on navigating complex legal landscapes for hydrocarbon exploration and production. Licensing and permitting processes, varying across nations, dictate project viability. For example, Indonesia's recent revisions in oil and gas regulations may impact INPEX's projects there. Delays in environmental approvals can significantly affect project timelines and budgets; consider potential impacts on the Ichthys LNG project. Legal compliance is a constant operational focus, influencing capital allocation and risk management strategies.

Taxation and Royalty Regimes

Changes in corporate tax rates and royalty payments directly affect INPEX's profitability. For example, in Australia, where INPEX has significant operations, the corporate tax rate is 30%. Any alterations to this or royalty structures could shift project economics. Fiscal regimes in different countries, such as Indonesia and Japan, also influence INPEX's financial outcomes. These regimes are dynamic and can be affected by global economic conditions, commodity prices, and local political decisions.

- Australia's corporate tax rate: 30%

- Royalty rates vary significantly by country and resource type.

- Changes impact project profitability and investment decisions.

- Fiscal regimes are influenced by global and local factors.

International Trade Laws and Agreements

INPEX must adhere to international trade laws and agreements due to its global operations, especially for oil, gas, and equipment. This includes compliance with regulations from organizations like the World Trade Organization (WTO), impacting tariffs and trade barriers. For instance, in 2024, the WTO reported that global trade in goods increased by 1.7%, influencing INPEX's import/export costs. Any violations can lead to significant financial penalties and operational disruptions.

- Compliance with WTO agreements and regional trade pacts (e.g., CPTPP).

- Tariff and non-tariff barriers affecting import/export of oil and gas.

- Sanctions and trade restrictions impacting operations in specific regions.

- Regulations on technology transfer and intellectual property rights.

Legal factors significantly shape INPEX's operations. It involves compliance with licensing, permits, and international trade rules. Changes in tax rates and royalty payments directly impact the profitability. Moreover, understanding these aspects is vital for strategic planning and risk mitigation.

| Legal Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Tax Rates | Affects Profitability | Australia's corporate tax: 30% |

| Trade Laws | Influence import/export costs | WTO reported global trade increased 1.7% in 2024 |

| Licensing/Permitting | Impacts Project Viability | Indonesia's regulatory changes affect projects. |

Environmental factors

INPEX faces climate change impacts and transition risks. Physical risks include extreme weather events affecting operations. Transition risks involve policy changes, tech shifts, and market sentiment. In 2024, global investment in energy transition reached $1.7 trillion. INPEX must adapt to remain competitive.

INPEX's activities, like all energy companies, contribute to greenhouse gas emissions. Measuring and reporting these emissions are crucial, reflecting environmental regulations and stakeholder demands. In 2024, INPEX aims to cut Scope 1 and 2 emissions by 30% by 2030. This includes investments in carbon capture and storage (CCS) projects. The company's carbon footprint is under constant scrutiny, with investors increasingly prioritizing sustainable practices.

INPEX operates in areas with rich biodiversity, requiring careful environmental impact assessments. They must minimize harm to ecosystems, aligning with global conservation targets. In 2024, INPEX invested heavily in environmental protection, allocating $150 million to biodiversity projects. For 2025, they plan to increase investment by 10%, focusing on habitat restoration and species protection.

Water Usage and Management

Water is crucial in oil and gas operations, including drilling and processing. Inpex must manage water responsibly to minimize environmental impacts. This involves sustainable sourcing, efficient usage, and proper wastewater treatment. Effective water management is essential for operational sustainability and regulatory compliance.

- In 2023, the oil and gas industry used about 4.5 billion barrels of water in the U.S. alone.

- Water use can vary significantly depending on the extraction method and location.

- Proper water management reduces environmental risks like contamination.

Waste Management and Pollution Prevention

Effective waste management and pollution prevention are vital for INPEX to reduce its environmental impact and adhere to environmental regulations. INPEX needs to invest in advanced technologies and practices to manage waste efficiently and prevent pollution. In 2024, the global waste management market was valued at approximately $2.0 trillion, reflecting the importance of these measures. Furthermore, reducing emissions and waste aligns with sustainability goals, enhancing INPEX's reputation and long-term viability.

- INPEX's environmental expenditure in 2023 was around $500 million.

- The company aims to reduce its carbon emissions by 30% by 2030.

- Waste recycling rates in the oil and gas sector average 60%.

- Investment in green technologies to reduce waste.

INPEX faces climate risks from extreme weather and emission regulations, adapting with sustainable investments. The company focuses on reducing its carbon footprint by investing in carbon capture and storage. Water and waste management are critical for environmental compliance and operational sustainability.

| Environmental Factor | Details | 2024 Data/2025 Outlook |

|---|---|---|

| Climate Change | Physical risks (weather), transition risks (policy). | 2024: Global investment in energy transition: $1.7T. INPEX aims to cut Scope 1&2 emissions 30% by 2030. |

| Emissions | Greenhouse gas emissions measurement and reduction. | INPEX's 2024 targets focus on cutting emissions. |

| Biodiversity | Environmental impact assessments & habitat conservation. | 2024: $150M investment in biodiversity. 2025: 10% increase in investment. |

| Water Management | Sustainable sourcing and efficient water use. | 2023: Oil & gas used ~4.5B barrels in U.S. |

| Waste Management | Reducing environmental impact through regulations and technologies. | 2024: Global waste market ~$2.0T. INPEX 2023 expenditure ~$500M, aiming for emission reductions. |

PESTLE Analysis Data Sources

The Inpex PESTLE Analysis utilizes data from governmental reports, industry-specific publications, and economic databases to offer insights.