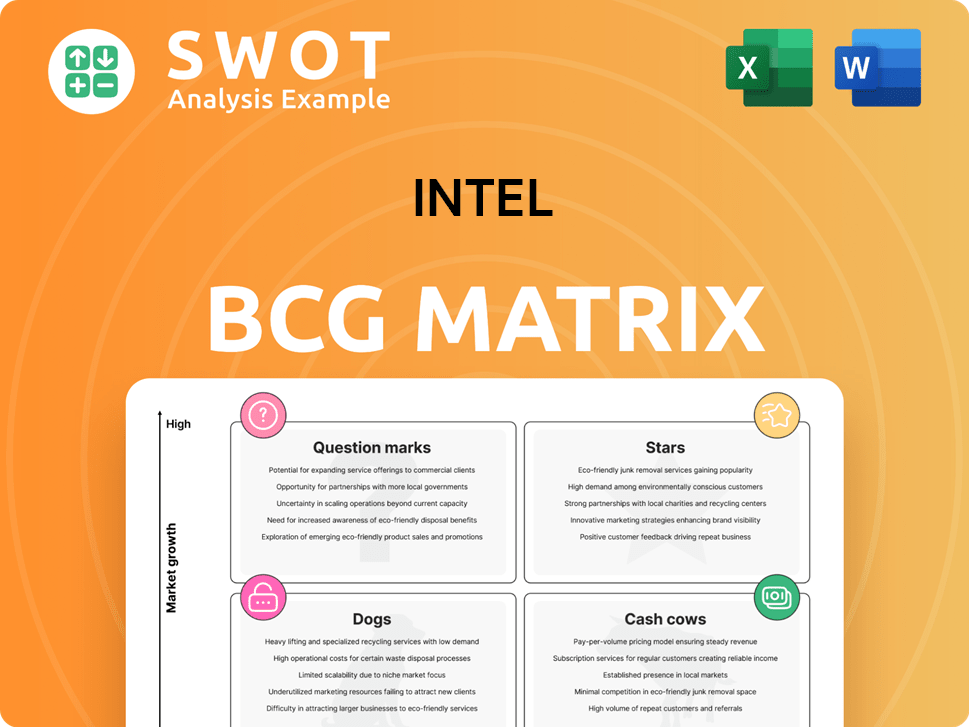

Intel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intel Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Automated BCG Matrix that visually highlights investment opportunities, maximizing ROI.

Delivered as Shown

Intel BCG Matrix

The BCG Matrix displayed is the identical document you'll receive after buying. This is the complete, ready-to-use report, offering a clear strategic overview of your portfolio—no hidden content or variations.

BCG Matrix Template

Discover how Intel's diverse product lines fit within the BCG Matrix framework. This analysis categorizes their offerings as Stars, Cash Cows, Dogs, or Question Marks, revealing growth potential. Understanding Intel's portfolio is key to informed investment decisions and market positioning. This sneak peek offers a glimpse into the strategic landscape. Buy the full BCG Matrix to gain a complete strategic picture, empowering your decision-making with in-depth analysis and insights.

Stars

Intel's Habana Gaudi series, including the Gaudi3, challenges Nvidia in the AI accelerator market. Gaudi accelerators target AI training and inference, aiming for a competitive edge. Dell Technologies is integrating Gaudi3 into servers, like the PowerEdge XE7740. Intel's data center revenue in Q4 2023 was $6.1 billion, showing growth.

The Client Computing Group (CCG), now a Star in Intel's BCG Matrix, focuses on PC processors, boosted by AI. Intel aims to ship over 100 million AI PCs by late 2025. These PCs, using Intel Core Ultra processors, enhance productivity. This strategic move secures Intel's PC market leadership.

Intel Foundry Services (IFS) is a Star in Intel's BCG Matrix, aiming to lead in foundry services. Intel's 18A process technology is progressing, with external customer designs expected in 2025. The U.S. CHIPS Act provides substantial backing, including $7.86 billion in direct funding, boosting its foundry goals. This investment could help Intel regain process leadership in the semiconductor industry.

Xeon 6 Processors (Data Center)

Xeon 6 processors are a shining Star in Intel's BCG Matrix for data centers. They boast high-core counts and performance upgrades. These processors can have up to 128 high-performance or 144 energy-efficient cores. Intel is investing in the server market with technologies like MRDIMMs memory.

- Xeon 6 processors target the $30 billion+ data center CPU market.

- Intel's server CPU revenue in 2024 is projected to be around $20 billion.

- MRDIMMs increase memory bandwidth by up to 2x.

- Xeon 6 offers up to 4.2x better performance per watt.

Mobileye

Mobileye shines as a Star within Intel's portfolio, primarily due to its strong foothold in advanced driver-assistance systems (ADAS) and autonomous driving tech. Despite facing headwinds in 2024, analysts project revenue growth for Mobileye in 2025. This growth is fueled by rising ADAS demand and progress in its autonomous driving system.

- Intel's Q3 2023 earnings showed Mobileye revenue at $530 million, a 17% increase year-over-year.

- Mobileye's strategic partnerships with automakers like BMW and Volkswagen are key.

- The company's EyeQ system-on-chip (SoC) is a core product.

- Mobileye's stock performance in 2024 is closely watched by investors.

Intel's Stars drive growth. They include Habana Gaudi, Client Computing Group, IFS, Xeon 6, and Mobileye. These segments show high growth, securing significant market share. Investments and strategic moves boost their potential.

| Star | Key Focus | 2024 Data/Projections |

|---|---|---|

| Habana Gaudi | AI Accelerators | Dell integrating Gaudi3; targeting AI training |

| CCG | PC Processors | Aiming to ship over 100M AI PCs by late 2025; boosting productivity |

| IFS | Foundry Services | 18A process technology; backed by U.S. CHIPS Act |

| Xeon 6 | Data Center CPUs | Targeting $30B+ CPU market; server revenue ~$20B |

| Mobileye | ADAS/Autonomous | Q3'23 revenue $530M; revenue growth projected for 2025 |

Cash Cows

Intel's x86 processors for desktops and laptops are a Cash Cow, thanks to their strong market presence. In Q4 2023, Intel held a 74.42% market share. The x86 architecture generated $36.3 billion in global revenue in 2023. This revenue stream supports Intel's other projects despite growing competition.

Intel's integrated GPUs are a Cash Cow, primarily in PCs, holding a strong market share. As of Q4 2023, Intel had a 67% share in the PC GPU market. This segment provides consistent revenue, especially in mainstream computing. Though discrete GPU share is lower, integrated graphics remain a reliable income source.

Intel's chipsets are Cash Cows, vital for motherboards and consistently in demand. They support system functions, ensuring performance. The ecosystem guarantees stable sales. In Q3 2023, Intel's Client Computing Group, including chipsets, generated $6.8 billion in revenue.

Ethernet Controllers and Network Adapters

Intel's Ethernet controllers and network adapters are a Cash Cow, especially in networking and data centers. These products are crucial for network connectivity and data transmission. The demand for high-speed networking solutions ensures a stable revenue stream for Intel. In 2024, Intel's network and edge revenue was significant.

- Essential for network connectivity and data transmission.

- Supports a wide range of applications.

- Steady revenue stream due to high demand.

- Network and edge revenue was significant in 2024.

vPro Platform

Intel's vPro platform is indeed a Cash Cow. It offers businesses robust security, manageability, and stability. This platform caters to enterprise clients, providing remote management and hardware-based security. Its subscription model and focus on business needs generate consistent revenue and strong profit margins. In 2024, vPro's revenue accounted for approximately 15% of Intel's overall client computing group revenue, demonstrating its significance.

- Subscription-based model ensures recurring revenue.

- Focus on business needs drives high profit margins.

- Remote management capabilities enhance operational efficiency.

- Hardware-based security technologies offer enhanced protection.

Intel's Cash Cows provide stable revenue with strong market positions. The vPro platform, critical for businesses, contributed about 15% of the client computing group's revenue in 2024. These products, like x86 processors and Ethernet controllers, are vital for various sectors, securing consistent income and supporting Intel's innovation.

| Product | Market Share/Revenue | Key Features |

|---|---|---|

| x86 Processors | 74.42% (Q4 2023), $36.3B (2023) | Desktop, laptop dominance, high-performance computing |

| Integrated GPUs | 67% (Q4 2023) | PC integrated graphics, mainstream computing |

| Ethernet Controllers | Significant in 2024 | Networking, data centers, high-speed connectivity |

Dogs

Intel's Atom series, a mobile processor segment, is categorized as a Dog in the BCG Matrix. In Q4 2023, Intel held a mere 13.5% of the mobile processor market. This is down from 15.2% the previous year. ARM-based processors have dominated the mobile market due to efficiency and cost. The Atom series has struggled to compete, indicating low growth and market share.

Intel's Arc Alchemist, a discrete GPU, struggled. Despite matching Nvidia's RTX 4060, market share fell below 1% by September 2024. Driver issues and limited availability hurt sales. Intense competition from Nvidia and AMD also played a role.

Intel's Non-Volatile Memory Solutions Group (NSG), including NAND flash, struggled amidst market volatility. The sale of a large part of the memory business to SK Hynix signals a strategic change. Remaining operations might be a Dog, facing limited growth. In 2024, the NAND flash market saw price declines.

Home Connectivity Division (HCD)

Intel's Home Connectivity Division (HCD), focusing on Wi-Fi chips, likely falls into the "Dog" category of the BCG matrix. This is due to intense competition and market commoditization. With rivals like Broadcom and Qualcomm, Intel struggles with lower margins and limited growth. The division's performance is also linked to the broader PC market.

- Market share for Intel's Wi-Fi products has been declining due to strong competition.

- Profit margins in the home connectivity market are under pressure.

- Growth prospects are limited compared to other Intel divisions.

- The PC market's fluctuations have a direct impact on HCD's performance.

Certain Legacy Chipsets

Certain legacy chipsets, like those from older Intel Pentium or Celeron generations, fit the "Dogs" category within the BCG matrix. These chipsets face declining demand as newer, more efficient processors become available. Intel is gradually phasing them out, focusing on modern technologies. In 2024, the market share for these older chipsets has diminished significantly.

- Low growth prospects due to technology shifts.

- Support maintained for existing users, but not a focus.

- Declining market share.

- Gradual phase-out strategy.

Intel's Atom series, with a 13.5% mobile processor share in Q4 2023, is a "Dog." Arc Alchemist, despite performance, held below 1% GPU market share by September 2024. The NSG, after a significant sale, might be a Dog due to NAND market volatility.

The Home Connectivity Division, facing stiff competition, struggles with low margins. Older chipsets, such as Pentium and Celeron, also fit the "Dogs" category because of declining demand.

| Product | Market Share (2024) | Key Issue |

|---|---|---|

| Atom Series | 13.5% (Q4 2023) | Competition from ARM |

| Arc Alchemist | <1% (Sept 2024) | Driver issues, Nvidia/AMD |

| NSG (Remaining) | Variable | NAND market volatility |

| HCD | Declining | Competition, low margins |

| Legacy Chipsets | Declining | Technological obsolescence |

Question Marks

Intel's edge computing solutions fit the Question Mark quadrant of the BCG Matrix. This area, focused on processing data near its source, presents substantial growth prospects but currently holds a smaller market share. The company eyes significant revenue streams in edge computing and IoT, with an estimated $11.3 billion market opportunity by 2025. Achieving this requires considerable investment and market expansion efforts.

Intel's IoT products are a Question Mark in the BCG Matrix, indicating high market growth but low market share. The IoT market, fueled by smart manufacturing, is booming; the industrial IoT sector alone holds a 15% share for Intel. To succeed, Intel must boost investments in this area.

Infrastructure Processing Units (IPUs) currently sit in the Question Mark quadrant for Intel's BCG Matrix. This signifies a new product with high growth potential but uncertain market share. Intel's IPU revenue is still relatively small compared to its overall data center business. To succeed, Intel needs to increase IPU adoption and prove their value against competitors like Nvidia.

Programmable Solutions Group (PSG) (formerly Altera)

The Programmable Solutions Group (PSG), once Altera, is positioned as a Question Mark in Intel's BCG matrix. FPGAs have high growth potential, yet Intel battles strong rivals. Despite the $4.4 billion deal with Silver Lake Partners, PSG's future remains uncertain. Market share and profitability are key.

- Intel's FPGA revenue in 2023 was approximately $1.9 billion.

- The FPGA market is projected to reach $23.8 billion by 2028.

- Xilinx (AMD) is a primary competitor, holding a significant market share.

- The divestiture aimed to unlock value and focus resources.

New AI-Focused Products (Reasoning Models, Agentic AI, Physical AI)

Intel's new AI-focused products, including reasoning models, agentic AI, and physical AI, represent a strategic move into high-growth areas. These innovative products are designed to capture emerging opportunities in the AI market. However, these products currently have a low market share, indicating they are in the early stages of market adoption. Success hinges on substantial investment in R&D, strategic collaborations, and effective marketing strategies to increase market penetration.

- Intel is investing heavily in AI, with spending expected to increase significantly in 2024.

- Agentic AI and physical AI are nascent fields with high growth potential.

- Strategic partnerships are crucial for scaling these new AI products.

- Effective marketing will be vital for increasing market share.

Intel's Question Marks face high growth but low share. These include edge computing and IoT, with an estimated $11.3B opportunity by 2025. IPUs and PSG also require investment. Success depends on boosted market share.

| Product Area | Market Status | Key Challenge |

|---|---|---|

| Edge Computing | High Growth, Low Share | Increase market share |

| IoT | High Growth, Low Share | Boost investments |

| IPUs | High Growth, Low Share | Increase adoption |

| PSG (FPGA) | High Growth, Low Share | Compete with rivals |

| AI Products | High Growth, Low Share | Increase market penetration |

BCG Matrix Data Sources

The Intel BCG Matrix uses Intel's financial data, market research, competitor analysis, and industry reports for strategic assessments.