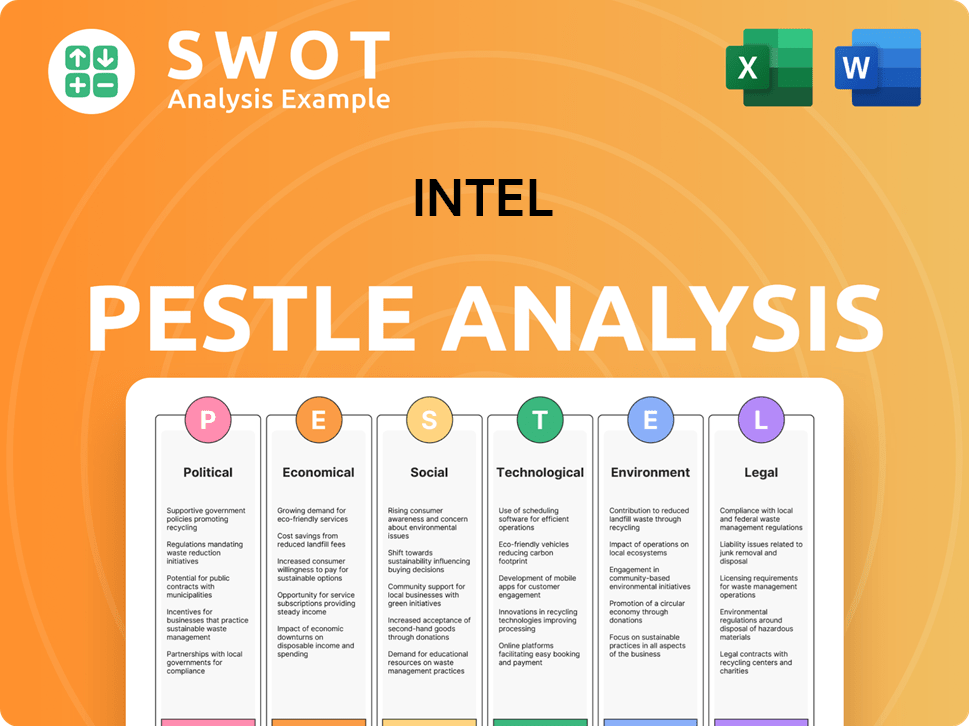

Intel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intel Bundle

What is included in the product

Analyzes how external factors shape Intel across political, economic, social, technological, environmental, and legal aspects.

Helps proactively assess the competitive landscape to support strategic decision-making.

Preview Before You Purchase

Intel PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured.

See a complete PESTLE analysis of Intel, including Political, Economic, Social, Technological, Legal, and Environmental factors.

Each section is thoroughly researched, offering key insights and strategic considerations.

This document is ready to download immediately after purchase.

Enjoy this complete and ready-to-use strategic tool!

PESTLE Analysis Template

Navigate Intel's future with a strategic advantage. This concise PESTLE analysis unveils key external factors impacting the tech giant. Understand political shifts, economic pressures, and technological advancements affecting Intel's path.

We explore social trends, legal hurdles, and environmental concerns relevant to its operations. Our analysis provides a quick yet insightful overview, ideal for those seeking an initial grasp of the situation. Download the full analysis for in-depth intelligence!

Political factors

Governments globally, especially in the US and Europe, are incentivizing domestic semiconductor production. The US CHIPS Act allocates billions, supporting Intel's fab expansions. Intel's investments, such as the $20 billion Ohio plant, directly benefit from these subsidies. This political backing aims to fortify national supply chains and reduce foreign dependency. In 2024, the CHIPS Act is expected to disburse over $10 billion in grants and tax credits.

Ongoing US-China trade tensions significantly affect Intel. Export controls limit advanced tech sales to China, impacting Intel's market access and supply chains. These tensions introduce uncertainty, potentially affecting revenues. In Q1 2024, Intel's revenue from China was $4.6 billion, a decrease from the previous year.

Intel's global presence faces geopolitical risks. Taiwan's potential conflicts or instability in Israel could disrupt supply chains. This impacts operations and financial performance. In 2024, geopolitical events caused a 5% rise in supply chain costs for tech firms.

Intergovernmental Action Against Monopolies

Governments worldwide are increasing scrutiny of tech monopolies. This affects Intel, potentially opening new markets through increased competition. However, it also presents risks if Intel faces antitrust actions. The U.S. Federal Trade Commission and Department of Justice are actively investigating tech giants. Antitrust fines can be substantial; for example, Google faced a $2.4 billion fine from the European Commission in 2017.

- Antitrust scrutiny can lead to market fragmentation.

- Intel could face pressure to divest assets or change business practices.

- Regulatory changes can impact Intel's pricing and market strategies.

- Increased competition can create both challenges and opportunities.

Government Support for Globalization and Protectionism

Government stances on globalization and protectionism significantly affect Intel. Support for globalization can boost market expansion, as seen with a 7% increase in global semiconductor sales in 2024. However, rising protectionism, like tariffs on imported chips, poses risks. These policies can disrupt supply chains and increase operational costs. Intel needs to navigate these conflicting political landscapes strategically.

- Global semiconductor sales reached $573.5 billion in 2024.

- The U.S. government has allocated billions for domestic chip manufacturing.

- Protectionist measures can limit market access.

Political factors significantly shape Intel's trajectory. Government subsidies like the US CHIPS Act, offering over $10 billion in 2024, fuel Intel's growth. However, US-China trade tensions and geopolitical risks in regions like Taiwan impact market access and supply chains. Antitrust scrutiny adds another layer, potentially reshaping market strategies.

| Political Factor | Impact on Intel | 2024/2025 Data Point |

|---|---|---|

| Subsidies/Incentives | Boosts investment/growth | CHIPS Act: $10B+ in grants/credits |

| Trade Tensions | Limits market access | China revenue Q1 2024: $4.6B (decline) |

| Geopolitical Risks | Disrupts supply chains | Supply chain cost increase 2024: 5% |

Economic factors

Intel's revenue is closely tied to global economic health. Economic downturns, like the projected 2.9% global GDP growth in 2024, can decrease demand for its products. Uncertainty makes financial planning harder for Intel. For instance, the semiconductor market saw a 10% revenue drop in 2023, impacting Intel's sales.

Intel battles tough rivals like AMD and Nvidia across PCs, servers, and AI markets. This fierce competition squeezes Intel's market share; for example, AMD's server CPU share hit about 20-30% in 2024. Heavy R&D spending is vital to stay ahead. Intel's R&D expenses were around $17 billion in 2023, reflecting the need to innovate.

Intel's substantial R&D spending, exceeding $17 billion in 2024, is pivotal for innovation. These investments, vital for future products, affect short-term profitability. The success of these R&D efforts in creating competitive products is essential for Intel's market position. R&D spending is expected to stay high in 2025.

Capital Expenditures and Investment in Manufacturing

Expanding and upgrading manufacturing facilities demands considerable capital expenditures. Intel's substantial investments in new fabs are supported by government incentives. These investments are vital for future capacity and technological progress. The company's financial outlay is significant. Intel plans to invest up to $100 billion in the U.S. for chip manufacturing.

- Intel's capital expenditures directly impact its financial performance.

- Government incentives, like those from the CHIPS Act, help offset costs.

- Investments are crucial for remaining competitive in the semiconductor market.

- These expenditures influence Intel's long-term growth prospects.

Supply Chain Disruptions and Costs

Intel's intricate global supply chain faces risks from disruptions, delays, and raw material shortages. These challenges can elevate production costs and influence product availability, affecting Intel's capacity to meet demand. This, in turn, may impact revenue and profitability, especially with the ongoing geopolitical tensions. For example, in 2024, the semiconductor industry saw a 10% increase in material costs due to supply chain issues.

- Raw material shortages can lead to production bottlenecks.

- Geopolitical events can exacerbate supply chain vulnerabilities.

- Increased production costs can reduce profit margins.

- Product availability issues can affect sales.

Economic conditions significantly affect Intel's revenue. Global GDP growth, forecast at 2.9% in 2024, impacts product demand and financial planning. The semiconductor market faced a 10% revenue drop in 2023. High R&D spending, around $17 billion in 2023, also shapes its economic profile.

| Economic Factor | Impact on Intel | 2023/2024 Data |

|---|---|---|

| Global GDP Growth | Influences product demand | 2024 forecast: 2.9% |

| Semiconductor Market Revenue | Affects Intel's sales | 2023 drop: 10% |

| R&D Spending | Impacts profitability and innovation | $17B in 2023 |

Sociological factors

The demand for AI-enabled products is surging across industries. This includes personal computing and data centers, creating opportunities for Intel. In 2024, the AI chip market is projected to reach $194.9 billion. Intel must innovate to meet this demand.

Consumer and business tech needs are always changing. They want personalized, connected, and efficient devices. In Q1 2024, global smartphone shipments reached 289.4 million units. Intel must adapt to stay relevant. The demand for AI-powered PCs is also growing, with sales expected to reach $50 billion by 2025.

The semiconductor industry faces talent shortages, particularly in manufacturing and R&D, which can hinder operations. In 2024, the US semiconductor industry employed over 280,000 people, with significant demand for specialized skills. These shortages can impact Intel's expansion and innovation. Addressing these challenges requires strategic workforce development and competitive compensation.

Remote Work and its Impact on PC Demand

The rise of remote and hybrid work models significantly impacts PC demand. This shift influences where and how people use computing devices, affecting Intel's market. A 2024 report showed that approximately 30% of the workforce is remote or hybrid. This trend drives demand for laptops and home office setups. Intel must adapt its product strategies to meet this evolving demand effectively.

- Remote work increases demand for home PCs and laptops.

- Hybrid models require versatile computing solutions.

- Intel must innovate to meet these changing needs.

Public Perception and Brand Image

Intel's brand image significantly impacts consumer trust and purchasing decisions. A strong reputation, built on technological innovation and product reliability, is vital for market success. Maintaining a positive public perception involves consistent quality and ethical corporate practices. In 2024, Intel's brand value was estimated at $45.7 billion. Positive perception drives customer loyalty and supports premium pricing strategies.

- Intel's brand value in 2024 was $45.7 billion.

- Customer trust is crucial for maintaining market share.

- Corporate responsibility enhances brand perception.

Societal shifts like remote work boost PC demand, crucial for Intel's strategy. Talent shortages in the semiconductor sector impact innovation and expansion, potentially limiting Intel. Strong brand perception, valued at $45.7 billion in 2024, influences customer trust.

| Factor | Impact on Intel | Data (2024/2025) |

|---|---|---|

| Remote Work | Increases PC & laptop demand | 30% workforce remote/hybrid |

| Talent Shortages | Hinders manufacturing & R&D | US Semiconductor employment >280K |

| Brand Perception | Impacts Customer Trust | Intel Brand Value $45.7B (2024) |

Technological factors

Intel's core hinges on semiconductor advancements. Transitioning to smaller nodes (3nm, 18A) boosts performance and efficiency. Delays in these transitions directly impact product timelines. In Q1 2024, Intel's advanced packaging revenue grew, indicating progress. However, challenges remain, as seen in past node transitions. The 18A process is crucial for future competitiveness.

The need for AI and high-performance computing fuels tech advancement. Intel competes fiercely, needing AI accelerators and data center processors to stay ahead. In Q1 2024, Intel's Data Center and AI group revenue was $8.4 billion. This area's growth is vital for Intel's future.

Intel's success hinges on its product roadmap, which includes new CPU and GPU architectures. Timely delivery of competitive products is crucial. In Q4 2024, Intel's revenue was $15.4 billion, reflecting market demand. Delays in product releases can impact market share.

Rise of Edge Computing and IoT

The rise of edge computing and IoT offers significant tech opportunities for Intel. These technologies demand specialized hardware and software solutions. The global edge computing market is projected to reach $250.6 billion by 2024. Developing optimized products for distributed environments is key. Intel can capture new market segments by focusing on these advancements.

- Edge computing market expected to reach $250.6B by 2024.

- IoT devices are increasing rapidly, creating demand for Intel's solutions.

- Intel's investments in AI and 5G are crucial for edge computing.

Security Vulnerabilities and Cybersecurity Threats

Intel, as a major processor provider, constantly battles security vulnerabilities and cyber threats. They must use secure design and timely updates to keep customer trust and protect their name. In 2024, the global cybersecurity market is valued at $217.9 billion, expected to reach $345.7 billion by 2028. This growth shows the importance of Intel's security efforts.

- 2024 Global Cybersecurity Market: $217.9 Billion.

- Projected 2028 Cybersecurity Market: $345.7 Billion.

- Intel's focus on security is crucial for market share.

Technological factors shape Intel's strategic landscape, driven by semiconductor advances and process node transitions. AI and high-performance computing drive Intel's focus, vital for its competitiveness; In Q1 2024, Intel's Data Center and AI group brought in $8.4 billion. Furthermore, the rise of edge computing and IoT opens new opportunities. However, cyber threats also pose major security concerns.

| Technology Focus | Market Data (2024) | Impact on Intel |

|---|---|---|

| Edge Computing | $250.6B market size | Expands market via specialized hardware and software. |

| AI & Data Centers | Q1 Data Center/AI revenue: $8.4B | Fuels innovation in AI accelerators and processors. |

| Cybersecurity | $217.9B market size | Demand for robust security, requiring continuous updates. |

Legal factors

Intel's extensive global patent portfolio is vital for safeguarding its innovations. The company actively defends its intellectual property through legal action. In 2024, Intel spent approximately $1.2 billion on R&D legal matters. Legal battles involving IP and market dominance can strain resources and influence financial outcomes. 2024 saw Intel facing several IP-related lawsuits.

Intel has encountered antitrust scrutiny globally, impacting its market strategies. In 2024, the EU fined Intel €1.06 billion for anticompetitive behavior. Such legal battles can lead to significant financial penalties. Furthermore, they may necessitate alterations in Intel's business practices to ensure compliance with competition laws. These challenges highlight the importance of navigating complex legal landscapes.

Intel's global footprint necessitates strict adherence to international technology trade regulations. This includes navigating export controls and import restrictions across various countries. In 2024, Intel faced challenges from U.S. export controls on advanced chips to China, impacting sales. Compliance costs, including legal and operational adjustments, are significant, potentially affecting profit margins. A recent report showed that in Q1 2024, Intel's revenue was $12.7 billion, with international sales contributing a substantial portion, making compliance critical.

Data Privacy and Cybersecurity Regulations

Intel faces increasing legal scrutiny regarding data privacy and cybersecurity. Compliance with global regulations like GDPR and CCPA is crucial. Data protection investments are ongoing legal necessities. Breaches can lead to substantial fines and reputational damage, impacting financial performance. Intel's cybersecurity budget for 2024 reached $1.5 billion.

- GDPR and CCPA compliance require continuous efforts.

- Cybersecurity breaches can result in significant financial penalties.

- Reputational damage affects investor confidence.

- Intel's cybersecurity spending is a significant operational cost.

Environmental, Health, and Safety Regulations

Intel's manufacturing faces stringent environmental, health, and safety regulations. These regulations, varying by country, necessitate significant and continuous investments. Compliance is crucial, demanding constant monitoring and adaptation to evolving standards. Intel's commitment to sustainability includes reducing emissions and waste. This commitment is reflected in its environmental reporting.

- In 2023, Intel reported spending $1.5 billion on environmental protection.

- Intel aims to achieve net-positive water use by 2030.

- Intel's 2023 greenhouse gas emissions were 2.8 million metric tons CO2e.

Intel's legal environment involves defending its patents and facing antitrust scrutiny. In 2024, Intel spent $1.2 billion on R&D legal matters. Global trade regulations and data privacy also create complex challenges and financial burdens. 2024 saw $1.5 billion spent on cybersecurity.

| Legal Area | Challenges | Financial Impact (2024) |

|---|---|---|

| Intellectual Property | Lawsuits, Patent Defense | $1.2B R&D legal spend |

| Antitrust | Fines, Compliance Changes | EU Fine: €1.06B |

| Data Privacy/Cybersecurity | Breaches, Compliance Costs | $1.5B Cybersecurity Budget |

Environmental factors

Intel is committed to reducing its environmental impact. The company targets net-zero greenhouse gas emissions by 2040. This includes initiatives like boosting energy efficiency and using renewable energy sources. In 2023, Intel's Scope 1 and 2 emissions were 1.2 million metric tons of CO2e.

Semiconductor manufacturing, like Intel's operations, is notably water-intensive. Intel actively addresses this through ambitious water conservation goals. The company is aiming for net positive water use, which means restoring more water than it uses. A key strategy involves the implementation of advanced water recycling systems across its facilities. In 2023, Intel restored 100% of the water it used in its U.S. facilities.

Intel's semiconductor manufacturing heavily relies on chemicals. The company actively explores safer alternatives. In 2024, Intel invested $50 million in sustainable chemical research. This aims to reduce health and environmental impacts. They collaborate with suppliers and industry peers, targeting a 20% reduction in hazardous chemical use by 2025.

Waste Management and Recycling

Intel is actively managing its environmental footprint by focusing on waste reduction and recycling. The company aims to minimize waste from its manufacturing processes and increase recycling rates across its operations. A key initiative involves recycling construction waste, contributing to a circular economy approach. Intel is also striving towards a zero-waste-to-landfill goal.

- In 2023, Intel recycled over 80% of its total waste.

- Intel's recycling programs include e-waste recycling, with over 90% of e-waste recycled.

- The company invested $100 million in sustainable projects in 2024.

Energy Efficiency of Products and Operations

Intel focuses on energy efficiency in its manufacturing and products to lower its environmental impact and costs. In 2023, Intel reduced its Scope 1 and 2 emissions by 20% compared to 2020, reflecting its commitment to sustainability. This includes upgrades to facilities and designing more energy-efficient chips. These efforts align with global trends towards greener technology and are crucial for long-term business viability.

- Reduced Scope 1 & 2 emissions by 20% (2023 vs. 2020).

- Energy-efficient chip designs.

- Facility upgrades for sustainability.

Intel's environmental strategy emphasizes emissions reduction. They aim for net-zero emissions by 2040, with 1.2 million metric tons of CO2e in Scope 1 & 2 emissions in 2023. Water conservation is also crucial, targeting net positive water use, with 100% of US facility water restored in 2023.

| Environmental Factor | Details | 2024/2025 Data |

|---|---|---|

| Emissions | Reducing greenhouse gases. | $50M invested in sustainable chemical research, aiming for 20% reduction in hazardous chemical use by 2025. |

| Water Usage | Focus on water conservation and recycling. | Aiming for net positive water use globally. |

| Waste Management | Waste reduction and recycling programs. | Over 80% total waste recycled in 2023. |

PESTLE Analysis Data Sources

This Intel PESTLE relies on market reports, tech journals, and economic databases for relevant data. We also include regulatory updates and government publications.