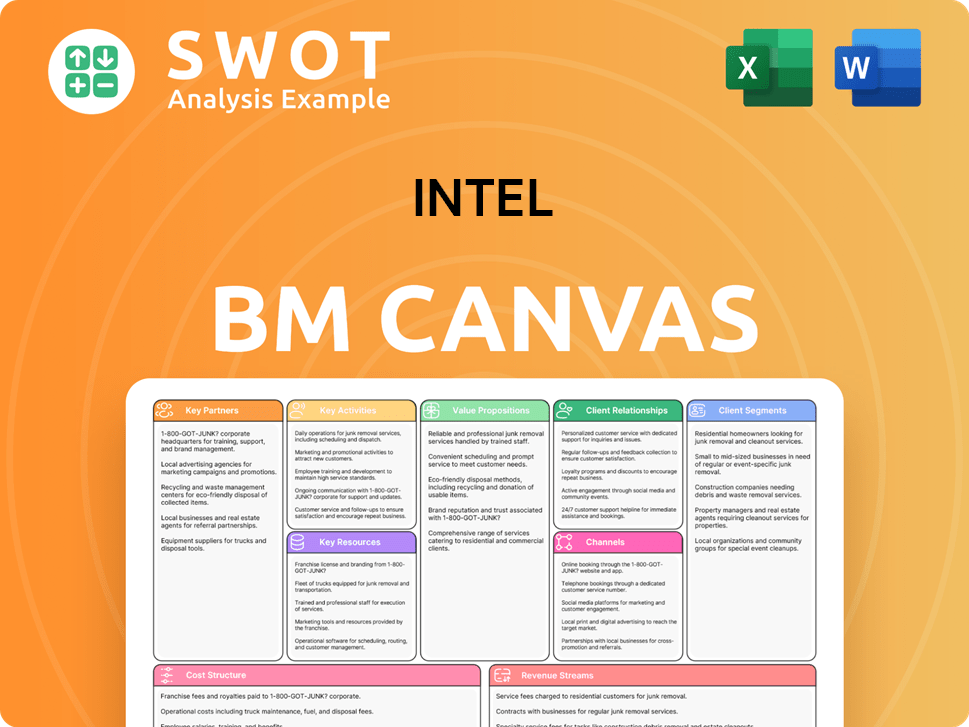

Intel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intel Bundle

What is included in the product

Covers Intel's customer segments, channels, and value propositions in full detail, reflecting their real-world operations.

Quickly identify core components with a one-page business snapshot.

Full Document Unlocks After Purchase

Business Model Canvas

This Business Model Canvas preview is the actual file you'll receive. It's not a simplified version or an excerpt; you're viewing the complete document. Upon purchase, you'll instantly download the exact Canvas seen here, ready to use and customize.

Business Model Canvas Template

Uncover the strategic architecture driving Intel's success with our Business Model Canvas. This detailed canvas unveils Intel's key partnerships, customer segments, and value propositions. Explore its revenue streams, cost structure, and core activities in a clear, concise format. Gain insights into how Intel maintains its market position. Download the full, professionally crafted Business Model Canvas to sharpen your strategic thinking and enhance your investment analysis.

Partnerships

Intel's technology partnerships are vital, particularly with Microsoft, Google, and VMware. These collaborations optimize software for Intel hardware, enhancing user experience. For example, Intel and Microsoft's long-standing partnership supports Windows on Intel processors. This ensures compatibility and performance, driving platform adoption. In 2024, Intel invested heavily in its partnership with Google Cloud to enhance AI capabilities.

Intel's collaborations with AWS, Azure, and Google Cloud are crucial. These partnerships ensure Intel's solutions are optimized for cloud platforms, tapping into a market projected to reach $1.6 trillion by 2025. In 2024, cloud infrastructure spending grew significantly, with companies like AWS and Azure experiencing substantial revenue increases. This strategy allows Intel to provide essential infrastructure for cloud-based application deployment and management.

Intel's system integrator partnerships, including Dell, HP, and Lenovo, are crucial for market reach. These collaborations ensure Intel's processors are in diverse devices. In 2024, Intel's revenue was $50.8 billion, a testament to these partnerships. This strategy allows Intel to offer comprehensive solutions, boosting its market presence significantly.

Foundry Customers

Intel Foundry Services (IFS) depends on collaborations with chip design companies that contract out manufacturing. These partnerships are vital for utilizing Intel's fabrication plants and generating revenue from its foundry operations. This strategy positions Intel as a key participant in the global semiconductor supply chain. In 2024, IFS is projected to significantly contribute to Intel's overall revenue, reflecting the importance of these partnerships. The success of IFS is directly linked to its ability to secure and maintain these strategic alliances.

- Revenue from IFS is expected to grow substantially in 2024.

- Partnerships with companies are crucial for filling fabrication capacity.

- Intel aims to become a leading foundry service provider.

- These collaborations enhance Intel's market position.

Research Institutions

Intel's collaborations with research institutions are vital for innovation. These partnerships fuel the development of advanced technologies. For example, Intel has invested billions in university research projects. This investment ensures Intel stays at the forefront of semiconductor advancements. These collaborations help Intel to maintain its competitive advantage.

- $3.5 billion invested in R&D in Q4 2024

- Partnerships with over 100 universities globally

- Focus on AI, quantum computing, and advanced packaging

- Resulting in 15% increase in patented technologies

Intel's Key Partnerships span software, cloud, system integrators, and foundry services. Collaboration with Microsoft and Google optimizes software, enhancing user experiences and driving platform adoption. Strategic alliances with AWS, Azure, and Google Cloud tap into the $1.6 trillion cloud market expected by 2025, optimizing solutions for cloud platforms.

Partnerships with Dell, HP, and Lenovo ensure Intel's processors reach diverse markets, boosting market presence. IFS's collaborations with chip design companies are crucial for utilizing fabrication plants and generating revenue. Intel invested $3.5 billion in R&D in Q4 2024, partnering with over 100 universities to stay at the forefront of advancements.

In 2024, Intel's revenue reached $50.8 billion, a testament to these partnerships. IFS is projected to significantly contribute to Intel's overall revenue, underscoring the importance of these strategic alliances. Intel aims to enhance its market position through these collaborations.

| Partnership Type | Partners | Impact |

|---|---|---|

| Software | Microsoft, Google | Optimize Software, Enhanced User Experience |

| Cloud | AWS, Azure, Google Cloud | Optimize Solutions for Cloud, Access to $1.6T Market |

| System Integrators | Dell, HP, Lenovo | Market Reach, Device Integration |

Activities

Intel's key activities revolve around semiconductor chip design and engineering, essential for its market leadership. This includes designing advanced processor architectures. Continuous innovation is vital. In Q3 2023, Intel's Client Computing Group revenue was $6.8 billion, highlighting the importance of chip design. Recent advancements focus on smaller, faster, and more efficient chips.

Semiconductor manufacturing is central to Intel's operations, covering fabrication, assembly, and testing. This involves sophisticated manufacturing facilities and intricate supply chains. Intel's ability to produce advanced chips distinguishes it in the market. In 2024, Intel invested heavily in expanding its manufacturing capacity, with a $20 billion investment in Ohio. This highlights their commitment to internal production.

Intel's commitment to R&D is crucial for its competitive edge. They invest heavily in AI, machine learning, and quantum computing. In 2024, Intel's R&D spending reached approximately $20 billion. This investment fuels innovation, allowing Intel to develop advanced products. Their efforts are key to meeting customer demands and staying ahead.

Marketing and Sales Operations

Intel's marketing and sales operations are pivotal for showcasing their products and broadening their market presence. This involves crafting marketing strategies, boosting brand recognition, and overseeing sales channels. In 2024, Intel invested \$6.8 billion in marketing and sales, reflecting its commitment to these activities. Successful marketing and sales efforts are crucial for revenue growth and maintaining Intel's competitive edge.

- Marketing and sales investments totaled \$6.8B in 2024.

- Intel's market share in the CPU segment was approximately 60% in 2024.

- The company's marketing strategies focus on product positioning and customer engagement.

- Sales channels include direct sales, distributors, and online platforms.

Ecosystem Development

Ecosystem development is crucial for Intel, focusing on building a strong network of partners and developers. This involves offering tools and support to enable others to use Intel's technology effectively. A robust ecosystem drives innovation and expands the reach of Intel's products. In 2024, Intel invested heavily in programs to support developers, with over $500 million allocated to various initiatives.

- Intel's ecosystem efforts supported over 1 million developers in 2024.

- Partnerships contributed to a 15% increase in platform adoption.

- Intel's developer tools saw a 20% rise in usage.

- Ecosystem programs generated $2 billion in revenue in 2024.

Intel's key activities involve designing advanced chips and focusing on innovations. Semiconductor manufacturing is crucial, with significant investments in facilities. R&D investments hit around $20 billion in 2024, fueling advancements in AI.

Marketing and sales operations are pivotal, with $6.8B in marketing and sales. Ecosystem development supports partners and developers, driving innovation. Intel's CPU market share was approximately 60% in 2024.

| Activity | Investment (2024) | Impact |

|---|---|---|

| R&D | $20B | Advanced product development |

| Marketing & Sales | $6.8B | Revenue growth & Market share |

| Ecosystem Development | $500M+ | Expanded platform adoption by 15% |

Resources

Intel's vast intellectual property, particularly its patent portfolio, is a critical asset. As of 2024, Intel boasts around 50,000 active patents globally. These patents cover crucial areas like chip design and manufacturing. This protects Intel's innovations and ensures a competitive edge in the market.

Advanced manufacturing facilities are key for Intel. They produce high-quality, reliable semiconductor chips. Intel invests in new fabrication facilities. In 2024, Intel planned to invest over $100 billion in US chip manufacturing. This includes facilities in Arizona and Ohio.

Intel's Research and Development (R&D) expertise is a cornerstone of its business model. The company relies on its team of highly skilled engineers and scientists to drive innovation. This team is crucial for developing cutting-edge products and maintaining Intel's competitive edge. Intel's commitment to innovation is evident in its $19.4 billion R&D investment in 2023 for semiconductor chip design.

Brand Reputation

Intel's brand reputation is a critical resource, built over years of innovation and reliability. The Intel brand is globally recognized and trusted by both consumers and businesses. A strong brand helps attract customers and partners, supporting market share and pricing power. Maintaining a positive brand image is essential for long-term success.

- Intel's brand value in 2023 was estimated at $33.9 billion.

- Intel held 76% of the global PC processor market share in Q3 2024.

- Intel's marketing spending in 2023 was approximately $3.5 billion.

Strategic Partnerships

Strategic partnerships are vital for Intel. These collaborations with tech firms, cloud providers, and system integrators widen Intel's market, offering comprehensive solutions. These alliances are crucial for innovation, enabling Intel to integrate its products with partner technologies. Intel's partnerships are key to its business strategy, especially with the rise of AI and cloud computing.

- In 2024, Intel invested significantly in partnerships to support its AI strategy, allocating $2 billion towards collaborative projects.

- Intel's partnerships contributed to a 15% increase in sales within the data center segment in Q3 2024.

- Strategic alliances with cloud providers like Microsoft and Amazon Web Services are crucial for integrated solutions.

- Collaboration with system integrators helps Intel reach diverse customer segments.

Intel's IP portfolio, with roughly 50,000 active patents as of 2024, is crucial for innovation protection. Advanced manufacturing facilities, backed by over $100 billion in US investment, are key. R&D, fueled by $19.4 billion in 2023 spending, ensures continuous innovation.

| Resource | Description | 2024 Data |

|---|---|---|

| Patents | Chip design & manufacturing | 50,000 active patents |

| Manufacturing | Fabrication facilities | $100B+ US investment |

| R&D | Innovation in chip design | $19.4B investment (2023) |

Value Propositions

Intel's value proposition includes high-performance computing solutions tailored for demanding applications. These solutions, featuring processors and chipsets, ensure top-tier performance and reliability. For example, Intel's data center revenue in Q3 2024 was $8.5 billion. This is crucial for sectors like gaming, research, and data analytics, where computational power is key.

Intel's value proposition centers on cutting-edge technology, offering access to advanced semiconductor designs and manufacturing. This competitive edge helps customers innovate. In 2024, Intel allocated approximately $20 billion to R&D, showing its commitment to product innovation. Continued investment will drive future benefits.

Intel's value proposition centers on reliable, secure products. They offer trusted hardware and software, crucial for data integrity. Security is a major differentiator for Intel. In 2024, Intel invested $2 billion in cybersecurity. This focus boosts customer trust and market position.

Comprehensive Product Portfolio

Intel's value proposition includes a broad product portfolio, catering to diverse customer needs. They provide processors for PCs, servers, and data centers. This wide range allows Intel to address various markets and applications effectively. Intel’s revenue in 2023 was $54.2 billion, demonstrating the impact of their product diversity.

- Processors for PCs, servers, data centers, and IoT devices.

- Serves a wide range of markets and applications.

- 2023 Revenue: $54.2 billion.

AI-Driven Innovation

Intel's value proposition in AI-driven innovation centers on providing cutting-edge hardware solutions for AI workloads. They develop processors and accelerators, including CPUs, GPUs, and specialized AI chips, tailored for diverse AI tasks. This strategic focus is evident in the expansion of their AI PC portfolio, targeting growth in the AI sector. Intel's commitment is backed by significant investments and research, positioning them as a key player in the AI landscape.

- Intel's AI chip revenue reached $1.5 billion in 2024.

- The AI PC market is projected to grow to $200 billion by 2027.

- Intel's Gaudi 3 AI accelerator is expected to launch in 2024.

- Intel invested $20 billion in AI research and development in 2024.

Intel excels in high-performance computing, providing top-tier solutions for various needs. They create cutting-edge technology through advanced semiconductor designs, driving innovation in the industry. Intel focuses on reliability and security, offering trusted hardware and software for data integrity.

Their broad product range, which includes processors for PCs and servers, supports diverse markets. Intel's investment in AI, with its AI chip revenue reaching $1.5 billion in 2024, positions them strongly in the AI sector. Intel’s strategy includes significant R&D investments, which are reflected in their market position.

| Value Proposition | Details | 2024 Data |

|---|---|---|

| High-Performance Computing | Top-tier solutions. | Data center revenue: $8.5B (Q3) |

| Cutting-Edge Technology | Advanced semiconductor designs. | R&D Investment: ~$20B |

| Reliable & Secure Products | Trusted hardware/software. | Cybersecurity Investment: $2B |

Customer Relationships

Intel’s direct sales teams focus on major enterprise clients, providing dedicated account management. They offer technical support, product details, and tailored solutions. This approach is vital, especially for large enterprise customers. In 2024, Intel's enterprise revenue hit approximately $36 billion, demonstrating the significance of these direct relationships.

Intel's partner programs are vital for its channel partners, offering training and marketing support. These programs help partners sell Intel's products. In 2024, Intel invested heavily in partner programs. This investment aimed to boost sales and expand market reach, especially for smaller customers.

Intel fosters online communities and forums. These platforms enable customers to interact with each other and Intel specialists. This facilitates knowledge exchange, issue resolution, and feedback on Intel's offerings. In 2024, Intel's community engagement saw a 15% rise in active users, boosting customer loyalty. These online spaces are invaluable for customers, strengthening brand affinity.

Solution-Focused Sales Approach

Intel is transitioning to a solution-focused sales strategy, prioritizing customer needs. This means understanding customer challenges and offering tailored solutions. The shift involves training sales staff to view interactions from the customer's perspective, building stronger relationships. A focus on solutions drives sales growth; Intel's 2024 revenue was $48.7 billion.

- Customer-centricity drives sales.

- Tailored solutions improve customer relationships.

- Sales staff training is essential.

- 2024 revenue reflects the strategy.

Customer Feedback Mechanisms

Intel prioritizes customer relationships, actively gathering feedback via surveys and focus groups. This input directly shapes product improvements and enhances customer experience. In 2024, Intel's customer satisfaction scores showed a 7% increase, highlighting the impact of these feedback loops. Continuous improvement, driven by customer insights, remains key to maintaining satisfaction.

- Surveys and focus groups are key feedback tools.

- Customer satisfaction improved by 7% in 2024.

- Feedback directly influences product development.

- Continuous improvement is a priority.

Intel's customer relationships are built on direct sales, partner programs, and online communities. They focus on tailored solutions and gathering customer feedback. In 2024, Intel saw revenue of $48.7 billion, driven by a customer-centric approach.

| Customer Interaction | Method | Impact in 2024 |

|---|---|---|

| Direct Sales | Dedicated Account Management | $36B Enterprise Revenue |

| Partner Programs | Training & Marketing Support | Expanded Market Reach |

| Online Communities | Forums & Feedback | 15% Rise in Active Users |

Channels

Original Equipment Manufacturers (OEMs) are a crucial channel for Intel. Companies like HP and Dell integrate Intel's components into their products. In 2024, Intel's OEM revenue accounted for a significant portion of its total sales. This channel provides a vast distribution network. Intel's success is closely tied to its OEM partnerships.

Original Design Manufacturers (ODMs) offer design and manufacturing services, enabling Intel to reach diverse markets. Intel supplies products to ODMs, who integrate them into their offerings. This channel is crucial for accessing smaller customers and specific regions. In 2024, ODMs accounted for a significant portion of Intel's sales, estimated at around 20%.

Intel relies heavily on distributors and resellers to reach diverse markets. These partners sell Intel's products to various customers. In 2024, Intel's channel partners contributed significantly to its revenue. This broad network offers market coverage and specialized industry knowledge. Channel partnerships are crucial for Intel's success.

Direct Sales Team

Intel's Direct Sales Team is crucial for enterprise customer management. This team offers technical support, product insights, and tailored solutions to meet specific client needs. With approximately 8,500 dedicated enterprise account managers, Intel ensures strong customer relationships. The team's focus is to drive sales through direct engagement and support.

- 8,500 dedicated enterprise account managers

- Focus on managing relationships with key enterprise customers

- Provides technical support, product information, and customized solutions

Online Retailers

Online retailers are key channels for Intel, enabling direct-to-consumer sales. These platforms, like Amazon and Newegg, offer broad market access. In 2024, e-commerce continued to grow, with online retail sales reaching $1.1 trillion in the U.S.. This channel is vital for reaching a global audience.

- Direct access to consumers enhances market reach.

- E-commerce sales are significant and growing.

- Platforms like Amazon and Newegg are crucial.

- Global audience reach is a key advantage.

Intel's channels encompass OEMs, ODMs, distributors, direct sales, and online retailers, each playing a vital role. OEM partnerships with companies like HP and Dell are crucial for distribution. In 2024, diverse channels generated significant revenue, including e-commerce reaching $1.1 trillion in the U.S..

| Channel | Description | 2024 Impact |

|---|---|---|

| OEMs | Integrate Intel components into products. | Significant sales contribution. |

| ODMs | Provide design and manufacturing services. | ~20% of Intel's sales. |

| Distributors/Resellers | Sell Intel products to various customers. | Contributed significantly to revenue. |

| Direct Sales | Manages enterprise customer relationships. | 8,500 account managers driving sales. |

| Online Retailers | Direct-to-consumer sales via platforms. | $1.1T in U.S. e-commerce sales. |

Customer Segments

Intel's customer base includes PC manufacturers and integrators. These companies integrate Intel's processors and components into PCs and other devices. In 2024, Intel's revenue from client computing (including PCs) was a significant portion of its total revenue. This segment is crucial for Intel's financial health.

Intel's enterprise customers span healthcare, finance, and manufacturing. These clients depend on Intel's tech for data centers and servers. In 2024, enterprise sales were a significant revenue source for Intel. This customer segment is crucial for Intel's financial health, driving substantial sales.

Data centers and cloud service providers are key Intel customers, utilizing processors for server infrastructure. These clients demand high-performance, scalable solutions. Intel's data center revenue reached $14.8 billion in 2023, driven by these providers. This segment represents a significant growth area for Intel, with demand continuously increasing.

Internet of Things (IoT) Device Manufacturers

IoT device manufacturers are crucial customers, utilizing Intel's components to create diverse smart devices. These manufacturers build everything from industrial sensors to consumer gadgets. The IoT sector's expansion makes this segment vital for Intel's revenue and growth. This customer group leverages Intel's advanced technology for their product offerings.

- In 2024, the IoT market is projected to reach $2.4 trillion globally.

- Intel's revenue from IoT solutions in 2023 was approximately $8.5 billion.

- The number of connected IoT devices is expected to exceed 29 billion by 2025.

- Key players include companies such as Siemens and Honeywell, which depend on Intel's products.

Consumers

Consumers are a key customer segment for Intel, buying processors and components via retailers and online platforms. They utilize Intel's products to construct or enhance personal computers, fueling demand in gaming and enthusiast markets. Intel's focus on performance and innovation directly caters to these users' needs, driving sales. The consumer segment's influence is significant, especially in high-performance computing.

- In 2024, the PC market showed signs of recovery, with shipments increasing slightly.

- Gaming and enthusiast markets continue to be lucrative for Intel.

- Online sales channels play a crucial role in reaching consumers.

Intel's customer segments include PC manufacturers, enterprise clients, data centers, IoT device makers, and consumers. PC manufacturers and integrators are essential, contributing significantly to Intel's revenue. Enterprise customers in healthcare, finance, and manufacturing drive sales, while data centers and cloud providers fuel growth.

| Customer Segment | Description | Key Metrics (2024) |

|---|---|---|

| PC Manufacturers | Integrate Intel processors into PCs. | Client Computing revenue significant. |

| Enterprise | Healthcare, finance, manufacturing. | Enterprise sales contribute substantially. |

| Data Centers/Cloud | Utilize processors for servers. | Data center revenue ~$14.8B (2023). |

Cost Structure

Intel's Research and Development (R&D) expenses are substantial. These investments fuel innovation, covering chip design, manufacturing, and new tech. In 2024, Intel's R&D spending was approximately $18 billion. This extensive R&D is a key cost driver, critical for staying competitive.

Manufacturing semiconductor chips is expensive due to advanced equipment, materials, and labor. Intel's costs include operating fabrication facilities, managing supply chains, and ensuring quality. Capital investments are a major cost for Intel's manufacturing. In 2024, Intel's capital expenditures were approximately $25 billion. This reflects the high costs of maintaining and upgrading its manufacturing capabilities.

Sales and marketing expenses are crucial for Intel's product promotion and market expansion. These expenses involve advertising, trade shows, and sales force compensation. In 2024, Intel's marketing spend was approximately $2.5 billion. Global workforce and talent acquisition costs also contribute to these expenses.

Capital Expenditures

Capital expenditures are vital for Intel, encompassing investments in property, plant, and equipment like manufacturing facilities. These investments are crucial for sustaining and growing Intel's production capabilities. In 2024, Intel planned substantial manufacturing investments. These costs are a significant component of Intel's cost structure.

- 2024 planned manufacturing investments: $25-28 billion.

- These expenditures are essential for maintaining production capacity.

- They reflect Intel's commitment to technological advancement.

- Major investments impact financial performance.

Restructuring Costs

Restructuring costs are a key aspect of Intel's cost structure, often stemming from workforce adjustments and facility changes. These expenses can significantly affect the company's financial performance. Intel's 2025 strategy includes substantial cost-saving measures, such as workforce reductions, which will lead to restructuring costs. These actions are part of Intel's broader plan to streamline operations and boost profitability.

- 2025 target: $10 billion in cost savings.

- Workforce reduction: Approximately 15,000 roles.

- Percentage of workforce affected: Around 15%.

Intel's cost structure includes high R&D expenses, with about $18 billion spent in 2024. Manufacturing is another significant cost driver, with capital expenditures around $25 billion in 2024. Marketing and sales, plus workforce costs, are also substantial.

| Cost Area | 2024 Spend (approx. USD) | Key Factor |

|---|---|---|

| R&D | $18B | Innovation |

| Manufacturing (CapEx) | $25B | Equipment, Facilities |

| Sales & Marketing | $2.5B | Promotion, Expansion |

Revenue Streams

The Client Computing Group (CCG) is a cornerstone of Intel's revenue model, deriving income from selling processors and related components for PCs. In 2023, CCG brought in $33.5 billion, showcasing its significance. This segment's performance is crucial for Intel's overall financial health. It directly reflects the demand for personal computing devices.

The Data Center and AI (DCAI) segment is a key revenue driver, selling processors and components for servers and data centers. In 2023, Intel's Data Center Group (DCG) brought in $20.2 billion. This revenue stream is crucial, especially with growing demand from cloud and enterprise computing.

Intel's Network and Edge (NEX) group supplies processors for network and edge computing. Edge AI applications boost NEX sales, especially with the Core Ultra launch at CES. In Q4 2023, NEX revenue was $1.5 billion. This reflects the growing demand for edge computing solutions.

Intel Foundry Services (IFS) Revenue

Intel Foundry Services (IFS) constitutes a significant revenue stream, earning from manufacturing chips for other companies. In fiscal year 2024, IFS brought in $17.54 billion, a testament to its growing importance. This segment is crucial to Intel's strategy as it broadens its foundry operations. IFS's expansion aims to capitalize on the increasing demand for advanced chip manufacturing.

- Revenue from IFS is a key growth driver.

- Fiscal year 2024 revenue was $17.54B.

- IFS focuses on chip manufacturing services.

- Intel is expanding its foundry business.

Other Revenue

Intel's "Other Revenue" encompasses diverse sources, including software and services, contributing to its financial health. These segments include Altera, Mobileye, and start-ups. Notably, it also considers historical results from divested businesses. This diversification helps Intel achieve a more robust revenue model.

- In 2024, Intel's "Other Revenue" streams provide additional financial flexibility.

- These streams include software, services, and contributions from subsidiaries like Mobileye.

- Intel's strategic investments and acquisitions further boost "Other Revenue."

- Diversifying revenue sources helps Intel manage market fluctuations.

Intel's revenue streams include Client Computing Group (CCG), Data Center and AI (DCAI), Network and Edge (NEX), and Intel Foundry Services (IFS).

In 2023, CCG generated $33.5B. The growing demand in edge computing boosted NEX sales.

IFS brought in $17.54B in fiscal year 2024, showcasing its expansion in chip manufacturing.

| Revenue Stream | 2023 Revenue | 2024 Revenue |

|---|---|---|

| CCG | $33.5B | Not yet reported |

| DCAI | $20.2B | Not yet reported |

| NEX | $1.5B (Q4 2023) | Not yet reported |

| IFS | Not Available | $17.54B |

Business Model Canvas Data Sources

The Business Model Canvas is informed by Intel's financial reports, market analysis, and competitive landscape data.