Sainsbury Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sainsbury Bundle

What is included in the product

Tailored analysis for Sainsbury's product portfolio.

Printable summary optimized for A4 and mobile PDFs, delivering clear and concise insights.

What You’re Viewing Is Included

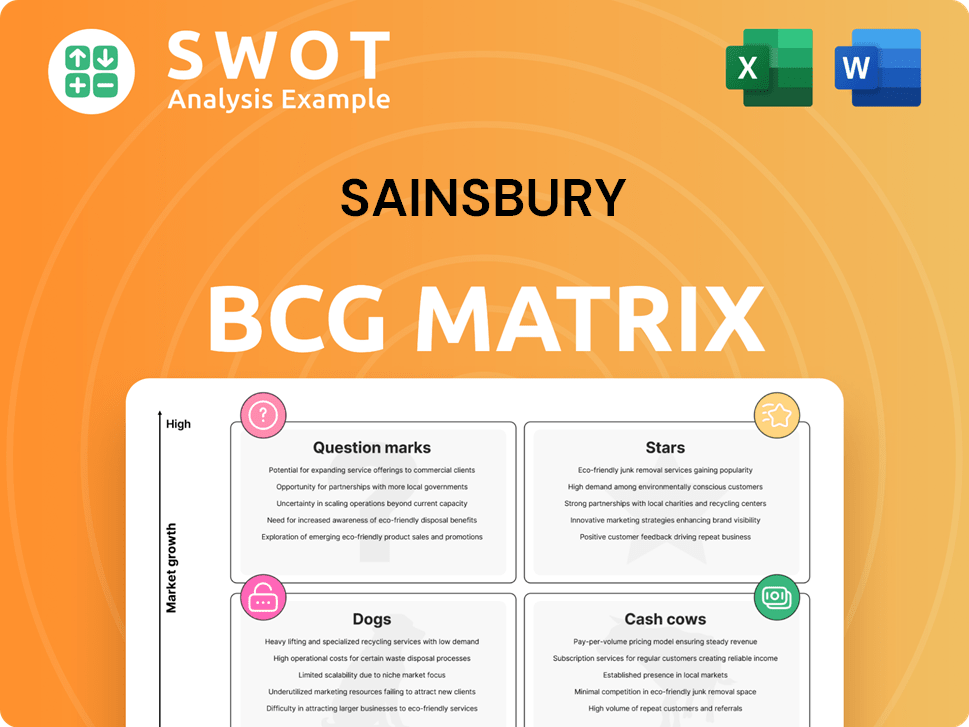

Sainsbury BCG Matrix

The Sainsbury's BCG Matrix you're previewing mirrors the complete, downloadable document. Receive the full report with all analyses and strategic insights after purchasing, ready for immediate application. No hidden content, just a ready-to-use strategic tool.

BCG Matrix Template

Sainsbury's, a retail giant, has a diverse portfolio. The BCG Matrix categorizes its offerings. We see potential 'Stars' like online grocery. Some established areas may be 'Cash Cows'. Others could be 'Dogs', requiring strategic decisions. A glimpse is helpful.

This preview is just a taste. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Sainsbury's online grocery platform is a "Star" in its BCG Matrix. In 2024, online grocery sales grew, with Sainsbury's capturing a significant share. Maintaining this requires investment in tech and logistics, with £60 million allocated in 2023. Continued investment could enhance their market leadership.

Tu Clothing, a star in Sainsbury's BCG matrix, has shown strong growth. In 2024, Tu's sales increased, driven by affordable fashion trends. Investment in design and marketing is key to maintaining its position. Expanding into new areas and partnerships can fuel further growth.

The Nectar loyalty program is a "Star" in Sainsbury's BCG matrix, boasting a vast user base and valuable customer data. Sainsbury's reported over 18 million active Nectar users in 2024. Enhanced personalization and partnerships can boost customer loyalty and sales. This data informs strategic decisions, supporting Sainsbury's growth strategies.

Own-Brand Food Products (by Sainsbury's)

Sainsbury's own-brand food products are Stars, boasting strong market shares thanks to quality and competitive pricing. These products require continuous innovation and marketing efforts to stay relevant. Sainsbury's invested £200 million in its brand in 2024. Sustainable sourcing and unique product development are vital investments for sustained growth.

- Market share: Sainsbury's own-brand accounts for a significant portion of its sales.

- Investment: Approximately £200 million invested in its own brand in 2024.

- Innovation: Focus on new product development and sustainable sourcing.

- Competitive Advantage: Quality and pricing drive market share.

Selected Convenience Stores

Selected Sainsbury's convenience stores, especially those in busy locations, can be considered Stars due to their strong sales and growth prospects. These stores thrive on focused marketing and product selections customized for their local markets. Boosting these stores through strategic expansions and modernizations can significantly improve their performance. In 2024, Sainsbury's convenience stores saw a sales increase of 6.5%.

- High Sales Growth: Sainsbury's convenience stores experienced a 6.5% sales increase in 2024.

- Targeted Marketing: Focused marketing efforts are key to success.

- Strategic Expansion: Modernization enhances performance.

- Local Market Focus: Tailored offerings meet local needs.

Sainsbury's "Stars" are growth drivers. They include online grocery, Tu Clothing, Nectar, own-brand foods, and select convenience stores. These segments show strong sales growth and market share in 2024. Sainsbury's invests in tech, marketing, and product development for continued growth.

| Star Category | Key Metrics (2024) | Strategic Focus |

|---|---|---|

| Online Grocery | Significant market share growth | Tech and logistics investment (£60M in 2023) |

| Tu Clothing | Sales increase | Design, marketing, and partnerships |

| Nectar | 18M+ active users | Personalization and strategic partnerships |

| Own-Brand Foods | £200M brand investment | Innovation, sustainable sourcing, and marketing |

| Convenience Stores | 6.5% sales increase | Targeted marketing and modernization |

Cash Cows

Sainsbury's established supermarkets are cash cows, generating substantial cash flow. They have a high market share and a loyal customer base in mature markets. Investments focus on efficiency and customer satisfaction to maintain their position. Strategic renovations and optimized layouts boost profitability. In 2024, Sainsbury's reported a revenue of £36.3 billion.

Sainsbury's core banking services, like savings accounts and credit cards, generate consistent revenue with limited growth. These services require minimal investment, focusing on profitability. Customer retention is key, with 2024 data showing a steady 3% annual growth in active banking users. This segment contributes significantly to overall financial stability.

Argos' home appliances and electronics are cash cows. These categories have a strong market presence. They require little marketing, generating consistent sales. Streamlining operations boosts cash flow. In 2024, Argos' revenue reached £4.8 billion.

Fuel Retailing

Sainsbury's fuel retailing, mainly at its supermarket locations, is a cash cow due to steady demand and high customer traffic. The focus is on maintaining infrastructure and competitive pricing to ensure profitability. Strategic partnerships and loyalty programs boost returns. In 2024, Sainsbury's reported strong fuel sales, leveraging its established customer base and convenient locations.

- Consistent Revenue: Fuel sales provide a reliable revenue stream.

- Low Investment: Primarily focused on maintenance, not major expansions.

- High Foot Traffic: Attracts customers to Sainsbury's stores.

- Loyalty Benefits: Nectar points enhance customer engagement.

Property Portfolio

Sainsbury's property portfolio, encompassing land and buildings, is a substantial asset. It generates rental income and offers redevelopment potential. Minimal investment is needed to maintain existing properties, while value enhancement is explored. Strategic property management and development create further value.

- In 2024, Sainsbury's property portfolio was valued at approximately £8.5 billion.

- Rental income from properties contributed significantly to overall revenue.

- Strategic redevelopment projects, like mixed-use developments, are ongoing.

- Property management initiatives aim to optimize asset utilization.

Sainsbury's cash cows include fuel sales and its property portfolio. These areas generate significant, consistent revenue with low investment needs. The property portfolio was valued at £8.5 billion in 2024, supporting strong financial stability. These elements boost overall performance through steady income and asset value.

| Cash Cow | Revenue Source | Investment Focus |

|---|---|---|

| Fuel Retail | Fuel Sales | Maintenance, pricing |

| Property Portfolio | Rental Income | Asset Management |

| Established Supermarkets | Grocery Sales | Efficiency and renovation |

Dogs

DVD and Blu-ray sales face a steep decline, with physical media revenue dropping significantly in 2024. Sainsbury's should decrease shelf space allocated to these products. This strategic move can free up valuable space. Consider allocating the space to more profitable categories, like ready-to-eat meals, which saw a 12% sales increase in 2024.

Traditional photo processing services are a "Dog" in Sainsbury's BCG Matrix due to digital advancements. The market share and growth are low for these services. In 2024, the demand significantly decreased. Focus should be on digital photo solutions.

The decline in physical music sales has significantly affected the profitability of in-store music and entertainment sections within Sainsbury's. Sainsbury's needs to evaluate the performance of these sections, potentially repurposing the space. Exploring partnerships with digital music services or offering curated playlists could revitalize this area. In 2024, physical music sales represented only a small fraction of total music revenue, highlighting the need for strategic adjustments.

Selected Older Argos Catalog Lines

Certain older Argos catalog product lines might be classified as dogs in Sainsbury's BCG matrix, due to low sales and limited growth prospects. To boost efficiency, Sainsbury's should streamline the catalog and concentrate on high-demand products. Data analytics is crucial for pinpointing and eliminating underperforming items, optimizing resource allocation. This approach can enhance profitability and customer satisfaction.

- Argos saw a 4.6% decrease in sales during the first half of 2024.

- Sainsbury's aims to cut costs by £1 billion by the end of 2027.

- Underperforming product lines are targeted for removal.

- Focusing on popular items can increase profit margins.

Outdated Financial Products

Outdated financial products, like those with low interest rates, are "dogs" in Sainsbury's BCG Matrix. These products don't attract customers and hinder profitability. Sainsbury's needs to innovate and offer competitive financial solutions. Removing or updating these underperforming products is crucial for financial health.

- Low-yield savings accounts may struggle in a high-rate environment.

- Outdated insurance plans with limited coverage.

- Focus on modern digital banking products.

- Discontinue products with low customer engagement.

Underperforming product lines within Sainsbury's, like certain older Argos offerings, fall into the "Dog" category. These products have low market share and minimal growth prospects. Sainsbury's should streamline these offerings to boost efficiency. This strategic focus on higher-demand products can enhance profitability.

| Category | Description | Strategic Action |

|---|---|---|

| Older Argos Catalog Items | Low sales, limited growth. | Streamline catalog, focus on high-demand. |

| Financial Products with Low Rates | Low customer attraction and profitability. | Innovate, offer competitive solutions. |

| Physical Music Sales | Low revenue in 2024. | Repurpose space, digital partnerships. |

| Photo Processing Services | Decreased demand in 2024. | Focus on digital photo solutions. |

Question Marks

Sainsbury's international expansion is a question mark, requiring significant investment with uncertain returns. Success hinges on market research and partnerships. A phased approach and performance monitoring are vital. In 2024, international revenue might constitute a small portion of Sainsbury's total, under 5%, highlighting the risk.

Investing in EV charging stations is a question mark for Sainsbury's. The EV market is still developing. Demand assessment, partnerships, and utilization rates are crucial. Government support can help offset costs. In 2024, the UK saw over 50,000 public charge points installed.

Implementing AI-powered personalized shopping experiences at Sainsbury's falls into the question mark category. This is due to technological complexities and uncertain customer adoption. For example, in 2024, only 30% of consumers fully trust AI in retail. Rigorous testing and data privacy measures are vital. A phased rollout and iterative improvements based on customer feedback are crucial for success.

Subscription Meal Kit Services

Subscription meal kit services represent a question mark for Sainsbury's, given the high competition. Success hinges on understanding customer needs, developing appealing recipes, and efficient delivery. Partnerships and smart marketing are key to boosting market share. The meal kit market's value in 2024 is estimated at $10 billion.

- Market size: The meal kit delivery services market was valued at $10.8 billion in 2023.

- Competition: HelloFresh and Blue Apron are major players.

- Logistics: Efficient delivery is crucial for profitability.

- Strategic moves: Partnerships could enhance market penetration.

Partnerships with Emerging Tech Companies

Partnerships with emerging tech companies represent a "question mark" for Sainsbury's, given the unpredictable nature of technological advancements. These collaborations, aimed at creating innovative retail solutions, require careful evaluation and testing. To mitigate risk, Sainsbury's should prioritize due diligence and pilot programs before large-scale implementation. The focus should be on addressing specific customer needs and enhancing operational efficiency.

- Sainsbury's has invested in AI to boost its Nectar loyalty scheme.

- The UK grocery market is highly competitive, with Sainsbury's holding a significant market share.

- Focusing on value and volume growth is a key strategy for Sainsbury's.

- Sainsbury's is introducing new own-brand ranges based on customer insights.

International expansion is a question mark, demanding investment with uncertain returns. Success hinges on market research and partnerships. In 2024, international revenue might be under 5% of total.

EV charging stations are a question mark, given the developing EV market. Demand assessment and partnerships are crucial. In 2024, over 50,000 public charge points were installed in the UK.

AI-powered shopping experiences are also a question mark. Technological complexities and customer adoption are key. In 2024, only 30% of consumers fully trusted AI in retail.

Subscription meal kits are a question mark due to high competition. Success relies on understanding customer needs and efficient delivery. The meal kit market's value in 2024 is estimated at $10 billion.

Partnerships with tech companies are question marks, given tech's unpredictability. Prioritize due diligence and pilot programs. Sainsbury's is investing in AI for its Nectar scheme.

| Category | Risk Level | Key Factors |

|---|---|---|

| International Expansion | High | Market research, partnerships, revenue % |

| EV Charging | Medium | Demand, partnerships, utilization |

| AI Shopping | Medium | Tech, customer trust, rollout |

| Meal Kits | High | Competition, delivery, customer needs |

| Tech Partnerships | Medium | Due diligence, innovation, pilot programs |

BCG Matrix Data Sources

The Sainsbury's BCG Matrix relies on market share, financial reports, and industry analysis to accurately represent market dynamics and provide strategic insights.