Sainsbury PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sainsbury Bundle

What is included in the product

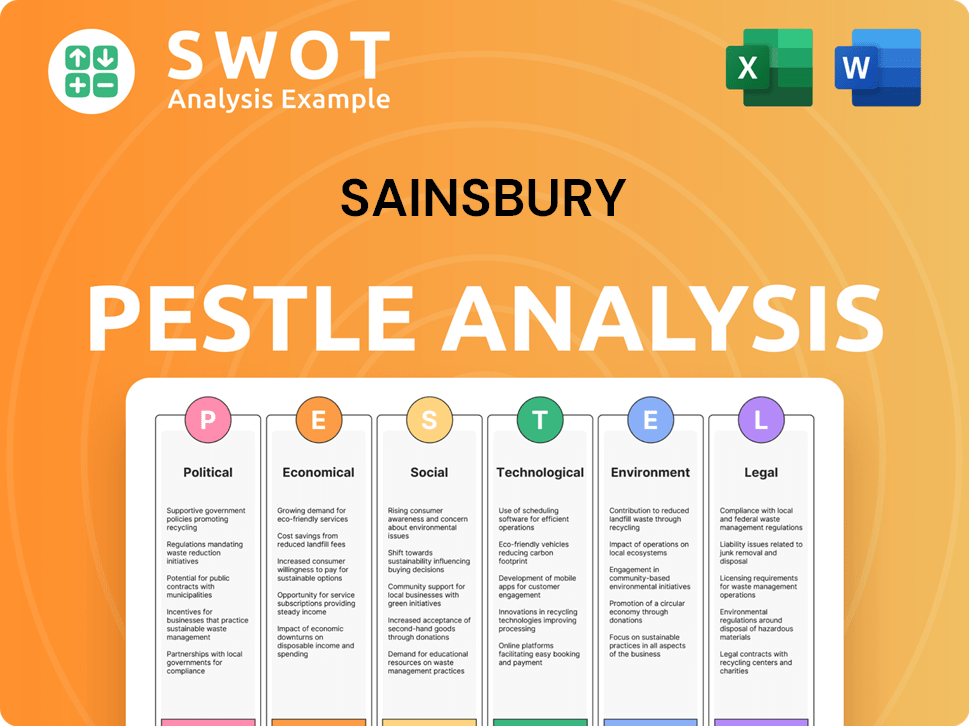

Evaluates the macro-environmental factors impacting Sainsbury's across Political, Economic, Social, etc.

Helps clarify Sainsbury's strategy by pinpointing specific external factors within each category.

Preview the Actual Deliverable

Sainsbury PESTLE Analysis

This preview showcases the Sainsbury's PESTLE Analysis in full.

Every element displayed, from the layout to the content, will be present.

The document's structure and insights remain unchanged after purchase.

After purchase, you'll download the very same analysis, ready to review.

What you're seeing is the final product you'll receive.

PESTLE Analysis Template

Sainsbury’s faces a complex landscape. Our PESTLE analysis dives deep, assessing the political and economic pressures affecting their market. We uncover how social trends and technological advancements reshape Sainsbury’s operations and strategy. Explore crucial legal factors and environmental concerns influencing the supermarket. This detailed breakdown is designed to inform and empower strategic planning. Download the full analysis now for actionable insights.

Political factors

Government policies heavily influence Sainsbury's. Changes in business rates and taxation directly affect costs and profits. Sainsbury's has advocated for business rates reform, highlighting the risk of store closures. In 2024, business rates remained a significant expense. Sainsbury's reported £693 million in business rates in the fiscal year 2023/2024.

Brexit continues to cast a shadow of uncertainty, particularly impacting Sainsbury's import costs. In 2024, the UK's inflation rate, influenced by Brexit, was around 4%. Supply chain complexities, another Brexit byproduct, could further inflate prices. Sainsbury's, therefore, faces ongoing challenges navigating these political shifts.

Qatar's substantial stake in Sainsbury's, as of early 2024, is a key political factor. This relationship can influence public perception and potentially affect Sainsbury's share value, especially amid geopolitical shifts. Any strained UK-Qatar relations could create market uncertainty. Sainsbury's must navigate these political dynamics carefully to protect its brand and financial interests. In 2024, Qatar Investment Authority held around 14.3% of Sainsbury's shares.

Employment law changes

Upcoming employment law changes will significantly affect Sainsbury's. These changes, including those regarding zero-hour contracts, redundancies, and minimum wage hikes, will demand adjustments to its HR strategies. Such adaptations could influence labor costs and operational efficiency, potentially affecting profitability. Sainsbury's must proactively manage these shifts to remain compliant and competitive. This includes strategic workforce planning and cost management.

- Minimum wage increased to £11.44 per hour in April 2024, impacting labor costs.

- Changes to zero-hour contracts could affect staffing flexibility.

- Updated redundancy laws may necessitate restructuring costs.

- Sainsbury's employs approximately 150,000 people.

Trade agreements and tariffs

Changes in global trade agreements and the possibility of tariffs, driven by worldwide political strains, could impact Sainsbury's import costs and its market position. The UK's trade relations, particularly post-Brexit, are critical. Sainsbury's relies on imports for a wide range of products. Recent data from the Office for National Statistics shows a fluctuation in import prices.

- UK imports from the EU decreased by 15% in 2024.

- Tariffs on food imports could increase prices by up to 10%.

- Sainsbury's reported a 2.5% rise in import costs.

Political factors, such as evolving employment laws and global trade agreements, significantly affect Sainsbury's. The minimum wage hike to £11.44 in April 2024 has increased labor expenses. Post-Brexit trade changes and potential tariffs on food imports impact Sainsbury's import costs.

| Factor | Impact | Data |

|---|---|---|

| Business Rates | Expense | £693M in FY23/24 |

| Brexit Inflation | Cost increase | ~4% UK inflation |

| Qatar Stake | Market Impact | 14.3% share (2024) |

| Min. Wage Hike | Labor Cost | £11.44/hr (Apr 2024) |

| Import Changes | Cost Pressure | 2.5% rise in costs |

Economic factors

Inflation remains a key concern. The UK's inflation rate was 3.2% in March 2024. This impacts consumer spending. Sainsbury's faces challenges due to reduced purchasing power. Customers seek better value. This could affect Sainsbury's sales.

Sainsbury's faces intense competition in the UK grocery market. Rivals include Tesco, Asda, and the growing discounters Aldi and Lidl. This environment forces Sainsbury's to invest in price reductions and enhance the customer experience. In 2024, the UK grocery market was valued at approximately £220 billion, with intense competition for market share. Sainsbury's must innovate to stay competitive.

Sainsbury's confronts escalating operational expenses. Energy and transportation fuel costs, alongside potential wage hikes, pose challenges. These factors may squeeze profit margins if not efficiently managed. In 2024, UK inflation impacted operating costs significantly. Sainsbury's must adapt to maintain profitability.

Supply chain disruptions

Economic instability and global occurrences can disrupt Sainsbury's supply chains, influencing product availability and costs. The Russia-Ukraine conflict, for example, has significantly impacted global supply chains, increasing transportation expenses. Furthermore, the UK's inflation rate, standing at 3.2% in March 2024, adds to the financial pressures on procurement. These factors necessitate careful management to maintain profitability.

- Increased transportation costs due to geopolitical events.

- Inflation impacting procurement expenses.

- Need for robust supply chain management.

- Potential for product shortages or price hikes.

Investment in growth and cost savings

Sainsbury's is actively pursuing cost-saving measures alongside investments to foster growth. The 'Next Level' plan, technological upgrades, and store expansions are key initiatives. These strategies aim to enhance financial performance and secure future market position. In 2024, Sainsbury's reported a 1.1% increase in underlying profit before tax, demonstrating early success from these efforts.

- £690 million in cost savings achieved by 2024.

- Investment of £1 billion in technology and store expansion.

- Target to reduce operational costs by an additional £1 billion by 2027.

Inflation remains a central concern. The UK's inflation was 3.2% in March 2024. Sainsbury's sales can be affected by changes in purchasing power.

Competition in the UK grocery market is very intense. Competitors are Tesco and Asda, and also discounters. Sainsbury's must reduce prices to stay competitive, the market value was around £220 billion.

Operating costs are rising. Energy, transportation, and potential wage increases pose challenges. Sainsbury's faces margin pressure if not managed. The 3.2% UK inflation affected operating costs.

| Economic Factor | Impact on Sainsbury's | Data |

|---|---|---|

| Inflation | Reduces purchasing power | 3.2% March 2024 |

| Market Competition | Pressures pricing and margins | £220B UK market in 2024 |

| Rising Costs | Squeezes profitability | Energy, transport costs up |

Sociological factors

Changing consumer habits significantly shape Sainsbury's strategy. Evolving preferences, like health and wellness, impact product lines. Ethical and sustainable consumption drive sourcing decisions. Online shopping's rise influences digital investments. In 2024, online grocery sales grew, reflecting these shifts.

The UK's aging population and rising ethnic diversity are key. Sainsbury's must adapt its product range and marketing. Over 18% of the UK population is now aged 65+, creating demand for specific products. By 2024, ethnic minorities make up over 14% of the population, influencing food preferences.

Sainsbury's focuses heavily on customer perception and loyalty. Their Nectar scheme offers personalized experiences, boosting customer retention. The UK grocery market is fiercely competitive, with Sainsbury's holding approximately 15.2% market share in 2024. Customer satisfaction scores directly affect sales and brand image.

Demand for convenience

The rising need for convenience significantly shapes Sainsbury's strategies. This includes boosting online platforms and home delivery, as well as expanding smaller store formats. These efforts aim to cater to busy consumers. Sainsbury's online sales grew, with digital accounting for 17% of total retail sales in 2024.

- Online grocery sales increased, reflecting the demand for convenience.

- Home delivery services are a key focus for market share growth.

- Smaller store formats are being developed to meet local needs.

Ethical and social concerns

Sainsbury's faces increasing scrutiny regarding ethical and social issues. Consumers and stakeholders are more aware of fair labor practices and human rights. This awareness pushes Sainsbury's to ensure responsible sourcing and ethical behavior. Failing to address these concerns could damage its reputation and affect sales. Sainsbury's is investing in ethical sourcing, with 75% of its key product ingredients coming from sustainable sources as of late 2024.

- 75% of key product ingredients from sustainable sources (late 2024).

- Increased consumer demand for ethical products.

- Risk of reputational damage from unethical practices.

Sainsbury's navigates shifts in consumer demographics, including an aging population, as over 18% of the UK is 65+. Rising ethnic diversity (14%+) impacts product demand and marketing strategies.

Customer perception and loyalty are key; the Nectar scheme boosts retention. The grocer focuses on ethical issues and convenience like home delivery, aiming for 17% of sales online by 2024.

Societal trends, ethical concerns and the quest for convenience fuel strategic decisions.

| Factor | Impact | Data (2024) |

|---|---|---|

| Aging Population | Demand for specific products | 18%+ of UK population is over 65 |

| Ethnic Diversity | Influence food preferences | Ethnic minorities make up 14%+ of UK |

| Online Grocery Sales | Convenience & accessibility | Digital accounting for 17% of total retail sales |

Technological factors

Technological factors significantly shape Sainsbury's operations. E-commerce is vital; Sainsbury's focuses on its online presence. In 2024, online grocery sales grew, reflecting digital transformation. Sainsbury's uses mobile apps and digital marketing to boost customer experience. Digital investments help drive sales, adapting to evolving consumer habits.

Sainsbury's uses data analytics to understand customers better. The Nectar program collects data for personalized offers and marketing. Data insights boost marketing effectiveness and sales. Sainsbury's saw a 4.6% increase in digital sales in 2024. This strategy enhances customer experience and loyalty.

Sainsbury's can optimize its supply chain through tech, boosting efficiency and cutting costs. AI-driven programs enhance logistics, ensuring product availability. In 2024, supply chain tech spending is projected to reach $25.7B globally. Sainsbury's invested £110M in automation in 2023, showing commitment. This investment helps improve margins and customer satisfaction.

In-store technology

Sainsbury's is actively integrating in-store technology to enhance both efficiency and the shopper's journey. This includes self-checkout systems and digital displays for promotions. These advancements aim to cut down on labor costs and provide a more engaging shopping experience. For example, in 2024, Sainsbury's reported a 10% increase in transactions via self-checkout.

- Self-checkout transactions up by 10% in 2024.

- Digital signage roll-out expanding across stores.

- Investment in automated inventory management.

- Focus on mobile app integration for in-store use.

Technological infrastructure investment

Sainsbury's is investing in technological infrastructure to boost its operations. They are modernizing commercial systems and adopting cloud-based solutions. This improves business agility and simplifies technology infrastructure. The goal is to enable future growth through these technological advancements. Sainsbury's allocated £200 million for technology investments in 2024, aiming for enhanced efficiency.

- Modernizing systems for better agility.

- Cloud solutions to streamline infrastructure.

- Investment of £200M in tech in 2024.

- Focus on efficiency and future growth.

Sainsbury's focuses on tech like e-commerce and digital marketing. Online grocery sales are crucial, with investments boosting customer experience. Investments in supply chain tech help, like the projected $25.7B spending in 2024.

| Area | Details | 2024 Data |

|---|---|---|

| Digital Sales | Growth Rate | 4.6% Increase |

| Self-Checkout | Transaction Increase | 10% Rise |

| Tech Investment | Total Allocation | £200M |

Legal factors

Sainsbury's faces numerous regulations in the UK retail sector. This includes competition laws, consumer protection, and health and safety standards. Compliance requires significant resources and can impact operational costs. For instance, in 2024, the UK government increased scrutiny on pricing practices, potentially affecting Sainsbury's promotional strategies.

Sainsbury's must adhere to stringent food safety regulations, encompassing labeling and product standards. These rules demand meticulous quality control across its entire supply chain. In 2024, the UK Food Standards Agency (FSA) reported 4,500 food safety inspections. Sainsbury's spends approximately £50 million annually on compliance, ensuring food safety and regulatory adherence. Non-compliance can lead to hefty fines and reputational damage.

Sainsbury's must adhere to employment laws. This covers areas like fair wages, working hours, and employee rights. For example, in 2024, the UK's minimum wage was updated. Failing compliance can lead to fines and reputational damage. Employment law changes frequently, demanding constant updates.

Competition law

Sainsbury's, operating within the highly competitive UK retail market, faces scrutiny under competition law. This ensures fair practices. The Competition and Markets Authority (CMA) actively monitors the sector. They prevent anti-competitive behaviors. In 2024, the CMA investigated the grocery market. They focused on pricing practices.

- CMA investigations into grocery pricing practices.

- Ongoing scrutiny to prevent market dominance.

- Compliance with regulations to avoid penalties.

- Focus on fair competition for consumer benefit.

Packaging and waste legislation

Sainsbury's faces increasing scrutiny regarding its packaging and waste management practices. Upcoming regulations, including potential new packaging taxes, will directly affect the company's operational costs. These changes necessitate strategic adjustments to packaging materials and waste reduction initiatives. Sainsbury's must adapt to comply with evolving environmental standards and consumer expectations.

- In 2023, the UK government introduced the Extended Producer Responsibility (EPR) scheme, which will hold businesses accountable for the full cost of recycling their packaging.

- Sainsbury's has committed to reducing plastic packaging by 50% by 2025.

- The company aims to make all own-brand packaging reusable, recyclable, or compostable by 2025.

Sainsbury's navigates strict UK retail laws concerning competition and consumer protection, impacting operational costs. Compliance with competition laws and CMA scrutiny remains critical, especially on pricing practices. Employment law and food safety regulations also require constant adherence, adding financial and operational burdens.

| Legal Area | Regulation | Impact for Sainsbury's |

|---|---|---|

| Competition Law | CMA investigations into pricing, market dominance. | Potential fines, operational changes. |

| Food Safety | FSA inspections, labeling, product standards. | £50M annual compliance cost, potential fines. |

| Employment Law | Fair wages, working hours, employee rights. | Updated minimum wage, potential fines. |

Environmental factors

Sainsbury's is committed to reducing its environmental impact, setting ambitious climate goals. The company aims for Net Zero emissions by 2035 for its operations and 2050 across its value chain. This commitment is driven by rising awareness of climate change. Sainsbury's has already invested over £1 billion in sustainability initiatives.

Sainsbury's prioritizes sustainable sourcing of raw materials. They aim to eliminate deforestation from their own-brand supply chains by 2025. This commitment is part of their broader environmental strategy. In 2024, they reported a 60% reduction in carbon emissions from their operations since 2005.

Sainsbury's focuses on reducing plastic and waste. They aim to halve plastic packaging by 2025. In 2023, they reduced plastic use by 4% and food waste by 10%. This aligns with consumer demand for eco-friendly practices, impacting brand reputation and costs.

Water usage and stewardship

Sainsbury's is focused on reducing water consumption within its operations and promoting sustainable water management throughout its supply chain. They actively monitor water usage across their stores, distribution centers, and manufacturing sites. The company is investing in water-efficient technologies and practices to minimize its environmental impact. Sainsbury's collaborates with suppliers to encourage responsible water usage in agricultural practices.

- Sainsbury's aims for a 50% reduction in water use by 2040.

- They are working with suppliers to implement water stewardship programs.

Biodiversity and nature protection

Sainsbury's is focusing on biodiversity and nature protection, aiming for a nature-positive impact. They are backing projects like tree planting and promoting sustainable agriculture practices. In 2024, Sainsbury's committed to sourcing key products from deforestation-free supply chains. The company has invested £1 million in biodiversity projects. This approach aligns with growing consumer and regulatory pressures for environmental responsibility.

- Deforestation-free supply chains commitment.

- £1 million invested in biodiversity projects.

- Focus on tree planting and sustainable agriculture.

Sainsbury's aggressively pursues environmental sustainability to meet ambitious goals. The retailer aims for Net Zero emissions by 2035 and has already slashed operational emissions. Their strategy involves sourcing sustainably, cutting waste, and protecting natural resources.

| Area | Target | Status (2024-2025) |

|---|---|---|

| Emissions | Net Zero (Ops 2035, Value Chain 2050) | 60% emissions cut since 2005. |

| Plastic Packaging | Halve by 2025 | 4% reduction in 2023 |

| Water Usage | 50% reduction by 2040 | Water efficient tech investment. |

PESTLE Analysis Data Sources

The Sainsbury's PESTLE Analysis incorporates diverse data from reputable sources. This includes governmental reports, industry publications, and market research for a comprehensive evaluation.