Kesko Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kesko Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

One-page overview that quickly visualizes Kesko's business units, aiding strategic decisions.

What You’re Viewing Is Included

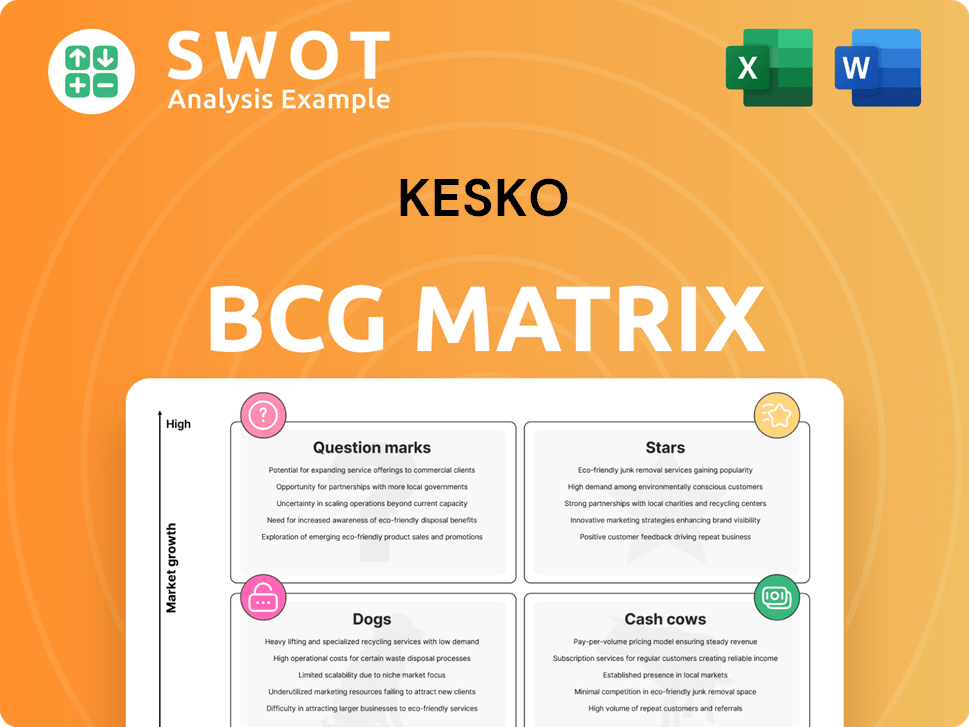

Kesko BCG Matrix

The BCG Matrix you’re previewing is the complete document you'll own post-purchase. This includes all elements, from its strategic framework to its insightful data analysis. It's designed for direct integration into your strategic planning process. This version is fully editable and instantly downloadable.

BCG Matrix Template

Kesko's BCG Matrix categorizes its diverse offerings, from Stars to Dogs. This snapshot shows strategic product positioning for optimal resource allocation. Understanding these dynamics is key to maximizing market performance. But this is just the beginning. The full version offers in-depth analysis and clear action plans.

Stars

Kesko's online grocery sales are flourishing, outpacing the market's expansion. This positions Kesko strongly in a growing sector, fitting the 'Star' profile. In 2024, online grocery sales surged, reflecting its leadership. Further investment could boost its market control and revenue.

Kesko's building and technical trade is a Star in Finland. In 2024, this segment saw robust growth, with sales reaching €6.6 billion. Its leading market share and strategic investments signal strong future prospects.

Kesko's car trade division, focusing on used cars and services, shows promise. The used car market is expanding, and Kesko's strong position could make it a 'Star'. In 2024, used car sales are up, with services driving revenue. For example, the used car market grew by 6% in the first half of 2024.

Kespro (Foodservice Business)

Kespro shines as a Star in Kesko's portfolio, excelling in the foodservice sector. Its robust market standing and growth potential are noteworthy. In 2024, Kespro's sales likely saw an increase, mirroring the industry's upward trend. Strategic moves should boost its Star status.

- Foodservice market leadership.

- Significant contribution to Kesko's grocery trade.

- Sales growth in 2024.

- Strategic initiatives to fortify its position.

Sustainability Initiatives

Kesko's robust sustainability initiatives position it as a 'Star' in the BCG matrix. The company focuses on emission reductions and expanding sustainable product lines. This strategy resonates with the increasing consumer preference for eco-friendly options. Kesko's strong brand image is further enhanced by these efforts.

- Kesko aims to cut its direct and indirect emissions by 90% by 2030 compared to 2019 levels.

- Sustainable products represented 40% of Kesko's grocery sales in 2023, showing strong growth.

- Kesko has been recognized as a leader in sustainability by the Dow Jones Sustainability Indices.

Kesko's "Stars" are strong, holding leading market shares and growth potential. Online grocery and building/technical trade are notable examples. Kespro and sustainability efforts also drive 'Star' performance.

| Segment | Key Feature | 2024 Data |

|---|---|---|

| Online Grocery | Market leadership | Sales surge |

| Building/Tech Trade | Robust growth | €6.6B in sales |

| Kespro | Foodservice excellence | Sales increase |

| Sustainability | Emission reductions | 40% of grocery sales in sustainable products (2023) |

Cash Cows

Kesko's grocery trade dominates Finland's market. While facing slight market share dips, its B2C and foodservice segments remain stable. This division is a 'Cash Cow,' fueled by consistent profits and substantial revenue generation. Focus on efficiency and sustaining profitability are crucial. In 2024, Kesko's grocery sales were approximately €6.7 billion.

Kesko's building and technical trade in Finland is a cash cow. This division consistently generates strong cash flow. In 2024, the building and technical trade segment saw a revenue of EUR 4.6 billion. The focus remains on efficiency to maximize returns.

The K-Plussa loyalty program, boasting over 3.2 million active members in Finland, is a significant asset for Kesko. This extensive membership base offers valuable customer data, enhancing sales and retention. In 2024, the program contributed significantly to Kesko's revenue. It is a stable source of income, positioning it firmly as a Cash Cow within the BCG Matrix.

Kesko's Store Network

Kesko's vast store network across Northern Europe acts as a dependable sales and distribution channel. This robust infrastructure consistently generates revenue, aligning with the 'Cash Cow' designation. It provides a stable foundation, supporting other business sectors. In 2024, Kesko's net sales reached approximately EUR 11.3 billion.

- Consistent revenue streams.

- Established market presence.

- Supports multiple business segments.

- Strong operational foundation.

Private Label Brands

Kesko's private label brands, especially in groceries and building supplies, boost profit margins. These brands are "cash cows" because they are profitable and have a strong market presence. They generate consistent revenue, essential for Kesko's financial health. In 2023, Kesko's net sales were EUR 10.9 billion, showing the significance of its diverse portfolio, including these brands.

- Higher Profit Margins

- Established Market Presence

- Consistent Revenue Generation

- Contribution to Overall Financial Health

Kesko's Cash Cows are core to its financial health. They generate steady profits and consistent cash flow. Examples include grocery trade, building supplies, and the K-Plussa program. These segments support Kesko's robust market position.

| Key Area | Description | 2024 Data (Approx.) |

|---|---|---|

| Grocery Sales | Dominant market presence. | €6.7 billion revenue |

| Building/Technical Trade | Strong cash flow generator. | €4.6 billion revenue |

| K-Plussa | Loyalty program asset. | 3.2M+ active members |

Dogs

The discontinuation of the K-Rauta chain in Sweden, a part of Kesko, signifies a strategic move away from a business facing challenges. With low growth prospects and market share, the chain likely underperformed. Kesko's decision to divest K-Rauta aligns with the BCG Matrix's 'Dog' classification, aiming to reduce financial strain. In 2024, Kesko's net sales were approximately EUR 11.4 billion, reflecting a complex business landscape.

Kesko's exit from Neste K groceries suggests underperformance. This aligns with the BCG Matrix, likely placing these operations in the "Dog" quadrant. In 2024, Kesko focused on core retail, streamlining operations. The divestment freed resources for higher-growth areas. This strategic shift aimed to boost overall profitability.

The new car market is challenged. Weak demand makes new car sales a 'Dog' for Kesko. In 2024, new car registrations in Finland decreased. Strategic restructuring might be needed. Careful management is essential.

Certain Underperforming Stores

Certain underperforming stores within Kesko's network, which struggle to meet financial targets and adapt to local demands, fall into the "Dogs" category. These stores might experience declining sales or high operational costs, impacting overall profitability. In 2024, Kesko has likely identified several such stores needing strategic intervention. These interventions could range from operational improvements to strategic closures to reallocate resources more efficiently.

- Low Profit Margins: Stores with margins consistently below the company average.

- Poor Sales Performance: Stores showing declining sales figures year-over-year.

- High Operational Costs: Locations with excessive expenses like rent or staffing.

- Market Inadaptability: Stores failing to adjust to local consumer preferences.

Businesses Lacking Synergies

Dogs in Kesko's BCG matrix represent business units without strategic alignment or synergy. These units often underperform, hindering overall profitability. Kesko might consider selling or restructuring these divisions to streamline operations. In 2024, such decisions are crucial for maintaining financial health.

- Examples include non-core retail formats or underperforming wholesale operations.

- Divestiture can free up capital for more promising ventures.

- Restructuring involves cost-cutting or operational improvements.

- The goal is to enhance Kesko's focus and efficiency.

Dogs in Kesko's BCG Matrix signify underperforming business areas, often marked by low market share and slow growth, as evident in the divestment of K-Rauta in Sweden. These units typically strain financial resources, as seen in the challenging new car market. In 2024, Kesko likely reviewed such operations, aiming to redirect capital to more profitable ventures, impacting overall financial results.

| Category | Characteristics | Kesko's Action (2024 Focus) |

|---|---|---|

| Underperforming Businesses | Low growth, low market share, poor financial results | Divestment, restructuring, strategic closures |

| Resource Drain | Requires more resources than it generates | Capital reallocation, efficiency improvements |

| Strategic Alignment Issues | Lack of synergy with core business goals | Streamlining operations, boosting profitability |

Question Marks

Kesko's expansion in Denmark's building and technical trade, via acquisitions, is a "Question Mark" in its BCG matrix. These ventures demand substantial investment for growth and integration. In 2024, Kesko's net sales in building and technical trade were approximately €6.2 billion, showing potential but requiring strategic focus. The market position needs to be solidified before it can be considered a "Star" or "Cash Cow".

The building and technical trade sector in Kesko's BCG matrix is a 'Question Mark', with a focus on integrating acquisitions in Sweden and Norway. This strategy aims to boost profitability through efficient market penetration. Success hinges on effective integration and capturing market share. In 2024, Kesko's net sales in building and technical trade were substantial, reflecting their ongoing efforts.

Kesko's sports trade, a 'Question Mark' in its BCG Matrix, shows some sales growth. However, its market share and future potential are still unclear. Strategic investments and marketing are crucial for expanding its presence. In 2024, the sports market saw varied performances, influencing Kesko's strategies.

Expansion into New Geographies

Kesko's move into new geographic markets, especially in building and technical trade, is a question mark in the BCG Matrix. These expansions require careful planning and strategic investments for success. For example, Kesko's sales in the building and technical trade grew in 2023. However, profitability can vary across new regions.

- Sales growth in building and technical trade in 2023.

- Potential for varying profitability in new markets.

- Strategic investments are crucial for success.

- Requires careful evaluation of each new market.

AI and Digital Service Initiatives

Kesko's foray into digital services and AI across its divisions places it in the "Question Mark" quadrant of the BCG Matrix. These investments aim to enhance customer experience and operational efficiency. However, the ultimate impact on profitability and market share is still uncertain. This uncertainty reflects the inherent risk and potential rewards of these innovative ventures, which are characteristic of Question Marks.

- Kesko's digital investments focus on improving customer experience and operational efficiency.

- The financial impact of these initiatives is currently uncertain.

- This positioning is based on the potential for high growth but low current market share.

- These investments are similar to other companies investing in AI.

Kesko's 'Question Marks' involve strategic investments. These include building and technical trade expansions, digital services, and AI integration. Success depends on market share gains and effective integration. Digital initiatives aim to boost customer experience and operational efficiency.

| Initiative | Focus | 2024 Performance |

|---|---|---|

| Building & Tech | Market Expansion | €6.2B Sales |

| Digital Services | Customer & Efficiency | Uncertain impact |

| Sports Trade | Growth and Market Share | Varied performances |

BCG Matrix Data Sources

The Kesko BCG Matrix uses financial reports, market studies, and expert assessments for accurate product portfolio insights.