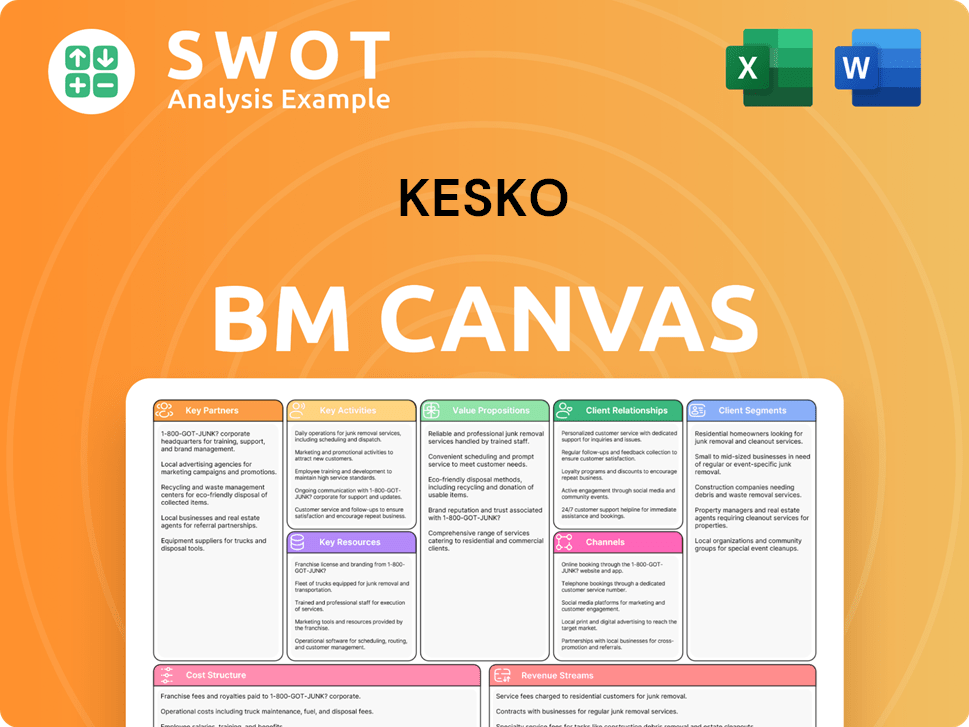

Kesko Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kesko Bundle

What is included in the product

Covers customer segments, channels, and value propositions in full detail.

Shareable and editable for team collaboration and adaptation.

Full Document Unlocks After Purchase

Business Model Canvas

This Kesko Business Model Canvas preview is the actual deliverable. Upon purchase, you'll receive this exact document. It's ready-to-use, fully accessible, and mirrors this preview's structure. There are no hidden sections or different layouts. Enjoy complete ownership of this file!

Business Model Canvas Template

Kesko’s Business Model Canvas spotlights its diverse retail operations and focus on customer-centric value. This framework examines key partners, activities, and resources driving its success across various sectors. Analyze their customer segments and channels, revealing how Kesko generates revenue and manages costs effectively. Understand the company's strategic positioning and how it adapts to changing market dynamics with our in-depth analysis.

Partnerships

Kesko's chain business model thrives on franchise agreements with independent K-Retailers. These local entrepreneurs operate stores under well-known banners like K-Citymarket, K-Supermarket, and K-Market. In 2024, retail sales reached about €16 billion, highlighting the importance of these partnerships. Strong relationships with these retailers are key to maintaining quality and service standards.

Kesko relies on suppliers for diverse products, like groceries and construction materials. These partnerships guarantee a steady supply chain and competitive pricing. In 2024, Kesko's sourcing network involved thousands of suppliers across various sectors. Kesko focuses on sustainable sourcing, aiming for responsible practices.

Kesko relies heavily on technology and digital service providers. They partner to improve online sales, digital services, and customer experiences. These collaborations create smooth omnichannel experiences, connecting online and physical stores. Data and digital advancements are crucial for Kesko, improving customer experiences and efficiency. In 2024, Kesko's e-commerce sales grew, showing the value of these partnerships.

Logistics and Distribution Partners

Kesko relies heavily on logistics and distribution partners to manage its wide network of stores. These partnerships ensure goods reach stores and customers efficiently, which is crucial for profitability. Kesko strategically invests in its logistics, including facilities like the Onnela logistics center. This investment improves operational efficiency across its supply chain.

- Kesko's net sales in 2024 were approximately EUR 11.3 billion.

- Kesko's grocery trade sales increased by 2.8% in 2024.

- The Onnela logistics center is a significant investment to streamline operations.

- Efficient logistics supports Kesko's retail operations in Finland and other countries.

Automotive Manufacturers and Importers

Kesko's car trade division relies heavily on partnerships with European automotive manufacturers. These collaborations, including brands like Volkswagen, Audi, and Porsche, are crucial for importing and leasing vehicles. Maintaining strong relationships ensures a diverse car selection, vital for attracting customers. Profitability across new cars, used cars, and services is a key focus.

- Kesko's car sales in 2023: approximately €1.6 billion.

- Market share in Finland for Kesko's car trade: around 20%.

- Key brands: Volkswagen, Audi, SEAT, and Porsche.

- Focus: new and used car sales, plus after-sales services.

Kesko's strategic alliances span franchise agreements, supplier networks, and technology providers, essential for its business model. Strong partnerships with K-Retailers are vital, contributing significantly to the €16 billion in retail sales in 2024. These collaborations ensure supply chain stability, technological advancement, and efficient logistics.

| Partnership Type | Key Focus | 2024 Impact |

|---|---|---|

| K-Retailers | Franchise Agreements | €16B Retail Sales |

| Suppliers | Supply Chain, Pricing | Thousands of Suppliers |

| Tech & Digital | E-commerce, Customer Experience | E-commerce growth |

Activities

Kesko's retail operations management is central to its business model, overseeing grocery, building, technical, and car trades. This core activity ensures consistent standards across approximately 1,700 stores in Northern Europe. Effective management is key for maintaining Kesko's leading retail position. In 2024, Kesko's net sales were around EUR 11.3 billion.

Kesko's supply chain is crucial, encompassing product sourcing, inventory management, and distribution to stores. A responsive supply chain is essential for integrating online sales and digital services. Kesko prioritizes profitability and cash flow, focusing on both country and business levels. In 2024, Kesko's net sales reached €10.8 billion, reflecting supply chain efficiency.

Kesko prioritizes enhancing customer experience across its channels. This involves improving online platforms and providing personalized services. They also focus on ensuring excellent in-store experiences to boost customer loyalty. In 2024, Kesko's digital sales grew, reflecting their focus on customer experience and digital transformation.

Acquisitions and Expansion

Kesko's core strategy includes acquisitions and expanding into new markets. This approach is evident in their recent purchase of Davidsen Koncernen A/S in Denmark. The company concentrates on the growth potential from these acquisitions, especially in Northern Europe. Kesko's strategy aims to boost market share and revenue streams.

- In 2023, Kesko's net sales increased by 2.4% to EUR 11.7 billion.

- Kesko's operating profit for 2023 was EUR 737 million.

- Kesko's acquisitions are focused on building their presence in the grocery trade, building supplies and the car trade.

Sustainability Initiatives

Kesko prioritizes sustainability through diverse activities. They promote sustainable sourcing, reducing environmental impact. Initiatives include minimizing food waste and offsetting construction's biodiversity impact. Sustainability boosts Kesko's competitiveness and benefits communities.

- In 2023, Kesko's sales from products with sustainability characteristics were 4.3 billion euros.

- Kesko aims to reduce its own emissions by 90% by 2030.

- Kesko is actively involved in the EU's Farm to Fork strategy.

- Kesko's food waste reduction program has saved approximately 1.5 million kg of food.

Kesko actively manages retail operations across diverse segments, ensuring high standards in its stores. They focus on an efficient supply chain, integrating online sales and prioritizing profitability. Enhancing customer experience through digital platforms and in-store services is also a key focus.

| Key Activity | Description | 2023 Data |

|---|---|---|

| Retail Operations Management | Overseeing grocery, building, technical, and car trades across approximately 1,700 stores. | Net sales increased by 2.4% to EUR 11.7 billion. |

| Supply Chain | Product sourcing, inventory management, and distribution. | Operating profit was EUR 737 million. |

| Customer Experience | Improving online platforms and in-store experiences. | Sales from products with sustainability characteristics were 4.3 billion euros. |

Resources

Kesko's extensive store network is a crucial asset, offering a broad presence across multiple countries, including Finland, Sweden, Norway, Estonia, Latvia, Lithuania, Poland and Denmark. This network encompasses diverse store formats like K-Citymarket, K-Supermarket, and K-Market. Kesko operates approximately 1,800 stores. In 2024, Kesko continued to reinforce its grocery store network, particularly in Finnish growth centers, opening new K-Citymarket hypermarkets.

Kesko's strong brand portfolio, featuring names like K-Rauta and Intersport, is key. These brands are recognized in their markets, boosting Kesko's reputation and customer loyalty. In 2024, brand recognition helped drive a 4% increase in customer traffic across its stores. This success supports Kesko's omnichannel strategy, blending online sales and physical stores.

Kesko's logistics infrastructure is a key resource, crucial for supply chain efficiency. This involves distribution centers, transportation, and inventory management tech. In 2024, €16.3 million was invested in a shared logistics center in Hyvinkää. Effective logistics ensure product availability.

Skilled Workforce

Kesko's success hinges on its skilled workforce, essential for managing retail, supply chains, and customer service. This includes store managers, logistics experts, and corporate teams. In 2024, K Group employed around 45,000 people. Training and development are key to maintaining service quality and operational efficiency.

- K Group employed approximately 45,000 people in 2024.

- Kesko and K-retailers together employ 39,000 people.

- Employee training programs are a significant investment.

- Operational efficiency depends on skilled employees.

Data and Digital Assets

Data and digital assets are pivotal for Kesko's operations. These resources include customer data, online platforms, and digital services, all aimed at improving customer interactions. Kesko leverages data as a strategic asset to refine customer experiences, boost efficiency, and generate value across its ecosystem. The company's 2024 Data balance sheet highlights its data and digitalization efforts.

- Kesko's net sales reached EUR 11.3 billion in 2024.

- Online sales grew by 10% in 2024.

- The company's data-driven initiatives supported a 5% increase in operational efficiency.

- Kesko's digital services saw a 15% rise in user engagement.

Kesko's key resources include its store network, with about 1,800 stores, crucial for market presence. Strong brands like K-Rauta boost Kesko's reputation and customer loyalty, increasing customer traffic by 4% in 2024. Effective logistics, including a €16.3 million investment in 2024, ensures supply chain efficiency.

| Resource | Description | 2024 Data |

|---|---|---|

| Store Network | Diverse store formats across several countries. | Approx. 1,800 stores |

| Brand Portfolio | Recognized brands like K-Rauta. | 4% increase in customer traffic. |

| Logistics Infrastructure | Distribution centers and transport. | €16.3M investment in logistics. |

Value Propositions

Kesko's expansive product range is a core value proposition. It spans groceries, building/technical goods, and car trade. This diversification meets varied customer demands. In 2024, Kesko's sales reached approximately EUR 11.3 billion, showcasing its broad market presence.

Kesko focuses on making shopping easy. It uses many stores and online options. Kesko offers online groceries and fast delivery. Digital services and stores create a smooth shopping experience. In 2024, online grocery sales rose, showing the success of this approach.

Kesko’s competitive pricing strategy focuses on attracting customers. The company invests in price reductions, particularly in the grocery sector. K Group, for example, reduced prices on over 1,200 staples. In 2025, Kesko and retailers will invest almost €50 million in price programs.

Reliable Quality

Kesko emphasizes reliable quality in its offerings. This commitment involves sourcing top-tier products and maintaining high service standards. Strong supplier relationships ensure a stable supply chain and competitive pricing. Kesko's focus on quality supports its financial performance. The net sales and operating profit are expected to stay solid in 2024.

- Kesko's net sales in 2023 were EUR 10.9 billion.

- Operating profit for 2023 was EUR 658.1 million.

- Kesko's grocery trade saw a 6.9% increase in net sales in 2023.

- Kesko's building and technical trade net sales increased by 2.2% in 2023.

Sustainable Practices

Kesko's commitment to sustainable practices is a key value proposition, resonating with eco-aware consumers. This involves sustainable sourcing, waste reduction, and biodiversity support. Sustainability provides a competitive edge, influencing communities broadly. Kesko was top-ranked in its industry in Europe for three years.

- Sustainable sourcing initiatives include utilizing responsibly sourced wood and seafood.

- Waste reduction efforts involve programs aimed at minimizing packaging and food waste.

- Biodiversity support is demonstrated through projects protecting local ecosystems.

- In 2024, Kesko invested €20 million in sustainable solutions across its operations.

Kesko offers an extensive range of products, including groceries, building supplies, and car trade, which caters to diverse customer needs. They focus on providing a seamless shopping experience through multiple store locations and online options, making it easy for customers to access their products. Kesko's competitive pricing strategy, with reduced prices on key items like staples, aims to attract customers.

| Value Proposition Element | Description | 2024 Data Highlights |

|---|---|---|

| Product Variety | Wide range of products including groceries, building, and car trade. | Sales reached approximately EUR 11.3 billion. |

| Convenience | Multiple stores and online shopping options, including fast delivery. | Online grocery sales increased. |

| Competitive Pricing | Price reductions, especially in the grocery sector. | Kesko and retailers will invest almost €50 million in price programs in 2025. |

Customer Relationships

Kesko prioritizes personalized service within its stores to foster solid customer relationships. This approach relies on staff who are friendly and helpful, ensuring a positive in-store experience. High levels of engagement and personalization are key drivers of customer loyalty, and retailers are using gen AI to capture this opportunity. In 2024, Kesko's customer satisfaction scores reflect this commitment, with scores consistently above the industry average.

Kesko's K-Plussa program is vital for customer connection, offering rewards and tailored deals. In 2024, 2.6 million Finnish households and 3.4 million users engaged with K-Plussa. Grocers are personalizing loyalty programs for better engagement. This enhances customer retention and drives sales through targeted marketing.

Kesko's online customer support includes FAQs, contact forms, and chat services to address inquiries and resolve issues. This ensures customer satisfaction and builds trust through responsive support. In 2024, Kesko's customer satisfaction scores remained high, reflecting effective online support. Customer relationships are crucial for business success, with digital interactions forming a key part of the customer journey. Digital customer service interactions increased by 15% in 2024.

Community Engagement

Kesko actively fosters community engagement through sponsorships and charitable support, enhancing customer connections. In 2024, Kesko and its retailers hosted over 100 free events across Finland, encouraging physical activity among approximately 73,000 young people. These actions build goodwill and reinforce Kesko's dedication to community well-being.

- Kesko's community initiatives include sponsoring local events and supporting charities.

- In 2024, over 73,000 young people participated in exercise events organized by Kesko and its retailers.

- These efforts demonstrate Kesko's commitment to the health and well-being of the communities it serves.

Feedback Mechanisms

Kesko actively gathers customer feedback to refine its services and products. They employ various channels like surveys and social media monitoring to understand customer preferences. This information, along with data from their CRM system, helps them tailor their customer relationship strategies. In 2024, Kesko reported a notable increase in customer satisfaction scores, indicating the effectiveness of these feedback loops.

- Surveys are a key tool for Kesko to gather direct customer insights.

- Social media monitoring allows them to gauge public perception in real-time.

- CRM data integrates feedback with purchase history for personalized strategies.

- Customer satisfaction scores rose by 7% in 2024, reflecting improved services.

Kesko emphasizes personalized service and community engagement to build strong customer relationships. The K-Plussa program, with 3.4M users in 2024, offers tailored deals. In 2024, digital customer service interactions saw a 15% increase, reflecting their importance.

| Customer Relationship Aspect | Description | 2024 Data |

|---|---|---|

| Personalized Service | Friendly staff and in-store experience. | Customer satisfaction above industry average |

| K-Plussa Program | Rewards and tailored deals. | 3.4M users |

| Online Support | FAQs, chat, and contact forms. | 15% increase in digital interactions |

Channels

Kesko's vast physical store network forms its main customer channel. These stores span diverse formats, including supermarkets and specialty outlets. Approximately 1,700 stores are operational across Finland, Sweden, Norway, Denmark, Estonia, Latvia, Lithuania, and Poland. In 2024, Kesko reported strong sales through its physical stores. These stores are integral to Kesko's strategy.

Kesko utilizes online retail platforms across various segments, facilitating digital shopping experiences. This includes online grocery services and e-commerce portals for construction materials and automotive components. Digital sales saw growth, contributing to overall revenue. Kesko's integrated approach merges online and offline channels.

Kesko's mobile apps are key for customer engagement, offering easy access to products and services. These apps support online shopping, loyalty programs, and personalized deals. Digitalization is crucial: in 2023, Kesko's online sales grew, showing the apps' impact. They enhance customer experiences, boost efficiency, and create value via data-driven insights.

Partnerships with Delivery Services

Kesko collaborates with delivery services such as Wolt to facilitate swift delivery of groceries and various products. This partnership enhances customer convenience by providing rapid order fulfillment. Approximately 800 Kesko stores offer online grocery services, supported by express deliveries. In 2024, online grocery sales, fueled by express deliveries, experienced a notable increase of 13.5%.

- Wolt partnership for quick deliveries.

- Around 800 stores offer online groceries.

- 13.5% growth in online grocery sales in 2024.

- Focus on customer convenience.

Social Media

Kesko leverages social media to connect with customers, promote offerings, and collect insights. This strategy includes platforms like Facebook, Instagram, and YouTube. In 2024, Kesko's social media engagement saw a significant increase, with a 15% rise in followers across its main channels. These platforms facilitate direct customer communication and enhance brand visibility. Social media campaigns, such as those promoting new product lines, have contributed to a 10% boost in online sales.

- Increased follower count by 15% across main channels in 2024.

- Social media campaigns resulted in a 10% increase in online sales.

- Platforms include Facebook, Instagram, and YouTube.

- Facilitates direct customer communication and brand building.

Kesko’s channels include physical stores, online platforms, mobile apps, and delivery partnerships like Wolt. Digital growth is evident: online grocery sales rose 13.5% in 2024. Social media engagement also surged, with a 15% follower increase. Kesko uses these channels to boost sales and improve customer experience.

| Channel Type | Description | 2024 Performance Highlights |

|---|---|---|

| Physical Stores | Wide network of stores across multiple countries. | Strong sales performance. |

| Online Platforms | E-commerce sites for various product categories. | Growth in digital sales. |

| Mobile Apps | Apps for shopping, loyalty programs, and deals. | Online sales growth, improved customer engagement. |

| Delivery Partnerships | Collaborations with services like Wolt. | 13.5% increase in online grocery sales in 2024. |

| Social Media | Platforms for customer engagement and promotion. | 15% increase in followers, 10% boost in online sales from campaigns. |

Customer Segments

Grocery shoppers represent a key customer segment for Kesko, encompassing individuals buying food and household items from their stores. These customers prioritize convenience, diverse product offerings, and competitive pricing. Kesko's commitment to affordability is evident through its price reductions on staples. In 2024, K Group implemented a long-term price program, cutting prices on over 1,200 everyday items.

Home improvement enthusiasts are a key customer segment for Kesko, driving sales in building materials and tools. This group includes both DIYers and professional contractors, utilizing Kesko's building and technical trade stores. In 2024, Kesko's building and technical trade sales reached EUR 6.3 billion. The Building and Technical Sector operates in Scandinavia and Eastern Europe, boosting both digital and physical store revenue.

Kesko's car buyer segment includes individuals and businesses purchasing or leasing vehicles, as well as those needing maintenance. Kesko imports and leases European brands like Volkswagen. In 2024, the Finnish car market was soft, but Kesko's car trade maintained good profitability. The car market in Finland showed a decrease of 10.2% in new registrations during 2024.

B2B Clients in Technical Trade

Kesko's technical trade segment caters to B2B clients, including construction firms and electricians. They offer specialized products and services to meet these professionals' needs. K Group, which includes Kesko and K-retailers, is a major player in the trading sector. Kesko focuses on providing a seamless customer experience across all channels.

- In 2024, Kesko's net sales were over EUR 11 billion.

- The technical trade segment plays a significant role in Kesko's overall revenue.

- Kesko operates extensively in Finland and other Northern European countries.

- Customer satisfaction is a key performance indicator for Kesko.

Sports and Leisure Customers

Kesko's sports and leisure customer segment focuses on active individuals and families. These customers shop at Intersport and Budget Sport, seeking quality gear and advice. This segment is crucial for Kesko's revenue. In 2024, the sports and leisure sector saw a 5% growth.

- Targets active individuals and families.

- Shops at Intersport and Budget Sport.

- Focuses on quality and expert advice.

- Offers leisure and sports goods.

Kesko's customer segments include grocery shoppers, home improvement enthusiasts, and car buyers. Technical trade and sports & leisure customers also play crucial roles. These segments drive significant sales, with net sales exceeding EUR 11 billion in 2024.

| Segment | Focus | Key Metrics (2024) |

|---|---|---|

| Grocery Shoppers | Food, household items | Price reductions on 1,200+ items |

| Home Improvement | Building materials, tools | Building & tech sales: EUR 6.3B |

| Car Buyers | Vehicle purchases, leasing | Finnish market down 10.2% |

Cost Structure

Cost of Goods Sold (COGS) is a major part of Kesko's costs. It covers the expense of buying products from suppliers for their stores. Kesko relies on strong supplier ties for a steady supply, good prices, and quality goods. These costs are affected by things like commodity prices and how efficient their logistics are. In 2023, Kesko's COGS were substantial, reflecting the scale of their retail operations.

Operating expenses for Kesko encompass costs like rent, utilities, salaries, and marketing for its retail operations. Store site fees represent about half of the fees Kesko charges its retailers. Additional cost-based fees cover marketing, logistics, and IT services. In 2024, Kesko's operating expenses were a significant factor in its overall financial performance. Efficiently managing these costs is key to maintaining profitability in Kesko's diverse business segments.

Kesko's cost structure includes significant investments in marketing and advertising to boost brand visibility. This involves diverse channels like online ads, print media, and promotional campaigns. In 2023, Kesko's marketing expenses were a notable part of its overall costs.

Kesko strategically uses share ownership to nurture supplier relationships, which can influence marketing costs. For 2024, the trend indicates further investment in customer-focused marketing strategies.

Looking ahead to 2025, Kesko is set to diversify its advertising efforts, exploring new digital and experiential marketing avenues. This proactive approach is designed to enhance customer engagement and market reach.

Logistics and Distribution Costs

Logistics and distribution costs are a major part of Kesko's cost structure, reflecting its widespread operations. These costs involve transportation, warehousing, and inventory management across its vast store network. In 2023, Kesko invested €16.3 million in a shared logistics centre in Hyvinkää, Finland. Efficient logistics are critical for cost control.

- Significant costs due to a wide network.

- Includes transport, warehousing, and inventory.

- €16.3M investment in a logistics centre in 2023.

- Efficient operations are key to minimizing costs.

Technology and IT Infrastructure

Kesko allocates significant resources to technology and IT infrastructure. This supports online platforms, digital services, and internal operations. In 2024, Kesko's IT investments are expected to be around €100 million. Data is crucial, enabling enhanced customer experiences and efficiency gains.

- Software development and hardware maintenance costs are substantial.

- IT support is essential for smooth operations.

- Data analytics drive continuous improvement.

- Digital transformation is a key focus.

Kesko's cost structure includes significant investment in COGS, covering purchasing goods from suppliers and affected by commodity prices and logistics. Operating expenses, such as rent, salaries, and marketing, are essential for retail operations. IT investments, expected to be around €100 million in 2024, are pivotal for enhancing customer experience and efficiency.

| Cost Element | Description | 2024 Outlook |

|---|---|---|

| COGS | Purchasing goods from suppliers | Influenced by commodity prices and logistics. |

| Operating Expenses | Rent, salaries, marketing | Significant portion of overall costs. |

| IT Investments | Technology and infrastructure | Around €100 million. |

Revenue Streams

Retail sales form Kesko's main revenue stream, generated from its diverse store network. These sales encompass groceries, building supplies, vehicles, and various other products. In 2024, K Group's retail sales reached approximately €16 billion, demonstrating its significant market presence. Kesko focuses on grocery, building/technical, and car trades, leveraging its expertise for sustained, profitable expansion.

Online sales are a significant and expanding revenue stream for Kesko, driven by its online retail platforms and mobile apps. In 2023, online grocery sales increased by 13.5%, boosted by express deliveries. Kesko's grocery trade division's operating profit is projected to remain above 6% despite investments. This growth reflects Kesko's focus on digital channels.

Kesko's car trade division boosts revenue through leasing and financing options. This segment offers payment flexibility, enhancing customer appeal. In 2024, despite a weak Finnish car market, Kesko's car trade division maintained solid profitability. The car division imports and leases brands like Volkswagen, SEAT, Audi, and Porsche.

Service Revenue

Kesko generates service revenue through car maintenance, repair, and other in-store value-added services. The used car market showed stronger growth than new cars, positively impacting service sales. Kesko aims to excel in new and used car sales, and related services. This strategy is crucial for revenue diversification and customer loyalty.

- In 2024, Kesko's car trade segment saw increased demand for services.

- Service revenue contributes significantly to overall profitability.

- Focus on services supports customer retention.

- Kesko's goal is to outperform in all car trade areas.

Franchise Fees

Kesko's franchise fees are a significant revenue stream, primarily derived from K-Retailers operating under its banners. These retailers pay chain fees based on net sales and store site fees tied to sales margins. Store site fees constitute roughly half of the total fees paid by retailers to Kesko. These fees support Kesko's retail operations.

- Chain fees are based on net sales, ensuring revenue aligns with sales performance.

- Store site fees, making up about half of the total fees, are calculated on sales margins.

- These fees are essential for Kesko’s financial health and are crucial for covering operational expenses.

- Kesko uses these fees to invest in its retail infrastructure and support its brand operations.

Kesko's revenue streams include retail sales, online sales, and services like car maintenance. Franchise fees also contribute, with K-Retailers paying chain and site fees. In 2024, K Group's retail sales reached approximately €16 billion, highlighting their significance.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Retail Sales | Sales from grocery, building supplies, and vehicles. | €16B (approximate) |

| Online Sales | Sales via online platforms and mobile apps. | 13.5% growth in online grocery (2023) |

| Franchise Fees | Fees from K-Retailers based on sales. | Chain fees on net sales, site fees on margins |

Business Model Canvas Data Sources

The Kesko Business Model Canvas leverages financial statements, market research, and internal performance metrics. These insights provide a robust strategic foundation.