Kesko Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kesko Bundle

What is included in the product

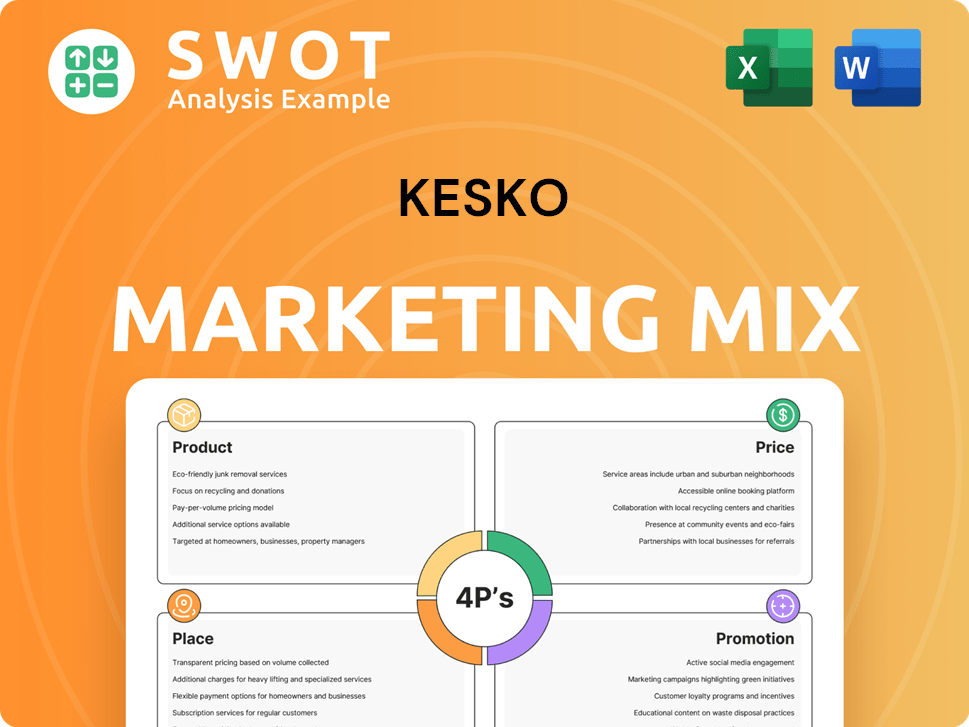

Kesko's 4P analysis: In-depth, strategic marketing mix breakdown, with practical examples.

Kesko's 4Ps analysis offers clear, structured insights, simplifying communication and marketing strategy.

What You See Is What You Get

Kesko 4P's Marketing Mix Analysis

The Kesko 4P's Marketing Mix analysis you see here is the same complete document you will receive after purchase.

4P's Marketing Mix Analysis Template

Kesko’s marketing success relies on a strong 4Ps foundation, targeting diverse markets. Its product strategy offers varied brands and services. Pricing balances affordability and value. Distribution leverages both physical stores and digital platforms, and their promotions are tailored to specific segments. Learn more how these work seamlessly by unlocking the full Marketing Mix analysis!

Product

Kesko's grocery product line features diverse food and household items via K-Market, K-Supermarket, and K-Citymarket. Fresh produce, baked goods, and meat are key offerings. Private labels, including Pirkka, Pirkka Parhaat, and K-Menu, are central. In 2024, Kesko's grocery sales were a significant portion of their revenue.

Kesko's building and home improvement supplies division, featuring K-Rauta and Onninen, targets diverse customer segments with building materials, interior design, and gardening supplies. In 2024, the building and technical trade segment's sales were a significant portion of Kesko's total revenue. The division’s product range supports both professional builders and individual consumers.

Kesko's K-Auto segment, a key part of its 4P strategy, focuses on car sales and services. They import, sell, and service brands like Volkswagen and Audi. In 2024, K-Auto saw a strong performance in used car sales. The K-Lataus network provides electric vehicle charging services.

Sports and Leisure Goods

Kesko's sports and leisure goods segment, primarily through Intersport and Budget Sport, is a key part of its product strategy. These chains provide a diverse range of sporting goods and leisure products, broadening Kesko's offerings beyond core retail. This diversification helps Kesko cater to a wider customer base. In 2024, the sports trade segment represented a significant portion of Kesko's revenue.

- In 2024, Kesko's net sales for the sports trade were a substantial part of the total revenue.

- Intersport and Budget Sport chains contribute significantly to Kesko's market share in sporting goods.

Wholesale and Foodservice

Kesko significantly impacts Finland's wholesale and foodservice sectors through Kespro. Kespro supplies hotels, restaurants, and caterers with goods and services, solidifying its B2B presence. This segment contributes substantially to Kesko's diverse product portfolio. In 2024, Kespro's sales were approximately €1.8 billion.

- Kespro's revenue in 2024 was approximately €1.8 billion.

- It serves hotels, restaurants, and catering businesses.

- This segment is a core part of Kesko's B2B operations.

Kesko's product strategy features diverse segments from groceries to auto. The product range includes private labels like Pirkka, and branded offerings like Volkswagen and Audi. In 2024, all segments contributed to its revenue. The diversification caters to wide customer needs.

| Segment | Key Products | 2024 Sales Contribution |

|---|---|---|

| Grocery Trade | Food, household items, private labels | Significant revenue portion |

| Building and Home Improvement | Building materials, interior design | Significant revenue portion |

| Car Trade | Car sales, services, EV charging | Strong performance in used cars |

| Sports Trade | Sporting goods, leisure products | Substantial part of revenue |

| Wholesale and Foodservice | Goods & services for HoReCa | Approx. €1.8B in 2024 |

Place

Kesko's vast network, boasting around 1,700 stores in 2024, is a cornerstone of its marketing. These stores, ranging from K-Market to K-Citymarket, ensure broad accessibility for customers. This diverse network helps Kesko cater to varied consumer needs and geographical locations. Physical presence remains crucial for retail success, and Kesko's footprint supports this.

Kesko's omnichannel strategy merges physical stores with digital platforms for a unified shopping experience. This integration lets customers browse and buy via e-commerce and mobile apps. In 2024, Kesko's online sales grew, reflecting the success of its omnichannel model. The goal is to offer shoppers both ease and adaptability.

Kesko operates online stores like K-Ruoka.fi and K-Citymarket.fi, expanding product reach. These platforms allow remote shopping, boosting customer convenience. Online sales are crucial, with digital retail growing. In 2024, Kesko's net sales were EUR 10.9 billion, showing online's impact.

Logistics and Supply Chain

Efficient logistics and supply chain management are vital for Kesko. K-Logistics offers comprehensive services like transport and warehousing. This ensures timely product delivery to stores and customers. This infrastructure backs both physical and digital sales.

- In 2024, Kesko's net sales were EUR 11.3 billion.

- K-Logistics supports over 1,000 stores.

- Approximately 80% of Kesko's products are distributed via its logistics network.

Presence in Northern Europe

Kesko's footprint in Northern Europe extends well beyond Finland. The company has a notable presence in Sweden, Norway, Denmark, Estonia, Latvia, Lithuania, and Poland. This expansive reach strengthens its market and distribution capabilities. For example, in 2024, Kesko's sales outside Finland accounted for roughly 30% of its total revenue.

- Kesko operates diverse store formats in the region.

- B2B services are also a key part of their international strategy.

- The international segment contributes significantly to Kesko's overall financial performance.

Kesko leverages its extensive store network and online platforms for market reach. Physical stores and digital channels merge to offer customers versatile shopping options. Efficient logistics and supply chains support timely deliveries across various locations. Its expansive presence in Northern Europe, like in Sweden, strengthens market and distribution, where 30% of total revenue came in 2024.

| Aspect | Details | 2024 Data |

|---|---|---|

| Store Count | Number of stores in the network | ~1,700 |

| Online Sales | Growth of online sales | Increased |

| Net Sales | Kesko's net sales | EUR 11.3B |

Promotion

Kesko's K-Plussa loyalty program is the largest in Finland, crucial for customer retention. It offers points, discounts, and tailored deals across its extensive network. In 2023, K-Plussa had over 3 million active users. This program helps Kesko gather valuable customer data. It supports personalized marketing strategies.

Kesko leverages customer data and AI for targeted marketing, offering personalized recommendations. This strategy boosts promotional relevance and effectiveness. Digital services are key to this personalization. In 2024, Kesko's digital sales grew, reflecting the success of these efforts. This focus on personalization aligns with current market trends.

Kesko utilizes diverse advertising, including digital and traditional media, to connect with consumers. Content marketing is a key strategy, seen with the K-Ruoka platform, offering recipes and lifestyle content. This strategy helps increase brand visibility and boost sales. In 2024, Kesko's marketing expenses reached approximately €200 million.

Sales s and Discounts

Kesko employs sales and discounts to draw in customers and boost sales. These promotions are either broad-based or tailored via the K-Plussa program. Price advantages are a key part of their promotional approach, especially in the competitive grocery sector. Kesko's focus on promotions boosted its net sales by 3.4% in 2023.

- Offers support sales growth.

- K-Plussa program offers personalized deals.

- Price benefits are crucial in the grocery market.

Unified K Brand Communication

Kesko is unifying brand communication across its K-chains to strengthen its image. The "K" brand is central to their marketing. This strategy aims for a more cohesive brand identity to resonate with consumers. In 2024, Kesko's net sales were approximately €11.3 billion. This initiative is expected to enhance brand recognition.

- Focus on the "K" brand for unified messaging.

- Improve brand consistency across all channels.

- Increase brand awareness and customer loyalty.

Kesko's promotions leverage sales and discounts to attract customers, and tailored deals are a key tactic, especially via the K-Plussa program.

Price advantages are emphasized in the competitive grocery market, enhancing Kesko’s promotional strategy. Promotional activities significantly boost sales; for example, the boost to net sales by 3.4% in 2023

They incorporate a unified brand communication to strengthen its image using the "K" brand. These promotional efforts are designed to improve recognition; Kesko's net sales were approximately €11.3 billion in 2024.

| Promotion Strategy | Key Activities | Impact |

|---|---|---|

| Sales & Discounts | K-Plussa offers, Price benefits | Boosted net sales by 3.4% in 2023 |

| Unified Branding | "K" brand emphasis | Enhanced Brand Image |

| Marketing budget | €200 million (2024) | Increased Customer engagement and sales |

Price

Kesko's pricing strategy centers on competitiveness within retail markets. They offer affordable choices, notably via private labels like K-Menu. In 2024, Kesko's grocery trade saw a strong emphasis on competitive pricing. This helped them maintain market share amidst inflation.

Kesko's pricing strategy focuses on competitive prices. They collaborate with K-retailers, implementing price cuts on essentials. This attracts price-conscious customers. In 2024, Kesko invested significantly in price competitiveness, reflecting its commitment to value. This approach helped maintain market share.

Kesko uses value-based pricing, balancing quality and service. Their premium brand, Pirkka Parhaat, highlights this approach. In 2024, Kesko's net sales were EUR 10.9 billion. This strategy supports customer loyalty and brand image. Kesko's focus on value helps maintain profitability.

Loyalty Program Benefits

Kesko's K-Plussa loyalty program is a key pricing strategy, offering members discounts and benefits. This drives customer retention and provides immediate savings, boosting sales. Accumulated points are redeemable for further discounts, creating a cycle of engagement. In 2024, K-Plussa had over 3.4 million active users.

- Price benefits and discounts for members.

- Encourages repeat purchases.

- Points accumulated can be redeemed for discounts.

- Over 3.4 million active users in 2024.

Retailer Pricing Flexibility

Kesko's K-retailer model grants independent retailers in Finland pricing autonomy. This allows for adjustments below Kesko's guidelines, adapting to local markets. This flexibility is crucial, considering Finland's inflation rate reached 3.2% in March 2024. Retailers use this to manage margins and attract customers.

- Price setting flexibility.

- Local market adaptation.

- Inflation management.

Kesko strategically prices goods to stay competitive, focusing on value. The company uses private labels and price cuts, appealing to cost-conscious customers. In 2024, Kesko invested in competitive pricing, especially in groceries, supporting market share. They also utilize the K-Plussa loyalty program to boost sales.

| Strategy | Details | 2024 Impact |

|---|---|---|

| Competitive Pricing | Price cuts, private labels (K-Menu). | Supported market share growth |

| Value-Based Pricing | Premium brands (Pirkka Parhaat). | Supported customer loyalty |

| K-Plussa Loyalty | Member discounts. | Over 3.4M active users |

4P's Marketing Mix Analysis Data Sources

We analyze Kesko's strategy via company communications, annual reports, and e-commerce data. We also use industry reports to confirm marketing decisions. Our data focuses on company's recent marketing efforts.