Kimberly-Clark Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kimberly-Clark Bundle

What is included in the product

Analyzes Kimberly-Clark's product portfolio within the BCG Matrix.

Optimized layout visualizing Kimberly-Clark's strategic positions.

What You See Is What You Get

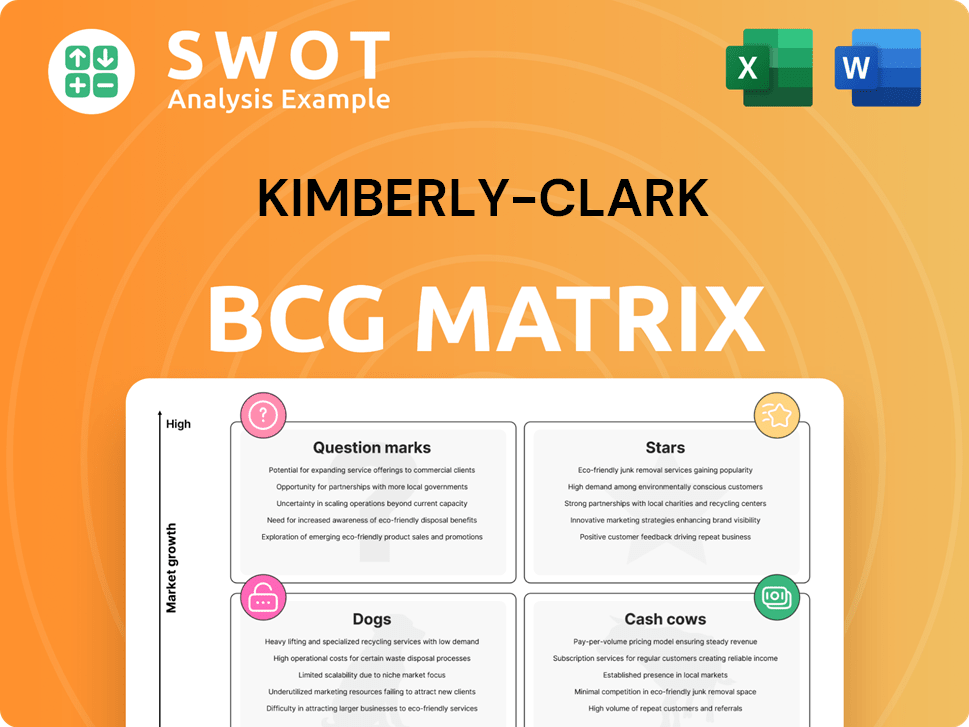

Kimberly-Clark BCG Matrix

This preview showcases the complete Kimberly-Clark BCG Matrix you'll receive instantly upon purchase. It's a ready-to-use, fully analyzed report—no alterations required after your order is processed. The complete document presents strategic insights with a professional format, perfect for your business planning.

BCG Matrix Template

Kimberly-Clark's BCG Matrix reveals its product portfolio's competitive landscape. Examining its Stars, like Huggies, is key for growth. Identifying Cash Cows, such as Kleenex, unlocks resource optimization. Pinpointing Dogs, such as some paper towels, prevents wasted investments. Understanding Question Marks guides crucial product development decisions. The complete BCG Matrix offers strategic clarity for informed choices. Purchase now for in-depth analysis and actionable recommendations!

Stars

Huggies, a star within Kimberly-Clark's portfolio, shines brightly in the baby care market. Huggies' strong position is evident in North America and China. In 2024, Kimberly-Clark's net sales in North America reached $5.1 billion, with baby and child care contributing significantly. Continued investment in Huggies' innovation and marketing could secure its market leadership.

Kleenex, a star in Kimberly-Clark's portfolio, holds a strong market position. The brand benefits from consistent consumer demand, especially post-COVID. In 2024, the global tissue market is estimated at $27.5 billion. Expansion and innovation are key to sustaining growth for Kleenex.

Kimberly-Clark's innovation in personal care is a star, fueled by a robust product pipeline. The company is planning launches for 2025. In 2024, Kimberly-Clark's net sales were roughly $20.4 billion. This focus on category-shaping tech will help expand its offerings.

Digital Transformation Initiatives

Kimberly-Clark's digital transformation initiatives, featuring AI and e-commerce strategies, are boosting efficiency and enhancing customer experiences. The Bengaluru-based Global Digital Technology Center (GDTC) is key in developing these solutions. These initiatives aim to improve sales and productivity, leading to global savings. For instance, e-commerce sales grew in 2024.

- E-commerce sales growth in 2024.

- GDTC's role in digital solution development.

- Focus on sales execution and employee productivity.

- Goal to generate global savings through digital initiatives.

Sustainability-Driven Products

Kimberly-Clark's commitment to sustainability resonates with consumers. The company is targeting significant reductions in its environmental impact by 2030. Products incorporating recycled materials or minimizing plastic usage are poised for success. This strategy aligns with consumer demand, which is increasing.

- Kimberly-Clark aims for a 50% reduction in virgin fiber use by 2030.

- The company's sustainable product sales are growing, reflecting consumer preference.

- Investments in eco-friendly packaging are also a part of the strategy.

The "Stars" in Kimberly-Clark's portfolio include Huggies, Kleenex, personal care innovations, and digital transformation initiatives. These business units hold strong market positions with high growth potential. Investments in innovation and expansion are key to their continued success. In 2024, the company's net sales were about $20.4 billion.

| Star | Description | 2024 Status |

|---|---|---|

| Huggies | Baby care products. | Significant contributor to $5.1B sales in North America. |

| Kleenex | Tissue products. | Steady demand, $27.5B global tissue market. |

| Personal Care | Product Innovation. | Robust pipeline with 2025 launches planned. |

| Digital Initiatives | AI and e-commerce. | E-commerce sales growth and efficiency boosts. |

Cash Cows

Scott paper towels are a cash cow for Kimberly-Clark, thriving in the mature North American tissue market. The brand benefits from strong recognition and customer loyalty, ensuring consistent revenue. In 2024, Kimberly-Clark's North American consumer tissue segment generated substantial sales. The company can focus on cost optimization to maximize profitability.

Cottonelle is a key player in Kimberly-Clark's portfolio, positioned as a Cash Cow due to its strong market presence. It enjoys steady demand and a loyal customer base. In 2024, the global tissue market was valued at approximately $200 billion, with Cottonelle capturing a significant share. Kimberly-Clark focuses on cost efficiency and brand extensions to maximize profits.

Depend, a key product for Kimberly-Clark, is a strong cash cow, dominating the adult incontinence market. The global adult incontinence products market was valued at $12.1 billion in 2023 and is projected to reach $17.6 billion by 2030. With an aging global population, demand remains stable. Kimberly-Clark can leverage Depend's strong position through innovation and marketing to maintain profitability.

Poise Feminine Care Products

Poise is a well-known brand in the feminine care market, offering products for light incontinence. Poise, like Depend, benefits from steady demand and a solid brand reputation. Kimberly-Clark can use its experience to innovate and broaden the Poise line, catering to specific consumer needs. In 2024, the global feminine hygiene market was valued at $38.5 billion, with projections to reach $52.5 billion by 2030.

- Poise has a strong market presence, contributing to Kimberly-Clark's revenue.

- The brand's established position ensures consistent sales and customer loyalty.

- Product innovation can drive growth within the expanding feminine care sector.

- Leveraging brand equity supports market share and profitability.

K-C Professional

Kimberly-Clark Professional (K-C Professional) is a cash cow, offering workplace solutions like hygiene and safety products. This segment focuses on consistent revenue generation rather than high growth. The strategy involves boosting profitability by expanding well-known brands within family care and professional markets. K-C Professional leverages shared technology platforms to streamline operations. In 2024, this segment likely contributed a significant portion of Kimberly-Clark's overall revenue.

- Steady revenue stream from workplace solutions.

- Focus on profitability and brand expansion.

- Utilizes shared technology platforms.

- Contributes to Kimberly-Clark's overall financial stability.

Poise, a key Kimberly-Clark brand, is a cash cow, delivering steady revenue in feminine care. It benefits from a strong brand reputation and loyal customer base. The feminine hygiene market, valued at $38.5B in 2024, supports Poise's profitability. Kimberly-Clark focuses on innovation and brand extension within this sector.

| Aspect | Details |

|---|---|

| Market | Feminine Hygiene |

| 2024 Market Value | $38.5 Billion |

| Key Strategy | Innovation and Brand Extension |

Dogs

Kimberly-Clark's exit from U.S. private label diapers signals underperformance, inconsistent with its strategy. Private labels typically have lower margins and face fierce competition. In 2024, Kimberly-Clark's net sales decreased, emphasizing the need to focus on higher-margin branded goods for improved profitability and market share. This move aligns with strategic resource allocation.

The PPE business, once part of Kimberly-Clark, has been divested. This move streamlines operations, allowing focus on core areas. The PPE market is subject to demand fluctuations. In 2024, Kimberly-Clark's focus shifted to core consumer brands.

Kimberly-Clark's 2024 Transformation Initiative involved strategic exits. This included selling the Brazil tissue and professional business. These moves aimed to streamline operations. Exits suggest underperformance, aligning with a focus on core areas. Kimberly-Clark's 2023 net sales were $20.4 billion.

Underperforming Geographies

Kimberly-Clark's performance in Latin America and Southeast Asia has been strained by economic hurdles, possibly placing these regions in the 'dogs' category. These areas might show limited growth due to reduced product usage amid financial strains. For instance, in Q3 2023, emerging markets' organic sales growth was just 3%, compared to 8% in North America. Re-evaluating strategies or divesting could be necessary.

- Emerging markets' organic sales growth was 3% in Q3 2023.

- North America's organic sales growth was 8% in Q3 2023.

- Economic pressures impact product use.

- Reassess or divest in underperforming markets.

Products with Declining Market Share

Kimberly-Clark's 'dogs' are product lines with declining market share and low growth. These underperformers may need substantial investment or could be divested. Identifying and addressing such products is crucial for portfolio optimization. Regular reviews help in making strategic decisions about these assets.

- Depend products experienced a decline in market share in 2024.

- The company may consider divesting or discontinuing these underperforming products.

- Kimberly-Clark's portfolio reviews are essential to address struggling product lines.

- The company's net sales decreased by 3% in 2024.

Kimberly-Clark's "Dogs" include product lines with low growth and market share. These face challenges, possibly needing divestment. Depend products saw a decline in 2024. Kimberly-Clark's net sales decreased 3% in 2024.

| Category | Description | 2024 Status |

|---|---|---|

| Depend Products | Declining Market Share | Underperformer |

| Emerging Markets (Q3 2023) | Organic Sales Growth: 3% | Strained |

| Overall | Net Sales Decline | -3% |

Question Marks

Confidence Daily Fresh in Indonesia is a question mark in Kimberly-Clark's BCG Matrix. The brand, though experiencing organic growth, contributes a small percentage to overall revenue. Strategic marketing and further investment are crucial. In 2024, Kimberly-Clark's net sales were approximately $20.4 billion.

Kimberly-Clark's push into emerging markets like India and China is a 'question mark' in its BCG Matrix. These regions offer high growth prospects, with India's consumer market expanding significantly in 2024. However, these markets also involve risks. In 2024, market volatility and currency fluctuations impacted profitability. Strategic investments and thorough market analysis are key to success.

Kimberly-Clark's new sustainable product lines are Question Marks in its BCG Matrix, responding to the rising consumer demand for green products. These eco-friendly products might have higher manufacturing expenses, potentially impacting profitability, as seen in 2024 with a 3% rise in raw material costs. Successful market entry hinges on educating consumers, requiring robust marketing investments; the company allocated $450 million for marketing in 2024. The long-term viability of these offerings needs strategic R&D.

Digital Health and Hygiene Solutions

Kimberly-Clark's digital health and hygiene solutions, such as the Kleenex pollen tracker and the Kotex period tracking app, are question marks in its BCG matrix. These initiatives aim to boost customer engagement and brand loyalty through innovative digital tools. However, their success hinges on attracting and retaining users, requiring continued investment and innovation in a competitive market. For instance, the digital health market is projected to reach $660 billion by 2025.

- Projected Growth: The digital health market is expected to reach $660 billion by 2025.

- Customer Engagement: Digital tools aim to increase customer interaction with the brand.

- Investment Needs: Requires ongoing investment and innovation to stay relevant.

- Market Competition: Success depends on standing out in a crowded digital space.

AI-Driven Supply Chain Optimizations

Kimberly-Clark's strategic investments in AI-driven supply chain optimizations, such as the Maestro platform, have demonstrated positive outcomes in terms of cost reduction. These AI initiatives require continuous investment and refinement to maintain their effectiveness. The company's ongoing exploration of AI to improve efficiency and cut costs is critical. According to a 2024 report, supply chain AI can reduce operational costs by up to 15%.

- Maestro platform implementation has shown cost savings.

- Ongoing investment is needed for AI initiatives.

- AI helps improve efficiency and reduce costs.

- Supply chain AI can cut operational costs by up to 15%.

Kimberly-Clark's 'Question Marks' need strategic focus for growth. Digital health initiatives aim to boost customer engagement. AI-driven supply chain optimizations are essential. The market for AI in supply chains is expected to reach $20 billion by 2025.

| Category | Example | Strategic Consideration |

|---|---|---|

| Digital Health | Kleenex pollen tracker | Investment in digital tools to boost engagement, $660B market by 2025 |

| AI Supply Chain | Maestro platform | Continuous investment, potential for 15% cost reduction, $20B market by 2025 |

| Sustainable Products | Eco-friendly lines | Consumer education and marketing, addressing increased costs, $450M allocated in 2024 |

BCG Matrix Data Sources

Kimberly-Clark's BCG Matrix is shaped by company financials, market studies, analyst insights, and sales data, for sound strategic recommendations.