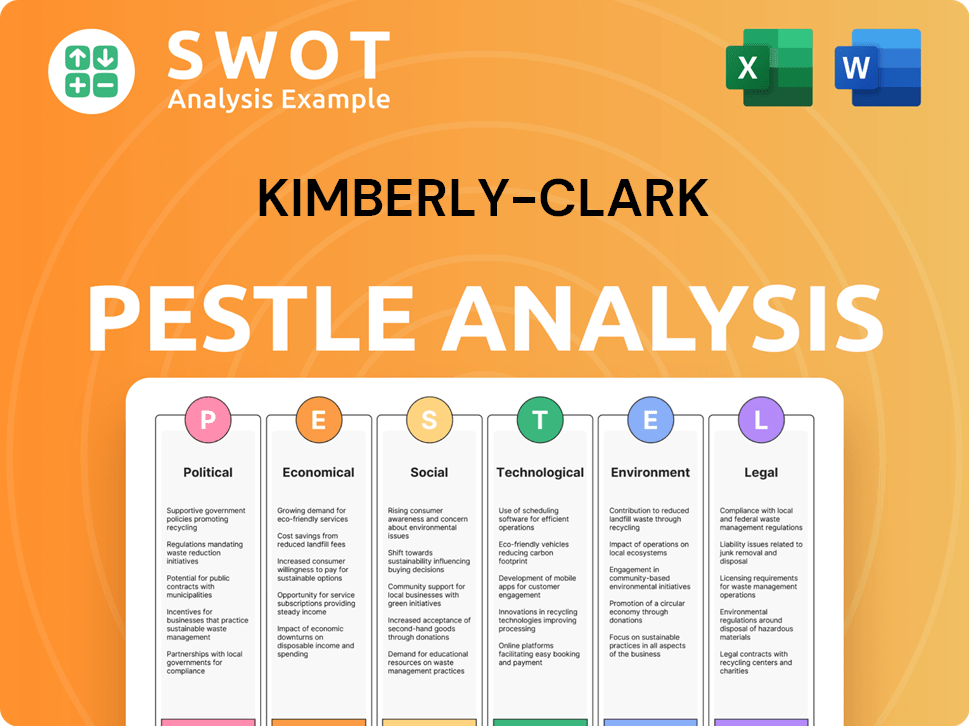

Kimberly-Clark PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kimberly-Clark Bundle

What is included in the product

Analyzes external factors shaping Kimberly-Clark through PESTLE: political, economic, social, technological, environmental, and legal aspects.

Provides insights into crucial external factors impacting strategy decisions.

What You See Is What You Get

Kimberly-Clark PESTLE Analysis

The content you see is the complete Kimberly-Clark PESTLE Analysis you'll receive. Fully formatted and ready for immediate use, just as shown here. Analyze the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Kimberly-Clark. Everything displayed is what you get.

PESTLE Analysis Template

Assess Kimberly-Clark's market positioning with our detailed PESTLE analysis.

Explore political, economic, social, technological, legal, and environmental impacts.

Discover how these external factors affect the company's operations and strategic planning.

Gain insights for risk assessment, strategic development, and market understanding.

Uncover actionable intelligence for investors, analysts, and industry professionals.

Ready-to-use insights, download our full PESTLE analysis for comprehensive understanding.

Political factors

Kimberly-Clark's global operations face trade policy impacts. Tariffs affect raw material costs and product competitiveness. For instance, U.S. tariffs on imported pulp could raise costs. In 2024, fluctuations in trade agreements, like those with China, are key. These policies influence supply chains and profitability, as seen with the 2023 impact on raw material pricing.

Kimberly-Clark faces political risks due to its global presence. Political instability, regional conflicts, and government actions can disrupt operations. For instance, the Ukraine war impacted supply chains. Such risks increase operational uncertainty. Consider political factors when assessing investments.

Kimberly-Clark faces a complex regulatory environment for its consumer products. Regulations on product safety, manufacturing, and environmental impact vary by market. Compliance impacts product formulation, labeling, and production costs. For example, in 2024, the company spent $150 million on regulatory compliance globally, a 5% increase from 2023.

Government Relations and Advocacy

Kimberly-Clark actively engages with governments and trade groups to push for policies that align with its goals. These include promoting sustainable products, recycling initiatives, and transparent climate impact reporting. Constructive relationships with government stakeholders are crucial for navigating the political environment. The company's advocacy efforts are likely influenced by the evolving regulatory landscape, with increased focus on environmental sustainability. In 2024, the company spent $1.5 million on lobbying.

- Lobbying expenditure: $1.5 million (2024).

- Focus areas: Sustainable products, recycling, and climate impact reporting.

- Importance: Navigating political landscape and regulatory changes.

International Market Entry Barriers

Entering international markets presents Kimberly-Clark with regulatory hurdles. These include product registrations, local manufacturing demands, and adherence to diverse standards. Such requirements escalate costs and complexity, affecting the company's global operations. For instance, in 2024, the average cost for product registration in the EU was approximately €2,500 per product, with variations based on product type.

- Product registration processes.

- Local manufacturing requirements.

- Compliance with various standards.

- Increased costs.

Kimberly-Clark navigates complex political factors that affect its global operations, like trade policies. Political risks, including instability and government actions, impact supply chains. The company actively engages in lobbying, spending $1.5 million in 2024, focusing on sustainable products.

| Aspect | Details | 2024 Data |

|---|---|---|

| Lobbying Spending | Advocacy efforts | $1.5 million |

| Compliance Cost | Regulatory requirements | $150 million |

| EU Registration Cost | Product registration | €2,500/product (avg.) |

Economic factors

Kimberly-Clark's success is tied to global economic health and consumer spending. Economic downturns can decrease demand, especially in specific regions. The company has observed reduced product use in Latin America and Southeast Asia. In 2024, global economic growth is projected at 3.2%, with consumer spending remaining cautious.

Kimberly-Clark's profitability is significantly influenced by raw material costs, particularly pulp and other commodities. In 2024, pulp prices fluctuated, impacting production expenses. The company must strategically manage these costs to protect its profit margins. For instance, in Q3 2024, KMB reported a gross margin of 36.8%, reflecting the impact of raw material costs.

Kimberly-Clark's global presence makes it vulnerable to foreign exchange rate swings. These shifts can affect reported sales and profits. For example, a strong US dollar reduces the value of international sales. In Q4 2023, currency headwinds decreased net sales by 1%. This shows the impact on financial results.

Inflation and Pricing Environment

Inflation significantly impacts Kimberly-Clark's operational expenses, necessitating strategic pricing adjustments. The company navigates a complex pricing landscape, including both muted growth and positive contributions from hyperinflationary markets. In 2024, Kimberly-Clark reported that its net sales increased by approximately 1% due to improved pricing. The company's ability to manage price increases is crucial for maintaining profitability.

- 2024 Net Sales Growth: Approximately 1% due to pricing.

- Pricing Environment: Complex, with both challenges and opportunities.

- Hyperinflation: Positive pricing contributions in some regions.

Productivity and Cost Savings Initiatives

Kimberly-Clark actively pursues productivity improvements and cost reductions to boost profitability. The company's strategies, such as Powering Care and supply chain overhauls, are designed to enhance efficiency and counter rising costs. These efforts are crucial for maintaining financial health and competitiveness in the market. As of 2024, the company aims to achieve significant savings through these initiatives.

- In 2023, Kimberly-Clark achieved $400 million in cost savings.

- The Powering Care program is expected to contribute substantially to these savings.

- Supply chain optimization is a key focus for 2024 and 2025.

Economic factors like global growth and consumer spending heavily influence Kimberly-Clark's performance. Fluctuating raw material costs and foreign exchange rates create further complexities, affecting profit margins. Inflation necessitates strategic pricing adjustments, which are crucial for maintaining profitability and growth.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Global Growth | Impacts demand. | 2024 projected 3.2% growth. |

| Raw Materials | Affects production costs. | Pulp prices fluctuate. |

| Exchange Rates | Affects sales and profits. | Q4 2023, 1% headwind. |

Sociological factors

Consumer preferences are in constant flux, impacting Kimberly-Clark. Demand shifts towards sustainable, high-quality products. For instance, in 2024, eco-friendly product sales rose 15%. Kimberly-Clark must innovate to meet these evolving needs to stay competitive and retain its market share.

Consumers' emphasis on health and hygiene boosts Kimberly-Clark's sales. This trend, amplified by global events, favors its personal care and professional lines. In 2024, the global hygiene market is valued at $600 billion. The sector is projected to reach $800 billion by 2025, which supports Kimberly-Clark's growth.

The world's aging population significantly boosts demand for adult care products. Kimberly-Clark's Depend brand directly addresses this need. In 2024, the global market for adult incontinence products was valued at approximately $13.2 billion, with projections to reach $17.8 billion by 2029. This demographic shift creates a sustained market for Kimberly-Clark's offerings.

Sustainability and Ethical Consumerism

Sustainability and ethical consumerism are significantly impacting consumer choices. A growing number of consumers prioritize environmental and social responsibility when making purchases. This trend pushes companies like Kimberly-Clark to adopt sustainable practices. In 2024, over 70% of consumers expressed a preference for sustainable brands. This shift necessitates enhanced environmental and social performance.

- 70% of consumers prefer sustainable brands.

- Kimberly-Clark aims to reduce its environmental footprint.

- Ethical sourcing is becoming a key factor.

Access to Essential Products and Social Impact

Kimberly-Clark prioritizes providing essential hygiene products to vulnerable communities, reflecting a strong social impact focus. They run programs centered on sanitation, maternal and infant health, and consumer empowerment, aiming to improve overall well-being. In 2024, the company invested over $100 million in social impact initiatives globally. These efforts align with the UN's Sustainable Development Goals, enhancing brand reputation and consumer trust.

- $100M+ invested in social impact in 2024.

- Focus on sanitation, health, and empowerment.

- Aligned with UN Sustainable Development Goals.

Evolving consumer demands prompt continuous innovation. Ethical sourcing is a growing factor in purchasing decisions. Hygiene and aging trends influence product demand.

| Sociological Factor | Impact on Kimberly-Clark | 2024/2025 Data |

|---|---|---|

| Consumer Preferences | Demand for sustainable, high-quality products. | Eco-friendly sales grew 15% in 2024; ~70% prefer sustainable brands. |

| Health & Hygiene | Boosts sales in personal care & professional lines. | Global hygiene market valued at $600B in 2024, $800B est. by 2025. |

| Aging Population | Increases demand for adult care products (Depend). | Adult incontinence market: $13.2B (2024), $17.8B est. by 2029. |

Technological factors

Kimberly-Clark leverages tech advancements in manufacturing. Automation and robotics boost efficiency, cut costs, and refine quality. They're investing heavily, aiming to optimize production. In 2024, K-C's capital expenditures reached $850 million, reflecting tech-driven supply chain upgrades.

Kimberly-Clark is heavily investing in digital transformation, using AI and ML to boost efficiency. They're focusing on supply chain, sales, and customer relations. The company is expanding digital technology centers to support these initiatives. This could lead to operational cost savings and better market insights. In 2024, digital sales grew, showing the impact of these tech investments.

Technological innovation drives new product development at Kimberly-Clark. The company invests heavily in R&D to create better, sustainable products. In 2024, R&D spending was approximately $400 million. This fuels innovation in hygiene products. This helps meet changing consumer demands.

E-commerce and Digital Sales Channels

Kimberly-Clark must navigate the evolving e-commerce landscape. This involves significant investments in digital sales channels and strategies. Success hinges on optimizing online pricing and utilizing data analytics. In 2024, e-commerce sales are projected to reach $6.3 trillion globally, highlighting the importance of a strong digital presence.

- E-commerce sales are forecasted to grow by 10% in 2024.

- Kimberly-Clark's digital sales grew by 15% in 2023.

- Data analytics can improve pricing strategies by 7%.

Supply Chain Technology and Optimization

Kimberly-Clark's supply chain is increasingly reliant on technology. This includes AI-driven logistics and automated distribution centers. Such technologies enhance efficiency and make the supply chain more responsive. These improvements are crucial for navigating market changes.

- The global supply chain software market is projected to reach $21.4 billion by 2025.

- Kimberly-Clark invested $200 million in supply chain optimization in 2023.

- Automated warehouses can reduce operational costs by up to 30%.

Kimberly-Clark (K-C) is heavily investing in technology across manufacturing, digital transformation, and R&D to boost efficiency and innovation. This includes using AI and ML. E-commerce and digital sales channels are also key priorities.

| Area | Investment (2024) | Growth/Impact |

|---|---|---|

| R&D | $400M | Fuels new, sustainable products |

| Supply Chain | $850M CapEx | Improved supply chain |

| Digital Sales | Projected to reach $6.3T globally | Digital sales increase |

Legal factors

Kimberly-Clark faces stringent product safety regulations globally. These rules cover chemical safety, materials, and labeling. Non-compliance can lead to significant penalties and reputational damage. For example, in 2024, there were 1,200 product recalls in the U.S. alone.

Kimberly-Clark must comply with labor laws and human rights standards. This involves addressing forced labor, working hours, and safety. The company has faced scrutiny over supply chain labor practices. In 2024, the company's commitment to ethical sourcing is crucial. The company's ESG report for 2024 highlights ongoing efforts.

Kimberly-Clark must adhere to stringent environmental regulations globally. Compliance includes managing emissions, waste, water, and sustainable sourcing. For example, in 2024, the company invested $25 million in water conservation. These regulations drive Kimberly-Clark's sustainability initiatives.

Intellectual Property Protection

Kimberly-Clark heavily relies on intellectual property (IP) to protect its competitive edge. This includes securing patents for innovative product designs and manufacturing processes, alongside trademarks for its well-known brands. Strong legal frameworks globally are important for Kimberly-Clark to safeguard its IP. In 2024, the company spent $175 million on research and development, indicating a continued focus on innovation and IP protection. The company's legal team actively monitors and enforces its IP rights worldwide.

- Trademarks: Kimberly-Clark owns numerous trademarks globally, including Kleenex, Huggies, and Scott.

- Patents: They have patents for various product features and manufacturing techniques.

- Legal Enforcement: The company actively litigates to protect its intellectual property.

- R&D Investment: Around $175 million was spent on R&D in 2024.

False Labeling and Advertising Litigation

Kimberly-Clark faces legal scrutiny over product labeling and advertising, a common challenge for consumer goods firms. This includes ensuring compliance with regulations and defending against claims of deceptive practices. Such litigation can impact brand reputation and financial performance. For example, in 2024, the company might face lawsuits regarding the accuracy of its "eco-friendly" claims.

- Compliance with labeling laws is essential to avoid legal issues.

- Defending against deceptive advertising claims is costly and time-consuming.

- Brand reputation can suffer from negative publicity related to lawsuits.

- Litigation can impact financial results due to legal fees and settlements.

Kimberly-Clark manages diverse legal risks. Product safety, like recalls (1,200 in the U.S. in 2024), and labor standards are critical. IP protection, with $175 million in R&D in 2024, is also key.

Advertising and labeling must meet stringent requirements, and the company has invested in ethical sourcing to combat scrutiny. Ongoing litigation, such as claims regarding environmental claims, requires proactive brand reputation protection and is common among companies in the industry.

| Legal Area | Specifics | 2024 Data |

|---|---|---|

| Product Safety | Recalls, Compliance | 1,200 recalls in U.S. |

| Labor Practices | Ethical Sourcing, Human Rights | Ongoing ESG efforts |

| Intellectual Property | Patents, Trademarks | $175M R&D Investment |

Environmental factors

Kimberly-Clark's PESTLE analysis highlights environmental factors, particularly sustainable sourcing. As a major wood pulp user, the company addresses pressure to sustainably source materials. They aim to decrease their natural forest fiber footprint. For 2024, Kimberly-Clark reported that 98% of its fiber was from certified or recycled sources. They are increasing the use of environmentally preferred fibers.

Kimberly-Clark faces environmental pressure to cut waste, especially plastic. In 2024, the company aimed to reduce its plastic footprint. They are pushing recycling programs and aiming to cut landfill waste. For instance, K-C's 2023 sustainability report showed advancements in waste diversion.

Kimberly-Clark prioritizes cutting greenhouse gas emissions, crucial for environmental sustainability. The company aims to decrease its absolute GHG emissions. In 2023, they reduced Scope 1 and 2 emissions by 47% from 2005 levels. They are investing in renewable energy to lower their carbon footprint.

Water Usage and Stewardship

Water scarcity and its impact on manufacturing are key environmental concerns for Kimberly-Clark, especially in water-stressed regions. The company actively works to minimize its water footprint. Their efforts include optimizing water usage in production processes. Kimberly-Clark is committed to sustainable water management practices.

- In 2023, Kimberly-Clark reduced water consumption by 11.5% compared to the 2015 baseline.

- They aim to reduce water use in water-stressed areas by 35% by 2030.

Biodiversity and Forest Conservation

Kimberly-Clark's commitment to biodiversity and forest conservation is evident in its forest management practices. The company actively works to reduce its reliance on natural forests, supporting conservation efforts. In 2024, Kimberly-Clark sourced 98% of its fiber from sustainably managed forests. This supports the protection of critical habitats and biodiversity.

- 2024: 98% of fiber from sustainably managed forests.

- Focus on reducing reliance on natural forests.

- Supports conservation of critical habitats.

Kimberly-Clark emphasizes sustainable sourcing, with 98% of fiber from certified or recycled sources in 2024. The company aims to reduce its plastic footprint and waste. Reducing GHG emissions is also key, with a 47% decrease in Scope 1 and 2 emissions by 2023. Water conservation efforts include an 11.5% reduction in consumption by 2023.

| Aspect | Initiative | 2023/2024 Data |

|---|---|---|

| Sustainable Sourcing | Fiber Sourcing | 98% from certified/recycled sources (2024) |

| Waste Reduction | Plastic Footprint | Focus on recycling & waste reduction |

| GHG Emissions | Emission Reduction | 47% decrease in Scope 1&2 from 2005 levels (2023) |

| Water Conservation | Water Usage | 11.5% reduction vs. 2015 baseline (2023) |

PESTLE Analysis Data Sources

Kimberly-Clark's PESTLE utilizes credible global economic & political databases, alongside industry reports. Data sources include government portals & consumer behavior studies.