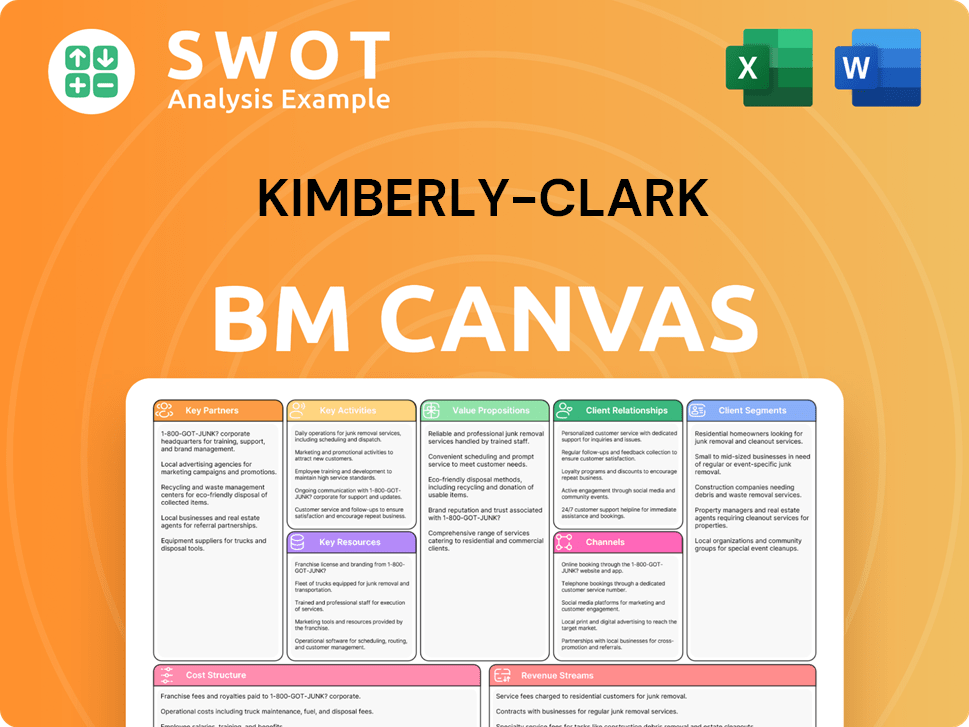

Kimberly-Clark Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kimberly-Clark Bundle

What is included in the product

A comprehensive business model canvas reflecting Kimberly-Clark's real-world operations. Organizes key aspects in 9 BMC blocks.

Quickly identify core components with a one-page business snapshot.

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you see is the document you will receive upon purchase. It's a direct representation of the complete, ready-to-use file. You'll get the identical layout, content, and formatting as displayed. No modifications or surprises—just full access to the entire document.

Business Model Canvas Template

Uncover the strategic framework of Kimberly-Clark’s business with our detailed Business Model Canvas. This snapshot reveals its core operations, customer segments, and revenue streams. Analyze key partnerships and cost structures for a comprehensive view. Understand how K-C creates, delivers, and captures value in the market. This tool is perfect for strategists, analysts, and investors. Ready to go beyond a preview? Get the full Business Model Canvas for Kimberly-Clark and access all nine building blocks with company-specific insights, strategic analysis, and financial implications—all designed to inspire and inform.

Partnerships

Kimberly-Clark depends on suppliers for vital raw materials like pulp and polymers. Strong supplier relationships guarantee a steady supply chain and better pricing. These alliances are key for cost control and consistent product quality. In 2024, the company's cost of products sold was approximately $15.5 billion.

Collaborations with major retailers like Walmart, Target, and Amazon are essential for reaching a broad consumer base. These partnerships involve shelf space agreements and promotional activities to boost sales. Effective retail partnerships maximize sales and market penetration. In 2024, Kimberly-Clark's retail sales accounted for a significant portion of its overall revenue, demonstrating the importance of these collaborations.

Kimberly-Clark collaborates with tech firms to boost manufacturing, supply chains, and digital marketing. They implement automation, data analytics, and e-commerce. In 2024, digital sales grew, showing the impact of tech partnerships. These collaborations improve efficiency and drive innovation.

Sustainability Partners

Kimberly-Clark actively forges partnerships to drive its sustainability agenda, focusing on environmental conservation and sustainable sourcing. These collaborations support responsible forestry, reduce plastic use, and boost recycling initiatives. Such partnerships enhance the company's image and further its environmental goals. In 2024, Kimberly-Clark expanded its sustainability efforts.

- New vPPAs in Italy and Spain were announced in 2024.

- Partnered with Independent Power Producer (IPP) BNZ.

- These partnerships are part of a broader strategy.

Community Partnerships

Kimberly-Clark prioritizes community partnerships to boost its Corporate Social Responsibility (CSR). These collaborations involve donations, volunteer work, and community projects. Such partnerships improve community relations and demonstrate the company’s commitment. In 2024, Kimberly-Clark invested over $50 million in social impact programs globally, including community health initiatives.

- CSR investments in 2024 reached over $50 million.

- Focus on health initiatives within communities.

- Partnerships enhance regional ties.

- Volunteer programs are a key component.

Kimberly-Clark's key partnerships span suppliers, retailers, tech firms, and sustainability initiatives, crucial for its business model. Strong supplier relationships and retailer alliances, like Walmart and Amazon, ensure supply chain stability and market reach. Tech collaborations boost efficiency, while sustainability partnerships enhance environmental goals. In 2024, the company's total revenue was about $20.4 billion.

| Partnership Type | Description | Impact in 2024 |

|---|---|---|

| Suppliers | Raw material sourcing, pulp and polymers. | Cost control, stable supply chain. |

| Retailers | Shelf space, promotions with Walmart, Target. | Significant retail sales growth. |

| Tech Firms | Automation, data analytics, e-commerce. | Digital sales growth, improved efficiency. |

| Sustainability | Responsible forestry, plastic reduction. | Expanded sustainability efforts. |

Activities

Kimberly-Clark's Key Activities include Product Development and Innovation. The company heavily invests in R&D to create new and improved products. This involves market trend identification and consumer research. Continuous innovation is crucial for maintaining a competitive edge. In 2024, Kimberly-Clark's net sales were approximately $20.4 billion.

Kimberly-Clark's success hinges on efficient manufacturing and supply chain management. They optimize production, manage inventory, and ensure timely distribution globally. In 2024, ecommerce sales surged, and the company reported double its market share in ecommerce compared to traditional retail. Effective operations control costs.

Kimberly-Clark heavily invests in marketing and branding to boost product visibility and customer loyalty. This includes ads, social media, and events, crucial for sales and recognition. They leverage data from over 100 million consumers for targeted marketing. In 2024, the company allocated a significant portion of its $20.3 billion revenue to marketing efforts.

Sales and Distribution

Sales and distribution are pivotal for Kimberly-Clark's success, ensuring its products reach consumers. This involves managing relationships with retailers, distributors, and online platforms like Amazon. A strong network drives product availability and boosts revenue. The company has expanded direct-to-consumer sales through e-commerce. In 2024, K-C's focus on effective distribution continues to grow.

- Kimberly-Clark's net sales in 2023 were approximately $20.4 billion.

- E-commerce sales are a growing segment for Kimberly-Clark.

- The company utilizes various distribution channels, including retail and online.

- Effective sales and distribution enhance market reach.

Sustainability Initiatives

Kimberly-Clark's dedication to sustainability is evident through its key activities. The company focuses on decreasing its environmental impact and promoting responsible practices. This involves waste reduction, resource conservation, and sustainable sourcing. These efforts boost the company's image and support its long-term objectives.

- In 2023, Kimberly-Clark reported a 10% reduction in its operational greenhouse gas emissions compared to 2015.

- Kimberly-Clark aims to be 100% Natural Forest Free across its product portfolio.

- The company plans to be more than halfway to this goal by 2030.

Kimberly-Clark's core activities encompass product innovation, investing heavily in R&D for new offerings and improvements. Efficient manufacturing, supply chain management, and optimized production processes are also key. In 2024, ecommerce sales rose, nearly doubling market share versus traditional retail, highlighting operational prowess.

| Activity | Description | 2024 Data |

|---|---|---|

| Product Development | R&D and innovation. | $20.4B Net Sales |

| Supply Chain | Manufacturing, distribution, and operations. | E-commerce growth |

| Marketing | Advertising, branding and promotions. | Targeting 100M consumers |

Resources

Kimberly-Clark's brand portfolio, including Kleenex and Huggies, is a crucial resource for revenue and customer loyalty. These brands benefit from strong market recognition and a quality reputation. In 2024, six brands generated over $1 billion in annual retail sales. Effective brand management is key to maintaining their competitive edge. Kimberly-Clark's 12 powerhouse brands drive over 80% of net sales.

Kimberly-Clark's manufacturing facilities are crucial for large-scale product output. These facilities require continuous investment to maintain efficiency and quality. Optimizing processes is key to controlling costs and meeting demand. The company is driving simplification through its global value stream organization. In 2024, KMB's capital expenditures were approximately $700 million.

Kimberly-Clark's intellectual property (IP) is a cornerstone of its business model. The company has a vast portfolio of patents, trademarks, and proprietary technologies. In 2024, Kimberly-Clark's R&D spending was approximately $500 million. This protects its competitive advantages and innovation. It allows Kimberly-Clark to maintain a strong market position by preventing rivals from copying its products.

Distribution Network

Kimberly-Clark's vast distribution network is crucial for global reach, ensuring product availability. This network, encompassing retailers and distributors, supports efficient delivery worldwide. Expansion of this network is vital for revenue growth, especially with the rise of ecommerce. In 2023, the company reported that ecommerce sales grew by double digits.

- Extensive network reaches consumers globally.

- Ensures product availability and efficient delivery.

- Ecommerce is a key growth area.

- Ecommerce sales grew by double digits in 2023.

Human Capital

Kimberly-Clark's human capital, encompassing its scientists, engineers, and marketing professionals, is vital for innovation. Attracting and retaining skilled employees is crucial for driving the company's success. A motivated workforce maintains a competitive edge, especially with the new operating model. The executive leadership team is focused on accelerating brand and business growth. In 2024, Kimberly-Clark's net sales increased.

- In 2024, Kimberly-Clark's net sales increased by approximately 1%.

- The company is focused on expanding its presence in emerging markets.

- Kimberly-Clark invests in employee development programs.

- The company's transformation includes key commercial initiatives.

The company's financial strength is reflected in its robust financials. Kimberly-Clark allocates resources effectively through strategic financial planning. In 2024, the company's adjusted operating profit reached $2.7 billion. Kimberly-Clark’s strong financial foundation supports long-term value creation.

| Financial Metric | 2024 | Notes |

|---|---|---|

| Adjusted Operating Profit | $2.7 billion | Reflects operational efficiency. |

| Capital Expenditures | ~$700 million | Investments in manufacturing. |

| R&D Spending | ~$500 million | Supports innovation and IP. |

Value Propositions

Kimberly-Clark's value proposition hinges on quality and reliability in hygiene and personal care. Their products consistently meet consumer needs, fostering trust. Strong quality secures market share and encourages repeat purchases. In 2024, K-C's net sales reached approximately $20.4 billion, reflecting this reliance on quality.

Kimberly-Clark's brand recognition, featuring names like Kleenex and Huggies, is a cornerstone of its value proposition. This instant recognition fosters consumer trust, directly impacting sales. In 2024, these strong brands helped the company achieve a global net sales of approximately $20.4 billion. Brand equity allows for premium pricing strategies.

Kimberly-Clark prioritizes innovation to stay competitive. They constantly develop new products and improve existing ones. Their 2024 'Powering Care' strategy highlights innovation as a key growth driver. This strategy aims to boost market opportunities. In 2024, net sales were approximately $20.4 billion.

Convenience

Kimberly-Clark's value proposition emphasizes convenience, a critical aspect of their business model. Their products are designed for ease of use and integration into daily routines, which is reflected in their disposable nature and user-friendly packaging. This focus on convenience significantly influences consumer purchasing decisions. In 2024, the company's sales were heavily influenced by this, with a notable portion of revenue driven by products designed for ease of use.

- Disposable Products: Diapers, wipes, and feminine care offer easy disposal.

- User-Friendly Packaging: Products are designed for easy access and storage.

- Wide Availability: Products are found in most retail locations.

- Market Impact: Convenience drives consumer loyalty and sales.

Sustainability

Kimberly-Clark prioritizes sustainability, using responsibly sourced materials and cutting its environmental impact. This resonates with eco-aware consumers, boosting the company's image. Sustainability fosters brand loyalty and draws in new customers. In 2024, the company held the #2 position on Barron's list of most sustainable U.S. companies. Kimberly-Clark aims to be 100% Natural Forest Free.

- Focus on sustainable sourcing.

- Enhance brand reputation.

- Increase customer loyalty.

- Achieve environmental goals.

Kimberly-Clark's value lies in offering quality products and brand recognition, achieving approximately $20.4 billion in net sales in 2024. Innovation and convenience, evident in disposable and user-friendly products, boost consumer loyalty. Sustainability efforts, like sourcing responsibly, also enhance the brand's appeal.

| Value Proposition Element | Description | 2024 Impact |

|---|---|---|

| Quality & Reliability | Products meeting consumer needs. | $20.4B Net Sales |

| Brand Recognition | Strong brands like Kleenex. | Influences Sales |

| Convenience | Ease of use, disposal, availability. | Drives Loyalty |

Customer Relationships

Kimberly-Clark prioritizes customer service via call centers and online support to handle inquiries and resolve issues. Their customer service strategy builds loyalty and strengthens brand reputation. They have enhanced customer experience through chatbots for personalized interactions across web, mobile, and voice. This has led to increased customer retention and a higher Net Promoter Score. In 2024, the company's customer satisfaction metrics saw notable improvements.

Kimberly-Clark's success hinges on strong retailer ties to boost sales and product visibility. This includes joint marketing, efficient supply chains, and promotions. These partnerships fueled a 3% organic sales growth in 2023. Kimberly-Clark Professional offers partnerships for better workplaces, enhancing productivity and safety for clients.

Kimberly-Clark uses loyalty programs to reward customers. These programs feature discounts and exclusive offers. They boost customer retention and drive sales. In 2024, customer loyalty programs significantly impacted sales. The company's focus is to enhance consumer engagement.

Social Media Engagement

Kimberly-Clark actively uses social media to connect with consumers, boost brand recognition, and gather insights. They create content, address inquiries, and run marketing campaigns on platforms like Facebook and Instagram. Social media strategies are crucial for building customer loyalty and boosting sales. In 2024, Kimberly-Clark ramped up social media efforts, particularly for seasonal products.

- Social media engagement boosts brand awareness.

- Customer feedback helps improve products.

- Marketing campaigns directly drive sales.

- In 2024, focus on seasonal promotions.

Personalized Marketing

Kimberly-Clark leverages data analytics to personalize marketing, tailoring messages and offers to individual customers. This strategy includes targeted advertising, personalized email campaigns, and product recommendations, enhancing customer engagement. In 2023, the company saw over 6 million product ratings and reviews, excluding China, which informed these targeted marketing efforts. This approach drives sales by creating more relevant and engaging customer experiences.

- Data-Driven Personalization: Uses data analytics for targeted advertising and personalized campaigns.

- Customer Engagement: Aims to enhance customer interaction and drive sales through tailored content.

- Real-World Examples: In 2023, over 6 million product ratings and reviews were used.

- Market Focus: Kimberly-Clark is using 3 billion searches related to pregnancy.

Kimberly-Clark's customer relationships center on superior service via call centers and online support, enhancing loyalty and reputation. They boost sales and visibility through strategic partnerships with retailers, including joint marketing and efficient supply chains. Data analytics are used for personalized marketing, tailoring offers to individual customers, and boosting customer engagement.

| Aspect | Details | Impact |

|---|---|---|

| Customer Service | Call centers and online support; Chatbots | Increased retention and higher NPS |

| Retailer Partnerships | Joint marketing, supply chain; KCP | 3% organic sales growth in 2023 |

| Personalized Marketing | Targeted ads, recommendations | Over 6 million product reviews (2023) |

Channels

Kimberly-Clark's retail presence spans supermarkets, drugstores, and mass merchandisers, ensuring broad consumer access. This widespread availability fuels substantial sales, with retail accounting for a significant portion of the $20.4 billion in net sales reported in 2023. Strong retailer relationships are key, as demonstrated by partnerships with giants like Walmart, Target, and Amazon. These collaborations facilitate extensive product distribution, reaching consumers nationwide.

Kimberly-Clark leverages e-commerce platforms, including its website and Amazon. This enhances consumer convenience and broadens its market presence. E-commerce is the fastest-growing sales channel, with a reported double market share compared to traditional retail. In 2024, online sales continue to be a focal point. The company's e-commerce sales grew by 10% in the third quarter of 2024.

Kimberly-Clark relies on distributors to broaden its reach, especially to smaller retailers and institutional clients. This strategy boosts product availability across various markets. Strong distributor partnerships are crucial for driving sales. The Kimberly-Clark Professional segment collaborates with businesses to improve workplaces, aiming for better health, safety, and productivity. In 2024, Kimberly-Clark's net sales were approximately $20.4 billion, reflecting the importance of its distribution channels.

Direct Sales

Kimberly-Clark utilizes direct sales to connect with institutional clients like hospitals and businesses, offering tailored solutions. This approach strengthens customer relationships and boosts revenue. For instance, in 2023, direct sales contributed significantly to the company's $20.4 billion in net sales. They partner with businesses to create Exceptional Workplaces, enhancing health, safety, and productivity. This strategy is part of their commitment to provide innovative products.

- Direct sales channel targets specific institutional clients.

- Customized solutions and direct customer engagement are key.

- Direct sales support revenue growth and customer relationship building.

- Partnerships focus on improving workplace environments.

Subscription Services

Kimberly-Clark leverages subscription services to boost customer loyalty and generate consistent revenue. These services, like auto-delivery for diapers and feminine care products, enhance convenience for consumers. Ecommerce is a major focus, with its market share in ecommerce doubling its traditional retail presence. This strategy fuels long-term sales growth through recurring purchases and digital transformation.

- Subscription services offer convenience and recurring revenue.

- Auto-delivery programs cover essentials like diapers and feminine care.

- Ecommerce is Kimberly-Clark's fastest-growing sales channel.

- The company's ecommerce market share is double its retail share.

Kimberly-Clark uses retail, including supermarkets and mass merchandisers, as a primary channel. E-commerce, including its own website and Amazon, is rapidly growing, with a double market share compared to traditional retail as of 2024. Distributors and direct sales, especially to institutional clients, broaden its market reach and drive revenue.

| Channel | Description | 2024 Data |

|---|---|---|

| Retail | Supermarkets, drugstores, mass merchandisers | Contributed a significant portion of the $20.4B net sales |

| E-commerce | Website and Amazon | Grew by 10% in Q3 2024, double market share vs retail |

| Distributors/Direct Sales | Smaller retailers, institutional clients | Vital for market reach and revenue |

Customer Segments

Families with young children are a key customer segment, driving demand for diapers, wipes, and baby care products. Huggies and Pull-Ups cater to this segment. Kimberly-Clark's focus on this group is vital for sales. Annually, there are 3 billion pregnancy-related searches. According to Russ Torres, there are 4 million searches for "best baby diaper."

Women are a significant customer segment, particularly for feminine care products. Kotex and U by Kotex cater to this segment. In 2024, Kimberly-Clark's net sales were approximately $20.4 billion, underscoring the importance of these product lines. Understanding their needs is vital for market success.

Adults with incontinence form a crucial customer segment for Kimberly-Clark, driving demand for products like Depend and Poise. In 2024, Kimberly-Clark saw a 26% year-over-year sales increase with a key online customer. Poise's success, reflecting a 30 basis points share gain, underscores Kimberly-Clark's innovation and marketing effectiveness within this segment.

Households

Households represent a significant customer segment for Kimberly-Clark, encompassing consumers who buy essential tissue products. These include well-known brands like Kleenex, Scott, and Cottonelle. Understanding and satisfying the varied demands of households is vital for boosting sales. A new solar farm project is set to generate renewable energy equivalent to over 40% of the total electricity used by the company's European production facilities. The launch is planned for the second quarter of 2025.

- Target audience: households.

- Key products: facial tissues, paper towels, bath tissue.

- Major brands: Kleenex, Scott, Cottonelle.

- Renewable energy: over 40% of European facilities' electricity.

Businesses and Institutions

Businesses and institutions form a crucial customer segment for Kimberly-Clark. This segment buys professional hygiene products, including paper towels and hand sanitizers. Kimberly-Clark Professional focuses on providing cost-effective solutions for these entities. The aim is to help create healthier, safer, and more productive workplaces through strategic partnerships.

- Kimberly-Clark Professional generated approximately $3.8 billion in sales in 2023.

- Key products include Kleenex, Scott, and WypAll.

- Partnerships involve tailored hygiene programs and solutions.

- Focus on enhancing workplace health and productivity.

Households represent a key customer segment, purchasing tissue products like Kleenex and Scott. In 2023, the global tissue market was valued at $29.9 billion. The launch of a solar farm is set for Q2 2025, generating over 40% renewable energy for European production. This shift aligns with sustainability goals, benefiting both the environment and customer perception.

| Segment | Products | Brands |

|---|---|---|

| Households | Facial Tissues, Paper Towels, Bath Tissue | Kleenex, Scott, Cottonelle |

| Businesses & Institutions | Professional Hygiene | Kimberly-Clark Professional |

| Adults with Incontinence | Depend, Poise | Depend, Poise |

Cost Structure

Raw materials, including pulp and polymers, form a major cost for Kimberly-Clark. The company actively manages these costs, optimizing its supply chain for efficiency. Raw material prices fluctuate due to factors like petroleum prices; this has been especially true in recent years. In 2024, Kimberly-Clark's cost of sales was nearly $18 billion.

Manufacturing costs are central to Kimberly-Clark's cost structure, encompassing labor, energy, and facility maintenance. Efficiency improvements are key; the company targets simplification via its global value stream. This strategy leverages local capabilities for optimal performance throughout the value chain. In 2023, Kimberly-Clark's cost of products sold was approximately $13.6 billion, reflecting these manufacturing expenses.

Kimberly-Clark's marketing and sales costs include advertising, promotions, and sales force expenses. These costs are crucial for driving revenue. In Q4 2024, North America's operating profit decreased by 10.0%, partly due to a planned, double-digit increase in marketing spending. Managing these expenses is vital for profitability.

Research and Development

Kimberly-Clark's commitment to research and development (R&D) is vital for innovation. These investments help create new products and enhance existing ones, ensuring a competitive advantage. R&D spending supports the company's strategy to focus on key brands within the $240 billion total addressable market. This approach drives growth in essential categories like Baby & Child Care and Feminine Care.

- In 2023, Kimberly-Clark's R&D expenses were approximately $400 million.

- The company aims to grow its 12 powerhouse brands, which generate over 80% of its net sales.

- These brands operate in five key daily-need spaces.

- Kimberly-Clark's strategic focus includes innovation in product offerings.

Distribution and Logistics

Distribution and logistics are crucial for Kimberly-Clark, encompassing warehousing, transportation, and delivery expenses. In 2024, the company focused on optimizing its distribution network. This effort included enhancing logistics efficiency to reduce costs, as demonstrated by significant gross margin expansion in Personal Care. The operating margin expanded by 210 basis points, reaching approximately 20% due to these improvements and strategic investments.

- Warehousing and transportation are key components of distribution costs.

- Logistics efficiency improvements are a key focus for cost reduction.

- Personal Care gross margin expanded due to distribution and logistics optimization.

- Operating margin expansion was a result of these efforts.

Kimberly-Clark's cost structure heavily involves raw materials, with significant expense in 2024. Manufacturing costs, including labor and energy, are also central, with strategies for efficiency. Marketing and sales expenses are essential for revenue generation, and R&D investment totaled around $400 million in 2023. Distribution, warehousing, and logistics costs are also crucial.

| Cost Category | Description | 2024 Data (Approx.) |

|---|---|---|

| Raw Materials | Pulp, polymers, etc. | $18B (Cost of Sales) |

| Manufacturing | Labor, energy, facilities | $13.6B (Cost of Products Sold, 2023) |

| Marketing & Sales | Advertising, promotions | Increased spending in Q4 2024 |

Revenue Streams

Product sales form Kimberly-Clark's main revenue stream, encompassing diapers, tissues, and personal care items. Revenue depends on sales volume, pricing strategies, and the product mix offered. Effective marketing and distribution are crucial for revenue growth. For the quarter ending March 31, 2025, revenue was $4.84B, down -6.00%. In 2024, annual revenue was $20.06B, a decrease of -1.83%.

Kimberly-Clark utilizes licensing fees, a low-risk revenue stream, by allowing other companies to use its brands or technologies. This strategy extends the company's market presence without significant capital investment. Managing these agreements is crucial to protect brand equity, especially for powerhouse brands like Huggies and Kleenex. These brands, contributing significantly to over 80% of net sales, enhance the value of licensing deals.

Kimberly-Clark utilizes subscription services, generating revenue from recurring purchases of items like diapers and feminine care products. These subscriptions boost customer loyalty and provide a steady income stream. In 2024, ecommerce sales, where subscriptions are common, grew significantly for Kimberly-Clark. Effective management of these programs is crucial for continued sales growth, especially within their expanding ecommerce sector.

Service Contracts

Kimberly-Clark Professional, a key segment, leverages service contracts for hygiene solutions. These contracts offer maintenance and product replenishment, ensuring consistent revenue streams. This approach fosters strong customer relationships, vital for long-term growth. The "Exceptional Workplaces" initiative highlights this commitment, focusing on healthier, safer, and more productive environments.

- Recurring revenue from service contracts contributed significantly to the Kimberly-Clark Professional segment's revenue in 2024.

- Service contracts help maintain customer loyalty and provide predictable income streams.

- Kimberly-Clark Professional's focus on workplace solutions is a key differentiator.

- The service contracts model supports a customer-centric business strategy.

Divestitures

Divestitures represent a revenue stream for Kimberly-Clark, enabling the company to capitalize on assets that no longer fit its strategic focus. This approach allows for the reallocation of resources towards more profitable ventures. For instance, Kimberly-Clark's sale of its personal protective equipment business generated substantial pre-tax gains.

- 2024: Kimberly-Clark's strategic divestitures are ongoing, enhancing its portfolio.

- The sale of the personal protective equipment business for $635 million.

- A pre-tax gain of $566 million was realized from the sale.

- Divestitures enable focus on core brands and growth areas.

Kimberly-Clark's revenue streams include diverse channels, with product sales being the primary source. Licensing fees and subscription services offer additional revenue, enhancing profitability and customer loyalty. Service contracts, especially in the professional segment, contribute to recurring revenue, creating stability.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Product Sales | Core business including diapers, tissues, and personal care items | $20.06B, -1.83% YoY |

| Licensing | Fees from brand and tech usage | Enhanced brand value |

| Subscription Services | Recurring sales via subscriptions, especially in e-commerce | Significant e-commerce growth |

Business Model Canvas Data Sources

Kimberly-Clark's Business Model Canvas uses financial reports, market analyses, and consumer research. This helps provide accurate and insightful strategic planning.