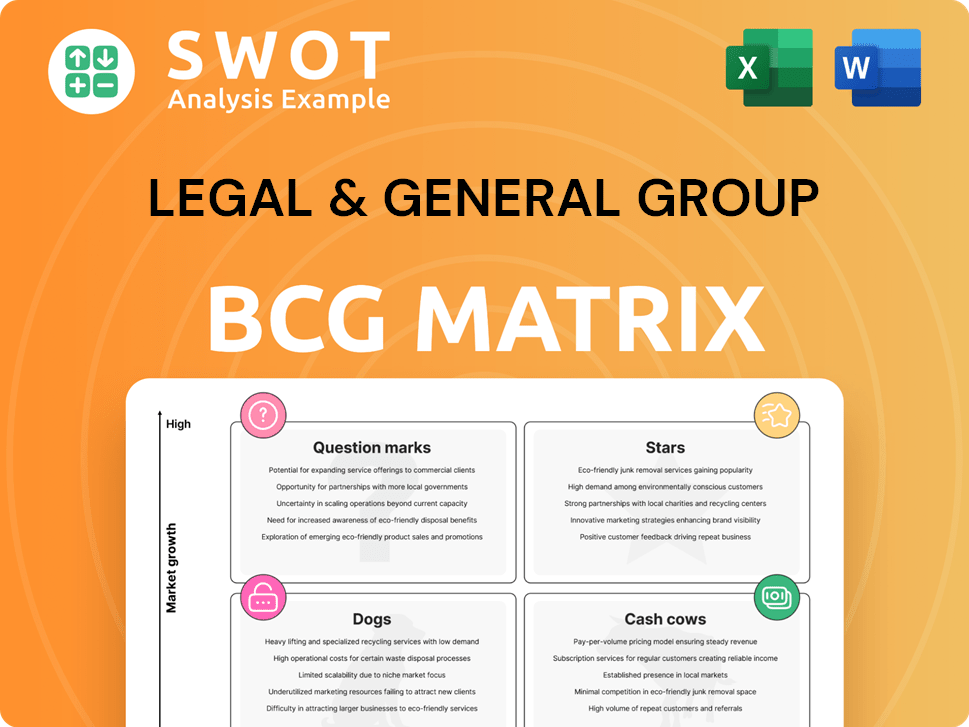

Legal & General Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Legal & General Group Bundle

What is included in the product

BCG matrix overview of Legal & General's business units.

Export-ready design for quick drag-and-drop into PowerPoint.

Full Transparency, Always

Legal & General Group BCG Matrix

The BCG Matrix you're previewing mirrors the purchased file. This is the complete, ready-to-use document, designed with Legal & General Group's specifics. After purchase, expect immediate access to the same detailed analysis. Use it to strategize or inform stakeholders—no extra steps needed. This is the full version you will receive.

BCG Matrix Template

Legal & General Group's BCG Matrix reveals the strategic landscape of its diverse portfolio. This initial glimpse highlights key product categories and their market positions. Understanding which products are Stars, Cash Cows, Dogs, or Question Marks is crucial. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Legal & General's PRT business in the US and Canada is booming, with record growth in 2024. They've captured a significant market share, fueled by trust from intermediaries. Their de-risking solutions are key. Continued investments ensure future success. In 2024, L&G completed $4.3B in US PRT deals.

Legal & General's Asset Management, especially private markets, boasts high growth potential. AUM is rising; they're launching new private market funds. External capital commitments are strong, signaling robust growth. Focus areas include real estate, private credit, and infrastructure, which is a solid strategy.

Legal & General holds a leading position in the UK workplace DC schemes. They have a significant market share, poised for growth. The move towards individual long-term savings boosts their prospects. Customer engagement is key to driving further expansion within this area. In 2024, Legal & General's DC assets reached £100+ billion, reflecting their market dominance.

Retail Annuities

Retail annuities are shining stars for Legal & General. The market is booming, thanks to higher interest rates and demand for secure retirement income. Legal & General's strong position drives impressive volumes in this segment. This growth is fueled by the need for safe retirement solutions.

- Legal & General's annuity sales in 2024 saw significant growth, reflecting the market's positive trend.

- Increased interest rates have made annuities more attractive, boosting demand.

- The focus on guaranteed income benefits aligns with consumer preferences for financial security.

- Legal & General's strategic market positioning continues to pay off.

Strategic Partnerships

Legal & General's strategic partnerships, like the one with Meiji Yasuda, are a key component of its "Stars" quadrant in the BCG Matrix. These collaborations boost growth in key markets. For example, in 2024, L&G's US PRT business saw significant expansion through such partnerships. These partnerships offer access to new investment opportunities, boosting growth and market share.

- Meiji Yasuda partnership boosts US PRT.

- Co-investment capital increases in Asset Management.

- Partnerships drive growth and market share.

- Access to new markets and investments.

Legal & General's "Stars" include high-growth areas. This encompasses PRT in the US and Canada, along with their retail annuities. Strategic partnerships further fuel their growth trajectory.

| Category | Key Area | 2024 Data |

|---|---|---|

| Market Share | UK Workplace DC | £100B+ in DC assets |

| Partnerships | Meiji Yasuda | US PRT growth |

| Sales Growth | Annuities | Significant Increase |

Cash Cows

Legal & General's UK PRT (Pension Risk Transfer) is a cash cow, leading the market. It provides substantial cash flow, fueled by its vast annuity portfolio. Their strong track record and established presence ensure reliable earnings. In 2024, L&G secured £3.1bn in UK PRT deals. Disciplined underwriting will help maintain profitability.

Legal & General's UK protection business is a cash cow. It generates steady cash flow through strong sales with disciplined margins. Core products and efficient operations boost profitability. In 2023, the UK protection business saw £1.5 billion in sales.

Legal & General Investment Management (LGIM) is a key player in index funds, managing a substantial Assets Under Management (AUM). Index funds offer consistent revenue, thanks to their passive, low-cost nature. In 2024, LGIM's AUM in index funds was significant, reflecting its market position. LGIM's expertise and scale drive efficiency and profitability in this area.

Lifetime Mortgages

Lifetime mortgages are a crucial part of Legal & General's retail retirement solutions, generating consistent income. This segment leverages the rising interest in equity release among older homeowners. As of 2024, the equity release market in the UK is valued at approximately £4.5 billion. Effective portfolio management is key to maintaining a stable cash flow from these mortgages.

- Steady Income Source: Lifetime mortgages provide a reliable stream of revenue for Legal & General.

- Market Growth: The equity release market is expanding, fueled by an aging population.

- Financial Data: The UK equity release market was worth £3.7 billion in 2023.

- Strategic Focus: Managing this portfolio is vital for financial stability.

Legacy Annuity Portfolio

Legal & General's legacy annuity portfolio is a cash cow, delivering consistent earnings over many years. This segment provides a dependable source of cash flow, contributing to the company's financial solidity. The portfolio gains from strong investment performance and adept management of its existing business. It's a central pillar of Legal & General's financial strength.

- In 2024, Legal & General's annuity business maintained its strong position.

- The annuity portfolio's assets under management (AUM) remained substantial.

- Back-book management continued to optimize the portfolio's performance.

- The annuity business provided a significant portion of Legal & General's overall profits.

Legal & General's cash cows consistently generate substantial cash flow, enhancing the company's financial stability. These include UK PRT, protection, and investment management. In 2024, key areas like UK PRT and annuity portfolios remained robust. These segments benefit from market leadership and effective management.

| Cash Cow Segment | 2024 Performance | Key Driver |

|---|---|---|

| UK PRT | £3.1bn deals | Market leadership |

| UK Protection | £1.5bn sales (2023) | Strong sales & margins |

| LGIM Index Funds | Significant AUM | Passive, low-cost nature |

Dogs

Legal & General sold its US Protection business, a sign of its position in the BCG matrix. This suggests it was a "dog," with low growth and market share. The sale lets Legal & General concentrate on core, higher-growth areas. In 2023, Legal & General's operating profit was £1.6 billion.

Legal & General sold Cala Homes, indicating it wasn't a strategic fit. This move allows reinvestment in core financial services. The sale helps streamline operations and capital allocation. In 2024, the sale likely freed up capital for strategic investments. This reflects a shift towards focused growth areas.

Legal & General's 2020 sale of its General Insurance to Allianz aligns with the BCG Matrix, labeling it a "Dog." This strategic move, valued at £242 million, enabled Legal & General to concentrate on core, high-growth sectors. The divestiture reflects a shift towards strengths in retirement and investment management.

L&G Modular Homes (Discontinued)

L&G Modular Homes, once a part of Legal & General Group, was discontinued due to planning delays and the COVID-19 pandemic's impact. The venture faced considerable losses, making it a poor strategic fit. This aligns with Legal & General's focus on capital efficiency and strategic objectives. The decision resulted in a write-down of £100 million in 2022.

- Legal & General discontinued its modular homes operation.

- The venture experienced significant losses.

- This decision reflects a focus on capital efficiency.

- A write-down of £100 million occurred in 2022.

Non-Strategic Assets in Corporate Investments Unit

Legal & General's Corporate Investments Unit handles non-strategic assets, potentially earmarked for sale. These assets may underperform or clash with the firm's core focus. This separation aims to boost shareholder value via sales or restructuring. In 2024, Legal & General's total assets under management reached £1.1 trillion.

- Non-strategic assets include property and other investments.

- The unit aims to streamline the portfolio.

- Legal & General seeks to improve capital allocation.

- Focus is on core insurance and investment businesses.

Legal & General categorizes underperforming businesses as "Dogs" in its BCG matrix. These are low-growth, low-share assets targeted for divestiture. The goal is to free up capital and streamline the portfolio. This strategy aims to boost shareholder value by focusing on core competencies. In 2024, Legal & General's operating profit was £1.7 billion.

| Category | Description | Examples |

|---|---|---|

| Definition | Low market share and low growth rate. | Businesses sold by L&G. |

| Strategy | Divest or restructure for capital. | US Protection, Cala Homes, General Insurance. |

| Impact | Frees capital for core growth areas. | Focus on insurance and investments. |

Question Marks

Legal & General (L&G) is targeting international expansion in pension de-risking, a high-growth market. Outside the UK, US, and Canada, L&G's presence is still emerging, requiring strategic investments. These markets, while offering growth, demand adaptation to local rules. In 2024, L&G's international revenue was up 15% YoY, showing initial progress.

Legal & General is expanding into private market funds, aiming for high growth but facing substantial initial investment needs. These funds focus on real estate, private credit, and infrastructure, presenting diverse opportunities. Success hinges on attracting capital and generating robust investment returns. In 2024, the private equity market saw over $700 billion in deals, showing the potential.

Legal & General's fintech and tech investments are high-growth, high-risk. These ventures require substantial upfront capital, potentially delaying profits. Success hinges on backing disruptive, innovative firms. In 2024, L&G invested £100M in fintech to expand its digital capabilities.

Sustainable Investment Products

Legal & General's (L&G) push into sustainable investment products taps into increasing investor interest in ESG strategies. The market is developing, and L&G must build a solid reputation to compete. Success hinges on creating innovative and effective sustainable investment options. For 2024, global sustainable fund assets reached $2.7 trillion.

- L&G's ESG assets under management grew in 2024.

- Competition in sustainable investments is intense.

- Innovation is key for market differentiation.

- Investor demand for ESG products continues.

Partnerships in Emerging Markets

Legal & General's partnerships in emerging markets, like IndiaFirst Life Insurance Company, are classified within the BCG Matrix as potentially high-growth ventures. These partnerships offer significant opportunities for expansion, especially in regions experiencing rapid economic growth, such as India. However, they also come with notable challenges that necessitate careful management.

Success in these markets hinges on adaptability, requiring Legal & General to tailor its products and services to local preferences and navigate complex regulatory landscapes. Building strong, enduring relationships with local partners is crucial for market penetration and sustainability. Delivering customized solutions that meet the specific needs of emerging market customers is also essential.

In 2024, India's insurance market showed robust growth, indicating the potential Legal & General aims to tap into. The company's strategic approach involves a combination of global expertise and local insights to manage risks and maximize returns.

- IndiaFirst Life Insurance Company is a joint venture between Legal & General, Bank of Baroda and Andhra Bank.

- Emerging markets often have less mature regulatory environments.

- These markets offer higher growth potential compared to developed markets.

- Customization of products and services is key for success.

Legal & General's partnerships, like IndiaFirst Life, are high-growth prospects. These ventures face regulatory and market challenges. Strategic partnerships drive growth, especially in rapidly growing economies.

| Category | Description | 2024 Data |

|---|---|---|

| Market Growth | India's insurance market expansion | ~12% annual growth |

| Partnership Value | Strategic partnerships leverage local insights | IndiaFirst AUM: ~$5B |

| Challenges | Navigating emerging market regulations | Regulatory hurdles remain |

BCG Matrix Data Sources

Our BCG Matrix is crafted with dependable sources: annual reports, financial statements, market share data, and industry analysis. These ensure strategic positioning.