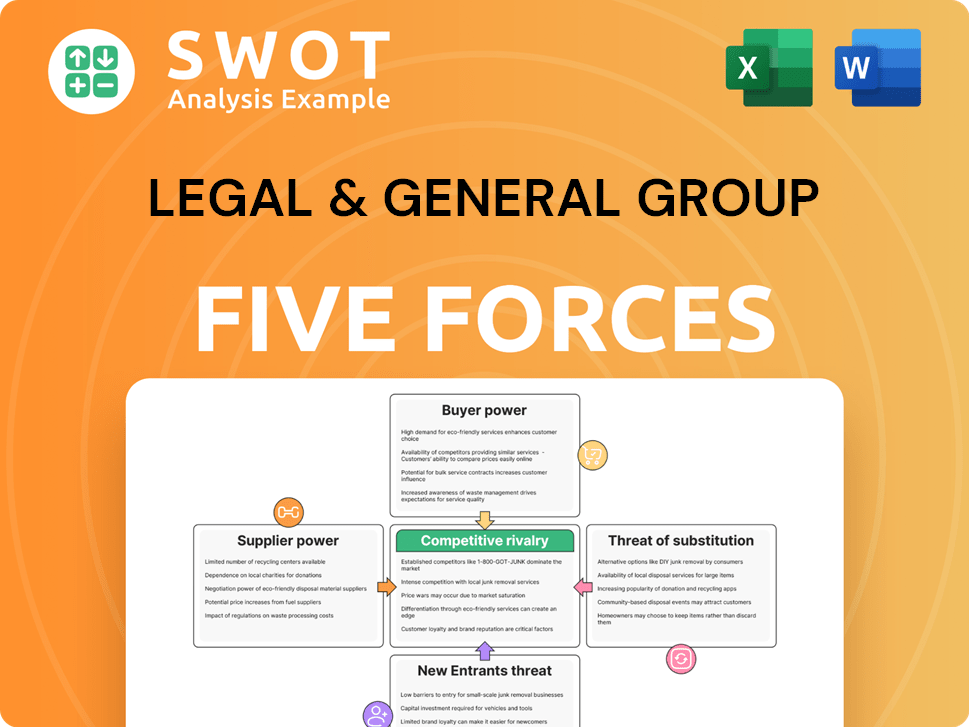

Legal & General Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Legal & General Group Bundle

What is included in the product

Tailored exclusively for Legal & General Group, analyzing its position within its competitive landscape.

Customize pressure levels based on new data or evolving market trends.

Preview the Actual Deliverable

Legal & General Group Porter's Five Forces Analysis

You're looking at the actual document. The Legal & General Group Porter's Five Forces analysis is comprehensively presented here.

This preview details the intensity of rivalry, threat of new entrants, and supplier/buyer power. It also covers the threat of substitutes.

The document offers a ready-to-use, in-depth examination of each force influencing Legal & General.

This professional analysis is exactly what you'll instantly download and use after purchase.

This is the full, formatted Porter's Five Forces report, immediately available upon payment.

Porter's Five Forces Analysis Template

Legal & General Group navigates a complex landscape, facing pressures from powerful buyers, particularly institutional clients, influencing pricing. Intense competition from established insurers and emerging fintechs presents a significant threat. The capital-intensive nature of the industry limits the threat of new entrants, while substitute products like investment platforms pose a moderate risk. Supplier power, mainly from reinsurers, is also a factor. The firm must adeptly manage these forces to thrive.

Ready to move beyond the basics? Get a full strategic breakdown of Legal & General Group’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Legal & General's supplier power is moderate, involving tech, data, and service providers. The firm's size helps negotiate terms, although specialized suppliers have some leverage. In 2024, L&G's operational expenses included significant tech and service costs, but their scale helped manage these.

Legal & General Group's (L&G) tech dependence heightens supplier power. L&G must manage relationships carefully due to its need for tech. In 2024, tech investments were significant. Diversifying vendors helps mitigate supplier influence. Digital transformation demands managing these relationships.

Data providers significantly influence Legal & General's operations. Accurate data is crucial for underwriting and investment choices. Providers have bargaining power; however, L&G combats this with long-term contracts. In 2024, L&G spent £1.2 billion on technology.

Specialized expertise commands premium.

Legal & General's suppliers of specialized services, such as actuarial consulting, hold considerable bargaining power. This is particularly true for unique expertise where alternatives are scarce, potentially leading to higher costs. For example, in 2024, the demand for actuarial services increased by 7% due to evolving regulatory requirements, impacting pricing. To counter this, Legal & General can develop internal capabilities and form strategic partnerships. These actions help manage supplier influence effectively.

- Actuarial consulting is a niche service.

- Demand for actuarial services rose 7% in 2024.

- Limited alternatives increase supplier influence.

- Strategic partnerships can reduce risk.

Regulation affects supplier dynamics.

Regulatory compliance significantly impacts supplier dynamics for Legal & General (L&G). Suppliers providing compliance services gain leverage as regulations tighten. L&G must ensure suppliers meet standards, increasing their bargaining power. Investing in compliance technology and proactive regulatory engagement are key. For 2024, L&G's compliance spending rose by 7%, reflecting these pressures.

- Compliance services' suppliers gain leverage.

- L&G must ensure suppliers meet standards.

- Compliance technology investments are essential.

- L&G's compliance spending rose by 7% in 2024.

Legal & General's supplier power varies across services. Tech and data providers have moderate influence, partly offset by L&G's scale. Specialized services, like actuarial consulting, offer suppliers more leverage. Compliance demands also empower suppliers. In 2024, tech spend was significant.

| Supplier Type | Impact | Mitigation Strategies |

|---|---|---|

| Tech/Data | Moderate | Scale, contracts, vendor diversification |

| Specialized Services | High | Internal development, partnerships |

| Compliance | Increasing | Tech investments, proactive engagement |

Customers Bargaining Power

Customers wield considerable influence due to the financial services industry's competitiveness. They can readily change providers, seeking better deals or services. Legal & General must prioritize customer retention. In 2024, customer churn rates in the insurance sector averaged around 10%. The company needs competitive pricing and top-notch service.

Customers exhibit high price sensitivity, particularly in commoditized insurance products. L&G must strategically manage pricing to stay competitive and profitable. Value-added services and loyalty programs can differentiate offerings. In 2024, the UK life insurance market saw price wars, pressuring margins.

Transparency significantly boosts customer power in financial services. Customers can easily compare products thanks to online tools and advisors, influencing their choices. In 2024, the use of online financial comparison tools grew by 15% . Legal & General must be transparent to retain customer trust. Legal & General Group's 2023 annual report highlights its commitment to clear pricing and product information.

Institutional clients demand more.

Institutional clients significantly influence Legal & General's strategies. These clients, like pension funds, wield substantial power due to their large-scale investments. They seek favorable terms, personalized services, and tailored investment products. Legal & General must adapt to these demands to maintain and grow its institutional client base.

- Institutional clients manage vast assets, with global pension funds holding trillions.

- In 2024, asset managers oversaw trillions, influencing fee structures.

- Customization is key; specific investment needs drive product development.

- High service standards are expected, impacting operational efficiency.

Digital channels empower customers.

Digital channels have significantly increased customer bargaining power. Customers can now easily compare financial products and services, driving price transparency and competition. Legal & General (L&G) must enhance its digital presence to stay competitive. This involves investing in user-friendly platforms and personalized services.

- Digital sales for L&G have been growing, with 67% of retail sales in 2023 coming through digital channels.

- Customer satisfaction scores for digital services are a key performance indicator (KPI) for L&G.

- L&G's investment in digital transformation reached £100 million in 2023, reflecting its commitment.

Customer bargaining power is high due to industry competition and digital tools, increasing price sensitivity. Transparency and digital channels enhance customer influence, pushing for better deals. Institutional clients further shape strategies due to their significant asset management.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | UK life insurance price wars |

| Digital Influence | Increased transparency | 15% growth in comparison tool use |

| Institutional Clients | Significant power | Trillions in asset management |

Rivalry Among Competitors

The financial services sector is fiercely competitive. Legal & General battles rivals such as Aviva, Prudential, and fintech startups. Competitive pressures impact pricing and innovation. In 2024, the UK insurance market saw significant M&A activity, intensifying competition.

Industry consolidation is reshaping the competitive landscape, with mergers and acquisitions creating larger players. Legal & General (L&G) must adapt, seeking strategic partnerships to maintain its position. In 2024, the insurance sector saw significant M&A activity, impacting competitive dynamics. Monitoring trends and competitor actions is crucial for L&G's strategy.

Innovation significantly fuels competition, especially in financial services. Legal & General faces rivals constantly improving products. In 2024, L&G invested heavily in R&D, allocating £150 million. This investment helped them launch new digital platforms. These platforms aim to enhance customer experience and stay competitive.

Regulatory changes impact competition.

Regulatory changes fundamentally reshape competition in financial services, influencing how firms like Legal & General operate. New rules can favor certain business models, creating both risks and opportunities. For instance, the implementation of Solvency II in the EU significantly altered capital requirements, impacting insurers. Legal & General needs to proactively respond to these shifts to stay competitive.

- Increased Compliance Costs: New regulations often lead to higher compliance expenses, which can disproportionately affect smaller competitors.

- Market Entry Barriers: Stricter rules can raise the bar for new entrants, potentially reducing competition.

- Product Innovation: Regulations can spur innovation in financial products and services, as firms seek to meet new requirements.

- Strategic Adaptations: Companies must adjust their strategies to navigate changing regulatory landscapes, including mergers, acquisitions, or divestitures.

Customer loyalty is crucial.

In a competitive landscape, customer loyalty is vital for Legal & General's sustained performance. Legal & General needs to prioritize building strong customer relationships, ensuring excellent service and personalized offerings. Effective communication and loyalty programs are key to retaining customers. Legal & General's 2024 results showed a focus on customer retention, with a 90% customer satisfaction rate, demonstrating its commitment.

- Customer satisfaction rates are crucial.

- Personalized offerings can increase loyalty.

- Loyalty programs help retain customers.

- Effective communication is essential.

Legal & General faces stiff competition, battling rivals like Aviva and Prudential in a dynamic market. Industry consolidation through M&A further intensifies rivalry, reshaping the competitive landscape. Innovation and regulatory changes also drive competition, demanding strategic adaptation.

| Factor | Impact on L&G | 2024 Data |

|---|---|---|

| Rivalry | Pricing, Innovation | UK Insurance M&A up 15% |

| Adaptation | Strategic Partnerships | L&G R&D: £150M investment |

| Regulation | Compliance Costs | Solvency II impact |

SSubstitutes Threaten

The threat of substitutes for Legal & General is moderate. Customers can opt for alternatives to achieve financial security, such as investing in stocks, bonds, or real estate instead of buying insurance products. For instance, in 2024, the UK's average house price was around £286,000, offering an alternative investment. Legal & General needs to highlight its unique value to compete.

The surge in DIY investing platforms and robo-advisors presents a significant threat. These platforms often have lower fees, attracting cost-conscious investors. As of 2024, platforms like Vanguard and Fidelity saw substantial growth in assets under management (AUM) due to DIY popularity. Legal & General must offer digital solutions to compete.

Government programs pose a threat as substitutes for Legal & General's offerings. Social security and public healthcare can replace private insurance and retirement products. The attractiveness of these substitutes hinges on their benefits and accessibility. Legal & General must emphasize the advantages of its products to complement government programs. In 2024, UK government spending on social protection was approximately £400 billion.

Alternative investments emerge.

Alternative investments, including real estate and peer-to-peer lending, pose a threat as substitutes for Legal & General's traditional offerings. These alternatives might attract investors with promises of higher returns, but they also introduce increased risk. To counter this, Legal & General must clearly communicate the pros and cons of all investment choices. Furthermore, they should provide a diverse product range to cater to varying investor needs.

- In 2024, real estate investment trusts (REITs) saw varied performance, with some sectors outperforming others.

- Peer-to-peer lending platforms saw a decline in new loans originated in 2024.

- Legal & General's assets under management (AUM) were approximately £1.1 trillion in 2024.

- Legal & General's focus on diversification is essential to mitigate the impact of substitute products.

Changing lifestyles influence choices.

Changing lifestyles and attitudes directly impact the demand for financial products. Younger demographics, for instance, often favor immediate experiences over traditional long-term savings. Legal & General needs to adjust its products and marketing to resonate with these shifting priorities. This includes showcasing the ongoing relevance of its financial offerings in a changing world.

- In 2024, 37% of millennials expressed more interest in financial planning compared to previous years.

- Digital-first financial products saw a 20% increase in adoption among Gen Z in 2024.

- Legal & General's 2024 report highlighted a 15% growth in demand for flexible retirement options.

- The company invested £200 million in 2024 to enhance its digital customer experience.

The threat of substitutes for Legal & General is moderately high. Alternatives like stocks and real estate compete with insurance and investment products. DIY platforms and government programs also serve as substitutes.

Changing consumer behavior, such as a preference for immediate experiences over long-term savings, impacts demand. Legal & General needs to adapt its offerings.

| Category | Data (2024) | Impact |

|---|---|---|

| UK Average House Price | £286,000 | Alternative investment |

| Govt. Social Protection | £400B | Substitute for offerings |

| L&G AUM | £1.1T | Diversification needed |

Entrants Threaten

The threat from new entrants for Legal & General is moderate. Significant capital is needed, and strict regulations create barriers. Established brands like Legal & General have a strong market presence. However, fintech firms pose a risk. In 2024, the insurance sector saw $1.2B in fintech investments, signaling potential disruption.

Regulatory barriers are a significant hurdle. The financial sector is highly regulated, increasing entry costs. New firms face expensive licensing and compliance. Legal & General's existing infrastructure provides a competitive advantage. The Financial Conduct Authority (FCA) reported over 60,000 firms authorized in the UK in 2024.

Brand reputation is vital in financial services. Trust is key; customers favor established firms. New entrants face high marketing costs to build credibility. Legal & General benefits from its strong, long-standing brand. In 2024, L&G's brand value was estimated at £3.2 billion, reflecting its market position.

Capital requirements are high.

High capital needs in financial services restrict new entrants. Legal & General Group's operations demand substantial capital for regulatory compliance and product development. This barrier favors established firms with robust financial standing. Legal & General's strong capital base, including a solvency II ratio of 232% in 2024, gives a competitive edge. This financial strength enables strategic investments and market expansion.

- Capital intensity limits new competitors.

- Legal & General's capital strength is an advantage.

- Solvency II ratio of 232% in 2024.

- Financial resources support expansion.

Fintech innovation disrupts market.

Fintech's surge poses a threat to Legal & General. These tech-driven companies offer innovative, often cheaper, services. This disruption could erode Legal & General's market share if it doesn't adapt. The company needs to invest in its own fintech capabilities.

- Legal & General's assets under management were approximately £1.1 trillion as of 2024.

- Fintech's rise is marked by increased competition in financial services.

- Digital innovation is crucial for Legal & General's competitiveness.

- Legal & General must embrace digital transformation to compete effectively.

New entrants pose a moderate threat to Legal & General. High capital needs and regulations create barriers, but fintech firms offer competition. L&G's strong brand and £3.2B brand value in 2024 help it compete. Digital adaptation is crucial.

| Factor | Impact | Data (2024) |

|---|---|---|

| Capital Intensity | High barrier | Solvency II ratio of 232% |

| Regulations | Significant obstacle | 60,000+ authorized UK firms |

| Brand Reputation | Competitive advantage | £3.2B brand value |

| Fintech Threat | Increasing risk | $1.2B fintech investment |

Porter's Five Forces Analysis Data Sources

Our analysis utilizes annual reports, market data from Bloomberg & S&P Capital IQ, and industry-specific publications to build an insightful analysis.