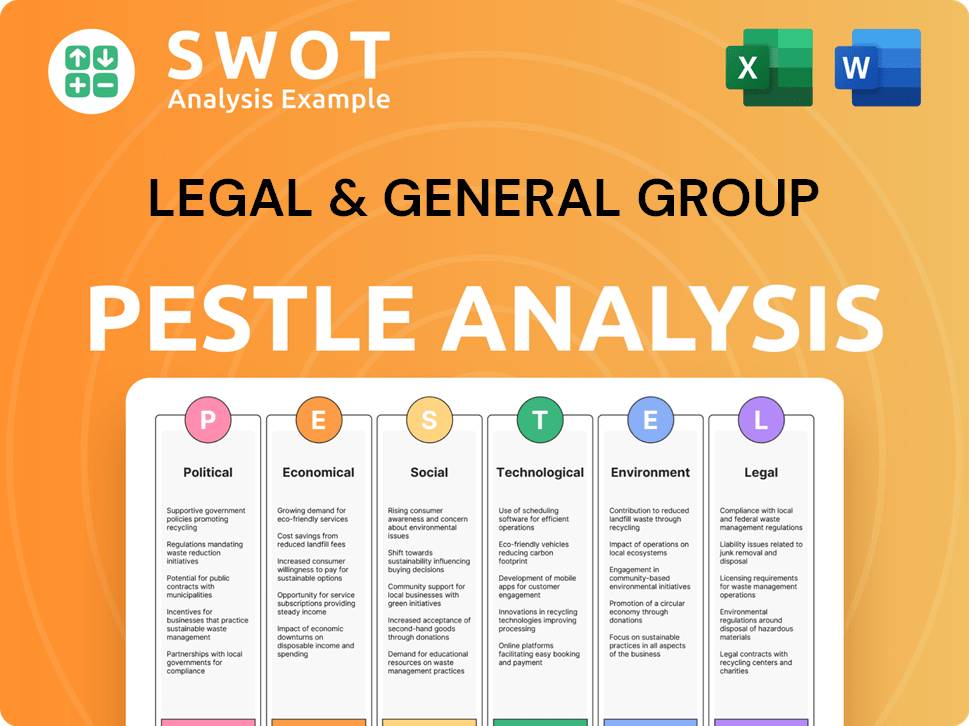

Legal & General Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Legal & General Group Bundle

What is included in the product

The PESTLE analysis assesses external macro-environmental factors impacting Legal & General Group.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Legal & General Group PESTLE Analysis

The PESTLE analysis you see is the final version—ready for immediate download after purchase. It covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Legal & General. Each section is comprehensively detailed for a complete view. This is the exact, finished document you’ll own post-purchase.

PESTLE Analysis Template

Legal & General Group faces a complex landscape, influenced by political changes, economic shifts, and technological advancements. Regulatory scrutiny, evolving consumer preferences, and environmental concerns are all at play. Our PESTLE analysis reveals how these external factors shape the company's strategic challenges and opportunities. Gain a competitive edge; understand the market forces driving their future and optimize your strategic planning. Download the complete analysis for actionable insights!

Political factors

Changes in government policies, especially those affecting financial services, pensions, and investments, directly influence Legal & General's strategies. Political stability is crucial; instability can create market uncertainty. For instance, the UK's economic policies, shaped by the current government, affect L&G's investment landscape. In 2024, the UK government's decisions on taxation and financial regulations will shape L&G's strategic planning.

Legal & General navigates a complex regulatory landscape. Changes to solvency rules and capital standards, as seen in the UK's Solvency II framework, significantly impact its financial planning. In 2024, the Prudential Regulation Authority (PRA) continues to refine these rules, affecting L&G's capital management. Consumer protection laws, like those from the Financial Conduct Authority (FCA), also shape its product offerings and customer service. These shifts demand constant adaptation to maintain compliance and operational efficiency, impacting investment strategies.

Changes in corporate tax rates, like the UK's 25% rate, directly affect Legal & General's profits. Taxes on financial products, such as stamp duty on investments, influence customer behavior and demand. International fiscal policies also matter, impacting cross-border operations and investments. For example, in 2024, the UK government adjusted corporation tax rates, influencing the company's financial planning.

International relations and trade policies

Legal & General (L&G) faces impacts from global trade policies and international political dynamics. Geopolitical risks and conflicts can affect international operations and investment strategies. For instance, the UK's trade with the EU post-Brexit saw significant shifts. In 2024, UK-EU trade was valued at approximately £800 billion.

- Brexit's impact on financial services regulations affecting L&G's European operations.

- Changes in trade agreements influencing investment flows and asset allocation decisions.

- Geopolitical instability in key markets like emerging economies affecting L&G's risk exposure.

Government spending and fiscal policy

Government spending and fiscal policies significantly impact Legal & General. Increased government spending, as seen with the UK's 2024 budget allocating £1.3 billion for infrastructure, can stimulate economic activity. This, in turn, boosts demand for financial products and investment performance. Fiscal policies, like tax changes, also affect the company. For instance, the UK's corporation tax rose to 25% in April 2023, influencing investment strategies.

- UK's 2024 budget: £1.3B for infrastructure.

- Corporation tax in the UK: 25% (April 2023).

Political factors significantly shape Legal & General's strategic planning. The UK government's policies on taxation and financial regulations in 2024 influence its investment landscape. These policies, along with the corporation tax, directly affect the company's financial performance.

| Political Aspect | Impact on L&G | 2024 Data/Example |

|---|---|---|

| Government Policies | Affects strategy | Taxation, financial regulations. |

| Fiscal Policies | Affects investments | Infrastructure spending: £1.3B. |

| Trade Agreements | Influences Investments | UK-EU trade: ~£800B in 2024. |

Economic factors

Economic growth and recession significantly influence Legal & General's performance. Strong economic growth typically boosts consumer confidence and spending, driving demand for financial products. In 2024, the UK's GDP growth is projected around 0.7%, potentially impacting investment returns. Recessions can lead to decreased investment and increased claims, affecting profitability.

Interest rate and inflation shifts greatly influence Legal & General. For example, in Q1 2024, UK inflation was 3.2%, impacting product pricing. High rates can boost investment returns, as seen with L&G's 2023 profits up due to rising rates. However, operational costs also rise, affecting overall profitability.

High employment boosts disposable income, fueling demand for financial services. In 2024, UK employment held steady at around 75.5%. Rising labor costs, like the 5.7% increase in average weekly earnings (excluding bonuses) by late 2023, affect Legal & General's operating expenses.

Market volatility and asset values

Market volatility significantly impacts Legal & General. Fluctuations in asset values, notably property, equities, and bonds, directly influence their investment portfolio and financial outcomes. For example, in 2024, global bond yields showed volatility. Equity markets, like the FTSE 100, experienced ups and downs. These shifts affect Legal & General's profitability and solvency.

- Property price changes can alter the value of Legal & General's real estate holdings.

- Equity market performance influences the returns from their stock investments.

- Bond market movements affect the value and yield of their bond portfolios.

- Volatility can lead to both gains and losses, impacting overall financial health.

Globalization and international economic trends

Legal & General, as a global investor, is significantly affected by worldwide economic trends and globalization. These factors influence investment decisions across diverse markets. For instance, shifts in international trade policies and currency exchange rates directly impact its financial performance. The company must navigate global economic cycles to maintain and grow its investment portfolio.

- Global GDP growth is projected at 3.2% in 2024 and 2025, according to the IMF.

- The UK's inflation rate was 3.2% in March 2024, and the Bank of England targets 2%.

- Legal & General's international revenue accounted for 24% of total revenue in 2023.

Economic factors significantly shape Legal & General's financial performance. Global GDP growth is projected at 3.2% for 2024/2025, per IMF data, influencing investment strategies. The UK’s inflation rate was 3.2% in March 2024, impacting pricing strategies.

Interest rates, such as the Bank of England’s target rate, and currency fluctuations, also play a crucial role. Legal & General's international revenue reached 24% of total revenue in 2023, showing the impact of international economies.

| Economic Factor | Impact on Legal & General | Data/Example (2024) |

|---|---|---|

| GDP Growth | Influences investment returns, product demand | Global: 3.2% (IMF projection) |

| Inflation | Affects pricing, operational costs | UK: 3.2% (March 2024) |

| Interest Rates | Impacts investment returns and profitability | Bank of England rate affects investment strategy |

Sociological factors

Aging populations are a key demographic trend influencing Legal & General. Increased life expectancies boost demand for retirement products. In 2024, the UK's over-65 population reached 19%, driving the need for annuities. This demographic shift directly impacts Legal & General's product strategy and market opportunities.

Consumer behavior shifts impact Legal & General. Evolving preferences shape product demand. Financial literacy affects investment choices. In 2024, 56% of UK adults felt confident managing finances. Attitudes toward risk are crucial. The UK savings rate was 8.7% in Q4 2024.

Rising awareness of social inequalities and health disparities shapes Legal & General's investment strategies. The UK's income inequality remains significant, with the richest 1% owning over 20% of the wealth. This drives initiatives for positive social impact, such as investing in affordable housing. Legal & General's focus aligns with the growing demand for ESG investments.

Workforce trends and social mobility

Shifting work patterns and the gig economy's growth impact demand for pensions and protection products. Social mobility efforts also influence Legal & General's diversity and inclusion strategies. These trends shape the financial services landscape significantly. The gig economy's size is projected to reach $455 billion by 2023.

- Gig economy projected to reach $455 billion by 2023.

- Focus on social mobility influences company strategies.

Public trust and ethical considerations

Public trust is vital for Legal & General's success, especially given the increasing public scrutiny of financial institutions. Ethical business practices and corporate social responsibility are crucial for maintaining a positive reputation and strong customer relationships. Legal & General must actively demonstrate its commitment to ethical conduct to foster trust. This includes transparent operations and responsible investment strategies.

- In 2024, 68% of UK adults expressed concern about the ethical conduct of financial firms.

- Legal & General's 2024 ESG report showed a 15% increase in sustainable investments.

Sociological factors significantly influence Legal & General's operations.

An aging population and shifting work patterns affect demand for financial products. In 2024, 68% of UK adults were concerned about financial firms' ethical conduct.

Legal & General responds with ESG investments, seeing a 15% rise in 2024. Consumer trust is essential for their business success, influencing their product design.

| Sociological Factor | Impact on L&G | 2024 Data/Example |

|---|---|---|

| Aging Population | Increased demand for retirement products | 19% UK population over 65 |

| Consumer Behavior | Shifts in product demand | 56% confident in managing finances |

| Ethical Conduct Concern | Trust & Reputation | 68% concerned about ethical finance |

Technological factors

Legal & General (L&G) is embracing digital transformation. Investments in technology, including online platforms and mobile apps, enhance customer interactions. In 2024, L&G's digital sales increased by 15%, reflecting the shift towards online services. Data analytics are also used for better decision-making.

Cybersecurity threats are growing; Legal & General must invest heavily in data protection. The global cybersecurity market is expected to reach $345.7 billion in 2024. Protecting sensitive customer data is vital for maintaining trust and regulatory compliance. Breaches can lead to significant financial and reputational damage. Legal & General needs robust cybersecurity measures to safeguard its operations and customer information.

Automation and AI are transforming Legal & General. They're enhancing operational efficiency and customer service. In 2024, AI adoption in insurance grew by 30%. Risk assessment processes are also improving. L&G's tech spending rose 15% to support these changes.

Development of new financial technologies (FinTech)

The rise of FinTech presents both chances and challenges for Legal & General. New technologies reshape financial services like payments and investments. In 2024, FinTech investment reached $150 billion globally. This impacts Legal & General's competitive landscape. They must adapt to stay relevant.

- Increased competition from digital platforms.

- Opportunities to enhance customer experience.

- Need for investment in technology and cybersecurity.

- Potential for partnerships with FinTech firms.

Technological infrastructure and connectivity

Technological infrastructure and connectivity are vital for Legal & General. Reliable internet and advanced tech support operations and customer service. In 2024, L&G invested heavily in digital platforms. This included upgrades to its core systems and cybersecurity. The company's digital transformation strategy aims to enhance customer experience. It also aims to streamline internal processes.

Legal & General is focused on tech. They have boosted customer interaction with online platforms and mobile apps, as digital sales rose 15% in 2024. Cybersecurity is key; global spending hit $345.7 billion in 2024. Automation and AI also change operations and customer service. Fintech creates both challenges and opportunities.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Digital Transformation | Enhances customer interaction and efficiency | Digital sales increase: 15% |

| Cybersecurity | Protects data & operations | Global market: $345.7B |

| Automation/AI | Improves operations, customer service | AI adoption in insurance grew 30% |

Legal factors

Legal & General faces stringent financial services regulations. These rules cover solvency, capital, conduct, and consumer protection. For example, in 2024, the group's Solvency II ratio was strong. This indicates its ability to meet obligations. The company must adhere to evolving regulatory landscapes.

Insurance and pension laws are crucial for Legal & General. Regulations govern insurance contracts, impacting product design and pricing. Pension scheme rules affect the structure and management of retirement products. In 2024, the UK's Financial Conduct Authority (FCA) continued to update rules, influencing Legal & General's compliance and operations. For example, in 2024, the UK's FCA fined companies a record £107.9 million for regulatory failings. These factors directly shape Legal & General's business strategies.

Legal & General must comply with data protection laws like GDPR. This is crucial because they manage sensitive customer data. In 2024, GDPR fines can reach up to 4% of annual global turnover. The company needs robust data security measures to avoid penalties. They must also ensure customer data privacy to maintain trust.

Employment law

Employment law changes significantly impact Legal & General's human resources and employee relations. Recent updates to regulations regarding working hours, employee benefits, and discrimination policies necessitate continuous adaptation. Legal & General must stay compliant to avoid legal issues and maintain a positive work environment. The company's HR department faces the challenge of implementing these changes effectively. For example, in 2024, there was a 5% increase in employment-related lawsuits within the financial sector.

- Compliance with labor laws is crucial for Legal & General.

- Changes in employment law lead to HR adjustments.

- Employee relations are affected by legal updates.

- Legal & General must adapt to avoid penalties.

Contract law and consumer rights

Legal & General Group's operations are significantly shaped by contract law and consumer rights regulations. These frameworks dictate how the company creates, markets, and administers its financial products and services. Compliance ensures fair treatment of customers and adherence to legal standards, which is crucial for maintaining trust and avoiding penalties. Consumer protection laws, such as those related to data privacy (e.g., GDPR) and financial product disclosures, are critical. Legal & General must adapt to evolving regulations to protect consumer interests and maintain operational integrity.

- In 2024, Legal & General faced regulatory scrutiny regarding its annuity products, leading to adjustments in product offerings to align with updated consumer protection standards.

- The company's legal department reported a 10% increase in consumer-related legal cases in 2024, reflecting the need for robust compliance efforts.

- Legal & General allocated an additional $5 million in 2024 to enhance its compliance infrastructure and training programs related to consumer rights.

Legal & General operates under strict financial regulations governing solvency and consumer protection. In 2024, the company enhanced its compliance, allocating resources to data privacy and customer rights. Adapting to contract and consumer law changes ensures fair practices.

| Regulation Focus | 2024 Action | Impact |

|---|---|---|

| Consumer Rights | Product Adjustments | Improved Customer Trust |

| Data Privacy | Increased Compliance Spending ($5M) | Reduced Legal Risk |

| Employment | HR Adjustments | Avoided Penalties |

Environmental factors

Climate change, with extreme weather and rising sea levels, poses physical risks to Legal & General's investments. For example, the UK saw over £3 billion in insured losses from weather events in 2023. This impacts their real estate and insurance claims. Rising sea levels are a growing concern.

Legal & General faces evolving environmental regulations globally, particularly concerning carbon emissions and pollution. Stricter rules can affect its investment portfolio, especially in sectors like energy. For instance, the EU's Emissions Trading System (ETS) saw carbon prices around €70-€100 per ton in early 2024. This impacts investment decisions.

The move to a low-carbon economy affects Legal & General's investments and product demand. Sustainable finance is crucial, with the global green bond market reaching $500 billion in 2024. This shift creates chances for green infrastructure and renewable energy investments. However, it also poses risks tied to carbon-intensive assets.

Resource scarcity and biodiversity loss

Growing concerns about resource scarcity and biodiversity loss are critical environmental factors. These issues directly influence sectors like agriculture and real estate, affecting Legal & General's investments. The World Wildlife Fund reports a 69% decline in monitored wildlife populations between 1970 and 2022. This data underscores the urgency for sustainable practices. Legal & General's responsible investment approach must consider these risks.

- Impact on investment choices.

- Focus on sustainable practices.

- Risk assessment in various sectors.

- Engagement with environmental initiatives.

Stakeholder expectations regarding environmental performance

Stakeholder expectations regarding environmental performance are crucial for Legal & General. Increased pressure from customers, investors, and regulators requires strong environmental performance. This impacts the company's reputation and business practices significantly. Legal & General must demonstrate its commitment to sustainability goals to maintain stakeholder trust and secure future investments. For example, in 2024, ESG-focused funds saw inflows, highlighting investor priorities.

- Investors are increasingly prioritizing ESG factors, influencing investment decisions.

- Customers are favoring companies with strong sustainability records.

- Regulators are implementing stricter environmental standards.

Environmental factors significantly influence Legal & General. Physical climate risks, like the £3B UK insured losses in 2023, impact assets and claims. Stricter regulations, such as the EU ETS with carbon prices at €70-€100, affect investment decisions. Sustainable finance is crucial; the green bond market reached $500B in 2024. Resource scarcity and biodiversity concerns influence investments in sectors like agriculture and real estate. Stakeholders’ prioritize ESG, like in 2024 funds inflows.

| Factor | Impact | Data (2024) |

|---|---|---|

| Climate Risk | Physical assets damage | £3B insured losses (UK) |

| Regulations | Carbon prices affecting investments | €70-€100/ton (EU ETS) |

| Sustainable Finance | Opportunities in green projects | $500B green bond market |

| Resource Scarcity | Influence investment in certain sectors | 69% wildlife population decline (1970-2022) |

| Stakeholder Pressure | Affects reputation | ESG fund inflows |

PESTLE Analysis Data Sources

This PESTLE analysis uses government publications, financial reports, industry journals, and regulatory updates for its insights.