Legrand Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Legrand Bundle

What is included in the product

Legrand's BCG Matrix analysis reveals optimal investment, hold, and divest strategies across its portfolio.

Export-ready design for quick drag-and-drop into PowerPoint, enabling fast strategy presentations.

Full Transparency, Always

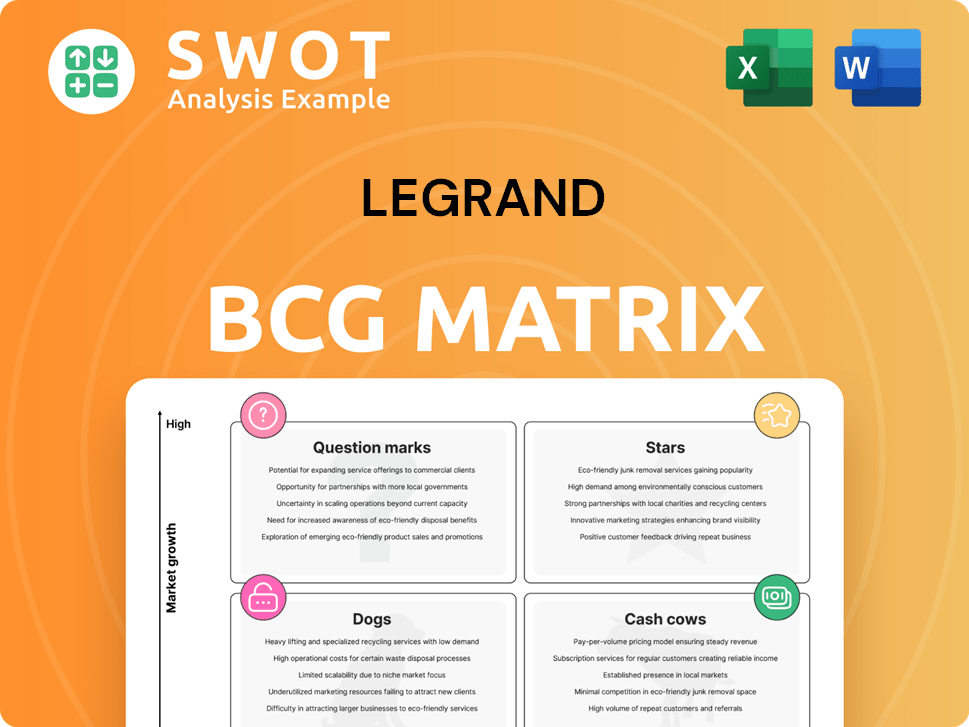

Legrand BCG Matrix

The BCG Matrix preview showcases the complete document you'll receive post-purchase. This is the final, fully formatted report ready for strategic application without any hidden elements.

BCG Matrix Template

Legrand's BCG Matrix helps visualize its product portfolio's potential. See which products shine as Stars or generate consistent Cash Cows. Identify Question Marks needing strategic attention and Dogs posing challenges. This overview barely scratches the surface. Purchase the full BCG Matrix for detailed quadrant analysis and actionable recommendations.

Stars

Legrand's data center solutions are a "Star" in its BCG matrix, fueled by robust growth. This segment accounted for roughly 20% of Legrand's 2024 revenue. Its focus is on high-value, customizable products essential for data center operations. Acquisitions further solidify Legrand's strong market position, highlighting its commitment to this area.

Legrand's energy efficiency solutions position it favorably. The company's 6th CSR roadmap (2025-2027) targets significant CO2 emission reductions. In 2024, the global energy efficiency market was valued at $290 billion, growing. Legrand's commitment enhances its market appeal. This focus aligns with sustainability demands.

Legrand's acquisition strategy fuels growth, especially in the datacenter sector. In 2024, Legrand made nine acquisitions, five in datacenters, boosting annual sales by about €430 million. These acquisitions focus on companies that enhance Legrand's offerings and hold key positions in infrastructure. This approach rapidly broadens Legrand's product range and market presence.

Innovation in Smart Lighting

Legrand's 2024 introduction of Matter-enabled Wi-Fi smart devices in the radiant collection marks a leap in smart lighting. This innovation enhances interoperability, allowing seamless use with various controllers like Amazon, Google, Apple, and Samsung. The new smart lighting generation integrates the Matter standard into switches, dimmers, and outlets, improving consumer experience.

- Legrand's revenue in 2023 reached €8.4 billion.

- The global smart lighting market is projected to reach $55.4 billion by 2027.

- Matter standard aims to simplify smart home device integration.

- Legrand's focus on interoperability aligns with industry trends.

Global Expansion

Legrand’s global expansion strategy is a key element of its success. The company boosts its presence in various markets through strategic acquisitions and organic growth, which enhances its resilience. Legrand operates in over 90 countries, constantly seeking opportunities to expand. For instance, the acquisition of CRS in 2024 strengthened its position in Oceania.

- Expansion in over 90 countries.

- Strategic acquisitions fuel growth.

- Acquisition of CRS in 2024.

- Focus on datacenter vertical.

Stars represent high-growth, high-market-share segments. Legrand's data center solutions and energy efficiency offerings are "Stars," fueled by innovation and acquisitions. Smart lighting's growth potential, projected to reach $55.4 billion by 2027, further solidifies its "Star" status.

| Category | Description | 2024 Data |

|---|---|---|

| Data Center Solutions | High growth segment. | ~20% of revenue. 9 acquisitions in 2024. |

| Energy Efficiency | Focus on sustainability. | Global market valued at $290B in 2024. |

| Smart Lighting | Interoperable devices. | Matter-enabled launch in 2024. |

Cash Cows

Legrand's electrical wiring devices are a cash cow, delivering consistent revenue. This core business thrives on essential products for buildings. Legrand's global infrastructure expertise offers a competitive edge. In 2024, Legrand's sales reached €8.4 billion, showing its strong market position.

Legrand's cable management solutions, such as wire mesh cable trays, are crucial for data centers and commercial buildings. In 2024, Legrand's top-selling wire mesh cable tray used 97% recycled materials and is fully recyclable. These products are a cost-effective way to organize cables, boosting operational efficiency. The global cable management market was valued at $13.8 billion in 2024, highlighting the demand.

Legrand's essential infrastructure products, vital for buildings, are a cash cow. These products, a significant revenue source, ensure consistent demand. Legrand reinforces its market leadership via innovation and operational excellence. In 2024, these segments generated a substantial portion of its €8.8 billion revenue. They provide a stable foundation for consistent cash flow.

Commercial and Industrial Solutions

Legrand's commercial and industrial solutions, such as power distribution and control systems, are cash cows. These solutions provide consistent revenue due to the constant demand for reliable electrical infrastructure in these sectors. Legrand's broad range of offerings positions it as a key player globally. The company continues to innovate, enhancing the performance and efficiency of its solutions.

- In 2024, Legrand's sales in North America, a key market for these solutions, reached €2.6 billion.

- Legrand's investment in R&D was approximately 4.5% of sales in 2024, indicating a commitment to innovation in these areas.

- The commercial and industrial segments account for a significant portion of Legrand's overall revenue, around 60% in 2024.

Residential Market Products

Legrand's residential market products act as cash cows, generating consistent revenue. They offer lighting controls and home automation, meeting steady demand. Legrand's smart lighting and home systems boost homeowner comfort. This segment saw strong growth in 2024.

- Smart lighting and home automation are key.

- Steady revenue comes from home improvements.

- Legrand focuses on comfort and convenience.

- Growth was noted in 2024.

Legrand's cash cows include its core electrical wiring devices and solutions vital for buildings, consistently generating revenue. They benefit from established market positions and essential product demand. Residential and commercial markets contribute significantly to overall sales. In 2024, the company's revenue from these sectors was substantial.

| Product Segment | 2024 Revenue Contribution | Key Feature |

|---|---|---|

| Electrical Wiring Devices | Significant | Core Products |

| Commercial Solutions | 60% of Total Revenue | Power distribution |

| Residential Products | Strong Growth | Smart lighting & home |

Dogs

Dogs in Legrand's portfolio are products losing ground due to tech shifts or market trends. Think older tech replaced by newer, more efficient options. For example, in 2024, Legrand's sales in traditional wiring systems might face pressure. Continuous innovation is crucial; in 2023, Legrand invested €630.8 million in R&D to avoid obsolescence.

Low-margin commodity products, like some electrical components, can be dogs in Legrand's BCG matrix. These products, facing stiff competition, offer minimal returns; in 2024, Legrand's gross margin was around 58%. Intense pricing pressure limits profit potential. Legrand should differentiate through innovation and value-added services to boost margins. In 2024, R&D spending was about 3% of sales.

Dogs in Legrand's portfolio are products with low market share and growth. These face tough competition, potentially from newer tech. For example, older electrical outlets might be dogs. Legrand must decide to revitalize or drop these, 2024 data show.

Niche Products with Limited Scalability

Niche products with limited scalability can be classified as dogs within Legrand's BCG matrix. These products often serve a small market, hindering significant revenue growth. Legrand should assess if these align with its strategic goals. In 2024, Legrand's focus was on high-growth segments, potentially divesting from low-potential areas.

- Market share of dogs is typically low, affecting overall profitability.

- Limited growth prospects may make it challenging to justify continued investment.

- Legrand may consider options like divestiture or phasedown for these products.

- Careful evaluation helps allocate resources to more promising ventures.

Products with High Environmental Impact

Products with a high environmental impact, like those failing to meet standards or with a large carbon footprint, could be "dogs" in Legrand's portfolio. These items may need serious investment to align with sustainability targets, which is crucial now. Legrand is focused on reducing its environmental effect, potentially phasing out unsustainable products. This shift is driven by both regulatory pressures and consumer demand.

- In 2024, environmental regulations intensified, impacting product lifecycles and requiring companies to adapt rapidly.

- Legrand's sustainability report in 2024 highlighted a 15% reduction in carbon emissions across its global operations, indicating a strategic pivot.

- Consumer preferences in 2024 showed a 20% increase in demand for sustainable products, forcing businesses to rethink their offerings.

- Companies like Legrand are increasingly using lifecycle assessments to evaluate the environmental impact of their products, influencing investment decisions.

Dogs in Legrand’s portfolio often show low market share and face limited growth prospects. These products may require substantial investment to revive or they are candidates for divestiture. Legrand needs to carefully assess each dog to optimize resource allocation. In 2024, such decisions impacted profitability and strategic focus.

| Category | Characteristics | Strategic Implications |

|---|---|---|

| Low Market Share | Small revenue contribution, high competition. | Divestiture, phasedown, or niche focus. |

| Limited Growth | Stagnant or declining market demand. | Reduce investment, explore exit strategies. |

| High Environmental Impact | Failing sustainability standards. | Investment in green solutions or phase-out. |

Question Marks

Emerging smart home tech, like Matter-enabled devices, are question marks for Legrand. These require investment to gain market share. Legrand's focus on smart lighting, with new product launches, is a strategic move. The smart home market is expected to reach $174.5 billion by 2025. Innovation is key to meet consumer demand.

Advanced connectivity solutions, vital for smart buildings and IoT devices, classify as question marks in Legrand's BCG matrix, demanding strategic investment for market penetration. Legrand is actively collaborating on new connectivity standards, like the partnership with Cisco announced in 2024. R&D spending in 2023 reached €700 million, showing commitment to innovation. Success hinges on Legrand's ability to secure a competitive edge.

Legrand's energy transition solutions, like EV charging and energy storage, are question marks. These require strategic investments to meet growing demand for sustainable energy. Legrand is investing in this area. The company must develop solutions to reduce customer carbon footprints. In 2024, the global EV charging market was valued at $18.8 billion.

Software and Digital Services

Software and digital services in building management are question marks for Legrand. These services offer data-driven insights, enhancing their value. To stay competitive, Legrand must invest in these areas. This could lead to increased operational efficiency and new revenue streams.

- In 2024, the global smart building market was valued at $80.6 billion.

- Legrand reported in 2023 that 17% of its sales came from digital infrastructure.

- Investments in IoT and cloud-based solutions are growing.

- Customer demand for integrated building management systems is rising.

Solutions for Assisted Living and Healthcare

In Legrand's BCG Matrix, solutions for assisted living and healthcare are categorized as question marks. This segment demands strategic investments to capitalize on the aging population and evolving healthcare needs. Legrand is actively making acquisitions in this area, indicating a commitment to growth. The company must continue to innovate and offer solutions that enhance the quality of life for seniors and individuals with disabilities.

- Legrand's acquisitions in connected health are part of its growth strategy.

- The connected health market is projected to reach significant value by 2024.

- Legrand's focus aligns with the increasing demand for smart home solutions in healthcare.

- Investment decisions are crucial for converting these question marks into stars.

Legrand's assisted living and healthcare solutions are question marks, requiring strategic investments. These investments aim to leverage the growing demand in connected health, projected to reach significant values. Legrand's acquisitions and innovations in this sector highlight their commitment.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Focus | Connected Health | Projected market value is significant |

| Legrand's Action | Acquisitions & Innovation | Strategic Growth |

| Goal | Enhance Quality of Life | Meet Aging Population Needs |

BCG Matrix Data Sources

The Legrand BCG Matrix leverages company financials, market analysis, competitor data, and industry insights to provide comprehensive assessments.