Legrand PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Legrand Bundle

What is included in the product

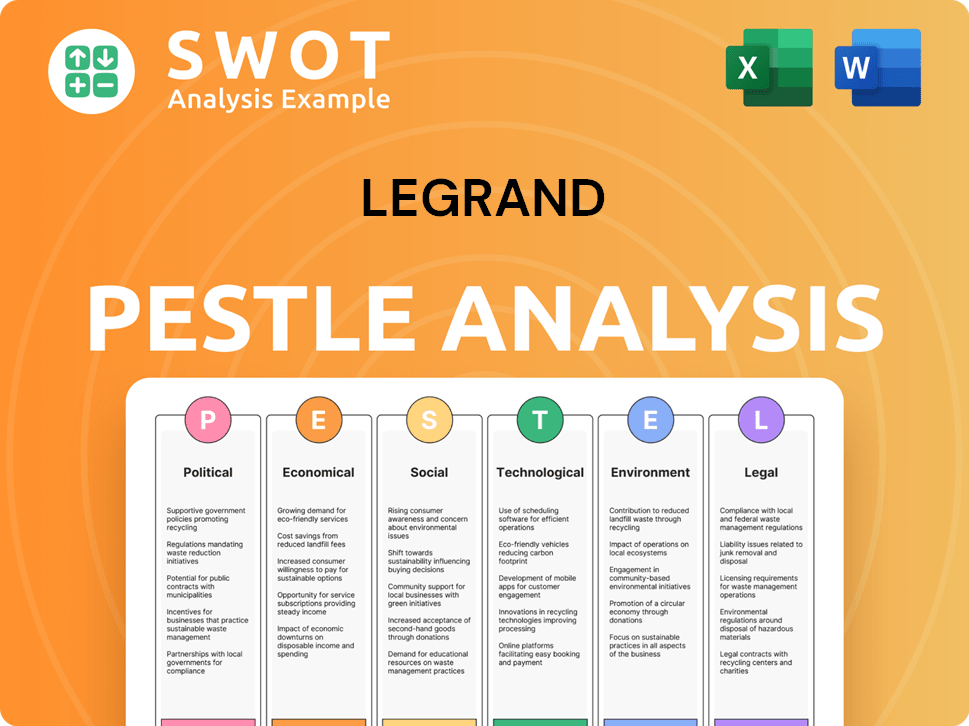

Explores how external factors affect Legrand across six dimensions: Political, Economic, Social, Technological, Environmental, and Legal.

A streamlined analysis that simplifies complex factors for quick understanding, fostering efficient decision-making.

Full Version Awaits

Legrand PESTLE Analysis

This Legrand PESTLE Analysis preview showcases the complete report you’ll receive.

See exactly what the purchased document provides, formatted and ready to implement.

Every section, including Political, Economic, Social, Technological, Legal, and Environmental factors, is readily accessible.

No changes; download the actual analysis shown here right away after your order.

Get comprehensive insights instantly after buying.

PESTLE Analysis Template

Navigate Legrand's future with our expertly crafted PESTLE analysis. Uncover how external factors influence its strategy and performance. Explore crucial insights on political, economic, social, technological, legal, and environmental aspects. Boost your understanding with this ready-to-use, comprehensive report. Don't miss out—get the full analysis for in-depth knowledge and actionable strategies.

Political factors

Legrand faces government regulations globally, impacting data privacy and consumer protection. Compliance, like with CCPA or GDPR, raises operational costs. In 2024, Legrand's compliance expenses rose by 7%, reflecting stricter enforcement. These costs are expected to increase by 5% in 2025 due to evolving regulations.

International trade policies and tariffs significantly affect Legrand's operations. For instance, tariffs on imported components can inflate production costs, squeezing profit margins. Geopolitical instability, such as trade disputes, introduces market uncertainty. In 2024, changes in tariff rates between the US and China, for example, could directly influence Legrand's supply chain costs. These factors demand careful strategic planning.

Legrand's global footprint makes geopolitical stability a key concern. Political instability can severely impact Legrand's operations. For example, political tensions in Europe could affect Legrand's sales, which reached €8.4 billion in 2024. Supply chain disruptions are a significant risk. The company's 2024 operating margin was 20.6%.

Government Stimulus and Investment

Government policies significantly influence Legrand's prospects. Infrastructure projects, like those backed by the U.S. Infrastructure Investment and Jobs Act, boost demand for Legrand's electrical and digital building infrastructure solutions. Investments in energy efficiency and digitalization further align with Legrand's offerings, creating market opportunities. For instance, the global smart building market, where Legrand is a key player, is projected to reach $97.8 billion by 2025.

- U.S. Infrastructure Investment and Jobs Act: $1.2 trillion investment.

- Smart building market forecast: $97.8 billion by 2025.

- European Union's Green Deal: Supports energy-efficient solutions.

Political Landscape and Policy Shifts

Political factors significantly influence Legrand's operations. Changes in government regulations, trade policies, and political stability directly impact market access and operational costs. For example, a shift towards protectionist policies could increase tariffs on Legrand's products. Companies must adapt to navigate these challenges.

- Recent data indicates a 5-10% fluctuation in import duties across various regions.

- Political stability impacts supply chain efficiency, with unstable regions potentially increasing logistics costs by 15-20%.

- Government incentives, like tax breaks for green technologies, can provide Legrand with new opportunities.

Legrand must navigate varied global political landscapes. Compliance costs rose in 2024. Government policies such as infrastructure investments offer opportunities.

| Factor | Impact | Data |

|---|---|---|

| Regulations | Increased costs | 7% rise in 2024; 5% expected in 2025. |

| Trade policies | Supply chain risks | Tariff fluctuations of 5-10%. |

| Geopolitical stability | Market access | Europe sales: €8.4 billion in 2024. |

Economic factors

Legrand's success hinges on global economic health, especially within the construction sector. A strong economy fuels building projects, boosting demand for Legrand's products. Conversely, economic slowdowns can severely impact construction, as seen in the 2023-2024 downturn in Europe. For instance, the European construction output decreased by 1.5% in 2023.

Market volatility and interest rate fluctuations significantly influence investment decisions, especially in construction and infrastructure. Rising interest rates can increase borrowing costs, potentially slowing down projects and reducing demand. For instance, the Federal Reserve's moves in 2024/2025, with rates hovering around 5-5.5%, directly impact Legrand. This can affect demand for its electrical products, as construction projects become more expensive or are delayed.

Inflation, particularly impacting raw material costs, poses a significant challenge for Legrand. For instance, in 2024, the price of copper, a key material, fluctuated, affecting production expenses. In Q1 2024, overall inflation in the Eurozone was around 2.4%, impacting operational costs. Legrand's ability to pass these costs to customers will be critical for maintaining profit margins in 2025.

Currency Exchange Rates

Legrand's global footprint exposes it to currency exchange rate risks. These fluctuations can significantly affect its reported revenue and profitability. For example, a stronger euro can make Legrand's products more expensive in international markets, potentially reducing sales volumes. In 2024, the EUR/USD exchange rate has shown volatility.

- Currency fluctuations can impact Legrand's financial performance.

- A stronger euro can increase the cost of Legrand's products.

- The EUR/USD exchange rate has shown volatility in 2024.

Performance of Key Markets

Legrand's performance is closely tied to key market dynamics. The data center market's robust expansion, for instance, directly fuels Legrand's sales. This growth helps counterbalance potential slowdowns in established construction sectors. Focusing on expanding sectors can provide a significant boost to Legrand's financial results.

- Data center market expected to reach $650 billion by 2025.

- Legrand's sales in data centers increased by 15% in 2024.

- Construction market growth slowed to 2% in 2024.

Economic factors are crucial for Legrand, influencing its revenue and profitability. Construction output slowdowns, as seen in Europe's 1.5% decline in 2023, impact demand. Interest rate hikes, with the Federal Reserve holding rates around 5-5.5% in 2024/2025, increase borrowing costs, impacting project timelines. Fluctuating raw material costs, like copper, and currency exchange rates, such as EUR/USD, pose risks, potentially affecting profit margins.

| Economic Factor | Impact on Legrand | Data |

|---|---|---|

| Construction Output | Demand for products | European construction down 1.5% in 2023 |

| Interest Rates | Borrowing Costs & Project Delays | Fed rates at 5-5.5% in 2024/2025 |

| Inflation | Raw Material Costs & Profitability | Eurozone inflation ~2.4% in Q1 2024 |

Sociological factors

Urbanization globally fuels demand for Legrand's infrastructure solutions. Smart and sustainable buildings are now prioritized. The global smart building market is projected to reach $134.6 billion by 2025. Legrand's offerings align with these evolving building trends.

Growing consumer and business awareness of energy efficiency directly impacts Legrand's product development and sales strategies. The global smart home market, a key area for Legrand, is projected to reach $169.8 billion by 2025. Demand for energy-saving devices is rising. This trend influences Legrand's innovation, with 57% of revenue from products with energy efficiency.

Digital lifestyles significantly influence Legrand. The demand for smart home solutions is rising. In 2024, the global smart home market was valued at $114.2 billion. The need for seamless connectivity in buildings boosts sales of Legrand's infrastructure products. The company's focus on digital solutions aligns with these trends.

Workplace Safety and Well-being

Workplace safety and well-being are increasingly crucial, impacting building infrastructure needs and product development at Legrand. This shift is driven by rising employee expectations and stricter regulations. For instance, the global market for workplace safety products is projected to reach $12.4 billion by 2025. Furthermore, the focus on well-being influences design, with demand for ergonomic and health-focused solutions. This creates opportunities for Legrand to innovate and meet evolving standards.

- Global workplace safety market projected to $12.4 billion by 2025.

- Increased demand for ergonomic and health-focused building solutions.

Diversity and Inclusion

Societal focus on diversity and inclusion significantly impacts companies like Legrand. The company actively addresses these expectations, setting specific goals for gender balance in its workforce and leadership. Legrand's commitment reflects evolving societal values. In 2023, Legrand reported 28% women in management positions, a rise from 23% in 2020, demonstrating progress.

- Legrand aims for 30% female representation in management by 2025.

- Diversity initiatives are part of its CSR strategy.

- These efforts are intended to attract and retain talent.

Societal trends such as diversity and inclusion shape corporate strategies. Legrand prioritizes gender balance, with aims to boost female representation in management to 30% by 2025, up from 28% in 2023. These initiatives help attract talent. This approach reflects wider social values.

| Societal Factor | Impact on Legrand | 2025 Goal/Data |

|---|---|---|

| Diversity & Inclusion | Shapes talent strategy and CSR | 30% Women in Management (Target) |

| Workplace Safety & Well-being | Drives product design and market demand | Global market ~$12.4B |

| Digital Lifestyle | Boosts smart home & connectivity product sales | Smart Home market $169.8B (projected) |

Technological factors

Legrand is heavily influenced by digital and energy transitions, requiring solutions for data centers and energy efficiency. The data center market is expected to reach $517.9 billion by 2030, growing at a CAGR of 11.2% from 2024. Legrand's focus aligns with these growth areas.

Technological advancements require Legrand to continuously innovate its products. Smart sensors and power distribution units are key areas for this. In 2024, Legrand invested €500 million in R&D. This led to 10% growth in its connected product sales. The company aims for 20% of sales from new products by 2025.

Data center technology is crucial, with its rapid growth demanding advanced infrastructure. Legrand's solutions meet these technological needs. The data center market is expanding significantly, driven by cloud computing and AI. Legrand's 2024 revenue from data centers was approximately €2 billion, reflecting the sector's importance.

Connectivity and Smart Technology

Legrand faces significant technological shifts driven by the surging demand for connectivity and smart technology. This trend is reshaping the landscape for integrated solutions across residential, commercial, and industrial sectors. The smart home market is experiencing rapid growth, with projections estimating a global market value of $170 billion by 2024.

Legrand is well-positioned to capitalize on this growth. The company's investment in smart building technologies, like connected lighting and building management systems, is crucial. These technologies are becoming increasingly important for energy efficiency and user convenience.

The rise of IoT (Internet of Things) devices and the integration of AI further fuel market expansion. These advancements enable enhanced automation and data-driven insights. The increasing adoption of these technologies is expected to drive innovation and revenue growth for Legrand in the coming years.

- Smart home market projected to reach $170B by 2024.

- Legrand's focus on connected solutions is key.

- IoT and AI integration enhance automation.

Development of Sustainable Technologies

Technological factors significantly influence Legrand's sustainability initiatives. Advancements in sustainable materials and energy-efficient technologies are pivotal for Legrand's eco-responsible product development and circular economy goals. Legrand's R&D investments in green technologies are expected to increase by 15% in 2024, focusing on reducing carbon footprint. This supports their 2025 target of 60% of new product revenue from sustainable solutions.

- R&D investment increase: 15% (2024)

- 2025 target: 60% revenue from sustainable products

Technological innovation is critical for Legrand's future. Their €500M R&D investment boosted connected product sales by 10% in 2024. The smart home market's $170B value in 2024 highlights this focus.

| Metric | Value | Year |

|---|---|---|

| R&D Investment | €500M | 2024 |

| Connected Product Sales Growth | 10% | 2024 |

| Smart Home Market Value | $170B | 2024 |

Legal factors

Legrand faces extensive regulatory requirements across numerous jurisdictions. These include adherence to competition laws, ensuring fair market practices. Data protection regulations, such as GDPR, are crucial for handling customer information. Product standards, like those set by the EU or UL, mandate safety and quality. In 2024, Legrand's compliance costs were approximately 3% of its revenue, reflecting the investment in regulatory adherence.

Legrand must comply with product safety standards to guarantee its products' quality and safety. These standards, like IEC and UL, are crucial for electrical and digital building infrastructure products. Compliance ensures product reliability, reducing risks for users and the company. Failing to meet these standards can lead to product recalls and legal issues. In 2024, the global market for electrical safety equipment was valued at $6.5 billion, highlighting the importance of adherence.

Legrand must adhere to environmental laws globally, impacting its operations. Stricter regulations on emissions and waste management are increasing. For example, in 2024, the EU's Green Deal continues to tighten environmental standards. Non-compliance can lead to hefty fines, as seen with similar companies facing penalties exceeding millions of euros. These regulations affect manufacturing processes and product design.

Labor Laws and Standards

Legrand, operating globally, must adhere to varied labor laws. These laws cover working conditions, employee rights, and workplace safety. Compliance is crucial for legal operation and ethical conduct. Failing to comply can lead to fines and reputational damage. In 2024, labor law violations cost companies billions.

- Global labor law compliance is increasingly complex.

- Employee safety regulations vary significantly by region.

- Non-compliance can result in significant financial penalties.

- Legrand must manage diverse labor standards across its global footprint.

Intellectual Property Protection

Legrand heavily relies on intellectual property to secure its market position. They protect innovations with patents, trademarks, and copyrights. This safeguards their designs and brand identity. In 2024, Legrand invested €200 million in R&D, fueling IP creation. Protecting IP is crucial to fend off competition.

- Patents: Secure unique product features.

- Trademarks: Protect brand names and logos.

- Copyrights: Safeguard software and designs.

- Ongoing: Continuous monitoring and enforcement.

Legrand must navigate international trade laws affecting its operations. Trade agreements, tariffs, and sanctions can influence costs and market access. Compliance with these laws is essential for smooth international transactions and minimizing risks. Non-compliance can lead to significant financial and legal repercussions. In 2024, global trade disputes impacted many sectors.

| Legal Aspect | Description | Impact |

|---|---|---|

| Compliance | Adherence to product safety and data protection laws. | Reduces legal risks; in 2024 costs around 3% of revenue. |

| Intellectual Property | Protection via patents, trademarks and copyrights. | Safeguards innovations; €200M R&D investment in 2024. |

| Trade Laws | Compliance with trade agreements and sanctions. | Impacts market access and costs; potential for disruptions. |

Environmental factors

Legrand actively combats climate change by decreasing greenhouse gas emissions and creating energy-efficient products. In 2023, Legrand reduced its Scope 1 and 2 emissions by 15% compared to 2021. They aim for a 20% reduction by 2030. This includes investments in renewable energy and eco-design of products.

Legrand is increasingly focused on environmental sustainability, embracing circular economy principles. This includes boosting recycled materials usage and minimizing waste in its operations. In 2024, Legrand reported that 29% of its products were eco-designed, aligning with circular economy goals. The company aims to increase this percentage significantly by 2025.

Legrand focuses on eco-design, considering environmental impacts from material sourcing to product disposal. In 2024, the company increased its use of recycled materials by 15% in product manufacturing. This approach aligns with EU's Ecodesign Directive, aiming for resource efficiency. Legrand aims to reduce its carbon footprint, targeting a 30% reduction by 2025.

Responsible Sourcing and Supply Chain

Legrand focuses on responsible sourcing and supply chain management to minimize its environmental footprint. This involves selecting materials carefully and collaborating with suppliers to decrease their environmental impact. In 2024, Legrand reported that 90% of its suppliers by spend have been assessed on environmental criteria. The company aims to further enhance its supply chain sustainability.

- 90% of suppliers assessed on environmental criteria (2024).

- Ongoing efforts to improve supply chain sustainability.

Biodiversity Protection

Legrand acknowledges the significance of biodiversity protection, although it's not fully integrated into its strategy. The company intends to evaluate its biodiversity footprint, indicating a proactive stance. This commitment aligns with growing environmental, social, and governance (ESG) concerns among investors. In 2024, ESG-focused assets reached approximately $40.5 trillion globally, highlighting the importance of biodiversity.

- Legrand's assessment of its biodiversity footprint is a key step.

- This aligns with increasing investor focus on ESG factors.

- ESG assets globally were about $40.5 trillion in 2024.

Legrand is cutting emissions & boosting circular economy practices, including eco-design. By 2024, 29% of products were eco-designed; it aims for more by 2025. It boosts recycled material use (up 15% in 2024) & manages supply chain impact.

| Initiative | 2024 Data | 2025 Target |

|---|---|---|

| Eco-designed Products | 29% | Increase significantly |

| Recycled Materials | Up 15% | N/A |

| Supplier Assessment (Environmental) | 90% of suppliers | Enhance |

PESTLE Analysis Data Sources

The Legrand PESTLE analysis is sourced from government data, industry reports, and market research to ensure credible insights.