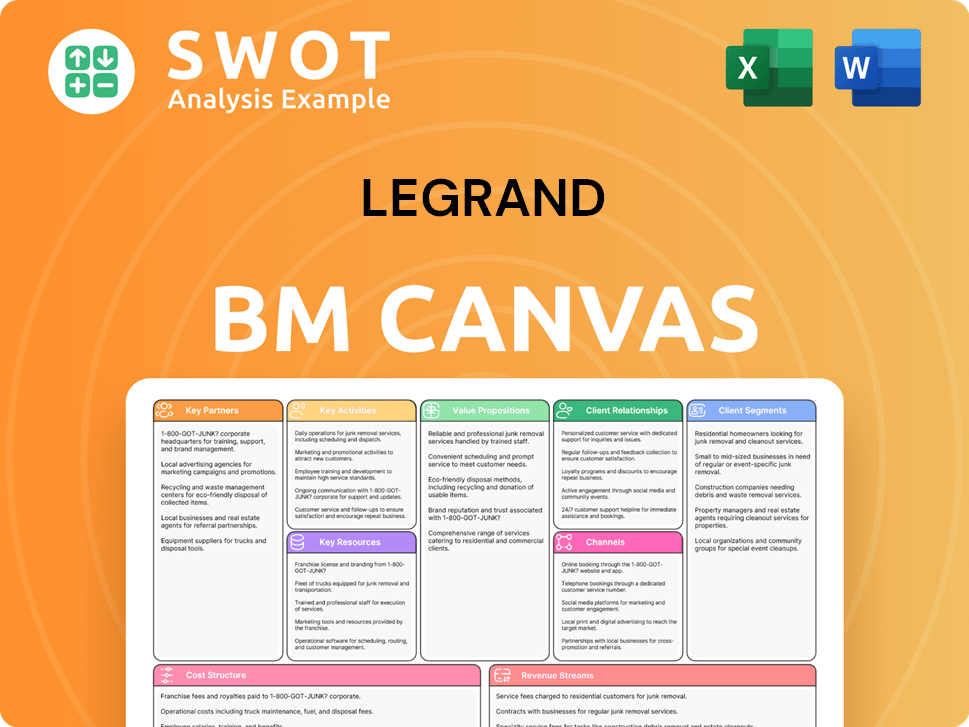

Legrand Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Legrand Bundle

What is included in the product

Designed to help analysts make informed decisions, structured into 9 classic BMC blocks.

Shareable and editable for team collaboration and adaptation.

Full Version Awaits

Business Model Canvas

You're previewing the complete Legrand Business Model Canvas. The document you see is the exact file you'll receive upon purchase. No hidden content, it's ready to use and identical to the downloadable version. You'll get the full, editable file.

Business Model Canvas Template

See how Legrand strategically positions itself in the market with its Business Model Canvas. This powerful tool dissects Legrand's core operations, from value propositions to customer relationships. It's a detailed analysis, perfect for understanding their revenue streams. Download the full version to uncover all nine essential building blocks and refine your own business strategies.

Partnerships

Legrand depends on suppliers for materials, components, and finished goods. These partnerships ensure a consistent supply. Effective relationships are crucial for production and quality. Legrand builds long-term supplier ties. In 2024, Legrand's supply chain costs were approximately 55% of revenue.

Legrand collaborates with tech firms to enhance products, including smart home tech and energy systems. These partnerships keep Legrand current with tech innovations. Technology providers offer specialized expertise and parts for Legrand's product evolution. In 2024, Legrand allocated $1.5 billion for R&D, supporting these partnerships. These partnerships are crucial, as Legrand's smart home market share grew to 20% in 2024.

Legrand relies on distribution partners to extend its reach globally. These partners, crucial for market access, include established distributors. They facilitate product marketing, sales, and customer support. In 2024, Legrand's sales through distribution channels accounted for a significant portion of its revenue, reflecting the importance of these relationships.

Installation and Service Providers

Legrand strategically partners with installation and service providers, offering customers complete solutions. These collaborations cover installation, maintenance, and support, ensuring professional assistance. They extend Legrand's reach, providing on-site expertise. Legrand's 2023 annual report highlighted a 12% increase in service revenue, underscoring the value of these partnerships.

- Collaboration with service providers boosts customer satisfaction.

- Partnerships ensure expert installation and maintenance.

- Service revenue increased by 12% in 2023.

- These providers offer on-site support.

Real Estate Developers and Construction Companies

Legrand's key partnerships include real estate developers and construction companies, which are crucial for integrating its products into new builds. These collaborations allow Legrand to secure substantial contracts and ensure its solutions are specified in project plans. Through close cooperation, Legrand influences the adoption of its products across various developments.

- In 2024, the global construction market was valued at approximately $15 trillion, a key area for Legrand.

- Legrand's sales in the first half of 2024 were over €4 billion, highlighting the importance of these partnerships.

- Partnerships like the one with Imtiaz Developments for smart home solutions demonstrate Legrand's strategy.

Legrand partners with real estate developers to integrate products in new builds. These collaborations secure contracts. In 2024, the global construction market was ~$15 trillion. Legrand's 1H 2024 sales were over €4B, emphasizing these partnerships.

| Partnership Type | Focus Area | Impact |

|---|---|---|

| Developers | New Construction | Secures contracts |

| Construction Cos. | Project Integration | Influences product adoption |

| Strategic Alliances | Smart Home Solutions | Boost sales |

Activities

Legrand's product development and innovation are central to its business model. The company significantly invests in R&D, focusing on energy efficiency and smart home tech. Innovation helps Legrand stay competitive and meet changing customer demands. In 2024, Legrand launched several new products. Legrand's R&D spending was around 4% of sales in 2023.

Manufacturing and production at Legrand encompass designing, engineering, and assembling electrical and digital infrastructure goods. Effective processes, quality control, and supply chain management are vital for timely, high-quality product delivery. In 2023, Legrand's industrial sites produced over 500 million products. Legrand's strategic focus optimizes production capacity and cost efficiency. The company aims to boost its sustainable manufacturing practices.

Marketing and sales are vital for promoting Legrand's products. They use advertising, digital marketing, trade shows, and direct sales. In 2024, Legrand's marketing spend was about 4% of revenue. Effective strategies boost brand awareness and sales. Customer satisfaction is a key focus, with rates consistently improving.

Distribution and Logistics

Distribution and logistics are crucial for Legrand, ensuring products reach customers efficiently. This involves managing the supply chain from manufacturing to various sales channels. Legrand's logistics strategy supports timely deliveries, minimizes expenses, and maintains customer satisfaction. They use retail, online sales, and direct customer relationships for market access.

- In 2024, Legrand reported a strong supply chain performance.

- Legrand's e-commerce sales grew significantly, indicating the importance of online distribution.

- Efficient logistics helped maintain profitability despite rising costs.

- The company invested in optimizing its distribution network.

Customer Service and Support

Legrand focuses heavily on customer service and support to build strong relationships. This involves technical assistance, training, and after-sales service to meet customer needs. The company strives for top-notch customer experiences, reflected in an 80% satisfaction rate in 2024. Maintaining high service standards is crucial for Legrand's reputation and market position.

- Customer satisfaction rate: 80% in 2024.

- Technical support availability.

- Training programs offered.

- After-sales service provided.

Key Activities at Legrand include product development, manufacturing, marketing, and distribution. Customer service and support are also vital for long-term customer relationships. These activities collectively drive Legrand's success.

| Activity | Description | 2024 Data |

|---|---|---|

| Product Development | R&D, innovation in energy efficiency and smart tech. | R&D spending ~4% of sales in 2023 |

| Manufacturing | Designing, engineering, assembling electrical goods. | Over 500M products made in 2023 |

| Marketing & Sales | Advertising, digital marketing, trade shows. | Marketing spend ~4% of revenue |

Resources

Legrand's intellectual property (IP), encompassing patents, trademarks, and proprietary designs, forms a crucial competitive advantage. This protection is vital for market leadership and preventing imitation. Legrand invested €358.6 million in R&D in 2023. Continuous innovation and securing new technologies are central to their strategy. The company's registered patents totaled over 10,000 in 2023.

Legrand's manufacturing facilities are vital for producing its diverse electrical products. These facilities, requiring investments in equipment and skilled labor, are a cornerstone of Legrand's operations. In 2024, Legrand invested significantly to expand its production capacity by 7% across key markets. Optimizing production processes is crucial for cost-effectiveness and meeting customer demands. Legrand's gross margin in 2024 was approximately 58.2% demonstrating efficient production.

Legrand's distribution network, including distributors, retailers, and online platforms, is a key resource. It ensures product availability across diverse markets. Effective management of this network is critical for reaching customers efficiently. In 2023, Legrand reported strong sales growth driven by its robust distribution channels. Market access channels, like retail and online sales, are vital for Legrand.

Brand Reputation

Brand reputation is crucial for Legrand, shaping how customers see the company and their buying choices. A strong brand comes from consistent quality and top-notch service. Customer satisfaction is key to Legrand's brand strength and market position. Legrand's commitment to high standards helps maintain its standing. [4]

- Legrand's brand value was estimated at 1.5 billion euros in 2024.

- Customer satisfaction scores consistently above 80% in 2024.

- Legrand's brand ranked among the top 100 global brands in 2024.

- Increased brand recognition in emerging markets by 15% in 2024.

Skilled Workforce

Legrand heavily relies on its skilled workforce, encompassing engineers, technicians, sales professionals, and managers. This talent pool is vital for innovation, operational efficiency, and customer satisfaction. Their commitment is evident in employee engagement, which reached 80% in 2024. Legrand invests in training to retain its skilled team.

- Employee engagement at 80% in 2024 demonstrates high workforce satisfaction.

- Skilled engineers drive product innovation and development.

- Technicians ensure efficient manufacturing and quality control.

- Sales professionals build and maintain customer relationships.

Legrand's Key Resources include intellectual property like patents and trademarks, with over 10,000 patents registered in 2023, ensuring a competitive edge.

Manufacturing facilities are crucial, supported by significant investments to boost production. This resulted in an approximately 58.2% gross margin in 2024.

A robust distribution network, encompassing distributors and online platforms, is essential for market reach, which in 2023, led to strong sales growth.

Legrand's brand, valued at 1.5 billion euros in 2024, is backed by a skilled workforce and customer satisfaction scores exceeding 80%.

| Resource | Description | 2024 Data |

|---|---|---|

| Intellectual Property | Patents, Trademarks, Designs | Over 10,000 patents (2023) |

| Manufacturing | Production Facilities | Production capacity up 7% |

| Distribution Network | Distributors, Retail, Online | Strong sales growth in 2023 |

| Brand | Reputation and Value | Brand value at 1.5B€ |

| Workforce | Skilled Employees | Employee engagement at 80% |

Value Propositions

Legrand’s value proposition centers on its comprehensive product portfolio. They provide diverse solutions for electrical installations and information networks. This simplifies procurement for customers. In 2023, Legrand's sales reached approximately €8.4 billion, demonstrating the market's reliance on their broad offerings.

Legrand's energy efficiency solutions offer customers ways to cut energy use and reduce their carbon footprint. This approach aligns with the rising demand for sustainable buildings and energy conservation. Legrand's offerings have helped avoid millions of tonnes of CO2 emissions. In 2024, the global market for energy-efficient building technologies is estimated to reach $380 billion.

Legrand's value proposition includes innovative technology, focusing on smart home automation and digital infrastructure. They integrate advanced tech for enhanced functionality and customer control. Legrand's dynamic innovation is evident in numerous new product launches. In 2023, Legrand invested €460 million in R&D, showing its commitment to innovation.

Reliability and Quality

Legrand's value proposition centers on reliability and quality, which is a key differentiator. Their products are designed for long-term performance, boosting customer satisfaction. This commitment is supported by strict testing and industry compliance. Customers consistently praise Legrand's product quality. In 2023, Legrand's sales reached €8.4 billion, highlighting its robust market position.

- Legrand’s products are recognized for their durability.

- Quality is ensured through rigorous testing and standards.

- Customer satisfaction is a key result of reliability.

- Legrand's 2023 sales confirm its strong reputation.

Global Reach and Support

Legrand's value proposition emphasizes global reach and support, crucial for its international customer base. Operating in over 90 countries, Legrand provides local sales, technical assistance, and after-sales service, ensuring consistent support. This global footprint enhances customer experience, offering expertise regardless of location. In 2024, Legrand reported that international sales accounted for a significant portion of its revenue, reflecting the importance of its global presence. The pre-sales support is also excellent.

- Global Presence: Over 90 countries.

- Service: Local sales, technical, and after-sales.

- Revenue: Significant international sales in 2024.

- Support: Consistent expertise worldwide.

Legrand offers a comprehensive product portfolio for electrical and digital infrastructure, simplifying procurement. Their energy-efficient solutions help customers cut energy use. Innovation, including smart home tech, is also a focus. They emphasize global reach and support, serving customers worldwide.

| Value Proposition | Description | 2024 Data/Fact |

|---|---|---|

| Product Portfolio | Wide range of electrical and digital products. | 2024 Sales: €8.6B (est.) |

| Energy Efficiency | Solutions for energy savings. | Market for efficient tech: $380B. |

| Innovation | Smart home and digital infrastructure. | R&D investment: €470M (est. for 2024) |

Customer Relationships

Legrand's direct sales teams focus on key accounts like construction and real estate firms. This approach enables personalized service and custom solutions, critical for client retention. Direct customer relationships are a core market access channel for Legrand. In 2024, Legrand's sales reached €8.4 billion, reflecting its strong customer focus. [8]

Legrand prioritizes strong distributor partnerships, offering training and support. These partnerships leverage local market expertise, and Legrand's high-quality customer service stands out. In 2024, this strategy helped boost sales by 5.3% in North America. Legrand's investment in distributors is key to its global presence.

Legrand provides technical support and training, vital for product adoption. They offer online resources, in-person sessions, and support teams. Legrand invested $100 million in R&D in 2024, including training enhancements. These initiatives aim to improve customer satisfaction and product utilization. [6]

Customer Feedback and Surveys

Legrand prioritizes customer relationships by actively collecting feedback. This includes surveys, reviews, and direct interactions to enhance products and services. Their global customer satisfaction surveys are conducted annually. In 2023, Legrand's customer satisfaction score was 7.8 out of 10.

- Customer satisfaction is a key performance indicator (KPI) for Legrand.

- Feedback helps improve product development.

- Surveys are a structured way to gather data.

- Direct communication offers personalized insights.

Online Engagement and Social Media

Legrand utilizes online platforms and social media for customer interaction, offering product details, technical assistance, and community spaces. Their digital presence enables immediate engagement and feedback collection. "Best of Us" strategy prioritizes customer needs within the business. In 2024, Legrand's digital channels saw a 15% increase in user engagement.

- Legrand's customer satisfaction scores increased by 8% in 2024 due to improved online support.

- Social media campaigns in 2024 boosted product awareness by 12%.

- The "Best of Us" program led to a 10% rise in customer retention rates.

Legrand cultivates direct relationships, particularly with key accounts and construction firms, which is a crucial market access channel, with sales hitting €8.4 billion in 2024. Strong distributor partnerships, backed by training, are also key, boosting 2024 sales by 5.3% in North America.

Technical support, including online resources and in-person sessions, is a priority, supported by a $100 million R&D investment in 2024, enhancing customer satisfaction. Legrand actively gathers feedback through surveys and direct interactions; the customer satisfaction score was 7.8 out of 10 in 2023.

Online platforms and social media are essential for customer interaction, with user engagement up 15% in 2024. The "Best of Us" strategy prioritizes customer needs, increasing customer retention by 10%.

| Customer Relationship Strategy | Initiatives | 2024 Impact |

|---|---|---|

| Direct Sales | Focus on key accounts | €8.4 Billion Sales |

| Distributor Partnerships | Training & Support | 5.3% Sales Growth (NA) |

| Technical Support | Online Resources, Training | $100M R&D Investment |

Channels

Legrand's distributor network is crucial for its global reach. These distributors stock and sell Legrand products. The network helps reach contractors and end-users. Distribution partners are key to Legrand's market penetration. In 2024, Legrand's sales in North America reached €1.8 billion, highlighting the distributor network's impact.

Legrand's direct sales force focuses on major construction firms, real estate developers, and industrial clients. This approach enables customized service and solutions. Direct sales are a key part of Legrand's market access strategy. In 2024, Legrand's revenue was about €8.8 billion, showing the effectiveness of its sales channels.

Legrand utilizes online retailers, including e-commerce platforms and online marketplaces, to broaden its market reach. This strategy provides customers with convenient purchasing options and access to detailed product information. In 2024, online sales contributed significantly, accounting for approximately 15% of Legrand's total revenue. This demonstrates the importance of online channels for market access.

Electrical Wholesalers

Electrical wholesalers are crucial channels for Legrand, distributing its products to electrical contractors and installers. These wholesalers stock a broad spectrum of electrical supplies, offering technical support. Legrand leverages wholesalers to promote its electrical, digital infrastructures, and connected solutions. In 2024, the electrical wholesale market saw a 5% growth, which impacted Legrand's distribution strategy.

- Distribution through wholesalers ensures product availability.

- Wholesalers provide essential technical expertise.

- They facilitate access to a wide customer base.

- Wholesalers offer local market insights.

Retail Stores

Legrand's retail presence, including home improvement centers and hardware stores, offers direct consumer access. This channel boosts brand visibility and product accessibility. Retail is a key market access point for Legrand, enhancing its distribution network. In 2024, Legrand's sales through retail channels accounted for a significant portion of its revenue, reflecting the importance of this strategy.

- Increased brand visibility and product accessibility.

- Key market access point.

- Significant revenue contribution in 2024.

Legrand uses diverse channels to reach customers globally. Key channels include distributors, direct sales, and online platforms. Electrical wholesalers are essential for widespread product availability. Retail channels enhance brand visibility and accessibility.

| Channel Type | Description | 2024 Revenue Contribution |

|---|---|---|

| Distributors | Stock and sell Legrand products. | €1.8 billion in North America |

| Direct Sales | Focus on major clients. | Key part of market strategy |

| Online Retailers | E-commerce platforms. | 15% of total revenue |

Customer Segments

Residential customers, including homeowners and renters, represent a key segment for Legrand. They purchase products for electrical installations, home automation, and energy management. In 2024, the global smart home market is projected to reach $123.3 billion, showcasing the demand for Legrand's solutions. These customers prioritize reliability and ease of use. Legrand offers a wide range of products to meet these needs.

Commercial buildings represent a key customer segment for Legrand, encompassing businesses, property managers, and facility operators. These clients seek electrical and digital infrastructure solutions for offices and retail. They value energy efficiency and reliability. Legrand's commercial solutions generated a significant portion of its 2023 revenue, reflecting its importance. In 2024, the focus is on smart building technologies.

Industrial facilities, including manufacturers and infrastructure operators, form a key customer segment for Legrand. These clients demand dependable electrical systems capable of withstanding harsh conditions. Legrand's offerings cater to their need for uninterrupted power, vital for their operations. In 2024, the industrial sector's demand for advanced electrical solutions saw a 7% increase, reflecting the importance of reliable infrastructure.

Data Centers

Data centers are crucial for Legrand, needing top-tier power, cooling, and connectivity. They seek reliable, energy-efficient, and scalable solutions for their vital operations. This customer segment is vital. Legrand's data center business has seen strong growth, now accounting for 20% of sales. [4]

- High demand for power solutions.

- Need for energy-efficient products.

- Focus on scalable infrastructure.

- 20% of sales from this segment.

Government and Public Sector

The Government and Public Sector segment encompasses entities like government agencies, schools, and public works projects. These clients need electrical and digital infrastructure solutions. Sustainability, energy efficiency, and regulatory compliance are key priorities. Legrand's contributions help reduce building-related climate impacts. Legrand's sales in North America were 3.6 billion euros in 2024.

- Focus on sustainability and regulatory compliance.

- Government clients require electrical and digital infrastructure.

- Legrand's expertise aids in climate change mitigation.

- Legrand's sales in North America were 3.6 billion euros in 2024.

Legrand's diverse customer segments drive its business model. These include residential, commercial, industrial, and data center clients. Each values specific solutions, from smart home tech to reliable power systems. Data centers are vital, with 20% of sales.

| Customer Segment | Key Needs | Legrand's Solutions |

|---|---|---|

| Residential | Reliability, Ease of Use | Electrical Installations, Home Automation |

| Commercial | Energy Efficiency, Reliability | Electrical & Digital Infrastructure |

| Industrial | Uninterrupted Power | Dependable Electrical Systems |

Cost Structure

Legrand's cost structure includes substantial investment in Research and Development (R&D). This commitment fuels innovation in new products and enhancements. Costs cover salaries for engineers and scientists, alongside equipment and facility expenses. In 2024, Legrand allocated a considerable portion of its budget to R&D to stay competitive. Approximately 22% of R&D teams are focused on firmware and software.

Manufacturing costs are crucial for Legrand. They encompass raw materials, labor, and equipment. Efficient processes and supply chain management are key. In 2023, Legrand's gross margin was 58.2%, highlighting effective cost control. Strategic initiatives optimize production capacity and cost structure.

Marketing and sales expenses at Legrand cover advertising, digital marketing, trade shows, commissions, and sales team salaries. These costs are essential for boosting revenue. Legrand focuses on delivering a top-notch customer experience. In 2024, Legrand's sales and marketing expenses were approximately 8% of its revenue. This investment supports its customer-centric approach.

Distribution and Logistics Costs

Distribution and logistics costs are crucial for Legrand, covering warehousing and shipping expenses. Legrand's efficient logistics are essential for minimizing these costs. The company uses various market access channels to optimize its distribution network. In 2024, Legrand's logistics expenses likely reflected the global supply chain dynamics.

- Warehousing and shipping expenses are crucial.

- Legrand uses various market access channels.

- Efficient logistics are essential for minimizing costs.

- Logistics expenses reflect global supply chain dynamics.

Administrative and Overhead Costs

Administrative and overhead costs cover expenses like salaries for administrative staff, rent, utilities, insurance, and general operating costs. These costs are crucial for profitability. Legrand focuses on digitalization and optimizing its cost structure to manage these expenses efficiently. In 2023, Legrand's operating margin was 19.7%, showcasing effective cost management.

- Cost optimization through digitalization.

- Focus on operational efficiency to boost profitability.

- Operating margin of 19.7% in 2023.

- Strategic initiatives to reduce expenses.

Legrand's cost structure encompasses R&D, manufacturing, marketing, sales, distribution, logistics, and administrative expenses. R&D focuses on innovation, with about 22% of teams dedicated to firmware/software. Efficient supply chain management is critical for manufacturing and distribution, influencing gross margins. Effective cost control and digitalization drive operational efficiency.

| Cost Category | Focus | Financial Impact (2024 est.) |

|---|---|---|

| R&D | Product Innovation | Significant budget allocation |

| Manufacturing | Raw materials, labor, efficiency | Gross margin of 58.2% (2023) |

| Sales and Marketing | Customer experience, revenue | ~8% of revenue |

Revenue Streams

Legrand's main income comes from selling electrical and digital infrastructure products. These products go to homes, businesses, and factories. Think of items like wiring, circuit breakers, and lighting controls. In 2024, Legrand's sales reached €8.6 billion, showing strong demand for its offerings.

Legrand's revenue includes system and solution sales, like smart home tech and data center infrastructure. These solutions boost value, often creating recurring income streams. In 2023, Legrand reported sales of €8.4 billion. The company focuses on growth through acquisitions and innovation.

Legrand secures revenue through service and maintenance contracts, ensuring continuous support for its products. This model fosters recurring income and cultivates enduring customer relationships. The company's commitment to exceptional customer service, including dedicated commissioning teams, enhances its service offerings. In 2024, Legrand's service revenue grew, reflecting the value of its maintenance contracts. This growth highlights the importance of these contracts to Legrand's overall financial performance.

Software and Subscription Services

Legrand's revenue streams include software and subscription services, which are pivotal for recurring income. These services, such as cloud-based energy management platforms, boost product value. Around 15% of Legrand's sales come from digital, connected offerings with embedded software. This shift is crucial for adapting to digital transformation.

- Digital transformation drives revenue.

- Recurring revenue from subscriptions.

- 15% of sales from software.

- Enhances product value.

Installation Services

Legrand boosts its revenue through installation services, offering expert setup of its products and systems. These services add value for customers by ensuring correct installation and optimal performance. Legrand collaborates with installation and service companies to provide complete solutions. This approach broadens their market reach and customer satisfaction. In 2024, Legrand's full-year results showcased its robust performance.

- Installation services ensure products function correctly.

- Partnerships with service companies expand Legrand's reach.

- This model contributes to overall revenue growth.

- Legrand's 2024 results reflect strong performance.

Legrand's revenue streams stem from diverse sources, including product sales and recurring services. Digital offerings, like software, drive a significant portion of sales. Installation services further boost revenue and customer satisfaction.

| Revenue Source | Description | 2024 Data |

|---|---|---|

| Product Sales | Electrical and digital infrastructure. | €8.6B in sales |

| Services | Maintenance and support contracts. | Service revenue growth |

| Digital Offerings | Software and subscriptions. | ~15% of sales |

Business Model Canvas Data Sources

The Legrand Business Model Canvas uses financial statements, market research reports, and competitive analysis for accurate representation.