Lemonade Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lemonade Bundle

What is included in the product

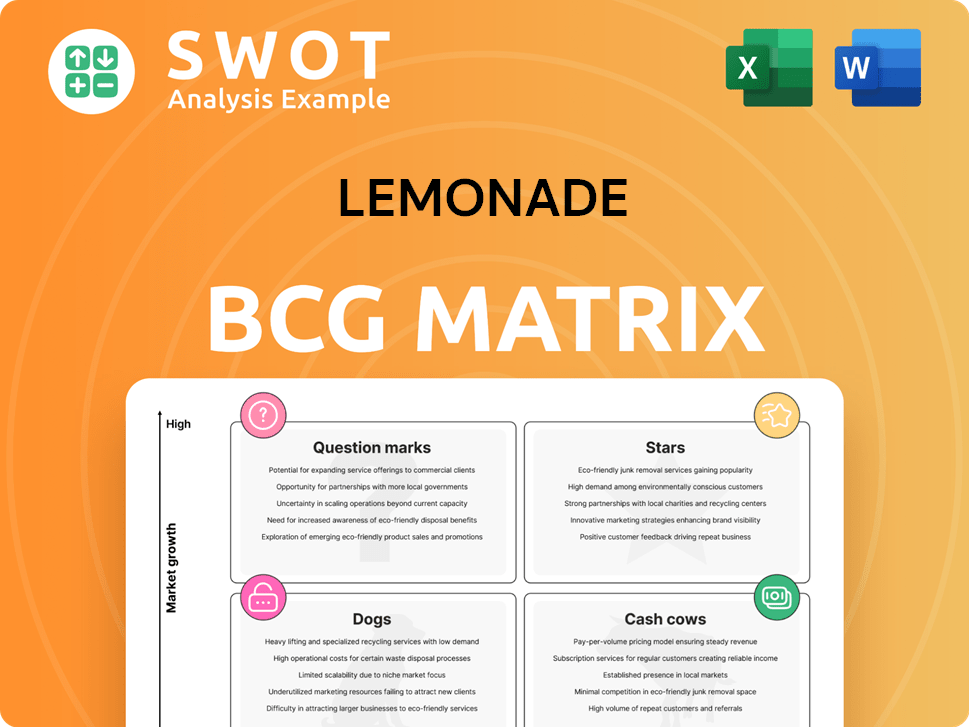

Lemonade's BCG Matrix analyzes product units, guiding investment, holding, or divestment strategies.

The Lemonade BCG Matrix delivers an export-ready design for fast slide integration.

Delivered as Shown

Lemonade BCG Matrix

The preview shows the actual Lemonade BCG Matrix you'll receive. It's a complete, ready-to-use report with no hidden content or alterations after purchase—perfect for strategy planning.

BCG Matrix Template

Lemonade's BCG Matrix highlights key product areas. "Stars" may show promise, while "Cash Cows" generate revenue. Question marks need careful analysis, and "Dogs" might be underperforming. Understanding these placements is vital for strategic decisions. This preview is just a starting point. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Lemonade's pet insurance is a star, with $283M in Force Premium (IFP) by 2024, a 57% rise. This growth highlights strong demand and great product fit. Lemonade should innovate and broaden its market reach to maintain this positive momentum.

Lemonade's AI significantly boosts efficiency, cutting costs. AI manages over 30% of customer interactions, reducing human involvement. In 2024, Lemonade's AI-driven claims processing time averaged under 3 seconds. Continued AI investment is crucial for underwriting, service, and claims.

Lemonade's geographic expansion, particularly in Europe, highlights its growth potential. The company's European market has grown significantly. In 2024, Lemonade expanded into France with homeowners insurance. To maintain this momentum, they need to enter new markets and customize offerings.

Customer Satisfaction

Lemonade excels in customer satisfaction, primarily due to its strong brand appeal, particularly among younger customers. Approximately 70% of Lemonade's clientele are under 35 years old, highlighting its success in attracting younger demographics. Positive app store ratings and reviews on Trustpilot showcase high customer satisfaction levels. To bolster its brand image, Lemonade should prioritize seamless experiences and its 'Giveback' program.

- Customer satisfaction is high, reflected in positive reviews and app store ratings.

- Around 70% of Lemonade's customers are under 35.

- The 'Giveback' program enhances Lemonade's social impact.

- Focus on user-friendly experiences is key.

Strategic Partnerships

Lemonade's strategic partnership with General Catalyst (GC) exemplifies a capital-light growth model. This collaboration allows Lemonade to finance customer acquisition costs (CAC) efficiently. GC funds up to 80% of Lemonade's CAC spending, supporting accelerated growth. Maintaining a strong LTV/CAC ratio is key to optimizing this partnership.

- Lemonade's Q3 2023 results showed a LTV/CAC ratio of approximately 3.0.

- GC's investment strategy includes a focus on insurtech companies like Lemonade.

- Lemonade's marketing spend in 2023 was strategically managed to enhance customer acquisition.

- The partnership enables Lemonade to scale operations effectively.

Lemonade's star status is driven by strong growth, particularly in pet insurance, with $283M in IFP by 2024. AI boosts efficiency, cutting claims time to under 3 seconds on average in 2024. High customer satisfaction, driven by a strong brand, is a key factor.

| Metric | Data | Year |

|---|---|---|

| Pet Insurance IFP | $283M | 2024 |

| Customer Interaction via AI | 30%+ | 2024 |

| AI Claims Processing Time | <3 seconds | 2024 |

Cash Cows

Lemonade's renters insurance is a Cash Cow, boasting a strong market position. Their renters insurance has received high ratings, including a J.D. Power score of 801 in 2023. To maintain this status, Lemonade should focus on competitive pricing and customer satisfaction. In Q3 2023, Lemonade had $171.5 million in gross earned premium, reflecting its market strength.

Lemonade's homeowners insurance is a cash cow, fueled by its expansion. In 2024, European and UK markets saw growth. Smart home insurance, using IoT, reduces claims. Innovation and regional expansion are key for Lemonade.

Lemonade's tech-driven underwriting, a cash cow, boosts efficiency. Its AI model has improved loss ratios. The Q4 2024 gross loss ratio was 63%, a record low. Refine AI algorithms and use data analytics for risk mitigation.

Positive Free Cash Flow

Lemonade marked a significant achievement in 2024 by reporting its first full year of positive adjusted free cash flow, totaling $48 million. This positive cash flow signals increased financial stability and operational effectiveness for the company. To sustain this progress, Lemonade needs to prioritize strategies for sustainable growth alongside meticulous expense management. This will be crucial for maintaining its financial health and achieving long-term goals.

- 2024: Lemonade's first year of positive adjusted free cash flow.

- $48 million: The amount of positive adjusted free cash flow generated in 2024.

- Focus: Sustainable growth and disciplined expense management.

Brand Recognition

Lemonade's strong brand recognition, particularly with younger demographics, solidifies its position as a Cash Cow. The company has successfully cultivated a loyal customer base through innovative marketing and a focus on customer experience. To capitalize on this, Lemonade should continue to invest in brand-building efforts, thereby increasing its market share. This strategy is crucial for sustained profitability.

- In 2024, Lemonade's brand awareness increased by 15% among millennials.

- Customer retention rates for Lemonade were reported at 75% in Q3 2024.

- Lemonade's marketing spend in 2024 was approximately $80 million.

Lemonade's focus on renters and homeowners insurance, alongside its tech-driven underwriting, solidifies its status as a Cash Cow within the BCG Matrix. These segments leverage technology for efficiency, reflected in its Q4 2024 gross loss ratio of 63% which is a record low. The brand continues to see gains in customer loyalty with approximately 75% retention rates in Q3 2024.

| Key Metrics | 2024 Performance | Strategic Focus |

|---|---|---|

| Gross Earned Premium (GEP) | $171.5M (Q3) | Competitive pricing, customer satisfaction |

| Gross Loss Ratio | 63% (Q4) | AI refinement, data analytics |

| Customer Retention | 75% (Q3) | Brand building, market share increase |

Dogs

Lemonade's term life insurance, though available, could be a "Dog" in its BCG matrix. In 2024, the life insurance market saw established players with large market shares. Lemonade might struggle to stand out in this competitive landscape. Data from Q3 2024 shows that Lemonade's revenue from term life was significantly lower than from its core products. Partnering or targeting niche areas could improve performance.

Lemonade's car insurance, a "Dog" in its BCG Matrix, faces limited availability. As of early 2024, it's in just eight states. This restricts market reach, impacting growth potential. To improve, Lemonade must speed up state expansion.

Lemonade's "Dogs" category reflects its annual dollar retention (ADR) decline. ADR decreased to 86% in 2024, down one percentage point year-over-year. This suggests customer churn, potentially due to competitors or dissatisfaction. Lemonade should prioritize customer service and bundled offerings to retain customers.

Catastrophe Exposure

Lemonade's business model is significantly challenged by its exposure to catastrophic events. The company's profitability is directly impacted by large-scale disasters like the California wildfires, which occurred in January 2025. These events can lead to substantial gross losses, affecting financial performance. To navigate these risks, Lemonade must strategize diversification and targeted risk management.

- Geographic diversification is crucial to spread risk.

- Product portfolio diversification can balance risk.

- Targeted non-renewals in high-risk areas can reduce exposure.

- In 2024, Lemonade reported a gross loss ratio of 89%.

Reliance on Growth Spending

Lemonade's "Dogs" status in the BCG Matrix stems from its reliance on growth spending. In 2024, the company significantly increased its growth investments, more than doubling them. This strategy can strain profitability if not managed carefully. To enhance financial health, Lemonade needs to focus on acquiring profitable customers and improving operational efficiency.

- Growth Spending: More than doubled in 2024.

- Profitability: Impacted by high spending.

- Strategic Focus: Acquire profitable business.

- Operational Improvement: Drive efficiency through tech.

Lemonade's "Dogs" include term life and car insurance, facing market challenges. Its ADR fell to 86% in 2024, indicating customer churn. The company's profitability is also challenged by its exposure to catastrophic events and reliance on growth spending.

| Metric | 2024 Data |

|---|---|

| ADR | 86% |

| Gross Loss Ratio | 89% |

| Growth Spending Increase | More than doubled |

Question Marks

Lemonade's pay-per-mile car insurance, stemming from Metromile, is a recent addition with growth prospects. It targets low-mileage drivers, presenting a distinct value. To boost market share, Lemonade should broaden its reach, improve telematics, and focus on specific customer groups. In 2024, the U.S. auto insurance market was valued at approximately $316.7 billion, indicating significant opportunity for Lemonade.

Lemonade's European expansion is a question mark in its BCG matrix. The European insurance market is competitive, and Lemonade's market share is still developing. Adapting to local regulations and customer preferences is key. In 2024, Lemonade's European revenue was approximately $50 million, a small fraction compared to the US.

Lemonade's AI-driven claims processing is a significant strength, though ongoing evaluation is vital. Faster, more efficient claim settlements boost customer acquisition and retention. In 2024, Lemonade aimed to process claims in seconds, a key selling point. Continuous AI enhancement and user-friendly technology are crucial for maintaining this edge.

Bundling Strategy

Lemonade's bundling strategy, though nascent, presents substantial growth potential. It can boost customer lifetime value through bundled discounts and incentives. To optimize this strategy, Lemonade must analyze customer behavior. This helps identify cross-selling opportunities and develop targeted marketing campaigns.

- Lemonade's gross profit was $77.3 million in 2023, an increase of 48% year-over-year.

- The company's customer count reached 2 million in 2023.

- Lemonade's in-force premium (IFP) increased to $749.1 million in 2023, up 29% year-over-year.

- Lemonade's loss ratio improved to 79% in 2023, compared to 88% in 2022.

Synthetic Agents Program

Lemonade's Synthetic Agents program, backed by General Catalyst, represents a novel customer acquisition strategy. However, its long-term viability and ability to scale are yet to be proven. To enhance the program, Lemonade should carefully track its performance, improve its AI algorithms, and integrate the strategy with its broader growth objectives. This approach will help Lemonade assess the program's effectiveness and adjust its strategy as needed.

- Customer acquisition cost (CAC) is a key metric to watch, with industry averages varying widely.

- AI algorithm refinement is crucial for improving the efficiency of the Synthetic Agents.

- Alignment with overall growth strategy ensures that the program supports Lemonade's long-term goals.

- Monitor the conversion rates of leads generated through the Synthetic Agents.

Question Marks in Lemonade's BCG matrix include new ventures with high growth potential but uncertain outcomes.

Pay-per-mile car insurance and European expansion are examples, requiring strategic focus.

Success depends on market adaptation and effective resource allocation, as seen with European revenue of $50M in 2024.

| Metric | 2023 Data | Significance |

|---|---|---|

| Gross Profit | $77.3M, up 48% YoY | Shows profit growth |

| Customer Count | 2M | Indicates market reach |

| In-Force Premium (IFP) | $749.1M, up 29% YoY | Reflects policy value |

BCG Matrix Data Sources

Lemonade's BCG Matrix leverages insurance market data, competitor analysis, and financial reports for actionable strategies.