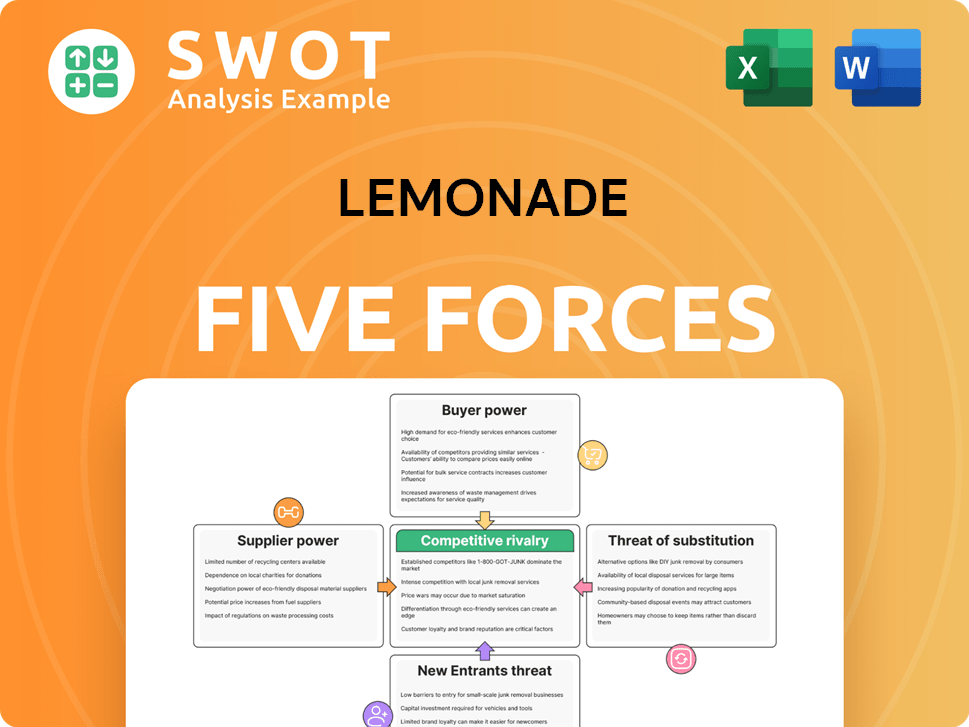

Lemonade Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lemonade Bundle

What is included in the product

Tailored exclusively for Lemonade, analyzing its position within its competitive landscape.

Customize pressure levels based on new data or evolving market trends.

Full Version Awaits

Lemonade Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders.

This analysis of Lemonade uses Porter's Five Forces: threat of new entrants, bargaining power of buyers, threat of substitutes, bargaining power of suppliers, and competitive rivalry. Each force is thoroughly examined. Factors influencing each are detailed. You’ll receive all the findings immediately.

Porter's Five Forces Analysis Template

Lemonade's market is influenced by strong rivalry, fueled by tech-savvy competitors. Buyer power is moderate, with consumers having choices. The threat of new entrants is significant due to low barriers. Substitute products, like traditional insurance, pose a challenge. Supplier power is generally low. This preview is just the beginning. The full analysis provides a complete strategic snapshot with force-by-force ratings, visuals, and business implications tailored to Lemonade.

Suppliers Bargaining Power

Lemonade's reliance on AI and chatbot tech gives providers significant power. If a few firms dominate AI insurance solutions, Lemonade's options shrink. Switching costs are high if a new AI platform is needed. In 2024, the AI insurance market was valued at $1.5 billion, expected to reach $10 billion by 2030.

Insurance models are heavily reliant on data, and suppliers of this data, especially for risk assessment, possess some bargaining power. Access to unique or comprehensive datasets is a critical dependency for Lemonade. In 2024, the cost of data analytics and risk modeling software, vital for insurers, averaged between $50,000 to $250,000 annually. Lemonade's negotiation skills with these providers directly influence its cost structure and profitability.

Lemonade relies heavily on cloud infrastructure for its operations, making it vulnerable to the bargaining power of suppliers. Dominant cloud providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, can significantly influence Lemonade. For instance, AWS's revenue reached $25 billion in Q4 2023. Outages or price hikes from these providers directly impact Lemonade's service delivery and profitability, as seen when AWS experienced outages in late 2023, affecting multiple companies.

Reinsurance Companies

Reinsurance companies, crucial for Lemonade's risk management, hold moderate bargaining power. These firms share Lemonade's insurance risks, impacting the company's financial stability. Changes in reinsurance rates directly affect Lemonade's profitability and capital needs.

- Lemonade's reinsurance costs in 2023 were approximately $160 million.

- Reinsurance agreements influence Lemonade's risk-adjusted capital (RAC) ratio.

- The reinsurance market's capacity and pricing trends are key external factors.

Software Development Talent

Specialized software engineers and AI developers hold significant sway over Lemonade due to their critical role in platform maintenance and enhancement. The scarcity of this talent pool elevates their bargaining power, enabling them to negotiate for better terms. To secure and retain these key personnel, Lemonade must offer competitive compensation packages and benefits. In 2024, the average salary for software engineers in the US ranged from $70,000 to $150,000, highlighting the cost of attracting top talent.

- High Demand: The tech industry's constant need for skilled developers.

- Specialized Skills: Expertise in AI and platform development is highly valued.

- Competitive Offers: Other tech firms and startups compete for the same talent.

- Compensation: Salaries and benefits must be attractive to retain employees.

Lemonade faces supplier bargaining power across several areas.

AI and data providers have leverage, especially if they dominate the market. Cloud infrastructure and reinsurance firms further impact Lemonade's costs.

Securing and retaining software engineers and AI developers are also key challenges.

| Supplier Type | Bargaining Power | Impact on Lemonade |

|---|---|---|

| AI & Data Providers | High | Cost of tech, data access |

| Cloud Infrastructure | High | Service costs, uptime |

| Reinsurance | Moderate | Risk-adjusted capital |

| Software Engineers | High | Talent acquisition costs |

Customers Bargaining Power

Insurance is a competitive market, making customers highly price-sensitive. Lemonade must offer competitive pricing to acquire and keep customers. Comparison shopping is easy, as evidenced by the 2024 data showing a 15% increase in online insurance quotes. This ease of comparison increases customer bargaining power. Lemonade must continuously adjust its pricing to stay attractive.

Switching insurance providers is straightforward for most customers. Digital platforms and comparison websites simplify the process, reducing friction significantly. This ease of switching puts pressure on Lemonade to maintain competitive offerings. For example, the average customer acquisition cost (CAC) in the insurtech sector was around $300 in 2024. Lemonade needs to offer compelling value to retain customers.

Insurance products, especially basic coverage, are becoming more standardized. This standardization boosts customer bargaining power, as consumers can easily compare prices. Lemonade, to counter this, must differentiate itself. In 2024, Lemonade's focus is on user experience and unique offerings to stay competitive.

Information Availability

Customers possess significant bargaining power due to readily available information and online reviews. This access enables them to compare prices and coverage easily. Transparency in pricing and policy details further strengthens their position. Lemonade's reputation, heavily influenced by online reviews, is crucial for attracting and retaining customers.

- Online reviews significantly impact customer decisions; 88% of consumers trust online reviews as much as personal recommendations.

- In 2024, the global insurance market was valued at over $6 trillion, highlighting the competitive landscape.

- Lemonade's customer satisfaction scores, as reflected in reviews, directly influence its customer acquisition costs.

- About 90% of consumers research products online before making a purchase.

Customer Concentration

Lemonade's customer base isn't concentrated, which limits customer bargaining power. Individual policyholders have little influence on Lemonade's pricing or terms. The company aims to attract and keep many individual customers. This strategy reduces the impact of any single customer's decisions. In 2024, Lemonade reported over 2 million customers.

- Low customer concentration reduces customer bargaining power.

- Individual customers have limited influence on pricing.

- Lemonade focuses on a large, diverse customer base.

- The company had over 2 million customers in 2024.

Customers have strong bargaining power in the insurance market due to price sensitivity and easy comparison shopping. Switching providers is straightforward, putting pressure on Lemonade to offer competitive value. Standardization and online reviews further enhance customer influence.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | 15% increase in online quotes |

| Switching Costs | Low | CAC ~ $300 in insurtech |

| Online Reviews | High Influence | 88% trust reviews |

Rivalry Among Competitors

Established insurers like State Farm and Geico present a formidable challenge to Lemonade. They boast extensive resources, brand recognition, and a large customer base. In 2024, State Farm's net premiums written were over $80 billion. Lemonade must innovate constantly to gain market share.

Digital-first competitors like Root and Hippo are significant rivals to Lemonade. These insurtechs also use technology for insurance efficiency. Differentiation in tech, customer experience, or niche markets is essential for survival. In 2024, Root's market cap was around $500 million, while Hippo's was about $1 billion, highlighting the competitive landscape.

Insurance aggregators, such as Policygenius and Compare.com, boost price transparency, intensifying competition. Customers can easily compare quotes, pressuring Lemonade to optimize pricing. In 2024, these platforms saw a 20% increase in user traffic, driving price wars. Lemonade must strategically position itself on these sites to remain competitive.

Marketing and Advertising

The insurance sector is known for aggressive marketing. Lemonade needs substantial marketing spending to gain visibility. Fierce competition exists for attracting customers. In 2024, the insurance industry's advertising spend hit billions. This environment demands significant investment.

- Marketing is key to build brand recognition.

- Customer acquisition is a competitive battleground.

- Insurance firms invest heavily in advertising.

- Lemonade faces established rivals.

Innovation and Technology

Innovation and technology are crucial in the insurance sector, with rapid changes. Lemonade needs to constantly innovate to compete effectively. Their AI and chatbot tech must evolve to maintain their advantage. This demands continuous investment in R&D to stay ahead. In 2024, Lemonade's tech spending was approximately $75 million.

- Rapid tech changes force continuous innovation.

- Lemonade's AI and chatbots are key to its competitive edge.

- Ongoing investment in R&D is essential.

- Lemonade's tech spending in 2024 was about $75 million.

Lemonade battles established insurers with vast resources, like State Farm, whose 2024 net premiums were over $80B. Digital-first rivals such as Root and Hippo also compete for market share. Aggressive marketing and price transparency from aggregators add pressure, as seen with a 20% traffic rise in 2024.

| Key Competitive Factors | Impact on Lemonade | 2024 Data/Examples |

|---|---|---|

| Established Insurers (e.g., State Farm) | Strong competition due to brand recognition and resources | State Farm net premiums written: over $80B |

| Digital-First Competitors (e.g., Root, Hippo) | Increased competition in tech and customer experience | Root market cap ~$500M, Hippo ~$1B |

| Insurance Aggregators (e.g., Policygenius) | Heightened price transparency and pressure | 20% increase in user traffic on aggregators |

SSubstitutes Threaten

Self-insurance poses a threat to Lemonade as an alternative to its offerings. Individuals or businesses with low-risk profiles might opt to self-insure, bypassing the need for external coverage. Lemonade must highlight the value of its policies to compete effectively against this substitute. In 2024, the self-insurance market grew, reflecting a shift in risk management strategies.

Government-sponsored insurance programs pose a threat to Lemonade. These programs, like those in healthcare, offer subsidized rates. They provide basic coverage, potentially drawing customers away. Lemonade competes on service and convenience to differentiate itself. For instance, in 2024, government health insurance enrollment hit record highs, showing the impact.

Alternative risk transfer (ART) mechanisms, such as captive insurance companies, represent a potential threat. Larger organizations may utilize ART to manage their risks, bypassing traditional insurance models. This could divert business away from Lemonade. However, Lemonade primarily targets individual consumers and small businesses. In 2024, the global captive insurance market was valued at approximately $60 billion.

Parametric Insurance

Parametric insurance, offering payouts based on predefined events, poses a threat to Lemonade. This approach simplifies claims but may not cover all losses, potentially attracting customers seeking specific, easily verifiable coverage. For example, in 2024, parametric insurance saw increased adoption in areas prone to natural disasters, indicating its growing appeal. Lemonade could counter this by strategically integrating parametric options into its product lineup. This could help Lemonade cater to a broader customer base.

- Parametric insurance simplifies claims, potentially attracting customers.

- It may not cover all losses, which is a potential drawback.

- Lemonade could explore offering parametric options to compete.

- Increased adoption in 2024 shows its growing appeal.

Risk Prevention Measures

Substitutes, such as investments in home security systems, threaten Lemonade. These measures can reduce the need for insurance. This shift impacts Lemonade's customer base. Lemonade can partner with risk prevention solution providers.

- In 2024, the home security market is valued at approximately $50 billion.

- A 2024 study shows that homes with security systems experience 30% fewer break-ins.

- Lemonade's 2024 annual report highlights a 15% decrease in claims due to smart home integrations.

- Partnerships could include discounts or bundled services to enhance value.

Home security systems are substitutes, impacting Lemonade. The home security market was valued at $50 billion in 2024. Homes with security experienced 30% fewer break-ins. Lemonade's report shows a 15% decrease in claims.

| Substitute | Impact on Lemonade | 2024 Data |

|---|---|---|

| Home Security Systems | Reduces need for insurance | $50B Market Value, 30% fewer break-ins, 15% fewer claims for Lemonade |

Entrants Threaten

Entering the insurance industry demands substantial capital. Regulatory compliance and reserve requirements are significant hurdles. Lemonade's strong capital base, including its $485 million in cash and investments as of Q3 2023, gives it an edge. This financial strength enables Lemonade to withstand market pressures. It allows for investments in technology and marketing.

The insurance industry faces significant regulatory hurdles, making it tough for new companies to enter. New entrants must comply with intricate licensing and legal requirements. Lemonade has an edge due to its established relationships with regulators, streamlining the compliance process. In 2024, insurance companies spent billions on compliance, making it a major barrier.

Established insurance giants like State Farm and Geico benefit from decades of brand recognition, a significant barrier for new entrants. New insurance companies must allocate substantial resources to marketing and advertising to build customer trust and awareness. Lemonade has made strides in brand building, but any new competitor will still face the challenge of establishing their presence in a crowded market. In 2024, State Farm held approximately 16% of the U.S. property and casualty insurance market share, highlighting the dominance of established brands.

Technology and Innovation

New entrants in the insurance market face a significant hurdle: technology. Lemonade's use of AI and chatbots demands specific technological expertise that newcomers may lack. This technological advantage makes it challenging for new companies to compete effectively. Lemonade's established tech infrastructure acts as a barrier to entry, slowing down potential rivals.

- AI and chatbots are key for Lemonade's operations.

- Specialized knowledge is needed to develop this technology.

- Lemonade's tech lead deters potential competitors.

Economies of Scale

Economies of scale pose a significant threat to new entrants in the insurance industry. Established insurance companies benefit from lower operational costs due to their size and established infrastructure. New companies often struggle to match these cost efficiencies, putting them at a disadvantage. Lemonade, for example, is actively working to scale its operations to improve profitability.

- Large insurers have lower operational costs.

- New entrants face challenges in achieving similar efficiencies.

- Lemonade aims to scale to improve profitability.

The threat of new entrants to Lemonade is moderate. High capital needs and regulatory hurdles are major obstacles. Brand recognition and technological advantages also protect Lemonade.

| Barrier | Impact | Data (2024) |

|---|---|---|

| Capital | High | Insurance startups need millions to start. |

| Regulations | High | Compliance costs billions annually. |

| Brand | Medium | State Farm has ~16% market share. |

Porter's Five Forces Analysis Data Sources

Lemonade's analysis utilizes company filings, industry reports, and market research data.