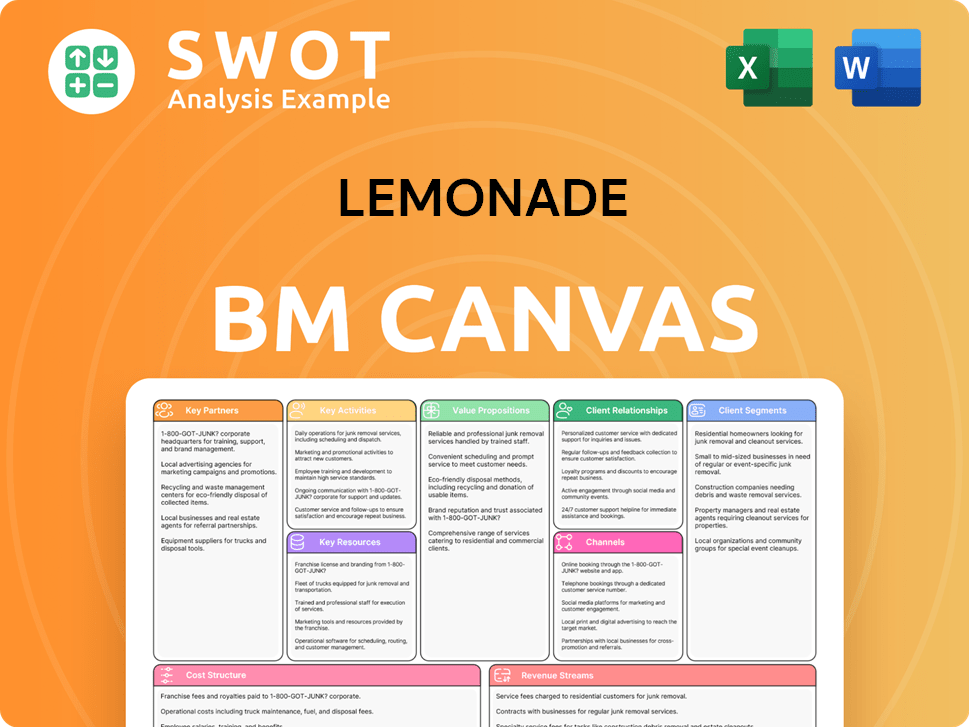

Lemonade Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lemonade Bundle

What is included in the product

Lemonade's BMC covers customer segments, channels, and value propositions in full detail.

Quickly identify core components with a one-page business snapshot.

Preview Before You Purchase

Business Model Canvas

This preview showcases the genuine Lemonade Business Model Canvas you'll receive. Upon purchase, you'll instantly download the complete, editable document.

Business Model Canvas Template

Lemonade disrupts insurance with its AI-powered platform, focusing on simplicity and customer experience. Their business model centers on a strong tech infrastructure, efficient claims processing, and a unique give-back program. Key partnerships with reinsurers and a focus on renters' and homeowners' insurance are crucial. This strategy attracts tech-savvy customers seeking ethical and accessible insurance options.

Transform your research into actionable insight with the full Business Model Canvas for Lemonade. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place.

Partnerships

Reinsurance partners are vital for Lemonade to handle risk, particularly during major events like hurricanes. These partnerships allow Lemonade to offload risk, which supports its financial stability and ensures it can pay policyholders. This strategy helps Lemonade manage risk while growing its insurance offerings, including car, pet, and life insurance. In 2024, Lemonade's gross written premium was $796.1 million, showing the scale of its operations and the importance of risk management.

Lemonade's AI-driven model crucially depends on tech partnerships. These alliances boost AI capabilities, customer experience, and operational efficiency. Collaborations enable more precise risk assessments and speedier claims. For example, in 2024, Lemonade's AI handled a significant portion of claims, showcasing the importance of tech integrations.

Lemonade leverages data and analytics companies for sophisticated underwriting and pricing. These collaborations grant access to extensive datasets and analytical tools, improving decision-making. This approach enhances risk assessment accuracy, minimizes losses, and supports competitive pricing. For instance, in 2024, Lemonade's AI-powered systems processed claims in an average of 20 seconds.

Charitable Organizations

Lemonade's Giveback program involves partnerships with various charitable organizations. This strategy appeals to customers who value social responsibility. The partnerships strengthen Lemonade's brand image and cultivate customer loyalty. This approach aligns with the growing consumer preference for ethical businesses. It is a core component of their business model.

- In 2024, Lemonade's Giveback program allocated over $2.7 million to various charities.

- Lemonade's customer retention rate is approximately 75%, partly due to its strong brand image.

- Lemonade's net promoter score (NPS), a measure of customer loyalty, consistently remains high.

- Lemonade has partnered with over 50 charitable organizations.

Strategic Investors

Lemonade's strategic partnerships with investors, such as General Catalyst, are crucial for its financial strategy. These alliances provide the necessary capital for acquiring customers, which is essential for growth. This approach lets Lemonade expand its customer base without putting too much strain on its financial resources. This has helped Lemonade scale effectively while maintaining financial stability.

- In 2024, Lemonade reported a gross loss ratio of 79%, showing the impact of efficient customer acquisition.

- General Catalyst invested in Lemonade's Series A round, contributing to its early-stage growth.

- Lemonade's partnerships help manage expenses, with sales and marketing costs at $54.8 million in Q3 2023.

Lemonade's partnerships are diverse, supporting different aspects of the business. Reinsurance, tech, and data partnerships help manage risk, improve efficiency, and refine underwriting. Charitable collaborations enhance brand image and customer loyalty. Strategic investor partnerships fuel growth.

| Partnership Type | Purpose | Impact |

|---|---|---|

| Reinsurance | Risk management | Supports financial stability |

| Tech | AI capabilities | Speeds up claims |

| Data & Analytics | Underwriting & Pricing | Improves decision-making |

Activities

Lemonade's AI-driven underwriting is a cornerstone of its business model. This process leverages AI to assess risk and set premiums quickly. In 2024, this approach enabled Lemonade to process claims in seconds. AI-powered underwriting also helps Lemonade maintain a competitive advantage.

Claims processing automation is crucial for Lemonade's efficiency. This activity allows for rapid claim handling, reducing costs. In 2024, Lemonade processed claims in an average of 15 seconds. The company's use of AI chatbots supports quick, customer-friendly service. This approach boosts customer satisfaction and operational savings.

Customer acquisition is vital for Lemonade's expansion, relying on marketing, sales, and partnerships to gain policyholders. They use digital marketing and strategic alliances to grow efficiently. In Q3 2024, Lemonade reported a 20% increase in customer count, reaching 2.1 million. Their marketing spend was $48.8 million in Q3 2024.

Product Development

Lemonade's product development is central to its business strategy, consistently broadening its insurance offerings. They introduce new insurance types and refine existing ones to satisfy customer demands, providing a versatile suite of policies. This includes renters, homeowners, car, pet, and life insurance, demonstrating their commitment to comprehensive coverage. This approach helps Lemonade attract and retain customers by meeting diverse insurance needs.

- In Q4 2023, Lemonade's in-force premium increased to $780.9 million, a 20% increase year-over-year.

- Lemonade launched car insurance in several states in 2024, expanding its product portfolio.

- Lemonade's gross loss ratio improved to 79% in Q4 2023, compared to 95% in Q4 2022.

Regulatory Compliance

Regulatory compliance is a crucial activity for Lemonade, ensuring it adheres to insurance regulations in various jurisdictions. This necessitates navigating intricate legal landscapes and acquiring essential licenses. Regulatory adherence is paramount for Lemonade's legal operation and maintaining its reputation. In 2024, Lemonade allocated a significant portion of its operational budget to compliance efforts, reflecting its commitment to regulatory standards.

- Compliance costs represented approximately 10% of Lemonade's operating expenses in 2024.

- Lemonade holds licenses in all 50 U.S. states and several international markets as of late 2024.

- Regular audits and updates to its compliance protocols are ongoing processes.

Key activities include AI-driven underwriting, essential for assessing risk and setting premiums. Claims processing automation is vital, supporting quick and customer-friendly service. Customer acquisition, involving marketing and partnerships, fuels expansion. Lemonade's product development also broadens insurance offerings.

| Activity | Description | 2024 Data |

|---|---|---|

| AI Underwriting | Uses AI to assess risk and set premiums. | Processed claims in seconds. |

| Claims Processing | Automated system for rapid claim handling. | Avg. 15 sec processing time. |

| Customer Acquisition | Marketing, sales, and partnerships. | 20% customer growth in Q3, 2.1M total. |

| Product Development | Expanding and refining insurance offerings. | Launched car insurance in several states. |

Resources

Lemonade's AI platform is a cornerstone, automating underwriting, claims, and customer service. This tech streamlines operations, cutting costs, and boosting customer experience. In 2024, Lemonade's AI handled over 75% of claims instantly. Integrating tech seamlessly with insurance is key for Lemonade. This tech focus helps them stand out in the market.

Lemonade's strong brand is a key asset, highlighting its tech-forward and ethical approach. This brand resonates with customers, encouraging loyalty and positive word-of-mouth. Transparency boosts customer relationships; Lemonade's customer satisfaction scores reflect this. In 2024, Lemonade's customer base grew, showing the brand's appeal.

Lemonade leverages data assets extensively. The data from policyholders and claims refines AI models, improving risk assessment. This drives underwriting and pricing accuracy. Lemonade analyzes vast customer data for dynamic profiles. In Q3 2023, Lemonade's gross earned premium grew 40% year-over-year to $211.6 million, showcasing its data-driven success.

Financial Capital

Financial capital is crucial for Lemonade, enabling it to cover claims, invest in growth, and meet regulatory requirements. Effective financial management ensures the company's ability to fulfill its obligations and expand. Lemonade's financial stability is key to its long-term success. Lemonade's financial resources support its operational capabilities and strategic initiatives.

- Financial capital enables Lemonade to cover claims and invest.

- Strong financial management is vital for meeting obligations.

- Lemonade ended Q3 2024 with 2,313,113 customers.

- The customer base increased by 17% year-over-year.

Human Capital

Lemonade's human capital, including AI specialists and insurance experts, is a cornerstone of its operations. Their expertise fuels innovation and ensures regulatory compliance, which is crucial in the insurance sector. As of 2024, the company has been investing in its team to support its expansion and enhance customer service. This investment reflects a strategy to maintain a competitive edge in a rapidly evolving market.

- 2024: Lemonade employs approximately 500 people.

- 2024: The customer satisfaction score is above 80%.

- 2024: Research and development expenses are approximately $20 million.

- 2024: The company's goal is to expand its team by 15%.

Lemonade's tech infrastructure, especially its AI, automates key functions, improving efficiency. This digital prowess helps in underwriting, claims, and customer service. In 2024, AI handled over 75% of claims instantly. The company's brand builds customer loyalty, with a rising customer base.

Data is a strategic asset, with customer and claims data refining AI. Data insights improve underwriting and pricing accuracy. Lemonade ended Q3 2024 with 2,313,113 customers.

Financial and human capital are also key. Financial capital covers claims and fuels growth. Human capital, including AI specialists, ensures innovation and compliance. Lemonade's customer satisfaction score is above 80% in 2024.

| Key Resource | Description | 2024 Data |

|---|---|---|

| AI Platform | Automates underwriting, claims, and service. | 75% of claims handled instantly |

| Brand | Tech-forward, ethical brand image. | Customer base grew |

| Data | Customer data for AI & risk assessment. | Q3 2024: 2,313,113 customers |

| Financial Capital | Covers claims, invests, and meets regulations. | Financial stability |

| Human Capital | AI specialists, insurance experts. | Customer satisfaction above 80% |

Value Propositions

Lemonade's value proposition of "Instant Insurance" is a core part of its appeal. The company leverages a digital platform for instant quotes and policy issuance. This approach streamlines the process, cutting out traditional insurance hassles. In 2024, Lemonade aimed for 90% of claims to be handled instantly. The company uses AI to handle most claims.

Lemonade leverages AI to revolutionize insurance. This leads to faster claims handling and improved customer experiences. The AI platform boasts a 97% automation rate. This cuts processing times by around 70%, according to 2024 reports.

Lemonade's "Giveback" program resonates with customers prioritizing social responsibility. They donate unclaimed premiums to charities selected by policyholders. In 2024, Lemonade donated over $3.3 million through Giveback. This model aligns insurance with positive social impact, attracting customers who value ethical practices.

Competitive Pricing

Lemonade's use of AI and streamlined operations allows for competitive pricing on insurance products. This strategy helps Lemonade to offer lower premiums than traditional insurers. This approach not only attracts price-sensitive customers but also broadens the market reach. For instance, Lemonade car insurance premiums are below the national average.

- Competitive pricing attracts customers.

- AI and efficiency reduce operational costs.

- Lemonade's car insurance is below average.

- Accessibility to a wider range of customers.

User-Friendly Experience

Lemonade's user-friendly digital platform simplifies insurance management. This focus boosts customer satisfaction and retention rates. In 2024, Lemonade's customer satisfaction score remained high. The UK market, with its digital savviness, benefits from this approach.

- Digital platform simplifies policy management.

- Enhances customer satisfaction.

- Boosts customer loyalty.

- UK market benefits from this.

Lemonade's value proposition centers on "Instant Insurance" via a digital platform. AI drives rapid claims processing, achieving 97% automation by 2024. This efficiency, paired with competitive pricing, attracts customers. Lemonade's "Giveback" program also resonates with customers.

| Value Proposition Element | Description | 2024 Data/Impact |

|---|---|---|

| Instant Insurance | Digital platform for instant quotes and policy issuance. | 90% of claims handled instantly (target). |

| AI-Driven Efficiency | AI handles most claims, improving processing times. | 97% automation rate, 70% faster processing. |

| Giveback Program | Donates unclaimed premiums to charities selected by policyholders. | Over $3.3 million donated in 2024. |

Customer Relationships

Lemonade leverages AI-powered chatbots for customer service, offering instant support and managing common queries. This approach boosts efficiency and allows for scalable operations. In 2024, Lemonade's AI handled 75% of customer interactions, cutting costs. This chatbot system is key to their low-cost model.

Lemonade's digital self-service allows customers to manage their insurance needs independently, from policy management to claims filing. This streamlined approach enhances customer experience and reduces operational costs. A 2024 study showed that 70% of Lemonade customers prefer digital interaction for policy management. Customers can get a quote and a policy in minutes via its website, increasing accessibility. This ease of use is key to customer satisfaction and retention.

Lemonade prioritizes transparency, fostering trust with customers. They clearly explain policies and claims processes. This approach has significantly improved customer relationships. In 2024, Lemonade reported a customer retention rate exceeding 75%. This transparency has increased customer satisfaction.

Community Engagement

Lemonade's Giveback program builds community by letting customers choose nonprofits. This boosts loyalty and highlights the company's social responsibility. Customers select their Giveback organization when getting Lemonade insurance. This model helps Lemonade create a strong, engaged customer base. Giveback is central to Lemonade's mission, fostering trust and engagement.

- In 2023, Lemonade's Giveback totaled over $3.6 million.

- Customers can choose from a variety of nonprofits.

- The program strengthens Lemonade's brand image.

- This approach encourages long-term customer relationships.

Personalized Communication

Lemonade excels in customer relationships through personalized communication. They leverage data analytics to tailor interactions, offering relevant information and recommendations. This data-driven approach boosts customer engagement and satisfaction levels, fostering a stronger connection. Personalization in customer experience (CX) has been on the rise, leading to better satisfaction.

- In 2024, 71% of consumers expect personalized interactions.

- Personalized emails have a 6x higher transaction rate.

- Companies with strong personalization see a 10-15% revenue increase.

Lemonade strengthens customer relationships via AI chatbots, digital self-service, and transparent practices. They use a Giveback program and personalized communication to foster loyalty. These methods have contributed to high customer retention and satisfaction rates.

| Strategy | Description | 2024 Impact |

|---|---|---|

| AI Chatbots | Instant customer service | 75% interactions handled |

| Self-Service | Digital policy management | 70% prefer digital interaction |

| Giveback | Customer-chosen nonprofits | $3.6M+ Giveback in 2023 |

Channels

Lemonade's mobile app is its main channel, enabling policy management, claims, and support. This digital-first approach is core to Lemonade's strategy. In 2024, the app saw increased user engagement as Lemonade expanded its services. As of April 2024, it's vital for user-friendly experiences.

Lemonade's website is a key touchpoint, detailing its offerings and ethos. It's where potential customers get quotes and start buying policies. In Q3 2024, Lemonade reported 2.03 million customers, indicating the website's importance. Investors should watch investor.lemonade.com for updates.

Lemonade heavily leverages social media for customer engagement and brand promotion. Platforms like X (formerly Twitter) and Instagram are used to share updates and build brand awareness. In 2024, Lemonade's social media strategy included active engagement, with a focus on content that resonates with its target audience. Follow @lemonade_inc on X for the latest news and insights.

Partnerships

Lemonade strategically partners with companies like Toyota and Aviva to boost its market reach. These collaborations enable Lemonade to offer its insurance products to more customers. Toyota, for example, integrates Lemonade's offerings, such as home and renters insurance, with its auto policies. This approach leverages existing distribution networks to broaden customer acquisition.

- Toyota aims to cross-sell home and renters insurance, bundling them with auto policies.

- Partnerships expand Lemonade's reach and distribution.

- Aviva is a strategic partner.

Digital Marketing

Lemonade heavily relies on digital marketing to reach its target audience. This includes online ads and content marketing to draw in potential customers. Digital marketing is vital for Lemonade's success in the competitive online insurance sector. Lemonade's marketing strategy uses digital campaigns to build customer loyalty.

- In 2024, Lemonade's marketing spend was approximately $160 million.

- Digital channels drive over 90% of Lemonade's customer acquisition.

- Customer acquisition cost (CAC) via digital channels is around $300.

- Lemonade's digital ads have a click-through rate (CTR) of about 3%.

Lemonade uses its app, website, and social media to connect with customers. Partnerships like Toyota and Aviva broaden distribution. Digital marketing is crucial, driving over 90% of customer acquisition.

| Channel | Description | Impact |

|---|---|---|

| Mobile App | Primary interface for policyholders, claims, support. | Key for user engagement and experience. |

| Website | Provides quotes, policy info, and customer acquisition. | Important for customer acquisition in Q3 2024. |

| Social Media | Used for brand promotion and customer engagement. | Focuses on audience engagement. |

Customer Segments

Lemonade focuses on tech-savvy individuals who prefer digital interactions for insurance. This segment values the ease and speed of Lemonade's app. The UK, with its digitally-inclined population, is a key market. In 2024, Lemonade's customer base in the UK grew by 30%.

A key part of Lemonade's customers are socially conscious. The Giveback program is a huge draw for these individuals. Lemonade's eighth Giveback cycle saw over $2 million donated to 43 charities chosen by its customers. This commitment to social good resonates with this segment.

Lemonade focuses on first-time insurance buyers, especially renters and young homeowners, drawing them in with its easy-to-use platform and competitive prices. In Q4 2023, Lemonade's revenue hit $148.8 million, surpassing the $144 million forecast. This growth indicates their success in attracting this segment. Their approachable interface simplifies the insurance process.

Urban Dwellers

Lemonade targets urban dwellers with its insurance products, including renters and homeowners insurance. This segment values convenience and affordability, which aligns with Lemonade's offerings. As of 2024, Lemonade expanded its products to include car, pet, and life insurance. This expansion caters to the diverse needs of urban residents.

- Focus on renters and homeowners insurance.

- Convenience and affordability are key.

- Offers car, pet, and life insurance.

- Caters to diverse urban needs.

Pet Owners

Lemonade's pet insurance focuses on pet owners needing cost-effective, complete coverage. This customer segment is crucial for Lemonade's expansion. The pet insurance segment saw strong growth, with in-force premiums reaching $283 million—a 57% rise. This highlights the segment's importance to Lemonade's financial performance.

- Targets pet owners.

- Offers affordable, comprehensive coverage.

- Key driver of growth.

- In-force premium reached $283 million.

Lemonade's customer segments include tech-savvy individuals, socially conscious consumers, and first-time insurance buyers. They also target urban dwellers and pet owners. As of 2024, Lemonade expanded its product offerings.

| Customer Segment | Key Attributes | Product Focus |

|---|---|---|

| Tech-Savvy | Digital preference | Renters, Homeowners |

| Socially Conscious | Values Giveback | All Products |

| First-Time Buyers | Ease of use | Renters, Homeowners |

Cost Structure

Claims payments form a substantial part of Lemonade's cost structure. In 2024, Lemonade's gross loss ratio, a key metric, was 79%. This figure indicates the percentage of premiums used to cover claims. Effective risk assessment and underwriting are crucial for managing these costs. The expansion strategy, while beneficial, exposes Lemonade to increased claim risks, as seen in areas with higher disaster frequencies.

Technology development is a significant cost for Lemonade, primarily due to its investment in AI and platform upkeep. Research and development, along with continuous maintenance, are major expenses. Lemonade's growth investment pace has increased since the launch of its Synthetic Agents program in July 2023. In 2024, Lemonade allocated a substantial portion of its budget to enhance its AI capabilities.

Lemonade's cost structure includes significant investments in marketing and customer acquisition. They utilize digital ads, partnerships, and referral programs. A key partnership is with General Catalyst, which funds up to 80% of Lemonade's CAC. In 2024, Lemonade's marketing spend was a key area.

Operating Expenses

Operating expenses, encompassing salaries, rent, and administrative costs, form a key part of Lemonade's cost structure. Stable operating expenses are essential for profitability. In 2024, excluding growth spend, expenses remained stable.

- General operating expenses include salaries, rent, and administrative costs.

- Stability in these expenses is vital for Lemonade's profitability.

- In 2024, excluding growth spend, expenses were stable.

- Expenses increased by just 2% to $332 million compared to 2023.

Regulatory Compliance

Regulatory compliance is a key cost for Lemonade, covering licensing and legal expenses necessary for operations. Maintaining compliance is crucial, especially as U.S. states increase scrutiny of AI algorithms for bias. Regulatory costs include fees for various state licenses and ongoing legal support, which are essential for Lemonade's business model.

- Licensing fees and legal costs are a crucial part of Lemonade's expenses.

- Ensuring compliance with state regulations is essential for operations.

- The scrutiny of AI algorithms adds complexity to regulatory compliance.

- Regulatory hurdles are a significant factor in Lemonade's cost structure.

Lemonade's cost structure is significantly shaped by claims payments, with a 79% gross loss ratio in 2024. Technology investments, particularly in AI, are another major expense, with continuous development. Marketing and customer acquisition costs are also substantial, utilizing digital channels and partnerships.

| Cost Area | Description | 2024 Data |

|---|---|---|

| Claims Payments | Payments for insurance claims. | Gross Loss Ratio: 79% |

| Technology | AI development and platform upkeep. | Substantial Budget Allocation |

| Marketing & Acquisition | Digital ads, partnerships. | Ongoing Investment |

Revenue Streams

Lemonade's main income source is insurance premiums collected from customers. In 2024, their in-force premium (IFP) hit $944 million, a 26% rise year-over-year. This growth reflects increasing customer confidence and policy adoption. The steady premium income supports Lemonade's operational costs and expansion plans.

Lemonade earns revenue through reinsurance commissions by offloading risk to partners. Reinsurance helps manage risk and reduce costs, supporting expansion into car, pet, and life insurance. In 2024, Lemonade increased its reinsurance coverage, showcasing its risk management strategy. This approach allows Lemonade to grow its business while protecting its financial stability.

Lemonade capitalizes on investment income from premiums before claims. Effective investment management is key to boosting this revenue. As of December 31, 2024, its cash, equivalents, and investments reached roughly $1 billion.

Policy Add-ons

Lemonade boosts revenue through policy add-ons, offering extra coverage. These include features like expanded protection plans. For instance, a new offering provides rebuild costs coverage, temporary accommodation, and liability, with contents coverage up to £100,000. This strategy diversifies income streams.

- Additional Coverage: Policy add-ons expand protection.

- New Offering: Covers rebuild costs and liability.

- Contents Coverage: Up to £100,000.

Cancellation Fees

Lemonade's revenue model includes cancellation fees, which are applied when policyholders end their policies prematurely. These fees represent a minor, yet consistent, revenue stream for the company. The strategic use of reinsurance further supports Lemonade's financial stability, allowing it to expand its insurance offerings. This approach helps in managing risks and broadening its product range to include car, pet, and life insurance.

- Cancellation fees contribute to a portion of Lemonade's revenue.

- Reinsurance helps manage risk and supports product expansion.

- Lemonade offers a range of insurance products including car, pet, and life.

- These fees are small compared to other revenue streams.

Lemonade's revenue is mainly from insurance premiums, reaching $944M IFP in 2024. They gain from reinsurance commissions, reducing risk. Investment income and policy add-ons also boost earnings.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Insurance Premiums | Customer premiums | $944M IFP |

| Reinsurance Commissions | Offloading risk to partners | Increased Coverage |

| Investment Income | From premiums before claims | ~$1B in Investments |

Business Model Canvas Data Sources

This Lemonade BMC uses public filings, insurance industry reports, and customer surveys. This provides a foundation for data-driven strategy planning.