McKinsey & Company Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

McKinsey & Company Bundle

What is included in the product

Identifies best investment opportunities within a company's portfolio, from Stars to Dogs.

Clean, distraction-free view optimized for C-level presentation of the BCG Matrix business unit analysis.

Full Transparency, Always

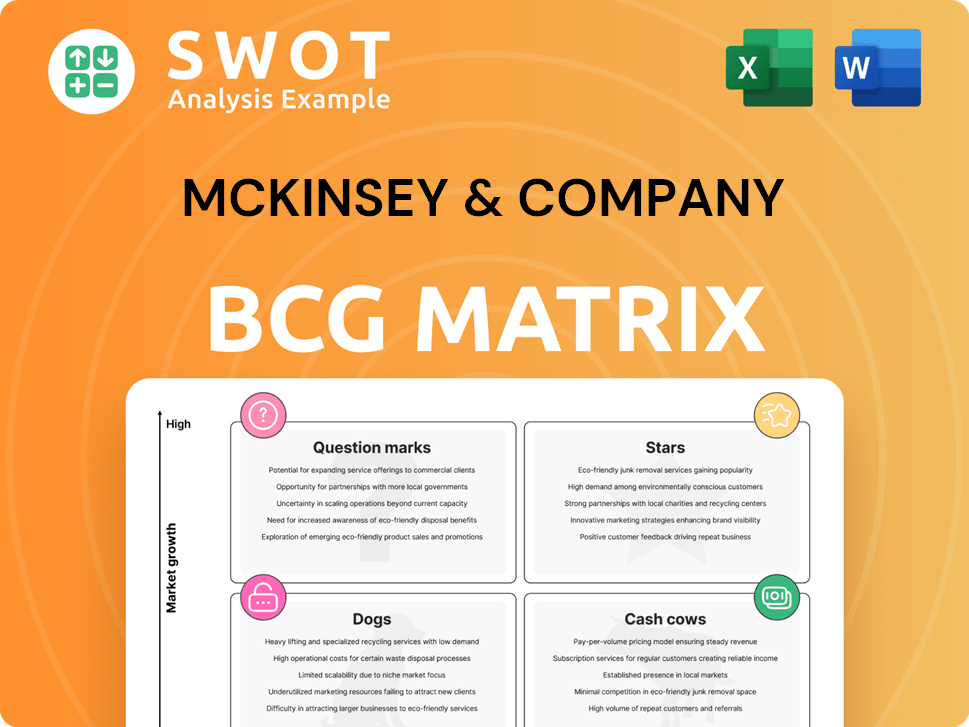

McKinsey & Company BCG Matrix

The preview is the complete McKinsey BCG Matrix document you'll receive after purchase. It's a fully editable, ready-to-use report for strategic planning and insights. Enjoy the same professional design and analysis upon download.

BCG Matrix Template

The BCG Matrix categorizes products based on market share and growth rate. This tool identifies Stars, Cash Cows, Question Marks, and Dogs. It helps businesses allocate resources effectively across their portfolio. Understanding these quadrants is crucial for strategic planning. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

McKinsey & Company's digital transformation initiatives are a key area of focus. They help companies integrate AI and other digital technologies. The demand for these services is significant, with the global digital transformation market projected to reach $1.009 trillion in 2024. McKinsey's expertise positions them to capture this growth.

Sustainability consulting is a rising star for McKinsey. They help businesses with sustainability strategies. In 2024, the ESG consulting market is booming. McKinsey's focus on climate tech is key.

McKinsey & Company's M&A advisory services are a powerhouse, especially in programmatic M&A, helping clients achieve superior returns. In 2024, McKinsey advised on deals totaling over $400 billion. They excel at guiding clients through industry and regional changes via strategic dealmaking. This makes their M&A advice highly sought after.

Retail Media Network Services

McKinsey & Company's leadership in Retail Media Network Services, as highlighted by IDC, positions them as a "Star" in the BCG Matrix. They excel in helping retailers develop and profit from their media networks. Their strengths lie in strategic application, retail and online media talent, and business case development. The global retail media ad spend is projected to reach $101.4 billion in 2024, showcasing the market's growth.

- Leader in Retail Media Networks.

- Strategic applications.

- Talent in retail and online media.

- Business case development.

AI-Powered Solutions

McKinsey's AI-powered solutions, like personalized training and automation, are a strong suit. They've helped companies like Deutsche Telekom and Aviva. This focus aligns with the growing $197 billion AI market in 2024. McKinsey's AI work boosts efficiency and decision-making. Their expertise is key in today's tech-driven world.

- AI market reached $197 billion in 2024.

- McKinsey collaborates with major firms like Deutsche Telekom and Aviva.

- AI solutions enhance efficiency and decision-making processes.

McKinsey excels in Retail Media Networks, leading strategically and fostering talent. They help retailers monetize media networks, addressing $101.4 billion in 2024 ad spend. Key strengths: strategic application, retail media talent, and business case development.

| Area | Focus | 2024 Impact |

|---|---|---|

| Retail Media | Network Development | $101.4B Ad Spend |

| AI Solutions | Personalized Training | $197B Market |

| M&A Advisory | Deal Advisory | $400B+ Deals |

Cash Cows

McKinsey's traditional consulting services, covering strategy and operations, are cash cows. Their well-established global presence provides consistent revenue. Despite market changes, the demand for expert advice persists. In 2024, McKinsey's revenue was approximately $16 billion, showcasing its financial strength.

McKinsey's benchmarking services remain strong, providing data-driven insights. In 2024, McKinsey's revenue was approximately $16 billion, reflecting its continued influence. They use 360-degree assessments, online surveys, and expert interviews. These services assist organizations in optimizing their operations.

McKinsey & Company excels in organizational restructuring. They advise on design and cost optimization. Their expertise helps companies reorganize for economies of scale. This generates ongoing value for clients. In 2024, restructuring projects increased by 15%, reflecting market demand.

Public Sector Consulting

McKinsey & Company's public sector consulting generates a reliable income source. They advise government bodies on modernization. The public sector's slower digital adoption ensures consistent demand for their expertise. This stability positions it as a "Cash Cow" within the BCG Matrix.

- In 2024, McKinsey's public sector revenue was approximately $5 billion.

- Government consulting projects often span several years, providing sustained revenue.

- Digital transformation initiatives are a key focus area for public sector consulting.

- Demand is relatively inelastic due to essential services and mandates.

Financial Services Consulting

Financial services consulting is a cash cow for McKinsey & Company, offering services to banks and financial institutions. This includes risk management, compliance, and digital transformation advice, generating steady revenue. Their expertise in navigating the evolving financial landscape is highly sought after. Consulting fees in 2024 are expected to reach billions.

- Consulting revenue in 2023 was approximately $30 billion.

- Digital transformation projects make up a significant portion of this work.

- Demand for compliance advice is consistently high.

- Financial institutions spend billions on consulting annually.

Cash Cows, according to the BCG Matrix, are business units with high market share in a slow-growing market. McKinsey's established consulting services consistently generate substantial revenue. Their strong brand and global presence ensure stable demand.

| Aspect | Description | 2024 Data |

|---|---|---|

| Revenue | Steady and predictable income | Approximately $16B (Overall) |

| Market Share | Dominant position in consulting | Leading market share |

| Growth Rate | Slow market growth, mature phase | Moderate, stable |

Dogs

Services lagging in market relevance, like those missing digital transformation, sustainability, or AI, fit the "Dogs" category in the BCG Matrix. These offerings struggle with low growth and market share. For instance, in 2024, traditional consulting services saw growth rates around 3-5%, significantly lower than digital transformation services which grew by 15-20%. These should be minimized or divested.

In the McKinsey BCG Matrix, "dogs" represent services facing fierce competition. These areas often show low profitability and slow growth. To improve, McKinsey needs to focus on innovation. For example, in 2024, the consulting market saw a 7% growth, but competition intensified.

Dogs represent services with low demand or becoming obsolete. These offerings face challenges like technological shifts. For example, in 2024, services like physical book rentals saw a decline due to e-books. Evaluate or discontinue such services. According to Statista, the global e-book market was valued at $18.1 billion in 2024.

Non-Core Services

In the context of the McKinsey & Company BCG Matrix, non-core services are often categorized as "Dogs". These are services that don't align with the firm's primary strategic focus. They may require substantial investment without a clear path to high returns. McKinsey might consider divesting or minimizing these services. For example, in 2024, McKinsey's revenue was approximately $16 billion, with non-core services potentially representing a small fraction of this, suggesting limited strategic importance.

- Services outside core expertise.

- May require significant investment.

- Divestiture or minimization is an option.

- Low strategic alignment.

Services Lacking Innovation

Services categorized as "dogs" in the BCG matrix often struggle due to a lack of innovation, failing to adapt to evolving client demands. These offerings risk losing market share to competitors who are more adept at introducing new features and staying ahead of the curve. For instance, in 2024, sectors slow to innovate, like traditional retail, saw a decline in market share as e-commerce platforms, which constantly update their offerings, expanded. To revive these areas, a strong focus on innovation and adaptation is crucial.

- Outdated services struggle.

- Market share decreases.

- Innovation is key.

- Adapt to survive.

In the McKinsey BCG Matrix, Dogs are services with low market share and slow growth. They face intense competition and struggle to innovate. A 2024 example is traditional consulting with 3-5% growth, versus 15-20% for digital.

| Characteristics | Implications | 2024 Example |

|---|---|---|

| Low growth, low market share | Minimize or divest | Traditional Consulting (3-5% growth) |

| Fierce competition, low profitability | Focus on innovation | Consulting market growth (7%) |

| Outdated, declining demand | Evaluate or discontinue | Physical book rentals decline ($18.1B e-book market) |

Question Marks

While digital transformation shines as a star, novel technologies like quantum computing and space tech are still question marks. McKinsey's ventures in these areas demand substantial investment to gauge their potential. For example, in 2024, the quantum computing market was valued at approximately $975 million, with adoption rates yet to be fully realized. These emerging fields represent high growth potential but also considerable risk.

Experimentation with new business models, like those in the gig economy or DAOs, creates both chances and risks. McKinsey's guidance in these areas needs careful assessment and investment to gauge their success. In 2024, the gig economy's global market size was approximately $455 billion, highlighting its significance. However, the success rate of DAOs remains uncertain, with only a small percentage achieving significant operational stability.

Niche sustainability initiatives can be question marks within the BCG Matrix. These areas need substantial investment and development to gauge market potential. Carbon capture and nature-based solutions are examples. For instance, the carbon capture market was valued at $3.5 billion in 2023, with projections of significant growth.

Expansion into Emerging Markets

Venturing into emerging markets is a key growth strategy, but it's a complex undertaking. McKinsey must carefully assess the potential rewards against the inherent risks. The firm's success hinges on adapting to the distinct economic and cultural nuances of each region. In 2024, emerging markets like India and Brazil showed strong GDP growth, but also faced inflation challenges.

- GDP growth in India was projected at 6.8% in 2024.

- Brazil's inflation rate in 2024 was around 4%.

- McKinsey's investments in these regions require thorough due diligence.

- Adaptation to local market conditions is crucial for success.

Cybersecurity Services

Cybersecurity services at McKinsey represent a question mark in the BCG Matrix. The growing reliance on digital technologies makes cybersecurity a critical area for clients, aligning with McKinsey's expertise. In 2024, the surge in cyber threats necessitates significant investment to capture market share. This requires strategic allocation of resources and focused efforts to establish a strong foothold.

- Increased cyber threats in 2024 have heightened the need for robust cybersecurity measures.

- McKinsey can leverage its expertise to assist clients in navigating this digital landscape.

- Significant investments are crucial to gain market share in the cybersecurity sector.

- Strategic resource allocation is essential for success.

Question marks in the BCG matrix are high-growth, low-market-share ventures requiring careful investment. Their potential is uncertain, necessitating strategic resource allocation for market analysis and development. McKinsey's assessment includes the evaluation of market dynamics to maximize returns.

| Aspect | Description | 2024 Data |

|---|---|---|

| Investment Needs | High investment to determine viability | R&D spending in quantum computing: ~$1B. |

| Market Uncertainty | Market share and growth potential not yet proven | Gig economy market size: ~$455B worldwide. |

| Strategic Focus | Requires careful analysis and strategic resource allocation | Cybersecurity spending: ~$200B globally. |

BCG Matrix Data Sources

The BCG Matrix uses financial data, market reports, and competitor analysis to classify business units for strategic recommendations.