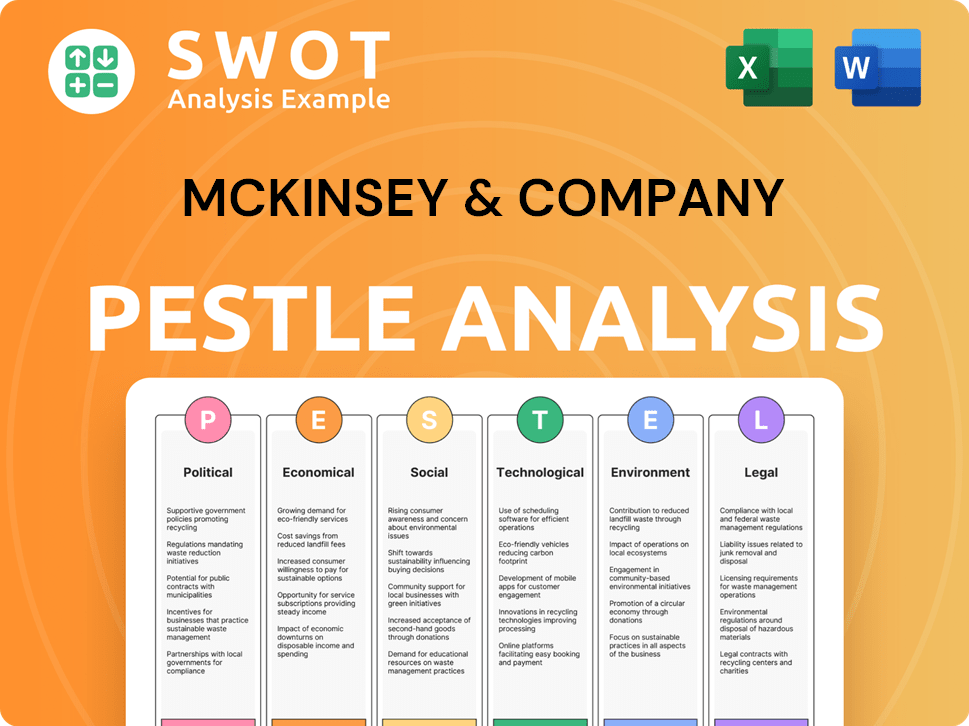

McKinsey & Company PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

McKinsey & Company Bundle

What is included in the product

Evaluates the macro-environmental factors impacting McKinsey across political, economic, social, technological, environmental, and legal dimensions.

Supports team alignment through an easily shareable format.

Preview the Actual Deliverable

McKinsey & Company PESTLE Analysis

The preview illustrates a complete McKinsey PESTLE analysis. This is the exact, fully formatted document you will receive.

PESTLE Analysis Template

Explore McKinsey & Company through the lens of our PESTLE analysis. Discover how political landscapes, economic shifts, and technological advancements impact the firm. Uncover social trends and legal challenges affecting its strategy. Our analysis provides a comprehensive view, empowering informed decision-making. Get the complete breakdown for strategic success—download the full version today.

Political factors

Geopolitical instability and conflict remain significant disruptors. Ongoing conflicts and rising tensions, like those in Eastern Europe and the Middle East, continue to impact global growth. According to the World Bank, global growth is projected to be 2.4% in 2024, down from previous forecasts due to these instabilities. Businesses face increased uncertainty, affecting supply chains and investment decisions.

Changes in trade policies, like tariffs, are a big worry for 2025. Executives foresee major impacts on global economies and company results. For example, the World Bank projects global trade growth slowing to 2.5% in 2024, with potential further declines in 2025 due to trade tensions.

Political transitions and policy shifts are crucial for businesses. Following 2024 elections, including in the US, executives watch for policy changes. These changes can impact trade and regulations. For example, shifts in US trade policy could affect $2.6 trillion in goods traded annually.

Government Regulations and Scrutiny

McKinsey & Company faces potential risks from government regulations and investigations. These can stem from their consulting work, especially regarding client projects and any perceived conflicts of interest. Recent scrutiny has focused on the firm's involvement with various entities. This includes examining its advice and the resulting impacts. The firm's operations must adapt to navigate these challenges.

- In 2024, McKinsey faced inquiries related to its work with opioid manufacturers.

- Government agencies have increased oversight of consulting contracts.

- The firm has implemented new compliance measures.

Declining Global Cooperation

Global cooperation has noticeably declined since 2020, creating an unstable environment for businesses. This stagnation, especially in peace and security initiatives, introduces uncertainty. The lack of international collaboration impedes progress on critical global issues.

- Global foreign direct investment (FDI) fell by 18% in 2020.

- The UN's peacekeeping budget for 2024 is approximately $6.37 billion.

Geopolitical risks and conflicts continue to reshape the economic landscape, influencing trade and investment decisions through 2025. The World Bank's forecast suggests global growth of 2.4% in 2024, dampened by instability. Trade policy shifts, like potential tariffs, present significant concerns; the UN's peacekeeping budget is roughly $6.37B in 2024.

| Political Factor | Impact | 2024/2025 Data |

|---|---|---|

| Geopolitical Instability | Disrupted Supply Chains | Global trade growth slowing to 2.5% in 2024. |

| Trade Policy Changes | Increased Uncertainty | US trade policy impacts $2.6T goods. |

| Government Scrutiny | Regulatory Risks | UN peacekeeping budget: $6.37B. |

Economic factors

Economic volatility and uncertainty are anticipated to persist into 2025. Inflation rates remain a concern, with projections suggesting continued fluctuations. Interest rate adjustments by central banks globally will also contribute to market instability. Moreover, potential economic slowdowns in key regions like Europe and China could further exacerbate these conditions. For example, the IMF forecasts global growth to be around 3.2% in 2024 and 2025.

Economic pressures are significantly influencing consumer behavior, with price sensitivity on the rise. Recent data shows a 6% increase in consumers prioritizing value in 2024. This shift is impacting demand across sectors; for example, the discount retail market is projected to grow by 8% in 2025.

Economic conditions and growth forecasts differ greatly regionally. For instance, in 2024, the Eurozone's GDP growth is estimated at 0.8%, while the US is projected at 2.1%. Some regions benefit from lower inflation and tourism surges. Conversely, certain areas struggle with sluggish demand impacting economic performance.

Interest Rate Changes

Rising interest rates are anticipated in certain areas, potentially affecting economic activity and increasing borrowing costs for companies. For example, the Federal Reserve held its benchmark interest rate steady in May 2024, but future decisions remain data-dependent. Higher rates can slow economic growth by making loans more expensive. Businesses must consider these costs when planning investments and expansions.

- Federal Reserve held rates steady in May 2024.

- Higher rates can slow economic growth.

- Businesses need to account for borrowing costs.

Industry-Specific Economic Trends

Economic trends vary significantly across industries, impacting strategic decisions. The fashion industry anticipates slower growth, influenced by changing consumer preferences and supply chain issues. Conversely, the energy sector projects robust growth, particularly in renewables, driven by global sustainability initiatives. These differing outlooks require tailored strategies for each industry, as reflected in financial forecasts.

- Fashion industry growth projected at 2-4% in 2024-2025.

- Renewable energy sector to grow by 8-12% annually.

- Oil & gas sector growth around 3-5% in 2024.

Economic uncertainties, like fluctuating inflation and interest rates, persist into 2025, with a forecasted global growth of about 3.2%. Consumer behavior is shifting towards increased price sensitivity, affecting demand across various sectors, with discount retail anticipated to grow by 8% in 2025. Industry-specific impacts, such as fashion seeing slower growth (2-4% in 2024-2025) and renewables experiencing robust expansion (8-12% annually), require tailored business strategies.

| Economic Factor | Impact | Data (2024-2025) |

|---|---|---|

| Inflation | Fluctuating | US: 3.3% (May 2024), EU: 2.6% (May 2024) |

| Interest Rates | Potential Instability | Fed held rates steady May 2024 |

| Consumer Behavior | Price Sensitivity | Value prioritized by 6% more consumers |

Sociological factors

Consumers' value consciousness is rising, influencing purchasing decisions. Sustainable products are gaining traction; in 2024, the sustainable market grew by 10%. Personalized experiences are also crucial. Companies must adapt to these evolving preferences. For example, McKinsey's research indicates that 70% of consumers want personalized offers.

Demographic shifts, like the aging population, significantly impact market segments. The "Silver Generation" (50+) is growing, influencing spending habits. In 2024, this group controls a substantial portion of consumer spending. Businesses must adapt to their needs, focusing on healthcare, retirement, and leisure. Understanding these demographic trends is crucial for strategic planning.

The labor market faces talent shortages and wage increases. In 2024, the US saw a 4.6% increase in average hourly earnings. Remote work and the gig economy are growing, affecting consulting firms. By 2025, 70% of companies plan to offer remote work options. This shift impacts workforce management.

Increasing Focus on Health and Wellness

Consumers are increasingly prioritizing health and wellness, driving significant shifts in spending habits. This focus has led to substantial growth in the health and wellness market. Businesses in the food, fitness, and pharmaceutical sectors are experiencing increased demand and investment.

- The global wellness market was valued at over $7 trillion in 2023.

- Spending on healthy food options rose by 10% in 2024.

- The fitness industry saw a 15% increase in membership in 2024.

Rising Inequality

Rising inequality is a critical sociological factor. The gap between the rich and the poor continues to widen, a trend with significant societal repercussions. Data from the World Inequality Report 2022 shows that the top 10% of earners globally capture 52% of total income. This disparity can lead to social unrest and decreased social mobility, impacting consumer behavior and market stability.

- Widening wealth gap.

- Decreased social mobility.

- Potential social unrest.

Growing consumer value consciousness, fueled by the sustainable market's 10% growth in 2024, reshapes purchasing. Demographic shifts, such as the aging population, also impact market segmentation; the "Silver Generation" controls a significant portion of spending.

The labor market responds with rising wages (4.6% increase in 2024) and a rise in remote work opportunities, changing workforce dynamics.

The widening gap between the rich and poor remains a critical concern, potentially causing societal unrest; in 2022, the top 10% of global earners captured 52% of total income. Consumer focus shifts toward health and wellness, significantly influencing spending patterns.

| Sociological Factor | Impact | 2024/2025 Data |

|---|---|---|

| Value Consciousness | Influence on Purchasing | Sustainable market +10% (2024), Personalized offers (70%) |

| Demographic Shifts | Changes in Market Segments | "Silver Generation" spending influence. |

| Labor Market | Talent Shortages/Wage Increase | US average hourly earnings +4.6%(2024), 70% companies to offer remote options(2025) |

| Health & Wellness | Shift in Consumer Spending | Healthy food spending +10% (2024) |

| Income Inequality | Potential Social Unrest | Top 10% earners capture 52% total income (2022). |

Technological factors

Artificial Intelligence (AI), especially generative AI, is reshaping sectors and business operations. It's used for research, analysis, content creation, and automation, promising substantial productivity gains. The AI market is forecast to reach $1.8 trillion by 2030, per Statista. McKinsey's recent reports highlight that AI could add trillions to the global economy.

Digital transformation continues to drive business strategies, with consulting firms at the forefront. McKinsey & Company helps clients embrace digital tools for enhanced efficiency and revenue. The pandemic sped up the move to online services and digital adoption. In 2024, digital transformation spending is projected to reach $2.8 trillion globally, highlighting its importance.

Cybersecurity and digital trust are paramount due to increased digitalization. Businesses must prioritize data protection and secure digital interactions. The global cybersecurity market is projected to reach $345.7 billion in 2024. This growth is driven by rising cyber threats. Investment in cybersecurity is crucial for financial stability.

Remote Work Technologies and Virtual Collaboration

Remote work and virtual collaboration technologies are critical. They facilitate communication, project management, and global talent access. The shift requires digital tool adoption and new skill sets. In 2024, remote work saw a 30% increase.

- Adoption of collaboration tools like Slack and Microsoft Teams surged by 40% in 2024.

- Cybersecurity spending for remote work infrastructure is projected to reach $20 billion in 2025.

- Companies with strong remote work policies report a 20% higher employee satisfaction.

Integration of Technology in Consulting Services

Consulting services are rapidly integrating technology to stay competitive. McKinsey & Company leverages AI and data analytics for improved client solutions and operational efficiency. In 2024, the global consulting market reached approximately $250 billion, with tech-driven services growing significantly. This includes personalized client strategies and streamlined project management.

- AI adoption in consulting increased by 40% in 2024.

- Data analytics tools help with quicker insights.

- Efficiency gains reduce project costs by 15%.

- Personalization boosts client satisfaction by 20%.

Technological advancements significantly influence business strategies. Generative AI and digital transformation drive major operational changes. Cybersecurity, remote work tools, and tech-integrated consulting are critical for success.

| Technology Aspect | Impact | 2024/2025 Data |

|---|---|---|

| AI Market | Boosts productivity, reshapes industries | Forecast: $1.8T by 2030; AI in consulting: 40% growth in 2024 |

| Digital Transformation | Enhances efficiency and revenue | $2.8T spending in 2024; adoption of collaboration tools: +40% |

| Cybersecurity | Protects digital interactions | $345.7B market in 2024; remote work security: $20B by 2025 |

Legal factors

Businesses navigate a shifting regulatory environment, especially concerning sustainability and data reporting. Consulting firms must stay updated to guide clients through these changes. For example, the EU's Corporate Sustainability Reporting Directive (CSRD) impacts a large number of companies. Failure to comply can result in significant fines and reputational damage.

Legal risks for McKinsey include investigations tied to client work and internal practices. Recent scrutiny involves ethical conduct and potential bribery. In 2024, several investigations targeted consulting firms globally. McKinsey faced legal challenges related to its business operations. The firm's legal expenses in 2024 were approximately $500 million.

Changes in trade policies and tariffs create legal hurdles for international businesses. For example, the US-China trade war saw tariffs affecting billions in goods. Consulting firms help clients understand and comply with these evolving regulations. In 2024, the World Trade Organization (WTO) continues to mediate trade disputes, influencing legal frameworks. Navigating these legal landscapes is crucial.

Data Privacy and Security Regulations

Data privacy and security regulations are tightening due to digital growth. Companies must adhere to laws like GDPR and CCPA to safeguard customer data. Non-compliance can lead to hefty fines. For instance, in 2024, Google faced a $74.6 million fine for GDPR violations. Protecting data is crucial for business success.

- GDPR fines in 2024 totaled over $1.5 billion.

- The global cybersecurity market is projected to reach $326.5 billion by 2027.

- Data breaches cost companies an average of $4.45 million in 2023.

Labor Laws and Employment Regulations

Labor laws and employment regulations are pivotal in workforce management. Recent changes demand that companies adjust their strategies. For instance, the rise of remote work necessitates new policies, as seen during the 2020-2024 period. Non-compliance may lead to legal issues. Businesses must proactively adapt to these evolving standards to ensure smooth operations.

- Minimum wage increases, such as the $15/hour movement, affect labor costs.

- The growing emphasis on employee benefits and protections.

- The need for compliance with evolving anti-discrimination laws.

- The impact of gig economy regulations on staffing models.

Legal factors significantly influence business operations. Stricter data privacy regulations like GDPR and CCPA lead to large fines; for example, GDPR fines surpassed $1.5 billion in 2024. Evolving labor laws and the shift towards remote work also pose legal challenges. Businesses need to proactively manage legal risks and compliance.

| Legal Aspect | Impact | 2024 Data/Example |

|---|---|---|

| Data Privacy | Non-compliance leads to fines & reputational damage | Google's $74.6M GDPR fine. |

| Labor Laws | Changes in minimum wage & employment benefits | $15/hour movement impacting costs. |

| Trade Policies | Tariffs & WTO disputes affecting international trade | US-China trade war impacting billions in goods. |

Environmental factors

Climate change presents tangible risks for businesses, such as extreme weather events and supply chain disruptions. These events can lead to operational shutdowns and increased costs. Companies are under growing pressure to reduce their environmental footprint. The global market for sustainable products is projected to reach $10 trillion by 2030, highlighting the financial implications of these changes. Businesses must adapt to meet these challenges.

Sustainability and ESG are now central to business strategy. Demand for sustainability consulting is rising. The global ESG investment market is projected to reach $50 trillion by 2025. McKinsey offers ESG services, reflecting this trend. This shift impacts all sectors.

Resource scarcity, including water, is a growing concern, pushing for sustainable practices. Companies are increasingly investing in resource conservation. For instance, in 2024, the global market for water-efficient technologies reached $25 billion. This trend is expected to grow by 8% annually through 2025.

Circular Economy and Sustainable Practices

The shift towards a circular economy and sustainable practices is accelerating, affecting various sectors. Companies are increasingly adopting circular business models to minimize waste and maximize resource utilization. This trend is driven by environmental concerns and the potential for economic gains, including in the built environment. According to a 2024 report, the circular economy could generate $4.5 trillion in economic output by 2030.

- Increased demand for eco-friendly products and services.

- Growing regulatory pressure to reduce environmental impact.

- Rise of green financing and investment in sustainable projects.

- Opportunities for innovation in waste management and recycling technologies.

Energy Transition and Renewable Energy

The transition to renewable energy is a critical environmental factor, reshaping industries globally. McKinsey & Company's analysis highlights the need to scale climate technologies. The energy demands of technologies like AI must align with net-zero goals. Consider these recent facts: Solar and wind capacity additions hit record highs in 2023, with investments reaching $675 billion.

- Global renewable energy capacity is projected to grow by over 50% between 2023 and 2028.

- AI's energy consumption is expected to surge, requiring significant renewable energy investments.

- Governments worldwide are increasing climate tech funding and incentives.

Environmental factors significantly influence business operations and strategy. Climate change and resource scarcity drive companies towards sustainable practices. The circular economy could generate $4.5T by 2030. Renewable energy is reshaping industries.

| Environmental Factor | Impact | Data |

|---|---|---|

| Climate Change | Extreme weather, supply chain issues | Global market for sustainable products projected to reach $10T by 2030 |

| Resource Scarcity | Increased focus on sustainable practices | Water-efficient tech market reached $25B in 2024 |

| Renewable Energy Transition | Industry transformation | Renewable capacity to grow by over 50% from 2023 to 2028. |

PESTLE Analysis Data Sources

Our PESTLE analyses leverage a blend of reputable data sources including government agencies and leading research institutions.