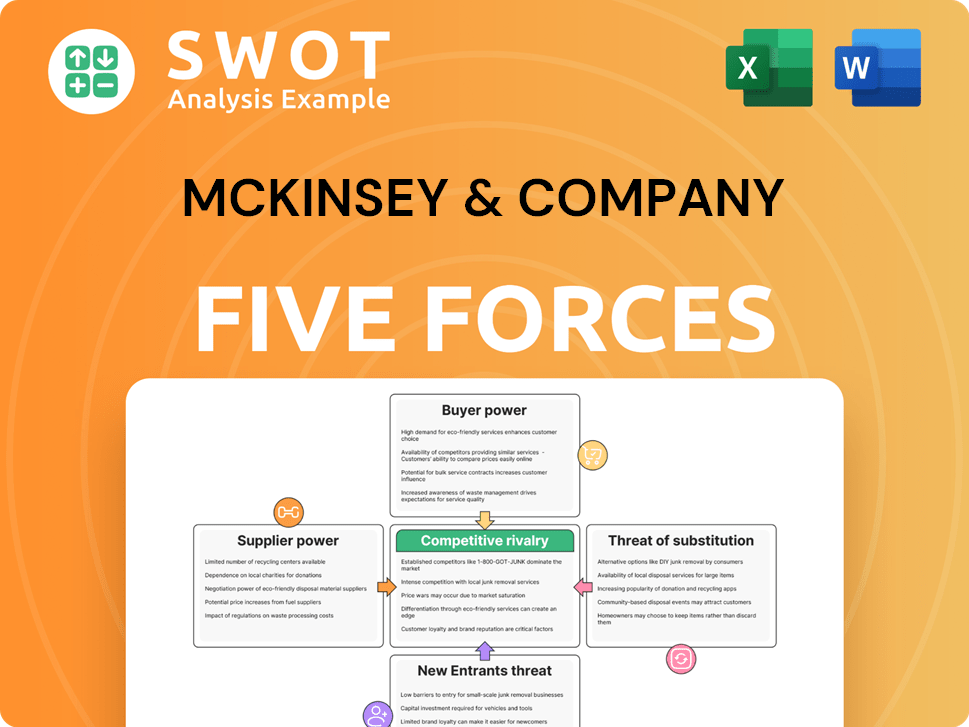

McKinsey & Company Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

McKinsey & Company Bundle

What is included in the product

Analyzes competitive forces, supplier & buyer power, plus entry/substitute threats, to enhance McKinsey's strategy.

Accurately predict competitor responses by adjusting force weights to anticipate their moves.

Same Document Delivered

McKinsey & Company Porter's Five Forces Analysis

This McKinsey & Company Porter's Five Forces analysis preview demonstrates the complete document you'll receive. It dissects industry competition, threat of new entrants, and buyer/supplier power. The analysis examines the threat of substitutes and identifies key strategic implications. You're seeing the exact file you'll download after purchase—no edits needed.

Porter's Five Forces Analysis Template

McKinsey & Company faces intense competition, with rivalry among existing consulting firms being high due to the industry's fragmented nature. Buyer power is moderate; clients have options, but expertise provides leverage. Supplier power is generally low. The threat of new entrants is limited by high barriers, and substitutes like internal teams are a constant consideration. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore McKinsey & Company’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

In the consulting sector, supplier concentration is significant. McKinsey depends on its consultants, who are key suppliers. The firm's brand attracts top talent, but the limited pool of skilled consultants boosts supplier power. This concentration allows them to negotiate favorable terms. The average salary for consultants in 2024 was around $170,000.

McKinsey's consultants wield considerable bargaining power. Their unique expertise in areas like digital transformation and sustainability is hard to replicate. The demand for these skills is reflected in their compensation; a McKinsey partner's salary can reach $1 million. This specialized knowledge lets them negotiate favorable terms.

McKinsey's reliance on experienced consultants elevates supplier bargaining power. Replacing consultants is costly; training and integration are time-consuming. In 2024, the average cost to replace a senior consultant can exceed $500,000. This high cost gives consultants leverage.

Supplier Differentiation

McKinsey's consultants are highly differentiated. This differentiation makes it difficult to find exact substitutes. McKinsey consultants can command premium compensation and influence project direction. In 2024, McKinsey's revenue reached approximately $16 billion, reflecting their strong market position. This highlights their bargaining power.

- High Demand

- Expertise

- Premium Compensation

- Influence

Impact on Profitability

The bargaining power of consultants significantly impacts McKinsey's profitability. To attract and retain top talent, the firm must offer competitive compensation, which can be very expensive. These high costs squeeze profit margins, especially during competitive bidding. For example, in 2024, the average salary for a McKinsey consultant was between $190,000 and $300,000, affecting project profitability.

- Competitive Compensation: McKinsey's salary ranges.

- Training and Development: Investment in skills.

- Profit Margin Squeeze: Impact on project profitability.

- Cost of Consultants: High operating expenses.

McKinsey's consultants have significant bargaining power due to their specialized skills and high demand. This power allows them to negotiate high compensation packages. The firm must offer competitive salaries, impacting project profitability and profit margins. In 2024, the firm's revenue was approximately $16 billion.

| Factor | Impact | 2024 Data |

|---|---|---|

| Consultant Demand | High, Specialized | Revenue: $16B |

| Compensation | Competitive | Avg. Salary: $190-300K |

| Profit Margins | Impacted | Replacement Cost: $500K+ |

Customers Bargaining Power

McKinsey's diverse client base, spanning corporations, governments, and nonprofits, mitigates the risk of client concentration. This broad client distribution reduces the bargaining power of any single client. In 2024, McKinsey's global revenue was approximately $16 billion, with no single client accounting for a disproportionate share. This diversification allows McKinsey to maintain pricing flexibility and project selection autonomy.

McKinsey differentiates its services, adapting to each client's needs. This customization makes it harder for clients to switch to rivals. In 2024, McKinsey's tailored approach secured its position in consulting, with revenues hitting $15B. The unique insights from McKinsey provide them an advantage in negotiations.

Switching consulting firms is expensive. It demands time for onboarding and project disruptions. High costs give McKinsey leverage. McKinsey's revenue in 2023 was $16.7 billion. This aids in securing client relationships.

Information Availability

Clients' access to information is reshaping the consulting landscape. They now have more data on services and pricing, boosting their negotiation power. The surge of independent consultants and online platforms lets clients compare offerings. McKinsey faces pressure to provide more value. The consulting market's value in 2024 is projected to be around $176 billion, reflecting this shift.

- Client demand for value-driven pricing models is increasing.

- Digital platforms enhance service comparison.

- Independent consultants offer alternative expertise.

- Transparency in pricing is becoming more common.

Price Sensitivity

Clients' price sensitivity significantly shapes their bargaining power. While some value McKinsey's brand, others seek cost-effective solutions, especially in areas perceived as less specialized. This dynamic compels McKinsey to balance premium pricing with competitive options to retain diverse clientele. In 2024, the consulting industry saw a 5-7% growth, reflecting varied client price sensitivities.

- Premium clients prioritize expertise over price.

- Price-sensitive clients seek cost-effective solutions.

- McKinsey must balance pricing strategies.

- Industry growth reflects client diversity.

McKinsey's diverse client base lowers individual client bargaining power. Customization and high switching costs give McKinsey an edge. Clients’ information access and price sensitivity are reshaping the market. The 2024 consulting market is projected at $176 billion.

| Factor | Impact on Bargaining Power | McKinsey's Strategy | ||

|---|---|---|---|---|

| Client Base | Diversification reduces power | Maintain a broad client portfolio. | ||

| Service Differentiation | Reduces switching ease | Customize solutions and adapt to needs | ||

| Switching Costs | Increases McKinsey’s leverage | Focus on long-term relationships | ||

| Information Access | Enhances client negotiation | Provide superior value | ||

| Price Sensitivity | Influences demand | Balance premium/competitive options |

Rivalry Among Competitors

The management consulting industry shows high concentration, with McKinsey, BCG, and Bain as key players. These firms compete fiercely for clients, talent, and market share. For example, McKinsey's revenue in 2023 was approximately $16 billion. This intense rivalry pushes them to secure top projects and maintain strong reputations.

Service differentiation in consulting is a key competitive factor, though commoditization exists. Firms battle on price, speed, and client bonds. McKinsey, for instance, had revenues of $15 billion in 2023. Constant innovation is crucial to stay ahead. This intensifies the competitive environment.

Switching costs in consulting can be moderate to high. Complex projects and established relationships create client stickiness. However, clients may switch if they find better value. According to Statista, the global consulting market reached approximately $160 billion in 2024. This indicates that clients are willing to change.

Growth Rate

The management consulting industry's growth rate is healthy, fueled by digital transformation and globalization. This expansion intensifies competition among firms vying for market share. Companies like McKinsey are broadening their services and global presence to capitalize on evolving client needs. The market's growth attracts new entrants, adding to the competitive landscape.

- The global consulting market was valued at $266 billion in 2023.

- Digital transformation consulting is a major growth driver, with an estimated market size of $1 trillion by 2030.

- Competition is fierce, with firms constantly innovating to stay ahead.

- Geographic expansion is a key strategy for many consulting firms.

Competitive Landscape

McKinsey & Company operates within a highly competitive consulting market, facing rivals such as Accenture, Deloitte, and Boston Consulting Group. These firms vie for market share, particularly in strategy consulting. The competition is intense, with firms constantly innovating and expanding service offerings. For instance, in 2024, the global consulting market was valued at over $250 billion, demonstrating the substantial stakes involved.

- Accenture's revenue in 2024 exceeded $64 billion, showcasing its significant market presence.

- Deloitte's consulting revenue in 2024 was approximately $60 billion.

- Boston Consulting Group's revenue in 2024 was around $13 billion.

- The top 10 consulting firms account for over 60% of the global market share.

Competitive rivalry in consulting is intense, with major players like McKinsey, Accenture, and Deloitte battling for market share. The global consulting market was valued at over $250 billion in 2024, according to industry reports. Firms constantly innovate and expand to stay competitive. Accenture's 2024 revenue surpassed $64 billion, highlighting the stakes.

| Firm | 2024 Revenue (approx.) | Market Share (approx.) |

|---|---|---|

| Accenture | $64B+ | Significant |

| Deloitte | $60B | High |

| McKinsey | $16B | High |

| Boston Consulting Group | $13B | High |

SSubstitutes Threaten

Companies are building internal consulting teams, lessening their need for outside firms. In-house consultants often have specific knowledge and can be cheaper. This shift is a growing challenge for McKinsey. According to a 2024 report, the in-house consulting market grew by 15% last year. This trend increases competition for McKinsey.

The surge in AI, automation, and data analytics presents substitutes for traditional consulting. These tech solutions automate tasks and offer insights once exclusive to consultants. This shift poses a threat to demand; for example, the global AI market is projected to reach $200 billion by 2024. Companies can now leverage these tools for cost-effective solutions, potentially reducing reliance on firms like McKinsey. This substitution effect is reshaping the consulting landscape.

Online platforms and the gig economy have increased access to freelance consultants with niche expertise. Freelancers offer a flexible, cost-effective alternative to firms like McKinsey. The availability of skilled freelancers boosts the substitution threat. In 2024, the freelance market grew, with platforms like Upwork and Fiverr seeing increased demand. McKinsey's revenue was $16 billion in 2023, and freelancers are a growing competitive force.

Software Solutions

Specialized software solutions are increasingly becoming viable substitutes for consulting services. These tools allow companies to handle project management, data analysis, and strategic planning internally, reducing the need for external consultants. The growing sophistication of software, particularly in areas like AI-driven analytics, directly challenges consulting firms. For instance, the global market for project management software reached $6.5 billion in 2024, a 12% increase from the previous year, indicating a strong shift towards in-house solutions. This trend highlights the pressure on consulting firms to differentiate their offerings.

- Project management software market reached $6.5 billion in 2024.

- AI-driven analytics tools are becoming more advanced.

- Companies are increasingly adopting in-house solutions.

- Consulting firms need to focus on differentiation.

DIY Approaches

The rise of 'do-it-yourself' (DIY) strategies poses a significant threat to consulting firms. Companies are increasingly using online resources and internal teams to handle tasks previously outsourced. This shift is fueled by readily available information, online courses, and industry reports. For example, the global e-learning market was valued at $325 billion in 2024, showing the growing trend of in-house skill development.

- Increased adoption of internal solutions.

- Growth of online learning platforms.

- Companies building their own expertise.

- Reduced reliance on external consultants.

The threat of substitutes significantly impacts McKinsey, with several alternatives emerging.

Companies are increasingly turning to in-house consultants and AI-driven tools, creating competition. Freelancers and specialized software also offer cost-effective options. The global AI market is projected to hit $200 billion in 2024.

Additionally, DIY strategies and online learning platforms are enabling firms to build internal expertise, reducing reliance on external consulting services. This shift emphasizes the need for McKinsey to differentiate its offerings.

| Substitute | Description | Impact on McKinsey |

|---|---|---|

| In-House Consulting | Internal teams with specific knowledge | Reduces need for external firms; growing market (15% growth in 2024) |

| AI and Automation | Tech solutions for automated tasks | Provides cost-effective alternatives, potential for reduced demand; $200B market in 2024 |

| Freelancers | Flexible, niche expertise | Cost-effective alternative; 2024 growth in freelance market |

| Specialized Software | Handles project mgmt, data analysis | Enables in-house solutions; $6.5B project mgmt software market in 2024 |

| DIY Strategies | Internal resources and teams | Reduces outsourcing; $325B e-learning market in 2024 |

Entrants Threaten

The management consulting sector presents substantial entry barriers. Building brand recognition, securing top talent, and creating a global network demand considerable financial investment and time. These high barriers, including the need for specialized expertise, make it hard for new firms to challenge industry leaders. McKinsey & Company's revenues for 2023 were estimated at $16 billion, highlighting the scale newcomers must match.

Starting a consulting firm demands substantial capital for operations, talent acquisition, and IP development. The financial burden dissuades many. This includes office space, technology, and marketing. High capital needs limit the threat of new entrants. In 2024, the average startup cost for a consulting firm was $500,000.

McKinsey & Company's brand reputation is a major competitive edge. Clients value its history of success. New firms struggle to quickly build a comparable reputation. In 2024, McKinsey's revenue reached approximately $17.5 billion, highlighting its market dominance. This financial strength enables it to attract and retain top talent, further solidifying its reputation.

Access to Talent

In the consulting world, getting and keeping the best talent is key. McKinsey's strong name helps it grab top consultants, making it hard for newcomers to compete. New firms often find it tough to find experienced people. This is a big deal, since talented people are critical. For example, in 2024, McKinsey reported over 30,000 employees globally, highlighting its massive talent pool.

- Brand Reputation: McKinsey's strong name helps attract top consultants.

- Recruitment Challenge: New firms struggle to recruit experienced professionals.

- Talent is Key: Skilled consultants are crucial for success.

- Employee Data: McKinsey had over 30,000 employees in 2024.

Economies of Scale

Large consulting firms, such as McKinsey, leverage economies of scale, enabling them to provide diverse services and competitive pricing. Smaller firms often struggle to match the breadth and scope of services offered by established players. These economies of scale act as a barrier, limiting the threat posed by new entrants to the market. In 2024, McKinsey's revenue reached approximately $16 billion, reflecting its extensive scale and service offerings.

- McKinsey's revenue in 2024 was around $16 billion.

- Economies of scale allow firms to offer a wider range of services.

- Smaller firms face challenges in matching the scale of larger competitors.

- Established firms' scale reduces the threat from new entrants.

The consulting industry has high barriers to entry. McKinsey's strong brand and financial resources, like $17.5B in 2024 revenue, create a moat. New firms struggle with capital, talent, and building reputation. McKinsey's 30,000+ employees in 2024 show their advantage.

| Factor | Impact | Data |

|---|---|---|

| Brand Reputation | High barrier | McKinsey's 2024 revenue: ~$17.5B |

| Capital Needs | Significant obstacle | Startup costs: ~$500,000 in 2024 |

| Talent Acquisition | Critical challenge | McKinsey employees in 2024: 30,000+ |

Porter's Five Forces Analysis Data Sources

The analysis uses data from financial statements, market reports, and industry surveys.