Meituan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Meituan Bundle

What is included in the product

Tailored analysis for Meituan's product portfolio, identifying growth strategies for each quadrant.

Printable summary optimized for A4 and mobile PDFs to quickly share Meituan's portfolio analysis.

Preview = Final Product

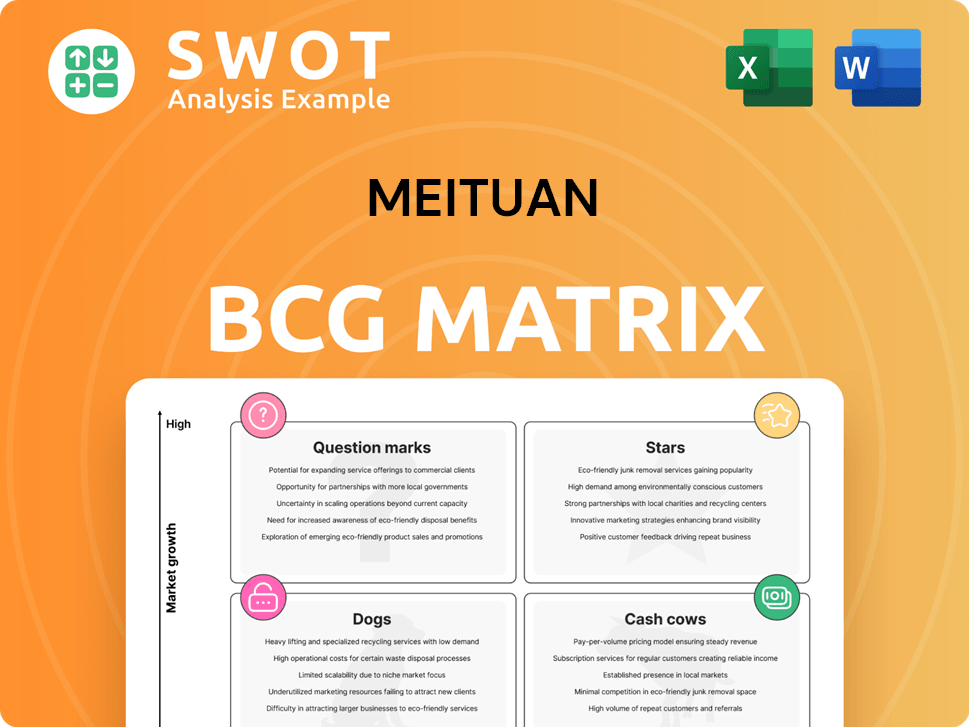

Meituan BCG Matrix

The Meituan BCG Matrix preview is identical to the purchased version. Get the same data visualization, analysis, and strategic insights ready to implement. Download the full, comprehensive report immediately after purchase—no hidden content. It's a professional-grade document, perfect for impactful decisions.

BCG Matrix Template

Meituan's BCG Matrix reveals its portfolio's health. Food delivery is a potential Cash Cow, while new ventures are Question Marks. Understanding these dynamics is key to strategic planning. The matrix spotlights resource allocation opportunities.

Explore Meituan's competitive landscape with the full BCG Matrix. Discover detailed quadrant placements, insightful data, and strategic recommendations. Make informed investment choices and drive product success.

Stars

Meituan's food delivery is a Star in its BCG Matrix, dominating China's market with a 60-70% share in 2024. The industry's growth is projected to hit $197.9 billion by 2033. This sector demands ongoing investments in AI and expanding merchant networks. To sustain its leading position, Meituan must focus on these strategic areas.

Meituan's In-store, Hotel & Travel (IHT) segment is a Star in its BCG Matrix. In 3Q24, this segment saw a 25% YoY revenue increase. This growth is driven by rebounding consumer spending. Meituan invests strategically in IHT, increasing merchant subscriptions and advertising revenue.

Meituan's AI-driven logistics is a Star, enhancing delivery speed and cost-effectiveness. The company optimizes routes and pricing with AI, improving unit economics. In 2024, Meituan's delivery volume reached billions of orders. Continuous AI investment is crucial for a competitive advantage.

Meituan Shangou (Instashopping)

Meituan Shangou, the quick commerce arm, is a "Star" within Meituan's BCG Matrix. It has achieved profitability by Q3 2024, demonstrating strong growth. Shangou is vital for Meituan's "everything" at-home delivery strategy. This growth warrants more investment.

- Shangou's order volume grew over 30% YoY in Q3 2024.

- Shangou's contribution margin turned positive in Q3 2024.

- Meituan's overall revenue increased by 22.1% YoY in Q3 2024.

- Meituan's net profit reached RMB 5.7 billion in Q3 2024.

International Expansion (Keeta)

Meituan's Keeta, targeting the Middle East and North Africa, is a high-growth opportunity, fitting the "Star" quadrant. The international venture's path mirrors the domestic food delivery trajectory. Meituan aims for profitability by 2027, indicating strategic long-term vision. Increased market penetration and logistics efficiency are key to its success.

- Keeta's expansion leverages Meituan's delivery expertise.

- The Middle East and North Africa offer significant growth potential.

- Meituan's domestic success provides a roadmap for international expansion.

- Profitability by 2027 is a key performance indicator.

Meituan's "Stars" show high growth potential, driven by strategic investments. The food delivery sector's market share dominance is significant. The quick commerce arm demonstrates impressive profit milestones.

| Segment | Key Metric | 2024 Data |

|---|---|---|

| Food Delivery | Market Share | 60-70% |

| In-store, Hotel & Travel | Revenue Growth YoY | 25% (3Q24) |

| Shangou | Order Volume Growth YoY | 30%+(Q3 2024) |

Cash Cows

While food delivery is a Star for Meituan, core local commerce, excluding food delivery, is a Cash Cow. This segment includes in-store services, hotel, and travel bookings. In 2024, core local commerce generated substantial revenue. The segment contributed to 74% of the total revenue. It generates steady revenue with lower investment needs.

Meituan's merchant commissions are a primary cash cow. The platform boasted 14.5 million active merchants in Q4 2024, ensuring a steady income stream. Commissions, typically 12-18%, are crucial. Strong merchant ties and optimized structures are vital for maximizing cash flow from this area.

Advertising revenue is a key cash generator for Meituan. In 2024, it generated billions of yuan. Merchants use ads to reach Meituan's vast user base. This revenue stream's growth is linked to user expansion and ad targeting.

Shen Hui Yuan Membership Program

Meituan's Shen Hui Yuan membership program is a Cash Cow, boosting user engagement. It provides coupons and discounts for various services, promoting cross-selling. In Q4 2024, over 40% of core local business orders came from Shen Hui Yuan members. This program consistently generates revenue.

- User engagement is driven by the Shen Hui Yuan membership program.

- Discounts are offered across food delivery and other services.

- The program encourages cross-selling to increase revenue.

- Over 40% of core local business orders come from members.

Economies of Scale

Meituan's vast scale gives it a solid cost advantage, a key trait of a Cash Cow. With millions of daily deliveries, fixed costs are spread thinly, boosting profitability. This leads to lower per-order expenses, making its services highly profitable compared to competitors. This operational efficiency translates into higher margins and strong cash flow.

- In 2024, Meituan's food delivery orders hit billions, showing its massive scale.

- Meituan's delivery network covers thousands of cities in China.

- Per-order delivery costs are significantly lower than those of smaller rivals.

- This cost advantage supports higher profit margins.

Meituan’s core local commerce, including in-store services, is a Cash Cow, contributing to 74% of the total revenue in 2024. Merchant commissions, from 14.5 million active merchants in Q4 2024, and advertising revenue also drive cash generation. Shen Hui Yuan membership program boosts user engagement. Meituan's scale gives it a solid cost advantage.

| Cash Cow Aspect | Key Data (2024) | Impact |

|---|---|---|

| Core Local Commerce Revenue | 74% of Total Revenue | Significant and stable income. |

| Active Merchants | 14.5 million (Q4) | Steady commission income stream. |

| Advertising Revenue | Billions of Yuan | Adds to profitability. |

Dogs

Meituan's Kuailv, its B2B restaurant supply chain, struggles with growth and profitability. This business faces stiff competition, potentially draining resources without substantial gains. In 2024, Kuailv's contribution to overall revenue remains modest. A restructuring or even divestiture could be considered to curb further losses.

Meituan's small loan services face regulatory and risk management challenges. This segment might be a "dog" due to underperformance. A strategic review is needed. In 2024, financial regulations tightened, impacting such services.

Before restructuring, Meituan's new initiatives, like Meituan Youxuan, were unprofitable. These ventures, especially in community group buying, significantly impacted overall profitability. Despite some narrowing of losses, these initiatives still drain resources. As of Q3 2023, Meituan's operating loss was RMB 4.9 billion. A clear path to profitability is crucial.

Lower-Tier Market Expansion (unprofitable segments)

Meituan's foray into lower-tier markets, while extensive, reveals some unprofitable segments. These areas may struggle with lower order values and tougher competition. Addressing these challenges requires a focused strategy to improve performance. In 2024, Meituan's initiatives in these markets saw varied success.

- Lower-tier markets can have order values 20-30% lower than higher-tier cities.

- Competition in these areas includes local players, intensifying price wars.

- Meituan's investments need careful ROI assessment.

- Targeted promotions and optimized logistics are crucial for success.

Power Bank Services

Meituan's power bank rental services, though integrated into its platform, might be struggling to deliver strong returns. This venture likely operates on thin margins, potentially straining resources without significant growth. As of 2024, the power bank rental market faces intense competition, limiting profitability. Considering these factors, it could be classified as a Dog.

- Low-margin business, potentially consuming resources.

- Intense competition in the power bank rental market.

- Strategic overhaul or divestiture may be necessary.

Several Meituan ventures are classified as "Dogs" due to low market share and slow growth. These businesses, including small loan services and some new initiatives, face challenges. Regulatory hurdles and profitability issues hinder their performance.

| Category | Characteristics | Financial Impact (2024 est.) |

|---|---|---|

| Small Loan Services | Regulatory hurdles, risk. | Potential losses due to regulatory fines. |

| New Initiatives (e.g., Youxuan) | Unprofitable, resource-intensive. | Contributed to Q3 operating loss of RMB 4.9B (2023). |

| Power Bank Rentals | Low margins, intense competition. | Revenue stagnation, resource drain. |

Question Marks

Meituan's drone delivery is a Question Mark in its BCG Matrix. The company is investing heavily, securing licenses and running trials to expand its drone delivery service. While the potential for growth is high, the current market share remains low. In 2024, Meituan's drone deliveries covered 19 cities with over 2 million orders. This area requires considerable investment for wider adoption.

Meituan Select, Meituan's community group buying service, has reduced losses, although it still operates at a loss. It holds a smaller market share compared to its competitors. The firm has shifted its focus from market share to profitability by reducing subsidies and increasing prices. Careful monitoring and strategic investment are crucial to assess its long-term sustainability. In Q3 2023, Meituan's new initiatives segment, which includes Meituan Select, saw a revenue increase of 18.4% year-over-year, reaching ¥18.7 billion, but still reported an operating loss.

Meituan's overseas expansion, particularly with Keeta, is currently positioned as a Question Mark. This venture demands substantial investment and confronts stiff competition. Despite a low initial market share, the potential for substantial growth remains high. Meituan aims to establish a strong presence in the Middle East within three years. Success hinges on adept execution and market adaptation. In 2024, Meituan's international revenue was still a small fraction of its total.

AI Capabilities (beyond core logistics)

Meituan is actively expanding its AI capabilities beyond logistics, focusing on consumer insights and merchant support. These efforts aim to enhance efficiency and customer experience. However, their current market share and impact are still developing. These AI initiatives are classified as a Question Mark within the BCG Matrix, needing further development and validation.

- Meituan's R&D spending increased by 20% in 2024, with a significant portion allocated to AI.

- Consumer insights AI aims to personalize recommendations, potentially boosting order frequency, which was up 15% in 2024.

- Merchant support AI focuses on optimizing service and reducing operational costs, aiming to improve the 10% churn rate.

Grocery Retail

Meituan's foray into grocery retail fits squarely within the "Question Mark" quadrant of the BCG Matrix. This is because, in 2024, Meituan is actively investing in new technologies like grocery retail and drone deliveries to expand its services [1, 2]. Grocery retail has significant growth potential, especially in China's rapidly evolving e-commerce market, but currently holds a relatively low market share for Meituan [3]. This necessitates substantial investment to scale operations and capture a larger customer base, representing a high-risk, high-reward scenario.

- Meituan's grocery retail faces strong competition from established players like Alibaba's Freshippo and JD.com's 7FRESH.

- The success of this venture hinges on Meituan's ability to efficiently manage logistics, build brand recognition, and offer competitive pricing.

- Significant capital expenditure is required for infrastructure, technology, and marketing to gain a foothold in this competitive market.

- The outcome is uncertain, as the market share and profitability of Meituan's grocery retail are still developing.

Meituan's AI initiatives, drone deliveries, Keeta, grocery retail, and community group buying services all fall under "Question Marks" due to their low market share and require substantial investments. These ventures, despite high growth potential, face significant competition and uncertainty. Success depends on effective execution, adaptation, and strategic investments. Meituan's R&D spending increased 20% in 2024, with AI being a key focus.

| Venture | Market Share | Investment |

|---|---|---|

| Drone Delivery (2024) | Low, expanding to 19 cities | High, focused expansion |

| Meituan Select | Smaller, focused on profitability | Strategic, reducing subsidies |

| Keeta | Low, international expansion | Substantial, Middle East focus |

| AI Initiatives (2024) | Developing, consumer insights | R&D up 20% |

| Grocery Retail | Low, competitive market | Significant, scaling operations |

BCG Matrix Data Sources

This Meituan BCG Matrix uses financial statements, market analysis, and industry reports for reliable insights.