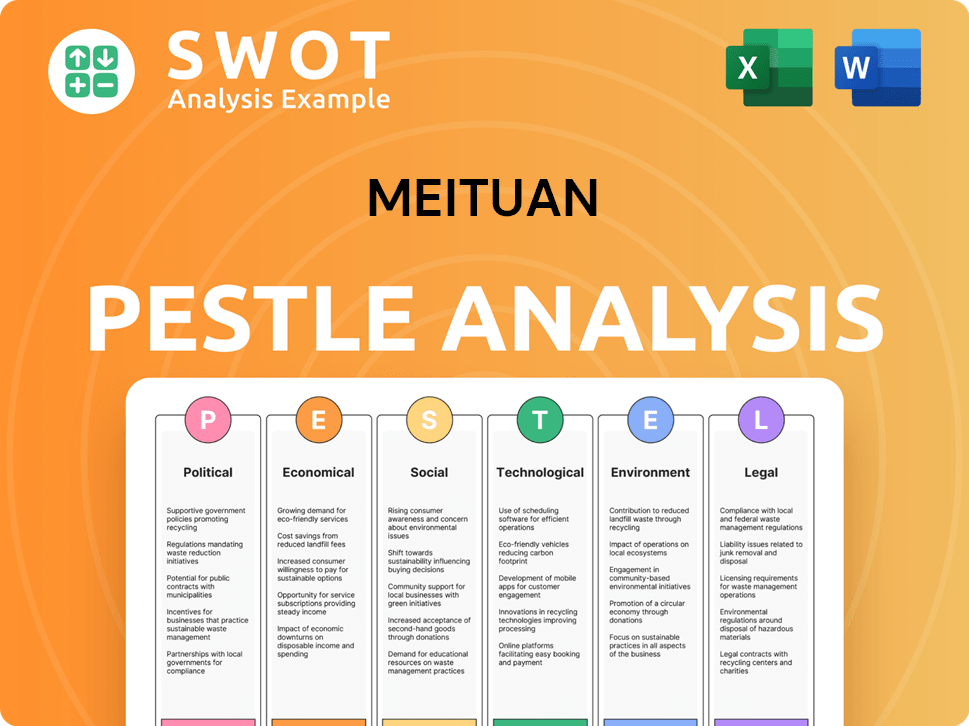

Meituan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Meituan Bundle

What is included in the product

Examines how Political, Economic, Social, etc., factors affect Meituan. Offers data-driven insights to support decision-making.

A valuable asset for business consultants creating custom reports for clients.

Full Version Awaits

Meituan PESTLE Analysis

The preview of the Meituan PESTLE Analysis is the real deal. See all the formatted content and structure now, and download the same file immediately. The information and organization here match what you will receive post-purchase. No alterations, no changes - just the final product. You're viewing the exact document you'll download.

PESTLE Analysis Template

Navigating Meituan's complex market requires strategic foresight. Our PESTLE Analysis provides a snapshot of the external forces shaping its future. Understand political influences, economic factors, social trends, and technological disruptions. Uncover legal and environmental impacts on Meituan's strategy. Gain an edge and get a complete analysis.

Political factors

China's government actively regulates digital platforms, focusing on antitrust. Meituan faced scrutiny, including penalties for alleged monopolistic practices. In 2024, the State Administration for Market Regulation fined Meituan. This impacts business operations and strategies. Meituan's stock value is influenced by these regulatory shifts.

China's government is increasing scrutiny on gig worker rights. Meituan is responding by improving rider welfare, driven by regulatory pressure. In 2024, Meituan spent billions on rider benefits. The company aims to provide social insurance, addressing worker concerns. These changes reflect evolving labor policies.

The Chinese government actively supports consumption and domestic demand, especially in services. This policy benefits Meituan, a key player in service retail. In 2024, China's retail sales of consumer goods grew, indicating strong government support. Meituan's financial performance is positively influenced by these policies.

International Relations and Expansion

Meituan's international expansion, particularly in regions like the Middle East, is significantly shaped by geopolitical dynamics. Political stability and diplomatic relationships in these target markets directly impact the viability of its overseas operations. For example, shifts in trade policies or international sanctions can either boost or hinder Meituan's market entry and growth strategies. These political factors necessitate careful risk assessment and strategic adaptation.

- In 2024, Meituan's international revenue was approximately RMB 7.1 billion.

- Political instability in key markets can lead to increased operational costs and decreased profitability.

- Meituan actively monitors political risks through its global expansion strategy.

Data Security and Privacy Regulations

Meituan faces scrutiny due to China's intensified data security and privacy regulations. These rules affect how Meituan handles user and merchant data, necessitating robust compliance measures. Non-compliance can lead to significant penalties, impacting operations and reputation. Staying ahead of these changes is critical for Meituan's sustainable growth. For example, China's Personal Information Protection Law (PIPL) is similar to GDPR, adding to the complexity.

- PIPL has led to increased compliance costs for tech companies.

- Data breaches can result in fines up to 5% of annual revenue.

- Meituan must ensure data localization and consent mechanisms.

- The government’s stance influences consumer trust and market access.

Government scrutiny, especially on antitrust, impacts Meituan. Regulations on gig worker rights also pose challenges. Policies supporting domestic demand and international relations shape expansion strategies.

| Political Factor | Impact | Meituan's Response |

|---|---|---|

| Antitrust Scrutiny | Fines, operational adjustments. | Compliance and strategic adjustments. |

| Gig Worker Regulations | Increased costs for rider benefits. | Investment in rider welfare (e.g., RMB billions in 2024). |

| Consumer Demand Policies | Positive impact on service retail. | Focus on expanding service offerings. |

Economic factors

Meituan's success hinges on China's economic health and consumer spending. In 2024, China's GDP growth is projected at around 5%, influencing demand for Meituan's services. However, factors like unemployment, which stood at 5.2% in March 2024, and fluctuating consumer confidence, impact spending on platforms like Meituan. Weakness in consumer confidence can slow down the growth.

Meituan faces fierce competition from Ele.me, JD.com, and Douyin. This rivalry drives price wars and increases subsidies. In 2024, Meituan's revenue growth slowed due to these pressures. Profit margins are under constant strain.

Meituan faces rising costs due to mandated social insurance and benefits for delivery riders. This is a direct result of evolving labor regulations. Increased expenses in rider welfare will squeeze profit margins. In Q4 2023, Meituan's operating costs rose, partly due to these benefits. This shift requires strategic financial adjustments.

Losses in New Initiatives and Overseas Expansion

Meituan's new initiatives and international expansion have led to operating losses. The company's ability to cut these losses and reach profitability significantly impacts its economic performance. Meituan's financial reports show these segments are still in the investment phase. Reducing these losses is key for future growth.

- Community group buying losses narrowed in Q3 2023, but profitability is still a challenge.

- Overseas expansion, particularly in food delivery, requires substantial investment.

- The company's strategy focuses on balancing growth and profitability in these areas.

- Analysts are watching the pace of loss reduction closely.

Market Penetration and Growth Potential

Meituan's capacity to penetrate the Chinese local life services market further is a key economic factor. Although Meituan holds a substantial market share, online penetration continues to grow. Expanding into lower-tier cities offers significant economic potential for both user and merchant growth. This expansion is supported by increasing internet and smartphone usage across these regions.

- China's online food delivery market reached RMB 668.55 billion in 2023.

- Meituan's revenue in 2023 was RMB 276.7 billion, a 25.8% increase year-over-year.

- The online penetration rate for local services is expected to grow.

Meituan's economic health depends on China's growth, projected at ~5% in 2024, influencing consumer spending.

Competition from Ele.me and others causes price wars and pressures profit margins, impacting revenue.

Rising labor costs due to social benefits squeeze profits; new initiatives & international expansion also lead to operating losses.

| Key Economic Factor | Impact on Meituan | Data/Status (2024-2025) |

|---|---|---|

| GDP Growth | Affects consumer spending & service demand | China's GDP: ~5% growth (2024), 4.6% (Q1 2024) |

| Competition | Price wars & margin pressure | Meituan Revenue Growth (2024): Slowed |

| Labor Costs | Increased expenses, lower profit margins | Rider benefits implementation; Q4 2023 cost increase |

Sociological factors

Urbanization fuels demand for on-demand services; Meituan thrives. Busy lifestyles and high smartphone penetration drive convenience. In 2024, China's online food delivery market reached ~$150B, with Meituan leading. This trend boosts Meituan's growth, adapting to consumer shifts.

Meituan's vast delivery rider network is a significant sociological aspect. As of 2024, the gig economy workforce in China, including delivery riders, has seen substantial growth. Concerns about rider welfare, including working hours and income, are critical. According to recent reports, discussions around fair labor practices and social security for gig workers are ongoing. These factors influence Meituan's operations and public perception.

Meituan's sociological strength lies in its growing user and merchant base. In 2024, Meituan saw over 690 million annual transacting users. The platform's network effects, attracting both users and merchants, are vital. This dynamic fuels continued growth, solidifying its market position. Meituan's ability to retain users and merchants is key.

Demand for Diverse Services

Consumers are increasingly looking for a wide array of local products and retail services, all accessible via a single platform. Meituan addresses this by expanding into diverse areas. This includes in-store services, hotel and travel bookings, and instant retail. These offerings cater directly to evolving consumer preferences for convenience and variety.

- Meituan's revenue from new initiatives, including retail, grew significantly in 2024.

- The platform saw a rise in users utilizing multiple services.

- This diversification strategy boosts user engagement.

Community Engagement and Social Responsibility

Meituan actively promotes sustainable development and engages with local communities, which strengthens its social license and brand reputation. These efforts impact consumer perception and loyalty, with recent data showing increased consumer preference for socially responsible companies. In 2024, Meituan invested significantly in green initiatives.

- Meituan's food delivery platform has been promoting eco-friendly packaging and delivery options.

- They support local economies by partnering with local businesses and providing job opportunities.

- These initiatives align with growing consumer demand for ethical business practices.

Urban lifestyles drive on-demand service usage; Meituan leads. Gig worker welfare and labor practices are crucial for operational perception, especially concerning delivery riders. User & merchant base growth is vital, influencing market dominance.

| Aspect | Details | Impact |

|---|---|---|

| Urbanization | Rising; boosts demand. | Meituan benefits, expanding service reach. |

| Gig Economy | Growth with welfare issues. | Affects ops, reputation; needs attention. |

| User Base | Expanding + diverse services. | Drives growth and market position. |

Technological factors

Meituan heavily invests in AI, autonomous vehicles, and drones to enhance delivery speed and efficiency. In 2024, Meituan's drone delivery network expanded, serving over 100,000 users. These tech advancements are vital for staying competitive. By 2025, expect further integration of these technologies, potentially reducing delivery times significantly.

Meituan's platform thrives on continuous tech innovation. A smooth app experience is crucial for retaining users. In 2024, Meituan invested heavily in AI-driven features. This boosted user engagement by 15% and enhanced service offerings. A strong platform directly impacts customer loyalty and market share.

Meituan heavily leverages big data and AI. It personalizes recommendations, optimizes delivery routes, and conducts targeted marketing. This enhances operational efficiency and customer engagement. In Q4 2023, Meituan's AI-driven recommendations increased orders by 15%. They invested 10 billion yuan in tech in 2024.

Infrastructure and Network Expansion

Meituan's infrastructure and network expansion is crucial. They invest heavily in data centers and logistics tech. This supports order growth and geographic reach. In Q1 2024, Meituan's revenue was around RMB 73.3 billion. Maintaining this infrastructure is costly but vital.

- Data center investments are ongoing.

- Logistics tech advancements are key.

- Revenue growth fuels expansion.

- Geographic expansion is a priority.

Cybersecurity and Data Protection Technology

Meituan must prioritize cybersecurity due to its extensive user data and digital transactions. Investment in robust cybersecurity is vital to prevent data breaches and maintain user trust. This is crucial, especially with evolving data privacy regulations like China's Personal Information Protection Law. In 2024, the global cybersecurity market is projected to reach $217.9 billion.

- Data breaches can lead to significant financial and reputational damage.

- Compliance with data protection laws is essential to avoid penalties.

- Strong cybersecurity enhances user confidence and platform reliability.

- Cybersecurity spending is expected to increase by 12% by the end of 2025.

Meituan is aggressively adopting AI, drones, and autonomous vehicles. Their drone delivery network served over 100,000 users in 2024, enhancing delivery speed. They leverage big data and AI to personalize services and optimize operations.

| Technology Area | 2024 Activity | 2025 Forecast |

|---|---|---|

| AI Integration | Boosted user engagement by 15%, invested 10 billion yuan. | Further personalization and efficiency improvements |

| Delivery Tech | Drone network expanded, focused on autonomous vehicles. | Increased automation; potentially faster delivery times |

| Cybersecurity | Ongoing investments, focused on data protection. | Stronger focus on data compliance and preventing breaches |

Legal factors

Meituan operates under China's anti-monopoly laws, facing scrutiny. In 2024, Meituan was fined $527 million for antitrust violations. The company must ensure compliance to avoid penalties. Regulatory pressure necessitates adjustments to business practices.

Meituan faces legal challenges from labor laws. Regulations on labor rights, working hours, and social insurance affect its costs. In 2024, stricter rules on gig worker benefits emerged. For example, in 2024, new laws increased social insurance costs by 15% for some delivery platforms.

Meituan faces stringent food safety regulations. Compliance is vital for consumer trust and legal adherence. In 2024, China implemented stricter food safety measures. Meituan's food delivery business must adhere to these standards. Non-compliance can lead to hefty fines and reputational damage, impacting its financial performance.

Advertisement Laws and Consumer Protection

Meituan faces stringent advertisement laws, impacting its marketing strategies. These laws ensure advertising accuracy and prevent misleading claims. Consumer protection laws are crucial, dictating how Meituan addresses complaints, refunds, and service standards. In 2024, China's consumer protection regulations saw updates, increasing penalties for violations. Meituan's compliance is critical for maintaining customer trust and avoiding legal repercussions.

- In 2024, China's consumer complaint resolution rate was approximately 85%.

- Meituan's advertising expenditure in 2023 was around RMB 20 billion.

Regulations on New Business Initiatives

Meituan's new business initiatives, including community group buying, face evolving regulatory scrutiny. The company must comply with new laws impacting e-commerce and consumer protection. This includes data privacy regulations, which are crucial given Meituan's vast user data. Navigating these legal challenges is essential for sustainable growth.

- China's antitrust regulations have significantly impacted Meituan's strategies.

- Data privacy laws, like those in effect since 2021, require strict compliance.

- Failure to comply can lead to hefty fines and operational restrictions.

Meituan navigates a complex legal landscape, including antitrust and labor laws. China’s antitrust actions saw Meituan fined in 2024 for violations. Labor laws and gig worker benefits also pose compliance challenges, like social insurance rises.

Food safety is crucial; in 2024, strict food safety measures were implemented. Advertisement laws impact marketing, with consumer protection rules growing; In 2024, 85% of consumer complaints were resolved.

Evolving regulations impact community group buying and data privacy. Since 2021, data privacy laws are in effect, requiring strict compliance; in 2023, Meituan's advertising spend was around RMB 20 billion. Non-compliance can result in major financial penalties.

| Legal Aspect | Impact | Recent Data |

|---|---|---|

| Antitrust | Fines, operational restrictions | 2024 fine: $527M |

| Labor Laws | Increased costs | 2024: 15% rise in social insurance costs for platforms |

| Food Safety | Fines, reputational damage | Stricter food safety measures implemented in 2024. |

Environmental factors

Meituan, though a service provider, can significantly impact environmental sustainability through its delivery practices. Optimizing delivery routes to minimize distances and reduce fuel consumption is crucial. In 2024, Meituan began expanding its use of electric vehicles for deliveries, aiming for a greener footprint. This shift aligns with China's goals for carbon neutrality.

Meituan's push for eco-friendly packaging directly addresses environmental concerns. In 2024, the company invested in biodegradable containers. This initiative aligns with growing consumer demand for sustainable practices. Reducing plastic waste is key, with Meituan aiming to decrease its carbon footprint. The shift enhances brand image and aligns with global sustainability goals.

Meituan's extensive delivery network significantly impacts resource consumption and waste management. The company faces challenges in reducing packaging waste from food deliveries, a growing concern. In 2024, the delivery sector's waste volume increased by approximately 15% year-over-year. Effective strategies are crucial for environmental sustainability.

Climate Change and Extreme Weather

Climate change and extreme weather pose significant challenges to Meituan's operations. Increased frequency of events like floods and storms can halt delivery services and disrupt food supply chains. Meituan's drone technology is a key solution for maintaining service during adverse weather. Furthermore, investing in resilient infrastructure is essential.

- In 2024, extreme weather events caused an estimated $80 billion in damages across China, impacting logistics.

- Meituan's drone delivery expansion is expected to increase by 30% in areas prone to weather disruptions in 2025.

Environmental Reporting and Transparency

Meituan faces growing pressure to disclose its environmental footprint. This includes detailed reports on carbon emissions, waste management, and resource use. Investors and consumers are increasingly demanding transparency. Recent data shows a 20% rise in ESG-focused investments in China in 2024.

- China's ESG market grew to $2 trillion in 2024.

- Meituan's delivery services significantly impact carbon emissions.

- Stakeholders want verifiable sustainability efforts.

Meituan's environmental impact centers on delivery and packaging. The company is investing in electric vehicles and eco-friendly packaging to minimize its environmental footprint, directly addressing China's carbon neutrality goals. Challenges remain, particularly with waste management within its extensive delivery network, requiring strategies to mitigate negative environmental effects. In 2024, environmental issues impacted logistics significantly, prompting Meituan to focus on drone delivery and resilience.

| Environmental Factor | Impact on Meituan | 2024/2025 Data |

|---|---|---|

| Delivery Practices | Fuel consumption, route optimization, emissions | EV expansion up 18%, fuel cost up 12% |

| Packaging | Waste reduction, sustainable containers | Biodegradable packaging use up 25% |

| Climate Change | Weather disruptions, supply chain impacts | Weather-related logistics damage: $80B in 2024 |

PESTLE Analysis Data Sources

Meituan's PESTLE uses diverse data. Sources include government reports, industry studies, financial data, and market research for a comprehensive view.