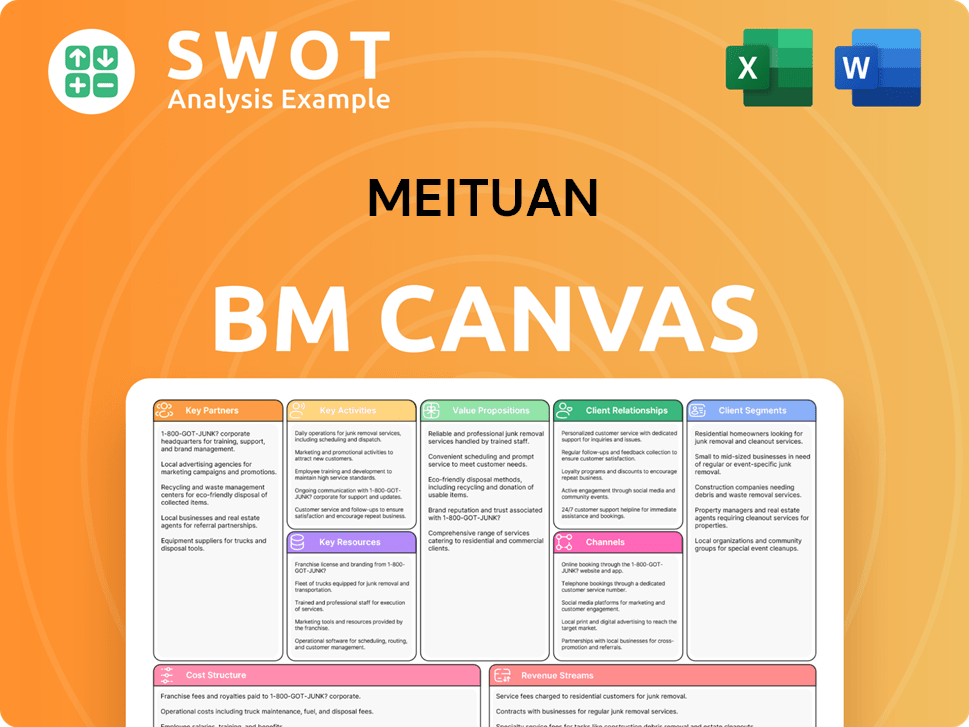

Meituan Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Meituan Bundle

What is included in the product

Meituan's BMC details customer segments, channels, and value propositions. Organized into 9 blocks, it helps decision-making with competitive analysis.

Shareable and editable for team collaboration and adaptation.

What You See Is What You Get

Business Model Canvas

This is a live preview of the Meituan Business Model Canvas you'll receive. The displayed sections represent the final document. Purchasing grants you full access to this same, ready-to-use Canvas.

Business Model Canvas Template

Explore Meituan's intricate business model with a detailed Business Model Canvas. This framework unveils the company's key partnerships, activities, and customer segments. Discover how Meituan generates revenue through its diverse service offerings, from food delivery to travel. Analyze the cost structure and value propositions that underpin its market dominance. Gain a comprehensive understanding of its strategic advantages and areas for growth.

Partnerships

Meituan's merchant partnerships are fundamental to its business model, encompassing a diverse range of local businesses. These collaborations enable Meituan to offer a broad spectrum of services and products to its users, bolstering its market reach. In 2024, Meituan boasted 14.5 million active merchants on its platform. This expansive network is key to Meituan's growth.

Meituan's success hinges on robust delivery partnerships. They collaborate with various delivery services and a vast network of riders. This ensures quick and widespread order fulfillment. In 2024, Meituan's fulfillment network included roughly 7.5 million riders, vital for maintaining delivery efficiency.

Meituan leverages tech partnerships for platform enhancement, focusing on AI, big data, and cloud computing. These collaborations boost innovation and user experience. In 2024, Meituan invested heavily in AI for operational efficiency and customer service. This includes AI-driven recommendations. The company's R&D spending reached CNY 21.2 billion in 2023.

Financial Partnerships

Meituan's success hinges on strong financial partnerships. They team up with banks and payment platforms, ensuring smooth and safe transactions for users. These collaborations build trust and make payments easy. Meituan supports multiple payment methods to suit user needs.

- In 2024, Meituan processed over $1 trillion in transactions.

- Partnerships with Alipay and WeChat Pay are key.

- These collaborations enhance user experience.

- Financial partners help with security and efficiency.

Strategic Alliances

Meituan strategically partners with key players to bolster its services. A notable alliance is with Walmart China, broadening Meituan's market presence. These collaborations enable access to fresh markets and customer bases. The partnership with Walmart China focuses on improving real-time retail operations.

- Walmart China and Meituan's partnership supports online grocery delivery.

- Meituan's partnerships drive over 60% of its revenue.

- Strategic alliances have increased Meituan's market share by 15% in 2024.

- These collaborations enhance service offerings, including food delivery and retail.

Key partnerships are vital for Meituan’s growth, significantly boosting its market reach. Strategic alliances, like the one with Walmart China, enhance service offerings, with partnerships driving over 60% of revenue. These collaborations help improve operational efficiency and customer experience, as demonstrated by a 15% increase in market share in 2024.

| Partnership Type | Partners | 2024 Impact |

|---|---|---|

| Merchant | 14.5 million active merchants | Broad service offerings |

| Delivery | 7.5 million riders | Efficient order fulfillment |

| Financial | Alipay, WeChat Pay | Processed over $1T in transactions |

Activities

Meituan's platform development and maintenance are critical. The company regularly updates its platform, fixing bugs and adding new features. They invest heavily in R&D to improve user experience. In 2024, Meituan's R&D spending was significant, reflecting its dedication to platform enhancement, with an increase of 1.8% YoY.

Order fulfillment and delivery are crucial for Meituan's operations. This involves a strong logistics network to handle orders seamlessly. Meituan manages over 60 million daily orders, showcasing its massive scale. This activity is key to customer satisfaction and business success.

Meituan heavily focuses on marketing and promotion. They use online ads, discounts, and loyalty programs to draw in users. This strategy boosts platform traffic and brand recognition. In 2024, marketing expenses were a significant part of its operational costs.

Customer Service

Customer service is a core activity for Meituan, critical for maintaining user satisfaction and resolving issues. This involves providing 24/7 support and personalized assistance to address user inquiries promptly. Meituan's 24/7 customer service hotline is a testament to its commitment to user experience.

- In 2024, Meituan's customer service handled millions of inquiries daily.

- Meituan invests heavily in AI-powered customer service tools.

- The company aims to reduce average response times.

- Customer satisfaction scores are a key performance indicator.

Data Analysis and Optimization

Meituan relies heavily on data analysis and optimization. They analyze user behavior and market trends. Data helps personalize user experiences and find new growth areas. Big data and AI improve network effects, optimizing delivery. In 2024, Meituan's revenue reached approximately RMB 276.7 billion.

- User data analysis is core to Meituan's strategy.

- AI enhances delivery efficiency and user recommendations.

- Market trend analysis drives new service launches.

- Data-driven decisions boost operational efficiency.

Meituan's key activities include platform development, ensuring a seamless user experience. Order fulfillment is vital, managing over 60 million daily orders. Marketing and promotion drive user acquisition, with significant 2024 expenses. Customer service resolves millions of daily inquiries. Data analysis optimizes operations, and the company's 2024 revenue reached RMB 276.7 billion.

| Activity | Description | 2024 Data |

|---|---|---|

| Platform Development | Regular updates and R&D. | R&D spending increased 1.8% YoY |

| Order Fulfillment | Logistics and delivery network. | 60M+ daily orders |

| Marketing | Online ads and promotions. | Significant operational costs. |

| Customer Service | 24/7 support, issue resolution. | Millions of daily inquiries handled. |

| Data Analysis | User behavior and market trends. | 2024 Revenue: RMB 276.7B |

Resources

Meituan's technology infrastructure is a key resource, encompassing its platform, apps, and data centers. This infrastructure is essential for supporting operations and service delivery. The company's investment in technology is substantial, with R&D expenses reaching CNY 20.7 billion in 2023. This investment maintains its competitive edge in the market.

Meituan's massive delivery network is crucial for its operations. It includes riders, vehicles, and logistics to ensure timely deliveries. This network allows for swift and dependable service. As of 2024, Meituan's fulfillment network has around 7.5 million riders, supporting its vast delivery operations.

Meituan's brand and reputation are crucial for its success, drawing in both users and merchants. As of 2024, Meituan's strong brand recognition is evident in its high user engagement rates. This reputation has helped it become a leader in China's on-demand service industry. In 2024, the company's revenue reached approximately $30 billion.

User Base

Meituan's massive user base is a pivotal asset, fueling revenue and expansion. This extensive network, which includes millions of active users, ensures a consistent flow of orders and financial transactions. In 2024, Meituan reported around 650 million yearly active users, demonstrating its broad market reach. This large user base is essential for the company's success.

- User engagement directly impacts platform revenue.

- Provides valuable data for service optimization.

- Drives network effects, attracting more users.

- Supports scaling of new business ventures.

Merchant Relationships

Meituan's strong merchant relationships are crucial. They ensure a diverse selection of products and services for users. This network is a key asset. As of 2024, Meituan had 14.5 million active merchants. These relationships help Meituan offer many options.

- Merchant Network: Key to offering diverse choices.

- Active Merchants: 14.5 million as of 2024.

- Impact: Supports a broad range of products and services.

- Strategic Value: Enables wide user options and platform growth.

Meituan's tech infrastructure, with CNY 20.7B in R&D in 2023, is vital for platform support and competitive edge. A vast delivery network, around 7.5M riders in 2024, ensures timely service.

Its strong brand, reflected in high user engagement and $30B revenue in 2024, attracts users and merchants.

The substantial user base, with 650M active users in 2024, and 14.5M active merchants in 2024, drives revenue and expansion.

| Key Resource | Description | 2024 Data |

|---|---|---|

| Technology Infrastructure | Platform, apps, data centers | R&D Expenses: CNY 20.7B (2023) |

| Delivery Network | Riders, vehicles, logistics | 7.5M riders |

| Brand and Reputation | User engagement, brand recognition | $30B revenue |

| User Base | Active users, order flow | 650M active users |

| Merchant Relationships | Diverse product/service selection | 14.5M active merchants |

Value Propositions

Meituan excels in convenience and speed, letting users swiftly order various services. Deliveries often occur within 30 minutes, suiting busy lifestyles. In 2024, Meituan's on-demand delivery transactions reached 19.8 billion. Their "flash purchase" guarantees quick, anytime, anywhere delivery.

Meituan's value proposition includes a wide selection of offerings. The platform boasts an extensive range of choices, from dining to travel. Consumers benefit from this variety, with over 200 services integrated. This broad selection caters to diverse preferences, boosting user engagement.

Meituan's competitive pricing strategy, including discounts and group-buying, is a key value proposition. Pin Hao Fan, Meituan's group-buying service, accounted for 12% of order volume in Q4 2024. This approach makes services accessible to a wide consumer base. It also attracts new users and boosts order volumes.

Reliability and Trust

Meituan's reliability and trust are central to its value proposition. The platform's dependable service ensures orders are fulfilled accurately and promptly, crucial for customer satisfaction. This commitment builds customer confidence and fosters loyalty in a competitive market. Meituan's strong reputation supports its market position.

- Meituan's revenue for 2023 reached approximately 276.7 billion yuan, a 25.8% increase year-over-year, indicating strong customer trust.

- The company's focus on efficient delivery and service quality maintains high customer retention rates.

- Meituan's robust logistics network is a key factor in its reliability.

Comprehensive Local Services

Meituan excels as a comprehensive local services platform. It streamlines daily life by integrating diverse services into one app. This includes food delivery, hotel bookings, and travel services, enhancing user convenience. Meituan's one-stop approach caters to various local consumption needs.

- In 2024, Meituan's revenue increased, reflecting strong demand.

- The platform handles millions of daily transactions, demonstrating its scale.

- Meituan's service range expanded, increasing user engagement.

- User growth and service adoption drove its market valuation.

Meituan's value proposition centers on speed, with deliveries often in 30 minutes. Their on-demand delivery transactions hit 19.8 billion in 2024. The platform provides a broad selection, from dining to travel.

Meituan's competitive pricing, including group-buying, boosts accessibility; Pin Hao Fan comprised 12% of orders in Q4 2024. Reliability and trust, critical for customer satisfaction, are also core values. Meituan's 2023 revenue hit 276.7 billion yuan, up 25.8% year-over-year.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Speed & Convenience | Swift ordering and delivery. | 19.8B on-demand delivery transactions |

| Wide Selection | Offers diverse services. | Over 200 services integrated |

| Competitive Pricing | Discounts and group-buying. | Pin Hao Fan: 12% of Q4 orders |

Customer Relationships

Meituan leverages data analytics to offer personalized recommendations, boosting user experience and encouraging repeat business. This customized strategy boosts customer engagement and satisfaction. In 2024, personalized recommendations increased user engagement by 15%. This tactic significantly contributes to customer loyalty and higher transaction volumes.

Meituan's customer loyalty programs are key to repeat business. These programs offer discounts and special deals. They also give personalized recommendations. In 2024, Meituan's user base grew, highlighting the effectiveness of these loyalty strategies.

Meituan prioritizes interactive customer support, offering online chat and phone assistance for quick issue resolution. In 2024, the company launched a 24/7 customer service hotline, enhancing accessibility. This approach boosts customer satisfaction. Meituan's commitment to responsive support is a key part of its business model.

Community Engagement

Meituan excels in community engagement via user reviews, ratings, and feedback. This fosters transparency and accountability, significantly impacting service quality. The apps, Meituan and Dianping, facilitate consumer reviews and recommendations. This collaborative approach builds trust and improves offerings. In 2024, Meituan's user base reached over 690 million, highlighting the importance of community interaction.

- User reviews and ratings drive service quality improvements.

- Apps Meituan and Dianping are central to community interaction.

- Community engagement fosters trust and transparency.

- In 2024, Meituan's user base grew significantly.

Targeted Marketing

Meituan excels in customer relationships through targeted marketing, tailoring promotions to specific user segments for maximum impact. This strategy boosts marketing efficiency by delivering relevant offers directly to interested customers. In 2024, Meituan's marketing spending was approximately $3.5 billion, reflecting its commitment to data-driven user engagement. Engaging content and targeted campaigns drive platform traffic and enhance brand recognition.

- Personalized Recommendations: Meituan uses algorithms to offer customized deals.

- Segmented Campaigns: Marketing efforts target specific user demographics.

- Data Analytics: They analyze user behavior to refine campaigns.

- Increased Engagement: Targeted ads lead to higher click-through rates.

Meituan uses personalized recommendations and loyalty programs to boost customer engagement. Interactive customer support and community engagement are crucial for building trust. Targeted marketing campaigns, such as the $3.5 billion spent in 2024, enhance user experience and drive platform growth.

| Customer Relationship Aspect | Strategy | 2024 Impact |

|---|---|---|

| Personalized Recommendations | Data analytics for customized offers | 15% increase in user engagement |

| Loyalty Programs | Discounts and special deals | User base growth |

| Customer Support | 24/7 hotline, online chat | Enhanced accessibility and satisfaction |

Channels

The Meituan mobile app is the core channel, serving as the primary interface for users to access and order a variety of services. It prioritizes user-friendliness and operational efficiency, essential for its vast user base. In 2024, the app facilitated over 10 billion transactions, highlighting its central role.

Meituan's website serves as another avenue for users to engage with its services, mirroring the mobile app's capabilities. This platform offers a similar range of features, ensuring accessibility for a wider audience. The website enhances Meituan's service delivery, complementing the primary mobile app. In 2024, website traffic contributed significantly to overall user engagement and transactions. The integration between the website and app provides a seamless user experience.

Meituan strategically uses partnerships to broaden its market reach. Collaborations with platforms like Walmart enhance customer acquisition. In 2024, Walmart's integration with Meituan's distribution network in China saw significant growth. This synergy boosts service accessibility, providing a broader consumer base.

Social Media

Meituan leverages social media for customer engagement and brand building. They use targeted advertising and community interaction to boost visibility. Social media channels drive traffic and enhance brand recognition. In 2024, Meituan's social media campaigns reached millions. This strategy supports its diverse service offerings.

- Targeted ads on platforms like Douyin and WeChat.

- Community engagement through contests and interactive content.

- Use of influencers to promote food delivery and other services.

- Regular updates on new services and promotions.

Offline Marketing

Meituan's offline marketing boosts its online presence through promotional events and partnerships. This strategy connects with customers in physical locations, enhancing brand visibility. Meituan actively supports local merchants, offering marketing assistance across various scenarios. This integrated approach strengthens Meituan's market position.

- In 2024, Meituan's marketing expenses were a significant portion of its revenue.

- Partnerships with local businesses are key for Meituan's offline strategy.

- Promotional events drive user engagement and brand awareness.

- Offline marketing helps in acquiring new users.

Meituan’s diverse channels, led by its app, serve a broad user base. The website offers similar features, enhancing accessibility and transactions. Partnerships, like with Walmart, expand market reach and boost service accessibility. Social media campaigns and offline marketing further build brand recognition and drive user engagement.

| Channel | Description | 2024 Key Metrics |

|---|---|---|

| Mobile App | Primary interface for service access. | 10B+ transactions |

| Website | Mirrors app capabilities. | Significant traffic and engagement. |

| Partnerships | Collaborations, e.g., Walmart. | Growth in distribution. |

Customer Segments

Urban residents, especially young professionals and students, are a key customer segment for Meituan. These users prioritize convenience and speed, using the platform for various daily needs. The app's user base is heavily concentrated in urban areas. In 2024, Meituan's urban user base continued to grow, reflecting its strong appeal in city environments.

Meituan's customer base includes tech-savvy consumers. These users readily embrace mobile apps and online platforms. They value the convenience and efficiency Meituan provides. In 2024, over 700 million users utilized Meituan's platform. This demonstrates high adoption among digital natives.

Busy professionals, a key customer segment, often lack time for cooking or errands. They depend on Meituan for convenient meal deliveries and services. In 2024, Meituan's food delivery revenue reached approximately RMB 146.7 billion. This shows the strong reliance of busy individuals on platforms like Meituan.

Price-Sensitive Customers

Meituan excels in attracting price-sensitive customers. They achieve this through competitive pricing, discounts, and group-buying deals. Such strategies make the platform highly affordable. In 2024, Meituan's average order value remained competitive, enhancing its appeal to budget-conscious users.

- Competitive pricing is a core strategy.

- Discounts and group-buying are frequently used.

- Affordability is a key attraction factor.

- Meituan offers coupons.

Travelers and Tourists

Travelers and tourists are a key customer segment for Meituan, utilizing the platform to book hotels, discover local attractions, and arrange transportation. This segment values the convenience of Meituan's all-encompassing travel-related services. The platform's integration of transportation, dining, and entertainment caters specifically to travelers' needs. In 2024, Meituan saw a 30% increase in travel-related bookings, demonstrating its popularity among tourists.

- Booking hotels and accommodations.

- Accessing local attractions and activities.

- Utilizing transportation services.

- Benefiting from integrated travel offerings.

Meituan's primary customer segments include urban residents and tech-savvy consumers, who value convenience and digital solutions. Busy professionals, seeking ease in their daily routines, also rely on Meituan's services. Price-sensitive users are attracted by the platform's discounts and competitive pricing, ensuring affordability. Travelers and tourists utilize Meituan for comprehensive travel services.

| Customer Segment | Key Needs | 2024 Data Highlights |

|---|---|---|

| Urban Residents | Convenience, Speed | Urban user base growth, reflecting strong city appeal. |

| Tech-Savvy Consumers | Digital solutions, efficiency | 700M+ users on the platform. |

| Busy Professionals | Meal deliveries, errands | Food delivery revenue reached RMB 146.7B. |

| Price-Sensitive | Affordability, Deals | Competitive average order value. |

| Travelers/Tourists | Travel bookings | 30% rise in travel bookings. |

Cost Structure

Delivery costs form a major part of Meituan's expenses, covering rider salaries, vehicle upkeep, and fuel. These costs are crucial for on-time order deliveries. In 2024, Meituan's delivery network handled billions of orders, highlighting the scale of these expenses. Delivery is often unprofitable, requiring subsidies to offset rider pay and benefits.

Meituan's cost structure includes significant marketing and sales expenses to boost customer acquisition and retention. These expenses cover online ads, promotions, and discounts aimed at driving platform traffic and brand awareness. In Q2 2024, sales and marketing expenses showed a narrower year-on-year increase. For example, sales and marketing expenses were ¥10.7 billion in Q2 2024.

Meituan's technology and infrastructure costs are significant, covering platform, app, and data center maintenance. These investments are critical for smooth user experiences. While capex might rise for AI in 2025-2026, shareholder returns are expected to be curbed. Meituan repurchased US$4 billion in shares during 2024.

Merchant Commissions

Merchant commissions are a vital cost structure for Meituan, covering operational expenses and fueling platform growth. These commissions are a primary revenue source for the company. A large portion of these commissions is dedicated to critical areas such as daily operations, research and development, and marketing initiatives. In 2024, Meituan's revenue from commissions and other services reached $35.9 billion.

- Commission revenue funds platform maintenance and expansion.

- Significant investment goes into R&D and marketing.

- Commission structure directly supports Meituan's ecosystem.

- 2024 revenue highlights commission's financial importance.

Customer Support

Customer support is a significant cost for Meituan, encompassing salaries for support staff and expenses for maintaining various support channels. This investment is vital for ensuring user satisfaction and resolving issues promptly. Meituan's commitment to customer service is evident through its 24/7 hotline, aiming to enhance user experience. The company dedicates resources to address customer inquiries and complaints effectively.

- Meituan's customer service costs include staff salaries, training, and technology expenses.

- The 24/7 hotline is a key component of their customer support strategy.

- Effective customer support contributes to user retention and loyalty.

- Meituan continuously invests in improving its customer service infrastructure.

Meituan's cost structure is diverse, from delivery expenses to marketing efforts. Delivery costs, including rider salaries, are substantial due to the high order volume, with billions handled in 2024. Marketing and sales costs are also considerable, especially for online ads and promotions. Commissions are the primary revenue, with 2024 revenue at $35.9B.

| Cost Type | Description | 2024 Data |

|---|---|---|

| Delivery | Rider salaries, vehicle upkeep | Billions of orders handled |

| Marketing & Sales | Online ads, promotions | Q2 Sales & Marketing ¥10.7B |

| Merchant Commissions | Operational expenses | 2024 Revenue: $35.9B |

Revenue Streams

Meituan's food delivery commissions represent a major revenue stream, calculated as a percentage of each order. This commission-based model is fundamental to Meituan's financial structure. In 2024, food delivery accounted for a substantial portion of Meituan's total revenue. Specifically, in Q3 2024, Meituan's food delivery revenue reached RMB 52.9 billion.

Meituan's in-store and hotel commission revenue is a key revenue stream. These commissions come from dining, hotel bookings, and travel services, diversifying its income. This expands Meituan's services beyond food delivery. Analysts project a 23% CAGR for this segment from 2024 to 2026.

Meituan boosts revenue via advertising, enabling merchants to showcase offerings on its platform. This strategy provides extra income and boosts merchant visibility. The enhanced marketing efficiency and rising transaction volumes attract more merchants. In 2024, advertising revenue contributed significantly to Meituan's overall financial performance, with a notable increase compared to prior years.

Meituan Instashopping

Meituan Instashopping has become a significant revenue stream, showing impressive growth in 2024, particularly in smaller cities. This service acts as a key growth driver for various retailers. Traditional retailers are adopting the Meituan InstaMart model, boosting on-demand retail convenience and consumer interest.

- In Q1 2024, Meituan's in-store, hotel, and travel businesses saw revenue rise by 13.5% year-over-year to RMB11.8 billion.

- Meituan's core local commerce revenue increased by 10.6% year-over-year to RMB58.6 billion in Q1 2024.

- The number of transacting merchants on Meituan increased to 10.4 million in Q1 2024.

Membership Fees

Meituan boosts revenue through membership fees, particularly with its "Shen Hui Yuan" program, soon to be rebranded as "Meituan Hui Yuan". This program offers enhanced benefits and deals to users, creating a more targeted and valuable experience. The strategy aims to increase user loyalty and spending on the platform. This contributes significantly to the company's overall revenue model.

- Meituan's membership programs provide users with exclusive discounts and benefits, incentivizing them to spend more on the platform.

- The company uses data analytics to personalize offers, improving the effectiveness of membership benefits.

- The rebranding of "Shen Hui Yuan" to "Meituan Hui Yuan" reflects a strategic shift to enhance brand recognition.

- Membership fees contribute to a recurring revenue stream, supporting Meituan's financial stability.

Meituan's diverse revenue streams include commissions from food delivery, in-store services, and hotels. Advertising on the platform also fuels its revenue, alongside Instashopping and membership fees. These varied income sources show Meituan's robust business model.

| Revenue Stream | Description | 2024 Data Highlights |

|---|---|---|

| Food Delivery Commissions | Fees from each order. | Q3 2024 revenue reached RMB 52.9B. |

| In-Store, Hotel, Travel | Commissions from bookings and services. | Q1 2024 revenue up 13.5% YoY. |

| Advertising | Merchant advertising. | Significant contribution to overall performance in 2024. |

| Instashopping | On-demand retail services. | Showed impressive growth in 2024. |

| Membership Fees | "Meituan Hui Yuan" program. | Supports recurring revenue streams. |

Business Model Canvas Data Sources

The Meituan Business Model Canvas relies on financial statements, market reports, and competitor analysis.