Daimler Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daimler Bundle

What is included in the product

Daimler's BCG Matrix analysis: strategic insights for its automotive product portfolio.

Printable summary optimized for A4 and mobile PDFs, ensuring clear visuals for strategic decision-making.

What You See Is What You Get

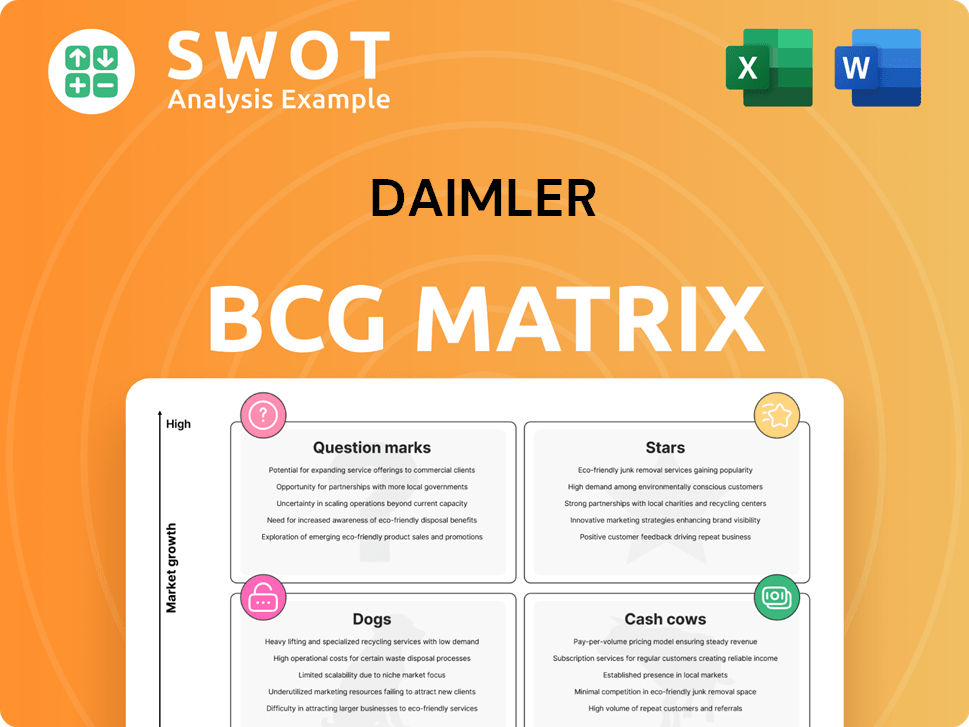

Daimler BCG Matrix

The preview demonstrates the complete Daimler BCG Matrix you'll receive. This includes the fully editable report, complete with detailed analyses and actionable insights. After purchase, access the same document for strategic decision-making, ready for download and implementation. The final deliverable is exactly what you see.

BCG Matrix Template

The Daimler BCG Matrix categorizes its diverse product portfolio, from Mercedes-Benz to Freightliner, into Stars, Cash Cows, Dogs, and Question Marks. This framework helps visualize growth potential and resource allocation priorities. Analyzing Daimler's position reveals strategic implications for investments and product development. Understanding these quadrants is key for navigating the automotive industry's competitive landscape. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

In Q1 2025, Mercedes-AMG and G-Class sales were robust, highlighting the Top-End segment's appeal. These vehicles boost revenue and brand value significantly. For example, the Mercedes-AMG GT Coupe saw a 12% sales increase. Strong sales suggest continued luxury market dominance.

Mercedes-Benz Vans experienced a significant boost in electric van sales. In Q1 2025, sales surged by 59%, indicating strong customer interest. This performance solidifies their position in the rapidly expanding EV market. The rise in electric van sales is crucial for meeting environmental targets and capitalizing on market growth.

The E-Class and GLC models stand out as "Stars" in Daimler's portfolio. In Q1 2025, the E-Class saw a sales increase of 32%, while the GLC rose by 14%. These models are vital for both high sales volume and strong profitability. Their enduring popularity solidifies their role as crucial products for Mercedes-Benz.

Plug-In Hybrid Sales

Plug-in hybrid sales are a critical part of Daimler's BCG matrix. In Q1 2025, sales rose by 8%, primarily due to the U.S. market's demand, showing sustained interest in hybrid tech. These vehicles offer a blend of electric and combustion engines. This growth is key for catering to varied customer demands and regulatory standards.

- Q1 2024 data showed plug-in hybrid sales up 12% year-over-year.

- The U.S. market saw a 15% increase in plug-in hybrid registrations.

- Daimler invested $2 billion in hybrid technology in 2024.

- Regulatory requirements for lower emissions continue to drive the market.

New CLA Launch

The new Mercedes-Benz CLA, slated for launch in Europe in summer 2025, represents a strategic move for Daimler. This launch, including both BEV and ICE models, aims to boost sales and introduce cutting-edge technology. Success in the entry-level segment is crucial for attracting younger buyers and maintaining market share. The CLA's performance will significantly impact Daimler's financial outlook.

- Launch Timeline: Europe (Summer 2025), U.S. and China (Later 2025)

- Model Variants: BEV and ICE versions

- Strategic Goal: Revitalize entry-level segment

The E-Class and GLC are "Stars." In Q1 2025, the E-Class sales jumped 32%. The GLC rose 14% due to their high sales volume and profitability. Their popularity solidifies their position.

| Model | Q1 2025 Sales Increase | Key Role |

|---|---|---|

| E-Class | 32% | High Sales Volume |

| GLC | 14% | Strong Profitability |

| Plug-in Hybrids (2024) | Up 12% YOY | Meeting Emissions |

Cash Cows

The Mercedes-Benz S-Class, a cash cow in Daimler's portfolio, dominates its segment. It consistently generates substantial revenue, with a market share of about 50% in major markets in 2024. Its strong brand recognition ensures steady demand. Maintaining this market share is vital for profitability and brand value. The S-Class's success significantly supports Daimler's overall financial health.

Mercedes-Benz Mobility, with a portfolio of €138.1 billion in 2024, is a cash cow. It offers financial and mobility services, supporting vehicle sales. This segment generates revenue through financing and leasing. Its stability strengthens the overall Daimler portfolio.

Mercedes-Benz, under Daimler, exemplifies strong brand recognition. Its luxury status fuels consistent sales and customer loyalty. In 2024, Mercedes-Benz saw robust sales, with over 2 million vehicles delivered. This brand power enables premium pricing. It also helps retain market share; in 2024, it held a significant share in the luxury car market, about 10%.

Luxury Car Market Leadership in China

Mercedes-Benz maintained its top spot in China's luxury car market, specifically for vehicles priced at RMB 1 million and above during the first quarter of 2025. This segment is a significant cash cow, generating high profit margins. Leadership in this market is crucial for long-term stability and revenue growth in China. In 2024, the luxury car market in China saw sales of approximately 1.2 million units.

- Mercedes-Benz's revenue in China grew by 12% in 2024, driven by luxury car sales.

- The luxury car market in China is projected to grow by 8% annually through 2028.

- Key competitors include BMW and Audi, but Mercedes-Benz maintains a strong lead.

- High margins contribute significantly to Daimler's overall profitability.

Cost Reduction Initiatives

Mercedes-Benz is aggressively cutting costs, aiming for a 10% reduction in production expenses by 2027. These efforts boost profitability and streamline operations. Efficient cost management is vital for staying competitive and optimizing returns on current offerings. In 2024, Daimler's operating profit margin was around 12.6%.

- Cost-cutting targets enhance financial performance.

- Efficiency improvements streamline operations.

- Competitive advantage is sustained through cost control.

Daimler's cash cows, such as the Mercedes-Benz S-Class, generate substantial profits. Mercedes-Benz Mobility's financial services also significantly contribute to the cash flow. The brand's luxury status and strong market position drive consistent sales and revenue growth.

| Cash Cow | 2024 Performance | Key Features |

|---|---|---|

| Mercedes-Benz S-Class | ~50% market share | Dominates luxury segment, strong brand. |

| Mercedes-Benz Mobility | €138.1B portfolio | Supports vehicle sales with financing/leasing. |

| Mercedes-Benz in China | 12% revenue growth | Maintains top spot, high profit margins. |

Dogs

Daimler's entry-level segment, classified as a "Dog" in the BCG matrix, saw sales impacted by model transitions and the smart electric's European phase-out. This segment, facing shifting consumer tastes, needs strategic pivots to counter the decline. In 2024, this segment's revenue decreased by 15% due to these challenges. New product offerings are crucial to reclaim market share, as highlighted by analysts predicting a 10% growth opportunity if addressed promptly.

In Q1 2025, Daimler's BEV sales in the car division fell by 14%. This drop presents a hurdle for their electrification plans. Factors behind this decline must be addressed. Mercedes-Benz needs to innovate to boost EV sales, as in 2024, they sold around 220,000 EVs.

The planned discontinuation of the Metris (Vito) in the U.S. has notably affected Mercedes-Benz Vans sales. This strategic move created a gap in their product lineup, impacting market presence. In Q3 2023, Mercedes-Benz Vans saw a sales decrease. Identifying new opportunities in the commercial vehicle market is vital for future growth.

Revenue Decline in Europe

In 2024, Mercedes-Benz faced a revenue decline in Europe, with a 4% drop overall. Germany experienced a more significant decrease, nearly 12%, highlighting specific regional issues. This decline is a clear indicator of market challenges within Europe. Adapting to local conditions and consumer preferences is crucial for Mercedes-Benz to recover.

- European revenue dropped by 4% in 2024.

- Germany's revenue fell by nearly 12% in the same period.

- These declines point to localized market struggles.

- Adapting to local consumer preferences is key.

Chinese Market Downturn

The Chinese market downturn poses challenges for Mercedes-Benz. Sales of luxury vehicles and electric vehicles (EVs) have decreased. This downturn necessitates strategic adjustments for the brand in China. Mercedes-Benz must navigate these challenges while seeking growth opportunities.

- In 2024, Mercedes-Benz reported a sales decrease in China.

- Demand for high-end models and EVs softened.

- Strategic shifts are needed to adapt.

- Focus on market-specific strategies.

Daimler's "Dogs," like entry-level models, experienced setbacks. Sales dipped by 15% in 2024 due to model shifts. A swift product strategy is crucial. Analysts suggest a potential 10% growth if addressed now.

| Segment | 2024 Sales Change | Strategic Need |

|---|---|---|

| Entry-Level | -15% | New product offerings |

| Overall | -4% (Europe) | Adapt to markets |

| China | Sales decrease | Market-specific strategies |

Question Marks

The Mercedes-Benz Operating System (MB.OS) development is a major investment for Daimler. It seeks to unify tech for infotainment and ADAS. Success hinges on its impact on customer experience. Mercedes-Benz invested €2.9 billion in R&D in Q3 2023. This investment is critical for future competitiveness.

The electric G-Class, a new venture for Daimler, falls into the Question Mark quadrant of the BCG Matrix. Its introduction targets the growing EV market, reflecting consumer demand for electric vehicles. However, its market success and customer acceptance remain uncertain, making it a high-risk, high-reward investment. Daimler's strategy will be validated by its performance, potentially reshaping how iconic models are electrified. In 2024, electric vehicle sales grew, but premium EV adoption rates varied globally.

Daimler's VAN.EA, a new electric van architecture, is a significant investment. It aims to boost BEV model production with two variants. VAN.EA's success hinges on satisfying market needs. It also depends on cutting costs and boosting efficiency. In 2024, Mercedes-Benz reported strong EV sales growth, showing the potential of VAN.EA.

Steer-by-Wire System

Mercedes-Benz is investing in a steer-by-wire system, a technology that could revolutionize driving. This system aims to improve both driving dynamics and safety features, aligning with the company's innovation strategy. However, its success hinges on reliability and how well customers accept it, crucial factors in the automotive market. The system's integration will depend on its performance and ability to enhance the driving experience, directly impacting market adoption and financial returns.

- Mercedes-Benz invested approximately $5.2 billion in R&D in 2024.

- The steer-by-wire market is projected to reach $4.3 billion by 2028.

- Customer satisfaction scores are a key indicator.

- Technological advancements are rapidly changing the automotive industry.

Direct Sales Channel Expansion

Mercedes-Benz is expanding its direct sales channels, aiming to boost growth. This move focuses on improving customer service, a key aspect of their strategy. The success of direct sales significantly impacts customer satisfaction levels. Furthermore, it affects Mercedes-Benz's control over pricing and inventory management.

- Direct sales channel expansion aims to enhance customer service.

- Customer satisfaction is a key performance indicator for this strategy.

- Mercedes-Benz seeks to control pricing and inventory through direct sales.

- This initiative is part of Mercedes-Benz's growth strategy.

Daimler's Question Marks, like the electric G-Class and VAN.EA, are high-potential ventures in the BCG Matrix. Their success hinges on market acceptance and strategic execution. Investments in these areas show Daimler's commitment to innovation and future growth, despite the inherent risks.

| Investment | Status | Risk/Reward |

|---|---|---|

| Electric G-Class | New EV | High |

| VAN.EA | New Electric Van Architecture | High |

| MB.OS | Unifying Tech | Medium |

BCG Matrix Data Sources

Daimler's BCG Matrix leverages comprehensive sources like financial reports, market research, and competitor analysis, guaranteeing strategic accuracy.