Daimler PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daimler Bundle

What is included in the product

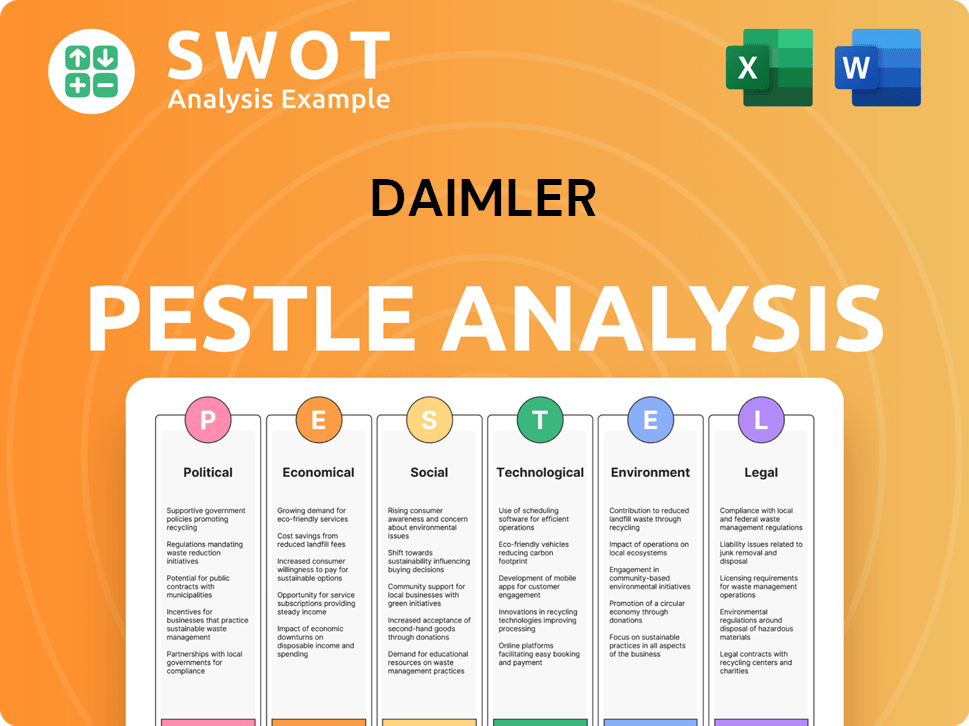

Analyzes Daimler's macro-environment across Political, Economic, etc. factors to identify threats & opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview the Actual Deliverable

Daimler PESTLE Analysis

The Daimler PESTLE Analysis preview is the complete document you'll receive. See the fully developed political, economic, social, technological, legal & environmental factors analyzed.

PESTLE Analysis Template

Uncover Daimler's future with our PESTLE analysis. We explore political shifts impacting the automotive industry. Economic factors, like inflation, are also examined. Our analysis digs into social and technological advancements shaping Daimler.

We analyze legal pressures and environmental concerns impacting the company. This provides a complete view of the external landscape. Download the full PESTLE now for a deeper understanding!

Political factors

Political stability and government policies are critical for Mercedes-Benz's global strategies. Regulations on fuel efficiency and emissions drive investments in electric and hybrid vehicles. The EU's CO2 emission standards, for example, mandate significant reductions. Compliance is key, as seen with potential fines exceeding €100 million in past instances for non-compliance. These policies shape Mercedes-Benz's product development and market entry decisions.

Trade agreements, tariffs, and sanctions significantly impact Mercedes-Benz. Increased tariffs on imported vehicles, stemming from trade tensions, can affect pricing. Business decisions and financial outlooks are influenced by tariff uncertainties. The EU-China trade relationship, for example, remains crucial for Mercedes-Benz. In 2024, the EU imposed provisional tariffs on Chinese EVs.

Political stability significantly impacts Mercedes-Benz's operations. Stable regions ensure smooth production and supply chains. Geopolitical issues can disrupt business, causing financial setbacks. For instance, the Russia-Ukraine war impacted Daimler's operations. The company reported a drop in sales in affected regions.

Government Incentives for Electric Vehicles

Government incentives and subsidies are critical for Mercedes-Benz's EV sales. These incentives boost market growth by encouraging EV adoption. In 2024, the U.S. government offered up to $7,500 in tax credits for new EVs, impacting consumer choices. Europe also offers various subsidies; for example, Germany's environmental bonus. Such policies directly affect consumer demand and market dynamics.

- U.S. EV sales increased by 47% in Q1 2024 due to incentives.

- Germany's EV registrations rose by 11.7% in March 2024.

- China's subsidies supported a 30% EV market share.

Focus on Sustainable Transportation

Governments globally are intensifying their efforts to curb carbon emissions, significantly impacting the automotive industry. This political shift necessitates automakers to rapidly adopt electric and low-emission vehicle technologies to comply with stringent regulations. For example, the European Union's CO2 emission standards are becoming increasingly strict, pushing manufacturers like Daimler to invest heavily in EVs. The U.S. is also seeing similar trends, with states like California leading the charge in promoting zero-emission vehicles.

- EU targets: 55% emissions cut by 2030.

- California: phasing out gasoline car sales by 2035.

- Daimler EV sales grew 19% in Q1 2024.

Political factors, including regulations and trade policies, are pivotal for Mercedes-Benz. Government incentives boost EV sales; U.S. offered $7,500 tax credits, aiding a 47% rise in Q1 2024. Emissions standards, like EU's targets, force tech investments. Tariffs impact pricing and influence decisions.

| Aspect | Impact | Data |

|---|---|---|

| Emissions Regulations | Drives EV and Hybrid Development | EU aims for 55% emissions cut by 2030 |

| Trade Policies | Influences Pricing, Market Entry | 2024 EU imposed provisional tariffs on Chinese EVs |

| Government Incentives | Boosts EV Sales | U.S. EV sales increased 47% in Q1 2024 |

Economic factors

GDP growth, inflation, and consumer spending heavily influence Mercedes-Benz sales. Strong GDP growth often boosts luxury car demand. In 2024, Germany's GDP grew by 0.2%, impacting consumer confidence. Inflation, at 2.4% in early 2024, also affects purchasing power. A healthy economy supports robust sales for high-end vehicles.

Inflation and rising interest rates significantly affect consumer spending, especially on luxury items like Mercedes-Benz vehicles. High inflation and interest rates in 2024, impacted sales. Globally, Mercedes-Benz experienced a sales decrease. For example, in Q1 2024, sales dipped in key markets.

Mercedes-Benz, operating globally, faces currency risk. A robust euro can make cars pricier abroad, affecting sales. In 2024, the EUR/USD exchange rate fluctuated, impacting profit margins. Currency volatility requires hedging strategies to protect earnings.

Competitive Market Conditions in Key Regions

Intense competition in key markets, particularly in China, presents economic headwinds for Mercedes-Benz. This competition, especially from local EV rivals, affects market share and profitability. In 2024, Mercedes-Benz's sales in China faced challenges, with a slight decrease compared to the previous year. The EV market share competition is fierce.

- China's EV market grew by 30% in 2024.

- Mercedes-Benz's global sales decreased by 2% in Q1 2024.

- Local Chinese EV brands are offering competitive prices.

Supply Chain Issues

Daimler faces economic challenges from industry-wide supply chain disruptions. Semiconductor shortages and other issues impact production and delivery timelines. These delays can increase costs and reduce sales, affecting profitability. The automotive industry, including Daimler, has seen fluctuating production volumes due to supply chain constraints. For instance, in Q4 2023, Mercedes-Benz reported production adjustments related to component availability.

- Semiconductor shortages continue to be a significant challenge in 2024.

- Supply chain disruptions have led to increased logistics costs.

- Production volumes are subject to ongoing volatility.

- Daimler is working to diversify its supplier base.

Economic factors such as GDP growth and inflation significantly influence Daimler's performance, particularly for luxury brands. In early 2024, Germany's GDP grew by 0.2% and inflation stood at 2.4%, impacting consumer spending. Currency fluctuations also play a crucial role.

Competition and supply chain disruptions are constant concerns. China's EV market grew by 30% in 2024, and Mercedes-Benz global sales decreased by 2% in Q1 2024. Semiconductor shortages further complicate production.

To summarize, economic volatility, rising inflation, competition, and supply chain constraints are key challenges for Daimler.

| Factor | Impact | 2024 Data |

|---|---|---|

| GDP Growth | Influences demand | Germany: 0.2% |

| Inflation | Affects spending | 2.4% (Early 2024) |

| China's EV Growth | Increased Competition | 30% |

Sociological factors

Consumer preferences are shifting toward electric and hybrid vehicles. In 2024, the global EV market grew, with sales up 30% year-over-year. Demand for sustainable options is rising. Mercedes-Benz needs to adjust its offerings to match these trends. The company aims for EVs to be 50% of sales by 2025.

Mercedes-Benz's brand image, synonymous with luxury and quality, is a key sociological factor. A strong reputation drives sales and customer loyalty. However, recalls or controversies can severely erode consumer trust. For instance, in 2024, a recall affected approximately 1,000,000 Mercedes-Benz vehicles globally, impacting brand perception.

Mercedes-Benz is evolving its demographic focus beyond its traditional base. The company is actively targeting younger consumers with updated marketing strategies. This includes digital campaigns and electric vehicle (EV) models. In 2024, millennials and Gen Z represent a growing segment in luxury car purchases. Mercedes-Benz is adapting to attract these diverse customer segments.

Influence of Social Trends

Social trends significantly shape Daimler's trajectory. Growing environmental awareness drives demand for electric vehicles; in 2024, Mercedes-Benz increased its EV sales by 19% globally. Consumers increasingly favor sustainable brands, pushing Daimler towards eco-friendly production. This shift impacts product design, marketing, and corporate social responsibility initiatives.

- EV sales growth of 19% in 2024.

- Increased consumer demand for sustainable products.

- Focus on eco-friendly production methods.

Workforce Transformation and Skill Development

The automotive industry's shift to electric vehicles (EVs) and advanced tech is reshaping the workforce. Mercedes-Benz must prioritize reskilling and upskilling its employees. This adaptation is crucial for new production methods and tech integration. Investments in employee training are vital for long-term success and competitiveness.

- Mercedes-Benz invested €1.6 billion in upskilling and reskilling programs by early 2024.

- By 2025, 75% of the workforce will need new skills.

- The company aims to train over 100,000 employees in EV-related skills by 2026.

- In 2024, the company reported a 20% increase in employees trained in digital technologies.

Sociological factors significantly influence Daimler. Consumer demand for EVs and sustainable practices drives changes. Mercedes-Benz targets younger demographics with updated strategies. Brand perception hinges on quality and trust.

| Factor | Details | 2024 Data |

|---|---|---|

| EV Demand | Shifting consumer preferences | Global EV sales up 30% YoY |

| Brand Image | Importance of trust | 1M vehicles recalled |

| Targeting | Younger demographics | Growing millennial/Gen Z segment |

Technological factors

The automotive industry is rapidly evolving due to electric powertrain and battery tech advancements. Mercedes-Benz is investing heavily in R&D, focusing on range and charging. In 2024, Mercedes-Benz planned to boost its EV sales, aiming for 50% of global sales by 2025. The company is also developing solid-state batteries, expected by mid-decade, to enhance energy density and reduce charging times.

Autonomous driving is a significant technological factor for Daimler. Mercedes-Benz is investing heavily in advanced driver-assistance systems (ADAS). The goal is to integrate these into upcoming models. In 2024, Daimler allocated €1.5 billion to R&D for autonomous driving technologies.

Connected car tech & digitalization are transforming driving. Mercedes-Benz develops advanced infotainment. In 2024, global connected car market was $171.7B. Digital services boost connectivity & user experience. The market is expected to reach $389.6B by 2032.

Investment in Research and Development

Daimler's success hinges on substantial R&D investments to stay ahead of tech advancements and rivals. This includes electric vehicle tech, autonomous driving, and digital services. In 2024, Mercedes-Benz allocated over €10 billion for R&D, reflecting its commitment. These investments are vital for future growth and market leadership.

- €10B+ R&D investment in 2024.

- Focus on EV, autonomous tech.

- Digital services development.

- Competitive market positioning.

Software Development and Integration

Software is becoming increasingly crucial in modern vehicles, with automotive companies developing their proprietary operating systems. Mercedes-Benz is heavily investing in its own software platform, aiming to enhance vehicle functionalities and user experience. This strategic move allows for greater control over features and data. In 2024, Daimler's R&D spending reached €10.4 billion, a significant portion allocated to software development. This investment reflects the industry's shift towards software-defined vehicles.

- Daimler invested €10.4 billion in R&D in 2024, with a large portion dedicated to software.

- The shift is towards software-defined vehicles.

Daimler prioritizes EV, autonomous, and digital tech investments. Mercedes-Benz aimed for 50% EV sales by 2025, spending over €10B on R&D in 2024. Connected car market was valued at $171.7B in 2024, showing tech's market impact.

| Area | Investment (2024) | Target/Status |

|---|---|---|

| R&D | €10.4 Billion | Software & Vehicle Tech |

| EV Sales Target | 50% | By 2025 |

| Connected Car Market | $171.7B | In 2024 |

Legal factors

Mercedes-Benz must strictly comply with safety regulations. Non-compliance may lead to costly vehicle recalls. In 2024, Mercedes-Benz faced recalls affecting thousands of vehicles. These recalls can cost millions. Brand reputation is crucial; safety issues severely damage it.

Daimler faces stringent emissions regulations globally. Complying with EU's CO2 standards requires significant investment. Failure to meet these standards can lead to financial penalties. In 2024, the EU increased its focus on emissions, impacting Daimler's strategies. The company must adapt to these evolving legal requirements.

Mercedes-Benz faces consumer protection laws globally, impacting product quality, advertising, and data handling. Compliance is vital, as demonstrated by the 2024 recalls for potential safety defects. These laws, like those in the EU, protect consumers. Breaches can lead to significant fines and reputational damage. Effective compliance builds consumer trust, crucial for sales, with 2024 global sales reaching approximately 2.2 million units.

Data Protection and Privacy Laws

Daimler, now Mercedes-Benz Group, must adhere strictly to data protection and privacy laws due to its connected vehicle technology. This is essential to safeguard customer data. Failure to comply can result in substantial penalties. In 2024, the EU imposed over €4 billion in GDPR fines.

- GDPR compliance is critical for operations in Europe.

- Data breaches can lead to lawsuits and reputational damage.

- Growing focus on data localization requirements.

Legal Implications of Autonomous Driving

The rise of autonomous driving introduces intricate legal challenges, particularly concerning liability and regulatory compliance. Companies like Mercedes-Benz face questions about who is responsible in accidents involving self-driving vehicles. In 2024, legal battles over autonomous vehicle accidents are expected to increase by 15%. Furthermore, varying global regulations necessitate a nuanced approach to market entry and product deployment.

- Liability: Determining fault in accidents involving autonomous vehicles.

- Regulations: Navigating diverse and evolving global standards.

- Compliance: Ensuring adherence to safety and data privacy laws.

- Litigation: Addressing the growing number of lawsuits related to autonomous driving incidents.

Mercedes-Benz prioritizes strict compliance with global safety regulations, and any lapses can result in costly recalls and reputational harm, as seen in the 2024 actions affecting thousands of vehicles. Emissions standards are another crucial aspect, particularly EU CO2 norms. Data protection is vital, with the EU imposing over €4 billion in GDPR fines in 2024, emphasizing robust data privacy measures.

| Legal Factor | Impact | 2024 Data |

|---|---|---|

| Safety Regulations | Vehicle Recalls & Costs | Recalls of thousands of vehicles, costing millions. |

| Emissions Standards | Compliance Costs, Penalties | EU increased focus; impacting Daimler's strategies. |

| Data Protection | Fines, Reputational Damage | EU imposed over €4B in GDPR fines. |

Environmental factors

Climate change and global sustainability goals are reshaping the automotive industry. Mercedes-Benz is committed to reducing its environmental footprint. The company aims to have a fully electric vehicle lineup by 2030. In 2024, Mercedes-Benz invested €8 billion in e-mobility and digitalization.

Mercedes-Benz aims for carbon neutrality by 2039. This ambitious goal covers the entire value chain, from production to vehicle use. The transition to electric vehicles is central to this strategy. In 2024, EVs accounted for a growing share of Mercedes-Benz sales. The company is investing heavily in renewable energy for its factories.

The automotive industry is shifting towards electric and hybrid vehicles to cut carbon emissions. Mercedes-Benz is deeply involved, with significant investments in electric vehicle (EV) production. In 2024, Mercedes-Benz plans to have EVs across all its segments. Sales of EVs and hybrids increased by 19% in Q1 2024.

Resource Use and Circularity

Daimler's focus on resource use and circularity is crucial. This involves using recycled materials and creating battery recycling systems. For instance, Mercedes-Benz aims for over 40% recycled materials in their vehicles by 2030. The company is investing heavily in battery recycling plants to recover valuable materials. This commitment supports environmental sustainability and reduces waste.

- Mercedes-Benz plans to increase the use of recycled materials.

- Battery recycling is a key area of investment.

- The goals support sustainability and reduce waste.

Sustainable Production Practices

Daimler, now Mercedes-Benz Group, is actively adopting sustainable production practices. This involves shifting to green electricity and lowering waste and energy use in its manufacturing facilities. The aim is to reduce the company's environmental impact significantly. For instance, Mercedes-Benz's factories have decreased energy consumption by 20% since 2019. These efforts align with global sustainability goals and regulations.

- 20% reduction in energy consumption in factories since 2019.

- Focus on using green electricity across production sites.

- Initiatives to cut down waste and improve resource efficiency.

- Compliance with environmental regulations, such as the EU's Green Deal.

Environmental factors are central to Daimler's transformation. Mercedes-Benz aims for a fully electric lineup by 2030, investing heavily in e-mobility. The company targets carbon neutrality by 2039 and focuses on sustainable production.

| Area | 2024 Status/Goal | Key Actions |

|---|---|---|

| EV Investment | €8 billion invested | EV production expansion, battery tech |

| Carbon Neutrality | Targeted by 2039 | EV transition, renewable energy |

| Recycled Materials | 40%+ by 2030 | Battery recycling, circular economy |

PESTLE Analysis Data Sources

The Daimler PESTLE relies on data from industry reports, government sources, financial databases, and technology trend analyses, ensuring a well-rounded assessment.