Facebook Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Facebook Bundle

What is included in the product

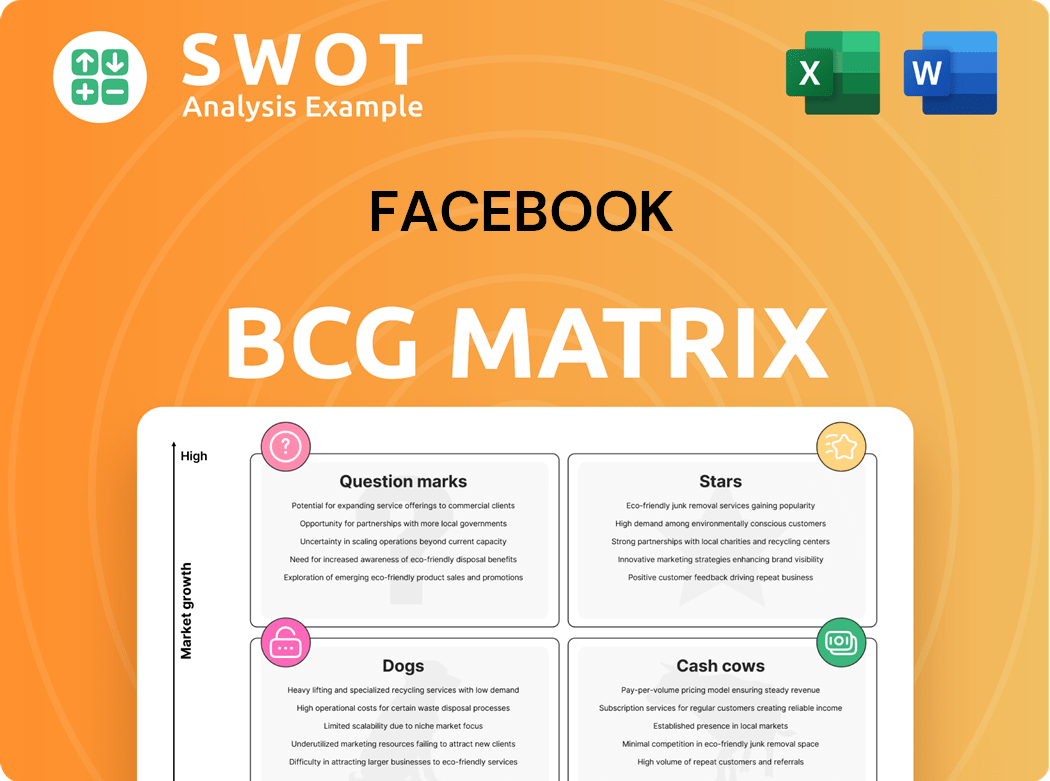

Facebook's BCG Matrix analyzes product units as Stars, Cash Cows, Question Marks, and Dogs, with strategic recommendations.

One-page overview placing each business unit in a quadrant.

What You See Is What You Get

Facebook BCG Matrix

The Facebook BCG Matrix you're viewing is the exact document you'll receive upon purchase. Ready to download immediately, this fully formatted report offers strategic insights without any hidden content or watermarks. It’s designed for professional use, right from your download.

BCG Matrix Template

Facebook's BCG Matrix helps understand its diverse offerings. This analysis categorizes products by market share and growth rate. See which are Stars, Cash Cows, Dogs, or Question Marks.

This glimpse is just the surface. Uncover detailed quadrant placements and strategic recommendations. Get the full BCG Matrix report now for actionable insights.

Stars

Instagram shines as a Star in Meta's portfolio, boasting high growth and a vast user base. Its success is fueled by visual content, influencer marketing, and e-commerce integration. In 2024, Instagram generated approximately $60 billion in ad revenue, with over 2.35 billion monthly active users.

Meta's AI initiatives are a shining star, fueled by significant investments. Generative AI and recommendation algorithms are boosting user engagement. In 2024, Meta invested billions in AI, seeing a 20% rise in ad revenue due to improved targeting. Prioritizing AI is crucial for future growth.

Meta's advertising business is a "Star" in its BCG Matrix, a major revenue source. Its huge user base and advanced ad targeting are key. Meta excels at delivering personalized ads to billions, attracting marketers. In Q4 2023, advertising revenue hit $38.7 billion, up 24% YoY. Innovation in ads is vital for continued growth.

Threads

Threads, Meta's text-based conversation app, has shown promising user adoption since its July 2023 debut. Its connection with Instagram boosts user acquisition and engagement within Meta's ecosystem. However, its impact on overall financial results is still evolving, with monetization strategies being developed. Differentiating itself through novel features is crucial for sustainable growth.

- Launched in July 2023, Threads quickly reached millions of users.

- Integration with Instagram is a key driver of user acquisition.

- Monetization strategies are still under development.

- Unique features are essential for market differentiation.

Video Content

Video content is a star for Facebook, driving user engagement and ad revenue. Meta heavily invests in video, offering diverse formats like Reels and Facebook Watch. This strategy is vital for staying competitive in the video market. Continued growth depends on video production tools and partnerships.

- In Q4 2023, Meta's advertising revenue reached $40.4 billion, with video playing a crucial role.

- Facebook's Reels are a significant contributor to this revenue, with over 140 billion plays per day as of Q4 2023.

- Meta is investing heavily in AI to enhance video content and recommendations.

- Partnerships with content creators are key to attracting and retaining users.

Stars in Meta's BCG Matrix show strong growth potential with high market share. They require significant investment to maintain their position. Success hinges on innovation and capturing market opportunities. These businesses are key revenue drivers.

| Star Business | Key Metrics | 2024 Data |

|---|---|---|

| Ad Revenue | $60B | |

| Meta's AI | Ad Revenue Increase | 20% |

| Advertising Business | Q4 2023 Revenue | $38.7B (+24% YoY) |

Cash Cows

Facebook, a cash cow, has billions of users. In Q4 2023, Meta's ad revenue hit $38.7 billion. Although growth has slowed, it still leads in social media. Meta should prioritize user retention and ad efficiency.

WhatsApp, a cash cow for Meta, boasts over 2.7 billion monthly active users globally. Its strong user base and high engagement offer significant monetization opportunities. In 2024, WhatsApp's revenue grew, driven by its business API and advertising initiatives. Meta should leverage these strengths for further growth.

Messenger, integrated with Facebook, is a cash cow. It boasts a massive user base, crucial for Meta's value. In 2024, Messenger had over 1 billion monthly active users, generating significant ad revenue. Meta should focus on feature upgrades and platform integration to maximize its financial contributions.

Facebook Marketplace

Facebook Marketplace is a cash cow due to its large user base and integration with Facebook. It facilitates billions of dollars in transactions annually, leveraging Facebook's existing infrastructure. This creates a convenient and trusted e-commerce environment for its users. Continued focus on safety and features will sustain its growth.

- In 2024, Facebook Marketplace had over 1 billion monthly active users.

- Facebook's revenue from Marketplace is estimated at several billion dollars annually.

- The platform hosts millions of listings daily, driving high engagement.

Data and Analytics

Meta's strength lies in its unparalleled data and analytics, a cornerstone of its "Cash Cows" status. This trove of user data allows for highly personalized experiences and targeted advertising, driving revenue. However, maintaining user trust is crucial, especially given the evolving landscape of data privacy regulations. In 2024, Meta's advertising revenue accounted for a significant portion of its total revenue.

- Meta's advertising revenue in 2024 was approximately $134.9 billion.

- Daily Active Users (DAU) on Facebook in Q4 2024 reached 2.96 billion.

- Meta's investment in AI and data infrastructure in 2024 was over $40 billion.

Facebook Marketplace is a significant cash cow for Meta, leveraging its vast user base and integrated infrastructure. In 2024, it had over 1 billion monthly active users, facilitating billions in transactions. Focusing on safety and features is key to sustaining its growth and revenue.

| Metric | 2023 | 2024 (Estimate) |

|---|---|---|

| Monthly Active Users (B) | 0.9 | 1.1 |

| Estimated Revenue (Billion $) | $2.5 | $3.0 |

| Transactions (Billion $) | $50+ | $60+ |

Dogs

Facebook Watch, Meta's video streaming service, hasn't taken off. Despite content investments, it competes with YouTube and Netflix. In Q3 2023, Meta's "Family of Apps" revenue, which includes Facebook, was $33.04 billion, showing the pressure. Consider divesting or changing its strategy.

Oculus, Meta's VR hardware, is a question mark in its BCG matrix. VR adoption remains slow, with high costs and limited uses. In Q3 2023, Reality Labs, including Oculus, saw a $3.7 billion operating loss. Meta needs cheaper, more accessible VR devices and new applications to boost demand.

Meta's metaverse, a "dog" in the BCG matrix, struggles for traction. User adoption remains low, hindering growth. In 2024, Reality Labs, focused on the metaverse, lost billions. Meta needs to reassess its strategy and investment pace. Consider pivoting or reducing spending until the market stabilizes.

Cryptocurrency Projects (e.g., Diem)

Meta's past crypto ventures, like Diem, stumbled due to regulatory issues and lack of user adoption. These projects faced considerable skepticism, hindering their progress. Given the challenges, Meta should steer clear of similar cryptocurrency projects. Instead, it should concentrate on its primary business areas.

- Diem's failure cost Meta over $200 million.

- Regulatory scrutiny remains a major obstacle for crypto projects.

- Focusing on core business aligns with investor expectations.

Standalone Apps with Limited Traction

Meta's standalone apps, like Threads, represent "Dogs" in its BCG Matrix due to their limited impact. These apps struggle to attract users, often lacking a distinct advantage over established platforms. For instance, despite initial hype, Threads' daily active users (DAU) are significantly lower than Instagram's, indicating a failure to gain traction. Meta needs to re-evaluate these underperforming apps, potentially shutting them down to focus resources effectively.

- Threads' DAU is substantially less than Instagram's.

- These apps struggle to gain a competitive edge.

- Meta should consider closing underperforming apps.

- Lack of clear value proposition.

Standalone apps like Threads are "Dogs". They lack impact and struggle for users. Threads' DAU is much lower than Instagram's. Meta may close these underperforming apps.

| Metric | Threads | |

|---|---|---|

| DAU (Millions) | ~10 (2023) | ~500+ (2024) |

| Value Proposition | Limited | Strong |

| Meta's Strategy | Re-evaluate/Close | Maintain/Invest |

Question Marks

Meta's AI-powered smart glasses are a "question mark" in the BCG matrix, representing high growth potential but uncertain market share. They could redefine how we interact with technology, offering hands-free access and augmented reality. However, adoption hinges on overcoming tech hurdles and privacy concerns. Meta's investment and innovation are crucial for success.

Meta's Llama AI model, an open-source large language model, sparks interest. Its applications are broad, but long-term impact is unclear. Meta should invest in Llama and explore commercialization. In 2024, Meta's AI investments reached $30 billion, signaling commitment. Further development could boost returns.

Meta's AI assistant functions as a question-answering and task-performing virtual helper. It's integrated into Meta's platforms for a smooth user experience. To compete, Meta must enhance its AI and broaden its availability. In 2024, Meta invested significantly in AI, allocating billions to research and development.

Monetization of WhatsApp Business

Meta is actively seeking to monetize WhatsApp Business, aiming to generate revenue from its vast user base. This involves charging businesses for premium features and services, a strategic move to leverage the platform's popularity. The success of this monetization hinges on providing tangible value to businesses, ensuring they see a return on investment. A key challenge is balancing revenue generation with user experience, avoiding actions that could drive away businesses or customers.

- WhatsApp Business had over 200 million monthly active users in 2024.

- Meta's revenue from WhatsApp could reach billions annually by 2026.

- Pricing strategies will be crucial for adoption and revenue.

- Offering valuable features like advanced analytics and CRM integration.

Expansion into New Markets (e.g., AI Data Centers)

Meta's strategic move into new markets, particularly AI data centers, is a core element of its growth strategy. These investments support its ambitious AI plans, which are critical for future innovation. However, these ventures come with notable risks, including high capital expenditures and the potential for technological obsolescence. In 2024, Meta is expected to allocate a significant portion of its budget to these areas, reflecting its commitment to AI.

- Meta's capital expenditures are projected to increase significantly in 2024, driven by investments in AI infrastructure.

- The success of these ventures is crucial for Meta's long-term competitiveness in the tech industry.

- Meta must carefully assess the ROI and manage the associated risks to ensure profitability.

- The AI data center market is highly competitive, requiring Meta to differentiate itself effectively.

Meta's AI assistant is a "question mark" due to uncertain market impact and high development costs.

Its success hinges on user adoption and tech enhancements. Meta's 2024 AI investments are substantial, signaling a focused approach.

The long-term return remains speculative, but Meta aims to integrate it into multiple platforms for a smooth experience.

| Metric | 2024 | Details |

|---|---|---|

| AI Investment | $30B | Meta's significant AI commitment. |

| User Base | Billions | Meta platform reach. |

| Market Position | Uncertain | AI assistant's long-term viability. |

BCG Matrix Data Sources

Facebook's BCG Matrix utilizes public financial data, social media statistics, and market analysis to provide comprehensive category insights.