Facebook PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Facebook Bundle

What is included in the product

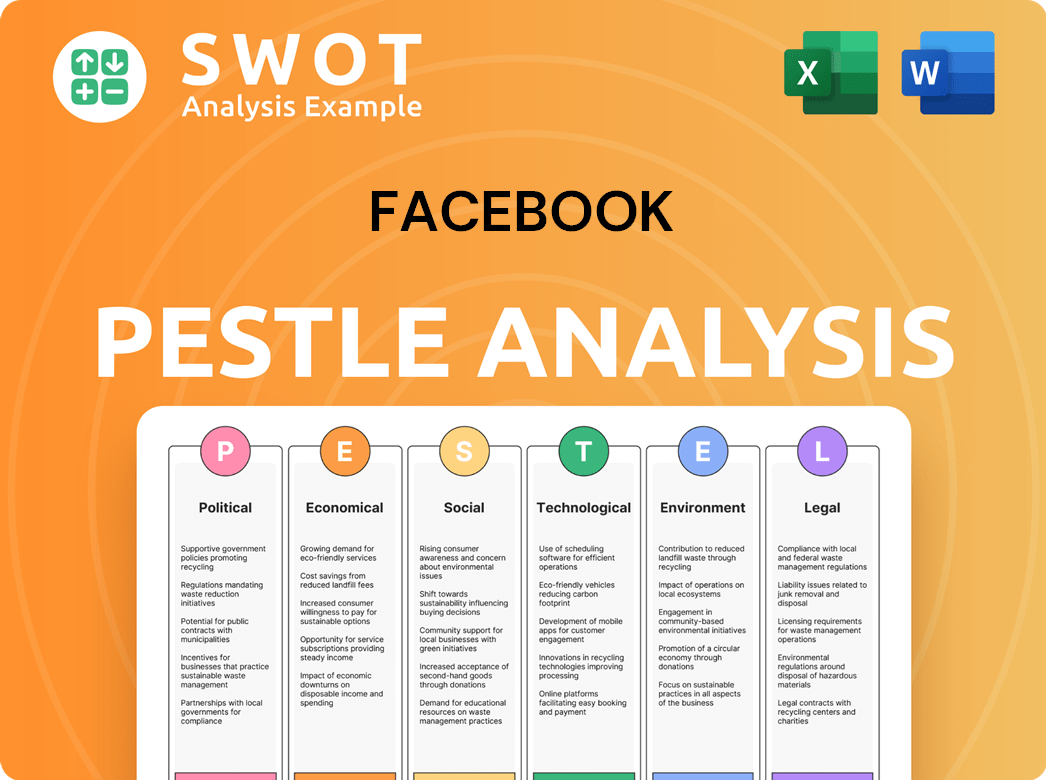

Analyzes how external forces impact Facebook, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

Helps support risk discussions, so Facebook stakeholders can better plan future strategies.

Preview Before You Purchase

Facebook PESTLE Analysis

This preview showcases the complete Facebook PESTLE Analysis you'll receive. It details the political, economic, social, technological, legal, and environmental factors. The information provided is comprehensive, accurate, and ready to be utilized. You'll get this very document right after purchasing.

PESTLE Analysis Template

Uncover the external forces impacting Facebook's strategy. Explore the political landscape, economic trends, and social shifts shaping its future. Understand technological advancements and the legal environment influencing the platform. Gain valuable insights into regulatory challenges and market opportunities. Make informed decisions using our expert-level PESTLE Analysis—perfect for staying ahead. Download now for a comprehensive understanding of Facebook's external environment.

Political factors

Meta encounters political hurdles due to global government regulations. Data privacy and content moderation are under scrutiny, especially in the EU and US. Antitrust concerns and potential monopolistic practices also pose challenges. These factors can significantly affect Meta's operations and financial performance. For example, in 2024, Meta faced a $700 million fine in the EU over data privacy issues.

Meta's content moderation policies face constant political pressure, especially during elections. The company has been criticized for not doing enough to combat misinformation and hate speech, as well as for perceived bias. Policy shifts can significantly affect user trust and the platform's role in political discussions. In 2024, over 70% of Americans get their news from social media, highlighting its political importance.

Geopolitical instability impacts Meta's global market access. Varying political climates lead to censorship or restrictions. For example, in 2024, Meta faced challenges in certain regions due to political tensions. These actions limit Meta's reach and business prospects.

Political Advertising Regulations

Political advertising regulations on platforms like Facebook are constantly changing. These rules aim to make political ads more transparent and combat misinformation, especially during election cycles. Facebook has implemented various measures, including verifying advertisers and disclosing who pays for political ads. The Federal Election Commission (FEC) is also actively involved in regulating online political advertising. These regulations can impact the types of ads allowed and the targeting capabilities available to advertisers.

- In 2023, Facebook spent $1.3 billion on lobbying, which is the most ever.

- The FEC has proposed new rules for online political ads, including clarifying disclosure requirements.

- Facebook's Ad Library provides data on political ads, including spending and reach.

Government Demands for Data Access

Governments globally can demand user data access from Facebook for security or law enforcement, sparking political tension and privacy concerns. This can lead to clashes with privacy laws and public outcry, as seen in various international cases. Facebook must navigate these demands while protecting user data and maintaining compliance. Facebook's transparency reports detail government data requests, with over 200,000 requests in the first half of 2024.

- Data requests are increasing each year.

- Facebook must balance legal compliance and user privacy.

- Public perception can be negatively impacted by data access issues.

- International laws and regulations vary widely.

Meta faces regulatory challenges globally, notably in data privacy and antitrust, with a $700 million EU fine in 2024. Content moderation faces constant pressure, especially during elections; over 70% of Americans get their news from social media. Political advertising regulations are always changing, and Facebook spent $1.3B on lobbying in 2023.

| Aspect | Impact | Examples |

|---|---|---|

| Data Privacy | Regulatory Fines, Legal Battles | $700M EU fine in 2024, 200,000+ data requests (H1 2024) |

| Content Moderation | User Trust, Political Influence | Combating Misinformation, Policy shifts affect discussion |

| Political Ads | Transparency, Targeting Changes | FEC Regulations, Ad Library data |

Economic factors

Meta heavily relies on advertising revenue, its primary income stream. Economic downturns directly affect advertising spending, potentially shrinking Meta's profits. In Q1 2024, advertising revenue accounted for $36.5 billion, a 27% increase year-over-year. During economic uncertainty, businesses often cut advertising budgets, impacting Meta's revenue.

Global economic conditions significantly impact Meta. Economic stability, inflation, and currency exchange rates directly affect its revenue. For instance, a strong dollar in 2024/2025 can hurt international sales. Rising inflation may increase advertising costs. Currency fluctuations can shift reported earnings.

Meta's substantial investments in AI and the metaverse are capital-intensive. The company allocated over $30 billion to Reality Labs in 2023. These investments are critical for future growth, but their economic success hinges on ROI. The metaverse market is projected to reach $473.7 billion by 2030.

Competition in the Digital Advertising Market

Meta encounters fierce competition in digital advertising. Rivals like Google and Amazon vie for ad revenue, influencing pricing and market share. In Q4 2023, Google's ad revenue was $65.5 billion, while Meta's was $38.7 billion. This competition pressures Meta's profitability.

- Google's ad revenue in Q4 2023: $65.5B

- Meta's ad revenue in Q4 2023: $38.7B

User Growth and Engagement

User growth and engagement are pivotal economic factors for Meta. Increased daily and monthly active users (DAUs/MAUs) fuel ad impressions, directly boosting revenue. In Q1 2024, Facebook's DAUs hit 2.06 billion. This growth is linked to Meta's economic expansion.

- Facebook's Q1 2024 MAUs: 3.09 billion.

- Instagram's ad revenue is a significant revenue contributor.

Economic factors, such as advertising revenue fluctuations and global economic stability, profoundly influence Meta's financial performance. The company’s advertising income directly ties into economic health; a downturn can squeeze profit. Competitors like Google and Amazon intensify the pressure to retain revenue and market share.

| Metric | Q1 2024 Data | Impact |

|---|---|---|

| Advertising Revenue | $36.5B, up 27% YoY | Strong performance reflects economic health; decline indicates stress |

| Facebook DAUs | 2.06 billion | User growth supports ad revenue. |

| Meta's ad revenue in Q4 2023 | $38.7B | Competition impacts the results. |

Sociological factors

Social media's impact on user behavior is constantly evolving. Short-form video content is surging, with platforms like TikTok and Instagram Reels seeing massive growth; about 60% of users now prefer this format. This shift influences how Facebook engages users and how effective its advertising is. In 2024, Facebook's ad revenue hit $134.9 billion, showing its sustained influence despite changing consumption patterns.

Meta's user base demographics are key for content and ads. As of Q1 2024, Facebook's daily active users (DAU) were 2.06 billion. Gender and geographic distribution heavily influence ad targeting. Understanding these shifts informs strategic decisions.

Societal concerns about social media's effect on mental health are growing. A 2024 study showed a 15% rise in reported anxiety among heavy social media users. This pressure prompts demands for platform adjustments or stricter oversight. Increased awareness of these issues drives public discourse and influences policy decisions.

Role in Social and Political Movements

Meta's platforms are crucial for social and political movements, shaping public opinion, yet they also carry risks. They facilitate rapid information sharing, enabling organization and mobilization. However, misinformation and echo chambers can amplify societal divisions. The 2024 US election cycle saw significant use of Meta's platforms for both campaigning and spreading disinformation, impacting voter behavior. This dual nature presents complex challenges for Meta and society.

- 2024: Over 70% of US adults get news from social media.

- 2024: Misinformation on social media increased by 20% during election periods.

- Meta's political ad revenue in 2024 is projected to reach $10 billion.

Cultural Norms and Content Acceptability

Cultural norms significantly shape content acceptability on Meta's platforms, necessitating region-specific moderation. For example, content deemed acceptable in the U.S. might violate norms in India or China. Meta employs diverse content moderation strategies to navigate these differences. In 2024, the company's spending on content moderation was approximately $16 billion.

- Content moderation costs: $16 billion (2024).

- User base globally: 3.98 billion (Q1 2024).

- Daily active users: 3.19 billion (Q1 2024).

Growing concerns over social media's impact on mental health shape platform use; anxiety is up 15% for heavy users. Meta's platforms are crucial for political movements, yet misinformation also rises, increasing by 20% during elections. Cultural norms require diverse content moderation; the company spends $16 billion annually on moderation.

| Factor | Details | 2024 Data |

|---|---|---|

| Mental Health | Anxiety rise | 15% increase reported |

| Misinformation | Increase during elections | 20% rise in misinformation |

| Content Moderation | Costs | $16 billion annual spend |

Technological factors

Meta is significantly investing in AI, allocating billions to enhance user experience and ad targeting. In Q1 2024, Meta's capital expenditures were $6.8 billion, much of which fuels AI advancements. AI drives the evolution of their platforms and the metaverse. This includes AI-powered content recommendations, improving ad performance by 20% in 2024.

Meta is heavily invested in the metaverse and AR/VR technologies. As of Q1 2024, Reality Labs, Meta's AR/VR division, reported a revenue of $440 million, showing growth potential. This development is vital for Meta's future, moving beyond social media. It's a long-term strategy. The company's investments in these areas totaled $4.6 billion in Q1 2024.

Facebook, now Meta, heavily relies on data centers. Its need for infrastructure supports its platforms and AI. Meta invested $37 billion in capital expenditures in 2023. This included data centers. This requires continuous tech upgrades.

Technological Competition and Innovation Pace

Technological factors significantly influence Facebook's market position. The company faces relentless competition, with firms like TikTok and X (formerly Twitter) constantly innovating and vying for user attention and advertising revenue. Staying ahead requires continuous investment in research and development, with Meta spending $39.4 billion on R&D in 2023. This includes advancements in AI, virtual reality, and the metaverse to maintain its competitive edge.

- Meta's R&D spending in 2023 was $39.4 billion.

- TikTok's global ad revenue is projected to reach $23.3 billion in 2024.

Data Privacy and Security Technologies

Data privacy and security technologies are crucial for Facebook to protect user data, especially with rising concerns about breaches. The company invests heavily in these technologies, spending billions annually on security. In 2024, Facebook's parent company, Meta, allocated approximately $40 billion to security and safety. Robust measures are needed to comply with evolving regulations like GDPR and CCPA.

- Meta's 2024 security spending: ~$40B.

- Data breaches cost the industry billions yearly.

- GDPR and CCPA are key data privacy regulations.

- User trust hinges on data protection.

Meta’s technology strategy heavily focuses on AI, spending billions in 2024. R&D investments were $39.4 billion in 2023. Data security and privacy remain crucial, with $40 billion allocated for safety.

| Factor | Impact | Data (2023/2024) |

|---|---|---|

| AI & Metaverse | Enhanced user experience, innovation | R&D $39.4B (2023), AI Ad Improvement: ~20% (2024) |

| Infrastructure | Supports platforms & AI | Capital Expenditures $37B (2023) |

| Data Privacy & Security | Maintains trust & complies | Security Spending ~$40B (2024) |

Legal factors

Meta faces stringent data privacy regulations worldwide, including GDPR and CCPA. Non-compliance can lead to hefty penalties, such as the €1.2 billion fine imposed by the EU in 2023. Navigating these laws is essential. This ensures the company maintains its operational integrity.

Meta faces ongoing antitrust scrutiny. The FTC is examining its acquisitions of Instagram and WhatsApp. In 2024, the EU fined Meta $1.3 billion for data misuse. Legal battles continue, impacting Meta's market control.

Legal frameworks concerning user-generated content liability and harmful material distribution on platforms like Facebook are constantly changing, creating potential legal issues for Meta. Recent legislation and court decisions worldwide are reshaping how platforms are held accountable for content moderation. For instance, the Digital Services Act in the EU sets new standards for content moderation and platform responsibility. In 2024, Meta faced legal challenges in various jurisdictions related to content liability, with potential fines and operational restrictions.

Intellectual Property Rights

Intellectual property rights are crucial for Meta. They constantly defend their innovations. In 2024, Meta faced 1,000+ IP infringement cases. They invest heavily in legal teams and technology. This includes AI-powered tools to detect and prevent copyright violations, costing them $500 million annually.

- Meta spends over $500M annually on IP protection.

- They faced 1,000+ IP infringement cases in 2024.

International Legal and Regulatory Landscape

Operating globally subjects Meta to a complex array of international laws and regulations. Compliance is crucial in diverse legal environments. Meta faces scrutiny regarding data privacy, content moderation, and antitrust issues across different jurisdictions. The company must adapt to varying legal standards, such as GDPR in Europe. Failure to comply can result in hefty fines and reputational damage.

- In 2023, Meta faced a $1.3 billion fine from the EU for data transfer violations.

- GDPR compliance costs for Meta are estimated to be in the billions annually.

- Antitrust investigations are ongoing in the US and EU, potentially impacting Meta's market position.

Meta battles strict data privacy rules globally, facing heavy fines for non-compliance, such as the €1.2 billion EU fine in 2023. Antitrust scrutiny remains a key issue, with ongoing investigations affecting its market position. Ongoing legal frameworks challenge user-generated content liability and require adapting to varied international laws.

| Legal Issue | Impact | Data |

|---|---|---|

| Data Privacy | Heavy Fines, Compliance Costs | GDPR fines, estimated billions in compliance costs annually |

| Antitrust | Market Position Impact | Ongoing investigations in US, EU. |

| Content Liability | Fines, Operational Restrictions | Content moderation challenges. Digital Services Act standards. |

Environmental factors

Meta's data centers consume significant energy, impacting its environmental footprint. In 2024, data centers accounted for about 2% of global electricity use. Meta is investing in renewable energy and energy efficiency. By 2024, Meta aimed to achieve net-zero emissions for its value chain. The company is making progress towards its sustainability goals.

Meta's data centers are water-intensive for cooling. In 2024, Meta aimed to restore more water than it used in certain areas. The company's water usage data is crucial for assessing its environmental impact. Meta invested in water restoration projects to meet its water positive goals.

Facebook's hardware, like VR headsets, adds to electronic waste (e-waste). Globally, e-waste generation hit 62 million tons in 2022, a 82% increase since 2010. Only 22.3% was recycled properly. Improper disposal harms the environment and human health. The e-waste market is projected to reach $100 billion by 2032.

Supply Chain Environmental Impact

Meta's supply chain, especially hardware manufacturing, faces growing environmental scrutiny. The company is pressured to reduce its carbon footprint and waste. Meta's sustainability reports highlight these challenges. They aim to improve resource efficiency across their operations.

- Meta aims for net-zero emissions across its value chain by 2030.

- In 2023, Meta reported a carbon footprint of 1.8 million metric tons of CO2e from its operations.

- Meta is investing in renewable energy to power its data centers and offices.

Commitment to Net Zero Emissions

Meta is dedicated to achieving net zero emissions. This involves substantial investments in renewable energy and emission reduction projects. The company's commitment aligns with global efforts to combat climate change, influencing its operational strategies. Meta's environmental goals are integral to its long-term sustainability and brand reputation. This includes partnerships and technological advancements.

- Meta achieved net-zero emissions for its global operations in 2020.

- In 2023, Meta invested over $1 billion in renewable energy projects.

- Meta aims to achieve net-zero emissions across its entire value chain by 2030.

Meta's environmental footprint stems from energy consumption, water usage, and e-waste, significantly impacting its sustainability profile. Data centers' electricity use represents a key area for environmental efforts, as they consume considerable energy globally, in 2024 about 2%. The company's sustainability initiatives are crucial. Addressing challenges across its operations and supply chain enhances environmental strategy.

| Aspect | Details | 2024/2025 Goals/Data |

|---|---|---|

| Energy Use | Data centers and offices | Meta aims for net-zero emissions in its operations. Invested over $1 billion in renewable projects by 2023. |

| Water Usage | Data centers | Target is to restore more water than used in specific regions. |

| E-waste | Hardware like VR headsets | Address e-waste issue that is about to hit $100 billion by 2032 in recycling market. |

PESTLE Analysis Data Sources

The analysis uses diverse data: financial reports, technology trend forecasts, regulatory updates, and market research to inform Facebook's macro-environmental factors.