Michelin Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Michelin Group Bundle

What is included in the product

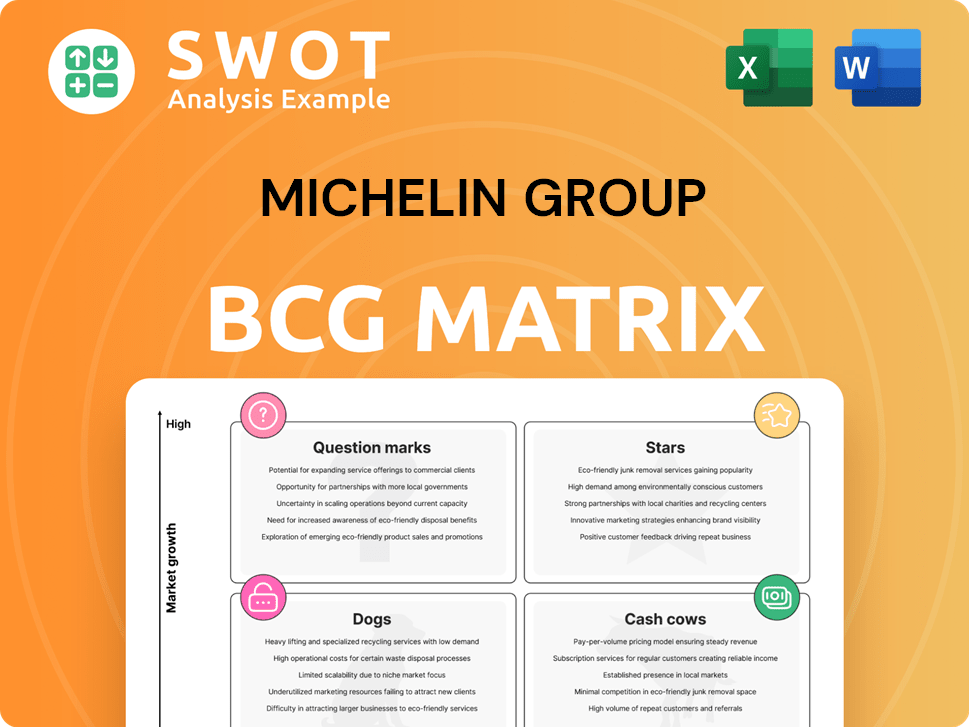

Analysis of Michelin's tire business using BCG Matrix. Covers Stars, Cash Cows, Question Marks, and Dogs.

Clean, distraction-free view optimized for C-level presentation. Focus on strategy, not visual overload.

Full Transparency, Always

Michelin Group BCG Matrix

The Michelin Group BCG Matrix displayed here is the same complete document you will receive after purchasing. This is the final, fully functional version without any additional steps. Download the ready-to-use report for immediate strategic implementation.

BCG Matrix Template

Michelin, a titan in the tire industry, presents a fascinating case for BCG Matrix analysis. Their diverse product portfolio, from tires to travel services, creates a complex strategic landscape. Understanding which offerings are "Stars," "Cash Cows," or "Dogs" is critical for investment decisions.

This preview offers a glimpse into their potential quadrant placements and strategic challenges. Analyzing their market share versus growth rate illuminates valuable insights for Michelin.

This sneak peek gives you a taste, but the full BCG Matrix delivers deep, data-rich analysis, strategic recommendations, and ready-to-present formats—all crafted for business impact.

Stars

Michelin's high-performance tires, especially 18-inch+ ones, are stars. They boast strong sales and market share. This taps into the rising demand for bigger tires in cars and light trucks. In 2024, the high-performance tire market grew by 7%, reflecting strong consumer interest. Continuous innovation here is key for Michelin.

The aircraft tire segment is growing, fueled by more air travel. Michelin's strong market position boosts revenue. For instance, in 2024, the aviation industry saw a 10% rise in passenger numbers globally. Innovation and partnerships can strengthen its presence.

Michelin's mining tire sales are bouncing back, fueled by ore market expansion and metal demand. In 2024, the mining tire segment showed positive signs of recovery. Focusing on core market strength and navigating short-term challenges, like inventory adjustments, is key. This strategic approach aims for consistent growth in this specific area.

Connected Fleet Solutions

Michelin's Connected Fleet Solutions is a Star, experiencing robust structural growth. The company aims for a 15% annual growth rate by 2030 in this sector. These solutions use data to improve fleet safety, performance, and environmental impact. Continued investment is expected to boost revenue significantly.

- Projected annual growth rate of 15% by 2030.

- Focus on fleet safety, operational performance, and environmental impact.

- Leverages data from connected objects.

- Expectation of significant revenue increase through expansion.

Sustainable Tire Initiatives

Michelin’s dedication to sustainable tire initiatives places it in the Stars quadrant of the BCG Matrix. This involves developing tires with recycled and bio-based materials, setting it apart in eco-friendly manufacturing. The company is targeting 40% renewable and recyclable materials in its tires by 2030, and 100% by 2050. These innovations appeal to both environmentally aware consumers and investors.

- Michelin's investment in sustainable materials is driven by the growing demand for eco-friendly products.

- The company’s strategy includes partnerships to advance recycling technologies and secure sustainable raw materials.

- Michelin’s financial reports highlight investments in research and development for sustainable tire technologies.

- By 2024, Michelin has already launched several tire models using sustainable materials, like the e.PRIMACY tire.

Stars are Michelin's shining assets, showing strong market growth and share. High-performance tires and Connected Fleet Solutions are prime examples. Sustainable tire initiatives also place Michelin in the Stars quadrant. By 2024, eco-friendly tires are a key focus.

| Segment | Growth Rate (2024) | Key Focus |

|---|---|---|

| High-Performance Tires | 7% | Innovation, demand |

| Connected Fleet Solutions | 15% (Target by 2030) | Data-driven solutions |

| Sustainable Tires | Increasing | Eco-friendly materials |

Cash Cows

The passenger car and light truck tire replacement market is a cash cow for Michelin, offering consistent revenue. This market is more stable compared to the original equipment (OE) segment. Michelin leverages its strong brand reputation to maintain market share. In 2024, the global tire market was valued at $200 billion.

Michelin's brand remains a robust cash cow, synonymous with quality and innovation. In 2024, Michelin's revenue was around €28.3 billion, demonstrating its market strength. Marketing and consistent product excellence are key to upholding this strong brand image. Leveraging this reputation helps boost sales across various tire lines and services.

Michelin's road transportation tire segment, including commercial truck tires, is recovering, with operating margins improving. A value-based approach and product enhancement are key. Continued focus ensures sustained profitability. In 2024, Michelin reported €14.2 billion in sales for its road transportation segment.

European Kleber Brand

The European KLEBER brand, part of the Michelin Group, showcases strong sales growth, signaling its cash cow status. Its market positioning and continued expansion drive stable returns, with a focus on product offerings. This strategic approach aims to solidify its market presence and profitability. In 2024, KLEBER's revenue increased by 7%, underlining its growth potential.

- Strong Sales Growth: KLEBER brand's performance.

- Market Positioning: Focus on brand image and consumer needs.

- Product Offerings: Expanding the range to meet consumer demands.

- Revenue Increase: Achieved a 7% rise in 2024.

Michelin Guide

The Michelin Guide is a valuable cash cow for the Michelin Group, significantly boosting its premium brand image. Despite its limited direct revenue, the guide plays a crucial role in driving tire sales by enhancing brand recognition. Expansion into new markets and continued investment are key to maximizing its influence. In 2024, the guide's digital reach and influence grew substantially.

- Brand Value: The Michelin brand is valued at several billion euros, with the guide contributing significantly to this.

- Global Presence: The guide is present in over 40 countries, with plans to expand further.

- Digital Growth: Digital platforms and partnerships have increased the guide's accessibility and impact.

Michelin's passenger car tire market and brand recognition serve as cash cows. The road transportation segment also provides stable revenue streams. These segments showed significant growth in 2024.

| Category | Segment | 2024 Revenue (Approx.) |

|---|---|---|

| Cash Cow | Passenger Car Tires | €14B |

| Cash Cow | Michelin Brand Value | €XXB |

| Cash Cow | Road Transportation | €14.2B |

Dogs

Michelin's OE tire sales face headwinds, especially in Europe and North America. Declines in automotive, truck, agriculture, and construction sectors are impacting volumes. In Q3 2023, Michelin's automotive OE sales dropped, reflecting market downturns. Strategic focus shifts to value-added segments to mitigate the impact.

Michelin's specialty tires, like those for agriculture and construction, face OE market dips. Mining tires see headwinds too. In 2024, OE tire sales dipped, impacting this segment. Diversification into other areas is key, as seen with increased focus on sustainable materials.

Polymer Composite Solutions sales saw a slight dip amid economic uncertainty, signaling a potential challenge. Focusing on belts and high-tech seals for vital industrial uses can help retain revenue. Adapting to shifting market needs and economic changes is key. In 2024, Michelin reported a slight decrease in overall sales volume.

Operations in Sri Lanka

Michelin's 2024 decision to sell its Sri Lanka plants to CEAT Group reflects a strategic shift. This move helps Michelin optimize its manufacturing network. The divestiture of underperforming assets allows for resource reallocation.

- CEAT Group acquired Michelin's operations.

- Michelin aims to focus on more profitable areas.

- The sale streamlines Michelin's global presence.

- Financial details of the transaction were not disclosed.

Chinese Tire Market

Michelin's presence in the Chinese tire market is categorized as a "Dog" in the BCG matrix due to sluggish demand and a small market share. This segment demands significant investment and strategic adjustments. To improve performance, Michelin must deeply understand local consumer preferences. This includes adapting product offerings and marketing strategies.

- In 2024, China's automotive market showed a mixed performance, with some segments experiencing growth while others faced challenges.

- Michelin's sales in the Asia region, including China, were impacted by these market dynamics.

- The company has been focusing on electric vehicle (EV) tire sales, which represent a growing segment in China.

- Michelin has been investing in R&D and local partnerships to better address the Chinese market's specific needs.

Michelin's "Dog" status in China reflects low market share and slow growth. This segment demands significant investments and strategic shifts to improve performance. Adapting to local consumer preferences is crucial for improvement.

| Category | Data (2024) |

|---|---|

| Market Share (China) | Below Average |

| Sales Growth (China) | Slow |

| Strategic Focus | Local Adaptation |

Question Marks

Michelin's UPTIS (Unique Puncture-proof Tire System) is in the question mark quadrant of the BCG matrix. This innovative airless tire, developed with General Motors, faces market uncertainties. While offering puncture resistance, its high production cost is a challenge. Michelin's revenue in 2024 was €28.3 billion, showing the company's resources to develop UPTIS.

Michelin's Tire-as-a-Service (TaaS) is positioned as a question mark within the BCG matrix. This model, still developing, shows potential for high growth, especially in the fleet market. Michelin aims to boost TaaS by highlighting cost savings; for instance, a 2024 study showed a 7% reduction in tire-related expenses for fleets using TaaS. Operational benefits, like optimized tire management, are also key.

Michelin's digital mobility services, like fleet management, are Question Marks in its BCG Matrix. These services need more investment to grow. Data analytics and integration with existing offers are crucial. In 2024, the connected fleet market was valued at $25.8 billion, showing potential for Michelin.

Bio-based Butadiene Production (BioButterfly)

The BioButterfly project, a Michelin Group initiative, focuses on bio-based butadiene production, placing it in the Question Mark quadrant of the BCG matrix. This involves innovative sustainable materials, but commercialization and scaling up are still in progress. The project is focused on optimizing production and securing partnerships to enhance its viability.

- By 2024, the global butadiene market was valued at approximately $20 billion.

- BioButterfly aims to produce butadiene from bio-based sources, potentially reducing reliance on fossil fuels.

- The project's success depends on technological advancements and cost-effectiveness.

- Key challenges include scaling up production and securing partnerships.

Tires from Recycled Plastics

Michelin's initiative to produce tires from recycled plastics represents a "Question Mark" in its BCG matrix. This venture holds potential but faces hurdles in terms of performance and cost, requiring ongoing research and development. Market acceptance hinges on scaling up the use of recycled materials and effectively communicating their benefits to consumers. Addressing technical challenges and ensuring environmental sustainability are crucial for this initiative's success.

- Michelin aims to have 40% sustainable materials in its tires by 2030.

- The global recycled plastics market is projected to reach $53.7 billion by 2028.

- Challenges include maintaining tire performance and competitive pricing.

- Sustainability efforts align with growing consumer demand for eco-friendly products.

Michelin's "Question Marks" in the BCG matrix are characterized by high market potential but uncertain outcomes. These include UPTIS, TaaS, digital services, BioButterfly, and recycled plastics initiatives.

The company is investing to overcome challenges like high costs and technological hurdles. Successful outcomes could drive significant revenue and enhance Michelin’s sustainable profile.

Focusing on innovation, strategic partnerships, and cost-effectiveness is vital for these projects to succeed and transition into more profitable categories.

| Initiative | Description | Challenges |

|---|---|---|

| UPTIS | Airless tires | High production costs |

| TaaS | Tire-as-a-Service | Market adoption |

| Digital Services | Fleet management | Investment needed |

BCG Matrix Data Sources

Michelin's BCG Matrix leverages financial reports, market share data, and industry analysis, plus expert assessments, for accurate product portfolio insights.