Michelin Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Michelin Group Bundle

What is included in the product

Examines competitive forces, buyer power, and market entry risks, tailored for Michelin.

Customize pressure levels based on changing market dynamics, ensuring precise strategic adjustments.

What You See Is What You Get

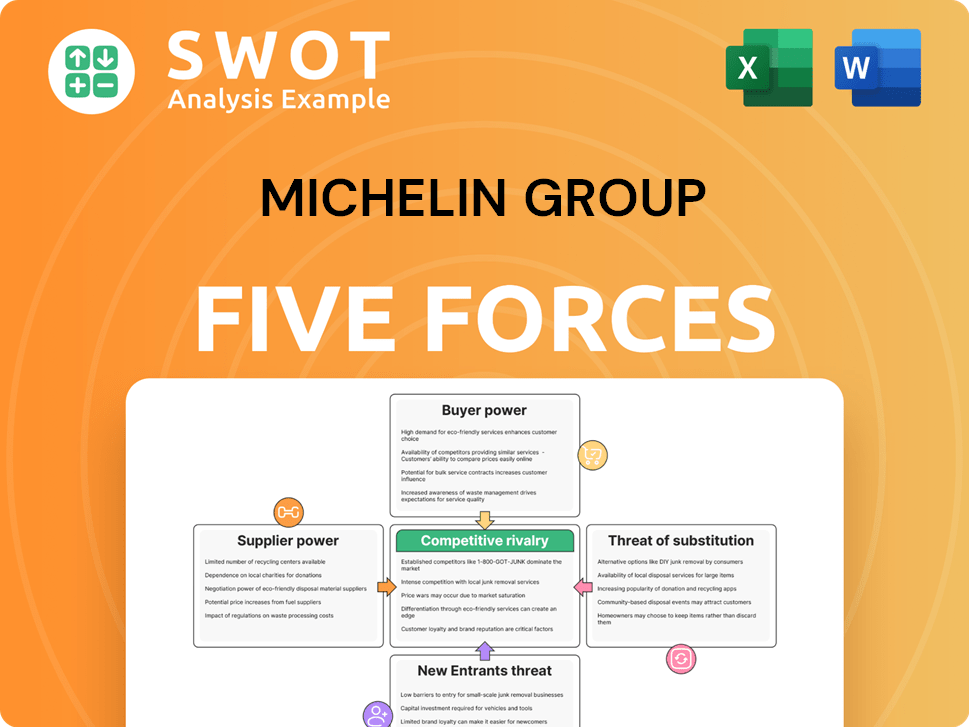

Michelin Group Porter's Five Forces Analysis

The Michelin Group Porter's Five Forces Analysis preview showcases the full report. This in-depth analysis of competitive forces, including threat of new entrants, bargaining power of buyers/suppliers, and rivalry, is what you'll receive. The document's complete, professionally written content is ready for download immediately after purchase. You're previewing the exact analysis file.

Porter's Five Forces Analysis Template

Michelin Group faces moderate competition. Buyer power is significant, especially from large automotive manufacturers. The threat of new entrants is relatively low due to high capital costs and brand recognition. However, substitute products, like alternative tire brands, pose a constant challenge. Supplier power, especially from raw material providers, is moderate. Rivalry among existing competitors is intense.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Michelin Group's real business risks and market opportunities.

Suppliers Bargaining Power

Michelin's supplier stability is a strength. They source raw materials like rubber and steel from diverse suppliers. This lessens their reliance on any one supplier. In 2024, the price of natural rubber saw fluctuations, but Michelin's diversification helped buffer these impacts.

Michelin's operations face commodity price volatility. Natural rubber, a core material, is affected by weather and demand. This can significantly impact production costs. For instance, in 2024, rubber prices fluctuated, affecting profitability.

Michelin's supplier concentration varies; while many materials are readily available, some specialized components are sourced from fewer suppliers. This concentration can increase supplier bargaining power, particularly if the components are crucial. For example, in 2024, raw material costs, including rubber and synthetic fibers, impacted Michelin's profitability.

Forward Integration Risk

The risk of suppliers moving into tire manufacturing is minimal. This is because the tire industry needs significant capital, advanced technology, and established distribution. It's tough for raw material suppliers to compete with major players like Michelin.

- Michelin's revenue in 2023 was approximately €28.59 billion.

- The global tire market is highly competitive, with significant barriers to entry.

- Raw material suppliers typically lack the brand recognition and infrastructure required for tire manufacturing.

- Forward integration would require massive investment in plants, technology, and marketing.

Sustainability Demands

Michelin's sustainability drive impacts supplier dynamics. The firm prioritizes suppliers with sustainable practices. This includes sourcing raw materials responsibly and using eco-friendly processes. Michelin's focus can increase the bargaining power of compliant suppliers.

- In 2024, Michelin aimed to increase the use of sustainable materials in its tires.

- Michelin's sustainability strategy includes reducing carbon emissions across its supply chain.

- The company is investing in research to find sustainable alternatives for raw materials.

- Michelin's goal is to have 100% of its tires made with sustainable materials by 2050.

Michelin's supplier power is mixed. Diverse sourcing of raw materials like rubber and steel reduces risk. Yet, specialized components and sustainable material demands can elevate some suppliers' influence. Fluctuations in raw material costs, as seen in 2024, continue to impact profitability.

| Aspect | Description | Impact |

|---|---|---|

| Supplier Diversity | Michelin sources from multiple suppliers. | Reduces supplier power. |

| Specialized Components | Sourcing from fewer suppliers. | Increases supplier power. |

| Sustainability Focus | Prioritizing sustainable suppliers. | Influences supplier dynamics. |

Customers Bargaining Power

Michelin's broad customer base, from OEMs to consumers, weakens customer bargaining power. Their sales are diversified across segments, reducing reliance on any single customer. In 2024, Michelin's revenue distribution across segments helped maintain this balance. This diversification strategy mitigates the impact of individual customer demands.

Switching costs for tire buyers are typically low, especially in the replacement market, where consumers can readily switch brands based on factors like price. In 2024, the global tire replacement market was valued at approximately $150 billion. Consumers' flexibility to switch is a key factor. However, for OEMs, switching can be more complex. These include established relationships and homologation processes.

Customers wield significant bargaining power due to information availability. They can easily access data on tire brands, performance, and pricing. Online resources like comparison sites and reviews enable informed decisions, increasing their leverage. This transparency challenges Michelin, as customers readily compare its products against rivals. In 2024, the global tire market was valued at approximately $180 billion, with digital information playing a key role in consumer choices.

Brand Loyalty

Michelin's strong brand loyalty gives it pricing power. Its reputation for quality, performance, and innovation fosters customer loyalty. This shields Michelin from price wars, unlike weaker brands. Michelin is consistently a top global tire brand.

- Michelin's brand value in 2024 is estimated at $7.8 billion.

- Michelin's customer satisfaction scores consistently rank above industry averages.

- Michelin's premium tires command higher prices, reflecting brand strength.

- Loyalty programs and brand heritage contribute to customer retention.

Price Sensitivity

Customer price sensitivity varies in the tire market, influencing Michelin's pricing strategies. Premium tires for performance-focused buyers command higher prices, while budget-conscious consumers drive demand for cheaper options. Michelin's product range spans price points to meet diverse customer needs, impacting profit margins. The ability to balance price and value is key. In 2024, the global tire market was valued at approximately $200 billion.

- Premium tires have higher profit margins.

- Budget tire sales volumes are larger.

- Michelin adjusts pricing to compete.

- Market size is approx. $200 billion in 2024.

Customer bargaining power varies but is generally moderate for Michelin. The replacement market's ease of switching brands and price sensitivity are key factors. In 2024, the global tire market was approximately $200 billion, reflecting the impact of consumer choice. Michelin's brand strength and diversified customer base somewhat counter this.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Switching Costs | Low in replacement market | Global tire replacement market: $150B |

| Information | High availability, impacting decisions | Digital info & reviews influence choices |

| Brand Loyalty | Mitigates price sensitivity | Michelin's brand value: $7.8B |

Rivalry Among Competitors

Michelin, a leading global tire manufacturer, competes in a market dominated by giants. The company holds a substantial market share, yet faces fierce rivalry. Key competitors include Bridgestone, Goodyear, and Continental. They battle on innovation, with Michelin investing €700 million in R&D in 2023. Pricing and expansion are also key battlegrounds.

Product differentiation in the tire industry is moderate, with manufacturers like Michelin setting themselves apart. They focus on performance, technology, and brand. Michelin's R&D spending in 2023 was roughly €700 million, showing its commitment to innovation. This helps maintain a competitive edge in the market.

The tire industry's moderate growth rate, fueled by vehicle production and ownership, impacts competitive rivalry. In 2024, the global tire market is estimated at $200 billion, with a projected 3-4% annual growth. EV adoption and autonomous vehicles boost competition in specialized tires. Slow growth can intensify rivalry as companies vie for market share.

Exit Barriers

Exit barriers in the tire industry are substantial, driven by considerable investments in specialized manufacturing plants and machinery. These high barriers prevent companies from easily leaving the market, even when profits are down. This can intensify competition, as firms remain operational, potentially leading to excess capacity and price wars. For example, in 2024, Michelin's capital expenditures were around €2.2 billion, highlighting the financial commitment. This level of investment underscores the high exit costs.

- High capital investments in manufacturing.

- Specialized equipment limits alternative uses.

- Brand reputation and market share maintenance.

- Potential for long-term contracts.

Strategic Alliances

Strategic alliances and joint ventures are prevalent in the tire sector, enabling resource sharing, market access, and tech development. Michelin forms partnerships to bolster its competitive edge and broaden its product range. For instance, Michelin and Bridgestone have collaborated on sustainability initiatives. These alliances can intensify competition, reshaping market dynamics. In 2024, the global tire market was valued at approximately $250 billion, highlighting the scale of these strategic maneuvers.

- Partnerships enable resource sharing and market access.

- Michelin collaborates on sustainability initiatives.

- Strategic alliances reshape competitive dynamics.

- The global tire market was worth $250 billion in 2024.

Michelin faces fierce competition from Bridgestone, Goodyear, and Continental, battling on innovation and pricing. Product differentiation through performance and tech helps Michelin. The tire industry's $200B market (2024 est.) with 3-4% growth fuels rivalry. High exit barriers, exemplified by Michelin's €2.2B capex in 2024, intensify competition. Strategic alliances reshape market dynamics.

| Aspect | Details | Impact |

|---|---|---|

| Key Competitors | Bridgestone, Goodyear, Continental | Intense rivalry |

| R&D (2023) | Michelin: €700M | Competitive advantage |

| Market Size (2024) | $200B | Increased competition |

SSubstitutes Threaten

Alternative transportation poses a threat to Michelin. Public transit, ride-sharing, and cycling offer substitutes for personal vehicles, which lowers tire demand. This is especially true in cities, but not all markets are equally affected. In 2024, ride-sharing grew, potentially impacting tire sales in urban areas. While the shift is ongoing, the threat's intensity varies regionally.

Tire repair services pose a threat to Michelin's new tire sales by extending tire lifespans. Patching and retreading offer cost-effective alternatives, especially for commercial fleets. In 2024, retreading could save fleets up to 50% compared to new tires. Michelin's retreading services help offset this threat, maintaining market share.

Airless tire technology presents a long-term threat to Michelin. These tires eliminate punctures and blowouts, increasing durability. Although still developing, they could disrupt the tire market. Michelin is actively investing in airless tire research; for example, Michelin's revenue for 2024 was around $30 billion.

Changes in Consumer Behavior

Changes in consumer behavior pose a threat to Michelin. Shifts towards sustainable products and vehicle leasing affect tire demand directly. Michelin is responding by investing in green technologies and offering tire subscriptions. This adaptation is crucial to maintain market position. Recent data indicates that electric vehicle tire demand grew by 25% in 2024.

- Eco-friendly tires are a growing segment, representing 15% of the market in 2024.

- Tire subscription services have seen a 10% increase in subscribers in 2024.

- The leasing market's share of new car sales reached 30% in 2024.

- Michelin's R&D spending on sustainable materials increased by 12% in 2024.

Counterfeit Tires

Counterfeit tires pose a notable threat to Michelin. The availability of these low-quality alternatives can damage Michelin's brand. These tires often lack safety standards. Michelin actively fights counterfeiting.

- Counterfeit tires are a significant issue in the tire market, with estimates suggesting that up to 5% of all tires sold globally are counterfeits.

- In 2023, Michelin invested over $100 million in anti-counterfeiting measures.

- Michelin's legal teams have been involved in over 500 cases against counterfeiters worldwide.

- The economic impact of counterfeit tires on legitimate manufacturers is estimated to be in the billions of dollars annually.

The threat of substitutes affects Michelin through several avenues. Alternative transportation such as ride-sharing and public transit directly compete with personal vehicle use, decreasing tire demand. Tire repair and retreading services extend tire lifespans, also impacting new tire sales. Airless tire technology and shifts in consumer behavior also pose long-term threats.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Ride-sharing | Reduced tire demand | Growth in urban areas, potential impact on tire sales |

| Tire Repair | Extended lifespan | Retreading saves up to 50% |

| Airless Tires | Disruption | Ongoing development, Michelin invests |

Entrants Threaten

The tire industry's high capital requirements significantly deter new entrants. Establishing manufacturing plants, developing technology, and creating distribution networks need substantial investment. In 2024, setting up a tire plant costs hundreds of millions of dollars. This financial barrier limits the number of new competitors, protecting existing players like Michelin.

Established tire manufacturers like Michelin, leverage economies of scale, enabling lower per-unit production costs. New entrants face challenges matching these efficiencies, creating a competitive disadvantage. Michelin's global presence amplifies cost advantages; for example, in 2024, Michelin's revenue reached approximately €28.3 billion. This scale allows for optimized resource allocation.

Brand recognition is a significant barrier in the tire industry. Michelin's reputation, built over 135 years, fosters customer trust. New entrants struggle against Michelin's established image and loyalty. In 2023, Michelin's brand value was estimated at $7.8 billion, a testament to its strength. Michelin's brand significantly deters potential competitors.

Technological Expertise

Michelin's technological expertise creates a significant barrier for new entrants. Tire manufacturing demands advanced skills in material science, design, and manufacturing. Michelin's heavy R&D investments have fostered strong technological advantages. New companies face considerable challenges in replicating this expertise to compete effectively.

- Michelin invested €700 million in R&D in 2023.

- Michelin holds over 10,000 patents.

- New entrants often lack the specialized equipment and personnel needed.

- Established players benefit from economies of scale.

Distribution Channels

Distribution channels are crucial in the tire industry. Michelin benefits from a robust global network, including retailers and OEM partnerships, making it tough for new entrants. These newcomers must build their own channels or secure access to existing ones, a significant hurdle. This often involves substantial investment and time to establish brand visibility and market presence, increasing the barriers to entry.

- Michelin's extensive distribution network spans over 170 countries.

- New entrants may struggle to match Michelin's reach and established relationships with key distributors.

- Building a distribution network can take several years and significant capital investment.

- The tire industry's distribution landscape is highly competitive, with established players controlling key channels.

The tire industry presents formidable barriers to new entrants, primarily due to high capital needs. Michelin's strong brand recognition and extensive distribution networks further protect its market position. These factors significantly limit the threat of new competitors.

| Barrier | Description | Michelin's Advantage |

|---|---|---|

| Capital Requirements | High costs for plants, tech, and distribution. | Established infrastructure and financial resources. |

| Economies of Scale | Existing firms have lower per-unit costs. | Global operations, €28.3B revenue in 2024. |

| Brand Recognition | Building trust and loyalty takes time and money. | $7.8B brand value (2023), 135 years of history. |

Porter's Five Forces Analysis Data Sources

Our analysis utilizes financial reports, market share data, industry research, and competitive intelligence to comprehensively assess Michelin's market position.