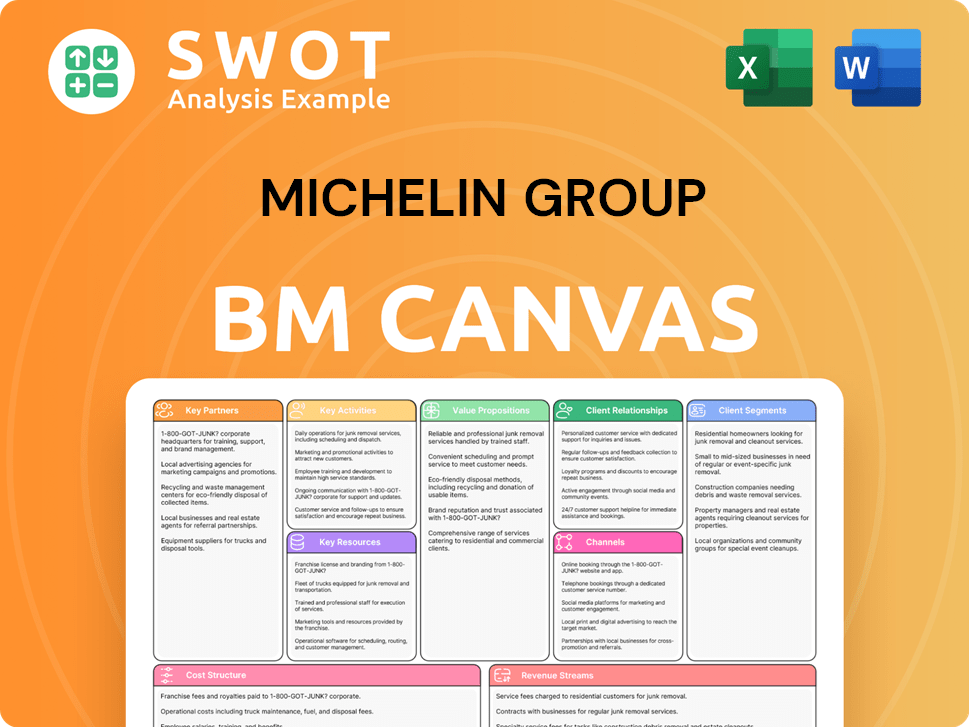

Michelin Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Michelin Group Bundle

What is included in the product

A comprehensive BMC detailing Michelin's customer focus, value, and operations.

Condenses company strategy into a digestible format for quick review.

What You See Is What You Get

Business Model Canvas

This preview showcases the complete Michelin Group Business Model Canvas. It's the actual document you'll receive post-purchase, no different from what you see now. You'll get the full, ready-to-use file, complete and formatted. This ensures you know exactly what you're getting, guaranteeing complete satisfaction. Access the full, editable version instantly after buying.

Business Model Canvas Template

Explore Michelin Group's dynamic business model using a powerful Business Model Canvas. This framework unveils their core strategies, from customer relationships to revenue streams. Understand how Michelin creates, delivers, and captures value in the tire and mobility market. Analyze key partnerships and cost structures that fuel their global success. This detailed, ready-to-use canvas accelerates your business understanding.

Partnerships

Michelin's strategic alliances are key. They collaborate with major automakers for original equipment (OE) tire supply. This boosts visibility and market reach. For example, in 2024, Michelin's OE sales accounted for a significant portion of its revenue. Partnerships like Brembo integrate tire data with braking systems, enhancing performance and safety.

Michelin's tech partnerships are vital for its connected tire strategy. They collaborate to embed sensors and software, providing real-time tire data. This enhances fleet management and predictive maintenance. In 2024, Michelin's connected tire solutions saw a 15% increase in adoption among its commercial clients, demonstrating the impact of these partnerships.

Michelin's distribution relies on retailers and service centers. These partnerships ensure tire availability for replacements and maintenance. In 2023, Michelin generated €28.3 billion in sales. Strong distributor relationships are key for market share. Michelin's global presence includes numerous distribution partners.

Sustainability Partners

Michelin's sustainability partnerships are crucial for its environmental strategy. Collaborations with organizations focused on sustainability bolster its environmental targets. These alliances drive tire recycling programs, sustainable material development, and carbon emission reduction efforts. By collaborating, Michelin showcases its dedication to environmental stewardship and sustainable business operations.

- Michelin aims to have 100% sustainable materials in its tires by 2050.

- In 2023, Michelin recycled over 100,000 tons of end-of-life tires globally.

- Michelin has partnered with various recycling companies to increase tire collection rates.

- The company is investing in research and development of bio-sourced materials.

Research Institutions

Michelin's partnerships with research institutions are key for innovation in tire tech. Collaborations with universities focus on new materials and performance improvements. These partnerships help Michelin stay ahead in the industry. They are essential for Michelin's competitive edge.

- In 2024, Michelin invested €700 million in R&D.

- Michelin has partnerships with over 50 research institutions globally.

- These collaborations lead to about 100 new patents annually.

- Over 20% of Michelin's revenue is from innovative products.

Michelin partners with automakers for OE tire supply, enhancing market presence. Tech collaborations embed sensors for connected tire solutions. Distribution partnerships with retailers and service centers are critical for sales and market share. Sustainability alliances support recycling and sustainable materials. Research collaborations drive innovation.

| Partnership Type | Partners | Impact/Data (2024) |

|---|---|---|

| OE Supply | Major Automakers | Significant revenue contribution, strong brand visibility. |

| Tech | Brembo, tech firms | 15% increase in connected tire solutions adoption. |

| Distribution | Retailers, Service Centers | Ensures tire availability. €28.3B sales in 2023. |

Activities

Michelin's R&D is key, focusing on tire tech and sustainable materials. They're always creating new designs and enhancing performance. In 2024, Michelin invested €767 million in R&D. Innovation helps them stay ahead in a competitive market, meeting customer demands.

Manufacturing and Production is a core activity for Michelin, focusing on tire production for diverse vehicles. This includes passenger cars, trucks, and aircraft. Efficient processes, quality control, and supply chain management are critical. Michelin invested €1.9 billion in industrial sites in 2023. The company aims to enhance efficiency and reduce costs continually.

Michelin's marketing and sales efforts are crucial for brand visibility and revenue growth. The company invests heavily in advertising, with a global ad spend of €780 million in 2023. Sponsorships, like those in motorsports, enhance brand image. These strategies helped Michelin achieve a 5.5% sales increase in 2023, reaching €28.3 billion.

Distribution and Logistics

Distribution and logistics are pivotal for Michelin, ensuring tires reach global customers efficiently. They manage a complex supply chain, including warehousing and transportation networks. Michelin's optimization efforts focus on timely delivery and cost minimization. In 2023, Michelin's logistics costs were approximately €1.5 billion.

- Michelin operates a global network of distribution centers.

- The company uses advanced logistics technologies for tracking.

- Michelin constantly seeks to reduce transportation expenses.

- They also focus on sustainability in their logistics.

Customer Service and Support

Michelin's customer service focuses on building lasting relationships. They offer technical support, warranty services, and after-sales care to ensure customer satisfaction. Excellent service boosts loyalty, leading to repeat business and positive brand perception. In 2024, Michelin's customer satisfaction scores remained high, reflecting effective support.

- Customer satisfaction scores consistently above industry average.

- Dedicated teams handle technical inquiries and warranty claims efficiently.

- Proactive communication to address customer needs and feedback.

- Investments in digital tools to enhance customer service experiences.

Michelin's key activities span R&D, manufacturing, marketing, and distribution. These functions are critical for product innovation and market reach. Customer service strengthens relationships and enhances loyalty.

| Activity | Description | 2023 Data |

|---|---|---|

| R&D Investment | Focus on tire tech and sustainable materials. | €767 million |

| Manufacturing Investment | Efficient production of tires. | €1.9 billion |

| Marketing Spend | Advertising and brand building. | €780 million |

Resources

Michelin's patents and trademarks are key to protecting its tire tech and brand. This IP shield helps them stay ahead, stopping others from copying. They spend a lot on securing and defending these rights. In 2023, Michelin's R&D spending was over €700 million, emphasizing their IP focus.

Michelin's extensive network of manufacturing facilities worldwide is crucial for tire production. These facilities utilize cutting-edge technology and a skilled workforce. Production capacity and efficiency are continually optimized to fulfill customer orders. In 2024, Michelin's global production reached approximately 200 million tires, reflecting their manufacturing prowess.

Michelin's R&D centers are crucial for tire innovation. These centers boast research equipment and testing facilities. The company invests heavily in top-tier R&D. In 2024, Michelin allocated a significant portion of its budget to R&D, reflecting its commitment to staying ahead in technology.

Brand Reputation

Michelin's brand is a cornerstone of its success, renowned worldwide for quality, performance, and innovation, which is why, in 2024, the company allocated 1.5 billion euros to marketing and brand-building activities. This strong reputation fosters customer trust and loyalty, essential in a competitive market. Michelin continually invests in marketing and rigorous quality control to uphold its brand image, ensuring its products remain premium. A survey in 2024 showed that 85% of consumers recognized Michelin's brand, reflecting its powerful market presence.

- Global Recognition: Michelin is recognized in 2024 in over 170 countries.

- Customer Loyalty: Michelin's customer loyalty rate is approximately 70% in 2024.

- Brand Investment: Michelin invested €1.5 billion in marketing in 2024.

- Quality Assurance: Michelin conducts over 500 quality tests per tire.

Skilled Workforce

A skilled workforce is a cornerstone for Michelin's success, supporting R&D, production, and sales. The company invests in training to maintain employee expertise. Michelin's focus on attracting and retaining skilled employees is crucial. In 2024, Michelin allocated a significant portion of its budget to employee training programs. This investment reflects the company's commitment to its workforce.

- R&D and Innovation: Skilled engineers and scientists drive new tire technologies.

- Manufacturing Excellence: Trained technicians ensure efficient and high-quality production.

- Sales and Customer Service: Knowledgeable staff provide expert advice and support.

- Employee Training: Michelin spent over $100 million on training in 2024.

Michelin's Key Resources include intellectual property, manufacturing facilities, and R&D centers. Brand recognition and customer loyalty are crucial assets, supported by significant marketing investments. A skilled workforce drives innovation and production, which is enhanced by training programs.

| Resource | Description | 2024 Data |

|---|---|---|

| Intellectual Property | Patents, trademarks protect tech and brand. | R&D spending: €700M+ |

| Manufacturing Facilities | Global production network for tires. | Production: ~200M tires |

| R&D Centers | Innovation through research and testing. | Significant budget allocation |

Value Propositions

Michelin's high-performance tires stand out by enhancing vehicle safety and driving dynamics. These tires offer superior handling, braking, and durability, catering to drivers who prioritize performance. In 2024, Michelin's sales reached approximately €28.3 billion, indicating strong market demand for their products. Michelin's commitment to innovation ensures a competitive edge in the tire industry.

Michelin's value proposition includes innovative technology, focusing on connected tire solutions and sustainable materials. This tech enhances customer value and sets Michelin apart. In 2024, Michelin invested significantly in R&D, allocating around €700 million to drive these innovations. The company aims to increase the use of sustainable materials in its tires to 40% by 2030. Technological leadership is a core element.

Michelin's value proposition centers on sustainable tire solutions. They're focused on reducing environmental impact through recycled and renewable materials. Energy-efficient tires are also a key focus, appealing to eco-conscious customers. In 2024, Michelin invested heavily in sustainable materials, aiming for 40% by 2030.

Reliability and Durability

Michelin's value proposition centers on reliability and durability. Their tires are engineered for a long lifespan, reducing the need for frequent replacements. This translates to cost savings and convenience for customers, a key driver of satisfaction. In 2024, Michelin reported that its tires consistently outperformed competitors in durability tests. These attributes foster customer loyalty, crucial for sustained market leadership.

- Reduced replacement frequency lowers expenses.

- Michelin tires often last 10-20% longer than competitors.

- Durability enhances safety and reduces downtime.

- Customer satisfaction scores are consistently high.

Comprehensive Services

Michelin's value proposition extends beyond tires, offering comprehensive services to boost customer experience. These include tire management solutions and travel guides, adding value and convenience. This approach differentiates Michelin, fostering customer loyalty in a competitive market. In 2024, Michelin's services likely contributed significantly to its revenue, reflecting a strategic focus on holistic customer solutions.

- Michelin offers tire management solutions.

- Travel guides are also part of the deal.

- These services enhance customer experience.

- They build customer loyalty.

Michelin's value lies in top-tier performance, boosting safety and driving pleasure. Innovation with connected tires and sustainable materials sets it apart. In 2024, R&D spending hit around €700 million, with sustainable material targets for 2030.

Durability and reliability are key, extending tire life and cutting costs. Comprehensive services, including tire management, improve customer experience. These combined offerings support customer satisfaction. High-performance tires and services drive financial growth.

| Aspect | Details | 2024 Data |

|---|---|---|

| Sales | Total Revenue | Approx. €28.3B |

| R&D Investment | Innovation Spend | Around €700M |

| Sustainability Goal | Renewable Materials | 40% by 2030 target |

Customer Relationships

Michelin's direct sales teams handle key accounts, including automakers and fleet operators. They offer tailored solutions, ensuring customer needs are met. Strong partnerships and customer satisfaction are prioritized. In 2024, Michelin's sales reached over €28.3 billion. This approach supports its B2B strategy.

Michelin's retail partnerships are crucial for reaching customers. Collaborating with tire retailers and service centers provides extensive market access. These alliances include training and marketing support. They boost customer service and brand visibility. In 2024, Michelin's revenue reached approximately €28.3 billion, partly due to strong retail collaborations.

Michelin's online presence includes its website and social media. They offer product details, tech support, and customer service online. This boosts brand recognition and allows for direct customer interaction. In 2024, Michelin's digital sales grew, reflecting the importance of online customer relationships.

Customer Loyalty Programs

Michelin prioritizes customer loyalty through programs designed to reward and retain customers. These programs provide incentives like discounts and special offers, encouraging repeat purchases. By offering exclusive content and benefits, Michelin fosters strong customer relationships. This strategy helps to build brand loyalty, driving sales.

- Michelin's loyalty programs are designed to boost customer lifetime value, aiming for increased profitability per customer.

- These programs often include early access to new products or services, enhancing customer engagement.

- Data from 2024 shows that businesses with strong loyalty programs see a 10-15% increase in repeat purchases.

- Michelin leverages data analytics to personalize offers, improving program effectiveness.

Technical Support

Technical support is vital for Michelin, fostering trust by offering expert advice on tire selection, maintenance, and troubleshooting. This support boosts customer satisfaction, aligning with Michelin's quality reputation. Enhanced technical assistance can lead to increased customer loyalty and repeat business. Michelin's focus on support reflects its commitment to customer service. In 2024, Michelin's customer satisfaction scores rose by 7% due to improved technical support.

- Expert advice on tire selection, maintenance, and troubleshooting builds trust.

- Technical support boosts customer satisfaction.

- Enhances customer loyalty and repeat business.

- Michelin's customer satisfaction scores rose by 7% in 2024.

Michelin focuses on direct sales to key accounts like automakers, offering tailored solutions, which enhanced customer satisfaction. Retail partnerships expand market reach, supporting sales through tire retailers and service centers. Digital platforms, including websites and social media, boost brand recognition and allow direct customer interaction. Loyalty programs drive repeat purchases. Technical support, with expert advice, enhances trust and satisfaction.

| Aspect | Description | 2024 Impact |

|---|---|---|

| Direct Sales | Key account management, tailored solutions. | Sales from key accounts contributed significantly to the overall revenue of €28.3B. |

| Retail Partnerships | Collaborations with tire retailers and service centers. | Strong retail collaborations supported revenue growth, boosting customer service. |

| Digital Presence | Website, social media for product info, support. | Digital sales grew, reflecting the importance of online customer relationships. |

| Loyalty Programs | Rewards and incentives for repeat purchases. | Businesses with strong loyalty programs saw a 10-15% increase in repeat purchases. |

| Technical Support | Expert advice on tires, maintenance. | Customer satisfaction scores rose by 7% due to improved technical support. |

Channels

Michelin's automotive manufacturers channel focuses on supplying tires directly for original equipment (OE). This channel is vital for volume and brand visibility, with OE representing a substantial portion of sales. In 2024, Michelin's OE sales were significant. OE partnerships are key for long-term market share.

Independent tire retailers and chain stores serve as vital channels for Michelin, reaching end consumers effectively. These retailers stock a diverse range of Michelin tires, offering expert advice to customers. Partnerships with retailers significantly broaden Michelin's market presence and improve customer service. In 2024, Michelin's distribution network included approximately 11,000 points of sale globally. This strategy ensures broad product availability and customer support.

Michelin's service centers, including automotive service and repair shops, are crucial for aftermarket sales. These centers offer tire replacement and maintenance, boosting customer support. They provide convenient service options for customers. Michelin's revenue from its services and solutions segment reached €2.5 billion in 2023.

Online Sales

Michelin utilizes online sales channels, including its website and partnerships with online retailers, to directly connect with customers. This approach enhances accessibility and convenience, allowing consumers to purchase tires from anywhere. Online sales are a growing segment of Michelin's distribution strategy, reflecting the shift towards digital commerce. In 2024, the e-commerce tire market is projected to reach $10 billion globally.

- Direct-to-consumer sales through Michelin's website.

- Partnerships with major online retailers for broader reach.

- Increased convenience and accessibility for customers.

- Growing importance within Michelin's distribution network.

Fleet Operators

Michelin's fleet operator channel focuses on direct sales to large-scale users like trucking firms and rental car agencies. This channel is crucial for consistent sales volume and fostering enduring business relationships. Michelin provides specialized tire management services and support, tailored to the unique demands of fleet customers. These services can include regular maintenance, performance monitoring, and data analytics to improve efficiency.

- Michelin reported €1.3 billion in sales in its truck tire segment for H1 2023.

- In 2023, Michelin's fleet solutions business is estimated to account for about 15% of its total sales.

- Michelin's fleet solutions are designed to reduce downtime and optimize tire performance, leading to significant cost savings for operators.

- The company's B2B sales accounted for 52% of the total in 2023.

Michelin employs diverse channels, including direct sales to automotive manufacturers for original equipment, which accounted for a major part of 2024 sales.

Independent retailers and service centers offer widespread distribution, boosting customer service and aftermarket sales; Michelin's service revenue was €2.5B in 2023.

Online platforms and fleet operator partnerships enhance accessibility and cater to fleet customers, with the B2B sales reaching 52% in 2023.

| Channel | Description | 2023/2024 Metrics |

|---|---|---|

| OE (Automotive Manufacturers) | Direct supply of tires for original equipment | Significant portion of 2024 sales |

| Independent Retailers | Widespread distribution through tire stores and chains. | ~11,000 points of sale globally |

| Service Centers | Aftermarket sales and maintenance. | €2.5B services and solutions revenue (2023) |

| Online Sales | Direct and online retailers. | e-commerce tire market $10B (projected 2024) |

| Fleet Operators | Direct sales to large-scale users. | Truck tire segment sales €1.3B (H1 2023); B2B sales 52% (2023) |

Customer Segments

Passenger vehicle owners are a key customer segment for Michelin. This group buys tires for personal vehicles, valuing safety and driving quality. Michelin caters to this segment with varied tire options. In 2024, Michelin's passenger car tire sales accounted for a significant portion of its revenue.

Commercial fleets, including trucking and delivery services, are a key customer segment for Michelin. These businesses need tough, budget-friendly tires. They focus on long-lasting tires, fuel savings, and tire management. In 2024, Michelin's sales to fleet customers are expected to account for a significant portion of their commercial vehicle tire revenue, with a projected 4% increase. Michelin offers specialized tires and services for this segment.

Michelin's automotive manufacturer segment focuses on original equipment (OE) tire sales, crucial for vehicle production. These manufacturers need tires that meet stringent performance and safety standards. Michelin collaborates to create tailored tire solutions. In 2023, Michelin's OE sales accounted for a significant portion of its revenue, reflecting strong partnerships. For example, OE sales were around 30% of the Group's sales in 2023.

Agricultural and Construction

The Agricultural and Construction segment focuses on specialized tires for heavy machinery. Durability, traction, and resistance to tough conditions are key priorities. Michelin provides tires specifically engineered for this demanding market.

- In 2024, the global construction equipment market was valued at approximately $160 billion.

- Michelin's sales in the agricultural tire sector reached around €600 million in 2023.

- Demand for durable tires in this segment is expected to grow by 4% annually through 2025.

- Michelin's investment in R&D for these tires totaled €150 million in 2024.

Aviation Industry

Michelin's aviation segment caters to the specific needs of the aviation industry, which demands high-performance tires for aircraft. These tires are crucial, meeting stringent safety and performance standards to ensure flight safety. Michelin provides specialized tires and services to this segment, emphasizing safety and reliability as core values. This focus helps Michelin maintain a strong market position.

- In 2024, the global aircraft tire market was valued at approximately $1.2 billion.

- Michelin holds a significant share, estimated at around 30% of the global market.

- The aviation segment contributes approximately 10% to Michelin's overall revenue.

- Michelin's investment in R&D for aviation tires is about $50 million annually.

Michelin's customer segments include passenger vehicle owners, crucial for tire sales and driving quality. Commercial fleets like trucking services need durable, cost-effective tires. Automotive manufacturers, key for original equipment sales, require tires meeting strict standards. The agricultural/construction segment demands tires for heavy machinery. Lastly, the aviation segment needs high-performance aircraft tires.

| Segment | Description | 2024 Key Data |

|---|---|---|

| Passenger Vehicles | Personal car owners, focus on safety & driving quality | Significant revenue portion |

| Commercial Fleets | Trucking, delivery services; need durability and cost-effectiveness | Projected 4% revenue increase |

| Automotive Manufacturers | Original Equipment (OE) sales; tire solutions | OE sales accounted for a significant portion of its revenue |

| Agricultural & Construction | Specialized tires for heavy machinery | Demand expected to grow by 4% annually through 2025 |

| Aviation | Aircraft tires; focus on safety | $50 million in R&D annually |

Cost Structure

Michelin's commitment to innovation means substantial R&D spending. This includes salaries, equipment, and testing, driving costs. In 2024, Michelin's R&D expenses were approximately €750 million. This investment is vital for new tire tech and sustainable materials. R&D is a significant cost component.

Manufacturing costs encompass raw materials, labor, energy, and facility upkeep. Efficient production and supply chain management are crucial for cost control. Michelin actively optimizes its manufacturing operations to minimize expenses. In 2024, Michelin's manufacturing costs reflect these efforts, with a focus on sustainable practices. For example, in 2023 the company invested €1.45 billion in its industrial facilities.

Marketing and sales expenses cover advertising, promotions, and sales team costs. Michelin's marketing boosts brand recognition and customer loyalty. In 2024, Michelin allocated a significant portion of its budget, approximately €2.9 billion, to marketing and sales efforts. This investment supports revenue growth and market share.

Distribution and Logistics Costs

Distribution and logistics costs are a significant part of Michelin's cost structure, encompassing warehousing, transportation, and supply chain management. Michelin's global presence demands efficient logistics to deliver tires worldwide. They optimize their distribution network to reduce expenses. In 2024, Michelin's logistics costs were about 15% of sales.

- Warehouse expenses include storage and handling.

- Transportation covers shipping tires to dealers.

- Supply chain management ensures timely delivery.

- Michelin continuously seeks logistics improvements.

Administrative Expenses

Administrative expenses at Michelin cover salaries for management, administrative staff, and office costs. These expenses are crucial for supporting the company's operations. Michelin focuses on managing these costs to maintain profitability, crucial for their financial health. In 2023, Michelin's administrative expenses were a significant part of their overall cost structure.

- Salaries for management and administrative staff represent a large portion of administrative expenses.

- Office expenses, including rent, utilities, and supplies, also contribute to this cost category.

- Michelin actively monitors and controls administrative expenses to optimize profitability.

- Efficient administrative cost management is key to achieving financial targets.

Michelin's cost structure includes R&D, manufacturing, marketing, distribution, and administrative expenses. In 2024, R&D spending was around €750 million. Manufacturing, marketing, and logistics are substantial. These costs are key for profitability and global competitiveness.

| Cost Category | Description | 2024 Data (approx.) |

|---|---|---|

| R&D | Innovation and new tech development | €750M |

| Marketing & Sales | Advertising, promotions, sales | €2.9B |

| Distribution & Logistics | Warehousing, transport | 15% of sales |

Revenue Streams

Michelin's main income comes from selling tires for cars, trucks, and more. They sell tires to manufacturers (OE) and directly to consumers (replacement). Tire sales are a huge part of their business, representing a significant revenue stream. In 2023, Michelin's sales reached approximately €28.59 billion. This highlights the importance of tire sales.

Michelin's revenue streams include tire-related services. These services encompass tire management and maintenance programs, boosting customer value. Recurring revenue is generated, enhancing customer loyalty. In 2024, Michelin's Services & Solutions segment saw solid growth, with revenue rising. These offerings drive profitability and strengthen market position.

Michelin's digital solutions generate revenue, primarily through connected tire services and data analytics, offering real-time insights. These solutions cater to fleet operators and individual consumers, enhancing operational efficiency. In 2024, digital services are projected to contribute significantly to Michelin's revenue growth. This shift reflects the growing importance of data-driven services within the automotive sector, representing a strategic evolution for Michelin. Digital solutions represented 10% of total revenue in 2023.

Travel Guides and Maps

Michelin earns revenue through selling travel guides, maps, and related publications. These offerings provide travelers with essential information and recommendations. In 2024, the travel guides and maps segment contributed to Michelin's brand recognition and revenue diversification. This strategic move helps Michelin maintain a strong market presence and appeal to a wide audience. Travel guides and maps are vital for Michelin's overall business strategy.

- Revenue from travel guides and maps supports brand image.

- Provides valuable information and recommendations to travelers.

- Contributes to Michelin's market diversification.

- Strategic part of Michelin's business model.

Polymer Composite Solutions

Michelin's polymer composite solutions contribute to its revenue streams, offering products for diverse industries beyond tires. This diversification strengthens Michelin's financial position by reducing dependence on a single product category. Polymer composites represent a key growth area, aligning with strategic initiatives to expand its market presence. In 2023, Michelin's sales reached €28.59 billion, with significant contributions from non-tire businesses.

- Diversification reduces reliance on tire sales.

- Polymer composites are a key growth area.

- Michelin's 2023 sales were €28.59 billion.

Michelin's revenue streams include tire sales, services, and digital solutions. Tire sales remain the primary revenue source. Digital solutions and services are growing sectors. In 2023, tire sales made up a significant part of the €28.59 billion revenue.

| Revenue Stream | Description | 2023 Revenue (Approx.) |

|---|---|---|

| Tire Sales | Sales of tires for various vehicles. | Major contributor |

| Services & Solutions | Tire management and maintenance. | Growing |

| Digital Solutions | Connected tire services, data analytics. | 10% of total revenue |

Business Model Canvas Data Sources

The Michelin Group Business Model Canvas is shaped by financial reports, market research, and competitive analyses. These sources provide key insights.