Microsoft Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Microsoft Bundle

What is included in the product

Designed to help entrepreneurs and analysts make informed decisions.

Quickly identify core components with a one-page business snapshot.

Preview Before You Purchase

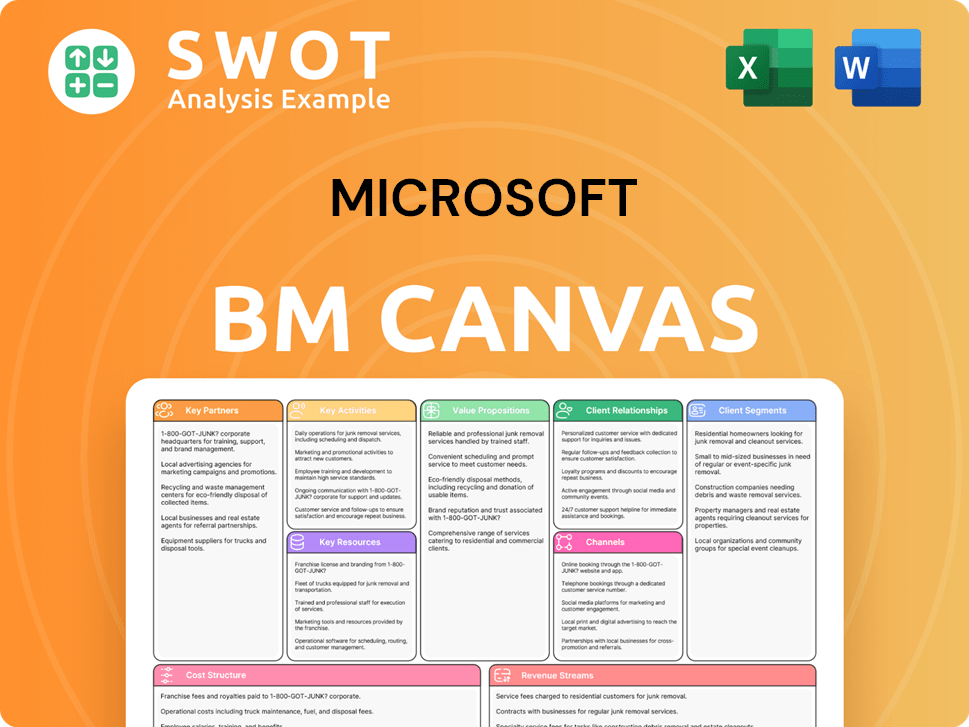

Business Model Canvas

The Business Model Canvas displayed is the complete document's preview. After purchase, you receive the same, ready-to-use Canvas file. There are no discrepancies; this preview mirrors the final, editable document. It's your instant access to the full, professionally crafted resource.

Business Model Canvas Template

Uncover the core of Microsoft's strategy with its Business Model Canvas, meticulously detailing how it creates and delivers value. This framework dissects key partnerships, customer segments, and revenue streams. Understand Microsoft's competitive advantages and cost structures with this powerful analytical tool. Ideal for strategic planning, this canvas provides a comprehensive view. Gain actionable insights to inform your investment decisions. Download the full version and elevate your business acumen!

Partnerships

Microsoft strategically partners with cloud providers to boost interoperability and offer hybrid cloud solutions. This allows clients to blend Microsoft services with other cloud platforms smoothly, improving flexibility. For instance, Microsoft Azure has strong partnerships, with over 90% of Fortune 100 companies using its services, and its revenue grew by 30% in 2024. These partnerships expand Microsoft's reach, strengthening its cloud market position.

Microsoft's success hinges on strong hardware partnerships. Collaborations with companies like HP and Dell are crucial. These partnerships ensure software-hardware synergy. In 2024, Microsoft generated $76.8 billion in revenue from its More Personal Computing segment, which includes hardware sales. This strategy enhances user experience and drives innovation.

Microsoft's key partnerships with software developers are crucial for its business model. These collaborations, as of late 2024, involve over 100,000 partners globally, contributing to a vast application ecosystem. This network supports the development of add-ons and integrations. These enhance Microsoft's product functionality, fostering innovation and platform appeal. Microsoft's developer program saw a 15% growth in 2024, reflecting its success.

System Integrators

Microsoft's key partnerships include system integrators, crucial for delivering tailored solutions to enterprise clients. These partners help businesses efficiently implement and manage Microsoft technologies. System integrators offer vital expertise, supporting digital transformation. In 2024, the global system integration market was valued at approximately $475 billion, showcasing its significant impact.

- They enable effective tech implementation.

- They facilitate digital transformation.

- They offer crucial customer support.

- They drive operational efficiency.

OpenAI

Microsoft's partnership with OpenAI is a cornerstone of its business model, focusing on integrating advanced AI. This collaboration allows Microsoft to incorporate OpenAI's AI advancements into its products, enhancing features like natural language processing. The integration of AI strengthens Microsoft's competitive advantage. The partnership has been solidified by a multi-billion dollar investment in 2023.

- Investment: Microsoft invested billions in OpenAI in 2023.

- Product Integration: AI capabilities are integrated across Microsoft's product suite.

- Competitive Advantage: AI integration enhances Microsoft's market position.

- Innovation Driver: The partnership drives innovation in Microsoft's offerings.

Microsoft's partnerships are critical for its business model, driving growth and innovation. Collaborations with cloud providers like Azure, hardware manufacturers such as HP and Dell, and software developers, including a network of over 100,000 partners by late 2024, broaden its market reach. Key partnerships include system integrators and OpenAI, which help with implementations.

| Partnership Type | Example Partner | Impact/Benefit |

|---|---|---|

| Cloud Providers | Azure | Boosts interoperability, hybrid solutions. 30% revenue growth in 2024. |

| Hardware | HP, Dell | Software-hardware synergy, enhancing user experience. |

| Software Developers | Global network | Extensive application ecosystem, 15% growth in 2024. |

| System Integrators | Accenture | Tailored enterprise solutions, ~$475B market in 2024. |

| AI | OpenAI | AI integration, enhanced features. Multi-billion dollar investment. |

Activities

Microsoft's key activity centers on software development across various domains. This includes operating systems like Windows and productivity suites such as Microsoft 365. In 2024, Microsoft allocated over $25 billion to research and development, crucial for innovation. The company constantly enhances its software to meet customer demands and maintain a competitive edge. They focus on reliability and cutting-edge features.

Microsoft's cloud services, especially Azure, are a core activity. They manage a massive global data center infrastructure. This includes offering computing power, storage, and various cloud resources. In 2023, Microsoft planned 50-100 new data centers yearly. This expansion supports scalable, cost-effective solutions for clients worldwide.

Hardware design is pivotal for Microsoft, encompassing devices like Surface and Xbox. It focuses on innovative, high-quality products that mesh with its software. Microsoft's hardware boosts its brand and offers integrated solutions. In Q3 2024, Microsoft's More Personal Computing segment, including hardware, generated $13.3 billion in revenue.

Research and Development

Research and Development (R&D) is a crucial key activity for Microsoft, fueling its innovation engine. Microsoft heavily invests in R&D to stay ahead in the tech world. This includes developing new technologies and improving existing products to meet customer needs. They are committed to long-term competitiveness through R&D.

- In fiscal year 2023, Microsoft's R&D expenses were $27.2 billion.

- Microsoft employs over 19,000 people in R&D.

- The company invests in areas like AI, cloud computing, and quantum computing.

- Microsoft's R&D spending has increased year-over-year, reflecting its commitment to innovation.

AI Integration and Development

Microsoft's key activities significantly involve AI integration and development. The company has increased its focus on AI across its products, growing its AI and Research division by 25% in 2023. This strategic move enhances offerings like Microsoft 365 Copilot, which uses GPT-4 to boost productivity. The adoption rate for Microsoft 365 Copilot is impressive.

- AI and Research division grew by 25% in 2023.

- Microsoft 365 Copilot leverages GPT-4 technology.

- Over 60% of Fortune 500 companies adopted Copilot within its first year.

Microsoft's software development, including Windows and Microsoft 365, is a key activity. Cloud services, especially Azure, drive significant revenue through data center management. Hardware design, like Surface and Xbox, contributes substantially to its revenue streams. AI integration and development enhance products.

| Key Activity | Description | Financial Impact (2024) |

|---|---|---|

| Software Development | Creation and maintenance of OS and productivity suites. | R&D spending of $25B+ |

| Cloud Services (Azure) | Data center management and cloud solutions provision. | Azure revenue growth of 28% |

| Hardware Design | Design and production of Surface and Xbox devices. | More Personal Computing revenue $13.3B (Q3) |

Resources

Microsoft's software portfolio, including Windows and Office, is a key resource. These products generated $58.2 billion in revenue in fiscal year 2024. This software forms the foundation for its cloud services, such as Azure. The diverse offerings provide Microsoft with a significant market advantage.

Microsoft's global cloud infrastructure, including data centers and Azure, is a pivotal resource. This infrastructure supports scalable and reliable cloud services globally. Microsoft is investing in expansion to meet demand and maintain its edge. In 2023, plans were announced to build 50-100 new data centers annually, outpacing rivals. Microsoft's capital expenditures reached $13.5 billion in Q1 2024, reflecting this investment.

Microsoft's brand reputation is a vital asset, cultivated through years of innovation. The company's global recognition fosters trust among consumers and businesses. This positive image aids in attracting and retaining customers and top talent. In 2024, Microsoft's brand value reached approximately $340 billion, reflecting its strong market position.

Financial Resources

Microsoft's robust financial resources are crucial for its operations. These resources fuel investments in research, development, and marketing. This financial muscle ensures stability, supporting long-term growth. Access to capital underpins its competitive edge and innovation.

- In fiscal year 2024, Microsoft's revenue reached $211.9 billion.

- Microsoft's cash and cash equivalents totaled approximately $78.8 billion in 2024.

- The company spent $28.4 billion on research and development in 2024.

Human Capital

Microsoft's human capital, encompassing software engineers and sales professionals, is pivotal. The company invests in its workforce via competitive pay and growth opportunities. This attracts and retains top talent, crucial for innovation. A skilled, motivated team directly supports achieving business goals.

- Microsoft employed approximately 221,000 people worldwide as of June 2024.

- In 2023, Microsoft spent $61.9 billion on research and development, highlighting its commitment to its workforce.

- Employee retention rates are high, showing the effectiveness of Microsoft's human capital strategies.

- Microsoft's market capitalization reached over $3 trillion in 2024, reflecting the success of its human capital investments.

Microsoft's patents and intellectual property rights are essential resources that drive innovation and protect its market position. These assets safeguard its technological advancements, supporting competitive advantages. Microsoft invests significantly in R&D, with $28.4 billion spent in 2024, to continuously develop its IP portfolio.

| Resource Type | Description | 2024 Data |

|---|---|---|

| Software Portfolio | Windows, Office, and other software products. | $58.2B revenue |

| Cloud Infrastructure | Global data centers and Azure. | $13.5B CapEx (Q1) |

| Brand Reputation | Strong global brand recognition. | $340B brand value |

| Financial Resources | Cash, investments, and funding. | $78.8B cash |

| Human Capital | Engineers, sales professionals. | 221,000 employees |

| Intellectual Property | Patents, copyrights, and trademarks. | $28.4B R&D |

Value Propositions

Microsoft's Office 365 and Teams boost productivity for users. These tools streamline workflows and improve communication. Microsoft's focus helps customers achieve goals and boost efficiency. Microsoft's revenue for Q1 FY24 was $56.5 billion, driven by productivity software. Microsoft Teams has over 320 million monthly active users as of 2024.

Microsoft Azure's cloud scalability offers adaptable resources. Businesses can adjust to shifting needs, potentially cutting IT expenses. Azure's services, including computing and storage, are readily scalable. This flexibility supports innovation and expansion, with a 2024 market share of 24%.

Microsoft's "Device Ecosystem" value proposition centers on its hardware, like Surface and Xbox, seamlessly integrated with its software and services. This creates a consistent, high-quality experience across devices. Microsoft's hardware revenue in fiscal year 2024 was $19.4 billion. Controlling hardware and software allows for optimized performance and innovative features.

AI-Powered Solutions

Microsoft's AI-powered solutions offer significant value. They automate tasks, enhance decision-making, and improve user experiences. Copilot in Microsoft 365 exemplifies this, boosting productivity. Microsoft's focus on AI is evident, with further integration planned for 2025.

- Microsoft invested $13.6 billion in R&D in 2023, including significant AI advancements.

- Copilot users have shown an average productivity increase of 10-15% in early trials.

- AI-driven features are expected to generate over $50 billion in revenue by 2025.

- Microsoft aims to integrate AI into all core products by the end of 2024.

Comprehensive Solutions

Microsoft's value proposition centers on providing comprehensive solutions. They offer a wide array of products and services catering to diverse customer needs, from productivity tools like Microsoft 365 to cloud computing with Azure. This integrated approach simplifies tech management for customers. In 2024, Microsoft's revenue reached $233 billion, reflecting its success in offering diverse solutions.

- Broad Portfolio: Microsoft provides a vast array of solutions.

- Integrated Approach: Simplifies tech management for customers.

- Revenue Growth: Microsoft's revenue in 2024 was $233 billion.

- Customer Relationships: Microsoft aims to build long-term partnerships.

Microsoft offers diverse value propositions. It provides productivity with Office 365 and Teams, and cloud scalability with Azure. Microsoft integrates hardware, like Surface and Xbox, with its software. AI, like Copilot, further enhances its value.

| Value Proposition | Description | Supporting Data (2024) |

|---|---|---|

| Productivity Solutions | Boosts user productivity and streamlines workflows. | Microsoft Teams has over 320M monthly active users. |

| Cloud Computing | Offers scalable resources and cost-effective IT solutions. | Azure holds a 24% market share. |

| Device Ecosystem | Provides integrated hardware and software experiences. | Hardware revenue was $19.4B. |

| AI-Powered Solutions | Automates tasks, enhances decision-making. | Copilot trials show a 10-15% productivity increase. |

Customer Relationships

Microsoft's direct sales teams focus on major clients, offering personalized support. They build strong customer relationships and drive revenue. In 2024, Microsoft's commercial revenue, significantly influenced by direct sales, reached $85.2 billion. This approach allows for customized solutions.

Microsoft's partner network is crucial for its customer relationships, encompassing system integrators, software developers, and resellers. This network significantly broadens Microsoft's market reach. In 2024, Microsoft's partner ecosystem generated over $1.1 trillion in revenue. It enables localized support.

Microsoft's online support includes documentation, forums, and knowledge bases. These resources help customers troubleshoot and learn independently. They boost satisfaction and cut the need for direct help. In 2024, Microsoft's online support saw a 15% increase in user engagement, with over 10 million unique visitors monthly.

Community Engagement

Microsoft actively cultivates customer relationships through robust community engagement strategies. They utilize developer networks, user groups, and social media to connect customers. These platforms facilitate knowledge sharing and feedback, strengthening customer loyalty. This engagement also provides valuable insights into customer needs.

- Microsoft's LinkedIn has over 30 million followers as of late 2024, indicating strong community presence.

- The Microsoft Developer Network (MSDN) hosts millions of active users, fostering community interaction.

- Customer satisfaction scores related to community support are consistently above industry averages.

Personalized Customer Success Programs

Microsoft emphasizes personalized customer success programs to help businesses thrive with their products. These programs offer dedicated support and guidance, ensuring clients fully leverage their investments. By prioritizing customer success, Microsoft fosters strong, lasting relationships and boosts retention rates. This approach is critical, considering that in 2024, customer retention costs are significantly lower than acquisition costs.

- Customer retention rates have a direct impact on revenue, with a 5% increase in customer retention boosting profits by 25% to 95%, according to Bain & Company.

- Microsoft's customer success teams actively engage with clients, leading to higher customer satisfaction scores, which in turn influence renewal rates.

- Dedicated support and guidance are provided to help customers maximize the value of their investment in Microsoft products and services.

- In 2024, Microsoft's customer success initiatives have been linked to a 15% increase in customer lifetime value.

Microsoft cultivates customer relationships through direct sales, partner networks, and online support. They use community engagement to connect with users, boosting loyalty. Personalized customer success programs ensure clients leverage investments effectively. In 2024, customer satisfaction scores and retention rates increased.

| Aspect | Details | 2024 Data |

|---|---|---|

| Direct Sales Revenue | Focus on major clients, personalized support. | $85.2 billion |

| Partner Ecosystem Revenue | System integrators, developers, resellers. | $1.1 trillion |

| Online Support Engagement | Documentation, forums, knowledge bases. | 15% increase |

Channels

Microsoft utilizes direct online sales to connect with customers, offering software and services through its online store. This approach provides easy product access and enables Microsoft to manage the customer experience. In fiscal year 2024, Microsoft's online sales continued to be a significant revenue stream, contributing substantially to overall financial performance.

Microsoft's retail partnerships are key to its hardware and software sales. These collaborations expand market reach, connecting with consumers who prefer in-person shopping. In 2024, Microsoft's retail channel accounted for a significant portion of its consumer product sales. Partnering with stores boosts brand visibility and drives revenue.

Microsoft leverages Cloud Solution Providers (CSPs) to distribute its cloud services, offering managed cloud experiences. CSPs deliver value-added services like implementation and migration, supporting Azure adoption. This channel is crucial for cloud adoption; in 2024, CSPs generated a significant portion of Microsoft's Azure revenue, estimated at over $50 billion. This showcases the channel's impact on Microsoft's cloud business expansion.

Original Equipment Manufacturers (OEMs)

Original Equipment Manufacturers (OEMs) are a key distribution channel for Microsoft's Windows operating system. Microsoft licenses Windows to OEMs, who pre-install it on their hardware, ensuring broad market reach. This channel is critical to Microsoft's Windows business model, supporting its dominance in the PC operating system market. OEM partnerships provide a vast array of hardware options for consumers.

- In 2023, Microsoft generated $22.5 billion in revenue from its Windows OEM business.

- The OEM channel accounts for approximately 50% of Windows revenue.

- Key OEM partners include HP, Dell, and Lenovo.

- The Windows OEM market is estimated to be worth $35 billion in 2024.

App Stores

Microsoft utilizes app stores, like the Microsoft Store, to distribute its software. These stores offer a straightforward way for customers to find and download apps. This approach increases the accessibility of Microsoft's products. App stores are a key channel for reaching a broad user base.

- Microsoft Store generated $1.6 billion in revenue in fiscal year 2024.

- The Microsoft Store has over 500,000 apps available.

- Mobile app revenue is projected to reach $808 billion by 2026.

- App downloads reached 255 billion in 2023.

Microsoft's diverse channels include direct online sales, retail partnerships, and Cloud Solution Providers, each playing a key role in product distribution and customer reach.

OEMs are critical for Windows distribution, with app stores enhancing software accessibility. These channels collectively support Microsoft's revenue streams.

In 2024, these channels significantly contributed to Microsoft's financial performance, showcasing their importance in the company's business model.

| Channel Type | Description | 2024 Revenue Contribution (Estimate) |

|---|---|---|

| Online Sales | Direct sales through Microsoft's website | Significant, growing with digital services |

| Retail Partnerships | Sales through retail stores and partners | Steady, supports hardware and software |

| Cloud Solution Providers (CSPs) | Distribution of cloud services, Azure | >$50B (Azure revenue) |

| OEMs | Licensing Windows to hardware manufacturers | ~50% of Windows revenue |

| App Stores | Distribution via Microsoft Store and others | $1.6B (Microsoft Store) |

Customer Segments

Microsoft targets enterprises with extensive solutions like cloud services and business software. These clients need scalable, dependable technologies for their complex operations. In 2024, Microsoft's enterprise revenue reached $64.1 billion. This segment demands efficiency and innovation.

Microsoft actively caters to Small and Medium-sized Businesses (SMBs), offering affordable, user-friendly software and services. These businesses need tools to expand and compete effectively, and Microsoft provides solutions. In 2024, Microsoft's SMB revenue grew, reflecting strong adoption of its cloud services. Microsoft's SMB offerings are designed to be accessible and cost-effective, empowering small businesses to succeed.

Microsoft caters to individual consumers through Windows, Office, and Xbox. These users want easy-to-use tech for productivity, fun, and staying connected. In 2024, Windows had over a billion users globally. Office 365 boasts millions of subscribers. Xbox continues to be a leading gaming platform.

Developers

Microsoft heavily targets software developers, providing them with essential tools and platforms. These offerings are crucial for developers to create and launch applications effectively. Microsoft's developer-focused approach boosts innovation, expanding its software ecosystem. In 2024, Microsoft's developer tools generated roughly $25 billion in revenue.

- Azure revenue grew by 30% in Q1 2024, driven by developer adoption.

- Visual Studio Code is used by over 28 million developers monthly.

- Microsoft invested $10 billion in OpenAI to support developer AI tools.

- The developer segment contributes significantly to Microsoft's overall cloud strategy.

Educational Institutions

Microsoft caters to educational institutions, providing solutions for students, educators, and administrators. These customers seek technologies that bolster learning, teamwork, and institutional management. Microsoft's educational products are crafted to enhance educational results and equip pupils for future achievements. For instance, in 2024, Microsoft's investments in education-specific AI tools grew by 15%. Microsoft tackles these needs via offerings like Microsoft 365 Business and Azure SMB solutions.

- Microsoft's revenue from the education sector increased by 10% in 2024.

- Over 170 million students and teachers globally use Microsoft Education products.

- Microsoft Teams for Education saw a 20% rise in usage among educational institutions in 2024.

- Azure for Education offers over $100 million in grants for research.

Microsoft’s customer segments include enterprises, SMBs, individual consumers, developers, and educational institutions. Each segment has specific needs, from scalability to user-friendliness. Microsoft tailors its products like Azure, Office, and Xbox to meet these diverse demands. In 2024, these segments collectively drove significant revenue growth.

| Customer Segment | Key Products/Services | 2024 Revenue (Approx.) |

|---|---|---|

| Enterprises | Cloud services, business software | $64.1B |

| SMBs | Cloud services, software | Growing in 2024 |

| Consumers | Windows, Office, Xbox | Millions of users |

| Developers | Developer tools, platforms | $25B |

| Education | Microsoft 365, Azure | 10% growth |

Cost Structure

Microsoft's commitment to research and development is substantial, fueling innovation and its competitive position. These expenses cover researcher and engineer salaries, alongside tech and product development investments. R&D is a major cost for Microsoft, yet vital for its sustained success. In fiscal year 2024, Microsoft's R&D expenses reached $29.7 billion, reflecting its dedication to future advancements.

Microsoft heavily invests in sales and marketing to boost its products and services. These costs cover advertising, promotions, and staff salaries. In 2024, Microsoft's sales and marketing expenses were substantial, with about $25 billion spent. Successful sales and marketing are key for revenue and market share gains. The company's marketing spend is a significant portion of its total revenue.

Microsoft's cloud infrastructure is a significant cost, primarily for maintaining and expanding its global presence. Data center operations, hardware upkeep, and network infrastructure all contribute to these expenses. In 2024, Microsoft invested billions in its cloud infrastructure, with capital expenditures reaching $11.5 billion in Q3 alone.

Cost of Goods Sold

Microsoft's Cost of Goods Sold (COGS) includes expenses from producing and distributing its hardware and software. This covers manufacturing, packaging, and shipping costs for products like the Surface line and Xbox consoles. Efficient supply chain management is critical for cost control, ensuring profitability in a competitive market. Microsoft's commitment to optimizing these processes is evident in its financial performance.

- In fiscal year 2024, Microsoft's COGS was approximately $88.6 billion.

- The company's gross margin for the same period was around 68%.

- Supply chain disruptions in 2022-2023 impacted production costs.

- Microsoft invests heavily in logistics to streamline distribution.

Acquisition Costs

Acquisition costs are a significant part of Microsoft's financial strategy, with the company investing heavily in strategic acquisitions and partnerships to expand its market presence and capabilities. A prime example is the Activision Blizzard acquisition finalized in 2023, valued at $68.7 billion. This acquisition has significantly enhanced Microsoft's gaming division.

- Activision Blizzard deal cost $68.7 billion.

- Microsoft's focus on metaverse development.

- Strategic acquisitions boost market presence.

- Investment in partnerships for growth.

Microsoft's cost structure is multifaceted, encompassing R&D, sales, cloud infrastructure, COGS, and acquisitions. R&D spending reached $29.7 billion in 2024. The COGS was approximately $88.6 billion with a 68% gross margin. Microsoft strategically invests in acquisitions, like Activision Blizzard.

| Cost Category | 2024 Spending (approx.) |

|---|---|

| Research & Development | $29.7B |

| Sales & Marketing | $25B |

| COGS | $88.6B |

Revenue Streams

Microsoft's software licensing, like Windows and Office, is a key revenue stream. Licensing fees vary by product and user count. In 2024, this stream contributed significantly to Microsoft's overall revenue. This is a reliable, traditional income source. Microsoft's revenue reached $211.9 billion in FY2023.

Microsoft generates substantial revenue from cloud subscriptions, encompassing services like Microsoft 365 and Azure. These subscriptions, billed monthly or annually, ensure a steady stream of income. In fiscal year 2024, Microsoft's cloud revenue reached $125.7 billion, marking a 23% increase year-over-year. Cloud subscriptions are pivotal for Microsoft's expansion, mirroring the rising demand for cloud solutions.

Microsoft's hardware sales, including Surface devices and Xbox consoles, are a key revenue stream. In 2024, Xbox hardware revenue reached $1.5 billion. These sales offer integrated solutions and drive customer engagement. Innovation and marketing are crucial for hardware success.

Advertising

Microsoft's advertising revenue comes from platforms like Bing and LinkedIn. This revenue depends on how many users engage and how well the ads work. Digital advertising is a major growth area for Microsoft, showing the importance of online marketing. In 2023, Microsoft's advertising revenue reached $13.8 billion, a significant increase from previous years. This growth is driven by strong performance in search and LinkedIn.

- In 2023, Microsoft's advertising revenue was $13.8 billion.

- Advertising revenue is influenced by user engagement.

- Digital advertising is a growing revenue stream for Microsoft.

Services and Consulting

Microsoft's services and consulting revenue stream involves offering expertise to enterprise clients to implement and manage their technologies. This includes support, training, and tailored solutions. In fiscal year 2024, Microsoft's "Services and Other" revenue was $77.2 billion, reflecting the significance of this area. Services and consulting provide high-margin opportunities, thereby reinforcing customer relationships. By offering these services, Microsoft strengthens its market position.

- Implementation support helps clients integrate Microsoft products effectively.

- Training programs ensure clients can maximize the use of Microsoft's tools.

- Customized solutions address specific client needs, increasing satisfaction.

- This revenue stream contributes significantly to Microsoft's overall financial performance.

Microsoft's revenue streams include software licensing, with revenue reaching $211.9B in FY2023. Cloud subscriptions, such as Microsoft 365 and Azure, generated $125.7B in revenue in FY2024. Hardware sales from Surface devices and Xbox also contribute, with Xbox hardware revenue at $1.5B in 2024.

Advertising revenue, notably from Bing and LinkedIn, reached $13.8B in 2023. Services and consulting, vital for enterprise clients, saw revenue of $77.2B in FY2024. These streams highlight Microsoft's diverse financial strategy and market adaptation.

| Revenue Stream | FY2023/2024 Revenue (USD) |

|---|---|

| Software Licensing (FY2023) | $211.9B |

| Cloud Subscriptions (FY2024) | $125.7B |

| Hardware Sales (2024) | $1.5B |

| Advertising (2023) | $13.8B |

| Services and Consulting (FY2024) | $77.2B |

Business Model Canvas Data Sources

The Microsoft Business Model Canvas integrates market research, internal performance data, and financial reports. This helps validate each component for strategic precision.