Microsoft PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Microsoft Bundle

What is included in the product

Analyzes how external factors impact Microsoft. This PESTLE uncovers opportunities and risks.

Provides a concise version for PowerPoints or team planning.

Preview Before You Purchase

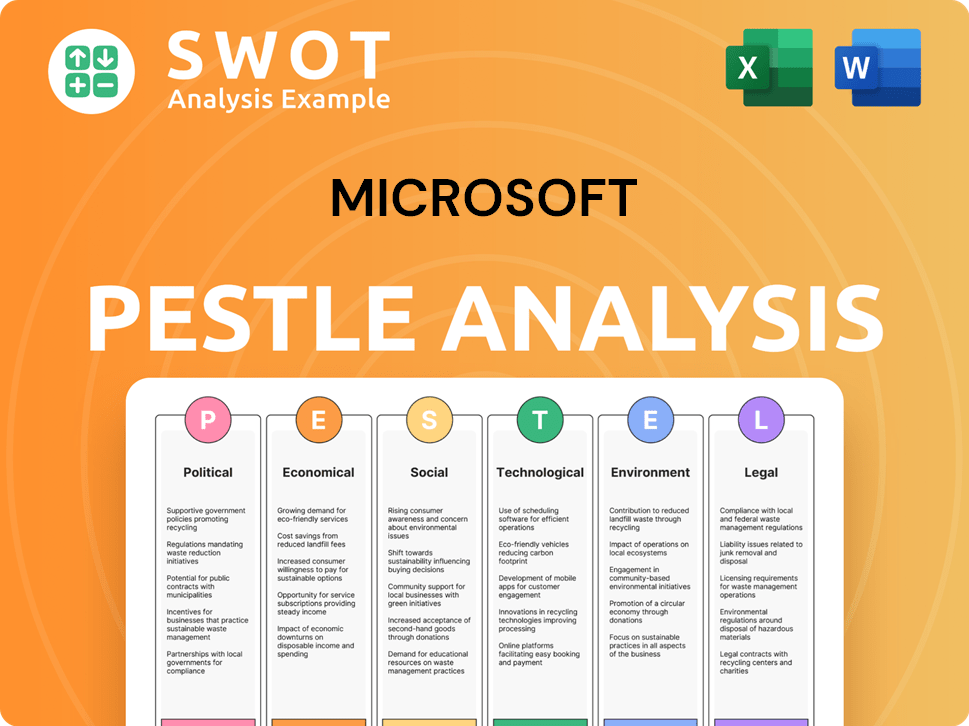

Microsoft PESTLE Analysis

The Microsoft PESTLE Analysis preview shows the complete document.

What you see here is the full, finalized analysis you'll download.

No changes or hidden sections; it's exactly what you get.

This is the actual, ready-to-use file after purchase.

You'll receive the same structured content shown now.

PESTLE Analysis Template

Navigate Microsoft's complex environment with our detailed PESTLE Analysis. Discover how external factors impact its operations and strategic decisions. This essential report offers a concise overview of key trends. Understand market opportunities and potential challenges. Get an edge by downloading the full, actionable analysis now!

Political factors

Microsoft faces intense governmental scrutiny worldwide. Antitrust concerns and data privacy are key issues. The EU fined Microsoft $2.2 billion in 2024 for bundling Teams with Office. This impacts market dominance and business practices. Cybersecurity regulations also pose significant compliance challenges.

International trade policies and geopolitical tensions significantly affect Microsoft. Trade disputes, such as those between the U.S. and China, can raise production costs. In 2024, Microsoft's international revenue accounted for about 50% of its total revenue. Market access and global sales face uncertainty due to these factors.

Governments globally are increasingly backing tech and automation, creating chances for Microsoft. This backing can boost sales of its products and services to public sectors. For example, in 2024, the U.S. government allocated over $50 billion for technology upgrades. This funding supports cloud services and AI adoption, areas where Microsoft is a key player.

Political Stability in Key Markets

Political stability is vital for Microsoft's global strategy. Stability ensures predictability in investment and operations. Unstable regions introduce risks like policy changes or disruptions. Microsoft closely monitors political landscapes for informed decisions.

- Microsoft operates in over 190 countries, each with varying political climates.

- Political risk assessments are integral to Microsoft's market entry strategies.

- Changes in government policies can significantly impact Microsoft's profitability.

Cybersecurity Regulations and National Security

Cybersecurity regulations are tightening globally, affecting tech firms. These rules, aimed at safeguarding infrastructure and data, demand significant investments from Microsoft. National security considerations further impact government tech procurement, influencing Microsoft's market access. For example, the U.S. government allocated $13.3 billion for cybersecurity in 2024.

- Stricter regulations increase compliance costs.

- National security concerns affect government contracts.

- Microsoft must enhance security features.

- Cybersecurity spending is on the rise.

Microsoft navigates varied political landscapes globally. Antitrust issues, like the 2024 EU fine of $2.2B, affect business. Governments support tech; the U.S. invested $50B+ in tech in 2024, benefiting cloud services and AI, central to Microsoft.

| Political Factor | Impact on Microsoft | Data (2024/2025) |

|---|---|---|

| Antitrust Regulations | Affect market dominance, operational costs | EU fine of $2.2B in 2024, continuous reviews |

| Government Support | Boosts sales, R&D opportunities | U.S. Gov $50B+ tech investment in 2024 |

| Cybersecurity | Increase compliance, operational cost | U.S. Gov allocated $13.3B for cybersecurity |

Economic factors

Microsoft's performance is tied to global economic health. In 2024, the IMF projects global growth at 3.2%. Recessions decrease IT spending, affecting Microsoft. Inflation and unemployment changes also impact demand. For example, the U.S. inflation rate was 3.5% in March 2024.

Microsoft's global presence exposes it to currency risk. Exchange rate fluctuations can significantly alter reported revenues and profits. For instance, a stronger US dollar can reduce the value of international sales when converted. In 2024, currency impacts could affect Microsoft's financial results.

High growth in emerging markets like India and Brazil offers Microsoft significant revenue chances. Expanding middle classes with more disposable income fuel demand for tech. For instance, India's IT market is projected to reach $350 billion by 2026. These markets are crucial for Microsoft's future growth.

Inflationary Pressures and IT Budgets

Inflation significantly influences Microsoft's operational costs and pricing. In 2024, the U.S. inflation rate fluctuated, impacting tech spending. Businesses might adjust IT budgets due to economic pressures. This could affect demand for Microsoft's software and cloud services.

- U.S. inflation rate in early 2024 varied between 3% and 4%.

- Microsoft's revenue growth could be affected by reduced IT spending.

- Price adjustments are a key strategy to manage inflationary pressures.

Investment in AI and Cloud Technologies

The economic climate significantly impacts investment in AI and cloud technologies, directly affecting Microsoft's performance. Perceived ROI drives corporate spending; high returns boost demand for Azure and AI software. According to a 2024 report, global cloud spending is projected to reach $678.8 billion. This growth signals opportunities for Microsoft.

- Cloud computing market is expected to reach $1.6 trillion by 2027.

- Microsoft's Azure revenue grew by 31% in Q1 2024.

- AI adoption is projected to add trillions to the global economy.

Economic factors shape Microsoft's trajectory. In 2024, global growth, influenced by inflation and IT spending, impacts revenues. Currency fluctuations present risk, while emerging markets like India offer significant growth opportunities for the company.

| Factor | Impact on Microsoft | Data/Examples (2024) |

|---|---|---|

| Global Economic Growth | Affects IT spending and revenue | IMF projects 3.2% growth. |

| Currency Exchange Rates | Impacts reported revenues | USD fluctuations influence international sales. |

| Emerging Markets | Offers growth potential | India's IT market projected $350B by 2026. |

Sociological factors

The increasing reliance on technology is a key sociological factor. It fuels the demand for software and digital services, boosting the global software industry. In 2024, the global software market was valued at over $750 billion, with projected growth to exceed $800 billion by 2025. This trend directly expands the market for Microsoft's products.

Consumer and business preferences are increasingly favoring cloud-based solutions. This shift boosts Microsoft's Azure and related cloud services. Azure's revenue grew 30% in fiscal year 2024. Cloud adoption offers flexibility and scalability. Accessibility is a key benefit, driving demand.

The digital skills gap is widening, posing a challenge for many. Microsoft actively combats this by providing digital literacy programs. In 2024, Microsoft invested over $1 billion in global skills initiatives. These efforts aim to empower individuals for the AI-driven economy, ensuring they possess the necessary digital competencies.

Societal Focus on Business Sustainability and Ethics

Societal focus on business sustainability and ethics is intensifying. Microsoft's strategic decisions are increasingly shaped by environmental and social concerns. Ethical practices and contributions to sustainable development are under scrutiny. For example, in 2024, Microsoft invested over $2 billion in sustainable initiatives. This includes efforts to reduce its carbon footprint and promote digital equity.

- Increasing stakeholder pressure for ethical operations.

- Growing demand for transparency in environmental impact.

- Focus on diversity and inclusion in workplace practices.

- Integration of ESG (Environmental, Social, and Governance) factors into business strategies.

Impact of AI on Society and the Future of Work

The swift evolution of AI is reshaping society and the job market. AI agents are becoming more prevalent, leading to adjustments in existing job roles and the creation of new ones. Ethical considerations are crucial as AI is developed and utilized. For instance, the global AI market is projected to reach $620.35 billion by 2025, with a compound annual growth rate of 13.8% from 2024 to 2030.

- AI's impact on employment could displace 85 million jobs by 2025.

- The AI market is expected to grow significantly by 2025.

- Ethical AI development is gaining importance.

Societal trends profoundly influence Microsoft's business. Emphasis on cloud services and AI boosts market growth; the global AI market will reach $620.35 billion by 2025. Ethical operations and digital equity drive investments; Microsoft invested over $2 billion in sustainable initiatives in 2024. Skills gaps, however, need more investments, particularly in response to 85 million job losses forecast due to AI by 2025.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Tech Reliance | Boosts Software Demand | Software Market: $750B+ (2024), $800B+ (2025 est.) |

| Cloud Adoption | Increases Azure Usage | Azure Revenue Growth: 30% (FY2024) |

| Digital Skills | Creates Demand for Training | Microsoft Investment: $1B+ (2024 skills initiatives) |

| Sustainability | Influences Strategic Decisions | Microsoft Investment: $2B+ (2024 sustainable initiatives) |

| AI Advancement | Reshapes Job Market | AI Market: $620.35B (2025 est.); 85M Jobs Potentially Displaced |

Technological factors

Microsoft heavily invests in AI, integrating it across its offerings. The speed of AI innovation is reshaping workflows, boosting productivity, and enabling advanced applications. In Q1 2024, Microsoft's revenue from AI-related services grew by 30%, showcasing strong market adoption. This growth underscores the transformative impact of AI on Microsoft's business model and the broader tech landscape.

Microsoft Azure's global presence is expanding, crucial for its strategy. The growth of hybrid and multi-cloud solutions is driving demand. Edge computing's rise also fuels cloud service needs. In Q1 2024, Azure's revenue grew by 31%.

Microsoft actively invests in quantum computing via Azure Quantum. The global quantum computing market is projected to reach $1.76 billion by 2025. This technology may revolutionize sectors, creating new computing methods. Microsoft's investments include strategic partnerships and research grants.

Enhanced Cybersecurity Solutions

Microsoft actively enhances cybersecurity, crucial due to increasing cyber threats. The company integrates AI-driven security, boosting protection across platforms. In 2024, Microsoft invested heavily in cybersecurity, with a 20% increase in its security budget. This focus aims to safeguard against evolving digital risks. Cybersecurity spending worldwide is projected to reach $218.4 billion in 2024.

- Microsoft's security revenue grew by 19% in fiscal year 2024.

- The company is investing $20 billion over five years in cybersecurity.

- Microsoft's Sentinel and Defender platforms are key offerings.

Evolution of Development Tools and Platforms

The continuous evolution of software development tools and platforms is crucial for innovation. Microsoft's Visual Studio and Power Platform are key, enabling efficient application building and deployment for developers and businesses. These tools support the creation of diverse applications, boosting productivity. Microsoft's cloud services, like Azure, also enhance development capabilities. The global low-code/no-code development platform market is expected to reach $65 billion by 2024, highlighting the importance of platforms like Power Platform.

- Power Platform has seen a 50% YoY growth in active users in 2024.

- Azure's revenue grew by 31% in Q1 2024.

- Visual Studio Code is used by over 75% of developers globally.

Microsoft prioritizes AI integration, growing its AI-related service revenue by 30% in Q1 2024. Azure's expanding global presence, with a 31% revenue increase in Q1 2024, boosts its cloud services. Cybersecurity investments are significant, including a 20% budget rise, while software development tools continue to evolve.

| Key Tech Areas | Recent Developments | Financial Data |

|---|---|---|

| AI | AI integrated across offerings | 30% revenue growth in AI services (Q1 2024) |

| Cloud Computing | Azure's Global expansion, Hybrid cloud solutions | 31% Azure revenue growth (Q1 2024) |

| Cybersecurity | AI-driven security enhancement | $218.4 billion cybersecurity spending (2024 projection) |

Legal factors

Microsoft navigates complex antitrust landscapes globally. In 2024, the EU fined Microsoft $2.2 billion for bundling Teams with Office. Ongoing probes scrutinize cloud service practices. Regulatory actions impact software licensing models. These challenges shape Microsoft's market strategies.

Microsoft must comply with global data privacy regulations like GDPR and CCPA. The company spends a lot on data privacy infrastructure to meet these requirements. In 2024, Microsoft's legal expenses related to compliance were approximately $2 billion. It shows their commitment to protecting user data globally.

Microsoft heavily relies on patents to safeguard its intellectual property. In 2024, Microsoft secured over 3,000 patents, highlighting its commitment to innovation. Patent litigation is a regular aspect, with costs reaching $500 million annually. This protects core technologies and product differentiation.

Electronic Waste Disposal Regulations

Electronic waste disposal regulations are increasingly impacting Microsoft. The company must comply with stringent rules globally, including the European Union's WEEE Directive and similar laws in the United States and Asia. These regulations necessitate proper recycling and disposal of e-waste, influencing product design and end-of-life strategies. Microsoft faces challenges in managing complex supply chains and ensuring compliance across various markets, but also sees opportunities in sustainable practices.

- EU's WEEE Directive: Requires producers to finance the collection, treatment, and recycling of electronic waste.

- U.S. State Laws: Many states have e-waste recycling laws, with varying requirements and mandates.

- Asia's Growth: Increasing e-waste regulations in China, India, and other Asian countries.

Software Licensing and Compliance

Microsoft's software licensing terms are legally binding, influencing how customers use their products. Legal issues can emerge from these terms, impacting both users and competitors. In 2024, Microsoft faced several licensing disputes, reflecting ongoing compliance challenges. Recent legal cases have highlighted the need for clear, enforceable licensing agreements.

- In 2023, Microsoft's revenue from its 'Productivity and Business Processes' segment, which includes software licenses, was approximately $69.8 billion.

- Microsoft's legal expenses related to licensing disputes and compliance were estimated at $1.2 billion in 2023.

- The global software piracy rate was estimated at 37% in 2023, impacting Microsoft's licensing revenue.

Microsoft faces continuous antitrust scrutiny, including a 2024 EU fine of $2.2B for bundling Teams. Data privacy is crucial, with $2B spent on compliance in 2024. Patent protection is vital, securing over 3,000 patents in 2024 amidst $500M in litigation costs.

| Regulation Focus | Impact | 2024 Data Highlights |

|---|---|---|

| Antitrust | Market Practices | EU Fine: $2.2B, ongoing cloud probes. |

| Data Privacy | Compliance | Compliance spend: ~$2B. |

| Intellectual Property | Innovation & Defense | Patents secured: 3,000+, litigation cost: $500M. |

Environmental factors

Microsoft's commitment to environmental sustainability is evident in its carbon goals. The company aims to be carbon negative by 2030 and remove all historical emissions by 2050. This includes a significant push towards renewable energy. In 2024, Microsoft's investment in carbon removal technologies reached $1.5 billion.

Microsoft is targeting water positivity by 2030. The company prioritizes water conservation, efficiency, and replenishment. This strategy tackles water scarcity challenges in water-stressed areas. For example, Microsoft's data centers are strategically located to minimize water usage.

Microsoft aims for zero waste by 2030. They focus on waste reduction in facilities, circular cloud hardware, and packaging. In 2024, Microsoft diverted 90% of operational waste from landfills. The company has invested $1 billion in its Climate Innovation Fund to support sustainability. They are also working to increase device and packaging circularity.

Renewable Energy Consumption

Microsoft is on track to use 100% renewable energy by 2025. The company actively expands its renewable energy portfolio and invests in green infrastructure. In 2023, Microsoft signed agreements for over 5.5 GW of renewable energy capacity. This includes solar and wind projects globally, supporting its sustainability goals.

- Over 5.5 GW of renewable energy capacity agreements signed in 2023.

- Focus on solar and wind energy projects worldwide.

- Commitment to net-zero emissions by 2030.

Ecosystem Preservation and Biodiversity

Microsoft actively supports ecosystem preservation and biodiversity, especially near its operational sites. The company focuses on land protection and green practices for its campuses and data centers. These efforts align with broader sustainability goals, reflecting a commitment to environmental stewardship. Microsoft's initiatives aim to reduce its environmental footprint, contributing to global biodiversity.

- Microsoft aims to be water positive by 2030, replenishing more water than it consumes.

- The company has committed to protecting more land than it uses by 2025.

- Microsoft's data centers are designed to be energy-efficient, reducing their impact on ecosystems.

Microsoft is aggressively pursuing environmental sustainability goals, targeting carbon negativity by 2030 and the removal of all historical emissions by 2050. The company focuses on renewable energy with agreements for over 5.5 GW in 2023 and aims for 100% renewable energy by 2025. Key environmental initiatives also include water positivity by 2030 and zero waste goals.

| Environmental Aspect | Microsoft's Goal | 2024/2025 Status |

|---|---|---|

| Carbon Emissions | Carbon Negative by 2030 | $1.5B in carbon removal tech, on track for 2030 |

| Renewable Energy | 100% by 2025 | Agreements for >5.5 GW by 2023; expanding capacity |

| Water | Water Positive by 2030 | Prioritizing conservation, efficiency and replenishment |

PESTLE Analysis Data Sources

The Microsoft PESTLE Analysis draws upon market research, financial reports, government publications, and industry insights.