Nexa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nexa Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Clear quadrant views reveal strategic investment areas, relieving decision paralysis.

Preview = Final Product

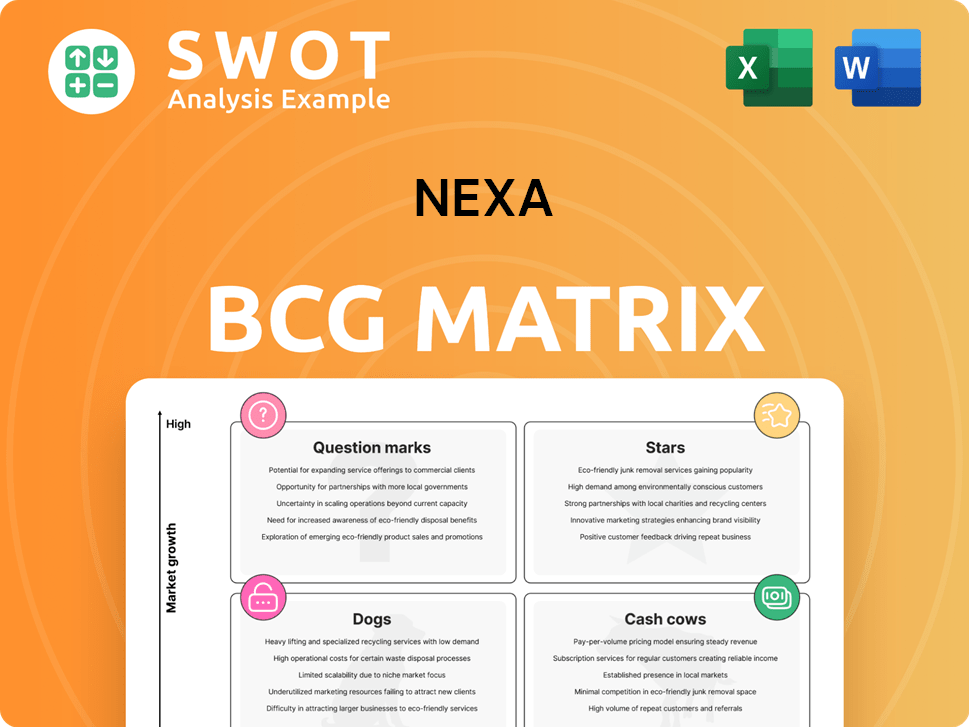

Nexa BCG Matrix

The displayed Nexa BCG Matrix is precisely what you'll receive upon purchase. This means the entire, fully functional report is immediately available, ready to boost your strategic planning.

BCG Matrix Template

The Nexa BCG Matrix categorizes Nexa's products, offering a quick view of their market performance. Stars are high-growth, high-share products, while Cash Cows are established profit generators. Dogs are low-growth, low-share, and question marks need careful consideration. This initial snapshot reveals crucial product strengths and weaknesses. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Aripuanã mine is a key asset for Nexa, boosting production of zinc, copper, lead, and silver, suggesting its "star" potential. Its contribution to Nexa's revenue and profitability is vital to confirm this. In Q1 2024, Aripuanã produced 16.4kt of zinc. Nexa is also acquiring a fourth tailings filter.

Nexa's copper production is a shining star, outperforming expectations. This is crucial as the demand for copper is rising, fueled by the growth in electric vehicles and renewable energy. In 2024, Nexa's copper production exceeded guidance, highlighting its operational strength. With copper prices projected to increase, this segment is poised for substantial growth.

Nexa's zinc production is a shining star within its portfolio, capitalizing on rising market demand. In 2024, Nexa's zinc production reached 327kt, a slight dip of 2% compared to 333kt in 2023. This decrease stemmed from reduced output at several mines and the divestment of Morro Agudo in April 2024.

Silver Production

Silver production is a strategic focus for Nexa, and its strong performance in this area solidifies its "Star" status. In 2024, Nexa's silver production reached 12 million ounces, achieving the midpoint of its guidance. This significant output, especially from Cerro Lindo, underscores Nexa's capacity to meet rising market demand. Nexa's continued success in silver production reinforces its position as a key player.

- 2024 Silver production: 12 million ounces.

- Cerro Lindo's output exceeded expectations.

- Nexa remains a significant silver producer.

Exploration Projects

Nexa Resources' exploration projects, especially near existing zinc operations, are critical for future growth. These projects aim to discover new mineral reserves, potentially transforming them into "stars" within the BCG matrix. Nexa plans extensive exploration in 2025, focusing on expanding resources near current operations. In 2024, Nexa invested $45 million in exploration and evaluation, aiming to increase mineral reserves and resources.

- Nexa invested $45 million in exploration in 2024.

- Exploration efforts are focused on zinc and brownfield projects.

- Success could lead to new mineral discoveries.

- Exploration will continue in 2025.

Nexa's Stars include zinc, copper, silver, and Aripuanã. Zinc production reached 327kt in 2024. Silver output hit 12 million ounces, and copper exceeded expectations, boosted by strong market demand. Nexa's exploration projects aim to discover future "Stars".

| Segment | 2024 Production | Market Demand |

|---|---|---|

| Zinc | 327kt | Rising |

| Copper | Exceeded Guidance | Rising (EVs, Renewables) |

| Silver | 12 million ounces | Rising |

| Aripuanã | 16.4kt Zinc (Q1 2024) | N/A |

Cash Cows

The Cajamarquilla smelter, with its enhanced operational stability, shows promise as a cash cow. In 2024, metal sales reached 591kt, fueled by higher production volumes. This performance is supported by strong demand and efficient supply chain logistics. The smelter's consistent cash flow generation with minimal investment highlights its value.

The Juiz de Fora smelter, much like Cajamarquilla, is positioned as a cash cow due to its operational stability and increased production. Efficient logistics and reduced downtime further enhance its cash-generating potential. In 2024, metal sales reached 591kt, driven by higher production volumes. This reflects enhanced operational stability and increased demand.

Nexa's robust zinc reserves are a core strength, ensuring long-term cash flow. In 2024, Nexa's zinc production reached 337.3 kt, demonstrating consistent output. The company's focus on expanding reserves near existing mines is crucial. Nexa plans continued exploration in 2025, supporting sustainable operations. This strategic approach enhances Nexa's cash-generating capabilities.

Polymetallic Production

Nexa's polymetallic production, focusing on zinc, copper, lead, and silver, positions it as a cash cow. Its diversified revenue streams provide a more stable cash flow. Nexa is the fifth-largest zinc producer globally. These operations are supported by strong exploration potential and greenfield projects.

- Nexa's 2024 revenue: $2.2 billion.

- Zinc production in 2024: 315,000 tonnes.

- Copper production in 2024: 35,000 tonnes.

- Silver production in 2024: 9.5 million ounces.

Sustainability Initiatives

Nexa's sustainability efforts, including decarbonization and ESG policies, boost its appeal to investors and brand image. These initiatives, like the BNDES credit tied to ESG criteria, drive cost savings and operational improvements. This alignment helps improve environmental and social indicators, demonstrating a commitment to long-term value. Nexa's focus on sustainability enhances its financial performance.

- ESG-linked financing: Nexa secured a credit line from BNDES tied to ESG performance.

- Environmental focus: Nexa actively pursues decarbonization practices.

- Social Responsibility: Nexa's policies include socio-environmental responsibility.

- Financial Benefits: These initiatives may lead to cost savings and increased efficiency.

Nexa's cash cows, like Cajamarquilla and Juiz de Fora smelters, generate consistent cash flow. Zinc production in 2024 was 315,000 tonnes, supporting stable revenue. Nexa's strong zinc reserves ensure long-term profitability. These assets benefit from efficient operations and strong market demand.

| Metric | 2024 Data | Notes |

|---|---|---|

| Revenue | $2.2 billion | Reflects overall financial strength |

| Zinc Production | 315,000 tonnes | Key driver of cash flow |

| Copper Production | 35,000 tonnes | Diversifies revenue streams |

Dogs

The Morro Agudo Complex, divested in April 2024, is no longer part of Nexa's portfolio. Before the sale, lower output and costly turnaround plans may have positioned it as a "dog" in the BCG matrix. Nexa finalized the sale on July 1, 2024. This strategic move removed the complex from Nexa's assets. The sale aligns with optimizing the company's focus.

The anticipated decrease in lead production at El Porvenir, driven by lower ore grades, positions this operation as a potential "dog" in the BCG matrix. Declining production within a low-growth market suggests it might be a candidate for reduction or disposal. For 2025, Nexa projects lower copper and lead output in Peru. Specifically, lead production at El Porvenir is estimated to fall to 21,000-26,000t due to lower grades.

Cerro Lindo's anticipated zinc output decline suggests it may be a dog in Nexa's portfolio. The lower grades and reduced production are problematic, especially in a mature market. In 2024, zinc production at Cerro Lindo is expected to be lower. However, this is offset by production increases at El Porvenir and Atacocha.

Vazante Mine

Vazante Mine, a part of Nexa's portfolio, saw zinc production decrease by 3% in 2024, totaling 141kt. This decline resulted from lower ore grades and reduced AgroZinc sales, a byproduct. Lead and silver output also fell, dropping by 35% and 18%, respectively, due to grade issues. Despite these challenges, the mine's performance remained within the 2024 guidance.

- Zinc production: 141kt in 2024 (down 3% from 2023).

- Lead production: Decreased by 35% in 2024.

- Silver production: Decreased by 18% in 2024.

- AgroZinc sales: Reduced due to lower ore grades.

Areas with High Operational Costs

In Nexa's BCG Matrix, "Dogs" represent business units with low market share in slow-growing markets. Mining operations, a key component of Nexa, face significant cost pressures. For 2025, consolidated run-of-mine mining costs are projected to surge by 16% year-over-year.

- Aripuanã's run-of-mine mining costs are included for the first time.

- Higher costs at Cerro Lindo and Vazante contribute to the increase.

- These rising costs can erode profitability and cash flow.

- Nexa must carefully manage these operations.

Several Nexa operations potentially align with the "Dog" quadrant of the BCG matrix, reflecting low market share and slow growth. The Morro Agudo Complex was divested in July 2024, possibly due to its "Dog" status. El Porvenir's lead production is projected to drop to 21,000-26,000t in 2025, potentially indicating a "Dog".

| Operation | 2024 Performance | 2025 Projection |

|---|---|---|

| El Porvenir (Lead) | Production ongoing | 21,000-26,000t (Lead) |

| Vazante (Zinc) | 141kt Zinc (down 3%) | N/A |

| Cerro Lindo | Lower Zinc Production | N/A |

Question Marks

The Cerro Pasco Integration Project is a question mark in Nexa's portfolio. The project has a capital expenditure of $140 million. Its success in extending the life of the mining complex is uncertain. The Board of Directors approved the first phase of the project. In 2024, Nexa's total revenue was around $2.7 billion.

Nexa's increased stake in Tinka Resources, reaching nearly 20% by December 2024, positions the Ayawilca project as a potential question mark within its portfolio. The Ayawilca project, fully owned by Tinka, is a significant zinc-silver deposit in Peru. Zinc prices have shown volatility, with recent data suggesting a price of around $2,800 per metric ton. The success hinges on project development and market dynamics.

Nexa's greenfield projects are like question marks in the BCG Matrix, representing high-growth potential but also considerable risk. These ventures demand substantial upfront investment, making their future returns uncertain. Nexa's exploration efforts in 2024 aimed to expand zinc reserves, with the company being the fifth-largest zinc producer worldwide. Success hinges on effective execution and market conditions, making them a key area for strategic focus.

New Mining Methods

Nexa's 2024 Year-End update shows a question mark scenario due to new mining methods. Expansion and replacement of zinc reserves signal potential growth. Increased zinc content from new methods and model adjustments reinforce asset sustainability. This positions Nexa in a dynamic market.

- Successful expansion of zinc reserves.

- Near-mine exploration and infill drilling.

- Increase in contained zinc.

- Asset sustainability reinforced.

Atacocha Mine

Atacocha Mine is part of Nexa's Pasco complex, where they're focusing on extending mineralized zones. In 2024, they plan to drill 13,650m at the Integración target. Additionally, they've planned 29,700m of regional diamond drilling. The strategy aims to optimize investments and boost the copper portfolio.

- Integración target drilling: 13,650m planned in 2024.

- Regional diamond drilling: 29,700m planned.

- Strategic Goal: Optimize investments and strengthen copper portfolio.

Nexa's question marks include projects like Cerro Pasco, Ayawilca, and greenfield ventures. These projects involve high investment and uncertain returns. Success depends on execution and market conditions, especially zinc prices. The company focuses on expanding zinc reserves, being the fifth-largest producer.

| Project | Status | Key Factors |

|---|---|---|

| Cerro Pasco | Uncertain | $140M CapEx, Life Extension |

| Ayawilca | Potential | Tinka stake, Zinc prices ($2,800/MT) |

| Greenfield | High Risk/Reward | Exploration, Zinc Reserves |

BCG Matrix Data Sources

Nexa's BCG Matrix leverages market data, financial statements, competitive analysis, and growth forecasts for its strategic insights.