Nexa SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nexa Bundle

What is included in the product

Maps out Nexa’s market strengths, operational gaps, and risks

Streamlines complex analysis into actionable insights with easy-to-digest visual presentation.

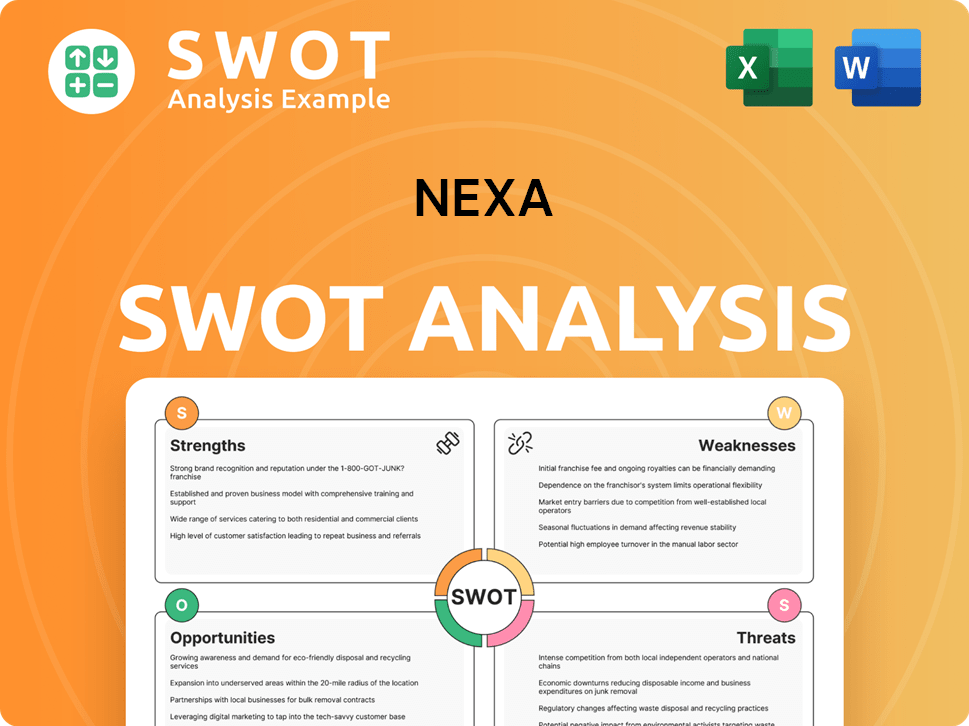

Preview the Actual Deliverable

Nexa SWOT Analysis

Preview the actual Nexa SWOT analysis now! The format and detail displayed are exactly what you'll receive upon purchase.

No hidden sections—this is the full document. Get immediate access to the complete report after checkout.

SWOT Analysis Template

The Nexa SWOT analysis preview uncovers key strengths, weaknesses, opportunities, and threats. You've seen a glimpse of their strategic landscape and market positioning. However, there's so much more to discover!

Unlock the full report for detailed strategic insights, a deep-dive into each element. Benefit from a professionally written and editable version in both Word and Excel.

Gain research-backed insights, ready for planning, analysis, or investment. Don’t settle for highlights.

Purchase the complete SWOT analysis, for smarter decisions and fast action!

Strengths

Nexa Resources' integrated producer model, encompassing both mining and smelting, offers significant advantages. This structure allows for cost savings and enhanced supply chain management, crucial in volatile commodity markets. In 2024, Nexa's zinc production reached approximately 330,000 tonnes. The company's control over its operations provides stability.

Nexa is a significant zinc producer, holding a strong position in the global market. In 2024, Nexa ranked among the top five producers of mined and metallic zinc. This substantial production scale supports a robust market presence. The company's capacity to supply significant volumes provides a competitive edge. This strength boosts Nexa's ability to meet global demand effectively.

Nexa's strength lies in its polymetallic production. Beyond zinc, Nexa extracts copper, lead, and silver, creating a diversified revenue stream. This diversification is key to risk management. In 2024, the prices of these metals varied, with silver at $25/oz and copper around $4/lb.

Operational Efficiency and Cost Management

Nexa has focused on boosting operational efficiency and keeping costs in check. In 2024, Nexa met its cost guidance for mining operations, showing effective cost management. This was helped by lower energy use and smarter spending. This focus leads to better profitability and financial health.

- Achieved consolidated run-of-mine mining costs and C1 cash cost guidance in 2024.

- Reduced energy consumption contributed to cost savings.

- Optimized expenses enhanced operational efficiency.

Commitment to Sustainability and Innovation

Nexa demonstrates a strong commitment to sustainability, publishing detailed reports and engaging in environmental initiatives. They are actively working on decarbonization, community involvement, and environmental care. This dedication is reflected in their innovative tech adoption. For example, Nexa's use of bio-oil and digital twin tech enhances operations and sustainability.

- Sustainability Report: Nexa publishes annual reports detailing environmental performance.

- Bio-Oil Implementation: Nexa is using bio-oil in their roasters, reducing carbon footprint.

- Digital Twin Technology: Nexa is exploring digital twin tech for improved efficiency.

Nexa's strengths include integrated operations, securing cost savings and supply chain control. A leading global zinc producer, Nexa holds a strong market position. Diversified metal production boosts revenue, while effective cost management enhances financial health. Strong sustainability initiatives, like bio-oil implementation, underline Nexa's commitment to environmentally responsible operations.

| Aspect | Details | 2024 Data |

|---|---|---|

| Production | Zinc, Copper, Lead, Silver | Zinc: ~330K tonnes |

| Market Position | Top 5 Zinc Producers | Ranked globally |

| Sustainability | Environmental initiatives | Bio-oil usage & Decarbonization Efforts |

Weaknesses

Nexa's financial reports reveal persistent net losses, a key weakness. These losses, coupled with increased leverage, raise concerns among investors. For example, in the last quarter of 2024, net losses reached $15 million. This financial strain can make it harder to attract investment.

Nexa faces operational hurdles, with production decreases in 2024. Lower ore grades and a mine divestment impacted volumes. For example, zinc production in 2024 was down. These challenges can affect profitability.

Nexa faces tailings management challenges, affecting project timelines. Aripuanã's full ramp-up is delayed due to these issues. In Q1 2024, Nexa's net debt was $887 million. Resolving these issues is vital for production. This directly impacts financial performance and investor confidence.

Safety Incidents

Nexa's mining operations face inherent safety risks, with fatal incidents impacting its track record. Despite efforts to enhance safety protocols, challenges persist in achieving a zero-incident environment. The industry's hazardous nature demands constant vigilance and improvement in safety measures. In 2023, the mining industry saw a significant number of incidents, underscoring the importance of rigorous safety practices.

- 2023: Mining accidents remain a concern globally.

- Ongoing: Continuous safety protocol upgrades are essential.

Exposure to Market Volatility

Nexa faces vulnerabilities due to market volatility as a mining firm. Metal prices, including zinc, copper, lead, and silver, significantly affect its financials. For instance, in 2024, zinc prices fluctuated by 15%, impacting revenue. Demand shifts also pose risks, potentially diminishing profitability. Nexa's financial results closely mirror these market swings.

- Zinc price volatility in 2024: +/- 15%

- Impact of metal price changes on revenue.

- Market demand fluctuation.

Nexa shows persistent financial losses, as highlighted by a $15 million net loss in late 2024. Production declines, such as lower zinc output, present challenges. Tailings issues and safety risks also continue to affect Nexa. Market volatility, seen through metal price swings, remains a significant risk to Nexa's profitability.

| Weakness | Impact | Data Point |

|---|---|---|

| Financial Losses | Reduced Investment | $15M Net Loss (late 2024) |

| Production Issues | Decreased Output | Zinc output down in 2024 |

| Market Volatility | Profitability Risks | Zinc price +/- 15% (2024) |

Opportunities

Nexa stands to benefit from the rising demand for industrial metals. Sectors like construction and renewable energy are driving this growth. Zinc prices reached approximately $2,800 per tonne in early 2024. This presents a chance for Nexa to boost sales and revenue. The company is well-positioned to capitalize on this trend.

Nexa's exploration program focuses on expanding mineral reserves, especially near existing mines. In 2024, Nexa invested $80 million in exploration, with a goal to increase reserves. Successful exploration can extend mine life and boost production. For instance, the Cerro Pasco mine in Peru has shown promising exploration results in 2024, potentially adding significant reserves.

Nexa's SWOT analysis highlights strategic partnerships. They aim for digital mining tech, mineral processing, and sustainable methods. This could boost operations and portfolio growth. In 2024, the mining industry saw $15 billion in M&A deals. Collaborations can drive Nexa's competitive edge.

Advancements in Sustainability and Technology

Nexa's focus on sustainability and tech presents opportunities. Investments in bio-oil and digital twin tech can boost efficiency. This strengthens their position as demand for sustainable materials rises. They are aiming for a 30% reduction in carbon emissions by 2030.

- Reduced environmental impact

- Improved efficiency

- Stronger market position

- Increased investor interest

Portfolio Optimization

Nexa's portfolio optimization strategy centers on maximizing returns via disciplined capital allocation. This involves strategic divestments and investments to enhance overall profitability. The Cerro Pasco Integration Project exemplifies this, aiming to extend mine life and improve financial performance. Nexa's capital expenditures for 2024 are projected to be around $600 million.

- Focus on higher-return assets.

- Strategic divestments and investments.

- Cerro Pasco Integration Project.

- 2024 capex of ~$600 million.

Nexa profits from industrial metals' rising demand, like zinc hitting $2,800/tonne in early 2024, boosting sales. Exploration, with $80M invested in 2024, targets reserve expansion near mines. Partnerships, amid $15B M&A in 2024, aid tech, sustainability efforts.

| Opportunity | Details | 2024/2025 Data |

|---|---|---|

| Rising Metal Demand | Increased need for industrial metals from construction & renewable energy sectors. | Zinc price ~$2,800/tonne (early 2024), strong demand growth forecast. |

| Exploration Program | Expanding mineral reserves, particularly near existing mine sites. | $80M invested in exploration (2024), Cerro Pasco potential reserves. |

| Strategic Partnerships | Collaborations in digital mining, mineral processing, & sustainability. | $15B in M&A deals in mining (2024), aimed to grow portfolio. |

Threats

Metal price volatility, especially for zinc, is a key threat. In 2024, zinc prices saw fluctuations, impacting profitability. Nexa's revenues can suffer if prices drop. This instability demands careful hedging strategies.

Nexa faces significant threats from regulatory scrutiny, particularly regarding ESG. Compliance with environmental standards adds operational costs. In 2024, environmental fines in the mining sector totaled approximately $1.2 billion globally. Evolving regulations demand constant adaptation and investment. This can hinder profitability and operational efficiency.

Nexa faces operational threats including accidents and equipment failures in its mining operations. In 2024, the mining industry saw a rise in incidents, increasing operational costs. Geopolitical risks are also a concern. Political instability and policy changes in Latin America, where Nexa operates, could disrupt operations.

Increased Competition and Market Shifts

Nexa confronts heightened competition in the global metals market, influencing its performance. Changes in customer inventory strategies and the emergence of new producers pose significant challenges. These shifts can directly affect Nexa's sales volumes, market share, and overall profitability.

- The global metal market size was valued at USD 1.72 trillion in 2023.

- Market share volatility can be observed, with some producers gaining ground.

- Changes in customer inventory levels can cause fluctuations in demand.

- Increased competition from emerging market producers.

Macroeconomic Factors

Broader macroeconomic instability, marked by increased volatility, poses a significant threat to Nexa. This includes potential impacts from tariffs, which could disrupt trade and supply chains. For example, in 2024, global trade growth slowed to around 2.6%, influenced by such factors. These conditions can directly affect metal demand and Nexa's operational environment.

- Global economic growth slowed to 3.1% in 2024.

- Tariffs and trade disputes continue to create uncertainty.

- Supply chain disruptions can increase production costs.

Metal price swings and regulatory hurdles pose threats to Nexa. In 2024, the mining industry faced approximately $1.2B in environmental fines, escalating operational expenses. Increased global competition and economic instability, alongside tariffs and slowing trade growth, further complicate Nexa's market position. These factors influence profitability.

| Threats | Impact | Data (2024) |

|---|---|---|

| Metal Price Volatility | Revenue Fluctuations | Zinc prices saw fluctuations |

| Regulatory Scrutiny (ESG) | Increased Costs | $1.2B in environmental fines |

| Economic Instability | Market Uncertainty | Global trade grew 2.6% |

SWOT Analysis Data Sources

This SWOT is data-driven. We used financials, market analysis, industry publications, and expert insights to inform the assessment.