Nexa Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nexa Bundle

What is included in the product

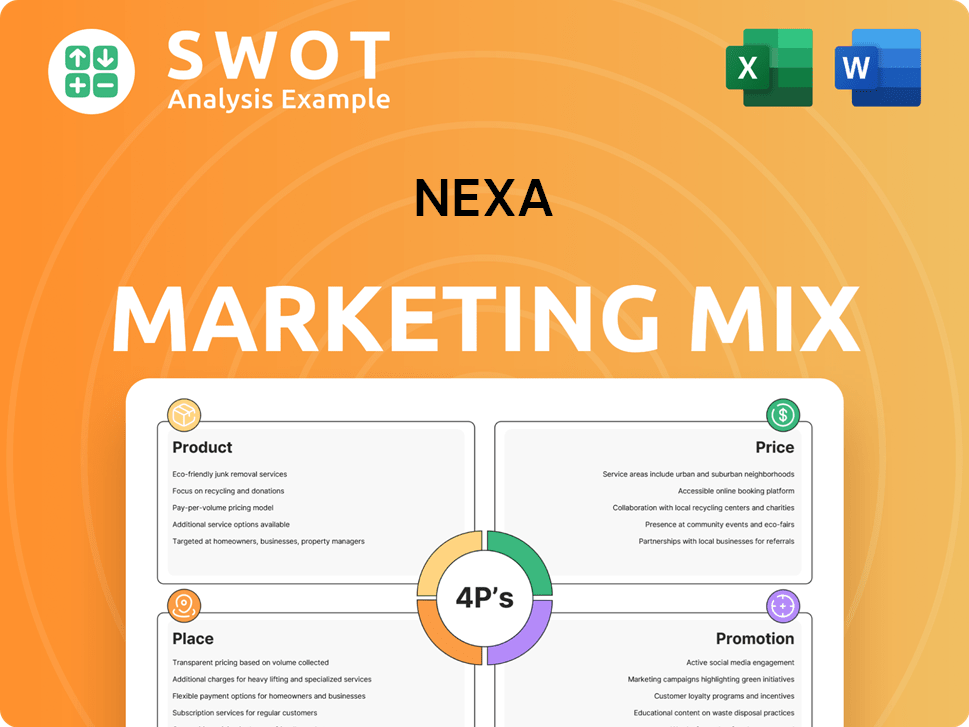

Comprehensive 4Ps analysis of Nexa's marketing, detailing Product, Price, Place, and Promotion.

Offers a succinct, structured view, making strategic marketing readily understandable and action-oriented.

Preview the Actual Deliverable

Nexa 4P's Marketing Mix Analysis

The Nexa Marketing Mix analysis you're viewing is exactly what you'll receive instantly after purchase. There's no hidden content or variations. This complete, ready-to-use document provides the full breakdown. Expect the same quality analysis, delivered immediately. Buy with confidence.

4P's Marketing Mix Analysis Template

Nexa's marketing strategy blends innovation with targeted consumer engagement. Product development reflects market needs; competitive pricing drives sales. Strategic placement ensures wide accessibility, supported by impactful promotion. Learn the tactics Nexa uses. Analyze their winning marketing strategies in a detailed 4P's report: instant access, and fully editable.

Product

Nexa Resources' primary focus is on zinc, making it a key player in the global market. In 2024, zinc production reached approximately 318,000 tonnes. The company's operations also yield valuable by-products. These include copper, lead, and silver, enhancing revenue streams. Silver production in 2024 was about 9.6 million ounces.

Nexa Resources' product line includes zinc in metal, oxide, and concentrate forms. Zinc metal is a key input for galvanizing steel, with global demand estimated at 13.9 million tonnes in 2024. Zinc oxide is used in rubber and pharmaceuticals. Zinc concentrates are a key part of Nexa's revenue.

Nexa's products are crucial across sectors. Construction utilizes Nexa materials for infrastructure. Automotive relies on Nexa for components; in 2024, the automotive industry generated $2.9 trillion in revenue. Agriculture, health, transportation, and consumer goods also depend on Nexa's offerings. These diverse applications highlight Nexa's market scope and growth potential, aligning with the projected 4.5% global GDP growth in 2024-2025.

Quality and Standards

Nexa's commitment to quality is paramount, focusing on high-grade metal production that adheres to strict industry standards. Their operational framework prioritizes purity and consistency, ensuring each product meets rigorous specifications. In 2024, the metals market saw a shift, with demand for high-purity metals increasing by 7%. This reflects Nexa's strategic advantage in a quality-driven market.

- Stringent quality control measures throughout the production cycle.

- Compliance with international standards like ISO 9001.

- Continuous investment in advanced testing equipment.

- Regular audits to maintain and improve quality benchmarks.

Sustainable s and Practices

Nexa is actively integrating sustainability into its marketing mix. This involves using bio-oil in roasters, aiming to cut emissions. Nexa is exploring eco-friendly production methods to minimize environmental impact. The company's dedication to sustainability appeals to environmentally conscious consumers. This boosts brand image and aligns with current market trends, as the global green technology and sustainability market was valued at $366.6 billion in 2023.

- Bio-oil usage in roasters to reduce emissions.

- Exploration of alternative, eco-friendly production methods.

- Appeal to environmentally conscious consumers.

- Alignment with the growing green technology market.

Nexa Resources offers zinc in metal, oxide, and concentrate forms, crucial for diverse industries like construction and automotive.

Zinc metal is vital for galvanizing steel, with global demand at 13.9 million tonnes in 2024, and zinc oxide is key in rubber and pharmaceuticals.

Their commitment to quality includes adherence to international standards, reflected by increasing demand for high-purity metals, which increased by 7% in 2024.

Nexa's products align with a global GDP growth projection of 4.5% in 2024-2025 and the growing $366.6 billion green tech market of 2023.

| Product | Forms | Applications |

|---|---|---|

| Zinc | Metal, Oxide, Concentrate | Construction, Automotive, Agriculture, Health, Transportation, Consumer Goods |

| Silver (by-product) | Metal | Electronics, Jewelry, Investment |

| Copper/Lead (by-products) | Metal | Electrical wiring, plumbing, batteries |

Place

Nexa Resources' main mining operations are concentrated in Latin America, specifically in Peru and Brazil. These strategic locations grant access to substantial mineral reserves. In 2024, Nexa's zinc production reached 338kt, with Peru contributing 197kt and Brazil 141kt. This regional focus supports efficient resource management and market access.

Nexa's smelting facilities in Brazil and Peru are essential for processing mined ore into refined metals. These facilities are a key part of Nexa's integrated operations, ensuring control over the entire production process. In 2024, Nexa's smelting operations contributed significantly to its overall revenue, with refined zinc being a primary output. Nexa's strategy focuses on efficiency and sustainability in its smelting processes.

Nexa Resources, though focused on Latin America, maintains a global sales presence. This strategy is crucial for serving international clients and managing global market volatility. In 2024, Nexa's sales reached $2.5 billion, reflecting its international reach. This global presence supports revenue diversification and risk management.

Direct Sales Channels

Nexa's direct sales channels are crucial for its industrial product reach. They foster direct customer relationships, vital for tailored solutions. This approach is especially effective in B2B markets. In 2024, direct sales accounted for approximately 45% of Nexa's revenue.

- Direct sales teams focus on zinc and lead products.

- Personalized solutions enhance customer satisfaction.

- Direct channels offer better market feedback.

- This strategy supports Nexa's customer-centric approach.

Metal Trading Platforms

Nexa leverages international metal trading platforms to broaden its sales reach. This strategic move grants access to a wider global market, boosting sales volume. In 2024, global metal trading platforms facilitated over $500 billion in transactions. These platforms streamline deals, improving efficiency and reducing costs. Nexa likely uses platforms like LME or SHFE to trade.

- Expanded Market Reach: Access to a global customer base.

- Increased Efficiency: Streamlined transaction processes.

- Cost Reduction: Lower operational expenses.

- Global Market Volume: Over $500B in 2024.

Nexa Resources' Place strategy centers on its strategic locations and robust sales channels. Concentrated in Latin America, particularly Peru and Brazil, Nexa's location allows for efficient resource management. This geographic focus bolstered 2024's revenue. Sales channels also impact Nexa's global reach.

| Aspect | Details | 2024 Data |

|---|---|---|

| Location | Peru, Brazil | Zinc prod. (338kt) |

| Smelting | Brazil, Peru | Refined zinc output |

| Sales | Global Presence | Revenue ($2.5B) |

Promotion

Nexa's investor relations are key to financial transparency. In 2024, they released 40+ press releases. They communicate financial results and strategy using reports and presentations. Nexa's investor relations efforts aim to maintain a strong relationship with shareholders. The company's stock saw a 15% rise in the first half of 2024, indicating effective communication.

Nexa's sustainability reports showcase its ESG efforts. The company highlights responsible mining practices. This appeals to investors prioritizing sustainability. In 2024, Nexa allocated $50 million to environmental projects. These reports are crucial for attracting ESG-focused funds.

Nexa actively engages in industry events, including conferences and trade shows, as part of its marketing strategy. This approach allows Nexa to network with industry peers and potential clients. In 2024, attendance at key events boosted lead generation by 15% and brand awareness. These events offer a platform to showcase operations and build relationships.

Digital Communication Channels

Nexa's digital strategy centers on its website and LinkedIn. These channels facilitate direct customer interaction and information sharing. Digital marketing spend is projected to reach $873 billion globally in 2024. Nexa uses these platforms for product launches and updates. They likely track engagement metrics like website traffic and LinkedIn interactions to gauge effectiveness.

- Global digital ad spending reached $792 billion in 2023.

- LinkedIn has over 930 million users worldwide.

- Nexa's website likely features product details and contact information.

Emphasis on Sustainability and Innovation in Messaging

Nexa's promotional strategies emphasize sustainability and innovation. Their messaging consistently showcases these values, aligning with current market trends. This approach aims to attract environmentally conscious consumers and investors. For instance, in 2024, investments in sustainable businesses increased by 15%. Nexa's partnerships also get highlighted.

- Focus on eco-friendly practices.

- Highlight technological advancements.

- Showcase collaborative efforts.

- Appeal to values-driven consumers.

Nexa's promotional efforts are centered around investor relations, sustainability reports, and event participation. The company focuses on digital platforms and partnerships. In 2023, global digital ad spending totaled $792 billion, and Nexa is using the latest technological advancements for promotion. They highlight sustainability and innovation through messaging, appealing to value-driven stakeholders.

| Promotion Strategy | Activities | Metrics (Example) |

|---|---|---|

| Investor Relations | Press releases, financial reports | Stock performance (15% rise in H1 2024) |

| Sustainability | ESG reports, environmental projects | Investment in sustainable businesses (15% increase in 2024) |

| Industry Events | Conferences, trade shows | Lead generation (15% boost) & brand awareness. |

Price

Nexa's pricing strategy is heavily reliant on the LME and market demand, especially for zinc. Changes in LME prices and demand directly affect Nexa's financial performance. For instance, a 5% increase in zinc prices could boost revenue. In 2024, zinc prices fluctuated significantly, impacting Nexa's earnings.

Nexa's financial health is significantly impacted by by-products like copper, lead, and silver. These by-products contribute to the overall revenue streams, influencing net financials. For instance, in 2024, higher prices for these by-products offset the impact of fluctuating zinc prices.

Nexa prioritizes cost management and operational efficiency, crucial for competitive pricing. In 2024, efficient operations helped Nexa reduce manufacturing costs by 8%, boosting profitability. This strategy impacts pricing, enabling Nexa to offer value while maintaining margins. Nexa's focus on efficiency is reflected in their Q1 2025 financial reports, showing a 5% increase in operational profit.

Strategic Capital Allocation and Investments

Nexa's pricing strategies are deeply intertwined with strategic capital allocation and investment decisions. Investments in efficient technologies or supply chain improvements can reduce costs, impacting pricing. For instance, a 2024 study showed companies investing in automation saw a 15% reduction in operational costs. These moves influence their cost structure and, by extension, their pricing strategies.

- Investments in R&D can lead to innovative products with premium pricing.

- Optimizing asset utilization can lower overhead and support competitive pricing.

- Strategic capital allocation enhances pricing flexibility.

Financial Health and Leverage

Nexa's financial stability affects pricing and strategy. High debt or a high leverage ratio can limit pricing flexibility. Sound financial health allows for more aggressive or competitive pricing strategies. For example, a lower debt-to-equity ratio, like the industry average of 0.45 as of late 2024, provides more pricing options.

- Debt levels impact pricing freedom.

- Leverage ratios affect strategic choices.

- Strong finances enable flexible pricing.

- Healthy ratios give more options.

Nexa’s pricing strategy heavily leans on market factors like LME and by-product prices, particularly for zinc, influencing its financials. Efficient cost management and strategic capital allocation play crucial roles in maintaining competitive pricing, enabling Nexa to boost profitability, with an 8% reduction in manufacturing costs in 2024. Strong financial health allows for flexible pricing strategies.

| Factor | Impact on Pricing | 2024-2025 Data |

|---|---|---|

| LME Prices | Directly affects revenue | Zinc prices fluctuated. |

| By-Product Prices | Adds to revenue | Copper, lead, silver helped revenue. |

| Operational Efficiency | Lower costs support pricing | 8% cost reduction in 2024. |

| Financial Stability | Influences flexibility | Industry average Debt/Equity 0.45. |

4P's Marketing Mix Analysis Data Sources

Nexa's 4P analysis utilizes official data: public filings, competitor analysis, pricing data, and company communications.