O-I Glass Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

O-I Glass Bundle

What is included in the product

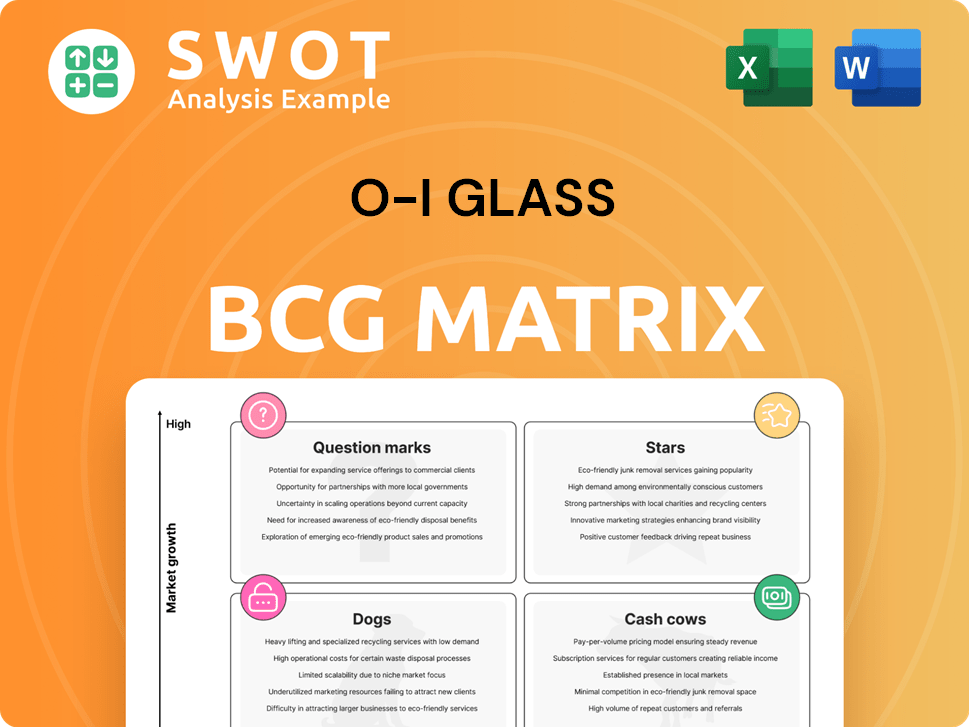

O-I Glass's BCG Matrix analysis showcases strategic actions for each unit.

One-page overview placing each business unit in a quadrant.

Full Transparency, Always

O-I Glass BCG Matrix

The O-I Glass BCG Matrix preview displays the complete, purchasable document. Upon purchase, you'll receive this same comprehensive report, ready for your strategic initiatives. No modifications are needed; it's instantly yours.

BCG Matrix Template

O-I Glass's product portfolio is a complex mix, each with its own market position and growth potential. Examining its products through the BCG Matrix framework offers strategic clarity. Learn which items are stars, driving market share and future growth. Discover cash cows, generating consistent revenue to fuel innovation.

This preview gives you a taste of the bigger picture, but the full O-I Glass BCG Matrix delivers deep, data-rich analysis, strategic recommendations, and ready-to-present formats—all crafted for business impact.

Stars

O-I Glass's MAGMA technology streamlines glass manufacturing. This innovation could be a "Star" in the BCG Matrix. In 2024, O-I Glass invested significantly in MAGMA, aiming for higher efficiency. The company's revenue in Q3 2024 was $1.7 billion, indicating strong growth potential.

O-I Glass is expanding in premium spirits, targeting higher margins. They are focusing on markets like the 'Bourbon Trail'. This strategic move aims to leverage consumer demand for premium products. In 2024, the premium spirits market grew, presenting a lucrative opportunity.

O-I Glass's sustainable packaging solutions are a "Star" in the BCG Matrix due to the rising demand for eco-friendly options. In 2024, the global sustainable packaging market was valued at $350 billion, with an expected annual growth rate of 6%. O-I's recyclable glass aligns well with consumer and regulatory shifts. This focus on sustainability drives growth and market share.

Strategic Partnerships

Strategic partnerships are a key aspect of O-I Glass's strategy, particularly in enhancing sustainability. Collaborations, like the one with GridBeyond, focus on innovative solutions such as battery storage. These partnerships aim to improve energy efficiency and reduce environmental impact. O-I Glass has been investing in sustainable practices, with a reported $100 million allocated to such initiatives in 2024.

- GridBeyond Collaboration: Implementing battery storage solutions.

- Sustainability Focus: Enhancing energy efficiency and reducing environmental impact.

- Investment: $100 million allocated to sustainability in 2024.

- Strategic Goal: Improving operational efficiency and sustainability.

Geographic Expansion

O-I Glass is expanding geographically, focusing on regions like Brazil, Canada, and Scotland. These expansions aim to boost capacity and financial performance, backed by long-term contracts. This strategy is particularly relevant in 2024, as the company seeks to capitalize on increasing demand and optimize its global footprint. O-I Glass's strategic moves in these regions reflect its commitment to growth and market leadership.

- Brazil: O-I Glass invested $100 million in 2023 to expand its Brazilian operations.

- Canada: O-I Glass has a significant presence in Canada, with plans for further investment in the coming years.

- Scotland: O-I Glass operates a major manufacturing facility in Scotland, serving the European market.

- Long-term contracts: These contracts provide revenue stability and support expansion investments.

O-I Glass's initiatives like MAGMA and sustainable packaging position it well. These innovations are prime examples of "Stars" due to their high growth potential and market share. In 2024, the sustainable packaging market was at $350 billion, with 6% annual growth.

| Category | Details | 2024 Data |

|---|---|---|

| MAGMA Investment | Efficiency focus | Significant investment |

| Premium Spirits | Market expansion | Growing demand |

| Sustainable Packaging | Eco-friendly solutions | $350B market |

Cash Cows

O-I Glass (OI) holds a dominant spot in the global glass container market. This established position is backed by a legacy of over 100 years, cementing its reputation. In 2024, OI reported net sales of $6.8 billion, reflecting its market strength. This solidifies its status as a cash cow within its strategic portfolio.

O-I Glass's food and beverage packaging segment acts as a cash cow. This segment consistently generates substantial revenue, driven by steady demand for glass containers. In 2024, O-I Glass reported stable sales, indicating a solid market position. Their focus on efficiency and market share maintenance allows for strong cash flow generation.

O-I Glass benefits from long-term customer relationships, ensuring stable revenue. These contracts, like those with major beverage companies, offer predictability. In 2024, O-I's revenue was approximately $6.8 billion, showcasing the impact of these agreements. This stability supports consistent cash flow and strategic planning. Long-term contracts are crucial for sustained financial performance.

European Beer Market

In the European beer market, O-I Glass benefits from a relatively stable market share for glass bottles, offering consistent cash flow due to competitive unit costs compared to cans. The European beer market saw a volume of approximately 33.9 billion liters in 2024. The glass bottle segment provides a reliable revenue stream. This is crucial for O-I Glass's financial health.

- Market share stability.

- Competitive unit costs.

- Consistent cash flow.

- 2024 market volume.

'Fit to Win' Initiative

O-I Glass's 'Fit to Win' initiative, a strategic move in 2024, focuses on cost reduction and operational efficiency to boost cash flow. This program is designed to streamline operations and cut expenses. According to the Q3 2024 report, this initiative is projected to deliver significant savings. It will help O-I Glass maintain its strong position in the market.

- Projected savings from 'Fit to Win' in 2024: $80 million.

- Operational efficiency improvements: expected 5% reduction in manufacturing costs.

- Focus area: optimizing supply chain and manufacturing processes.

O-I Glass functions as a Cash Cow, generating steady revenue from its established market position. In 2024, the company reported approximately $6.8 billion in net sales. The focus is on maintaining market share and operational efficiency to ensure a consistent cash flow.

| Aspect | Details |

|---|---|

| 2024 Net Sales | $6.8 billion |

| Market Share Stability | Strong |

| 'Fit to Win' Savings (2024) | $80 million |

Dogs

In 2024, O-I Glass faces headwinds in the commodity beer market. Glass bottles' role is shrinking in North America. Cans offer a cost edge, impacting O-I's market share. O-I's revenue in 2023 was $6.9 billion.

Underperforming plants, classified as "Dogs" in O-I Glass's BCG matrix, face potential closure due to redundancy or low profitability. In 2024, O-I Glass reported a net loss of $158 million. This financial strain often leads to decisions about facilities. The company's restructuring efforts in 2023 included plant closures.

In the O-I Glass BCG Matrix, "Dogs" represent markets with tough competition and excess supply. For instance, the wine market in France could be a "Dog." O-I Glass's revenue in 2024 was about $6.8 billion, facing challenges. The company constantly analyzes market conditions to improve strategies.

High Debt Burden

O-I Glass faces challenges due to its high debt levels, potentially limiting its financial flexibility. A high debt burden can restrict investments and strategic initiatives. This situation can be especially problematic if the company's profitability is inconsistent. In 2024, the company's debt-to-equity ratio was concerning.

- Debt-to-equity ratio above industry average.

- Significant interest expenses impacting net income.

- Limited resources for innovation and expansion.

- Increased vulnerability to economic downturns.

Destocking Impacts

Dogs in O-I Glass's BCG matrix highlight struggling business units. Customer destocking and weak consumer demand hurt sales and profits. For example, in 2024, O-I Glass faced challenges. These issues lead to poor financial outcomes.

- Sales volumes decrease.

- Profit margins shrink.

- Stock value declines.

- Market share loss.

Dogs in O-I Glass's BCG matrix represent underperforming segments with low market share in slow-growing markets. In 2024, these units faced decreased sales volumes and shrinking profit margins. For example, O-I Glass saw a net loss of $158 million, indicating financial strain.

| Metric | 2024 | Impact |

|---|---|---|

| Net Loss | $158M | Financial Strain |

| Revenue | $6.8B | Market Challenges |

| Debt-to-Equity Ratio | Above Industry Average | Limited Flexibility |

Question Marks

MAGMA technology, a potential growth driver for O-I Glass, currently faces uncertain adoption rates, positioning it as a question mark in the BCG matrix. Despite its innovative potential for glass container manufacturing, the technology’s market penetration is still developing. The adoption rate and its impact on the company's revenue streams remain to be seen. O-I Glass invested $60 million in 2024 to support MAGMA's development.

O-I Glass can explore premium markets, such as spirits and ready-to-drink cocktails, to boost growth. This shift offers potential, but faces hurdles. For instance, the global premium spirits market was valued at $359.8 billion in 2024. Success requires strong branding and distribution. O-I Glass's 2023 revenue was $6.8 billion, so expansion needs strategic planning.

O-I Glass's venture into new sustainable technologies, like hybrid electric furnaces and biofuels, lands in the Question Mark quadrant of the BCG matrix. These are high-growth, uncertain-return investments, as their long-term profitability isn't yet proven. In 2024, the company allocated $150 million for sustainability initiatives. The success hinges on market adoption and operational efficiency improvements.

Strategic Optionality (M&A)

Strategic optionality for O-I Glass involves future growth via geographic expansion, mergers, and acquisitions (M&A). This approach allows for market diversification and increased market share. However, it demands meticulous planning and execution to realize value. For example, in 2024, the global M&A market saw fluctuations, so O-I must navigate these dynamics skillfully.

- Geographic expansion can unlock new revenue streams.

- M&A provides opportunities for market consolidation.

- Careful planning is crucial to avoid integration challenges.

- Execution must be aligned with strategic goals.

Pharmaceutical Glass Packaging

The pharmaceutical glass packaging sector is experiencing robust growth, offering O-I Glass a prime opportunity for expansion. This market is driven by the increasing demand for safe and effective drug packaging. O-I Glass can leverage its expertise to capture a larger share of this market. In 2024, the global pharmaceutical packaging market was valued at approximately $100 billion, with glass packaging holding a significant portion.

- Market Growth: The pharmaceutical glass packaging market is expanding.

- Opportunity: O-I Glass can increase its market share.

- Demand: Driven by the need for safe drug packaging.

- Value: The global market was about $100 billion in 2024.

Question Marks represent high-potential, yet uncertain ventures for O-I Glass, as per the BCG matrix. These include innovative technologies and new market entries. They require substantial investment. The company's ability to convert them into Stars will determine future success.

| Initiative | Status | Investment (2024) |

|---|---|---|

| MAGMA Technology | Uncertain adoption | $60 million |

| Sustainability Initiatives | High-growth, uncertain returns | $150 million |

| Geographic Expansion/M&A | Strategic Optionality | Fluctuating market |

BCG Matrix Data Sources

The O-I Glass BCG Matrix leverages financial data, market reports, and industry analysis. This builds strategic insights for confident decision-making.