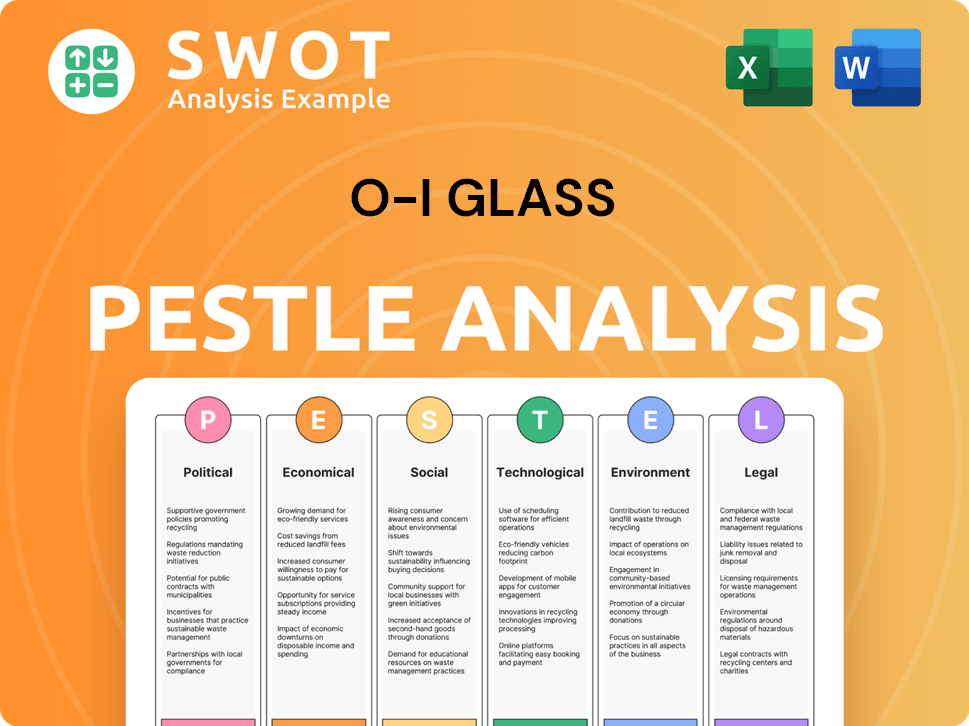

O-I Glass PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

O-I Glass Bundle

What is included in the product

Analyzes macro-environmental factors impacting O-I Glass across six dimensions, backed by data.

Helps support discussions on external risk and market positioning during planning sessions.

What You See Is What You Get

O-I Glass PESTLE Analysis

The O-I Glass PESTLE Analysis preview offers a glimpse of the final report. This is the exact document you'll download after purchase, fully prepared. All sections are included and readily available.

PESTLE Analysis Template

Analyze O-I Glass through the PESTLE framework—revealing vital external factors.

This ready-made analysis explores political, economic, social, technological, legal, and environmental forces impacting the company. Get expert-level insights to refine your business strategy.

Perfect for investors, consultants, and anyone needing a comprehensive view. Download now to get actionable intelligence!

Political factors

O-I Glass's global operations make it vulnerable to trade tensions. Tariffs on materials like soda ash can raise costs. For example, in 2024, the US imposed tariffs on some imported glass products. The company also profits from trade deals, like those in the EU.

Governments globally are intensifying carbon emission regulations. O-I Glass must comply with these changing rules, including those in the EU, US, and Brazil. The EU's ETS, the US's EPA, and Brazil's National Policy on Climate Change mandate emission reductions. These regulations impact production costs and require sustainable practices. For example, the EU aims to cut emissions by 55% by 2030.

Government incentives for green manufacturing are increasing worldwide. For example, the Inflation Reduction Act in the US provides substantial tax credits for renewable energy and sustainable manufacturing. These incentives can significantly lower operational costs. O-I Glass could benefit by investing in eco-friendly technologies, potentially increasing profitability. In 2024, the global green technology and sustainability market was valued at $36.6 billion.

Geopolitical Risks in International Markets

Operating across various international markets subjects O-I Glass to geopolitical risks, including potential political instability. Such instability can disrupt operations and negatively affect revenue streams. For instance, the ongoing conflicts and political tensions in Eastern Europe have already impacted supply chains. The company's global footprint means it is vulnerable to these events.

- Revenue in Europe decreased by 5.3% in 2023.

- O-I Glass operates in over 20 countries.

- Geopolitical risks are a primary focus area in the company's risk assessments.

Regulatory Compliance with Safety Standards

O-I Glass faces regulatory compliance challenges, particularly concerning safety and health standards like OSHA in the U.S. These regulations necessitate continuous investment in safety enhancements across its global operations. Compliance costs are significant, impacting operational expenses and capital allocation. Specifically, in 2024, O-I Glass spent approximately $35 million on environmental, health, and safety initiatives.

- OSHA fines in the U.S. can range from $16,131 to $161,323 per violation as of 2024.

- O-I Glass operates in over 20 countries, each with its own safety regulations.

- Failure to comply can lead to production delays and reputational damage.

O-I Glass confronts political elements through trade, regulatory demands, and global dynamics. Trade tariffs and deals significantly impact its financials. Regulations on emissions, with the EU targeting 55% reductions by 2030, raise production costs. Global operations render it susceptible to instability affecting supply chains.

| Political Factor | Impact | Example |

|---|---|---|

| Trade Policies | Affects cost and market access. | US tariffs on glass products in 2024. |

| Environmental Regulations | Increases production expenses. | EU's ETS targeting emission cuts. |

| Geopolitical Risk | Disrupts operations & revenue. | Conflict's effect on supply chains. |

Economic factors

O-I Glass faces fluctuating raw material costs, critical for glass production. Silica sand and soda ash price changes directly affect expenses. Recent data shows silica sand costs rose 7% in Q1 2024. This increases operational expenditure, impacting profit margins. Soda ash prices also showed volatility, affecting production costs.

Inflationary pressures significantly impact O-I Glass. Increased costs for raw materials, energy, and transportation can squeeze profit margins. For instance, the Producer Price Index (PPI) for glass and glass products rose by 2.5% in 2024, increasing production expenses. Labor costs also rise, with wage growth averaging 4% in the manufacturing sector, further affecting operational expenses. These factors necessitate careful financial planning.

The global glass packaging market faces fluctuating demand. O-I Glass, for instance, saw a 2.6% organic sales volume decline in 2023, impacted by destocking. Consumer shifts and economic factors create uncertainty. For 2024, analysts forecast moderate growth, but challenges persist. The company must adapt to changing consumer behaviors.

Foreign Currency Fluctuations

O-I Glass, operating globally, faces currency exchange rate risks. Fluctuations in foreign currencies against the U.S. dollar affect its financial outcomes. A stronger dollar can reduce the value of international sales when converted. In 2024, currency impacts were notable, influencing reported revenues and profitability.

- Currency exchange rate volatility is a significant risk for multinational companies.

- A stronger U.S. dollar can decrease the value of international earnings.

- O-I Glass's financial reports reflect the effects of currency fluctuations.

- Companies use hedging strategies to mitigate currency risks.

Energy Costs Volatility

Energy costs significantly impact O-I Glass's profitability, as glass manufacturing is energy-intensive. Fluctuations in energy prices, especially natural gas, which is crucial for its European operations, can directly affect production expenses. For instance, in 2024, natural gas prices in Europe saw considerable volatility. This volatility necessitates careful hedging strategies to mitigate risks and maintain stable margins. O-I Glass must actively manage these costs to ensure financial stability.

- Natural gas prices in Europe fluctuated significantly in 2024, impacting manufacturing costs.

- Energy costs are a key factor in the company's profitability.

- Hedging strategies are crucial for managing volatile energy markets.

Economic factors profoundly shape O-I Glass's performance. Raw material costs, like silica sand, rose in Q1 2024. Inflationary pressures, reflected in a 2.5% rise in the Producer Price Index for glass, increase expenses. The global glass packaging market's demand and currency fluctuations also pose risks.

| Factor | Impact | Data (2024) |

|---|---|---|

| Raw Materials | Cost Increases | Silica sand +7% Q1 |

| Inflation | Margin Pressure | PPI +2.5% |

| Demand | Uncertainty | Organic sales -2.6% (2023) |

Sociological factors

Consumer preferences are changing, potentially affecting the demand for beverages, including alcoholic drinks. Alcoholic beverages accounted for approximately 30% of O-I Glass's revenue in 2024. There's also a rising demand for sustainable packaging solutions. O-I Glass is adapting by offering eco-friendly glass options. This shift impacts O-I Glass's product mix and market strategy.

Brands are shifting to sustainable packaging, boosting demand for recyclable materials. This boosts O-I Glass, as glass is highly recyclable. In 2024, the sustainable packaging market was valued at $350 billion, projected to reach $450 billion by 2025. O-I Glass can leverage this trend.

O-I Glass prioritizes workforce health and safety, managing over 21,000 employees globally. Uniform safety standards are crucial across diverse plant locations. The company actively addresses risks like heat stress to protect its workforce. In 2024, the glass manufacturing sector saw a 5% increase in safety incidents, highlighting the importance of O-I's focus.

Diversity, Equity, and Inclusion

O-I Glass actively promotes diversity, equity, and inclusion (DE&I). This involves fostering an inclusive workplace and ensuring equal chances for all employees. O-I Glass's commitment to DE&I is reflected in its policies and programs. For instance, in 2024, the company increased the number of diverse hires by 15%.

- DE&I initiatives include mentorship programs and employee resource groups.

- O-I Glass aims to reflect the diversity of its global customer base.

- The company tracks DE&I metrics to measure progress and identify areas for improvement.

Community Engagement and Recycling Initiatives

O-I Glass actively participates in community engagement to boost glass recycling and build recycling systems. This includes working with local partners and stakeholders to increase the recycled content in their products. Such efforts align with broader sustainability goals and enhance brand reputation. O-I Glass's commitment to community engagement highlights its dedication to environmental stewardship.

- In 2024, O-I Glass reported a 30% increase in recycled glass usage.

- Collaborations with over 50 local communities to improve recycling rates.

- Invested $10 million in recycling infrastructure in 2024.

Consumer behavior drives shifts toward sustainable products. Sustainable packaging is predicted to grow from $350 billion (2024) to $450 billion (2025). Diversity and inclusion initiatives are also crucial; O-I Glass increased diverse hires by 15% in 2024. Community engagement, highlighted by a 30% increase in recycled glass usage in 2024, enhances brand reputation and meets environmental goals.

| Factor | Details | Impact |

|---|---|---|

| Consumer Preferences | Demand for sustainable packaging and diverse products is rising. | Changes in product mix and brand strategy, potential revenue changes in alcoholic beverages (approx. 30% of O-I Glass revenue in 2024). |

| Workforce | Focus on health, safety, and DE&I programs. | Reduced workplace incidents, better employee relations, and reflecting diversity in the consumer base. |

| Community Engagement | Investment in recycling infrastructure. | Increased recycled glass usage, enhanced brand reputation, meets environmental goals, collaborates with 50+ local communities in 2024, and invested $10M in recycling infrastructure in 2024. |

Technological factors

O-I Glass is actively implementing advanced furnace technologies. These include gas-oxygen combustion and heat recovery (GOAT) systems. This boosts energy efficiency and cuts emissions. In 2024, O-I Glass allocated $100 million to upgrade furnaces, aiming for a 20% reduction in carbon emissions by 2030.

O-I Glass's technological advancements focus on lightweight glass designs. This innovation reduces raw material use and boosts sustainability. In 2024, O-I Glass invested $150 million in R&D. These efforts align with growing consumer demand for eco-friendly packaging, with a projected 7% annual growth in sustainable packaging through 2025.

O-I Glass is advancing its MAGMA technology, a comprehensive system focusing on lightweighting and sustainability. This innovation aims to boost recycled glass use and renewable energy integration. In 2024, O-I Glass invested significantly in MAGMA, expecting enhanced production efficiency. The company projects MAGMA to reduce energy consumption by up to 20% in its glass-making processes by 2025.

Investment in Renewable Energy Sources

O-I Glass is actively pursuing renewable energy sources to reduce its carbon footprint, aligning with global sustainability trends. This includes investments in renewable electricity to power its manufacturing facilities. O-I Glass aims to reduce its carbon emissions by 30% by 2030. The company is also exploring innovative technologies to enhance energy efficiency. These efforts support both environmental goals and long-term cost savings.

- 30% reduction in carbon emissions by 2030.

- Investment in renewable electricity.

- Exploration of energy-efficient technologies.

Automation and Operational Efficiency

Automation and process optimization are key for O-I Glass's operational efficiency and cost reduction in manufacturing. The company has invested in advanced technologies to streamline production and improve output. In 2024, O-I Glass reported a 5% increase in production efficiency due to these technological upgrades.

- Robotics and AI implementation in glass forming processes.

- Real-time data analytics for predictive maintenance.

- Advanced quality control systems.

- Integration of IoT for supply chain optimization.

O-I Glass integrates advanced furnace tech, including GOAT systems, to boost energy efficiency and cut emissions. They invested $100M in furnace upgrades in 2024, targeting a 20% emissions reduction by 2030. Investments also target lightweight glass design and MAGMA tech to increase efficiency and reduce energy use.

| Technology | Investment (2024) | Goal |

|---|---|---|

| Furnace Upgrades | $100M | 20% emissions cut by 2030 |

| R&D | $150M | 7% annual growth in sustainable packaging by 2025 |

| MAGMA | Significant | 20% energy reduction by 2025 |

Legal factors

O-I Glass faces growing regulatory hurdles concerning emissions. They must adhere to strict greenhouse gas reduction targets. For example, the EU's Emissions Trading System (ETS) impacts O-I's European plants. In 2024, the ETS price per ton of CO2 was around €70-€90, impacting operating costs. Compliance necessitates investments in cleaner technologies.

O-I Glass faces stringent product safety and quality standards due to its role in food and beverage packaging. Compliance with regulations like the FDA's standards is essential. In 2024, the company invested $100 million to improve manufacturing. Failure to meet these standards can lead to product recalls and legal issues. These factors significantly impact O-I Glass's operational costs and brand reputation.

O-I Glass must comply with varying labor laws globally. These laws cover workforce reductions and employee rights, impacting operational flexibility. For instance, in 2024, O-I faced labor disputes in some European plants. Compliance costs, including legal fees and severance packages, are significant, potentially affecting profitability. These factors are essential in financial forecasts.

Recycling and Recycled Content Laws

Recycling and recycled content laws are pivotal for O-I Glass. These regulations affect how the company sources materials and designs its products. Compliance with these laws is crucial for avoiding penalties and maintaining market access. For instance, the European Union's Packaging and Packaging Waste Directive sets targets for recycling rates. As of 2024, the EU aimed to recycle 65% of all packaging waste.

- Meeting recycling targets can influence O-I Glass's operational costs.

- Increased use of recycled content can lower the carbon footprint.

- Changes in legislation may require adjustments to production processes.

- Companies must adapt to evolving standards to stay competitive.

Trade Regulations and Tariffs

O-I Glass must adhere to global trade regulations and tariffs, which impact its supply chain and expenses. Recent data shows that the U.S. imposed tariffs on certain imported glass products. These tariffs can increase the cost of raw materials. Compliance costs, including legal and administrative fees, are a constant concern.

- 2024: U.S. tariffs on specific glass imports remain in effect.

- 2024/2025: Ongoing monitoring for trade policy changes.

Legal factors significantly shape O-I Glass's operations. These include strict emissions and product safety rules, with the EU ETS impacting costs; the price of carbon allowances was about €70-€90 per ton in 2024. Labor laws and recycling targets, such as the EU's 65% packaging waste recycling aim, further drive compliance efforts. Trade regulations and tariffs also play a role.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Emissions | Compliance Costs | ETS at €70-€90/ton CO2 |

| Product Safety | Operational costs, reputational risk | $100M investment in manufacturing upgrades |

| Labor | Flexibility and cost | EU labor disputes |

Environmental factors

O-I Glass aims to slash greenhouse gas emissions, setting targets for 2025 and 2030. These goals drive investments in eco-friendly tech and energy. The firm's sustainability report highlights progress. For instance, renewable energy use is increasing. These efforts align with global climate initiatives.

O-I Glass prioritizes environmental sustainability, especially through increased use of recycled glass, or cullet. This strategy aims to cut down on raw material consumption and decrease the company's carbon emissions. By 2023, O-I Glass reported a global cullet usage rate of 52%. The company has set ambitious goals to boost cullet usage by 2030. This effort not only benefits the environment but also enhances resource efficiency.

O-I Glass focuses on decreasing water usage worldwide, especially where water scarcity is a concern. The company aims to cut water use by 15% by 2030, based on a 2018 baseline. In 2023, O-I Glass reported a 12% reduction in water consumption across its global operations, showing progress towards its environmental goals.

Waste Reduction and Circular Economy

O-I Glass focuses on waste reduction and the circular economy to enhance sustainability. The company aims to minimize landfill waste and boost glass recycling rates. O-I Glass's efforts align with global initiatives to reduce environmental impact. The company is investing in technologies to improve glass recycling processes. In 2024, O-I Glass reported a 60% recycling rate across its operations.

- Recycling Rate: 60% in 2024

- Landfill Waste Reduction: Ongoing initiatives.

- Circular Economy Focus: Central to sustainability strategy.

- Investment: Technologies for improved recycling.

Responsible Sourcing and Supply Chain Sustainability

O-I Glass is committed to sustainable sourcing, aiming to ensure its supply chain supports its environmental goals. This involves responsible procurement of raw materials and promoting sustainable practices across its value chain. In 2024, O-I Glass reported that 90% of its key suppliers have sustainability programs in place. The company's focus includes reducing environmental impact and promoting ethical sourcing.

- Responsible Sourcing: Focusing on ethical and sustainable procurement of raw materials.

- Supply Chain Sustainability: Promoting environmentally friendly practices throughout the value chain.

- Supplier Engagement: Working with suppliers to improve sustainability performance.

- Transparency: Aiming for greater visibility and accountability in the supply chain.

O-I Glass targets significant emission reductions and invests in eco-friendly tech, setting specific 2025 and 2030 goals, supported by renewable energy. Emphasis is placed on high cullet usage, targeting further increases, and decreasing raw material reliance and emissions. The company is enhancing its resource efficiency through a focus on reduced water consumption, aiming for 15% less by 2030 from 2018. O-I Glass prioritizes waste reduction and supports the circular economy through advancements in glass recycling.

| Environmental Factor | Strategy | 2024/2025 Data |

|---|---|---|

| Greenhouse Gas Emissions | Targeted reductions. | Targets set for 2025 & 2030; Focus on renewable energy. |

| Recycled Glass Usage (Cullet) | Increased usage to lower raw materials | 52% (2023), aiming higher. |

| Water Consumption | Reduce worldwide | 12% reduction in 2023 (from 2018). |

| Waste Reduction | Minimize landfill & boost glass recycling. | 60% recycling rate (2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis uses IMF, World Bank data plus reports from Statista, government sources, and industry publications.