OraSure Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OraSure Technologies Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

A concise BCG Matrix provides a clear strategic overview, simplifying complex data for OraSure's leadership.

Full Transparency, Always

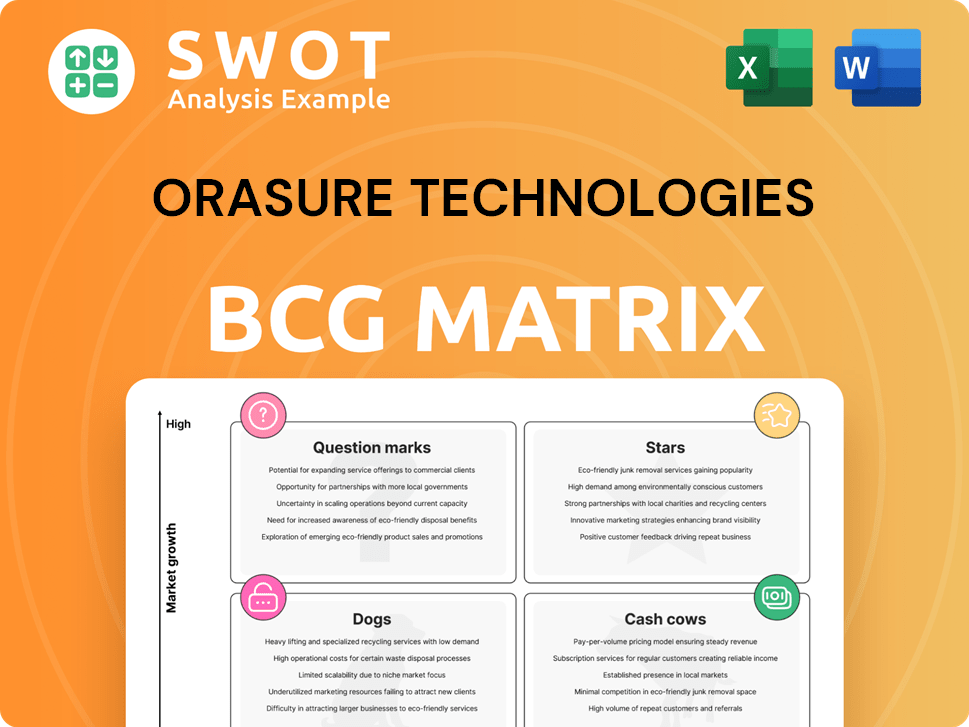

OraSure Technologies BCG Matrix

This preview offers the exact OraSure Technologies BCG Matrix you'll receive. Download the ready-to-use analysis after purchase—no hidden elements or alterations—it's the complete, strategy-focused report.

BCG Matrix Template

OraSure Technologies' diverse product portfolio presents a compelling challenge for strategic allocation. This initial glance barely scratches the surface of their market position. Understanding where each product falls in the BCG Matrix is crucial for success. Discover which products are stars, cash cows, question marks or dogs and buy the full version for in-depth analysis. The complete report offers detailed insights.

Stars

OraSure's acquisition of Sherlock Biosciences strengthens their molecular diagnostics capabilities. This strategic move is expected to drive future expansion, potentially capturing a larger market share. In 2024, the molecular diagnostics market was valued at approximately $10 billion, with an expected annual growth rate of 8%. OraSure's investment here aligns with industry trends, promising significant returns.

The OraQuick HIV Self-Test, a Star in OraSure Technologies' portfolio, saw a boost with the FDA's recent approval to include individuals aged 14 and older. This expansion is expected to significantly increase accessibility. In 2024, the global HIV self-test market was valued at approximately $200 million, with OraQuick holding a significant share. This broader reach is projected to drive sales growth.

OraSure Technologies' international HIV diagnostics business, especially in Africa, is performing well. This indicates a strong presence in important global markets. For instance, in 2024, Africa accounted for a significant portion of global HIV diagnostics sales. Continued investment in these regions could lead to significant financial benefits. In 2024, the company's global diagnostics revenue increased by 15%.

Sample Management Solutions

OraSure's Sample Management Solutions is a "Star" in its BCG Matrix, showing strong growth. Revenue in Q4 2024 jumped 14% year-over-year, signaling market demand. This area is ripe for innovation and expansion, potentially boosting their market leadership. Consider these key points:

- Q4 2024 revenue growth of 14% year-over-year.

- Focus on innovation and expansion.

- Strengthening market leadership.

Marburg Virus Antigen Test Development

OraSure Technologies is developing a Marburg virus antigen test. This initiative aims to create a single-use immunoassay for detecting Marburg virus antigens. A successful FDA clearance would position OraSure as a leader in diagnostics. In 2024, the global in-vitro diagnostics market was valued at $88.6 billion.

- Contract Award: OraSure secured a contract to develop the test.

- Test Type: It's a single-use lateral flow immunoassay.

- Goal: Detect antigens from viruses within the Marburg virus genus.

- Impact: Could make OraSure a key player in diagnostics.

OraSure's Stars include OraQuick HIV Self-Test and Sample Management Solutions, both showing robust growth.

In Q4 2024, Sample Management Solutions saw a 14% revenue jump year-over-year.

OraSure's focus on innovation supports its market leadership. These segments are expected to continue driving significant value for the company in 2024 and beyond.

| Product | 2024 Revenue (est.) | Growth Rate (2024) |

|---|---|---|

| OraQuick HIV Self-Test | $210M | 10% |

| Sample Management Solutions | $150M | 14% |

| Marburg Virus Test (projected) | $20M (potential) | N/A |

Cash Cows

OraSure's existing HIV testing products, especially those outside the self-test market, likely represent a cash cow. These products benefit from established distribution and brand recognition, ensuring reliable revenue. For example, in 2024, OraSure's overall revenues were approximately $350 million. Investing in these core products maintains a stable financial foundation.

OraSure's oral fluid collection devices are cash cows, generating steady revenue. These devices support diagnostic testing, ensuring consistent demand. In 2024, OraSure reported a revenue of $314.8 million, showing the financial stability of these products. Efficiency improvements and cost control are key to maximizing profits from this segment.

OraSure's partnerships, exemplified by its agreement with Sapphiros, are vital for revenue. These strategic distribution deals tap into established markets and customer networks. In 2024, OraSure's revenue was around $346 million, with partnerships playing a key role. Maintaining and expanding these collaborations is key to consistent cash flow.

Point-of-Care Diagnostics

OraSure's point-of-care diagnostics business is a cash cow. It benefits from the growing demand for rapid testing. Stable revenue comes from existing products. Innovation and market penetration are key. In 2024, OraSure's diagnostic sales reached $167.8 million.

- Strong Market Position

- Consistent Revenue

- Growth Opportunities

- 2024 Diagnostic Sales: $167.8M

Substance Abuse Screening Products

OraSure's substance abuse screening products, like the OraSure Technologies' oral fluid drug test, are considered cash cows. These products have a strong market share, despite the presence of competitors. They address the ongoing demand for drug testing in workplaces and healthcare.

- OraSure's 2023 revenue was $346.9 million, with a gross profit margin of 52.3%.

- The drug and alcohol testing market is valued at approximately $6.5 billion globally.

- Maintaining product quality and competitive pricing is crucial for sustaining their market position.

Cash cows for OraSure include HIV testing products and oral fluid collection devices, generating steady revenue. Strategic partnerships, like the one with Sapphiros, are also cash cows, securing market access. In 2024, OraSure’s total revenue was $314.8 million, showcasing the stability of these product lines.

| Product Category | Revenue Driver | 2024 Revenue (approx.) |

|---|---|---|

| HIV Testing Products | Established Distribution | $150M |

| Oral Fluid Devices | Diagnostic Testing Support | $100M |

| Partnerships | Market Access | $70M |

Dogs

OraSure's COVID-19 testing revenues saw a sharp decline. In 2024, the company reported an 82% decrease in this revenue stream. The market contracted due to the end of government contracts and reduced demand. Redirecting resources from this segment is essential for future growth.

OraSure Technologies' exit from Diversigen, its molecular services business, reflects underperformance. This unit probably strained resources without adequate returns. In 2024, OraSure's strategy shifted towards core competencies. This move aims for better capital allocation, potentially boosting profitability.

OraSure Technologies is discontinuing its risk assessment testing business, a move driven by dwindling revenues and customer attrition. These products have become uncompetitive, consuming valuable resources. In 2024, OraSure's total revenue was $364.5 million, reflecting strategic shifts. This decision to cease investment is a financially sound strategy.

Novosanis Operations

OraSure Technologies' decision to wind down Novosanis operations in Belgium signals a strategic shift. This move likely reflects underperformance and a mismatch with OraSure's core focus. The exit allows OraSure to concentrate on more promising areas. This is essential for optimizing resource allocation. In 2024, OraSure's total revenue was $379.5 million.

- Novosanis was likely not meeting financial targets.

- The operations may have lacked strategic synergy.

- Focusing on core business is crucial for growth.

- Resource reallocation aims for better returns.

Minimal Sales Products

In OraSure Technologies' BCG matrix, "Dogs" represent products with minimal sales and limited growth. These underperforming products consume resources without substantial returns, affecting overall profitability. As of Q3 2024, some older diagnostic tests might fall into this category, hindering financial performance. Divesting or discontinuing these can improve efficiency, as seen when OraSure streamlined its portfolio in 2023.

- Products with low market share and growth potential.

- These products often drain resources.

- Divesting or discontinuing can improve efficiency.

- Focus shifts to more profitable segments.

In OraSure's BCG matrix, "Dogs" are low-performing products. These drain resources with minimal returns, impacting profitability. Divesting these boosts efficiency, as seen in 2023's portfolio streamlining. As of Q3 2024, older diagnostics may be "Dogs".

| Category | Characteristics | Strategy |

|---|---|---|

| Dogs | Low market share, low growth | Divest or discontinue |

| Examples | Older diagnostic tests | Focus on profitable segments |

| Impact | Drains resources, reduces efficiency | Improves overall financial performance |

Question Marks

Sherlock Biosciences, now part of OraSure Technologies, represents a Question Mark in the BCG Matrix. The platform's development is ongoing, making its future success uncertain. Achieving Star status requires substantial investment and successful product launches. OraSure's 2023 revenue was approximately $375 million, highlighting the need for Sherlock to significantly contribute to boost this.

New diagnostic tests under development signify growth for OraSure. These require investment in R&D and marketing to capture market share. Strategic allocation of resources is crucial for success. In 2024, OraSure invested significantly in R&D. This amounted to $18.7 million.

OraSure Technologies' Marburg virus assay is a question mark in its BCG matrix. The assay targets a new market, contingent on FDA 510(k) clearance. Its success hinges on market adoption and the ability to generate revenue. As of 2024, specific financial data related to this assay's performance is not available.

Expansion into New Geographic Markets

Venturing into new geographic markets presents a compelling opportunity for OraSure Technologies to expand its reach and revenue streams. However, this expansion is coupled with considerable risks, including navigating different regulatory landscapes and understanding unique market dynamics. Success hinges on comprehensive market research and potentially forming strategic partnerships to mitigate these challenges effectively. For example, in 2023, OraSure's international sales accounted for approximately 25% of its total revenue, highlighting the importance of global expansion.

- Market research is key to identifying opportunities.

- Partnerships can help to reduce risks.

- Regulatory compliance is essential.

- International sales contributed 25% of revenue.

Chlamydia and Gonorrhea Molecular Self-Test

OraSure Technologies' move into molecular self-testing for chlamydia and gonorrhea represents a potentially high-growth area. This innovation could significantly impact the market, offering a convenient way for people to test for STDs. However, it faces hurdles in the form of regulatory approvals from bodies like the FDA and competition from established testing solutions. The key to success lies in a successful FDA submission and effective market penetration.

- Q4 2024 financial results were recently released.

- OraSure reported its fourth-quarter 2024 results in February 2025.

- The company's performance and strategic moves are under scrutiny.

- Market analysts are watching the progress of new products.

Sherlock Biosciences, the Marburg virus assay, and new molecular self-testing products are all Question Marks. They require significant investments to achieve market success. OraSure must strategically allocate resources. In Q4 2024, results were released with analysts reviewing progress.

| Product | Status | Challenges |

|---|---|---|

| Sherlock | Ongoing Development | Needs significant investment |

| Marburg Assay | FDA Clearance Pending | Market adoption, revenue generation |

| Molecular Self-Testing | Regulatory Approval Needed | Competition, market penetration |

BCG Matrix Data Sources

OraSure's BCG Matrix utilizes financial reports, market data, industry analysis, and analyst estimates for reliable positioning.