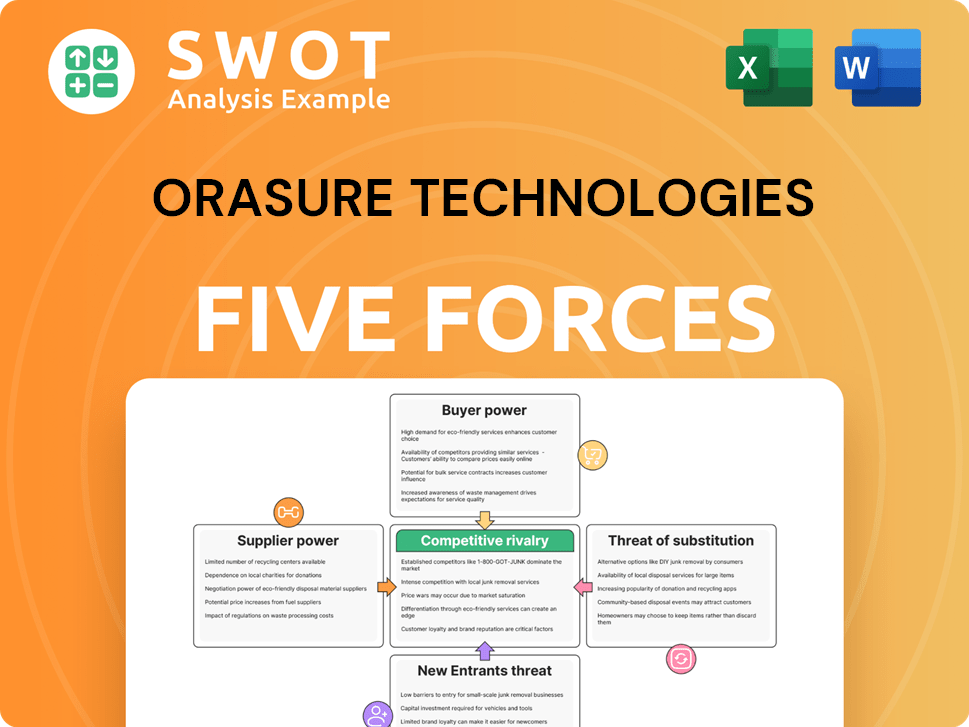

OraSure Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OraSure Technologies Bundle

What is included in the product

Analyzes OraSure's competitive landscape, highlighting threats from rivals, buyers, and suppliers.

Swap in your own data, labels, and notes to reflect current business conditions.

Preview Before You Purchase

OraSure Technologies Porter's Five Forces Analysis

This is the full OraSure Technologies Porter's Five Forces Analysis. The document you see here is the complete analysis you will receive. It's ready to download and utilize immediately after your purchase.

Porter's Five Forces Analysis Template

OraSure Technologies faces moderate competition. Buyer power varies with distribution channels. Suppliers have some influence due to specialized components. New entrants pose a moderate threat. Substitutes like PCR tests exist. Rivalry is driven by market share dynamics.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore OraSure Technologies’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

OraSure Technologies' reliance on specialized suppliers for components in diagnostics and molecular solutions is significant. The availability of alternative suppliers is limited, particularly for components requiring advanced technology or regulatory approvals. This dependency could increase suppliers' negotiating power. In 2024, about 60% of OraSure's cost of goods sold (COGS) came from key suppliers. This situation might impact profitability.

Fluctuations in raw material costs directly affect OraSure's production expenses. Suppliers of plastics and chemicals can raise prices, impacting gross margins. For example, in 2024, raw material costs accounted for a significant portion of their COGS. Monitoring these costs is crucial to maintain profitability. Long-term contracts with key suppliers are vital to mitigate this risk.

Supplier concentration significantly impacts OraSure Technologies. If few suppliers dominate critical components, they gain pricing power. This can lead to cost increases or supply issues. For example, in 2024, a shortage of a key raw material could raise costs by 10%. OraSure should diversify its supplier base.

Importance of Quality and Reliability

OraSure's products rely on high-quality, reliable components for accurate results. Suppliers meeting these standards gain bargaining power. OraSure must maintain strong supplier relationships and rigorous quality control. In 2024, the diagnostic testing market valued billions, highlighting the importance of dependable supply chains. This directly impacts OraSure's operational costs and product integrity.

- Dependable components: Key for product accuracy.

- Quality suppliers: Hold increased influence.

- Strong relationships: Essential for supply chain.

- Rigorous control: Ensures product integrity.

Potential for Supplier Integration

Supplier integration is a less significant threat for OraSure. Suppliers could move into the diagnostics market, but this is not a major concern currently. OraSure should still monitor suppliers. Strategic alliances could protect their position.

- OraSure's revenue for 2023 was approximately $361.7 million.

- The company's gross profit for 2023 was about $192.2 million.

- OraSure's market capitalization as of late 2024 is around $500 million.

OraSure depends on key suppliers for components, especially those with advanced tech or regulatory approvals. Limited alternatives boost supplier power. In 2024, about 60% of COGS came from them. This impacts margins.

Raw material cost fluctuations affect production. Suppliers can raise prices, influencing profits. Monitoring costs and long-term contracts are vital. A key raw material shortage could raise costs by 10%.

Concentrated suppliers increase pricing power. OraSure must diversify its base and maintain strong relationships to safeguard supply chains. Product accuracy relies on high-quality components. The diagnostics market was worth billions in 2024.

| Factor | Impact | Mitigation |

|---|---|---|

| Supplier Concentration | Higher costs, supply issues | Diversify supplier base |

| Raw Material Costs | Margin pressure | Long-term contracts, cost monitoring |

| Component Quality | Product accuracy | Strong supplier relationships, control |

Customers Bargaining Power

OraSure Technologies faces diverse customer price sensitivities across segments like clinical labs, hospitals, and consumers. Large government contracts may push for lower prices, impacting revenue. In 2024, OraSure's government sales accounted for a significant portion of total sales. Individual consumers show higher price sensitivity, especially for over-the-counter products. This requires tailored pricing strategies to maximize profitability.

OraSure Technologies might face customer concentration, with major revenues from a few key clients like large healthcare providers. This concentration grants these customers significant bargaining power, potentially leading to price negotiations. In 2024, a diversified customer base is crucial for OraSure. This would help in mitigating the risks associated with dependency on a few large buyers.

Switching costs for OraSure's customers can be low, particularly for tests. Customers' power grows if they can easily switch to other products. Strong brand loyalty is key to keeping customers. In 2024, OraSure's sales were $391.1 million. Customer service and product quality help build loyalty.

Availability of Information

Customers' bargaining power is amplified by readily available information on diagnostic tests. This includes pricing, performance, and alternative options, enabling informed decisions. OraSure needs to highlight its products' unique value to justify its pricing strategies effectively. Increased customer knowledge directly impacts OraSure's pricing power, necessitating strong value communication.

- OraSure's Q3 2023 revenue was $107.6 million, reflecting market dynamics.

- The diagnostics market's competitive landscape includes various pricing models.

- Customer reviews and comparisons significantly influence purchasing decisions.

- OraSure faces pressure to offer competitive pricing, especially for at-home tests.

Influence of Group Purchasing Organizations (GPOs)

Hospitals and labs often use Group Purchasing Organizations (GPOs) to negotiate prices with suppliers, like OraSure Technologies. GPOs consolidate purchasing power, giving them significant leverage. This can pressure diagnostic test providers to lower prices. For example, in 2024, GPOs managed over $800 billion in purchasing volume.

- GPOs negotiate prices for hospitals and labs.

- They consolidate purchasing power, giving them leverage.

- This can lead to lower profit margins for suppliers.

- GPOs managed over $800 billion in purchasing volume in 2024.

OraSure faces customer bargaining power through price sensitivity and market information. Large contracts and customer concentration enhance this power. Switching costs and GPOs further amplify customer leverage. In 2024, GPOs managed over $800 billion in purchasing volume, influencing pricing.

| Factor | Impact | Mitigation |

|---|---|---|

| Price Sensitivity | Higher demand for competitive pricing | Highlight product value |

| Customer Concentration | Potential for price negotiation | Diversify customer base |

| Switching Costs | Easier to switch providers | Build strong brand loyalty |

| GPOs | Pressure for lower prices | Negotiate effectively |

| Market Information | Informed purchasing | Communicate value |

Rivalry Among Competitors

The diagnostic market is fiercely competitive. OraSure contends with major corporations and agile startups, all vying for market presence. In 2024, the in vitro diagnostics market was valued at $100 billion. This rivalry leads to pricing pressures and battles for market share, impacting profitability.

OraSure Technologies faces intense competition, with rivals constantly innovating diagnostic tests. To remain competitive, OraSure must prioritize research and development. The acquisition of Sherlock Biosciences in 2021 for $80 million underscores this focus. This strategic move aims to enhance its product portfolio, ensuring future market relevance in the rapidly evolving diagnostics sector. In 2024, OraSure's R&D spending reached $43.2 million.

Price competition is a key factor, particularly in the market for routine diagnostic tests. Competitors might reduce prices to capture market share, which can squeeze OraSure's profits. For example, in 2024, the average price for rapid COVID-19 tests dropped significantly due to increased competition. OraSure can counter this by offering superior products or unique features, like its molecular testing capabilities, to maintain margins. This strategy was crucial in 2024 as overall healthcare costs continued to be a key concern for both consumers and providers.

Market Consolidation

Market consolidation is reshaping the diagnostic industry, with acquisitions becoming common. This trend intensifies rivalry, as larger firms gain more resources and market power. OraSure Technologies must strategize to thrive amid this changing environment. The global in-vitro diagnostics market was valued at $89.1 billion in 2023.

- Acquisitions can lead to increased market concentration.

- Larger companies often have better economies of scale.

- Consolidation may change innovation dynamics.

- OraSure needs to focus on its niche or differentiation.

Geographic Competition

OraSure Technologies navigates diverse competitive landscapes across geographies. Local competitors hold sway in some areas, while international firms lead in others. For example, in 2024, North America accounted for approximately 60% of OraSure's revenue, indicating a significant focus. Tailoring market strategies is crucial for success.

- North America is a Key Market: In 2024, approximately 60% of OraSure's revenue came from North America.

- Competition Varies: Local players may be strong in certain regions.

- International Presence: International companies dominate in other areas.

- Strategic Adaptation: Tailored strategies are essential for each market.

OraSure faces intense competition in the diagnostics market, including established players and emerging startups. The pressure impacts pricing and market share. In 2024, the global in-vitro diagnostics market reached $100 billion.

Research and development, exemplified by the $80 million Sherlock Biosciences acquisition in 2021 and $43.2 million in R&D spending in 2024, is critical. Price competition in the diagnostics sector, particularly for tests like COVID-19, also affects profitability.

Market consolidation, with acquisitions like the 2023 global in-vitro diagnostics market valuation of $89.1 billion, reshapes the industry. OraSure must strategize its market approach, considering that in 2024 North America accounted for about 60% of its revenue.

| Factor | Impact | 2024 Data |

|---|---|---|

| Market Size | Competitive Landscape | $100B (In-Vitro Diagnostics) |

| R&D Spending | Innovation | $43.2M |

| Regional Focus | Revenue Concentration | ~60% from North America |

SSubstitutes Threaten

Alternative diagnostic methods, including lab tests and imaging, present a substitute threat to OraSure. These alternatives might be favored in specific clinical scenarios. OraSure's products, like its rapid tests for HIV, compete with these options. In 2024, the global in vitro diagnostics market was valued at over $90 billion, showcasing the scale of competition.

The threat of substitutes for OraSure includes the rise of new diagnostic tech. Molecular diagnostics and next-gen sequencing could replace some tests. OraSure acquired Sherlock Biosciences to stay competitive. In 2024, the molecular diagnostics market was valued at over $9 billion. OraSure aims to capitalize on this growth.

OraSure Technologies faces the threat of substitutes from other self-testing options. Competitors and alternative methodologies offer consumers choices. To combat this, OraSure must emphasize its products' accuracy and reliability. Government programs supporting home testing also affect this market. In 2024, the home diagnostics market is valued at over $6 billion.

Wait-and-See Approach

The "wait-and-see" approach poses a threat to OraSure Technologies, as individuals might opt out of testing. This is particularly true if they perceive the risk of infection to be low or if testing costs are a concern. This behavior directly substitutes OraSure's diagnostic products. Increased emphasis on early detection benefits could boost testing rates. In 2024, the global in-vitro diagnostics market was valued at $98.6 billion, illustrating the scale of the market OraSure competes within.

- Cost Sensitivity: High test costs can deter individuals.

- Risk Perception: Low perceived risk reduces testing demand.

- Preventative Measures: Promoting early detection is crucial.

- Market Size: The global IVD market was $98.6B in 2024.

Telemedicine and Remote Monitoring

Telemedicine and remote patient monitoring pose a threat to OraSure. These methods offer alternative diagnostic solutions, potentially reducing the need for traditional testing. OraSure must adapt by integrating its products into these evolving healthcare models to stay relevant. The global telemedicine market was valued at $61.4 billion in 2023 and is projected to reach $350.8 billion by 2030.

- Telemedicine offers virtual consultations.

- Remote monitoring uses sensor-based data.

- OraSure needs to adapt to these changes.

- The telemedicine market is growing rapidly.

OraSure faces substitute threats from various diagnostic methods. Alternatives like lab tests, molecular diagnostics, and home testing options compete with its products.

Factors such as cost sensitivity, risk perception, and telemedicine influence substitute adoption. The global IVD market reached $98.6B in 2024.

OraSure must emphasize product accuracy and adapt to evolving healthcare models, including telemedicine which was valued at $61.4B in 2023.

| Substitute | Impact | 2024 Market Value |

|---|---|---|

| Lab Tests | Direct Competition | $90B+ |

| Molecular Diagnostics | Technological Shift | $9B+ |

| Home Diagnostics | Consumer Choice | $6B+ |

Entrants Threaten

OraSure Technologies faces high regulatory hurdles, especially in the diagnostic market. The FDA approval process and CLIA certifications are demanding and expensive. These requirements significantly raise the entry barriers for new companies. For example, in 2024, the average cost to get FDA approval for a new diagnostic device can exceed $30 million. This protects OraSure from new competitors.

The need for specialized knowledge acts as a significant barrier. Developing and manufacturing diagnostic tests demands expertise in biology, chemistry, and engineering, thus limiting new entrants. OraSure Technologies benefits from decades of experience, creating a competitive advantage. In 2024, the diagnostic testing market was valued at approximately $85 billion, highlighting the high stakes and specialized requirements for new companies.

OraSure, with its established brand, benefits from customer trust, a key asset in healthcare. New competitors face high barriers, needing substantial investments for brand building. For instance, OraSure's focus on improving diagnostic accuracy strengthens its market position. In 2024, OraSure's brand value reflected its market presence. This brand strength deters new entrants.

Access to Distribution Channels

New entrants to the medical diagnostics market face significant hurdles in accessing distribution channels. Established companies like OraSure Technologies benefit from existing relationships with hospitals, labs, and pharmacies. These channels are crucial for product reach and market penetration. OraSure's success is tied to its robust global distribution network and strategic partnerships.

- OraSure's distribution network spans over 130 countries, enhancing market access.

- Strategic partnerships are vital for expanding distribution capabilities.

- New entrants struggle to replicate established distribution networks.

- Building a distribution network requires considerable time and investment.

Economies of Scale

The threat of new entrants to OraSure Technologies is influenced by the existing companies' economies of scale. Established diagnostic companies have advantages in manufacturing, marketing, and distribution, making it challenging for new entrants to compete on cost. OraSure's ability to consolidate its manufacturing footprint allows for cost-effective operations. This strategic move helps maintain its competitive edge in the market.

- Economies of scale in manufacturing, marketing, and distribution provide advantages to established companies.

- New entrants may struggle to compete on cost without achieving similar scale.

- OraSure's efforts to consolidate its manufacturing footprint help maintain a cost-effective operation.

- The diagnostic market is competitive, with OraSure facing challenges from both established players and potential new entrants.

OraSure Technologies faces a moderate threat from new entrants due to regulatory hurdles, specialized knowledge requirements, and brand recognition. High FDA approval costs, which can exceed $30 million, and the need for scientific expertise limit new competitors. While the market size was approximately $85 billion in 2024, established companies hold advantages, deterring new entries.

| Factor | Impact on New Entrants | Example (2024) |

|---|---|---|

| Regulations | High Barriers | FDA approval costs can exceed $30M |

| Specialized Knowledge | Significant barrier | Expertise in biology, chemistry, and engineering are needed |

| Brand Recognition | Customer trust advantage | OraSure's brand value supports market position |

Porter's Five Forces Analysis Data Sources

OraSure's analysis employs annual reports, market research, and SEC filings. Industry data and competitive landscapes are gleaned from specialized publications.