OraSure Technologies Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OraSure Technologies Bundle

What is included in the product

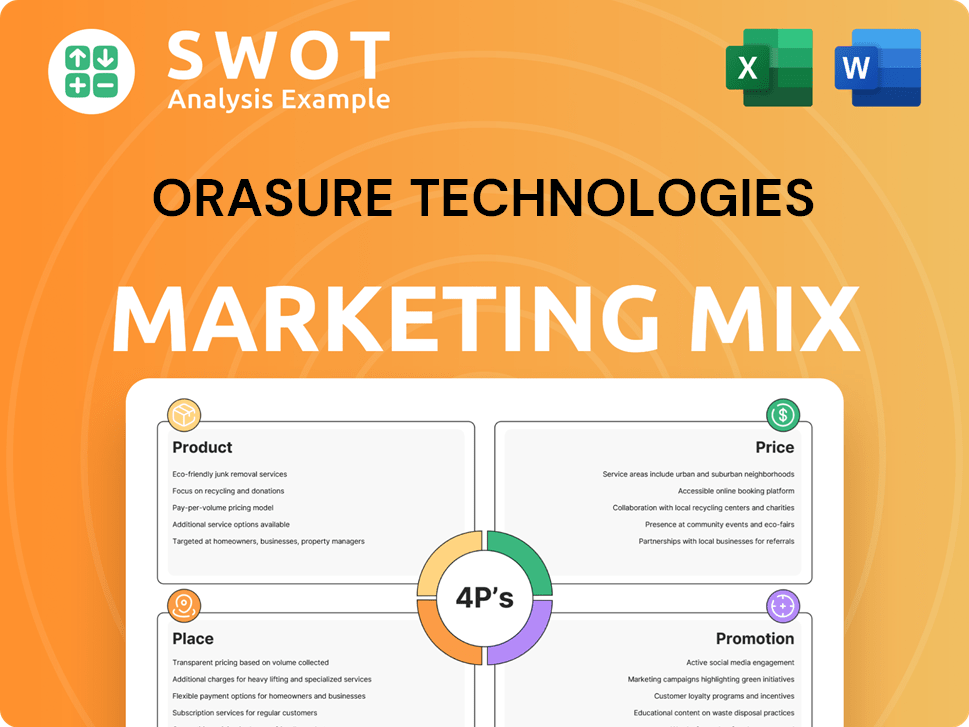

An in-depth look at OraSure Technologies' marketing, covering Product, Price, Place, and Promotion.

OraSure's 4Ps analysis offers a structured summary for quick brand strategy understanding.

Same Document Delivered

OraSure Technologies 4P's Marketing Mix Analysis

This 4Ps Marketing Mix analysis preview showcases the complete document you'll receive.

No changes, edits or redactions – what you see is what you get immediately.

The purchase delivers the full, finalized document for your use.

Enjoy the convenience of having it instantly post-purchase.

Rest assured, it's the comprehensive analysis, ready now!

4P's Marketing Mix Analysis Template

OraSure Technologies’ innovative products in diagnostics have made them a recognizable brand. They focus on providing convenient testing solutions. Their pricing strategy targets affordability, ensuring accessibility for everyone. OraSure utilizes diverse distribution channels to reach a global audience. Marketing tactics highlight accuracy and ease of use.

Ready to unlock a complete strategic deep dive? Get the full analysis now!

Product

OraSure Technologies focuses on rapid diagnostic tests, notably for HIV, Hepatitis C, Syphilis, and COVID-19. These tests, often using oral fluid samples, offer a less invasive testing method. The OraQuick platform is central to these tests, delivering quick results. In 2024, the global rapid diagnostics market was valued at approximately $38.5 billion. Sales for OraSure's infectious disease tests in Q1 2024 were $29.7 million.

OraSure Technologies' product mix features oral fluid and sample collection devices. These devices stabilize various samples like oral fluid, used in molecular diagnostics and genomics. In Q1 2024, OraSure reported total revenues of $84.9 million, with a focus on expanding its diagnostic offerings. These products support diverse applications, aiding research and clinical needs.

OraSure Technologies previously offered substance abuse testing products like the Intercept oral fluid drug test and the Q.E.D. saliva alcohol test. Historically, these tests were part of OraSure's product lineup. The company has since exited the substance abuse testing market.

Molecular Diagnostic Platforms

OraSure Technologies, through Sherlock Biosciences, enhances its product offerings with molecular diagnostic platforms. This strategic move allows OraSure to tap into the growing market for advanced diagnostics, providing more comprehensive testing solutions. In Q1 2024, the molecular diagnostics market was valued at approximately $28 billion. OraSure's focus on this area could lead to significant growth.

- The global molecular diagnostics market is projected to reach $48 billion by 2029.

- Sherlock Biosciences' technology is designed for rapid and accurate disease detection.

- OraSure aims to offer convenient and accessible diagnostic tests.

Other Diagnostic s

OraSure Technologies extends its diagnostic reach beyond infectious diseases and sample collection. The company offers immunoassay tests used for insurance risk assessment and forensic toxicology. Moreover, OraSure provides products for skin lesion removal. In Q1 2024, OraSure's diagnostics segment contributed significantly to overall revenue, reflecting the importance of its diverse product offerings.

- Immunoassay tests for insurance risk assessment and forensic toxicology.

- Products for the removal of skin lesions.

- Q1 2024 diagnostics segment contributed to overall revenue.

OraSure's product strategy revolves around diagnostic tests. Key offerings include tests for infectious diseases like HIV and COVID-19 using the OraQuick platform. The company has a strong focus on oral fluid sample collection devices.

| Product Type | Key Products | Market Data (2024) |

|---|---|---|

| Diagnostics | OraQuick, Molecular tests | Rapid diagnostics market ~$38.5B, Molecular diagnostics ~$28B (Q1). |

| Sample Collection | Oral fluid devices | Total Q1 2024 revenues: $84.9M. |

| Other | Immunoassay tests, Skin lesion removal | Sherlock Biosciences tech for rapid detection |

Place

OraSure Technologies boasts a global distribution network, crucial for its 4Ps of marketing. They reach customers worldwide, including the Americas, Europe, and Asia-Pacific. A network of distributors supports this extensive reach. In 2024, OraSure's international sales accounted for a significant portion of its revenue. This global presence is vital for market penetration and revenue growth.

OraSure Technologies utilizes direct sales to reach various institutions. This strategy targets clinical labs, hospitals, and government agencies. Direct sales accounted for a significant portion of their revenue in 2024. For instance, in Q3 2024, sales to institutions were crucial. This approach allows for tailored service.

OraSure's direct-to-consumer (DTC) strategy focuses on self-testing kits. Key products include the OraQuick HIV Self-Test and InteliSwab COVID-19 test. In Q1 2024, OraSure reported $7.2 million in sales for its DTC segment. This channel allows for broader market reach and increased brand awareness. This approach aligns with growing consumer demand for convenient health solutions.

Strategic Partnerships for Distribution

OraSure Technologies strategically partners to broaden its product reach. A notable example is the agreement with Sapphiros, expanding distribution of consumer diagnostic products. These partnerships are crucial for market penetration and revenue growth. In Q1 2024, OraSure reported a 12% increase in product revenue, partially driven by enhanced distribution networks. The company continues to seek strategic alliances to boost global availability.

- Sapphiros partnership for consumer diagnostics.

- Q1 2024 product revenue increased by 12%.

Online Platforms and E-commerce

OraSure Technologies likely utilizes online platforms and e-commerce for direct-to-consumer sales. This approach broadens market reach and enhances accessibility for individual consumers. The e-commerce market is booming; in 2024, U.S. e-commerce sales reached approximately $1.1 trillion. This trend is expected to continue. This strategy allows OraSure to bypass intermediaries and engage directly with its customer base.

- Direct-to-consumer sales via online platforms.

- Expanded market reach and accessibility.

- U.S. e-commerce sales in 2024 hit around $1.1 trillion.

- Opportunity for direct customer engagement.

OraSure's 'Place' strategy involves a multi-channel distribution network, encompassing a global reach through distributors, direct sales to institutions, and direct-to-consumer (DTC) initiatives.

In Q1 2024, DTC sales generated $7.2 million, while product revenue rose by 12%, enhanced by broadened distribution networks via strategic alliances.

E-commerce, crucial for DTC, saw U.S. sales hitting about $1.1 trillion in 2024, mirroring the company's drive for direct customer interaction and wider accessibility.

| Distribution Channel | Sales Approach | 2024 Strategy |

|---|---|---|

| Global Distributors | Extensive network | Expand globally |

| Direct Sales (Institutions) | Targeted at hospitals | Drive sales to medical institutions |

| DTC (e-commerce) | Online sales of kits | Expand market reach |

Promotion

OraSure strategically boosts its brand visibility by attending medical conferences and trade shows. This direct engagement with healthcare professionals is crucial for product promotion. In 2024, such events generated approximately $15 million in leads for similar firms. These platforms facilitate vital networking, fostering relationships with potential clients and industry experts. This approach supports the company's sales and marketing efforts directly.

OraSure Technologies leverages digital marketing and social media for global reach. They manage social media to engage audiences and foster health awareness. In 2024, digital ad spending hit $225 billion, showing marketing's importance. This strategy supports their diverse product lines. Their online presence drives brand visibility and consumer interaction.

OraSure strategically uses targeted advertising in medical and scientific publications. This approach effectively reaches healthcare professionals and researchers. In 2024, the global medical advertising market was valued at approximately $30 billion. Digital advertising spending in healthcare is expected to grow significantly by 2025.

Educational Webinars and Symposiums

OraSure Technologies actively promotes its products through educational webinars and scientific symposiums. These events are designed to educate healthcare professionals and researchers about its offerings and relevant health topics. This approach enhances brand awareness and positions the company as a thought leader in the industry. For instance, in 2024, OraSure hosted over 50 webinars, reaching more than 10,000 attendees. These efforts support sales growth and customer engagement.

- Webinars and symposiums educate healthcare professionals.

- They build brand awareness and thought leadership.

- Over 10,000 attendees joined webinars in 2024.

- This strategy supports sales and customer engagement.

Public Relations and Press Releases

OraSure Technologies utilizes public relations and press releases as a key promotional tool. The company regularly issues press releases to share financial results, new product advancements, and strategic alliances, keeping investors and the public informed. This communication strategy is designed to boost brand visibility and manage its public image effectively. For instance, in Q1 2024, OraSure's press releases highlighted key milestones, including FDA approvals and partnership expansions.

- Q1 2024: OraSure's press releases focused on FDA approvals.

- Partnership expansions were also a key focus in their communications.

OraSure employs a multi-faceted promotion strategy to boost brand awareness. They use trade shows, digital marketing, and advertising in medical publications, focusing on healthcare professionals. Public relations and webinars enhance visibility. In 2024, digital ad spending hit $225 billion, showing marketing’s impact.

| Promotion Strategy | Activities | Impact/Reach (2024) |

|---|---|---|

| Events | Medical Conferences/Trade Shows | $15M in Leads for similar firms |

| Digital Marketing | Social Media/Digital Ads | $225B Digital Ad Spend |

| Advertising | Medical Publications | $30B Global Market |

Price

OraSure's competitive pricing strategy adjusts based on test type and complexity. For example, the OraQuick HIV self-test is priced around $40, reflecting market competition. This strategy aims to balance profitability with market share. In 2024, OraSure's revenue was approximately $380 million, indicating the effectiveness of its pricing approach.

OraSure Technologies likely employs tiered pricing. This strategy offers volume discounts to bulk purchasers. For example, a 2024 report showed discounts for large orders of COVID-19 tests.

OraSure's pricing strategy considers product type and complexity. For instance, the OraQuick HIV test's price differs from advanced molecular diagnostic tests. In Q1 2024, OraSure's total revenue was $81.4 million, with product sales driving a significant portion. The pricing also reflects the technological sophistication of each offering.

Impact of Government Funding and Contracts

OraSure's revenue and pricing strategies are significantly influenced by government funding and contracts. For instance, during the COVID-19 pandemic, government contracts for rapid tests directly impacted sales volume and pricing. The company's ability to secure and fulfill these contracts at favorable terms is crucial for financial performance.

- Government contracts can provide a stable revenue stream.

- Pricing is often dictated by contract terms and market competition.

- Changes in government policies can affect demand.

- Funding availability directly impacts product sales.

Consideration of Perceived Value and Market Positioning

OraSure Technologies' pricing likely reflects the perceived value of its diagnostic products and services. Market positioning, whether premium or value-oriented, influences pricing decisions. For instance, OraSure's rapid COVID-19 tests, priced competitively in 2024, aimed for market penetration. This strategy considered the product's value and the need for accessible testing. In 2024, the global in-vitro diagnostics market was valued at approximately $87.2 billion, with expectations to reach $115 billion by 2029.

- OraSure's pricing strategy is influenced by the products' perceived value.

- Market positioning, such as premium or value-oriented, impacts pricing.

- Competitive pricing for products like COVID-19 tests aimed for market penetration.

- The global in-vitro diagnostics market was worth $87.2B in 2024.

OraSure employs varied pricing models, influenced by product, market position, and contracts. It adjusts prices for tests like OraQuick HIV, approximately $40, balancing profitability and market share. In 2024, government contracts greatly affected sales, indicating its reliance on external funding.

| Aspect | Details |

|---|---|

| Pricing Strategy | Tiered, competitive |

| Revenue (2024) | $380M (approx.) |

| Market Focus | Value-oriented, penetration |

4P's Marketing Mix Analysis Data Sources

We analyze SEC filings, investor presentations, and press releases. E-commerce platforms, advertising campaigns, and industry reports provide supporting details.