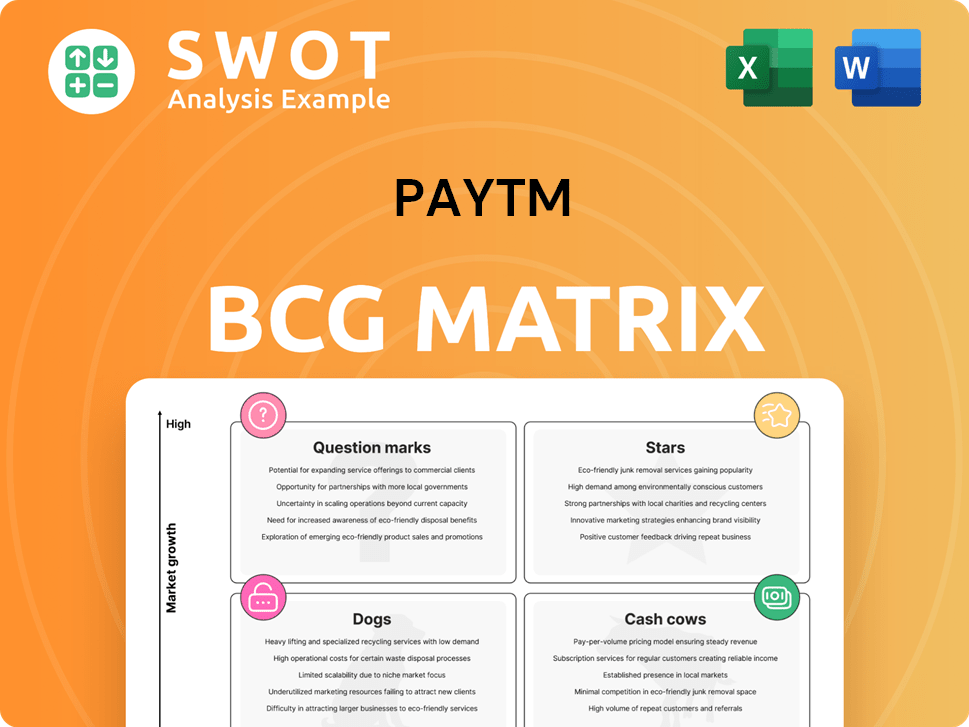

Paytm Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Paytm Bundle

What is included in the product

Paytm's BCG Matrix analysis identifies investment opportunities, highlighting growth potential and areas needing strategic focus.

Clean, distraction-free view optimized for C-level presentation, offering a concise Paytm business analysis.

Delivered as Shown

Paytm BCG Matrix

The Paytm BCG Matrix preview you're seeing mirrors the complete report you'll receive after purchase. This professional document provides an in-depth analysis, immediately ready for your strategic planning and business presentations.

BCG Matrix Template

Paytm navigates a complex market landscape. Their diverse offerings, from payments to financial services, face varying growth rates and market shares. Understanding their product portfolio's position is key. The BCG Matrix classifies Paytm's products into Stars, Cash Cows, Dogs, and Question Marks. This preview offers a glimpse, but the full analysis provides a complete picture. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Paytm's UPI and payment gateway services are a cornerstone of its business, holding a "Stars" position in its BCG matrix. These services facilitate a high volume of daily transactions, crucial for revenue generation. In 2024, Paytm processed 1.4 billion transactions monthly via UPI. Its extensive merchant and consumer reach solidifies its market leadership.

Paytm's Soundbox and POS devices are cash cows, showing strong adoption. These devices boost subscription revenue by providing payment alerts and facilitating digital transactions. Paytm is actively redeploying inactive devices for better efficiency. In fiscal year 2024, Paytm deployed 9.5 million devices, increasing subscription revenue.

Paytm's financial services distribution, encompassing loans, insurance, and wealth management, exhibits considerable growth. Partnering with lenders, Paytm distributes loans and offers various financial products. This segment is a key revenue driver, contributing to diversified income. In 2024, financial services revenue grew significantly. Paytm's distribution strategy leverages its extensive user base.

Merchant Lending

Merchant lending is a shining star for Paytm, fueled by the DLG model. This strategy is driving momentum. The average ticket size is growing, showing a positive trend in the company’s financial performance. Paytm's success is further highlighted by the fact that over 50% of loans go to repeat borrowers, reflecting strong customer loyalty.

- DLG model boosts merchant lending.

- Increasing average ticket size.

- Over 50% of loans to repeat borrowers.

International Expansion

Paytm's global ambitions, targeting the UAE, Saudi Arabia, and Singapore, position it as a 'Star' in its BCG Matrix. This expansion leverages its proven merchant acquisition model, aiming to replicate success internationally. The move diversifies revenue and strengthens Paytm's global footprint. In 2024, international transactions are expected to contribute significantly to overall growth.

- Target markets: UAE, Saudi Arabia, Singapore.

- Strategy: Replicate merchant acquisition model.

- Goal: Diversify revenue streams.

- Impact: Strengthens global presence.

Paytm's UPI and payment gateway services, a "Star," facilitated 1.4B monthly transactions in 2024, enhancing revenue. Merchant lending also shines, bolstered by the DLG model and repeat borrowers. International expansion, targeting UAE, Saudi Arabia, and Singapore, further solidifies its 'Star' status.

| Feature | Details | 2024 Data |

|---|---|---|

| UPI Transactions | Monthly volume | 1.4 Billion |

| Merchant Lending | Repeat Borrowers | Over 50% |

| International Focus | Target Markets | UAE, Saudi Arabia, Singapore |

Cash Cows

Paytm's mobile recharge and bill payment services remain a solid revenue stream. These services boast high user adoption and consistent transaction volumes. In 2024, this segment contributed significantly to overall revenue, with millions of transactions daily. Enhancing user experience and service reliability is key to continued growth. This is an important segment of the Paytm BCG Matrix.

Paytm's ticket booking, covering movies, trains, flights, and buses, generates consistent revenue. These services, favored for convenience, include partnerships with providers like Cinepolis. In 2024, this segment saw substantial growth; movie ticket bookings increased by 30%. Overall, these bookings provide a steady revenue stream.

Paytm Money is a cash cow, offering investment products like mutual funds and stock trading. India's growing demat accounts and mutual fund investments boost Paytm Money. The platform caters to diverse investors. Paytm's revenue from financial services grew 44% YoY in Q1 FY24.

Paytm FASTag

Paytm FASTag is a prime example of a cash cow within Paytm's BCG matrix. It streamlines toll payments, drawing funds directly from the Paytm wallet, enhancing user convenience across highways. Revenue streams are consistent, driven by the widespread adoption of electronic toll systems. This service is a steady revenue generator, capitalizing on increased highway traffic. In 2024, Paytm FASTag processed over 100 million transactions.

- Facilitates electronic toll collection.

- Generates steady revenue.

- Enhances user convenience.

- Processed over 100 million transactions in 2024.

UPI Lite

Paytm's UPI Lite is a cash cow, streamlining small transactions for digital payments in India. It boosts accessibility and convenience, with enhanced transaction and wallet limits. This service eases the burden on banking systems, driving digital payment growth. In 2024, UPI transactions reached ₹18.28 trillion, showing its importance.

- Simplified small-value transactions.

- Increased transaction limits and wallet limits.

- Reduces load on core banking systems.

- Promotes digital payment adoption.

Cash Cows provide stable revenue streams for Paytm, fueled by established services. These include Paytm Money, FASTag, and UPI Lite, which have gained user trust. Key figures include a 44% YoY growth in financial services revenue and 100M+ FASTag transactions in 2024.

| Service | Description | 2024 Performance Highlights |

|---|---|---|

| Paytm Money | Investment platform for mutual funds and stocks. | 44% YoY revenue growth in financial services (Q1 FY24) |

| Paytm FASTag | Electronic toll payment system. | Processed over 100 million transactions |

| UPI Lite | Simplified small-value digital transactions. | Facilitated a part of ₹18.28 trillion UPI transactions |

Dogs

Paytm Payments Bank, a "dog" in Paytm's BCG matrix, struggled after RBI restrictions. The bank couldn't accept new deposits or conduct all transactions. The RBI's actions, in January 2024, severely limited its operations. Paytm needed new banking partners, affecting its financial performance, with losses of ₹227 crore reported in Q3 FY24.

Paytm's consumer-to-consumer payments struggle with market share. Intense competition from PhonePe and Google Pay is a key issue. Paytm's market share in UPI transactions was 9% in January 2024. Innovation is crucial for Paytm to regain consumer trust. They need to differentiate their offerings to stay relevant.

Paytm's discontinuation of certain personal loan products, due to regulatory issues, has negatively impacted its financial performance. This strategic shift has resulted in a decrease in operating revenue and contribution profit for the company. In 2024, Paytm's focus has shifted towards merchant lending to mitigate these losses.

Paytm Mall

Paytm Mall, Paytm's e-commerce arm, struggles against giants like Amazon and Flipkart. The market is tough, demanding heavy spending on promotion and delivery. Paytm's e-commerce revenue in fiscal year 2024 was ₹726 crore, with a net loss of ₹207 crore. A strategic rethink might be needed to boost its performance.

- Competitive Pressure: Paytm Mall competes with established e-commerce leaders.

- Financial Performance: Paytm Mall's revenue was ₹726 crore in fiscal year 2024.

- Strategic Adjustment: Paytm might need to change its approach.

- Market Challenges: The e-commerce landscape is intensely competitive.

Inactive User Accounts

Paytm's inactive user accounts pose a significant challenge, affecting its growth. Addressing this issue requires focusing on user reactivation and engagement strategies. The company's success depends on converting dormant users into active participants. The decline in Paytm's monthly transacting users (MTU) is a direct consequence.

- MTU dropped to 90 million in Q3 FY24, a 5% decrease.

- Inactive accounts reduce transaction volumes and revenue.

- User retention strategies are crucial for long-term sustainability.

- Paytm must incentivize usage to boost engagement.

Paytm's "dogs" struggle in a competitive market. Key issues include the payments bank facing RBI restrictions, declining market share in UPI, and Paytm Mall's losses. In Q3 FY24, Paytm reported a loss of ₹227 crore.

| Aspect | Challenge | Impact |

|---|---|---|

| Payments Bank | RBI restrictions | Financial losses, operational limits |

| UPI Market Share | Competition from PhonePe, Google Pay | 9% market share in January 2024 |

| Paytm Mall | Competition with Amazon, Flipkart | ₹726 crore revenue, ₹207 crore loss in FY24 |

Question Marks

Paytm can revolutionize financial solutions via credit on UPI. Partnering with banks enables credit lines through UPI. This attracts users and boosts transactions. Managing credit risk is crucial. In 2024, UPI transactions hit ₹18.41 trillion monthly.

Paytm can use AI to personalize user experiences, providing tailored financial solutions. This personalization boosts customer engagement, encouraging the use of new services. AI implementation enhances operational efficiency and customer satisfaction. For instance, in 2024, AI-driven recommendations increased transaction values by 15%.

Expanding into international remittances opens a substantial growth avenue for Paytm. The company can provide cross-border payment services. Entering this market demands adherence to regulations and partnerships with global financial institutions. In 2024, global remittance flows reached $669 billion. Paytm's move aligns with its growth strategy.

Wealth Management Services

Paytm's wealth management arm is a question mark in its BCG matrix. There's potential to grow by offering more investment products and advice. India's rising interest in wealth management is a key opportunity.

Paytm can use tech for personalized investment help. The Indian wealth management market was valued at $377 billion in 2024.

- Market opportunity: India's wealth management sector is growing.

- Tech Leverage: Use technology for personalized services.

- Product Expansion: Offer a broader range of investment options.

- Market size: The Indian wealth management market was $377 billion in 2024.

Paytm Mini App Store

Paytm's mini-app store is a "Question Mark" in its BCG Matrix, representing a business with high potential but uncertain market share. This platform allows third-party apps, enhancing user engagement and potentially boosting revenue. Success hinges on attracting developers and promoting the store effectively. As of 2024, the mini-app store continues to evolve, with ongoing efforts to expand its offerings and user base.

- High Growth Potential: The mini-app store could become a significant revenue generator.

- Uncertain Market Share: Competition from other platforms makes it difficult to gain substantial market share.

- Developer Attraction: Attracting and retaining developers is vital for app availability.

- Promotion and Engagement: Effective marketing is crucial to increase user adoption.

Paytm's wealth management and mini-app store are question marks. Both have high growth potential but uncertain market positions. Success depends on strategic investments and effective execution to capture market share.

| Aspect | Wealth Management | Mini-App Store |

|---|---|---|

| Market Opportunity | Growing Indian market | Enhance user engagement |

| Key Challenge | Competition and regulations | Attracting developers |

| 2024 Data | $377B market size | Ongoing expansion |

BCG Matrix Data Sources

The Paytm BCG Matrix utilizes financial filings, market analysis reports, and industry research to accurately categorize business units.