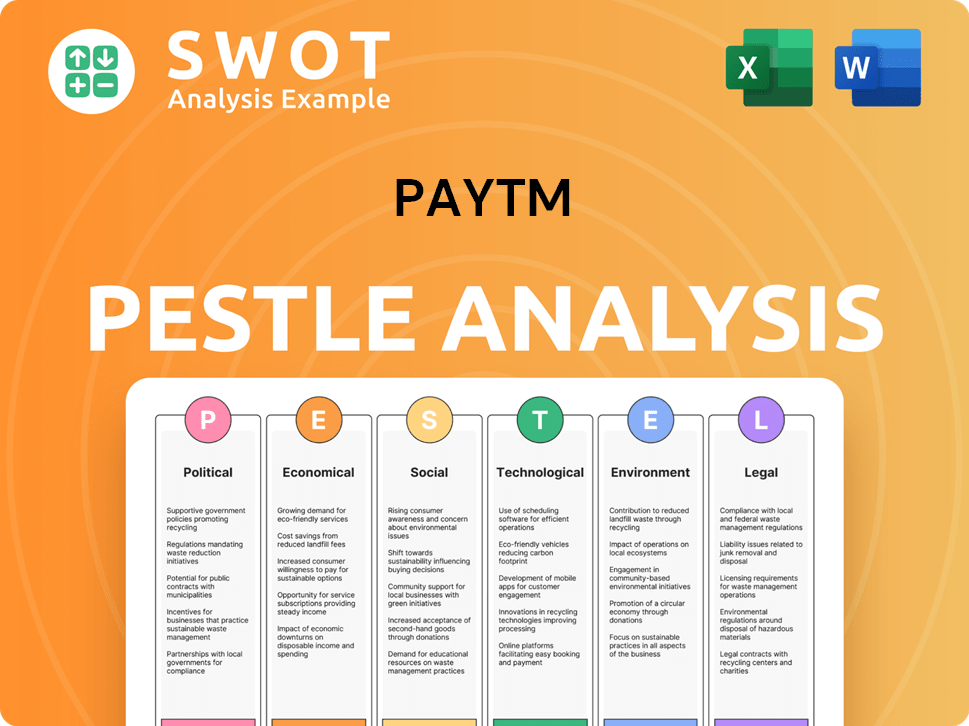

Paytm PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Paytm Bundle

What is included in the product

Examines how external forces impact Paytm across Political, Economic, Social, Tech, Environmental, and Legal sectors.

Easily shareable summary format ideal for quick alignment across teams or departments.

Same Document Delivered

Paytm PESTLE Analysis

Previewing the Paytm PESTLE Analysis? This is the real deal! What you're seeing is the exact, final version. After purchase, you’ll receive this document immediately. Fully formatted and ready to use, no editing needed.

PESTLE Analysis Template

Paytm operates within a complex environment influenced by political shifts and evolving economic landscapes. Social trends like digital payment adoption and technological advancements also play a vital role. Analyze the legal framework and environmental concerns impacting Paytm’s strategies. Gain comprehensive market intelligence instantly. Download the complete Paytm PESTLE analysis to uncover deep insights.

Political factors

The Indian government's strong backing of digital payments and financial inclusion, via initiatives like Digital India, forms a supportive political landscape for Paytm. This backing helps Paytm align with India's push for a cashless economy. In 2024, UPI transactions surged, processing ₹18.4 lakh crore in value, demonstrating the government's impact. The government's focus on digital literacy further benefits Paytm's growth by increasing its user base.

Government bodies, such as the Reserve Bank of India (RBI), heavily influence the fintech sector. Recent regulatory actions, including show-cause notices, have affected Paytm. For example, in January 2024, RBI restrictions on Paytm Payments Bank impacted its operations. These actions underscore the importance of regulatory compliance for Paytm. The RBI's oversight is crucial for ensuring financial stability and consumer protection.

India's political stability is vital for businesses. Stable politics mean consistent policies and investor trust. In 2024, India's GDP growth is projected at 6.5-7%, showing confidence. Paytm benefits from this, as stability supports its expansion and user growth, as the digital payments market in India is expected to reach $10 trillion by 2026.

Data Localization Policies

Data localization policies, which dictate where data must be stored and processed, present a significant political factor for Paytm. These policies, driven by governments worldwide, directly affect Paytm's operational strategies and infrastructure investments. Compliance is crucial, as failure can lead to hefty penalties and operational disruptions. The global data storage market is projected to reach $230.6 billion by 2025.

- India's digital economy is growing rapidly, with data privacy laws becoming stricter.

- Paytm must adapt its data storage and processing to meet these requirements.

- Data localization can increase operational costs due to infrastructure changes.

- Failure to comply can result in fines, reputational damage, and operational disruptions.

Initiatives for Financial Inclusion

Government initiatives to boost financial inclusion, particularly in rural and underserved areas, create significant opportunities for Paytm. These efforts expand Paytm's potential customer base and encourage digital payment adoption. Digital literacy programs and infrastructure development further support Paytm's business model. For example, the Indian government aims to digitize 75,000 villages by 2024. This push directly benefits Paytm.

- Digital India initiative promotes digital payments.

- Government schemes drive financial inclusion.

- Focus on rural digital infrastructure.

- Increased mobile and internet penetration.

Political factors heavily influence Paytm. Government support for digital payments and financial inclusion creates a favorable environment. Regulatory compliance, like RBI mandates, is crucial. Data localization policies also impact operations and costs.

| Factor | Impact on Paytm | Data (2024-2025) |

|---|---|---|

| Digital India | Supports growth | UPI transactions: ₹18.4L Cr (2024) |

| RBI Regulations | Requires Compliance | Fines for non-compliance |

| Data Localization | Affects infrastructure | Global data market: $230.6B (2025) |

Economic factors

India's digital economy is booming, creating significant opportunities for Paytm. Smartphone and internet use are soaring, driving demand for digital payments. The digital payments market in India is projected to reach $10 trillion by 2026. This growth is fueled by increasing digital literacy and supportive government policies. Paytm is well-positioned to capitalize on this expanding market.

Consumer spending habits significantly influence Paytm. Online shopping and digital transactions are rising, boosting Paytm's business. In 2024, digital payments grew, with UPI transactions hitting ₹18.04 trillion in August. Paytm benefits from this trend. Convenience and offers on platforms like Paytm drive this shift, increasing transaction volumes and revenue.

The Indian fintech market is incredibly competitive, with numerous companies battling for dominance. This includes players like PhonePe, Google Pay, and others. Intense competition pressures Paytm's pricing, market stance, and earnings. To stay ahead, Paytm needs ongoing innovation and strategic alliances. In 2024, the Indian fintech market was valued at $50-60 billion.

Inflation and Economic Stability

Inflation and economic stability are critical for Paytm. High inflation erodes consumer purchasing power, potentially reducing digital transactions. Economic stability fosters business confidence, impacting Paytm's transaction volumes and revenue. For 2024, India's inflation rate is projected around 4.5-5.0%, influencing consumer spending. Paytm's performance is closely tied to these macroeconomic indicators.

- India's GDP growth in FY24 is estimated at 7.6%.

- RBI aims to keep inflation within 2-6% range.

- Paytm's revenue growth is influenced by transaction values.

Investment and Funding Landscape

The investment and funding landscape in India significantly influences Paytm's financial strategy. A robust funding environment facilitates Paytm's expansion plans, technology upgrades, and customer acquisition efforts. According to recent reports, India's fintech sector secured approximately $2.5 billion in funding during 2023, showing a slight decrease from the previous year but still indicating considerable investor interest. This financial backing is crucial for Paytm's growth trajectory.

- Fintech funding in India reached $2.5 billion in 2023.

- Paytm's ability to raise capital depends on market conditions.

- Positive funding environments support growth.

India's robust economic growth directly supports Paytm's expansion. The nation's GDP growth is projected at 7.6% for FY24, boosting digital transactions. However, inflation, targeted between 2-6%, impacts consumer spending. Funding environment, with $2.5B in 2023 fintech investments, is crucial.

| Economic Factor | Impact on Paytm | Data |

|---|---|---|

| GDP Growth | Positive, increases transaction volumes | 7.6% (FY24 estimate) |

| Inflation | Potential negative impact on spending | RBI target: 2-6% |

| Fintech Funding | Supports expansion | $2.5B (2023) |

Sociological factors

Digital literacy is surging in India. Smartphone use is also rising, with over 750 million users in 2024. This growth boosts platforms like Paytm. Paytm's user base expanded by 10% in the last year. More tech-savvy users mean greater digital payment adoption.

Changing consumer preferences heavily influence Paytm's trajectory. Consumers now prioritize speed and security in payments. Data indicates that digital wallet transactions surged by 40% in 2024. Paytm's focus on these areas is vital for sustained growth in 2025.

India's youthful demographic, with a median age of about 28 years in 2024, is a key driver for Paytm. This group is highly receptive to digital payment solutions. Around 60% of India's population is under 35, boosting digital service adoption. This tech-savvy generation fuels Paytm's growth.

Trust and Security Concerns

Consumer trust is crucial for Paytm's success. Concerns about data security and fraud influence platform adoption. Robust security measures and transparent practices are essential for building and maintaining trust. Data breaches and fraudulent activities can significantly erode user confidence, impacting transaction volumes and user retention rates. Recent data indicates a growing emphasis on data privacy, with 76% of consumers globally expressing concerns about their online data security in 2024.

- Data breaches can cost businesses an average of $4.45 million.

- 76% of consumers worry about online data security.

- Fraudulent transactions cost businesses billions annually.

- Trust is vital for digital platform success.

Financial Inclusion and Urban-Rural Divide

Paytm's expansion hinges on bridging the urban-rural financial divide, a key sociological factor. Efforts to include semi-urban and rural populations shape its market approach. Adapting services to meet varied customer needs is essential for growth and adoption. In 2024, India's digital payments market is projected to reach $10 trillion, highlighting the potential.

- 67% of Indians live in rural areas, representing a significant untapped market.

- Paytm's strategy involves offering services in local languages and providing offline payment options.

- The Reserve Bank of India (RBI) promotes financial inclusion through various initiatives.

Sociological factors like digital literacy, consumer trust, and the urban-rural divide influence Paytm. Rising smartphone use, with 750M users in 2024, boosts Paytm. However, data breaches & fraud concerns, reflected by 76% of consumers in 2024 worrying about online security, impact user confidence.

| Sociological Factor | Impact on Paytm | Data/Statistic |

|---|---|---|

| Digital Literacy | Drives adoption of digital payments | 750M smartphone users in 2024 |

| Consumer Trust | Influences platform adoption, transaction volume | 76% consumers worry about online data security (2024) |

| Urban-Rural Divide | Shapes market approach, expansion potential | Digital payment market projected to reach $10T in 2024 |

Technological factors

Advancements in mobile tech, like 5G, boost Paytm's platform. In 2024, mobile data usage grew by 30%. This improves user experience and transaction speed. Enhanced smartphone capabilities also support new features. Faster mobile tech adoption expands Paytm's reach.

The evolution of India's digital payments landscape, especially with the Unified Payments Interface (UPI), has been transformative. Paytm heavily relies on UPI, enabling instant transactions for its users. In fiscal year 2024, UPI processed over 134 billion transactions, showing its massive adoption. This growth has made digital payments, like those facilitated by Paytm, more accessible and efficient for a large user base.

Technological factors significantly influence Paytm's operations. Innovation in digital payment solutions, including QR codes and contactless payments, is essential. Paytm needs to integrate financial services to stay competitive. In 2024, India's digital payments market was estimated at $3 trillion, with significant growth expected through 2025.

Data Analytics and Artificial Intelligence

Data analytics and AI are crucial for Paytm's growth. They improve services and user experience through personalized offerings. In 2024, AI-driven fraud detection reduced fraud by 15%. Paytm invests heavily in AI, with a 20% increase in its AI budget in the last fiscal year.

- Enhanced User Experience: Personalized recommendations.

- Fraud Prevention: AI-powered security.

- Service Improvement: Data-driven optimization.

- Investment: Increased AI budget.

Cybersecurity and Data Protection

Cybersecurity and data protection are crucial for Paytm, given its digital transaction focus. Technological advancements are key to safeguarding user data and trust. In 2024, India's cybersecurity market was valued at $6.6 billion, growing over 20% annually. Paytm must invest in advanced security to stay compliant with data protection regulations. This includes robust encryption and fraud detection systems.

- India's cybersecurity market is projected to reach $13.6 billion by 2028.

- Data breaches cost Indian companies an average of $2.3 million in 2024.

- RBI mandates stringent data security for digital payment platforms.

Technological innovations like 5G and UPI significantly boost Paytm. Data analytics and AI enhance user experience, with AI reducing fraud by 15% in 2024. Cybersecurity, crucial for protecting user data, is a major focus given the growth in digital transactions.

| Feature | Impact | 2024 Data |

|---|---|---|

| 5G & UPI | Improved Transaction Speed & Accessibility | UPI processed 134B transactions |

| AI & Data Analytics | Personalized Services & Fraud Reduction | AI Fraud Reduction: 15% |

| Cybersecurity | Data Protection & Compliance | India's Cybersecurity Market: $6.6B |

Legal factors

Paytm must adhere to RBI regulations for payment systems, digital wallets, and payment banks. These regulations cover aspects like Know Your Customer (KYC) norms, data storage, and transaction limits. In 2024, the RBI has increased its scrutiny of fintech companies, including Paytm. Non-compliance can lead to penalties, operational restrictions, and reputational damage. For example, in January 2024, RBI barred Paytm Payments Bank from accepting new deposits.

Paytm must strictly adhere to KYC and AML regulations. Regulatory scrutiny and penalties can arise from non-compliance. In January 2024, the Reserve Bank of India (RBI) took action against Paytm Payments Bank. The RBI cited persistent non-compliance issues. This highlights the importance of legal adherence.

Paytm must strictly adhere to data privacy regulations. The Personal Data Protection Bill (PDPB), if enacted, will significantly impact how Paytm collects, processes, and stores user data. Non-compliance could result in substantial penalties, potentially affecting the company's financial performance. For example, in 2024, several tech companies faced fines for data breaches, highlighting the importance of stringent data protection measures. Paytm's ability to maintain user trust hinges on its commitment to data privacy.

Licensing and Authorization Requirements

Paytm's operations hinge on obtaining and maintaining licenses from regulatory bodies like the Reserve Bank of India (RBI). These licenses are crucial for providing services such as digital payments and lending. Any modifications to these licensing stipulations can significantly affect Paytm's business strategies and its ability to broaden its service offerings. In 2024, Paytm faced scrutiny regarding its regulatory compliance, highlighting the importance of adhering to licensing standards.

- RBI mandates specific licenses for various Paytm services, including Payment Aggregator and PPI licenses.

- In 2024, Paytm Payments Bank faced regulatory actions, underscoring the impact of compliance.

- Changes in licensing policies can alter Paytm's operational scope and expansion capabilities.

Consumer Protection Laws

Paytm must strictly adhere to consumer protection laws to maintain customer trust and avoid legal issues. These laws ensure transparency in fees, terms, and conditions for services like digital payments and lending. Failure to comply can lead to penalties and reputational damage, as seen with other fintech companies. According to recent reports, consumer complaints against fintech companies have increased by 20% in 2024.

- Data Privacy: Ensure compliance with data protection regulations like GDPR and CCPA to safeguard user information.

- Fair Practices: Avoid deceptive marketing or unfair contract terms to maintain ethical standards.

- Redressal Mechanisms: Establish efficient systems for handling consumer complaints and resolving disputes promptly.

- Regulatory Updates: Continuously monitor and adapt to evolving consumer protection laws and guidelines.

Paytm must adhere to stringent RBI regulations, particularly in areas like KYC and data storage. Non-compliance may result in substantial financial penalties or operational restrictions. Consumer protection laws require transparency, and failures can lead to customer trust erosion.

| Legal Aspect | Compliance Areas | 2024 Impact |

|---|---|---|

| RBI Regulations | KYC, Data Storage, Transaction Limits | Paytm Payments Bank penalized in Jan 2024; regulatory scrutiny increased. |

| Data Privacy | PDPB compliance, data breach prevention | Fines increased in 2024, affecting financial performance |

| Licensing | Payment Aggregator, PPI | Changes in licensing impact operational scope. |

Environmental factors

Paytm's digital transactions help reduce paper usage. This aligns with environmental goals. In 2024, digital payments surged, minimizing paper waste. Paytm's move supports sustainability efforts. This contributes to a greener financial ecosystem.

Paytm's operations depend on energy-intensive data centers. These centers support the platform's digital transactions. The environmental impact, specifically the carbon footprint from energy use, is a key concern. Globally, data centers consume roughly 2% of all electricity. In 2024, the data center energy consumption is expected to increase by 10%.

The surge in digital payments via platforms like Paytm fuels e-waste from discarded devices. Paytm's operations indirectly affect this, even without hardware production. Globally, e-waste generation reached 62 million tonnes in 2022, with significant growth expected. Effective e-waste management is essential for sustainability.

Promoting Sustainable Practices through CSR

Paytm's Corporate Social Responsibility (CSR) efforts include initiatives focused on environmental sustainability. These actions, such as tree plantation drives, aim to reduce Paytm's carbon footprint. Such endeavors boost Paytm's public image and align with growing consumer demand for eco-friendly practices. In 2024, CSR spending in India is projected to reach $3 billion, reflecting a focus on sustainability.

- Paytm's CSR initiatives support environmental protection.

- These actions can enhance Paytm's brand reputation.

- CSR spending in India is rising, showing a commitment to sustainability.

Climate Change Impact on Infrastructure

Climate change poses indirect risks to Paytm's infrastructure. Extreme weather events, intensified by climate change, could disrupt network connectivity and power supply, crucial for digital payments. For example, in 2024, the World Bank estimated that climate change could cost developing countries $1.2 trillion annually by 2030 due to infrastructure damage. These disruptions could impact Paytm's service availability and reliability, affecting user experience and transaction processing. The financial implications include potential revenue losses and increased operational costs for disaster preparedness.

Paytm’s environmental footprint spans paper reduction to energy use and e-waste. In 2024, data center energy consumption increased, and e-waste grew globally. Paytm's CSR includes environmental efforts. Climate change poses risks to its infrastructure and services.

| Aspect | Details | 2024 Data |

|---|---|---|

| Digital Transactions | Reduces paper usage, supports environmental goals. | Digital payments surged, reducing waste. |

| Data Centers | Energy-intensive operations supporting transactions. | Data center energy use up 10% globally. |

| E-waste | Indirectly contributes to e-waste from devices. | 62M tonnes generated, growing annually. |

| CSR Efforts | Focus on sustainability, tree plantations. | India's CSR spending projected $3B. |

| Climate Change | Risks from extreme weather to infrastructure. | Cost $1.2T to developing countries by 2030. |

PESTLE Analysis Data Sources

Paytm's PESTLE leverages official Indian government data, financial reports, and tech industry publications. Regulatory updates and market analysis provide context.