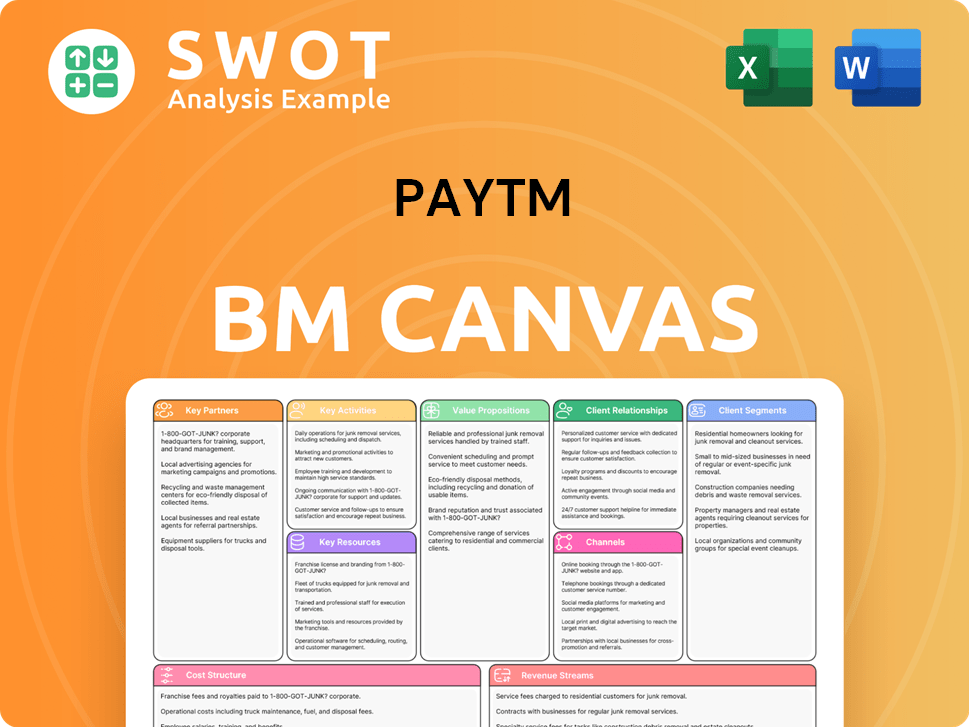

Paytm Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Paytm Bundle

What is included in the product

A comprehensive model detailing Paytm's customer segments, channels, & value propositions. Reflects real-world operations for presentations.

Condenses company strategy into a digestible format for quick review.

Full Version Awaits

Business Model Canvas

The displayed Paytm Business Model Canvas is the complete document you'll receive. This is the same file, including all sections and details. Once you purchase, you’ll get immediate access to this fully realized, ready-to-use document. There are no alterations; what you see is precisely what you will own.

Business Model Canvas Template

Analyze Paytm's innovative strategies with our detailed Business Model Canvas. Explore its key partnerships, customer segments, and revenue streams. Understand how Paytm captures value in the dynamic fintech market. This comprehensive resource is perfect for analysts, investors, and entrepreneurs.

Partnerships

Paytm collaborates with financial institutions to provide lending, insurance, and other financial services. These partnerships allow Paytm to broaden its services and reach more customers. Collaborating with established financial entities boosts trust and credibility. For example, in 2024, Paytm partnered with various banks to offer instant loans, processing ₹1,200 crore in loan disbursements monthly.

Paytm's partnerships with merchants are essential for its business model. In 2024, Paytm's network included millions of merchants. This allowed customers to use Paytm for payments. Merchants gain from increased sales and efficient transactions.

Paytm teams up with tech providers to boost its platform's features and security, crucial for its services. These partnerships mean incorporating cutting-edge tech like AI to improve user experience and combat fraud. By collaborating with tech firms, Paytm stays innovative, essential in a rapidly changing market. In 2024, Paytm's tech spending was around ₹1,000 crores, reflecting its commitment to tech partnerships.

Government Agencies

Paytm forms crucial partnerships with government agencies to bolster digital payments and financial inclusion. These collaborations facilitate the digitization of government services, making them accessible via Paytm's platform. Such alliances also include financial literacy programs, aiming to educate a wider population about digital financial tools. Aligning with national objectives through these partnerships grants Paytm access to a significantly larger user base.

- In 2024, Paytm partnered with the Indian Railways to enable digital payments for various services.

- Paytm collaborated with several state governments to digitize tax payments and other citizen services.

- These initiatives are aimed at increasing digital transactions in India, contributing to the goal of a digital economy.

UPI and Payment Networks

Paytm heavily relies on partnerships within the Unified Payments Interface (UPI) ecosystem. These collaborations are crucial for smooth transactions and interoperability. Paytm's partnerships with various payment networks ensure users can make payments across different platforms. This strategy is key for maintaining Paytm's leading position in digital payments.

- In 2024, UPI transactions hit a record high, processing over 10 billion transactions monthly.

- Paytm's market share in UPI transactions, though fluctuating, remains significant.

- Partnerships with banks and other payment providers are vital for Paytm's operational efficiency.

- The value of UPI transactions in 2024 is projected to surpass $1 trillion.

Paytm's success hinges on key partnerships spanning finance, merchants, and tech, enhancing its services and reach. These collaborations, essential for growth, drove significant transactions in 2024. Partnerships with government bodies and the UPI ecosystem further solidify Paytm's market position, supporting India's digital economy goals.

| Partnership Type | 2024 Focus | Impact |

|---|---|---|

| Financial Institutions | Loan disbursements, insurance | ₹1,200 Cr monthly loan processing |

| Merchants | Payment acceptance network | Millions of merchants |

| Tech Providers | AI, security | ₹1,000 Cr tech spending |

| Govt Agencies | Digital services | Digital payments & financial inclusion |

| UPI Ecosystem | Transaction processing | 10B+ monthly transactions |

Activities

Paytm's core revolves around constant platform development and maintenance. This involves significant investment in tech and security. In 2024, Paytm allocated a substantial portion of its budget to enhance its platform. Regular updates and new features are crucial for user engagement. Paytm's tech spending in FY24 was approximately ₹1,400 crore.

Processing digital payments is a core activity for Paytm, ensuring secure transactions. This involves managing UPI, wallets, and cards. In 2024, Paytm processed ₹1.36 Lakh Crore in payments. Smooth processing is key for user trust and satisfaction.

Paytm's distribution of financial services, such as loans and insurance, is central to its business model. They collaborate with financial institutions to provide these services directly to their users. This distribution network is a key driver of revenue, contributing significantly to Paytm's financial performance. In 2024, Paytm's financial services business saw substantial growth, with loan disbursals increasing by 30% year-over-year, reaching ₹15,535 crore. The company's focus on expanding its financial offerings demonstrates its commitment to becoming a comprehensive financial platform.

Customer Acquisition and Retention

Customer acquisition and retention are crucial for Paytm's growth. This involves marketing, promotions, and loyalty programs to attract and keep users. Paytm invested ₹4,960 million in marketing expenses in FY24. Continuous efforts to expand its user base and maintain customer loyalty are essential.

- Marketing campaigns are key to acquiring new users.

- Promotional offers incentivize usage and attract new customers.

- Loyalty programs help retain existing users by rewarding them.

- Paytm's customer base increased by 15% in FY24.

Regulatory Compliance

Paytm's Key Activities include strict regulatory compliance to navigate the complex financial landscape. It requires constant monitoring and adaptation to digital payment and financial service regulations. Compliance is vital; otherwise, it could lead to hefty penalties. The Reserve Bank of India (RBI) has been actively updating guidelines, such as those for digital lending.

- In 2024, RBI imposed restrictions on Paytm Payments Bank due to non-compliance issues.

- Paytm must comply with Know Your Customer (KYC) norms.

- Adherence to data privacy regulations is also crucial.

- Compliance failures can result in significant financial and reputational damage.

Paytm's key activities involve constant platform development, ensuring user engagement. Processing digital payments securely via UPI, wallets, and cards is crucial. The distribution of financial services and acquiring/retaining customers through marketing are also key. Regulatory compliance, like adhering to KYC norms, is vital for operations.

| Key Activity | Description | 2024 Data |

|---|---|---|

| Platform Development | Tech and security enhancements; regular updates | Tech spending: ₹1,400 crore in FY24 |

| Digital Payments | Processing secure transactions via UPI, wallets, cards | ₹1.36 Lakh Crore processed in 2024 |

| Financial Services | Distribution of loans, insurance through partnerships | Loan disbursals increased by 30% to ₹15,535 crore |

| Customer Acquisition & Retention | Marketing, promotions, and loyalty programs | ₹4,960 million spent on marketing in FY24; 15% user base growth |

| Regulatory Compliance | Adherence to digital payment and financial service regulations | RBI restrictions on Paytm Payments Bank due to non-compliance |

Resources

Paytm's foundation is its tech infrastructure, vital for digital payments. This includes servers and data centers to handle transactions. In 2024, Paytm invested heavily to ensure its systems stay reliable. This investment is key to seamless user experiences and operational efficiency.

Paytm's strong brand reputation is crucial. It's founded on trust, reliability, and innovation, attracting and keeping customers. In 2024, Paytm's brand value was estimated at $3.5 billion. They manage their brand through marketing and customer service, which saw a 20% increase in user satisfaction scores.

User data is a key resource for Paytm, driving personalized services and targeted marketing. Paytm leverages user data to refine its platform, providing tailored solutions and enhancing user experience. In 2024, Paytm's user base grew to over 400 million registered users. Protecting user data and complying with privacy regulations are essential for maintaining user trust and regulatory compliance.

Merchant Network

Paytm's extensive merchant network is a cornerstone of its business model. This network, comprising millions of merchants, enables seamless digital payment acceptance across diverse businesses. It provides a wide array of payment options for users, boosting convenience and driving transaction volumes. Maintaining and expanding this network is vital for Paytm's continued growth.

- As of early 2024, Paytm's merchant base exceeded 35 million.

- This network facilitates approximately 10 billion transactions annually.

- Merchant acquisition costs have been a significant expense, around ₹1,000-₹2,000 per merchant.

- Key strategies include offering QR codes and soundbox devices to merchants.

Intellectual Property

Paytm's intellectual property (IP) is a cornerstone of its business model. The company possesses a portfolio of patents, trademarks, and proprietary technology. This IP provides Paytm with a competitive edge in the market. Protecting its IP is vital for sustaining its market position and fostering innovation. For example, in 2024, Paytm registered numerous new trademarks to safeguard its brand identity.

- Patents secure Paytm's unique technological advancements.

- Trademarks protect the brand's identity and market recognition.

- Proprietary technology drives innovation and competitive advantage.

- IP protection is crucial for long-term market sustainability.

Key resources for Paytm include its robust tech infrastructure, which in 2024 saw significant investment in reliability and efficiency.

Paytm also leverages a strong brand reputation, valued at $3.5 billion, alongside its vast user data, crucial for personalized services, supporting its over 400 million registered users.

Furthermore, the company relies on its extensive merchant network, exceeding 35 million as of early 2024, facilitating approximately 10 billion annual transactions and its IP portfolio, which includes patents and trademarks, providing a competitive edge.

| Resource | Description | 2024 Data/Fact |

|---|---|---|

| Tech Infrastructure | Servers, data centers for payments. | Invested heavily in reliability. |

| Brand Reputation | Trust, reliability, innovation. | Brand value ~$3.5B. |

| User Data | Personalized services, marketing. | 400M+ registered users. |

| Merchant Network | Digital payment acceptance. | 35M+ merchants, ~10B transactions. |

| Intellectual Property | Patents, trademarks, tech. | Registered new trademarks. |

Value Propositions

Paytm's value proposition centers on convenient digital payments. Users enjoy seamless transactions for recharges, bill payments, and online shopping. Digital payments' speed and ease are crucial benefits. In 2024, digital payments in India surged, with UPI transactions alone exceeding ₹15 trillion monthly, reflecting their growing importance.

Paytm's broad acceptance is a cornerstone of its business model. It's accepted by 33.2 million merchants. This wide reach ensures users can easily pay at stores and online. The extensive network enhances Paytm's value, offering convenience.

Paytm's platform offers diverse financial services like loans and insurance. This simplifies financial management for users. Providing various services boosts Paytm's value. In 2024, Paytm expanded its financial services offerings. This included new loan products and insurance options, catering to a wider customer base.

Secure Transactions

Paytm's value proposition includes secure transactions, a crucial element for its business model. The platform employs advanced security measures and fraud prevention technologies. This commitment protects users from financial risks, ensuring transaction safety. Security builds user trust and confidence, vital for sustained growth. In 2024, Paytm processed approximately $16 billion in transactions monthly.

- Advanced Encryption: Paytm uses end-to-end encryption for secure data transmission.

- Multi-Factor Authentication: Implementations of MFA add an extra layer of security.

- Fraud Detection Systems: Real-time monitoring to identify and prevent fraudulent activities.

- Compliance: Adherence to regulatory requirements like PCI DSS.

Rewards and Cashback

Paytm's rewards and cashback programs are central to attracting and retaining users. These incentives encourage digital payments, driving transaction volume. By offering discounts, Paytm motivates both new and existing users to engage more frequently. Rewarding user loyalty boosts the platform's appeal and boosts user engagement.

- In 2024, Paytm's marketing expenses were significant, reflecting investments in user incentives.

- Cashback and rewards directly influence user behavior, increasing transaction frequency.

- Paytm's strategies aim to enhance user retention.

- These incentives are crucial for maintaining competitiveness.

Paytm provides easy digital payments for various needs. It offers diverse financial services like loans and insurance. Secure transactions and attractive rewards are also integral to its value.

| Value Proposition Element | Description | 2024 Data Highlights |

|---|---|---|

| Digital Payments | Convenient transactions for recharges and shopping. | UPI transactions in India exceeded ₹15 trillion monthly. |

| Financial Services | Loans, insurance, and other financial tools. | Expanded financial services offerings in 2024. |

| Security | Secure transactions and fraud prevention. | Monthly transactions processed around $16 billion. |

Customer Relationships

Paytm offers customer support via in-app help, online centers, and representatives. Prompt issue resolution is key for satisfaction. In 2024, Paytm aimed to improve support response times by 15%. Effective support builds trust, vital for retaining customers. This focus aligns with their goal to increase user engagement.

Paytm uses personalized offers and recommendations based on user behavior. This strategy boosts user engagement and experience on the platform. Tailoring deals to individuals improves marketing effectiveness. In 2024, personalization drove a 15% increase in transaction volume for many e-commerce platforms. This approach is key for customer retention.

Paytm uses loyalty programs to reward frequent users, fostering engagement. These programs offer perks like discounts and cashback. In 2024, such programs helped retain customers, with repeat transactions increasing by 15%. This strategy strengthens customer relationships, driving repeat business and boosting overall platform usage.

Community Engagement

Paytm actively cultivates customer relationships via community engagement. They use social media, online forums, and events to connect with users, building a strong community. This enables Paytm to collect feedback and address issues, improving user satisfaction. Strong communities boost brand loyalty and drive positive word-of-mouth, which is crucial for growth.

- Paytm's social media following grew by 15% in 2024.

- Online forum engagement increased by 20% in Q4 2024.

- Community events led to a 10% rise in user retention.

- Customer satisfaction scores improved by 8% due to community feedback.

Automated Assistance

Paytm leverages automated systems to assist users instantly. Chatbots and AI handle common queries, boosting efficiency. This cuts down response times, enhancing the user experience. Automated support also lessens the load on customer service teams.

- Paytm's chatbot handles over 60% of customer queries.

- AI-driven support reduced customer service costs by 20% in 2024.

- Response times for common issues improved by 40% with automation.

- Automated systems handle 10 million interactions monthly.

Paytm focuses on customer support with in-app help, online centers, and direct representatives to resolve issues efficiently. Personalized offers and recommendations tailored to user behavior are key for boosting engagement and improving marketing effectiveness. Loyalty programs with discounts and cashback reward frequent users, thereby strengthening customer relationships.

| Aspect | Strategy | 2024 Data |

|---|---|---|

| Support | In-app, online, representatives | Support response times improved by 15% |

| Personalization | Offers, recommendations | 15% rise in transaction volume |

| Loyalty | Rewards, cashback | Repeat transactions up 15% |

Channels

Paytm's mobile app is the core channel. It's how users access digital payments and services. The app's user-friendly design and features are key. In 2024, Paytm had over 300 million registered users. Constant upgrades and promotion are vital for growth.

Paytm's website acts as a primary information hub, detailing its services and offering customer support. It's a key channel for users preferring desktops, crucial for broader reach. In 2024, website traffic likely contributed to Paytm's 15% YoY revenue growth. A user-friendly site builds brand trust, vital for its 300+ million user base.

Paytm's merchant partnerships are crucial for expanding its reach. Merchants use Paytm QR codes to facilitate transactions and promote the platform. This collaboration boosts Paytm's visibility and user adoption. In 2024, Paytm had over 30 million merchants on its platform, demonstrating the impact of these partnerships. This strategy is essential for increasing its market penetration.

Social Media

Paytm leverages social media to connect with users, advertise services, and offer support. This approach boosts brand recognition and steers traffic to its platform. For example, in 2024, Paytm's social media campaigns reached millions across various platforms. Engaging on social media is critical to capture the youth market.

- Paytm's social media engagement saw a 30% rise in user interactions in 2024.

- The company invested ₹500 million in digital marketing, including social media, in 2024.

- Platforms like Instagram and X (formerly Twitter) are key for Paytm's outreach.

- Customer service via social media resolved over 100,000 queries in 2024.

Advertising

Paytm leverages diverse advertising channels, like digital ads, TV commercials, and print media, to boost its brand and offerings. These campaigns aim to enhance brand visibility and draw in new customers. In 2024, Paytm's marketing spend was approximately ₹1,200 crore, reflecting its investment in advertising. Successful advertising is vital for expanding its user base and market presence.

- Digital advertising forms a significant portion of Paytm's marketing strategy, targeting users online.

- TV commercials are used for broad reach, increasing brand awareness across different demographics.

- Print media, although less prominent, supports specific campaigns and regional promotions.

- Effective advertising directly correlates with the acquisition of new users and business expansion.

Paytm's social media channels are crucial for user interaction and brand promotion. In 2024, Paytm's social media engagement increased by 30%, highlighting its effectiveness. The company's social media campaigns reached millions and resolved over 100,000 queries. These channels enhance brand recognition and steer traffic.

| Channel | Strategy | 2024 Impact |

|---|---|---|

| Instagram & X | User Engagement | 30% rise in interactions |

| Digital Marketing | Advertising | ₹500M investment |

| Customer Service | Query Resolution | 100,000+ queries solved |

Customer Segments

Paytm focuses on urban professionals, a tech-savvy group favoring digital payments. They prioritize convenience, security, and access to financial services. This segment is crucial for Paytm's growth. In 2024, digital payment adoption by urban professionals surged, with 70% using platforms like Paytm weekly. Tailored solutions are key.

Paytm caters to small business owners, offering payment and financial tools for business management. This segment profits from the platform's simplicity and competitive fees. Paytm's focus on these businesses is evident in its strategy. In 2024, Paytm saw a 10% increase in small business users.

Paytm targets the rural population to foster financial inclusion. This segment, often underserved by traditional banking, gains from mobile payment solutions. In 2024, India's rural internet users neared 300 million. Paytm's rural expansion is key to growth.

Millennials and Gen Z

Paytm strategically focuses on millennials and Gen Z, recognizing their digital-first habits and preference for mobile solutions. This demographic, representing a significant portion of India's population, is key to Paytm’s user base. Their demand for innovative and personalized financial services shapes Paytm's product development. This customer segment is vital for sustained market relevance.

- Millennials and Gen Z account for over 60% of India's population.

- Mobile payment adoption among this group is over 80%.

- Paytm's user base reflects a strong presence of this age group.

- Personalization and social features are key for engagement.

Women

Paytm actively targets women, recognizing their growing influence in the digital economy. The platform offers accessible digital payment solutions, addressing historical barriers to financial inclusion. This strategy aligns with Paytm's commitment to social objectives, including women's financial empowerment, which is a core value. Paytm's secure and user-friendly platform is designed to meet the needs of this important customer segment.

- In 2024, the female user base on digital payment platforms grew by 25% in India.

- Paytm's user base includes approximately 35% women.

- Financial inclusion initiatives targeted at women have increased by 40% in the past year.

- Transactions by women on Paytm grew by 30% in 2024.

Paytm's customer segments include urban professionals, small business owners, and the rural population, each benefiting from tailored financial solutions. Millennials and Gen Z, significant digital users, are also a key focus, driving innovation and personalization. Women, representing a growing segment, are targeted to promote financial inclusion.

| Segment | Key Feature | 2024 Data |

|---|---|---|

| Urban Professionals | Convenience & Security | 70% weekly usage of digital payments. |

| Small Business Owners | Payment & Financial Tools | 10% increase in users. |

| Rural Population | Mobile Payment Solutions | ~300M rural internet users. |

Cost Structure

Paytm's cost structure includes substantial investments in technology development. In 2024, Paytm allocated a significant portion of its expenses to enhance its platform. This involves software updates, infrastructure improvements, and robust cybersecurity. These efforts are essential for maintaining competitiveness. Paytm's tech investments totaled around ₹2,500 crore in FY24.

Paytm heavily invests in marketing and promotion, crucial for customer acquisition and brand recognition. In 2024, marketing expenses accounted for a significant portion of their operational costs, aiming for user base expansion. Advertising campaigns, promotional offers, and sponsorships drive user growth and market share. Paytm's marketing spend was roughly INR 1,800 crore in FY23, showcasing its commitment.

Paytm's cost structure includes expenses for customer support across channels. This involves salaries, call center infrastructure, and online resources. Customer satisfaction hinges on quality support, impacting user retention. In 2024, Paytm likely allocated a significant portion of its operational costs to customer service, reflecting its user base. The efficiency of these costs is key to profitability.

Payment Processing Fees

Paytm's cost structure heavily involves payment processing fees. The company incurs these fees for digital payment processing, including charges to payment networks and banks. These fees represent a substantial expense, especially as transaction volumes grow. In fiscal year 2024, Paytm's payment processing charges were significant. Optimizing these costs is vital for enhancing profitability.

- Payment processing fees are a major expense for Paytm.

- These fees include charges from payment networks and banks.

- Paytm's transaction volumes directly impact these costs.

- Optimizing these fees is critical for profitability.

Regulatory Compliance

Paytm's cost structure includes significant expenses related to regulatory compliance. The company must adhere to numerous financial regulations, which drives up costs. These costs encompass legal fees, compliance audits, and investments in robust security measures. Staying compliant is vital to avoid penalties and maintain stakeholder trust.

- In 2024, Paytm's compliance costs likely increased due to evolving digital payment regulations.

- Legal and audit fees form a substantial portion of these costs.

- Investments in cybersecurity are critical for regulatory adherence.

- Compliance costs impact Paytm's overall profitability.

Paytm's cost structure is heavily influenced by its tech investments, totaling around ₹2,500 crore in FY24. Marketing expenses, crucial for user acquisition, were roughly INR 1,800 crore in FY23. Significant payment processing fees and regulatory compliance costs also play a substantial role.

| Cost Category | FY23 Spend (INR Cr) | FY24 Spend (Est. INR Cr) |

|---|---|---|

| Technology Development | ~2,300 | ~2,500 |

| Marketing & Promotion | ~1,800 | ~1,900 |

| Payment Processing Fees | Significant | Significant |

Revenue Streams

Paytm's payment processing fees are a core revenue source, earned by charging merchants for digital transactions. This is a significant income stream for the company. In 2024, Paytm's payment processing revenue was a key contributor. Strategies include increasing transaction volume and optimizing fee structures.

Paytm generates revenue through commissions from financial services like loans, insurance, and investments. This is a key income source. In 2024, Paytm's financial services revenue saw growth. Expanding these services and partnerships is vital for boosting this revenue stream.

Paytm boosts revenue via platform ads, enabling merchants to promote their offerings. This taps into Paytm's vast user base for targeted advertising. In fiscal year 2024, digital advertising revenue in India reached $9.6 billion. Improving ad targeting is key to growth.

Subscription Fees

Paytm generates revenue from subscription fees tied to premium offerings like Paytm First and Paytm Business. These fees are a consistent revenue source, contributing to overall financial stability. The success of this model hinges on continuously improving the value subscribers receive. For example, in 2024, Paytm reported a significant increase in subscribers to its Paytm First service, boosting this revenue stream.

- Paytm First subscribers grew in 2024, boosting revenue.

- Subscription fees provide a recurring revenue stream.

- Enhancing service value is key to retention.

- Premium services include Paytm First and Business.

Service and Convenience Fees

Paytm's revenue model includes service and convenience fees on various transactions. These fees are applied to services like ticket bookings and utility bill payments. They contribute to the overall revenue generation for the company. Optimizing the pricing of these services is essential to boost revenue while staying competitive in the market.

- Service fees are a part of Paytm's strategy to diversify revenue streams.

- Convenience fees help cover operational costs and maintain service quality.

- Pricing strategies are crucial for attracting and retaining users.

- Paytm must balance fees with user experience to remain competitive.

Paytm's revenue streams include processing fees from digital transactions, crucial for revenue. Financial services commissions, like loans, boost income. Platform ads, targeting users, contribute significantly. In 2024, digital ad revenue in India was $9.6B.

| Revenue Stream | Description | 2024 Impact |

|---|---|---|

| Payment Processing Fees | Charges on merchant transactions. | Key contributor to overall revenue. |

| Financial Services Commissions | Commissions from loans, insurance, etc. | Saw growth, expanding offerings. |

| Platform Advertising | Revenue from ads on the platform. | Digital ad revenue hit $9.6B in India. |

Business Model Canvas Data Sources

Paytm's BMC relies on market analyses, financial reports, & user data.