PDD Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PDD Holdings Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio.

Printable summary optimized for A4 and mobile PDFs, offering a succinct view of PDD Holdings' portfolio.

Full Transparency, Always

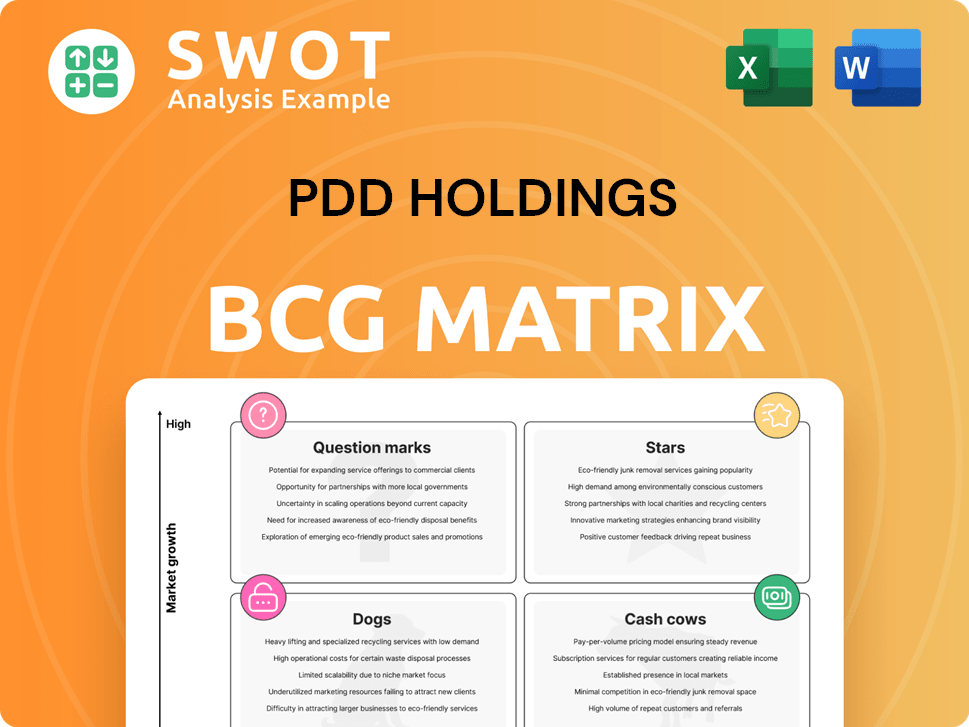

PDD Holdings BCG Matrix

The preview is the complete PDD Holdings BCG Matrix you'll receive. Immediately after purchase, download the fully editable report, ready for analysis and presentation. No hidden content—the same quality, polished document awaits.

BCG Matrix Template

PDD Holdings operates in a dynamic market with a diverse portfolio. Our preliminary analysis suggests a complex mix of product offerings. Identifying the Stars, Cash Cows, Dogs, and Question Marks is critical. A clear understanding of these quadrants informs strategic resource allocation. This preview only scratches the surface. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Temu, PDD Holdings' global e-commerce platform, has rapidly expanded to over 80 countries. Temu's direct connection of Chinese sellers with international buyers enables competitive pricing. In 2023, Temu's revenue surged, with estimates exceeding $14 billion. The platform uses tactics like the half-assignment model to manage geopolitical risks.

Pinduoduo's agricultural marketplace is a "Star" within its BCG Matrix, fueled by connecting farmers directly to consumers. This approach disrupts traditional retail, giving PDD a competitive edge. In Q3 2023, agricultural product GMV grew, showing strong consumer demand. Investments in tech and supply chains further solidify their leading market position.

PDD Holdings' discount e-commerce model thrives on its Pinduoduo platform, offering affordable goods and attracting a large user base, especially in China's lower-income areas. In 2024, Pinduoduo saw a 39% revenue increase, reaching $15.1 billion. Group buying and social features boost user engagement and sales. This strategy has helped PDD capture significant market share.

High Revenue Growth

PDD Holdings exemplifies high revenue growth, a key attribute in the BCG matrix. Its revenue surged, fueled by online marketing and transaction services. PDD's profitability, even with increasing costs, shows effective cost management. The company's robust financials support its e-commerce success.

- 2023 revenue reached $31.1 billion, a 90% increase year-over-year.

- Operating profit for 2023 was $9.8 billion.

- PDD's net income attributable to ordinary shareholders for Q4 2023 was $2.18 billion.

- The company's strategic investments have fueled rapid expansion.

Mobile-First Strategy

PDD Holdings shines in mobile commerce, leveraging high mobile penetration, especially in China. Its platforms offer seamless mobile shopping, crucial for attracting users. This mobile-first strategy matches digital-age consumer behaviors. In 2024, over 90% of China's internet users accessed it via mobile. PDD's focus on mobile drives its market success.

- Mobile penetration rates in China consistently exceed 90% of internet users.

- PDD's mobile strategy boosts user engagement and retention.

- This approach aligns with evolving consumer digital preferences.

- Mobile commerce is key to PDD's market leadership.

PDD's "Stars" include Pinduoduo's agriculture and Temu. These segments show high growth and market share, making them vital for PDD. Both benefit from strategic investments and strong consumer demand, solidifying their positions.

| Segment | Key Feature | 2024 Revenue (Estimate) |

|---|---|---|

| Pinduoduo Agriculture | Direct Farmer-to-Consumer | GMV growth in Q3 |

| Temu | Global E-commerce | Over $14B |

| PDD Holdings | Overall Growth | $15.1B in Q1 |

Cash Cows

Pinduoduo is a dominant e-commerce platform in China, with a huge user base and a strong market presence. This position enables it to produce considerable cash flow with minimal spending on promotion. In 2024, PDD's revenue reached approximately $32 billion, highlighting its financial strength. Its focus on affordable products and interactive shopping attracts Chinese shoppers.

PDD Holdings' online marketing services are a cash cow, generating substantial revenue by helping merchants promote products. This revenue stream is stable and requires less investment. In 2024, online ad revenue grew significantly, with PDD's platforms seeing strong growth. This boosts the company's profitability.

Transaction services, like commissions and fees from merchants, boost PDD Holdings' cash flow. As platform transactions rise, so does revenue, without extra costs. This scalable model strengthens the company financially. For example, in 2024, transaction revenue grew, reflecting increased activity. This growth helps maintain financial stability.

Strong Balance Sheet

PDD Holdings' robust financial health is evident in its substantial cash reserves and short-term investments. This strong position allows the company to pursue growth opportunities, including platform enhancements and global expansion. The solid balance sheet offers protection against economic downturns and competitive threats. This financial stability is crucial for sustaining its market position.

- In Q3 2023, PDD Holdings reported $77.5 billion in cash, cash equivalents, and short-term investments.

- This financial strength facilitated PDD's international expansion, particularly in markets like the United States and Europe.

- The company's ability to invest in research and development is also supported by its strong balance sheet.

Efficient Operations

PDD Holdings shines as a cash cow due to its operational efficiency, a key factor in its profitability. The company adeptly manages costs and refines its supply chain, which boosts its financial health. This efficiency lets PDD offer competitive prices, drawing in more customers. This is crucial in a market where cost control directly impacts success.

- In Q3 2023, PDD's revenue hit $8.6 billion, up 94% year-over-year, showcasing strong growth.

- PDD's gross margin in Q3 2023 was 69%, demonstrating effective cost management.

- The company's operating expenses in Q3 2023 were well-controlled, contributing to its profitability.

PDD Holdings' Cash Cow status is evident from its strong revenue streams and operational efficiencies. This success is seen through significant online marketing services and transaction fees. PDD's financial health, supported by its large cash reserves, promotes growth and stability.

| Metric | Q3 2023 | 2024 (Projected) |

|---|---|---|

| Revenue (USD Billion) | $8.6 | $32 |

| Gross Margin | 69% | - |

| Cash, Cash Equivalents, and Short-Term Investments (USD Billion) | $77.5 | - |

Dogs

PDD Holdings shifted away from its lower-margin, first-party marketplace to boost profitability. This move aligns with their strategy to prioritize a more profitable third-party platform. The first-party marketplace likely strained resources without delivering substantial returns. In 2024, this pivot helped PDD Holdings improve margins, with third-party sales driving growth.

Unsuccessful expansion initiatives can be a "Dog" in PDD Holdings' BCG Matrix. These ventures might have failed to deliver the expected revenue or market share gains. For example, if a new product launch in 2024 didn't meet sales targets, it could be categorized here. Such initiatives often drain resources.

Dogs in PDD Holdings' BCG matrix could include products facing declining demand. This might be due to shifts in consumer behavior or technological advancements. These offerings could drain resources without substantial profits. In 2024, PDD Holdings' revenue was approximately $30 billion, and identifying underperforming segments is key.

Inefficient Marketing Campaigns

Inefficient marketing campaigns can be classified as Dogs within PDD Holdings' BCG matrix. These campaigns fail to yield a positive return on investment, wasting valuable resources. For instance, in 2024, PDD Holdings’ marketing spend increased by 15%, yet customer acquisition costs rose by 10%, suggesting inefficiencies. PDD Holdings must analyze these campaigns to reallocate resources to more effective strategies.

- Rising marketing costs with diminishing returns.

- Ineffective ad spend on underperforming channels.

- Lack of clear ROI metrics for marketing initiatives.

- Need for better targeting and segmentation.

Segments Facing Intense Competition with Low Market Share

In PDD Holdings' BCG matrix, "Dogs" represent segments with low market share in highly competitive markets. These areas, where PDD might struggle, could include specific product categories or regions. To compete effectively, significant investment would be needed, potentially without a guarantee of high returns. PDD Holdings should carefully review these segments and consider strategic exits if they are not profitable.

- Areas with low market share and intense competition could include certain e-commerce niches.

- High investment needs in these segments might not yield sufficient returns.

- PDD Holdings should assess the viability and consider divestment options.

- Focusing resources on more promising areas could improve overall performance.

Dogs in PDD Holdings' BCG matrix represent underperforming segments with low market share and limited growth potential. These segments might include specific product categories or regions that struggle against strong competition. PDD Holdings should consider reallocating resources away from these areas. In 2024, PDD's operating expenses were around $15 billion; proper resource allocation is crucial.

| Category | Characteristics | Strategic Implications |

|---|---|---|

| Market Share | Low relative to competitors | Reallocate resources |

| Growth Potential | Limited, possibly declining | Consider divestment |

| Profitability | Low or negative margins | Reduce investment |

Question Marks

Temu's rapid expansion places it firmly in the question mark quadrant of PDD Holdings' BCG matrix. The e-commerce platform confronts substantial challenges, including high customer acquisition costs, regulatory uncertainties, and fierce competition. In 2024, Temu's aggressive marketing drove significant user growth, but at a cost, with reported losses. PDD Holdings must strategically assess Temu's viability to secure its future.

PDD Holdings' international expansion is a question mark in its BCG matrix. The company has entered various markets, facing hurdles like local preferences and regulations. Its success hinges on adapting to these challenges effectively. In 2024, PDD's international revenue was around $5 billion, showing growth potential.

New product categories with small market shares are question marks for PDD Holdings. These ventures have high growth potential but need investment to compete. PDD must assess the market carefully and invest strategically. In 2024, PDD expanded into various sectors, and its revenue grew by 40%.

Innovative Technologies

Innovative technologies, like AI and machine learning, are a question mark for PDD Holdings. These could boost the platform's features and user experience, but their success hinges on how well they're used and accepted. PDD must carefully handle these investments. In 2023, PDD invested heavily in tech, showing a focus on future growth.

- PDD's R&D spending increased significantly in 2023.

- AI and ML are key areas for platform enhancement.

- Market adoption is crucial for investment success.

- Investments must align with the growth plan.

Supply Chain Optimization Initiatives

PDD Holdings' supply chain optimization initiatives fall under the "Question Mark" category in the BCG Matrix. These efforts aim to boost efficiency, which could lead to lower costs and faster deliveries, but success isn't guaranteed. Challenges include managing complex logistics and coordinating with various suppliers. Effective execution and collaboration are crucial for these initiatives to pay off.

- PDD Holdings' revenue in 2023 was approximately $31.5 billion, reflecting significant growth.

- The company faces challenges in managing its extensive logistics network.

- Coordination with suppliers is vital for successful supply chain optimization.

- Market conditions can shift rapidly, impacting supply chain strategies.

PDD's Question Marks face uncertain futures, requiring strategic decisions. High costs and market shifts challenge these areas. PDD must decide whether to invest or divest to secure future growth. In 2024, R&D spending reached $8 billion, targeting these critical areas.

| Area | Challenge | 2024 Status |

|---|---|---|

| Temu | High Acquisition Costs | Reported losses despite user growth |

| International Expansion | Local Market Adaption | $5 billion revenue |

| New Product Categories | Investment Needs | 40% Revenue Growth |

| Tech Innovations | Market Adoption | $8B R&D in 2024 |

BCG Matrix Data Sources

The PDD Holdings BCG Matrix leverages financial reports, market share data, and growth projections from reliable industry publications.